March 2026

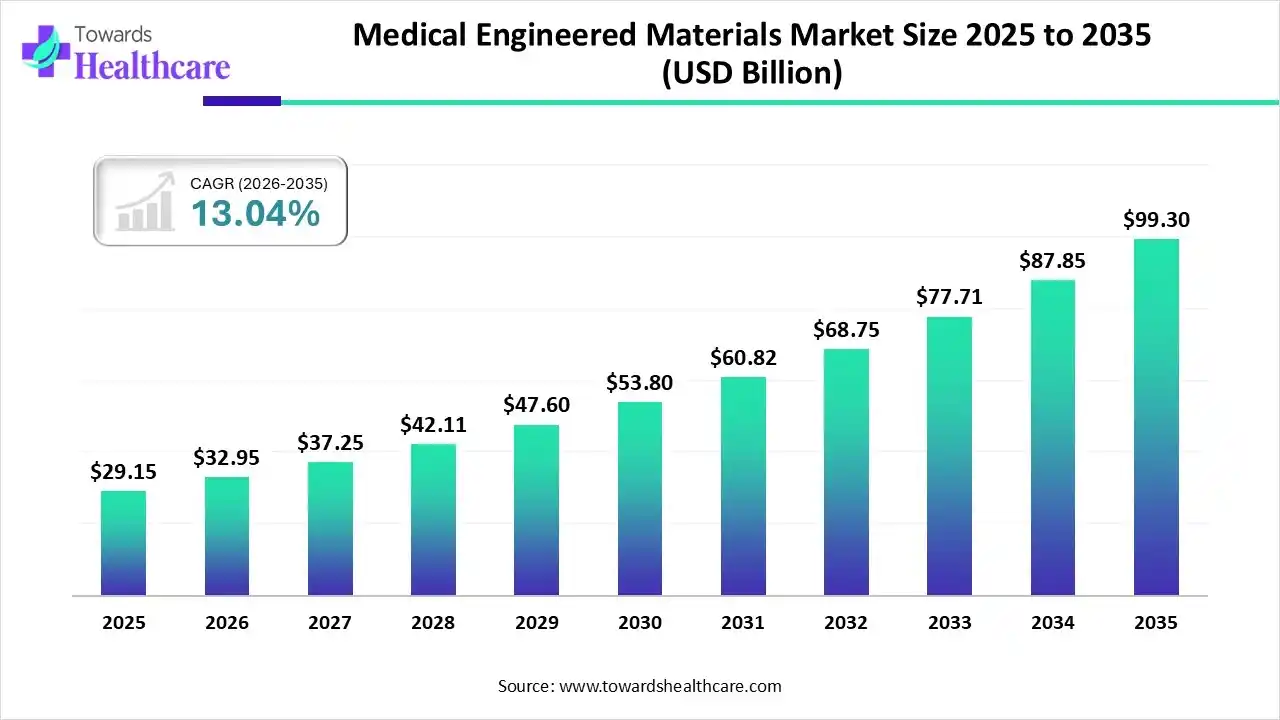

The global medical engineered materials market size was estimated at USD 29.15 billion in 2025 and is predicted to increase from USD 32.95 billion in 2026 to approximately USD 99.3 billion by 2035, expanding at a CAGR of 13.04% from 2026 to 2035.

The medical engineered materials market is growing due to these advanced materials, which are revolutionizing the game in healthcare technology by offering services that are more efficient, affordable, and last longer for patients.

| Key Elements | Scope |

| Market Size in 2026 | USD 32.95 Billion |

| Projected Market Size in 2035 | USD 99.3 Billion |

| CAGR (2026 - 2035) | 13.04% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Application, Regional Outlook |

| Top Key Players | Evonik Industries AG, Covestro AG, BASF SE, Solvay, SABIC, Trelleborg AB, Celanese Corporation |

The integration of AI-driven technology into the medical engineered materials drives the growth of the market, as AI-based technology is an attractive keystone of biomedical engineering by improving diagnostic capabilities, targeting treatment approaches, enhancing biomedical tools' performance, and optimizing medical care systems. AI incorporation in healthcare devices is driving advanced novelty in diagnostics, operational precision, and personalized medicine. AI-integrated materials are used for smart sensors, drug delivery, and tissue repair.

Which Type Led the Medical Engineered Materials Market in 2025?

In 2025, the medical plastics segment held the dominant market as medical plastic itself is intended to be chemical, temperature, and corrosion resistant. It handles recurrent sterilization cycles and any other medical or bodily fluids it comes into contact with. Their lightweight, affordability, biocompatibility, design flexibility, sterilisation compatibility, and electrical and radiation resistance make them an attractive choice in different applications.

Medical Adhesives

Whereas the medical adhesives segment is the fastest-growing in the market, as their capability to provide secure wound closure eliminates the requirements for outdated staples or suturing processes. These processes reduce the risks of infection, encourage rapid healing, and reduce scarring. Medical adhesives are available in versatile forms, and it used in different types of surgeries, including dermatology, orthopaedics, and cardiovascular technology. Their flexibility helps in adhering to various tissue types, ensuring a dependable bond that withstands the patient's body’s natural healing.

Why did the Medical Disposable Segment Dominate the Market in 2025?

The medical disposable segment is dominant in the medical engineered materials market in 2025, as it provides convenience, sterility, effectiveness, and, more significantly, improves the safety of patients. Disposable healthcare supplies are important in modern medicine. It removes reprocessing expenses because of the cleaning, sterilization, and logistics.

Medical Devices

Whereas the medical devices segment is the fastest growing in the market, as medical engineered materials device connectivity supports reducing errors and omissions in patient diagnostic information, and it allows doctors to access the most recent data on demand. Engineered medical devices are redesigning biomedical engineering in ways. Their biocompatibility, customizability, and scalability make them the greater choice over biological materials in various applications.

In 2025, the Asia Pacific led the medical engineered materials market. By 2050, the number of people aged 60 and above in the APAC region is expected to more than double, reaching a staggering 1.3 billion, which will increase the demand for medical engineered materials. The three major NCDs in the Asia Pacific region are CVDs, cancer, and diabetes because the increasing loss of disability-adjusted life years (DALYs) drives a consistent requirement for specialized materials in sensors and implants.

India Market Trends

In India growing adoption of advanced technology like 3D printing in the medical care industry is quickly transforming how medical treatments are advanced, delivered, and modified for individual patients. This technology requires a medical engineered material. India's medical care landscape is experiencing a digital transformation, driven by regulatory initiatives, guideline reforms, and technological developments, which drives the growth of the market.

North America is set to experience rapid growth in the medical engineered materials market, as this region has an advanced healthcare infrastructure that helps the growth and development of novel start-ups. North America also has world-class research institutions, like MIT, Stanford, and Harvard. This region maintains its leadership in developing technologies to confirm that technological advances favour democratic values and strengthen national security. Increasing partnership between the public and private sectors is significant to driving technological invention and driving the growth of the market.

For Instance,

U.S. Market Trends

The U.S. has long been a worldwide leader in healthcare tools production; the medical device field is significant to both healthcare innovation and economic strength. U.S. healthcare production is a dynamic landscape, continuously emerging with technological developments, shifting geopolitical tides, and a renewed focus on domestic resilience.

Europe is experiencing substantial growth in the medical engineered materials market, as European healthcare tools production grows due to increasing ageing populations, growing chronic diseases, regulatory support, robust research networks, and strong expenditure in medical care technology. Strong partnerships among higher education institutions and industry are a significant pillar of Europe's competitiveness. The EU government predominantly promotes the use of research groups and networks, including science universities, research institutes, public organizations, and private businesses, which contribute to the growth of the market.

UK Market Trends

UK medical device manufacturers operate in one of the most advanced governing frameworks in the world. With many innovations in technology and applications, the UK is still one of the most promising places for healthcare device production. This region is the largest life sciences industry in Europe, which attracts worldwide interest and investment.

| Company | Headquarters | Latest Update |

| Evonik Industries AG | Germany | In September 2025, Evonik and AMSilk, a worldwide leader in advanced biomaterials based on silk proteins, deepened their partnership with a long-term agreement to produce sustainable silk proteins at an industrial scale. |

| Covestro AG | United Kindom | In December 2025, Covestro, one of the world’s leading suppliers of high-performance polymer materials, and Allmed, a worldwide blood purification specialist, announced a partnership to examine together the recycling of used artificial kidney filters. |

| BASF SE | Japan | In June 2025, BASF strengthens its commitment to the biopharma and pharmaceutical ingredients industries through a novel investment in North America. |

| Solvay | Belgium | Solvay is hurrying its worldwide circularity efforts by adapting its extremely dispersible silica (HDS) production in Asia to circular raw materials |

| SABIC | Saudi Arabia | In December 2025, SABIC, a worldwide chemical sector leader, unveiled LNP ELCRES NPCRX9612U, the first in a novel family of polycarbonate copolymer resins formulated completely without fluorine or other per- and polyfluoroalkyl substances (PFAS). |

| Trelleborg AB | Sweden | In December 2025, Trelleborg Medical Solutions announced the grand opening of its novel 107,600 square feet/10,000 square meter manufacturing facility in Costa Rica’s Evolution Free Zone Industrial Park. |

| Celanese Corporation | United States | In May 2025, Celanese Corporation, a worldwide field materials and chemical company, increase cost for a wide range of products and wishes to offer customers context for decision and suitable notice for planning purposes. |

By Type

By Application

By Region

March 2026

March 2026

February 2026

February 2026