January 2026

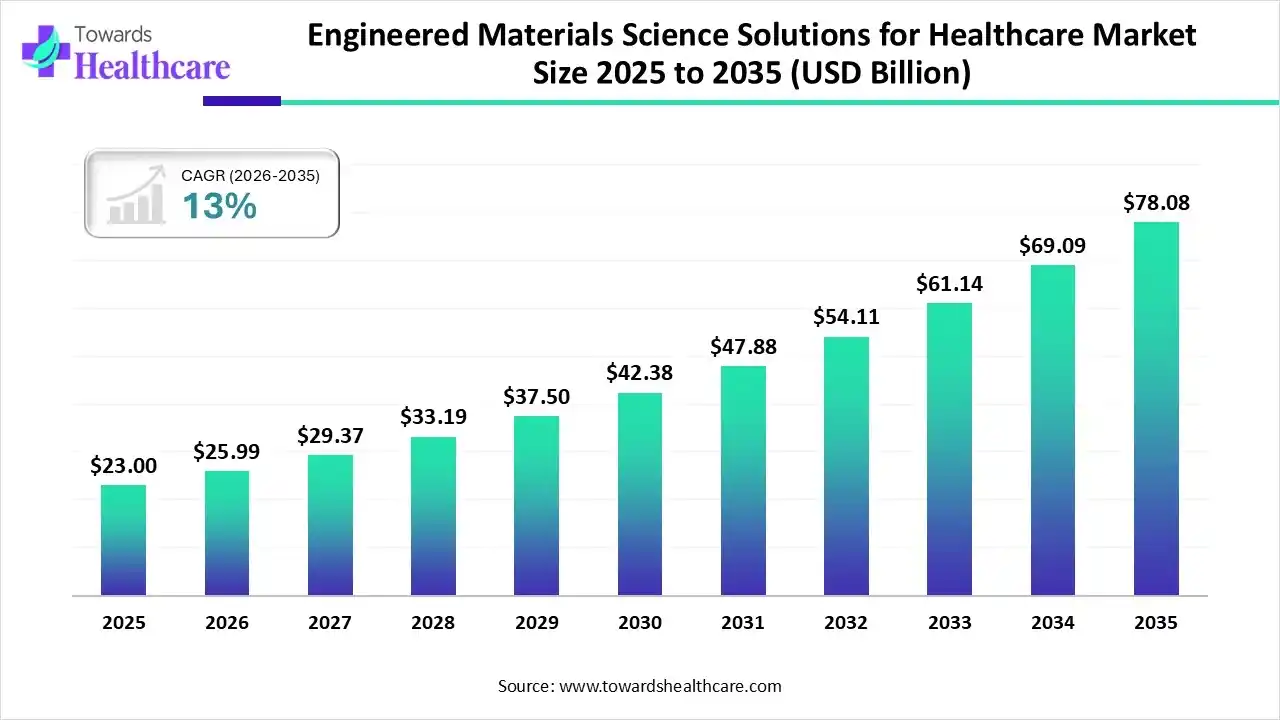

The global engineered materials science solutions for healthcare market size was estimated at USD 23 billion in 2025 and is predicted to increase from USD 25.99 billion in 2026 to approximately USD 78.08 billion by 2035, expanding at a CAGR of 13% from 2026 to 2035.

Many vital companies are promoting the innovations and use of bioactive materials, specifically for smart & responsive biomaterials, tailored implants, tissue regeneration, prosthetics, and other customised devices. Besides this, they are also transforming composites and hybrid materials, along with the wider adoption of AI algorithms in diagnostics mainly for medical devices.

| Key Elements | Scope |

| Market Size in 2026 | USD 25.99 Billion |

| Projected Market Size in 2035 | USD 78.08 Billion |

| CAGR (2026 - 2035) | 13% |

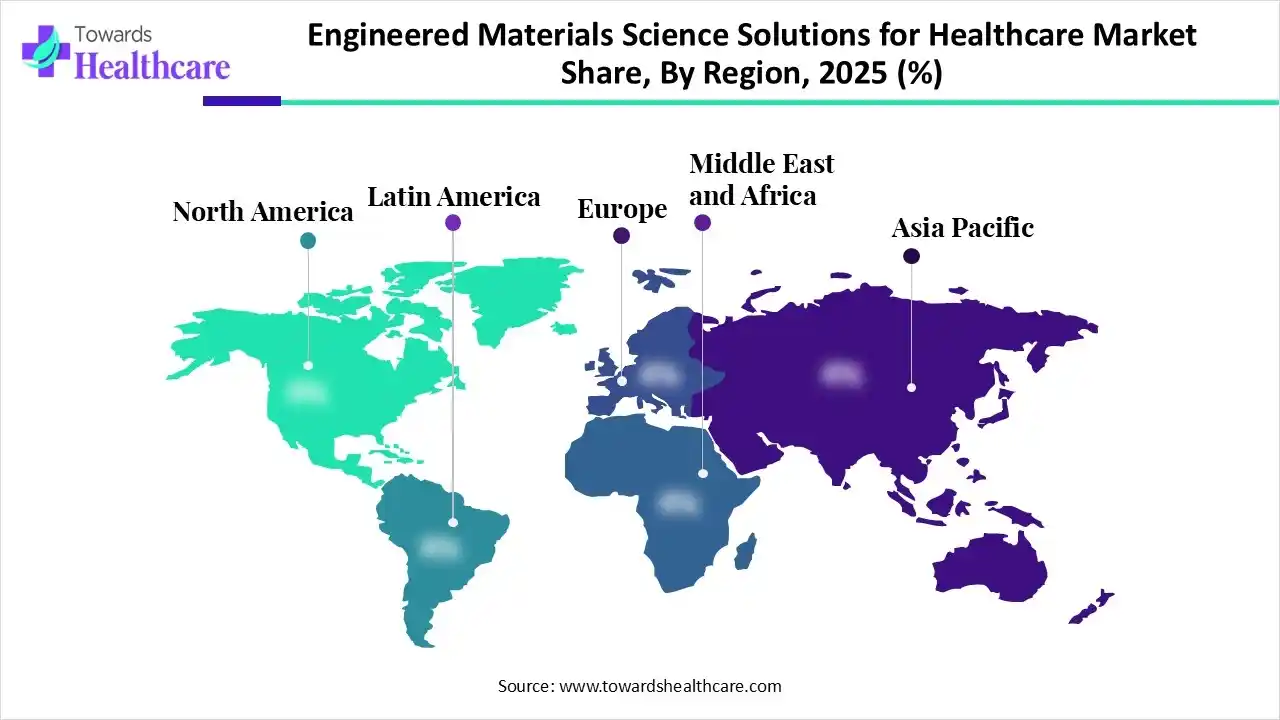

| Leading Region | North America |

| Market Segmentation | By Material Type/Product Type, By Application, By Function of Material, By Device Category Supported, By Region |

| Top Key Players | Evonik Industries AG, Covestro AG, Stryker Corporation, Royal DSM, BASF SE, Solvay S.A., Medtronic plc, 3M |

Primarily, the global engineered materials science solutions for healthcare market comprises diverse biocompatible implants from titanium/polymers, tissue engineering scaffolds for regeneration, sophisticated biosensors for early diagnostics, and 3D-printed personalized devices. This diversity is fueled by the increasing breakthroughs in medical technology, the rising geriatric population, and the growth in healthcare investments. Recently, Meril's MeRes100 was developed, which is an ultra-thin (100 µm) sirolimus-eluting bioresorbable stent used to treat coronary artery disease.

How is AI Impacting the Engineered Materials Science Solutions for Healthcare Market?

In the case of polymer discovery and synthesis, AI algorithms are widely used, including the French startup Synboli, which uses these algorithms to develop newer polymer structures and estimate their properties. This further accelerates the evolution of custom polymers for medical devices and other healthcare applications. Recently, AI assistance has been employed in the analysis and improvement of a piezoelectric nanocomposite (Au@BTO), which is a highly efficient, non-invasive sonodynamic cancer therapy.

The use of engineering materials, such as advanced Nitinol for stents and 3D printing for patient-specific implants, especially in hips, knees, skull, and cardiovascular, offers a perfect fit and better integration.

The globe is fostering the development of materials that mimic natural tissues to establish functional replacements, such as vascularized tissues for organ printing.

In the coming era, leaders will leverage "smart" biomaterials for responding to external or internal stimuli, like Glucose-responsive hydrogels for automated insulin delivery in diabetic patients.

In the future, nanomaterials will be used in highly sensitive biosensors and imaging contrast agents for earlier disease detection and deeper molecular profiling.

| Company | Key Investments & Alliances |

| Gator Bio | In December 2025, a player partnered with Monod Bio to establish next-generation biosensors for advanced life science research. |

| Tiger Aesthetics Medical | In November 2025, a company invested in GenesisTissue to explore 3D bioprinted scaffolds for breast reconstruction & augmentation |

| restor3d | In August 2025, it entered into a strategic investment partnership with Partners Group to accelerate progression in tailored orthopaedic solutions. |

| HydroGraph | In August 2025, it joined forces with Hawkeye Bio to reinforce a new graphene biosensor solution for the LEAP Lung Cancer Test from Ease Healthcare. |

| Sava Technologies | In July 2025, it secured €16.6M for the wearable biosensor. |

How did the Medical Plastics Segment Lead the Market in 2025?

In 2025, the medical plastics segment held the biggest share of the engineered materials science solutions for healthcare market. A significant driver is the rising requirement for more medical interventions, long-term care solutions, and implants and prosthetics. Day by day, the globe is progressing towards sustainability, such as bio-plastics, closed-loop recycling, smart materials, like antimicrobial, sensory textiles, and advanced manufacturing, including 3D printing, tailored devices, and multi-layer co-extrusion.

Composites & Hybrid Materials

The composites & hybrid materials segment will witness rapid growth. Including its major uses, especially from dental fillings and orthopedic implants to surgical tools, drug delivery, and wound care, is propelling the expansion. Researchers are pioneering the combination of synthetic polymers, such as PCL (poly-caprolactone) or PLGA (poly(lactic-co-glycolic acid)), with bioceramics like nano-hydroxyapatite (nHA) for designing scaffolds for bone tissue engineering.

What made the Medical Disposables Segment Dominant in the Market in 2025?

The medical disposables segment captured a major share of the engineered materials science solutions for healthcare market in 2025. Post-COVID-19, numerous hospitals and clinics are fostering the use of single-use, sterile engineered materials, like nonwoven fabrics for masks and gowns, and medical-grade plastics for syringes and catheters, to maintain a hygienic environment. Nowadays, they are employing silver-ion and other nanotechnology coatings used on single-use catheters, respirators, and surgical instruments to combat bacterial growth and lower HAI rates.

Tissue Engineering & Regenerative Medicine

In the coming era, the tissue engineering & regenerative medicine segment will register the fastest expansion. The latest research activities explored a four-component composite implemented for bone regeneration that combines bacterial cellulose (BC), MXenes, iron oxide nanoparticles (MNPs), and hydroxyapatite (HAp). Also, advancing graphene oxide for modulating immune responses and influencing stem cell behavior. Moreover, shifting towards the progression of composite hydrogels with antioxidant and antibacterial properties to boost wound healing and reduce complications.

Why did the Biocompatibility Materials Segment Lead the Market in 2025?

The biocompatibility materials segment dominated the engineered materials science solutions for healthcare market in 2025. The market is escalating with a focus on multifunctional, bioinspired, and bioresorbable materials that support tissue regeneration and resist infection. In 2025, researchers used zinc and magnesium alloys for orthopedic implants and cardiovascular stents, which facilitates mechanical strength similar to natural bone and controlled corrosion rates.

Bioactive Materials

However, the bioactive materials segment is predicted to expand at a rapid CAGR. These materials have wider use in scaffolds and drug delivery systems to encourage cell adhesion, proliferation, differentiation, and overall tissue regeneration. Recently, bioactive glasses, like FDA-approved 45S5 and S53P4, have been highly used as bone graft substitutes and implant coatings for their ability to bond with bone and support new bone formation (osteogenesis).

How did the Orthopedic Devices Segment Dominate the Market in 2025?

In the engineered materials science solutions for healthcare market, the orthopedic devices segment held a dominant share in 2025. A rise in cases of osteoarthritis, osteoporosis, and degenerative bone diseases, especially among the aged population, is propelling the demand. The leading players are fostering the incorporation of hydroxyapatite and similar calcium phosphate ceramics, which leverage osseointegration (bone bonding) by mimicking the natural bone structure.

Cardiovascular Devices

Whereas the cardiovascular devices segment is estimated to register the fastest growth. Day by day, researchers are emphasizing the use of piezoelectric nanoparticles in stimuli-responsive hydrogel scaffolds for the conversion of mechanical strain into bioelectric signals, which assists in accelerating cardiomyocyte function and mimicking the natural rhythm of the heart. Ongoing breakthroughs in bioinks for 3D and 4D bioprinting are resulting in the development of tailored cardiac patches and even functional heart models for surgical planning.

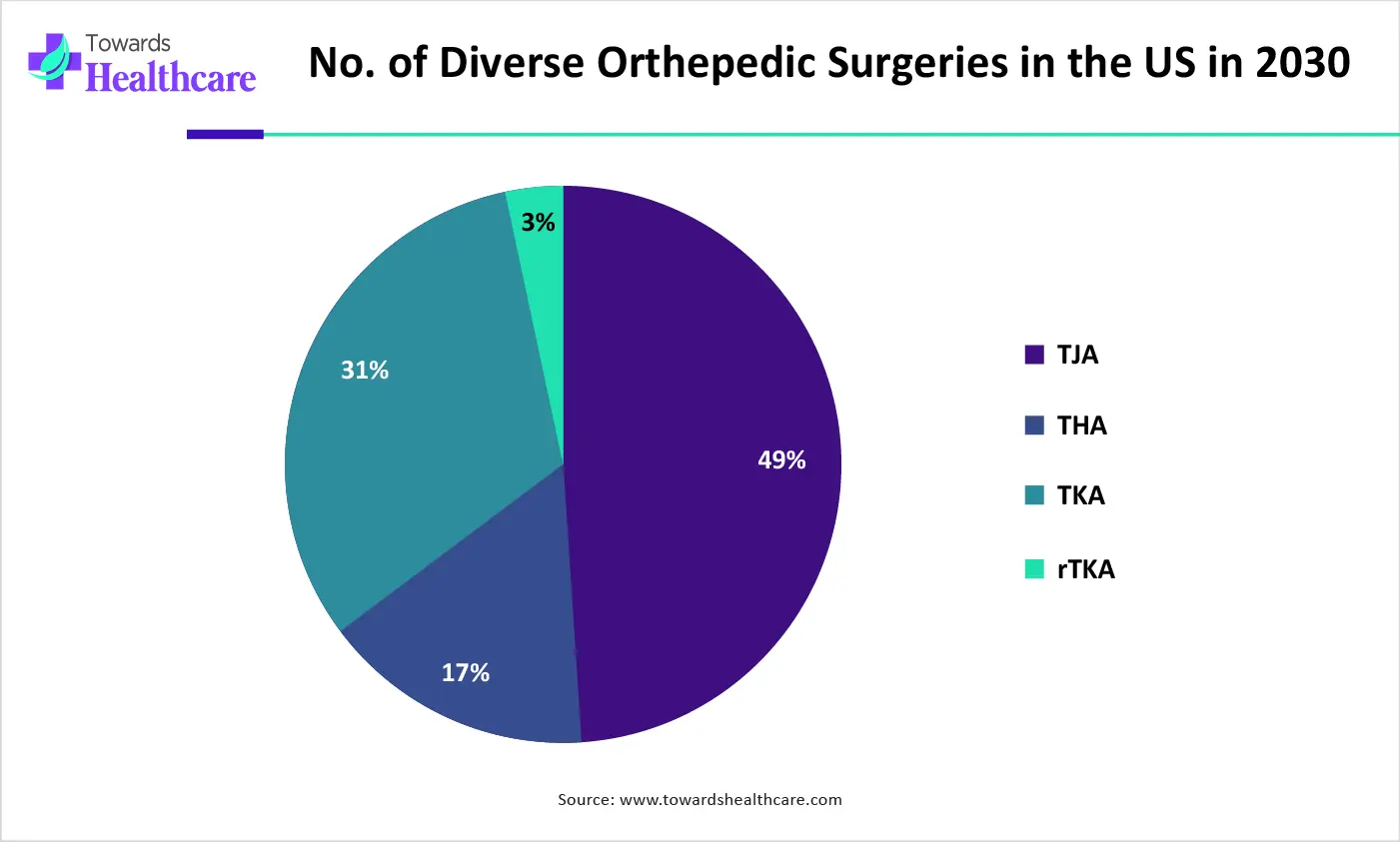

With a major share, North America led the engineered materials science solutions for healthcare market in 2025. The regional growth is mainly driven by a rise in focus on biocompatible polymers, ceramics, and composites for implants, devices, and advanced wound care. Alongside, many leaders are empowering the market with major investments in the healthcare sector. Researchers are increasingly using titanium alloys, cobalt-chrome, and advanced polymers in developing patient-specific orthopedic implants (knees, spine, hips) and surgical guides.

However, the U.S. market is also promoting significant breakthroughs in advanced biomaterials for enhanced implants, nanomaterials for targeted drug delivery, and specialized materials for 3D bioprinting.

For instance,

| Total Joint Arthroplasty (TJA) | 1,225,132 procedures |

| Primary Total Hip Arthroplasty (THA) | 433,372 procedures |

| Primary Total Knee Arthroplasty (TKA) | 791,760 procedures |

| Revision total knee arthroplasty (rTKA) | 72,968 procedures |

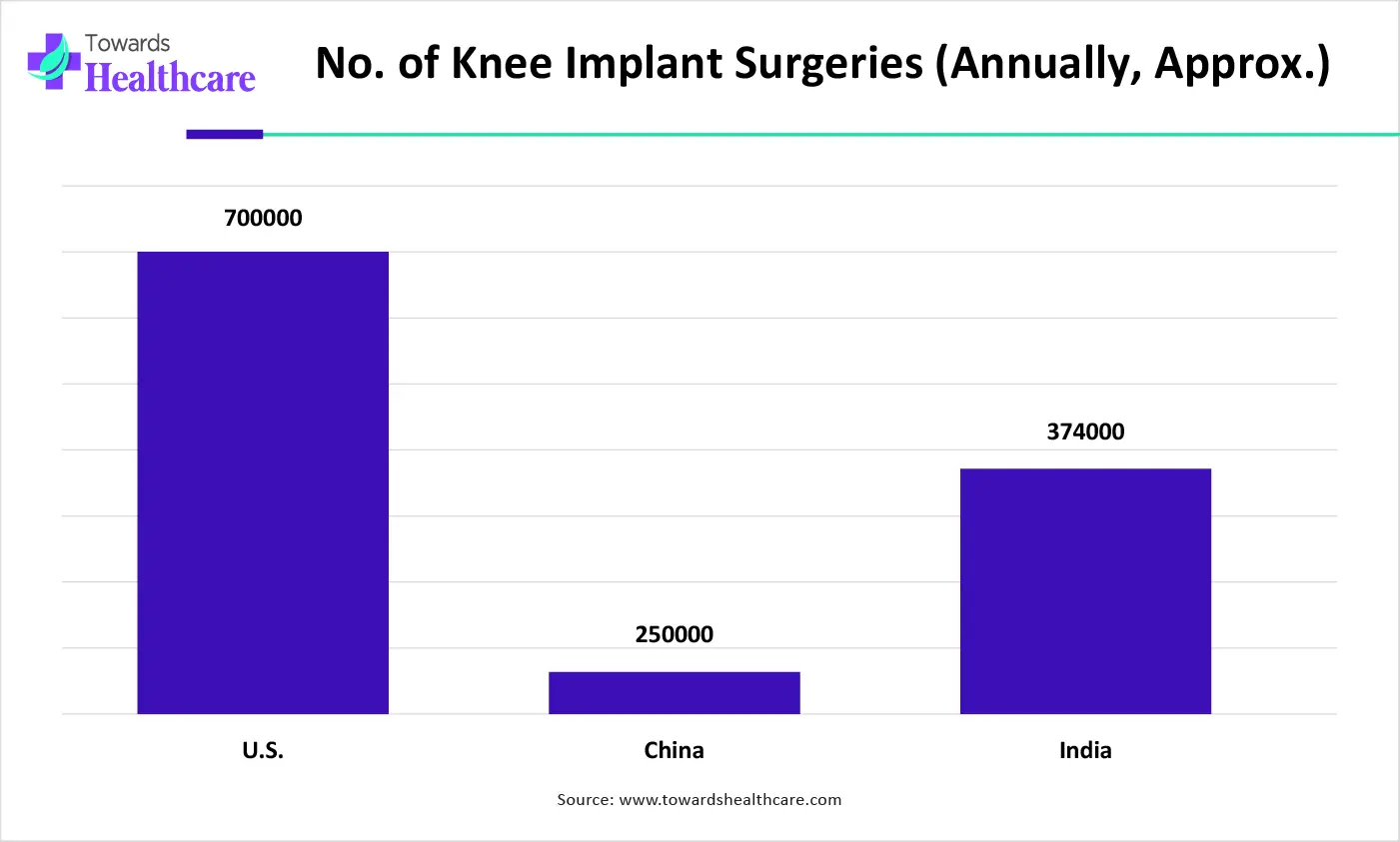

During the prospective period, the Asia Pacific will expand rapidly in the engineered materials science solutions for healthcare market. This will be prominently led by the accelerating disposable income and involvement of supportive government policies, specifically, "Make in India" and China's tech expansion. Alongside, they are shifting towards the use of biodegradable polymers (e.g., Polylactic Acid and Polyglycolic Acid) and metal alloys (magnesium, zinc, iron-based) for medical devices.

Japan is broadly using these materials mainly in orthopedic and neurologic tissue engineering to raise their strength and predictable degradation periods, allowing the repair of bone, cartilage, and nerve tissues.

For instance,

Latin America will expand notably, due to the escalating adoption of IoT-enabled (Internet of Things) and smart medical devices, from connected monitoring tools to diagnostic equipment. This is mainly bolstered by the incorporation of advanced materials, particularly medical plastics and elastomers, for increased durability, flexibility, and biocompatibility.

On the other hand, Brazil is encouraging innovations in surgical techniques, such as the Jatene procedure (heart surgery) and Cone procedure (tricuspid valve), which further demand advanced materials. Also, they are leveraging unique biodiversity for newer material and biotech solutions.

For instance,

| Leading Players | Offerings |

| Evonik Industries AG | This usually facilitates a complete portfolio of engineered material science solutions, such as VESTAKEEP PEEK (Polyether ether ketone). |

| Covestro AG | A company offers broader engineered material science solutions for the healthcare industry, with emphasis on high-performance polycarbonate and polyurethane-based materials. |

| Stryker Corporation | It mainly specialises in engineered materials science, specifically through additive manufacturing (3D printing). |

| Royal DSM | A company explores the advanced material portfolio called the "Care" line for non-invasive medical devices. |

| BASF SE | This significantly provides a "PRO" (Profile covered Raw materials Only) line of high-performance plastics optimized for medical applications. |

| Victrex PLC (Invibio) | A leader offers, through its medical division, Invibio Biomaterial Solutions, to provide high-performance PEEK (Polyetheretherketone) and PAEK-based polymers. |

| Solvay S.A. | It explores different medical-grade polymers known for their durability, chemical resistance, high-temperature tolerance, and regulatory compliance, like sulfone polymers. |

| Celanese Corporation | This mainly specialises in high-performance polymers and electronic inks for medical devices, drug delivery systems, and pharmaceutical components. |

| Medtronic plc | A company is focusing on biocompatible polymers, specialized metals and ceramics, and advanced medical textiles to develop diverse medical devices and implants. |

| 3M | It primarily facilitates various components and materials to other manufacturers, such as medical-grade adhesives. |

By Material Type/Product Type

By Application

By Function of Material

By Device Category Supported

By Region

January 2026

December 2025

December 2025

December 2025