February 2026

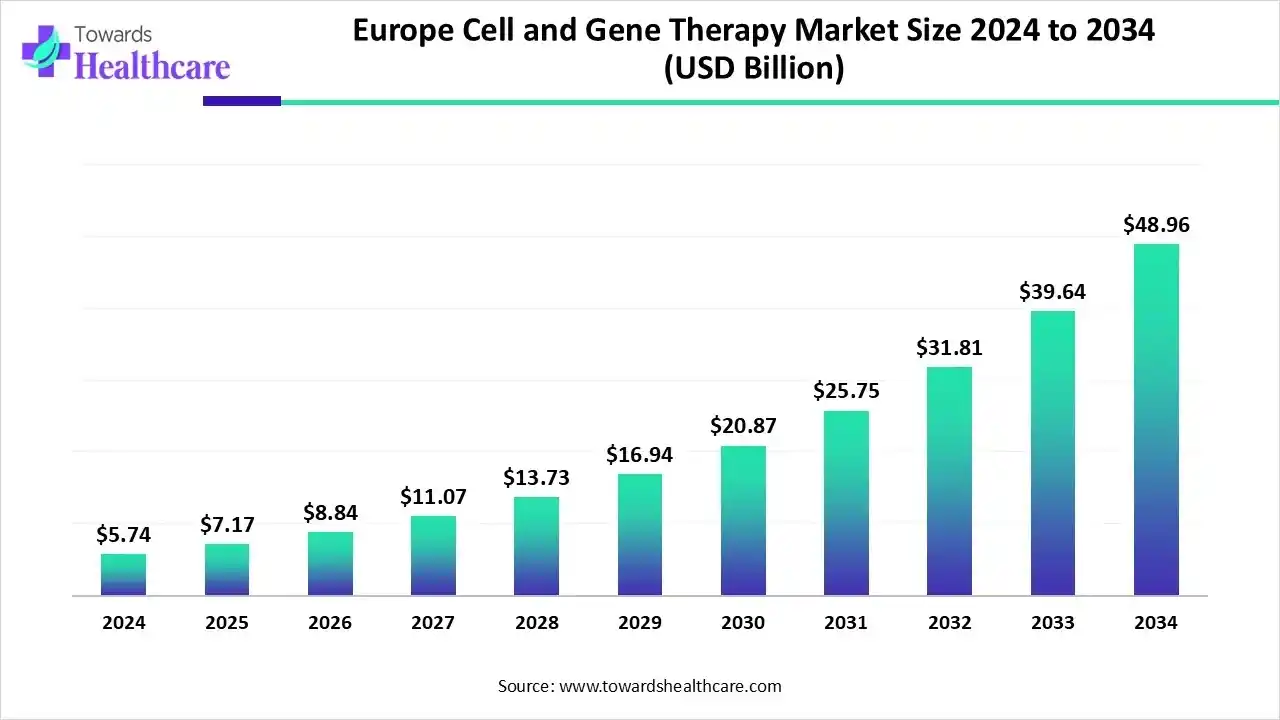

The Europe cell and gene therapy market size is estimated at US$ 2.74 billion in 2024, is projected to grow to US$ 7.17 billion in 2025, and is expected to reach around US$ 48.96 billion by 2034. The market is projected to expand at a CAGR of 23.90% between 2025 and 2034.

The Europe cell and gene therapy market is growing because of the rising spending by the government, supportive regulatory investment, and growing demand for advanced therapies. Major key players such as biotech firms, pharmaceutical companies, and academic institutions. CAR-T cell therapies gained popularity, supported by EMA approvals and funding initiatives such as Horizon Europe, which drives the growth of the market.

| Table | Scope |

| Market Size in 2025 | USD 7.17 Billion |

| Projected Market Size in 2034 | USD 48.96 Billion |

| CAGR (2025 - 2034) | 23.90% |

| Market Segmentation | By Therapy Type, By Therapeutic Area, By Vector Type, By Cell Source, By Manufacturing Scale, By End User, By Region |

| Top Key Players | Oxford Biomedica (UK), Orchard Therapeutics (UK), Autolus Therapeutics (UK), GlaxoSmithKline (UK), AstraZeneca (UK/Sweden), Sanofi (France), Cellectis (France), Miltenyi Biotec (Germany), Evotec (Germany), Cell Medica (UK), MolMed (Italy), GenSight Biologics (France), uniQure (Netherlands), Adaptimmune (UK), Horizon Discovery (UK, now PerkinElmer) |

The Europe cell and gene therapy market represents one of the most advanced hubs for regenerative medicine worldwide, supported by strong regulatory pathways such as the European Medicines Agency (EMA) and the Committee for Advanced Therapies (CAT). Cell therapy focuses on the use of living cells, including stem cells and immune cells, for tissue repair, immune modulation, or cancer therapy.

Gene therapy involves the transfer of genetic material via viral or non-viral vectors to treat rare and chronic diseases. Europe is distinguished by its collaborative research networks, active public-private partnerships, and specialized innovation hubs in Germany, the UK, France, Spain, and Italy. Strategic investments in clinical trials, coupled with growing rare disease initiatives, make Europe a critical region for market expansion.

For Instance,

Incorporation of AI drives the growth of the Europe cell and gene therapy market, as AI-driven technologies streamline CGT production through automating batch recording and data analysis, lowering challenges, and confirming compliance. AI-driven systems excel in gene therapy efficiency and safety prediction by integrating various datasets. AI-based techniques uncover expressive patterns and the strength of biomarkers in genomics and molecular datasets. This finding process aids in classifying new therapeutic targets, evolving patient stratification strategies, and establishing biomarkers to monitor treatment efficiency.

This technology helps in cell and gene therapy processes, from an improved design of genetic constructs based on an integrated analysis of technical evidence, to the optimization of procedures or the selection of the ideal targeted product for a particular patient, based on the integrated knowledge generated by any earlier treated patient with a similar medical product or condition.

Increasing the multi-partner initiatives to accelerate advancement in cell and gene therapy for treating rare and genetic diseases, which contributes to the growth of the Europe cell and gene therapy market.

For instance,

Escalating government announcements related to modern biotech solutions, which drive the growth of the market.

For Instance,

| Company | Investment |

| HAYA Therapeutics | HAYA Therapeutics Raises $65 Million in Series A Funding to Deliver Precision RNA-Guided Medicines for Chronic and Age-Related Diseases. |

| Laverock Therapeutics | Laverock Therapeutics, a UK-based gene control company, has expanded its seed funding round, raising over £20 million. |

| Splice Bio | SpliceBio secures $135 million Series B financing to advance lead program SB-007 in Stargardt disease and expand pipeline of genetic medicines. |

In therapy type, the cell therapy segment led the Europe cell and gene therapy market, with approximately 58% share, as cell and gene therapies have huge potential to renew nerves and enhance the quality of life for those with neurodegenerative diseases or spinal cord injuries. Cell therapy lowers inflammation and modulates the immune system, making it a hopeful treatment option for different medical conditions. Potential uses of cell therapies involve treating cancers, urinary problems, autoimmune disease, and infectious disease, transforming damaged cartilage in joints, restoring spinal cord injuries, enhancing a weakened immune system, and serving patients with nerve disorders.

For Instance,

On the other hand, the gene therapy segment is projected to experience the fastest CAGR from 2025 to 2034, as gene editing therapy is a method to manage genetic diseases. Approved gene therapies manage inherited blood, eye, and neuromuscular diseases, and other genetic health conditions. It functions by either replacing a disease-causing gene or giving patients a working copy of that gene. To edit a gene, researchers use particular tools such as CRISPR/Cas9 to change a disease-causing gene, therefore, it makes the correct protein.

By therapeutic area, the oncology segment led the Europe cell and gene therapy market in 2024, with approximately 48% share, as cell and gene therapies (CGT) are transforming cancer treatment. These therapies offer targeted and novel ways to tackle various types of the disease. These treatment modalities provide the hope of finding precise and effective interventions for different pediatric, hematologic, solid tumors, and genetic cancers. CGT has shown effectiveness in different types of cancer, pointing to a glimmer of hope for patients with complex diagnoses.

On the other hand, the rare genetic disorders segment is projected to experience the fastest CAGR from 2025 to 2034, as cell and gene therapy rapidly offer a cure, repairing the genetic defect and freeing patients from life-threatening disease and the requirement for symptomatic or disease-modifying treatment. These therapies introduce genetic material into a patient’s cells to precise or compensate for a faulty or missing gene. This therapy is promising as many rare diseases are caused by a single genetic mutation. By correcting or reimbursing for this mutation, cell and gene therapy has the potential to offer a long-term, possibly curative treatment.

By Vector Type, the viral vectors segment led the Europe cell and gene therapy market in 2024, with approximately 72% share, as they are significantly used to transport target or therapeutic genes in gene therapy. The vector is beneficial for alleviating the gene of interest in the specific cell genome. These vectors assimilate into the host genome by reverse transcriptase.

On the other hand, the non-viral vectors segment is projected to experience the fastest CAGR from 2025 to 2034, as it lowers pathogenicity, has low expenses, and is simple to produce; non-viral vectors have significant safety benefits over viral strategies. The significant benefit of using non-viral vectors is due to their biosafety. Non-viral vectors have drawn noteworthy consideration as its less immunotoxicity.

By cell source, the autologous segment led the Europe cell and gene therapy market in 2024, with approximately 62% share, as autologous cells provide many advantages, such as lower challenges of rejection, targeted treatment choice, improved engraftment, and reduced ethical concerns. Autologous cell therapy comprises harvesting cells from a patient and then modifying them outside the body in a lab by using gene editing or different techniques. These adjustments aim to correct or improve their function to address the basic healthcare condition.

On the other hand, the allogeneic segment is projected to experience the fastest CAGR from 2025 to 2034, as it is a potential cell source, with donated tissues, umbilical cord blood, placenta, bone marrow, and encouraged embryonic and pluripotent stem cells. Patient-derived samples are matched to the receiver before transplantation. This cell is obtained from young healthy donors, removing any co-morbidities associated with states of the disease.

By manufacturing scale, the clinical-scale segment led the Europe cell and gene therapy market in 2024, with approximately 67% share, as clinical scale provides numerous advantages, including cost reduction, enhanced consistency of product, improved control, and the strength to meet government standards. Clinical-scale manufacturing uses automated and closed systems, enabling therapies to evolve capably from early-stage progress to wider patient access.

On the other hand, the commercial-scale segment is projected to experience the fastest CAGR from 2025 to 2034, through this scale improves efficiency, affordability, and controls quality. This is attained by shifting away from the manual, variable, and expensive processes applied in clinical trials toward more advanced, automated, and standardized manufacturing systems.

By end-user, the biopharma and biotechnology companies segment led the Europe cell and gene therapy market in 2024 with approximately 52% share, as these companies use genetic material to manufacture genomic material gene, cell, and gene editing treatments that repair genetic mutations and introduce efficient genes to take the place of the mutated gene. This therapy is targeted and lowers adverse effects.

On the other hand, the hospitals and specialty clinics segment is projected to experience the fastest CAGR from 2025 to 2034, as cell and gene therapy is a promising, speedily progressing sector with huge potential to transform medicine in disease areas with significant therapeutic requirements in hospitals and specialty clinics. These therapies emerged as a promising therapeutic modality with the latent to treat and manage different types of diseases.

Germany is dominant in the market in 2024, with approximately 28% share, due to the presence of advanced R&D infrastructure, massive spending from the government and private sectors, an extremely industrialised biotech ecosystem, and a facilitative government framework. Now Germany prepares a novel national strategy for gene and cell therapies, as the German Federal Ministry of Education and Research (BMBF) has custom-made the Berlin Institute of Health (BIH) to organise and moderate the expansion of a national strategy for GCT, which drives the growth of the market.

For instance,

R&D processes optimize manufacturing processes, often using bioreactors for viral vector production or chemical synthesis for non-viral systems. It also involves cell and DNA engineering, rigorous quality control, and innovative clinical trial design to demonstrate safety and efficiency in humans.

Key Players: Novartis and Bristol Myers Squibb (BMS)

Gene and cell therapy clinical trials are often structured as a phase I / II study where a small group of participants with the disease are enrolled, and both safety and efficacy tests are performed.

Key Players: Gilead Sciences and Roche

Personalized care, financial navigation assistance, educational resources, data-assisted decisions, and collaboration with patient advocacy groups are some of the significant components in this complex equation.

Key Players: Johnson & Johnson and Bluebird Bio

By Therapy Type

By Therapeutic Area

By Vector Type (for Gene Therapy)

By Cell Source (for Cell Therapy)

By Manufacturing Scale

By End User

By Region

February 2026

February 2026

February 2026

February 2026