February 2026

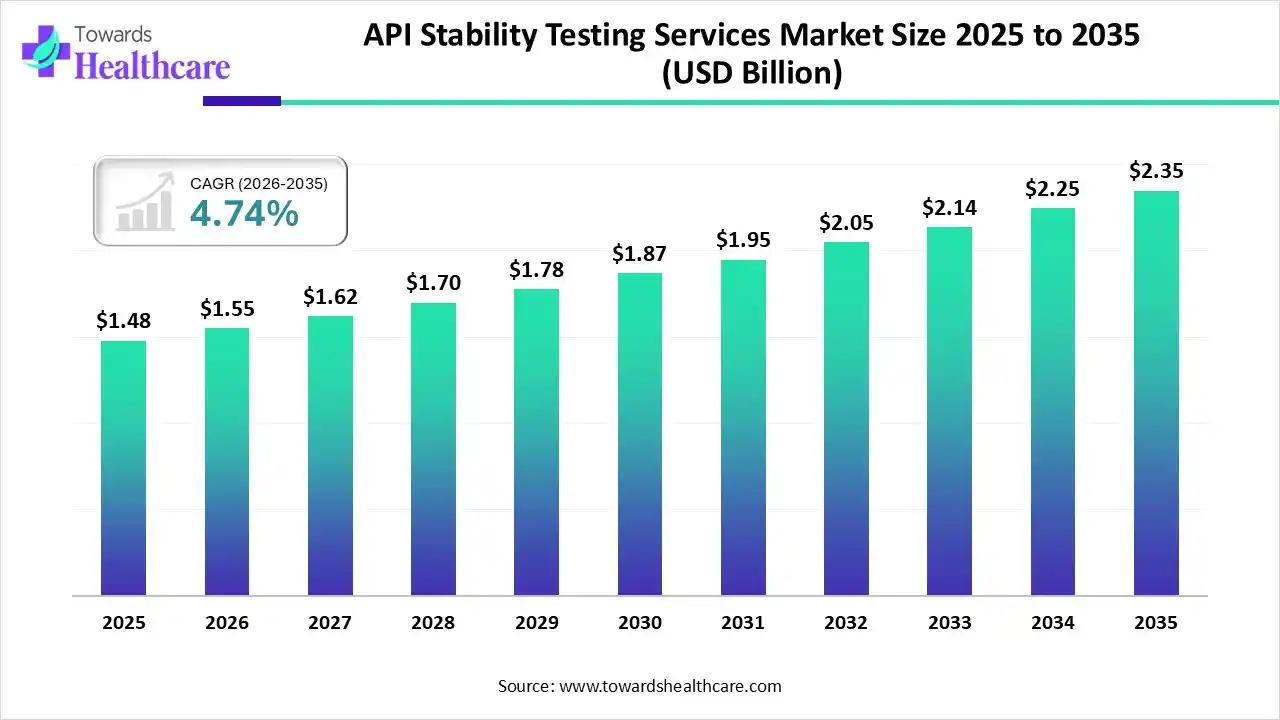

The global API stability testing services market size was estimated at USD 1.48 billion in 2025 and is predicted to increase from USD 1.55 billion in 2026 to approximately USD 2.35 billion by 2035, expanding at a CAGR of 4.74% from 2026 to 2035.

The "Biologics Boom" and a massive wave of global regulatory updates (specifically ICH Q1A to Q1F revisions) that require more rigorous, multi-year real-time and accelerated data for drug substances are driving the demand for API stability testing services. Growing diseases, AI integration, and new stability testing platform launches are also promoting the market growth.

The API stability testing services market is driven by stringent regulatory requirements for drug substances before they are formulated into finished products. The API stability testing services encompass specialized laboratory services utilized to evaluate and monitor the API stability. Moreover, these services help in ensuring the product’s safety, efficacy, and quality throughout its shelf life.

The use of AI in the API stability testing services market is increasing, where it analyzes large datasets of the API, ensuring their stability and quality. Its algorithms also analyze the degradation pathways, reducing the reliance on real-time stability studies. It also detects the product variations, monitors the product’s lifecycle, and helps in the optimization of stability studies under various stress conditions.

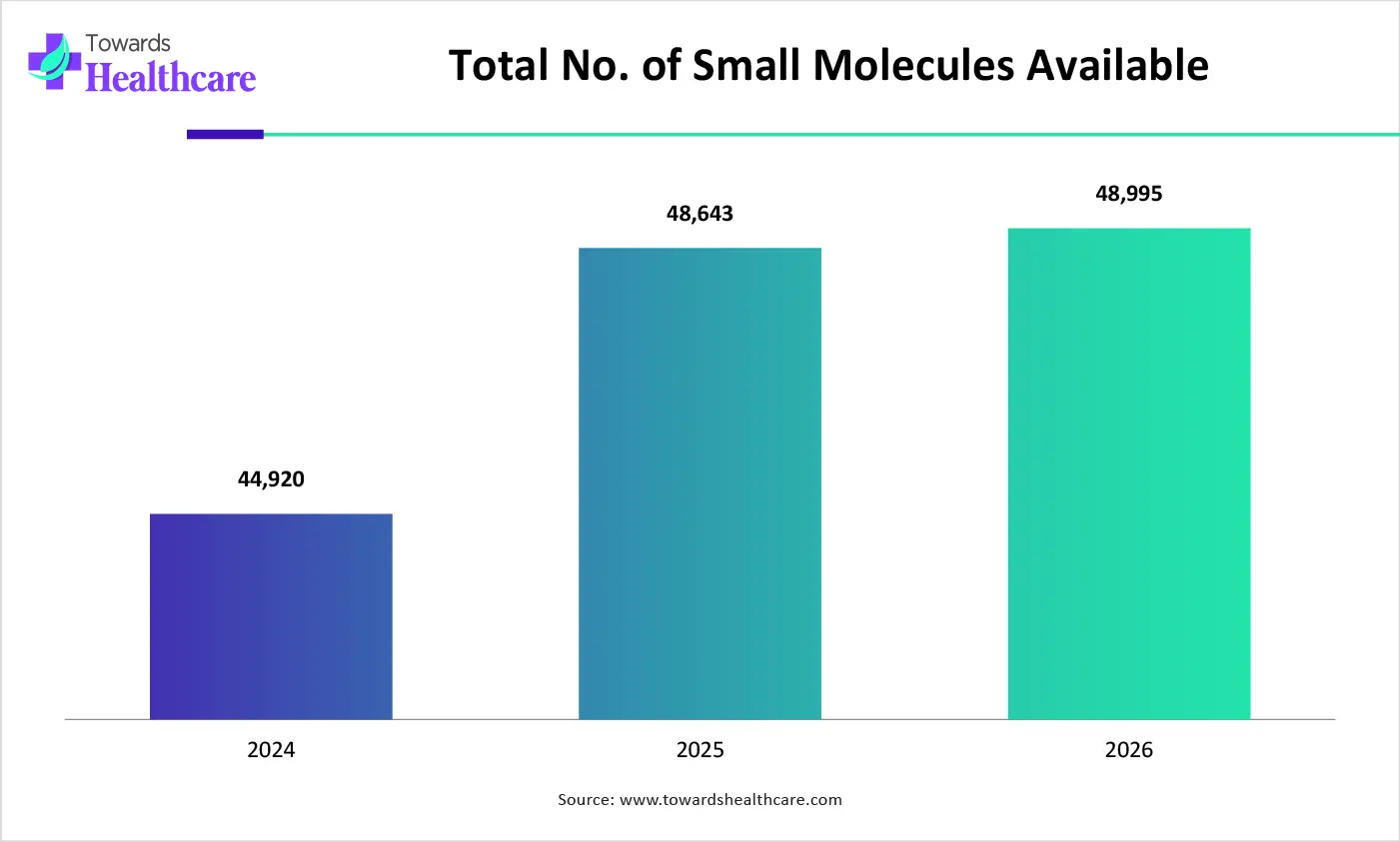

Different types of small molecules, large molecules, biologics, biosimilars, and advanced therapies are being developed, which is increasing the demand for stability data, leading to increased use of API stability testing services.

Various digital tools and analytical techniques are being developed and utilized for automated analysis and remote monitoring, where automated stability chambers are also being utilized to enhance the product reproducibility.

The growing R&D activities, stringent regulations, and investment are leading to new collaborations with CROs and CDMOs to leverage their end-to-end and affordable API stability testing services.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.55 Billion |

| Projected Market Size in 2035 | USD 2.35 Billion |

| CAGR (2026 - 2035) | 4.74% |

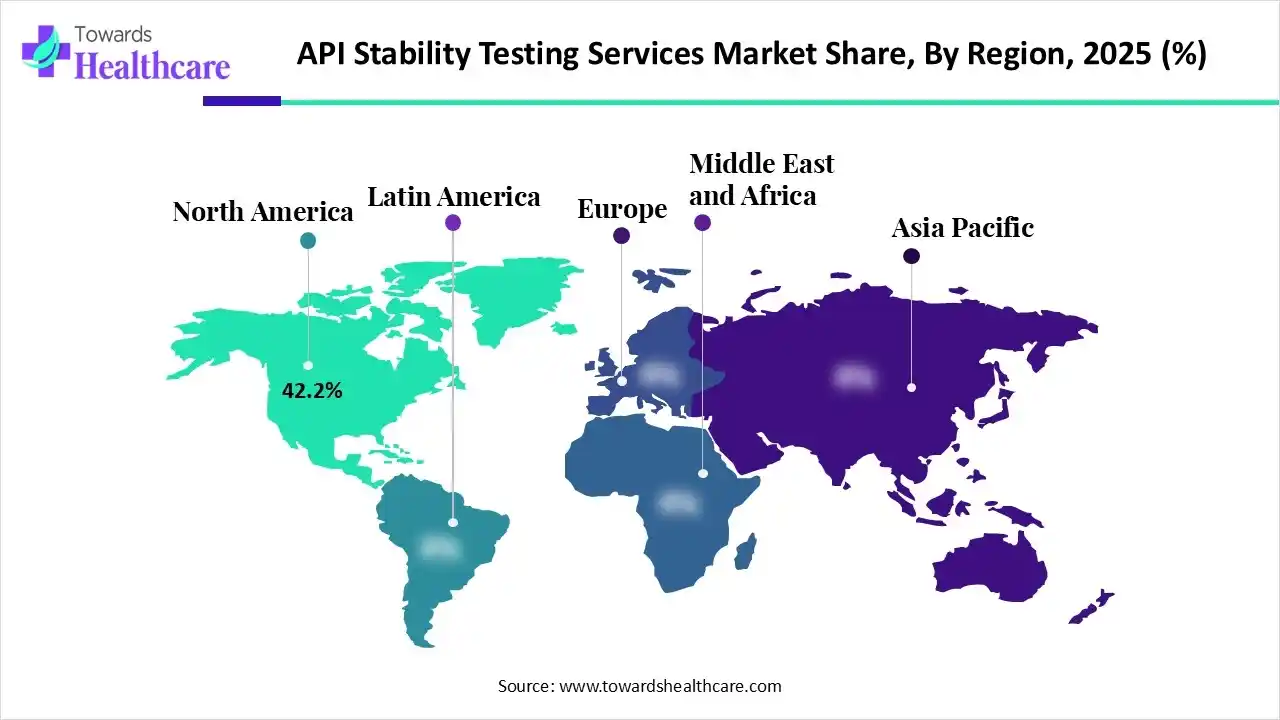

| Leading Region | North America by 42.2% |

| Market Segmentation | By Test Type, By Molecule Type, By End-User, By Region |

| Top Key Players | Eurofins Scientific, SGS S.A., WuXi AppTec, Charles River Laboratories, Intertek Group PLC, Catalent, Inc., LabCorp, Thermo Fisher Scientific, PPD, Vimta Labs |

Which Test Type Segment Held the Dominating Share of the Market in 2025?

The accelerated stability testing segment held the dominant share of approximate 42% in the API stability testing services market in 2025, as they utilized stress conditions (high temperature/humidity) to predict shelf-life and degradation pathways quickly. Moreover, their affordability, faster results, and compliance with regulatory standards also increased their adoption rates.

Real-time Stability Testing

The real-time stability testing segment is expected to show the highest growth during the predicted time, as it is essential for regulatory approvals and validation of product shelf life. They also provide real-world performance, actual storage conditions, and ensure product safety and efficacy, which is increasing their use.

Why Did the Small Molecules Segment Dominate in the Market in 2025?

The small molecules segment led the API stability testing services market with approximate 58% share in 2025, due to the massive generic drug pipeline. The API stability testing services were also utilized for stability and storage assessments, where their regulatory compliance also encouraged their use.

Large Molecules

The large molecules segment is expected to show the fastest growth rate with 12.1% CAGR during the upcoming years, as they require ultra-cold storage ($-80$°C) and complex analytical methods (capillary electrophoresis, bioassays) that command 3x higher service fees. The growing chronic diseases are increasing the demand, where all these factors are promoting the use of API stability testing services.

What Made Pharmaceutical & Biotech Companies the Dominant Segment in the Market in 2025?

The pharmaceutical & biotech companies segment held the dominant share of approximately 63.6% in the API stability testing services market in 2025, driven by their increased reliance on "Stability-as-a-Service" to avoid the cost of building compliant in-house stability suites. Additionally, stringent regulations and growth in R&D investments also increased the use of API stability testing services.

Contract Development & Manufacturing Organizations (CDMOs)

The contract development & manufacturing organizations (CDMOs) segment is expected to show the highest growth during the forthcoming years, due to growing outsourcing trends. The CDMOs offer affordable in-house stability testing infrastructure and expertise, which is increasing their collaborations, where their scalable services and regulatory compliance are also attracting the industries.

North America dominated the API stability testing services market with approximate 42.2% in 2025, due to the presence of advanced pharmaceutical and biotech industries, which contributed to the increased development of various medications, increasing the use of API stability testing services. Stringent regulation and enhanced R&D activities also increased their use, where the growth in outsourcing trends also contributed to the market growth.

U.S. Market Trends

The growth in the R&D investment and presence of advanced pharmaceutical biotech companies are increasing the use of API stability testing services in the U.S. The increasing advancement in biologics and biosimilars is also increasing their demand. Additionally, growing stringent regulations and outsourcing trends are also increasing their demand.

Asia Pacific is expected to host the fastest-growing API stability testing services market with 9.1% CAGR during the forecast period, due to expanding pharmaceutical manufacturing capabilities, driving the production of generic products, and increasing the use of API stability testing services. The expanding CDMOs and CROs ecosystem is also increasing its demand, where the growing government support is also enhancing the market growth.

China Market Trends

The expanding API manufacturing hubs and pharmaceutical industries in China are propelling the development of small molecules and generic APIs, which is increasing the demand for API stability testing services. Additionally, the growing government initiatives and reliance on CDMOs are also increasing their use.

Europe is expected to grow significantly in the API stability testing services market during the forecast period, due to the presence of a stringent regulatory framework, which is driving the use of API stability testing services to ensure product safety and effectiveness. The presence of robust industries and healthcare infrastructure is also increasing the use of biologics, encouraging their advancements, which ultimately promotes market growth.

UK Market Trends

The presence of a well-developed pharmaceutical and biotech hub in the UK is increasing the use of API stability testing services due to growing demand and adoption of biologics and biosimilars. The stringent regulations are also increasing their use, where the growing R&D and outsourcing trends are also encouraging their demand.

| Companies | Headquarters | API Stability Testing Services |

| Eurofins Scientific | Luxembourg City, Luxembourg | ICH-compliant stability services |

| SGS S.A. | Geneva, Switzerland | Comprehensive API testing following ICH Q1A to Q1F guidelines |

| WuXi AppTec | Shanghai, China | Flexible stability programs for small molecules and biologics |

| Charles River Laboratories | Wilmington, U.S. | Tailored stability studies with integrated analytical support |

| Intertek Group PLC | London, UK | cGMP stability testing |

| Catalent, Inc. | Somerset, U.S. | End-to-end stability, storage, and analytical testing |

| Labcorp | Burlington, U.S. | Large-scale stability testing with clinical development expertise |

| Thermo Fisher Scientific | Waltham, U.S. | Integrated API development and stability testing |

| PPD | Wilmington, U.S. | Tailored stability solution and consultations |

| Vimta Labs | Hyderabad, India | Large storage capacity for clinical, transport, and freeze-thaw cycling stability studies |

By Test Type

By Molecule Type

By End-User

By Region

February 2026

February 2026

February 2026

January 2026