February 2026

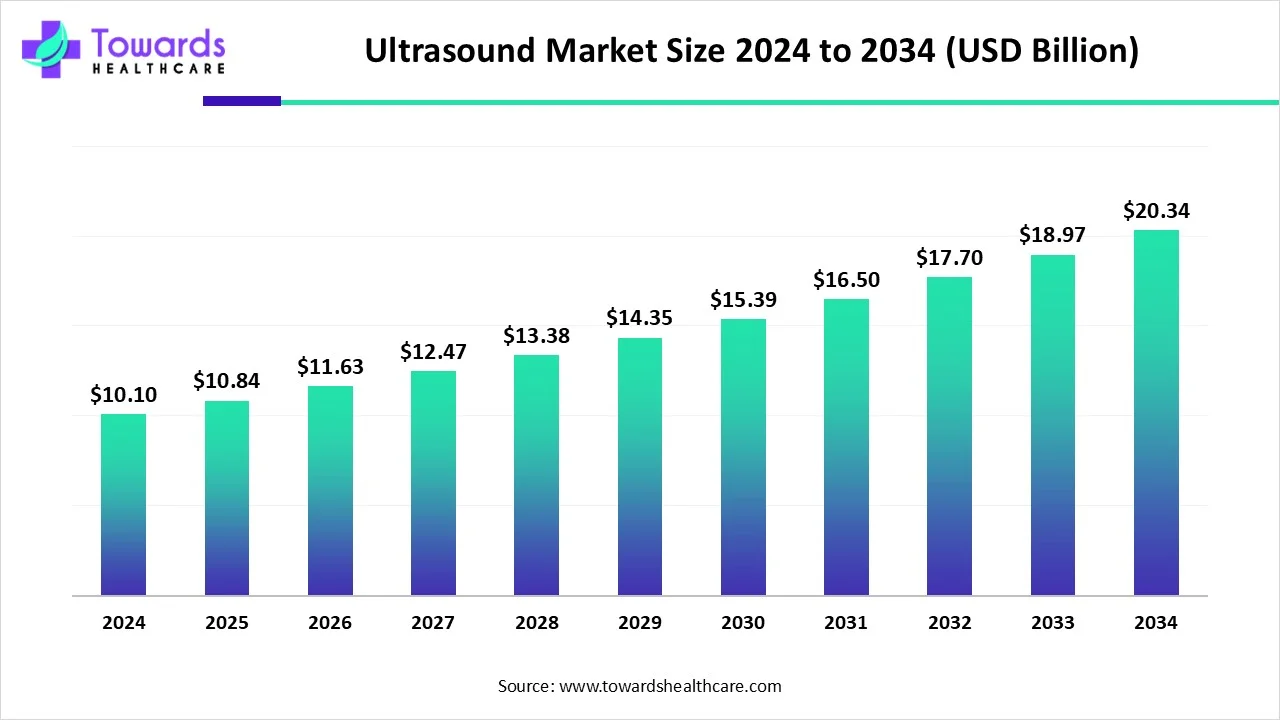

The global ultrasound market size is calculated at USD 10.1 billion in 2024, grow to USD 10.84 billion in 2025, and is projected to reach around USD 20.34 billion by 2034, increasing at a 7.26% CAGR for the period of 2024 to 2034.

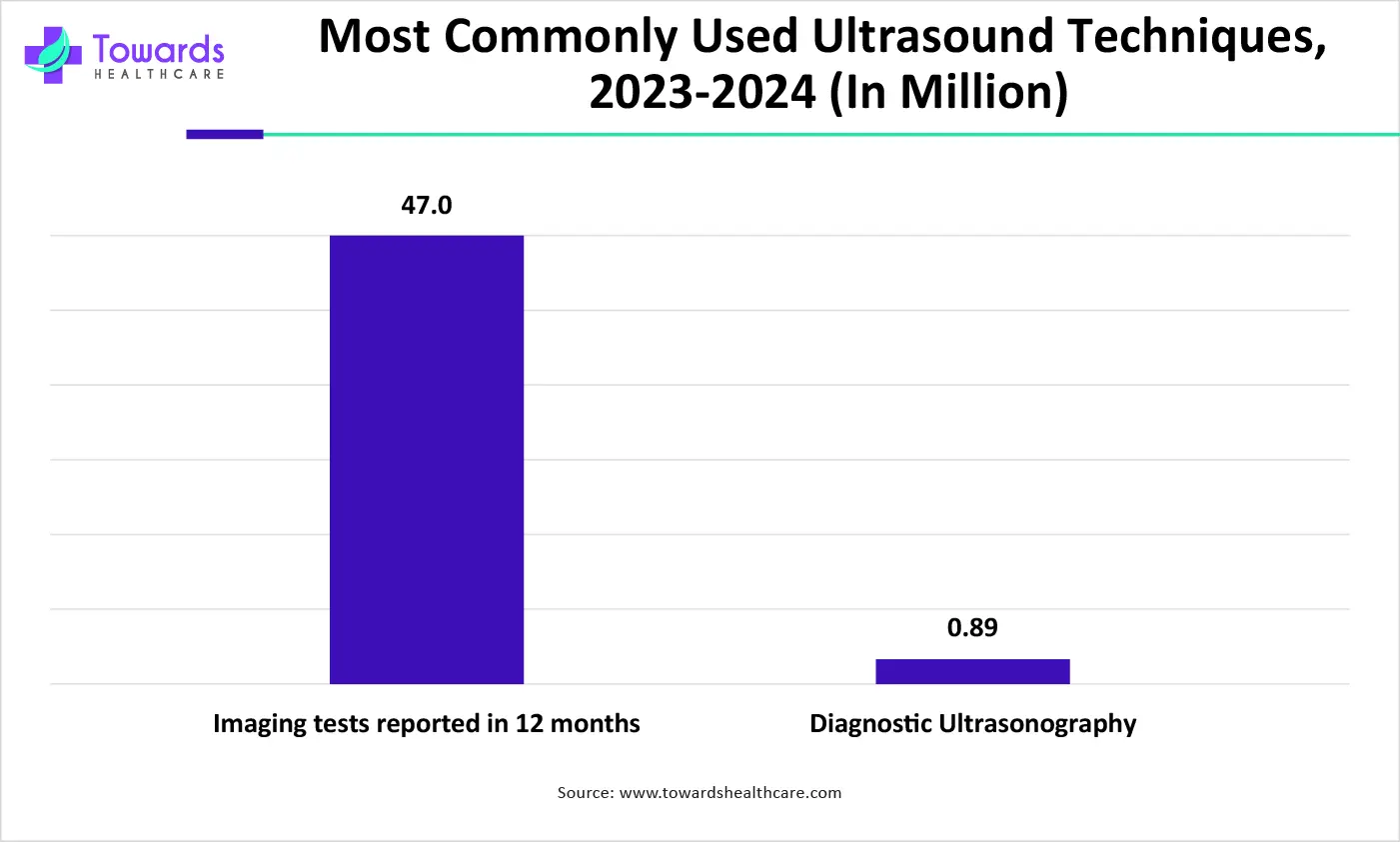

Ultrasound is also known as ultrasonography. It is widely recognized as a safe and non-invasive method for examining important body organs like the heart, abdominal blood vessels, joints, and more. It uses high-frequency sound waves to create images of internal structures, which doctors analyze to identify any health issues. Besides imaging, ultrasound is also as biopsies, tracking blood flow, and assessing the damage caused by a heart attack.

The global ultrasound market is expanding rapidly due to its growing use as a safe, non-invasive diagnostic tool across various medical fields. Technological advancements such as portable devices, AI integration, and 3D/4D imaging have made ultrasound more accessible and efficient. The increasing prevalence of chronic diseases, a rising aging population, and greater demand for early diagnosis are major contributors to market growth. Furthermore, the expansion of healthcare infrastructure in emerging economies and rising government and private sector investments in medical technology are also supporting the global market’s upward trajectory.

AI is transforming the market by enhancing diagnostic accuracy, speed, and overall efficiency. Through advanced image analysis, AI can identify patterns and detect abnormalities with higher precision, reducing the chances of human error. It also enables automated measurements and real-time guidance, helping even less experienced users perform accurate scans. This is particularly beneficial in remote or low-resource settings. AI streamlines workflows by simplifying data management, reporting, and image interpretation, saving time for healthcare providers. As a result, AI not only improves patient care but also makes ultrasound technology more accessible and efficient across various medical environments.

An Increasing Number of Chronic Cases

The rising number of chronic cases, such as cardiovascular diseases, cancer, and kidney disorders, drives the ultrasound market because these conditions often require regular monitoring and early diagnosis. The global rise in cancer and heart disease cases has led to a higher demand for early and accurate diagnosis. Major cancer types like carcinoma, melanoma, and leukemia are becoming more common, with 20 million new cases and 9.7 million deaths reported in 2023 by the WHO.

Similarly, cardiovascular diseases affected over 500 million people and caused 20.5 million deaths in 2023, according to the World Heart Federation. This growing need for early detection is driving the demand for ultrasound devices and fueling market growth. Ultrasound provides a non-invasive, safe, and cost-effective way to track disease progression, guide treatment, and assess organ function. As more patients need ongoing care, the demand for reliable imaging solutions like ultrasound continues to grow, supporting better outcomes and reducing the burden on the healthcare system.

High Operating Cost

The expenses involved in purchasing advanced ultrasound systems, maintaining equipment, upgrading software, and training skilled professionals can be quite high. Due to the high cost of advanced ultrasound systems and budget constraints, many smaller healthcare providers opt for refurbished equipment. In North America, new 3D/4D ultrasound systems can range from USD 20,000 to USD 75,000, while refurbished models are significantly cheaper, priced between USD 5,000 and USD 40,000, making them a more affordable option. Those costs can be a burden, especially for small clinics, rural hospitals, and healthcare facilities in developing regions. As a result, many institutions may delay or avoid investing in ultrasound technology, limiting its accessibility and slowing overall market expansion.

Technological Advancement

Technological advancement presents a significant opportunity for the ultrasound market by improving image quality, diagnostic accuracy, and system efficiency. Innovations such as portable ultrasound devices. AI integration and 3D/4D imaging are expanding the use of ultrasound across various medical fields, including cardiology, obstetrics, and emergency care. These advancements enable faster, more accurate diagnoses, making ultrasound more reliable and accessible. Additionally, AI-powered ultrasound systems can automate image analysis, reducing the need for specialized training and enhancing ease of use. As technology continues to evolve, ultrasound devices become more cost-effective, user-friendly, and versatile, driving widespread adoption and fueling market growth.

By product, the diagnostic ultrasound devices segment held a dominant presence in the market in 2024, due to their widespread use in a variety of medical applications, such as obstetrics, cardiology, and musculoskeletal imaging. These devices are essential for non-invasive, real-time imaging, allowing healthcare providers to quickly diagnose and monitor a wide range of conditions. With advancements in technology, diagnostic ultrasound devices have become more accurate, portable, and cost-effective, making them increasingly accessible across healthcare settings. Their ability to offer detailed, high-quality images without the need for radiation further boosts their popularity, ensuring their dominance in the ultrasound market.

By product, the therapeutic ultrasound devices segment is anticipated to grow at the fastest rate in the market during the studied years. The increasing applications in pain management, physiotherapy, and tissue healing. These devices are widely used for targeted treatments, such as promoting tissue regeneration, reducing inflammation, and managing musculoskeletal pain. With advancements in technology, therapeutic ultrasound has become more effective and versatile, offering non-invasive treatment options. The growing demand for alternative, non-surgical treatments and the rise in chronic pain conditions are expected to drive the rapid growth of this segment in the coming years.

By portability, the cart/trolley segment was dominant in the market in 2024. Cart-trolley ultrasound systems offer a range of capabilities, including high-quality imaging and integration with multiple probes, making them ideal for use in hospitals, clinics, and diagnostic centers. Their portability allows for easy movement between departments or patient rooms, providing flexibility in various medical settings. The demand for reliable, high-performance systems that can be easily transported within healthcare facilities contributes to the continued dominance of cart-trolley ultrasound devices in the ultrasound market.

By portability, the handheld segment is expected to grow at the fastest rate in the coming years. These compact devices enable healthcare professionals to perform quick, real-time imaging in various settings, including remote locations, emergency care, and point-of-care environments. Their mobility allows for immediate diagnostics without the need for bulky equipment, making them ideal for both developed and developing regions. As demand for accessible and cost-effective diagnostic tools increases, handheld ultrasound devices are becoming more popular, driving rapid ultrasound market growth.

By application, the radiology segment held the highest share of the market in 2024, due to its critical role in diagnosing a wide range of conditions such as tumors, organ abnormalities, and vascular diseases. Ultrasound is often used in conjunction with other imaging techniques, providing valuable insights for accurate diagnosis and treatment planning. Its ability to deliver real-time, dynamic imaging is particularly useful in radiology for guiding interventions, making it a go-to tool for many radiologists. Furthermore, its safety, cost-effectiveness, and versatility have contributed to its dominance in this application.

By application, the Obstetrics/Gynaecology segment is estimated to grow at the fastest rate during the predicted timeframe. Ultrasound plays a vital role in monitoring fetal development, detecting abnormalities, and ensuring the health of both the mother and the baby during pregnancy. Additionally, it is widely used for diagnosing and managing various gynecological conditions, such as ovarian cysts, fibroids, and endometriosis. As awareness of women’s health issues grows and the need for early detection increases, the demand for ultrasound in this field is expected to rise significantly.

By end-use, the hospitals segment held the largest share of the ultrasound market in 2024, due to the high volume of diagnostic and therapeutic procedures performed in hospital settings. Hospitals are equipped with advanced ultrasound systems for a wide range of applications, including obstetrics, cardiology, and emergency care. The availability of skilled professionals and specialized equipment in hospitals ensures the accurate and efficient use of ultrasound for patient diagnosis and treatment. Additionally, hospitals cater to a broad patient population, further driving the demand for ultrasound devices in various medical departments.

By end-use, the imaging centers segment is projected to grow at the fastest rate during the forecast period. These centers focus on providing advanced imaging solutions, such as ultrasound, to diagnose a wide range of conditions efficiently. With the growing preference for outpatient care and the rising number of patients seeking quick, accurate diagnostics, imaging centers are becoming a preferred choice. Additionally, their ability to offer affordable and accessible services contributes to the fast growth of this segment in the ultrasound market.

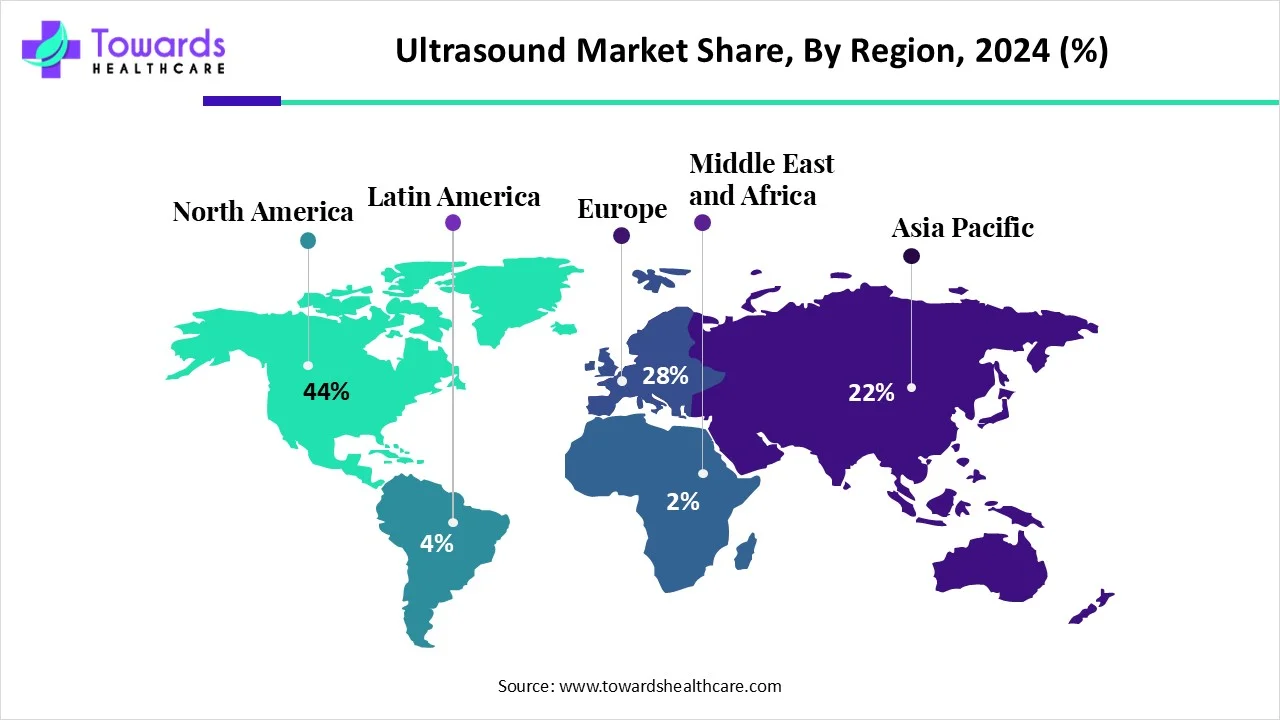

North America dominated the global ultrasound market share by 44% in 2024, due to its advanced healthcare infrastructure spending and the presence of key industry players like GE Healthcare and Philips. The region quickly adopts innovations such as portable and point-of-care ultrasound devices, driven by growing demand in emergency and critical care. Favorable reimbursement policies in the U.S. support investment in diagnostic tools, while a high prevalence of chronic diseases boosts imaging needs. Additionally, strong medical training and education ensure widespread, skilled use of ultrasound technology, reinforcing North America’s position as a leader in the global market.

The US market is expanding due to a shift towards value-based healthcare, where early diagnosis and cost-effective imaging solutions are prioritized. Ultrasound fits this model well, offering safe, radiation-free diagnostics at a lower cost compared to CT or MRI. The increased use of ultrasound in outpatient and ambulatory surgical centers, as well as in-home care settings, is broadening its application. Additionally, there is a growing trend of miniaturized and handheld ultrasound devices, making the technology more accessible to primary care providers. The role of telemedicine and remote diagnostics is also integrating ultrasound into virtual care workflows.

The aging population is increasing the demand for non-invasive diagnostic tools to monitor age-related conditions like cardiovascular diseases and cancer. Technological advancements, such as the integration of artificial intelligence and the development of portable ultrasound devices, are enhancing diagnostic accuracy and accessibility. Government initiatives, including funding for digital health solutions and medical equipment upgrades, are further supporting market growth. Additionally, the rising preference for point-of-care ultrasound systems in various healthcare settings is contributing to the expansion of the market.

Asia-Pacific is anticipated to grow at the highest CAGR in the market during the forecast period, due to rapid urbanization and expanding healthcare facilities, especially in countries like China, India, and Southeast Asia. Rising disposable income is allowing more people to seek healthcare services, increasing the demand for diagnostic imaging. Additionally, the growing trend of medical tourism in countries like India and Thailand is driving the demand for high-quality ultrasound equipment. Moreover, significant investment in healthcare digitization and government initiatives aimed at improving maternal and child healthcare are boosting the ultrasound in the region.

The growth market in China is fueled by factors like rapid urbanization and the expansion of healthcare networks, including private and public hospitals, which are increasing the demand for advanced medical imaging. China’s government is also investing heavily in expanding rural healthcare access, which boosts ultrasound adoption in underserved areas. Additionally, there is a strong push for medical innovation and the development of local manufacturing capabilities for ultrasound devices, making the technology more affordable. The rising awareness about the importance of early disease detection and preventative healthcare also contributes to the market’s growth.

Technological advancements such as integration and the development of portable ultrasound devices have enhanced diagnostic capabilities and accessibility. Government initiatives aimed at improving healthcare infrastructure and providing subsidies for medical equipment have further supported market growth. The increasing prevalence of chronic diseases, rising awareness of early disease detection, and the growing demand for non-invasive diagnostic procedures have also contributed to the expansion of the ultrasound market in India.

Europe is expected to see significant growth in the market during the forecast period, due to increasing demand for outpatient and home-based diagnostic services. The region is witnessing a shift towards decentralized healthcare, where mobile and handheld ultrasound devices are becoming essential tools in general practice and emergency care. Additionally, cross-border healthcare collaboration and research funding with the EU are accelerating innovation and adoption of advanced ultrasound technologies. Europe's strong regulatory framework ensures the quality and safety of devices, encouraging faster clinical acceptance and integration across public and private healthcare systems.

The UK market is expanding due to the rising adoption of personalized medicine and precision diagnostics. The growing demand for treatment planning, especially for oncology and cardiology. Ultrasound plays a key role in real-time monitoring. Additionally, the private healthcare sector in the UK is expanding, leading to increased procurement of advanced ultrasound systems to meet patient expectations for faster, high-quality images. The integration of ultrasound in sports medicine and physiotherapy is also gaining traction, as clinicians seek real-time imaging for soft tissue injuries and rehabilitation assessment.

The country's aging population is increasing the demand for diagnostic imaging, particularly in cardiology, oncology, and musculoskeletal disorders. Technological advancements, such as the integration of artificial intelligence and the development of portable ultrasound devices, are enhancing diagnostic capabilities and accessibility. The growing prevalence of chronic diseases and the emphasis on early disease detection are further contributing to market expansion. Additionally, the rise in point-of-care diagnostics and government investments in healthcare infrastructure are supporting the adoption of ultrasound technology across various medical specialties.

Latin America is expected to grow at a notable CAGR in the ultrasound market in the foreseeable future. Latin American countries have a favorable infrastructure for developing and manufacturing innovative ultrasound. Government organizations launch initiatives to promote indigenous manufacturing and provide incentives for the same. They also encourage the general public to screen for and seek early diagnosis of chronic disorders. The rapidly expanding medical device sector also contributes to market growth.

The Hospital Juárez de México’s radiology services conducted 43,000 studies, including X-rays, ultrasounds, and mammograms, in 2023. The study found the significance of AI integration in modern radiology, detecting complex conditions and abnormalities. In 2024, the number of births exceeded the number of deaths by 1.96 million.

In July 2024, Philips Foundation and SAS Brazil announced the launch of an innovation lab dedicated to digital health education. They will provide quality training, leverage ultrasound technology, and serve as a testing ground for researching the impact of new healthcare technologies. Philips Foundation aims to provide access to quality healthcare for 100 million people a year in underserved communities by 2030.

In January 2025, Samsung Medison introduced the Z20 ultrasound system in the U.S., designed for advanced OB/GYN applications. The Z20 uses AI technology to tackle challenges like high BMI patients, operator variability, and staffing shortages, aiming to enhance diagnostic accuracy and efficiency. CEO Kyu Tae Yoo emphasized that the Z20 reflects Samsung’s commitment to transforming women’s health imaging through innovation. The launch highlights Samsung's focus on AI-driven healthcare solutions and delivering high-quality, accessible care.

By Product

By Portability

By Application

By End-use

By Region

February 2026

February 2026

February 2026

February 2026