January 2026

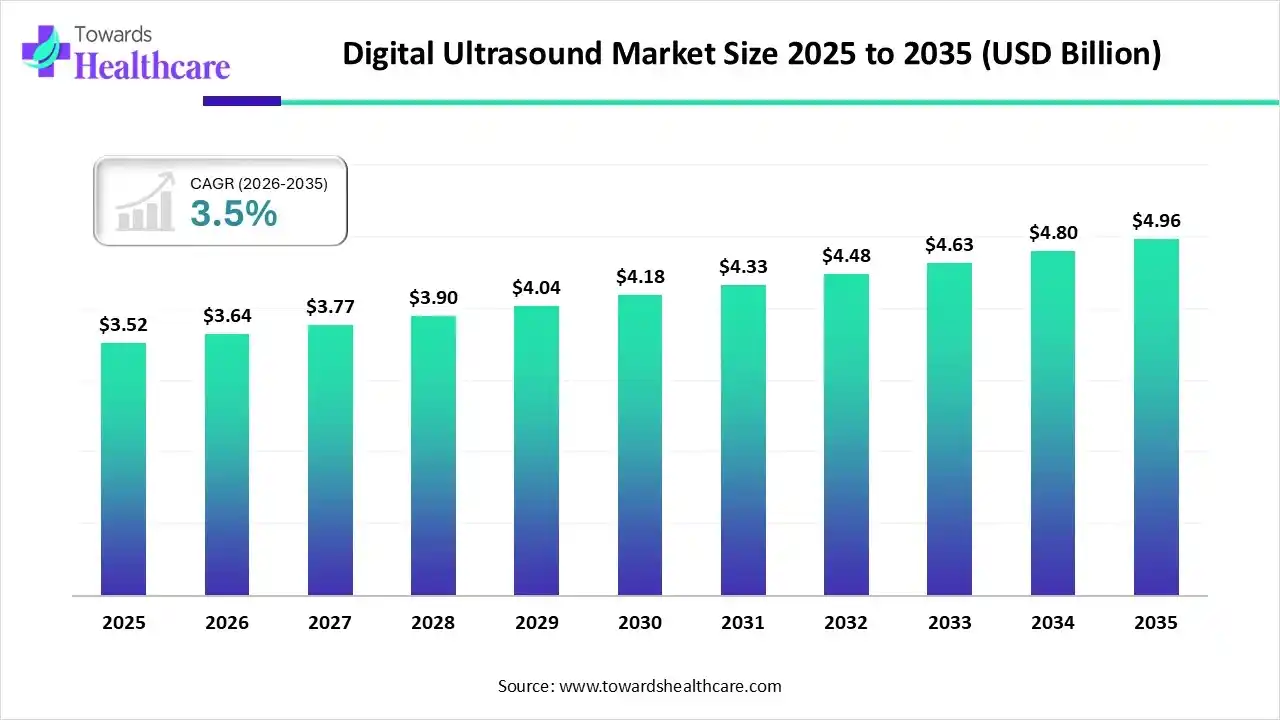

The global digital ultrasound market size was estimated at USD 3.52 billion in 2025 and is predicted to increase from USD 3.64 billion in 2026 to approximately USD 4.96 billion by 2035, expanding at a CAGR of 3.5% from 2026 to 2035.

Significantly, the globe is experiencing a huge rise in chronic disease prevalence, which further accelerates demand for more sophisticated and AI-enabled solutions. Alongside, some regions are fostering the development of portable/handheld devices and the expansion of telemedicine platforms.

The global digital ultrasound market covers sophisticated, non-invasive medical imaging by using high-frequency soundwaves. This adoption is mainly propelled by the growing instances of chronic illnesses and the quicker step towards portable, AI-driven, and point-of-care ultrasound (POCUS) devices. Continuous research activities are establishing compact, wireless transducers that link with smartphones, like the Vscan Air or the WTIO-1, allowing for instant, point-of-care diagnostics in ambulances and rural clinics.

An immersive role of AI is allowing guided ultrasound, where the software offers real-time, GPS-like feedback to improve probe placement, and also enables persistent, high-quality images regardless of operator skill level. Moreover, deep learning solutions are assisting through their integration to automatically adjust transducer frequencies and compression settings, relying on real-time tissue feedback. AI is also employed in reconstructing 3D volumes automatically, developing "5D" imaging to bolster visualization of fetal anatomy or cardiac structures.

Advanced ultrasound is shifting beyond radiology departments, with POCUS fostering distributed imaging to rural areas, ambulances, and homes, closing equity gaps.

The leading firms are promoting dynamic, real-time 4D imaging, which is vital for deeper fetal scans, cardiac evaluations, and visualizing movement.

Researchers are highly fostering the integration of ultrasound probes directly into surgical tools, like for robotic surgery, to visualize underlying nerves or blood vessels during procedures.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.64 Billion |

| Projected Market Size in 2035 | USD 4.96 Billion |

| CAGR (2026 - 2035) | 3.5% |

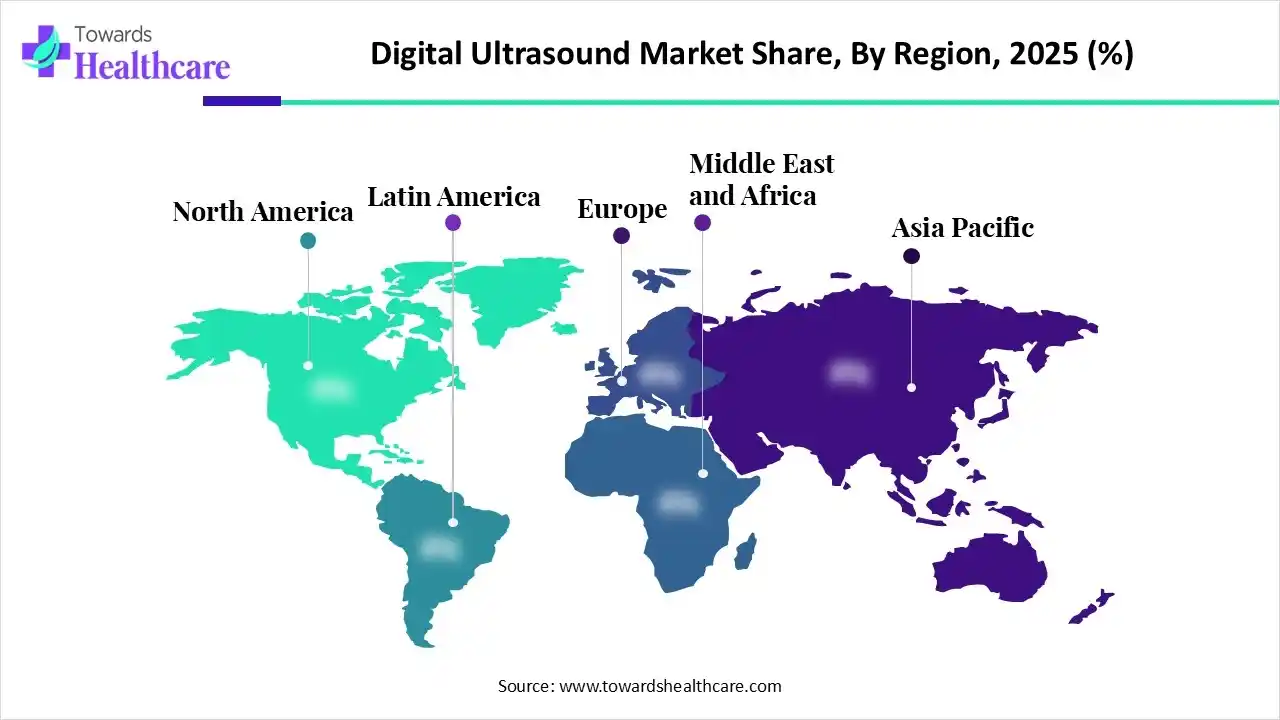

| Leading Region | North America |

| Market Segmentation | By Product/Equipment Type, By Application/Clinical Use, By Technology, By End-User/Care Setting, By Region |

| Top Key Players | GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Samsung Medison, Toshiba/Canon Group, Fujifilm SonoSite, Mindray Medical International, Hitachi Medical Systems |

How did the Cart-Based/Console Ultrasound Systems Segment Lead the market in 2025?

In 2025, the cart-based/console ultrasound systems segment captured the dominating share of the digital ultrasound market. It is fueled by the wider adoption in busy hospital areas for its durability, extensive image quality, and ability to manage high patient volumes as compared to handheld devices. A recent advance comprises the MyLab C30 and C25, which are novel, compact cart-based approaches, with the C30 specifically improved for interventional radiology and the C25 for general point-of-care.

Portable/Handheld Ultrasound Systems

However, the portable/handheld ultrasound systems segment will expand fastest. Its uses are accelerated by a rise in need for POC diagnostics, and broader adoption by non-radiologists, primarily for maternal, cardiac, and emergency care, making imaging rapid and affordable at the bedside. Recent technologies are enabling a single probe to operate as a linear, convex, and phased array, which allows "whole-body" imaging from a single, pocket-sized device.

Which Application/Clinical Use Dominated the Digital Ultrasound Market in 2025?

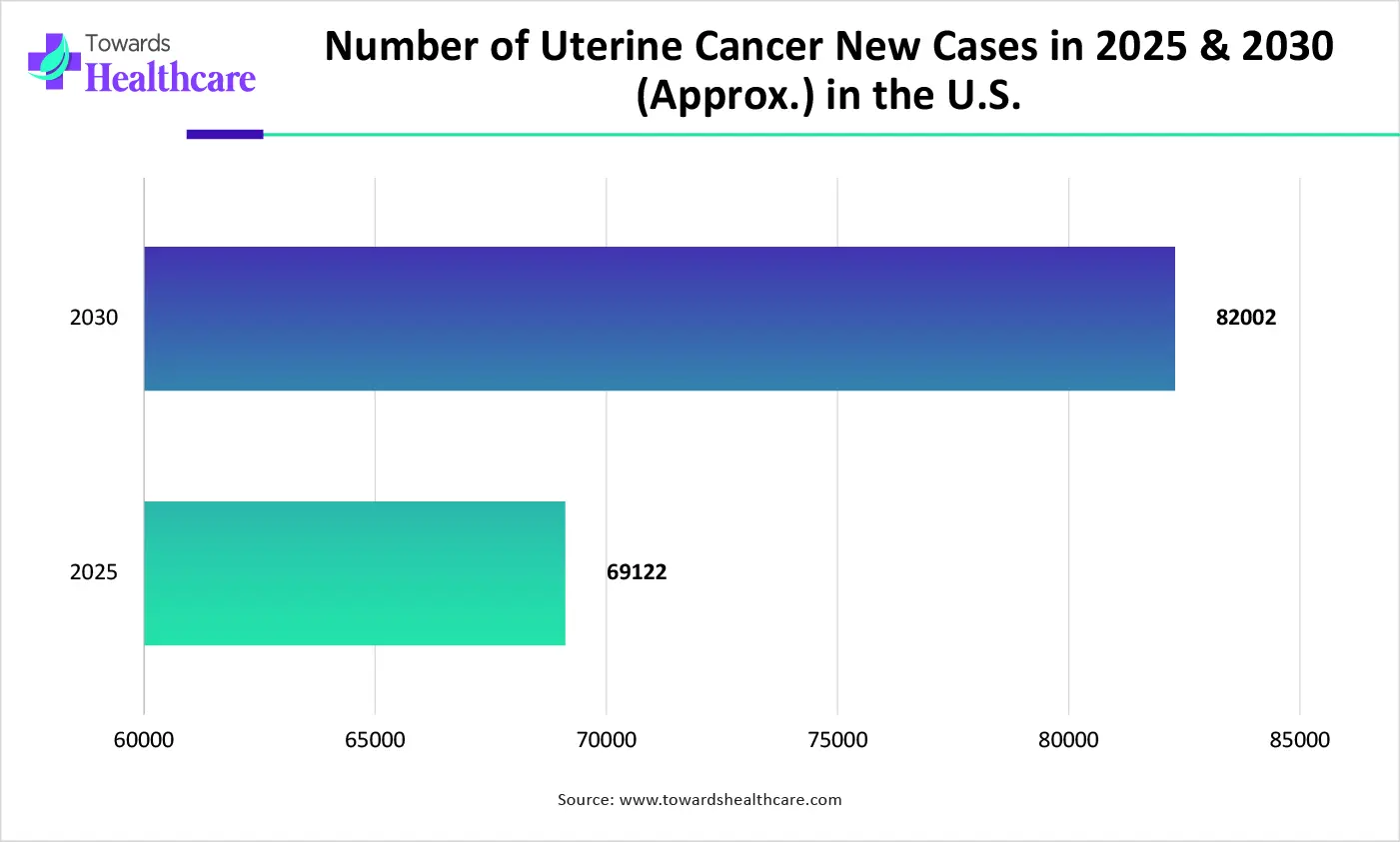

The obstetrics & gynecology segment registered dominance in the market in 2025. Globally increasing cases of uterine fibroids, ovarian cysts, and cancers are driving the need for advanced imaging solutions. The market is spurring "Glass Body" imaging, which enables robust visualization of fetal anatomy and vascular structures in utero, optimizing the evaluation of complex anomalies.

Point-Of-Care Ultrasound (POCUS)

In the future, the point-of-care ultrasound (POCUS) segment will grow rapidly. Globally rising instances of abdominal pain, cardiac concerns, and respiratory distress further drive POCUS demand for faster diagnosis and therapy guidance, like line placement & fluid checks. Moreover, the globe is putting efforts into sophisticated POCUS devices that are fully digital and connect directly to electronic health records (EHRs) and PACS systems.

Which Technology Led the Digital Ultrasound Market in 2025?

The 2D ultrasound segment was dominant in the market in 2025. A prominent catalyst is its cost-effectiveness compared to 3D/4D, which makes it adaptable for small-to-mid-sized clinics and hospitals in emerging countries. Alongside, they facilitate enhanced image quality, AI-assisted diagnostic tools, and advanced software. Breakthroughs in 2D SWE are promoting quicker, more accurate tissue stiffness measurements for liver fibrosis and breast lesions.

AI-Enhanced Imaging & Automated Analysis Tools

The AI-enhanced imaging & automated analysis tools segment is predicted to witness rapid growth. Their adoption is raised by the worldwide huge burden of chronic conditions and major shortages of specialized professionals. Companies are implementing a combination of Photon-Counting CT (PCCT) with deep learning to transfer sharper, high-contrast, ultra-low-dose scans, which finally improves details for earlier disease diagnoses.

What Made the Hospitals & Specialty Clinics Segment Dominant in the Market in 2025?

The hospitals & specialty clinics segment held a major share of the digital ultrasound market in 2025. Their expansion is propelled by the need for modern imaging in oncology, cardiology, and obstetrics. Additionally, clinics and smaller, private facilities in India, China, and Southeast Asia are highly using handheld devices for rapid, point-of-care, or outpatient diagnostics. Whereas Chang Gung Memorial Hospital, Taiwan, is a substantial hub for medical advances and vast patient care.

Home Care & Telemedicine Integration

Although the home care & telemedicine integration segment is anticipated to expand fastest. Day by day, widening remote patient monitoring programs are demanding portable, handheld, and easy-to-use ultrasound devices that offer patients to monitor their health status from home, and also allow for timely interventions. This provided minimal load on hospitals and lowered expenditures. The latest unveiling includes the Pulsenmore ES device, which enables pregnant users to perform ultrasound scans at home.

North America captured the biggest revenue share of the digital ultrasound market in 2025. This dominance is driven by a rise in demand for non-invasive diagnostics and technological innovations, such as AI & portable POCUS devices. Alongside, the region is widely implementing telerobotic solutions, including those from AdEchoTech and Dopl Technologies, which are being allocated to enable specialists to guide remote operators in real time.

U.S. Market Trends

Whereas the U.S. market is focusing on extensive integration of Artificial Intelligence for automated diagnostics, the omnipresence of handheld wireless devices (POCUS), and breakthroughs in 4D imaging. Additionally, Philips has upgraded their EPIQ Elite and Affiniti systems with AI to optimize workflow effectiveness.

In the future, the Asia Pacific is anticipated to expand rapidly in the digital ultrasound market, as many governments are executing suitable policies and funding encouragement to adopt sophisticated diagnostic tools. Specifically, governments in Southeast Asia, especially Malaysia and Thailand, have explored regulatory reliance guidelines to fast-track the approval of portable, digital-first ultrasound devices.

China Market Trends

However, China is immensely booming in AI-powered diagnostic and screening solutions, such as the Fudan University Shanghai Cancer Center established a portable AI-driven ultrasound device trained on over 300,000 breast lesions. This further demonstrates greater accuracy in finding early-stage cancer, making it favourable for community screenings.

The market in Europe is expanding rapidly, driven by the increasing adoption of AI-powered, portable, and handheld devices that enhance diagnostic precision. Growing demand for non-invasive, real-time imaging, particularly for cardiovascular diseases, is further boosting market growth.

Germany Market Trends

Germany’s market is growing significantly, fueled by the rising geriatric population, increasing chronic disease prevalence, and a strong push toward healthcare digitization. The Hospital Future Act and wider reimbursement for point-of-care (POCUS) devices, along with advanced 3D/4D technologies, are accelerating adoption.

| Company | Description |

| GE Healthcare | It explored diversity, such as LOGIQ Series, Voluson Series, Vivid Series, and Vscan Air. |

| Siemens Healthineers | This usually facilitates high-resolution imaging, AI-enabled automation, and specialized systems for various clinical environments. |

| Philips Healthcare | A company specializes in xMATRIX & PureWave, tele-ultrasound for remote alliance, and systems across cardiology, general imaging, OB/GYN, & PoC. |

| Canon Medical Systems | They unveiled SMI (Superb Micro-vascular Imaging) for tiny blood vessels, & Shear Wave Dispersion (SWD) for liver stiffness. |

| Samsung Medison | This offers Live ViewAssist for automated imaging and measurements, advanced image processing, like S-Harmonic, ClearVision, ergonomic designs, etc. |

| Toshiba/Canon Group | It focuses on the Aplio i-series and Aplio a-series platforms |

| Fujifilm SonoSite | This facilitates various portable digital systems for durability, ease of use, and faster diagnosis at the bedside. |

| Mindray Medical International | It is promoting ZONE Sonography Technology (ZST+), which employs software-driven beamforming for high-resolution imaging and tissue uniformity. |

| Hitachi Medical Systems | Their portfolio explored the ARIETTA and LISENDO series, portable, compact units. |

By Product/Equipment Type

By Application/Clinical Use

By Technology

By End-User/Care Setting

By Region

January 2026

January 2026

January 2026

January 2026