January 2026

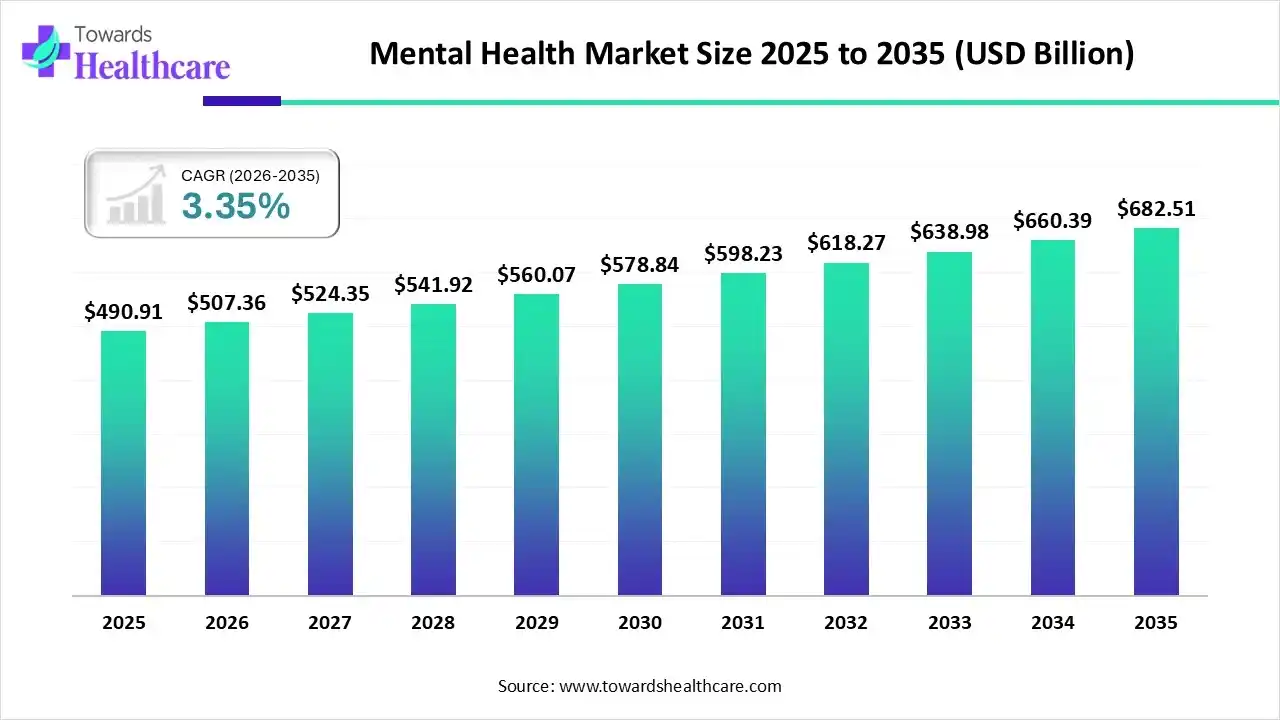

The global mental health market size is expected to be worth around USD 682.51 Billion by 2035, from USD 490.91 billion in 2025, growing at a CAGR of 3.35% during the forecast period from 2026 to 2035.

The mental health market is experiencing robust growth, driven by growing awareness of mental health conditions and their early diagnosis and treatment. Government bodies play a crucial role in raising awareness of mental health through several programs. The market is booming in emerging countries of the Asia-Pacific, Europe, and South America. The increasing use of telemedicine and other digital solutions presents future opportunities for market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 507.36 Billion |

| Projected Market Size in 2035 | USD 682.51 Billion |

| CAGR (2026 - 2035) | 3.35% |

| Leading Region | North America |

| Market Segmentation | By Services, By Disorder, By Platform, By Age Group, By End-User, By Region |

| Top Key Players | Boehringer Ingelheim, Alkermes plc, Compass Pathways, Relmada Therapeutics, Inc., Eli Lilly and Company, Alto Neuroscience, Lyra Health, Wysa, Acadia Healthcare |

The mental health market refers to developing diagnostics and therapeutics, as well as providing preventive, diagnostic, therapeutic, and rehabilitative measures for patients suffering from anxiety, depression, substance use disorder, and other mental health conditions. The World Health Organization (WHO) states that over a billion people live with a mental health condition globally. Mental health is a state of mental well-being that enables people to cope with the stresses of life, realize their abilities, learn well, and work well.

Artificial intelligence (AI) and machine learning (ML) offer the potential to revolutionize mental healthcare by providing insights and solutions. They provide advanced detection capabilities, tailored therapies, and virtual therapeutic platforms. AI-based tools enable remote patient monitoring, eliminating the need for patients to visit healthcare organizations. Wearable sensors can continuously monitor patients' vital signs, providing real-time data to healthcare professionals. This enables doctors to make effective clinical decisions. Thus, integrating AI into mental health is reshaping the landscape of mental healthcare.

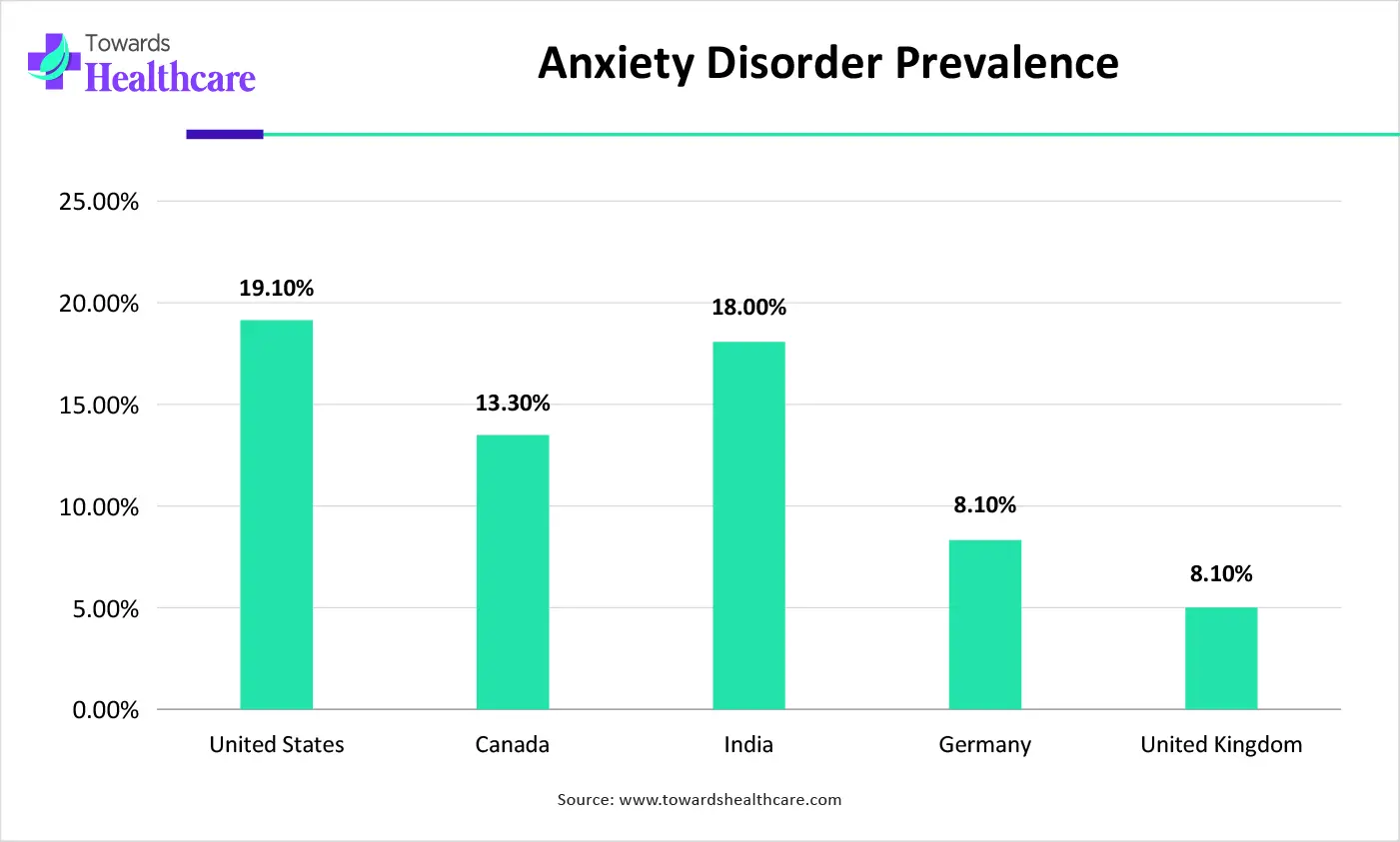

| Countries | Prevalence Rate of Anxiety Disorders |

| United States | 19.10% |

| Canada | 13.30% |

| India | 18.00% |

| Germany | 8.10% |

| United Kingdom | 5.00% |

Which Services Segment Dominated the Mental Health Market?

The outpatient counselling segment held a dominant position in the market in 2025, due to the need for personalized and physical care. Outpatient counselling eliminates the need for patients to stay overnight in healthcare organizations, saving extra costs. Doctors offer compassionate and holistic mental wellness services through therapy, counseling, and mindful healing. They can observe minute behavioral changes in their patients and provide appropriate treatment.

Emergency Mental Health Services

The emergency mental health services segment is expected to grow at the fastest CAGR in the market during the forecast period. Emergency mental health services provide immediate support for crises like suicidal thoughts or severe distress. These services are available 24/7 and have skilled professionals to act immediately. They prevent delayed support, resulting in immediate care. Care coordination becomes easier, and providers can collaborate to continue the healing journey.

Why Did the Depression Segment Dominate the Mental Health Market?

The depression segment held the largest revenue share of the market in 2025, due to the rising incidences of clinical depression and the growing need for immediate care. The WHO reported that approximately 5.7% of global adults suffer from depression. Also, depression is about 1.5 times more common among women than men. It is a persistent feeling of sadness and changes in how patients think, act, or sleep. Common treatment regimens for depression include psychotherapy, medication, and brain stimulation therapy.

Anxiety

The anxiety segment is expected to grow with the highest CAGR in the market during the studied years. Anxiety disorders are the most common mental illness around the world, affecting over 360 million people. They cause fear, dread, and other physical symptoms, such as a pounding heart and sweating. Anxiety is treated using medications, such as antidepressants, benzodiazepines, and beta-blockers, as well as psychotherapy, such as cognitive behavioral therapy (CBT) and exposure therapy.

How the Online Therapy Platforms Segment Dominated the Mental Health Market?

The online therapy platforms segment contributed the biggest revenue share of the market in 2025, due to the growing demand for telemedicine and remote monitoring. Online therapy platforms connect patients with expert healthcare professionals from diverse geographical locations, eliminating the need to travel. They enable confidential counselling through video, audio, or chat modes. BetterLYF, TalktoAngel, and Talkspace are commonly used online therapy platforms.

AI-Powered Mental Health Tools

The AI-powered mental health tools segment is expected to expand rapidly in the market in the coming years. AI-powered mental health tools become a patient assistance in detecting and evaluating common symptoms of mental health disorders. They provide customized solutions and certain measures to prevent severe conditions. AI-driven virtual therapists and chatbots offer scalable solutions to the growing demand for mental health support.

What Made the Adult Segment the Dominant Segment in the Mental Health Market?

The adult segment accounted for the highest revenue share of the market in 2025, due to the growing awareness among adults and sedentary lifestyles. The adult population suffers from high stress levels due to work-life balance and family issues. Young adults, from 18 to 29 years, are still experiencing cognitive development, leading to mental illness. Moreover, adults are comparatively more aware of treating mental illnesses than other age groups through social media or government awareness programs.

Which End-User Segment Led the Market?

The hospitals & clinics segment led the market in 2025, due to the presence of skilled professionals and favorable infrastructure. Hospitals have experts from various departments, providing multidisciplinary expertise to patients. Hospitals & clinics have sufficient capital investment to adopt specialized equipment for mental health diagnosis and treatment. They provide personalized care to patients and have provisions for both inpatient and outpatient services.

Homecare Settings

The homecare settings segment is expected to witness the fastest growth in the mental health market over the forecast period. Patients demand home-based care and treatment from the comfort of their homes, reducing the risk of social anxiety. The increasing adoption of smartphones and tablets has enhanced access to digital therapeutics or teletherapy. The use of digital therapeutics accelerated during the post-COVID era.

North America dominated the global market in 2025. The presence of key players, favorable regulatory support, and the rising adoption of digital tools for mental health are major factors that drive market growth in North America. Countries like the U.S. and Canada witness a surge in mental health startups and venture capital investments, propelling market growth. Government agencies raise public awareness for mental health disorders through initiatives and action plans.

It is estimated that approximately 23.4% of U.S. adults had mental illnesses in 2024, accounting for 61.5 million people. The digital mental health startups in the U.S. raised $682 million collectively in H1 2024. Of which, Talkiatry and Grow Therapy raised the highest amounts, accounting for $130 million and $88 million, respectively. Such an investment trend has amplified market growth in the U.S.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The rising prevalence of mental health disorders and growing awareness augments the market. More than 60% of the burden of mental health disorders in APAC is known to be due to depressive disorders, migraine, anxiety disorders, and schizophrenia. Thus, regulatory bodies implement strong promotion and prevention strategies and strengthen accessible and wide-ranging services for diverse mental health conditions.

The WHO estimated that around 54 million Chinese suffer from depression and 41 million suffer from anxiety. The burgeoning healthcare sector and several government measures propel the market. The National Health Commission (NHC) of China designated 2025 to 2027 as the “Years of Pediatric and Mental Health Services” to expand the professional workforce, enhance capabilities, and improve standards.

Europe is expected to grow at a notable CAGR in the foreseeable future. Mental health disorders are on the rise across Europe, affecting over 1 in 6 people. The increasing healthcare expenditure, technological advancements, and favorable government support foster the market. The rising collaborations among key players and public-private partnerships lead to the development of innovative solutions for mental health. The growing research activities and the increasing number of clinical trials also contribute to market growth.

Mental health affects 1 in 4 people in England and costs approximately £300 billion annually to the UK economy. The UK government invested £50 million in groundbreaking research to deliver more effective treatments. Additionally, the “Mental Health Goals programme” will attract industry partnerships and commercial clinical trials across the UK. As of 10th December 2025, 297 clinical trials are registered in the UK related to mental health.

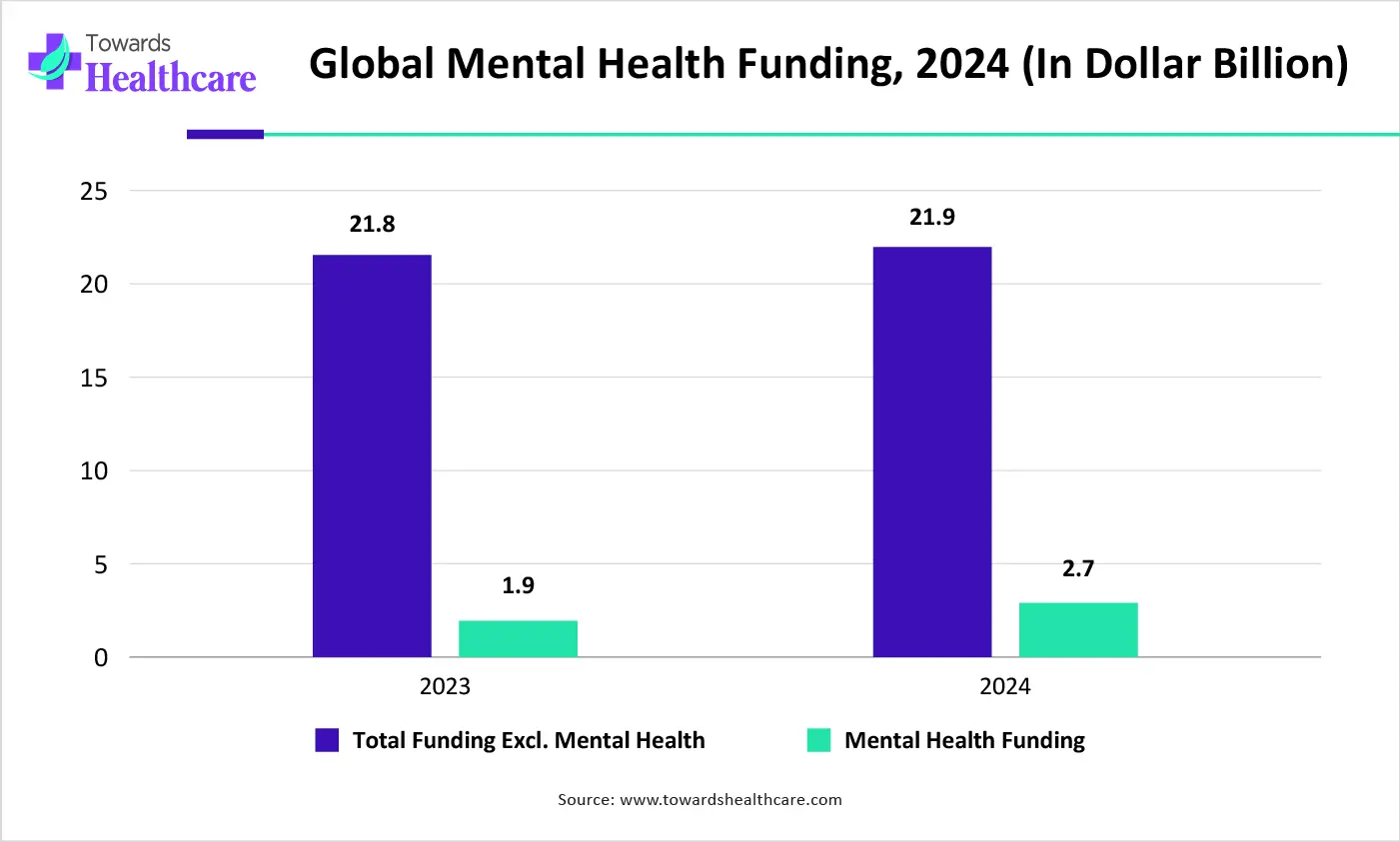

| Years | Total Funding excl. Mental Health | Mental Health Funding |

| 2023 | $21.8 billion | $1.9 billion |

| 2024 | $21.9 billion | $2.7 billion |

| Companies | Headquarters | Offerings | Revenue (2024) |

| Boehringer Ingelheim | Rhein, Germany | The company provides mental health treatment approaches and has 4 Phase 1 trials, 1 Phase 2 trial, and 1 Phase 3 trial. | EUR 26,796 million |

| Alkermes plc | Dublin, Ireland | It specializes in neuroscience to develop medicines designed to help people living with complex and difficult-to-treat psychiatric and neurological disorders. | $1.56 billion |

| Compass Pathways | United Kingdom | The biotech company is dedicated to accelerating patient access to evidence-based innovation in mental health. | - |

| Relmada Therapeutics, Inc. | Florida, United States | It focuses on R&D of transformative medicines for those living with debilitating disorders. It offers REL-1017, an NMDA receptor antagonist, for treating depression. | - |

| Eli Lilly and Company | Indiana, United States | The company offers anti-depressive and anti-psychotic medications and helps patients deal with complex disorders. | $45.042 billion |

| Alto Neuroscience | California, United States | It advances a suite of precision psychiatric medicines. ALTO-101 and ALTO-207 are under clinical development. | $169 million (cash position) |

| Lyra Health | California, United States | It offers a digital mental health platform that combines technology with human therapists and coaches. | $235 million |

| Wysa | Bengaluru, India | It provides a mental well-being AI app that keeps track of patients’ mood with friendly chats and helps fight stress and anxiety. | Rs 40 crore |

| Acadia Healthcare | Tennessee, United States | The company’s behavioral health treatment facilities specialize in helping children, adolescents, adults, and seniors suffering from mental health issues. | $3.15 billion |

By Services

By Disorder

By Platform

By Age Group

By End-User

By Region

January 2026

January 2026

January 2026

January 2026