November 2025

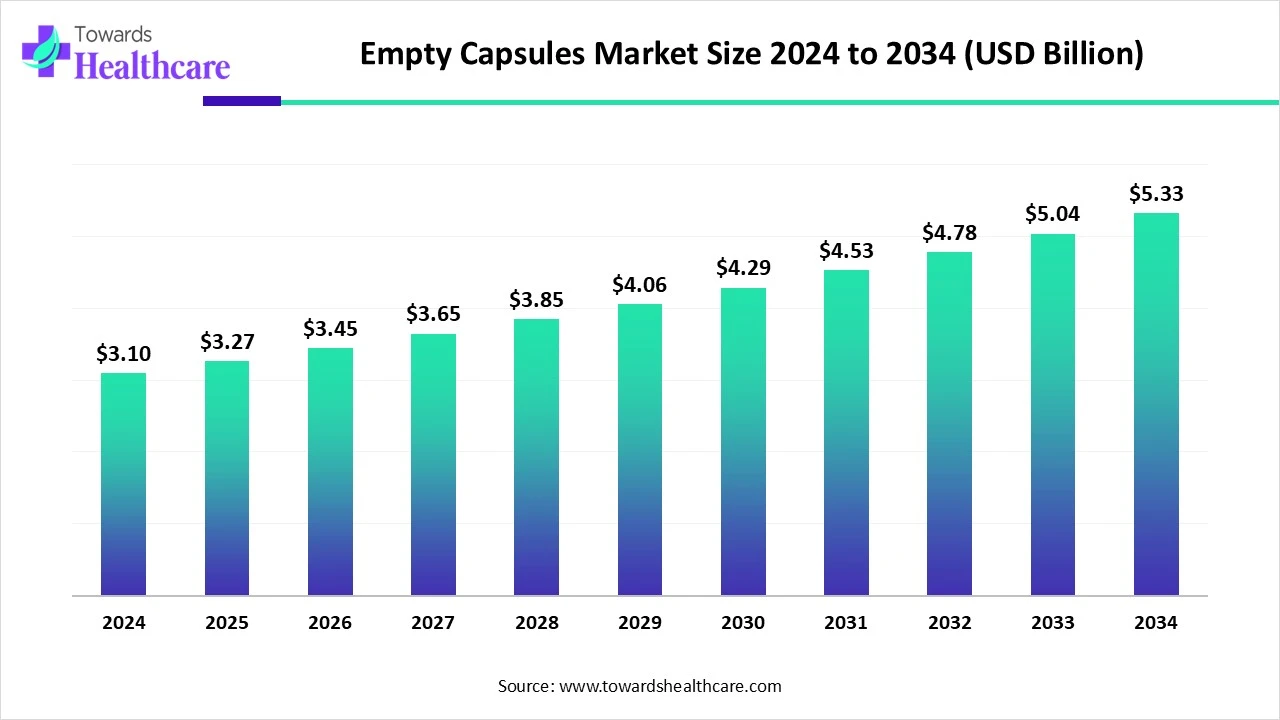

The global empty capsules market size marked US$ 3.1 billion in 2024 and is forecast to experience consistent growth, reaching US$ 3.27 billion in 2025 and US$ 5.33 billion by 2034 at a CAGR of 5.56%.

The empty capsules market is witnessing significant growth, fueled by rising demand from the pharmaceutical and nutraceutical sectors. Factors such as increasing health awareness, preference for easy-to-swallow dosage forms, and the shift toward plant-based capsules are driving expansion. Technological advancements in capsule production, coupled with the growing trend of personalized medicine and expanding global healthcare access, are further strengthening market potential across both developed and emerging regions.

| Table | Scope |

| Market Size in 2025 | USD 3.27 Billion |

| Projected Market Size in 2034 | USD 5.33 Billion |

| CAGR (2025 - 2034) | 5.56% |

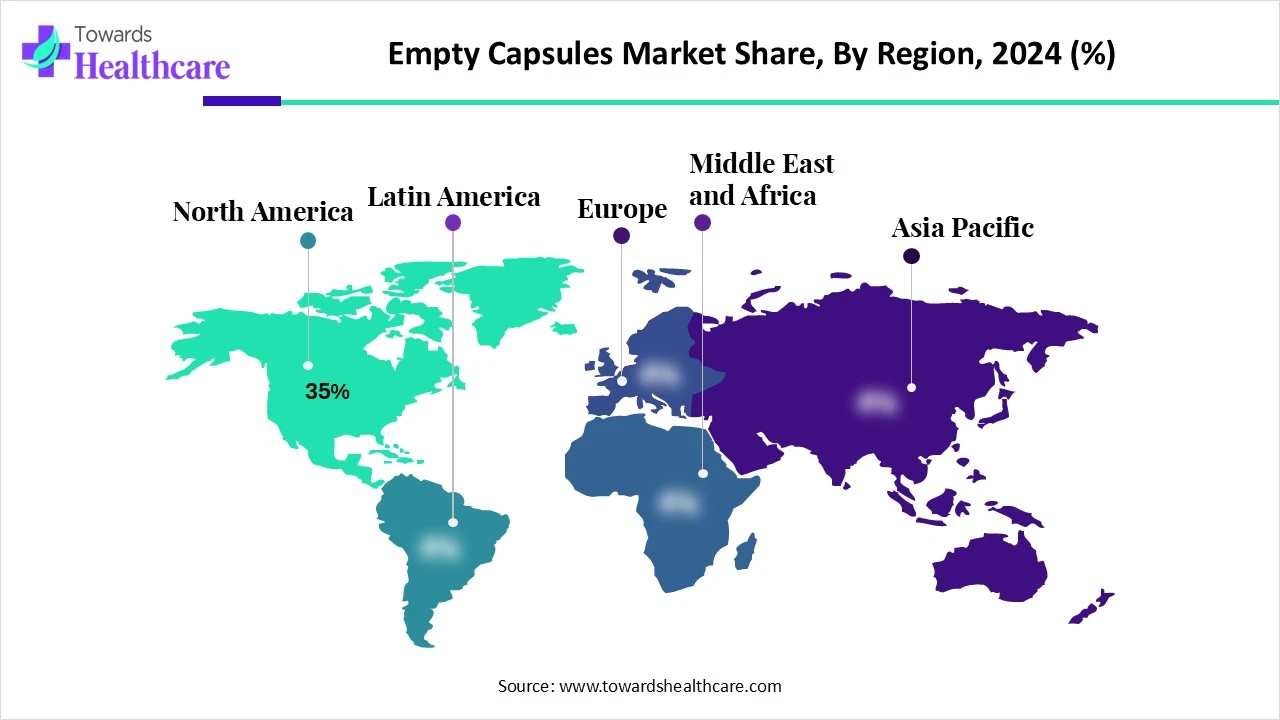

| Leading Region | North America Share 38% |

| Market Segmentation | By Product Type, By Size, By End User, By Application, By Region |

| Top Key Players | Capsugel (Lonza Group), Aenova Group, Shin-Etsu Chemical Co., Ltd., Qualicaps, Pharmaplast, Sunil Healthcare Ltd., Suheung Co., Ltd., The Capsugel Company, Natural Capsules Ltd., Lonza Group Ltd., Colorcon, Inc., Huaao Group, HealthCaps India Ltd., Biocaps Laboratories, Suheung Co., Ltd., CapsCanada, Gujarat Capsules Ltd., Axiom Capsule Pvt Ltd., Jangsu Suheung Co., Ltd., Kuwait Capsules Manufacturing Company |

The empty capsules market refers to the industry producing hollow capsules used as carriers for pharmaceutical drugs, nutraceuticals, and dietary supplements. These capsules provide an easy-to-swallow dosage form, protect sensitive ingredients, mask unpleasant tastes, and enable controlled release of active compounds. The market includes various types of capsules, such as gelatin-based, hydroxypropyl methylcellulose (HPMC) vegetarian capsules, and pullulan capsules. Growth is driven by increasing demand for dietary supplements, preference for convenient dosage forms, and rising consumer awareness about health and wellness.

The market is witnessing strong growth, driven by rising demand in pharmaceuticals and nutraceuticals, increasing preference for vegetarian and specialized capsules, and advancements in capsule manufacturing technologies. Innovations such as enteric-coated and sustained-release formulations are expanding applications. Additionally, growing health awareness, aging populations, and expanding production in emerging economies are boosting market potential, making it a dynamic and evolving segment in the global healthcare industry.

Expansion in Emerging Markets: Rising healthcare infrastructure and pharmaceutical production in regions like Asia-Pacific and Latin America are creating new market opportunities for capsule manufacturers.

Growth of Nutraceuticals and Dietary Supplements: Health-conscious consumers are increasingly opting for vitamins, minerals, and herbal supplements, boosting the adoption of capsules in the nutraceutical segment.

AI is transforming the market by optimizing manufacturing processes, improving quality control, and enhancing formulation development. Predictive analytics and machine learning help manufacturers reduce production errors, lower costs, and accelerate product development. AI-driven automation enables precise filling and packaging, while data-driven insights support demand forecasting and inventory management. Additionally, AI facilitates innovation in personalized and specialty capsules, meeting evolving consumer preferences. Overall, AI adoption boosts efficiency, scalability, and competitiveness across the global empty capsules industry.

Rising Demand for Pharmaceuticals and Nutraceuticals

The growing consumption of pharmaceuticals and nutraceuticals is driving the empty capsules market as manufacturers seek versatile and efficient dosage forms. Capsules enable faster production, easier customization, and enhanced bioavailability of active ingredients. With expanding global healthcare access and increasing consumer preferences for convenient, ready-to-use supplements, the demand for empty capsules rises. Moreover, regulatory support and advances in capsule technologies allow companies to cater to diverse formulations, boosting the market growth potential.

Stringent Regulatory Requirement

Regulatory hurdles limit the growth of the empty capsules market because different countries have varying standards for ingredient sourcing, manufacturing practices, and testing protocols. Companies must invest heavily in compliance, documentation, and facility audits, which can delay production and increase operational costs. These complex and manufacturing processes make it challenging for smaller manufacturers to enter the market and for innovators to launch new capsule types quickly, thereby restraining overall market expansion.

Advancements in Plant-based and Vegetarian Capsules

The development of plant-based and vegetarian capsules presents a future opportunity because it allows manufacturing to meet the rising demand for allergen-free, halal, and kosher products. These capsules also support global sustainability goals by reducing animal-derived ingredients and environmental impact. Moreover, they enable pharmaceutical and nutraceutical companies to create more diverse and specialized formulations, attracting wider consumer segments and opening new original markets where ethical and dietary preferences strongly influence purchasing decisions.

The dominance of the gelatin capsules segment in the empty capsule market stems from its ease of production, high patient compliance, and ability to mask the unpleasant tastes or odors of active ingredients. They are highly adaptable for immediate-release and modified-release formulations, supporting diverse therapeutic applications. Additionally, gelatin capsules have a long-standing presence in the pharmaceutical industry, ensuring widespread availability and trust among manufacturers and consumers, which collectively drives higher adoption and revenue compared to newer capsule alternatives.

The vegetarian capsules (HPMC) segment is poised for rapid growth because it caters to the rising demand for clean-label, plant-based, and sustainable dosage forms. These capsules offer superior moisture resistance, chemical stability, and compatibility with sensitive ingredients compared to traditional gelatin capsules. Expanding use in specialty nutraceuticals, herbal supplements, and personalized medicine, combined with increasing regulatory acceptance of plant-based products, is driving manufacturers to adopt HPMC capsules, making this segment the fastest growing in the empty capsules market.

The size 0 capsule segment led the market in 2024 due to its broad applicability in commercial production and compatibility with diverse formulations. They provide sufficient space for combination drugs and complex nutraceutical blends, reducing the need for multiple capsules per dose. Additionally, size 0 is preferred by manufacturers for standardization across product lines, streamlining production and packaging processes, which enhances efficiency and cost-effectiveness, contributing to their top revenue generation in the empty capsules market.

The pharmaceutical companies segment dominated the market in 2024 because these firms require high-volume, standardized capsule supplies for diverse therapeutic applications. Their focus on innovation, formulation development, and combination therapies increases reliance on reliable empty capsule suppliers. Moreover, partnerships with contract manufacturers and global distribution networks boost capsule consumption. Rising investment in research and development, coupled with expanding production capacities to meet global home healthcare needs, further strengthened the market share of pharmaceutical companies within the empty capsules sector.

The dietary supplements & nutraceutical companies segment is expected to grow rapidly because manufacturers are increasingly launching innovative supplements to meet evolving consumer preferences. Empty capsules allow for easy incorporation of sensitive or complex ingredients, including probiotics, botanicals, and antioxidants. Additionally, the global trend toward natural, plant-based, and clean-label products is driving higher adoption of capsules in this sector. Growing e-commerce sales of health supplements and the expansion of wellness-focused markets worldwide further accelerate the segment's growth.

The pharmaceuticals segment dominated the empty capsules market in 2-24 because of its critical role in enabling efficient and scalable drug production. Capsules facilitate faster development of combination therapies, pediatric formulations, and targeted-release medications. The segment's growth is also supported by continuous R&D, increasing drug approvals, and expansion into emerging markets. Additionally, pharmaceutical companies favor capsules for their manufacturing efficiency, stability, and global regulatory acceptance, which collectively contributed to the market's highest revenue share in the market.

The veterinary applications segment is projected to grow rapidly because of the increasing focus on preventive care and nutritional supplementation for animals. Capsule-based delivery allows for easy administration of medications and supplements, especially for pets and small livestock, enhancing compliance and reducing stress during dosing. Rising consumer spending on pet healthcare, expansion of veterinary services, and growing demand for functional animal supplements are encouraging manufacturers to invest in capsule-based solutions, making this segment one of the fastest-growing in the empty capsules market.

North America led the market share by 35% in 2024 because of its mature supply chain, strong presence of major capsule manufacturers, and widespread consumer preference for convenient dosage forms. The region’s focus on R&D, high adoption of plant-based and specialty capsules, and growing e-commerce distribution for nutraceuticals and supplements further fueled demand. Additionally, favorable government policies, advanced healthcare infrastructure, and increasing investment in pharmaceutical innovations contributed to North America achieving the highest revenue share in the global empty capsules market.

The U.S. market is growing due to increasing demand for pharmaceuticals, dietary supplements, and nutraceuticals. Rising health awareness, a preference for convenient and plant-based dosage forms, and the expansion of the nutraceutical sector are driving consumption. Additionally, continuous innovations in capsule technology, strong manufacturing infrastructure, and supportive regulatory frameworks encourage market expansion, enabling pharmaceutical and supplement companies to meet the needs of a large, health-conscious population.

The Canadian market is expanding as more pharmaceutical and nutraceutical companies invest in advanced capsule formulations to meet evolving consumer needs. Rising demand for convenient, stable, and easily digestible dosage forms in both prescription drugs and supplements is fueling growth. Furthermore, the country’s emphasis on natural and clean-label products, along with increasing veterinary and specialty applications, is encouraging manufacturers to adopt empty capsules, driving the market forward.

Asia-Pacific is projected to witness the fastest growth in the market due to the region’s expanding manufacturing capabilities and favorable government initiatives supporting pharmaceutical and nutraceutical production. Increasing consumer interest in preventive healthcare and functional foods, along with rising awareness of plant-based and vegetarian capsules, is driving demand. Moreover, the presence of cost-competitive production facilities and growing exports to global markets are encouraging investment, making Asia-Pacific the fastest-growing region in the empty capsules market during the forecast period.

Regulatory approvals are essential for empty capsules, especially hard gelatin ones, to ensure safety and effectiveness. This process includes strict quality testing, meeting pharmacopeial standards, and complying with guidelines from authorities such as the FDA and EMA.

Key players: Lonza, Qualicaps, Roxlor, CapsCanada

The empty capsules are made from gelatin, HPMC, or starch, with gelatin being most common and HPMC/starch serving as vegetarian alternatives.

Key players: Bright Pharma Caps Inc., Medi-Caps, ACG

Empty gelatin capsules are packed in polythene bags, which are then placed in strong double-layered cartons lined with thermocol on all sides to provide cushioning and temperature protection.

Key players: HealthCaps India Ltd, Suheung Co., Ltd, Medi-Caps Ltd.

In May 2024, Suheung (South Korea) launched the EMBOCAPS® AP60, a delayed-release capsule providing over 60 minutes of acid protection without shellacs, phthalates, or coatings. The capsule uses a patented hypromellose and pectin blend to protect sensitive ingredients like probiotics. Suheung’s CEO, Joo Hwan Yang, highlighted the company’s focus on innovation and customer support, stating that the new Alpha plant boosts production capacity and reinforces their commitment to quality and advanced capsule solutions.

By Product Type

By Size

By End User

By Application

By Region

November 2025

December 2025

November 2025

November 2025