February 2026

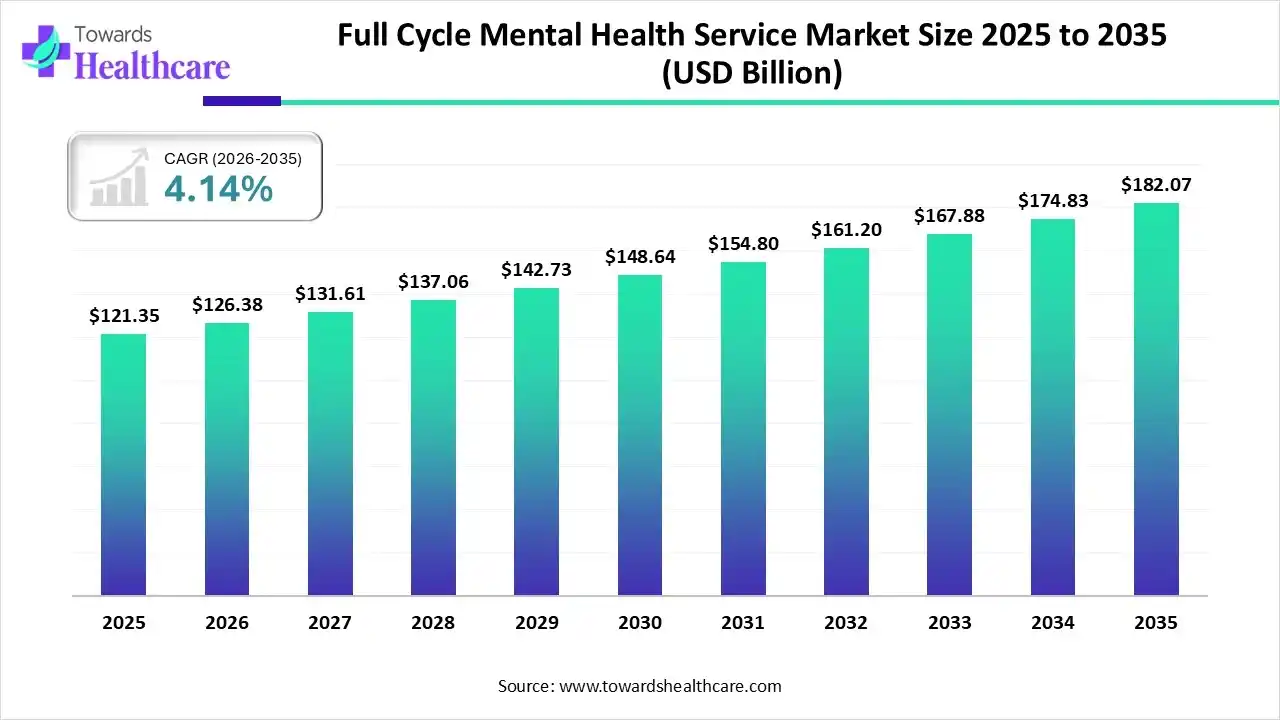

The global full-cycle mental health service market size is expected to be worth around USD 182.07 Billion by 2035, from USD 121.35 billion in 2025, growing at a CAGR of 4.14% during the forecast period from 2026 to 2035.

The full-cycle mental health service market is experiencing robust growth, driven by the growing awareness of mental health care and the increasing demand for telehealth. Government bodies launch initiatives to raise awareness about early detection and intervention in mental health. The availability of reimbursement policies from government and private insurers also contributes to market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 126.38 Billion |

| Projected Market Size in 2035 | USD 182.07 Billion |

| CAGR (2026 - 2035) | 4.14% |

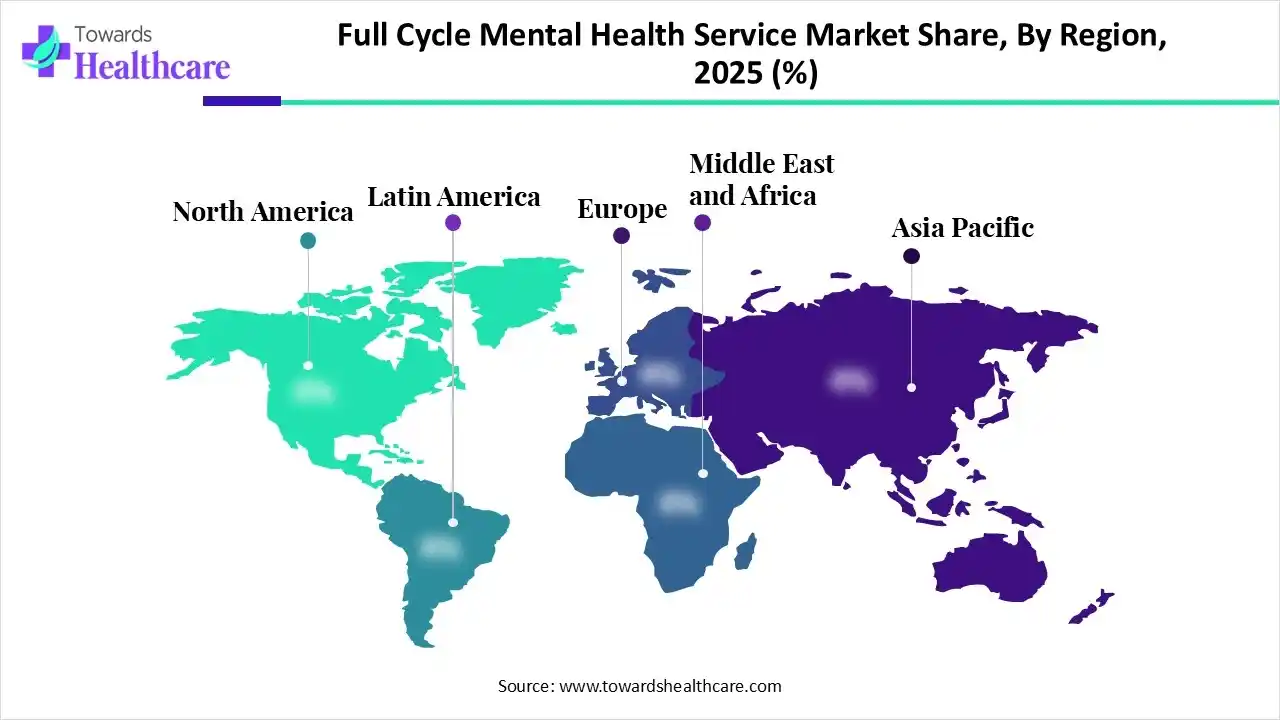

| Leading Region | North America |

| Market Segmentation | By Service Type, By Target Population, By Delivery Method, By Provider Type, By Region |

| Top Key Players | Universal Health Services, Inc., Core Solutions, Inc., Modern Health, TalktoAngel, Optum, Teladoc Health, Carelon Behavioral Health, Lyra Health, Magellan Health |

The full-cycle mental health service market refers to providing a wide range of services, including diagnosis, treatment, and rehabilitation, for people of different age groups. It is a comprehensive, integrated system of care that addresses a person’s mental health disorders across their entire lifespan. Full-cycle service addresses factors that promote mental well-being, offer protection, and mitigate risks at each life stage while considering the intergenerational influences on mental health.

Artificial intelligence (AI) plays a vital role in providing personalized care and intervention to individuals of all age groups, revolutionizing the market. AI and machine learning (ML) algorithms can analyze vast amounts of data and predict behavioral patterns of patients. They keep track of patients’ records and provide real-time data to healthcare professionals, enabling them to make proactive clinical decisions. AI-based sensors are embedded in wearable devices to improve symptom tracking and maintain mental well-being.

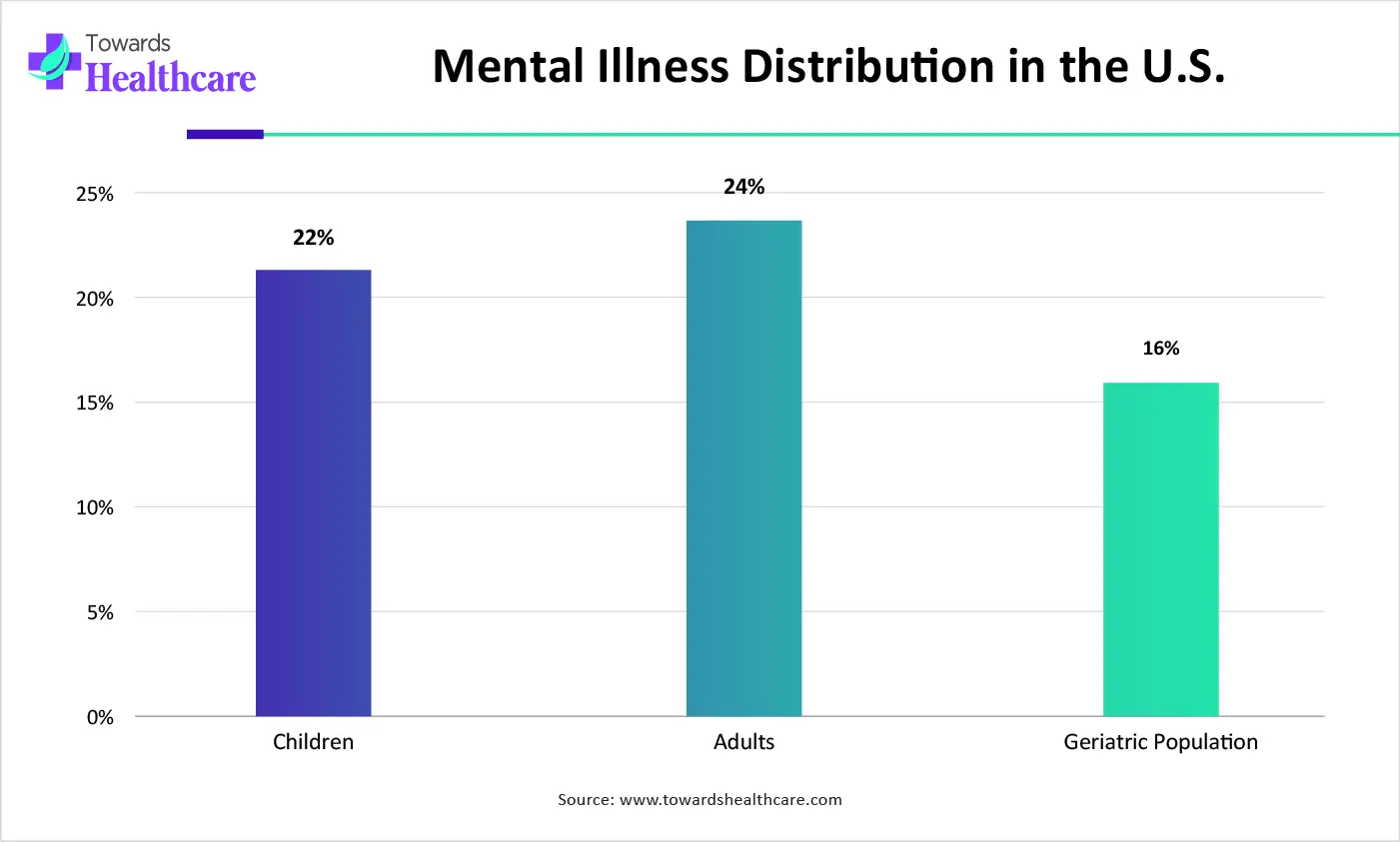

| Age Groups | Prevalence Rate of Mental Illnesses in the U.S. |

| Children | 22% |

| Adults | 24% |

| Geriatric Population | 16% |

Which Service Type Segment Dominated the Full-Cycle Mental Health Service Market?

The assessment and diagnosis segment held a dominant revenue share of the market in 2025, due to the growing awareness of mental health illnesses diagnosis. Government organizations launch initiatives to promote screening and early diagnosis of mental health disorders. Telehealth enables online counseling and a detailed mental health assessment, reducing geographical barriers. Some common diagnostic parameters in detecting mental health disorders include a physical exam, lab tests, and a psychological evaluation.

Therapeutic Services

The therapeutic services segment is expected to grow at the fastest CAGR in the market during the forecast period. Early intervention for mental health disorders is essential to prevent further complications and disease severity. Therapeutic services include medications, counseling, peer support, and community support services. They help patients develop the ability to understand and solve problems and manage stress.

Why Did the Adults Segment Dominate the Full-Cycle Mental Health Service Market?

The adult segment held the largest revenue share of the market in 2025, due to the high risk of developing mental illness in young adults. Mental health conditions often stem from life events, such as pregnancy, divorce, bereavement, unemployment, and imprisonment. Adults are more aware of preventing, diagnosing, and treating mental health disorders. Targeted workplace strategies and integrating mental health screening into antenatal care are some effective treatment strategies.

Children and Adolescents

The children and adolescents segment is expected to grow with the highest CAGR in the market during the studied years. Children and adolescents are at high risk of developing mental illness due to academic pressures, peer interactions, and performance challenges. Depression, anxiety, and behavioral disorders are among the leading causes of illness and disability among adolescents. The World Health Organization (WHO) reported that about 1 in 7 10-19-year-old children experience a mental disorder.

How the In-person Services Segment Dominated the Full-Cycle Mental Health Service Market?

The in-person services segment contributed the biggest revenue share of the market in 2025, due to the ability of patients to access appropriate equipment and facilities. In-person services are valuable for physical examinations and adjusting treatment plans by assessing patients’ conditions. They usually provide higher-quality care compared to remote monitoring services. A recent survey on 1,226 participants found that 865 people, or 71%, preferred in-person visits.

Telehealth Services

The telehealth services segment is expected to expand rapidly in the market in the coming years. Telehealth services enable patients to receive personalized and advanced services from healthcare professionals across the globe. They save patients’ time and costs associated with visiting a doctor personally. They also reduce the administrative burden on healthcare staff. They also enhance patient engagement with guided support and regular contact.

Which Provider Type Segment Led the Full-Cycle Mental Health Service Market?

The private practitioner segment led the market in 2025, due to the growing demand for personalized care. Private practitioners help patients through talk therapy, medication management, or specialized treatments. They collaborate with other practitioners to serve a larger patient population. They offer advanced services for a wide range of disorders owing to the presence of specialized facilities.

Healthcare Institutions

The healthcare institutions segment is expected to witness the fastest growth in the market over the forecast period. Healthcare institutions provide a spectrum of mental health services, from primary care integration to specialized inpatient care. They have specialized professionals from all departments, providing multidisciplinary expertise to patients. They are part of community-based programs from government bodies.

North America dominated the global market in 2025. The presence of key players, a robust healthcare infrastructure, and favorable regulatory support are major factors that drive market growth in North America. The growing demand for personalized therapy and the rising adoption of advanced technologies bolster market growth. The increasing burden of mental health illnesses among people living in the U.S. and Canada potentiates the demand for full-cycle mental health services.

Canada Market Trends

It is estimated that over 1 in 5 people in Canada are living with mental health disorders. The Canadian Mental Health Association projects that by age 40, about half of Canada’s population will have or have had a mental illness. Mental illness is a significant issue among Canadians, affecting the productivity of 500,000 Canadians.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. People are becoming aware of personalized mental health services due to rapidly changing demographics. The increasing investment in developing the necessary infrastructure for mental health services contributes to market growth. The rising public-private partnerships and favorable government initiatives also augment the market. Out of 1 billion people living with mental health conditions globally, approximately 260 million people live in the Southeast Asia region.

Australia Market Trends

In Australia, there were about 268,500 overnight mental health-related hospitalizations and 245,500 same-day hospitalizations in 2023-24. The Australian government provides coverage for mental health services through its Medicare Benefits Schedule (MBS). As part of MBS, about 2.7 million Australians, representing 10% of the total population, received 12.7 million Medicare mental health services.

Europe is expected to grow at a notable CAGR in the foreseeable future. European nations collaborate with the WHO to enhance access to mental health services, especially in rural areas and marginalized populations. Government organizations launch initiatives and provide funding to develop a suitable infrastructure for personalized mental health services. The increasing use of telehealth services and the growing demand for decentralized care foster market growth.

UK Market Trends

Mental illnesses account for a total annual cost of £24 billion to £27 billion to the government in the workplace. Hence, the UK government invests in several initiatives and measures to support mental healthcare across the nation. From 2023 to 2024, the NHS invested £57 million to support local suicide prevention plans and bereavement services.

| Companies | Headquarters | Offerings |

| Universal Health Services, Inc. | Pennsylvania, United States | It is one of the leading healthcare management companies with over 400 acute care and behavioral care facilities. |

| Core Solutions, Inc. | Pennsylvania, United States | It offers an EMR/EHR behavioral health platform that simplifies care, elevates clinical and financial excellence, and empowers behavioral health providers and clients. |

| Modern Health | California, United States | It delivers evidence-based, equitable mental health services globally, from self-guided tools to crisis care. |

| TalktoAngel | New Delhi, India | It is an online counseling platform that offers affordable, confidential, and solution-oriented online counseling and online therapy. |

| Optum | Minnesota, United States | It offers personalized behavioral health solutions to create greater access to care while improving the value of care. |

| Teladoc Health | New York, United States | It provides online therapy and mental health counseling for patients with mental illnesses and virtual mental healthcare for employers. |

| Carelon Behavioral Health | Massachusetts, United States | It offers a full range of mental health services, from counseling and support to intensive inpatient treatment. |

| Lyra Health | California, United States | It delivers evidence-based mental health care to boost employee well-being and drive business impact. |

| Magellan Health | Arizona, United States | The company offers a person-centered approach to behavioral health, well-being, and related solutions through a clinical-first philosophy focused on evidence-based solutions. |

By Service Type

By Target Population

By Delivery Method

By Provider Type

By Region

February 2026

February 2026

February 2026

February 2026