February 2026

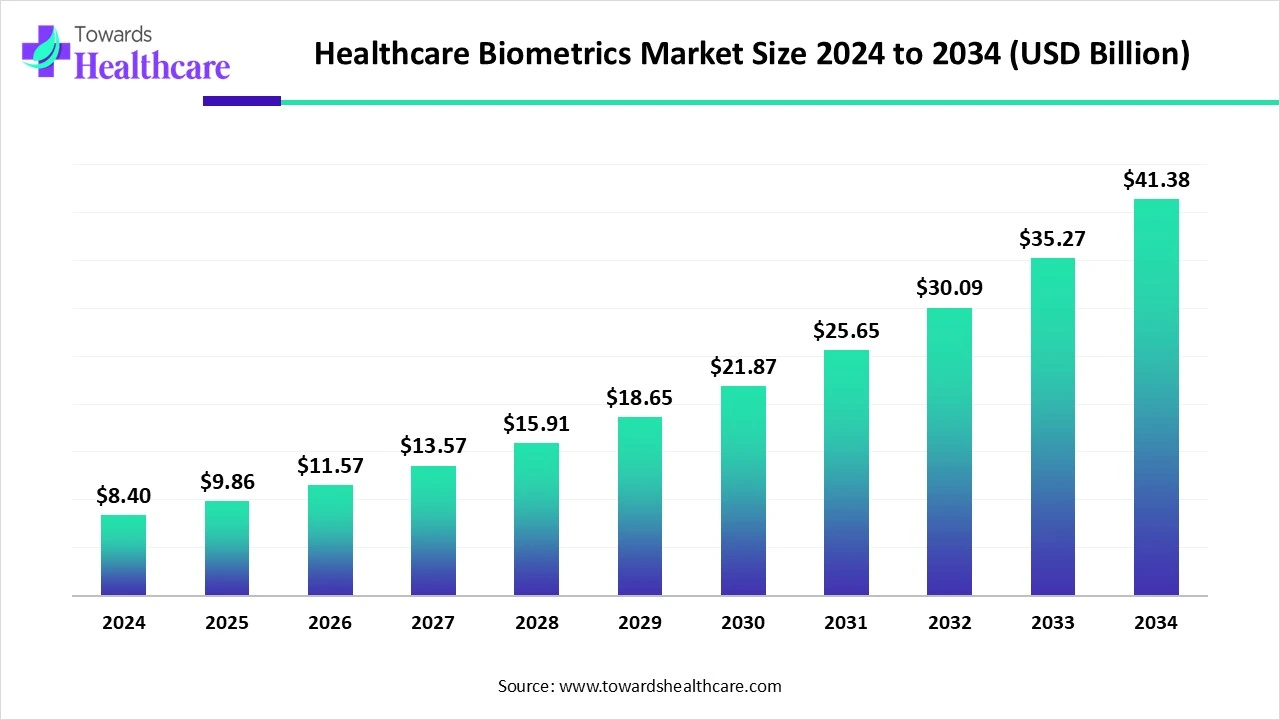

The global healthcare biometrics market size in 2024 was US$ 8.4 billion, expected to grow to US$ 9.86 billion in 2025 and further to US$ 41.38 billion by 2034, backed by a robust CAGR of 17.34% between 2025 and 2034.

The healthcare biometrics market is experiencing strong growth, driven by the rising need for secure patient identification, data protection, and fraud prevention in healthcare systems. Biometric solutions such as fingerprint, facial, and iris recognition are increasingly being integrated into hospitals, clinics, and digital health platforms to enhance security and streamline workflows. The expansion of telemedicine, electronic health records, and regulatory requirements for data privacy are further fueling adoption, positioning biometrics as a crucial tool in modern healthcare management.

| Table | Scope |

| Market Size in 2025 | USD 9.86 Billion |

| Projected Market Size in 2034 | USD 41.38 Billion |

| CAGR (2025 - 2034) | 17.34% |

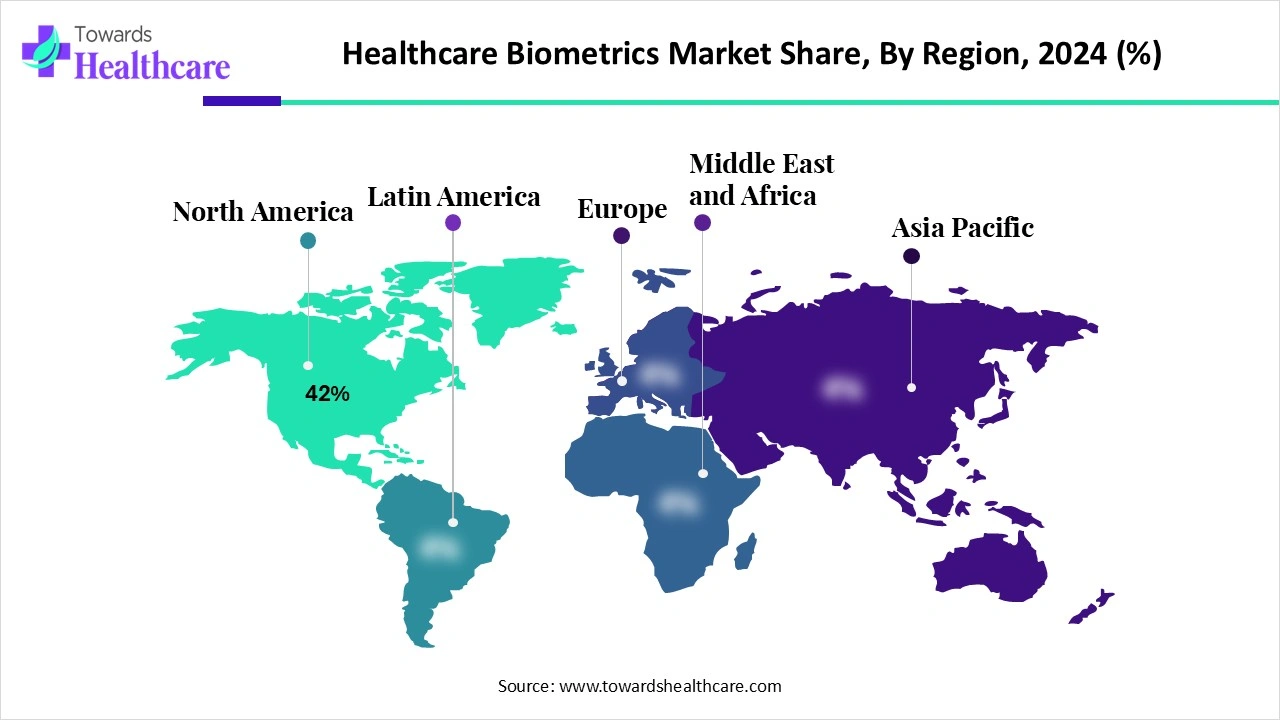

| Leading Region | North America Share 42% |

| Market Segmentation | By Biometric Type, By Solution Component, By Use Case / Application, By End User, By Deployment Mode, By Integration Type, By Regions |

| Top Key Players | Imprivata, IDEMIA, NEC Corporation, Thales / Gemalto, HID Global, Fujitsu, Suprema, M2SYS Technology, RightPatient, Bio-key International, Aware, Inc., Cognitec, Innovatrics, Dermalog Identification Systems, NextGate, BioCatch, Fingerprint Cards (FPC), Veridos, Nuance / Microsoft partners, Large systems integrators/consultancies |

The Healthcare Biometrics Market comprises hardware, software, and services that use biological or behavioral characteristics (fingerprint, face, iris, palm vein, voice, behavioral keystroke/mouse patterns, etc.) to identify, authenticate, and monitor patients, clinicians, and devices across healthcare workflows. Use cases include patient identification and matching, clinician authentication (EHR / medication access), access control, time & attendance, telehealth identity verification, fraud prevention, remote monitoring, and biometric-enabled point-of-care workflows.

Adoption is driven by the need to reduce patient identity errors, improve clinician workflow security, enable seamless telehealth, comply with privacy/regulatory requirements, and cut administrative costs from duplicate records and billing errors. The healthcare biometrics market is driven by key factors such as the rising threat of medical data breaches, increasing demand for accurate patient identification, and widespread adoption of electronic health records(EHRs). Growing use of telemedicine and digital healthcare platforms has further increased the need for secure authentication. Moreover, strict government regulations on data privacy and advancements in AI-powered biometric technologies are accelerating the adoption of biometrics in healthcare systems worldwide.

New Product Launches: The introduction of advanced biometric solutions, like AI-enabled facial and fingerprint systems, is boosting adoption by improving accuracy and convenience in healthcare settings.

Expansion of Telemedicine: Remote healthcare services need reliable authentication, making biometrics essential for patient and provider verification.

AI can significantly impact the market by enhancing the accuracy, speed, and reliability of patient identification and authentication systems. AI-powered algorithms improve facial, iris, and fingerprint recognition, reducing errors and fraud. Additionally, AI enables real-time data analysis, seamless integration with electronic health records, and predictive security measures. These advancements make biometric systems more efficient, scalable, and user-friendly, driving broader adoption across hospitals, clinics, and digital health platforms.

Increased Need for Enhanced Data Security in Healthcare

Rising concerns over patient data breaches and unauthorized access are fueling the demand for biometric solutions in healthcare. Hospitals and clinics require reliable ways to verify patients' identities and protect sensitive health records. Biometrics, such as palm vein scanning, facial recognition, and voice authentication, provide a secure, tamper-proof alternative to traditional methods. The heightened emphasis on safeguarding patient information not only prevents fraud but also ensures compliance with stringent healthcare data protection regulations, boosting market growth.

For Instance,

High Implementation and Maintenance Costs

The healthcare biometrics market faces limitations due to the significant upfront and ongoing expenses associated with these technologies. Installing sophisticated biometric devices, integrating them with existing healthcare IT systems, and ensuring continuous system calibration and software updates can be costly. Additionally, specialized personnel are required to manage and troubleshoot these systems, increasing operational expenditure. Such high financial demand makes smaller healthcare facilities hesitant to adopt biometrics, slowing overall market penetration despite growing security and efficiency needs.

Expansion in Remote Patient Monitoring and Telemedicine

The growing adoption of telemedicine and remote patient monitoring offers a significant opportunity for healthcare biometrics. As virtual healthcare expands, providers need secure ways to authenticate patients without physical interaction. Biometric solutions like iris scanning, palm vein recognition, and voice identification enable accurate verification, reduce identity fraud, and streamline access to digital health platforms. This trend is particularly promising in regions with limited healthcare infrastructure, where biometrics can ensure safe, efficient, and scalable remote care delivery.

For Instance,

The fingerprint recognition segment leads the market because it offers a fast, non-intrusive, and widely accepted method for patient identification. Its portability and integration with mobile and desktop systems make it ideal for both large hospitals and smaller clinics. Unlike some advanced biometric methods, fingerprint systems are durable, require less maintenance, and perform reliably across a diverse patient population. These practical advantages, combined with growing adoption in electronic health records and access control, contribute to its market dominance and higher revenue generation.

The face recognition segment is projected to grow rapidly in the healthcare biometrics market because it enables seamless, hands-free patient verification, reducing administration bottlenecks and wait times. The technology is increasingly integrated with smart devices, hospital kiosks, and electronic health record systems, making it ideal for modern healthcare workflows. Rising investments in AI-driven facial analytics and growing patient preference for non-contact solutions further accelerate its adoption. These factors make face recognition a high-growth segment compared to traditional biometric methods.

In 2024, the software & algorithms segment dominated the healthcare biometrics market because it enables customization and scalability of biometric systems for diverse healthcare settings. Sophisticated algorithms support multiple biometric modalities, improve recognition speed, and reduce false matches. They also facilitate seamless integration with cloud platforms, mobile applications, and remote monitoring devices. As healthcare providers increasingly prioritize digital transformation and secure patient management, the demand for advanced software drives the market.

The services segment is poised for rapid growth as healthcare providers seek specialized support to delay and maintain biometric solutions efficiently. Integration services simplify connecting new systems with existing hospital infrastructure, while managed services offer ongoing performance monitoring and troubleshooting. Onboarding services help ensure smooth adoption by both staff and patients, minimizing resistance and errors. As hospitals and clinics expand digital healthcare initiatives, the reliance on professional biometric services to optimize system functionality and enhance patient experience drives this market's fastest CAGR.

The patient identification & matching segment dominated the market as it addresses operational efficiency and patient safety simultaneously. Hospitals and clinics require accurate verification to streamline check-ins, reduce duplicate records, and avoid treatment errors. Biometric solutions offer a fast, user-friendly method for confirming patient identity, especially in high-volume or multi-facility settings. Growing regulatory emphasis on secure patient data and the need for seamless integration with digital health platforms further fuel adoption, resulting in the market's largest revenue share.

The clinician authentication & HER access segment is projected to grow quickly as healthcare facilities focus on enhancing workflow efficiency and minimizing credential-sharing risks. Biometric systems allow instant, secure access to electronic health records, reducing time spent on password management and manual verification. With the rise of cloud-based health platforms and mobile HER access, hospitals and clinics increasingly rely on biometrics to protect sensitive data while enabling seamless staff operations, driving this segment's rapid adoption and fastest CAGR in the market.

In 2024, the hospitals & health systems segment dominated the healthcare biometrics market because they face complex operational demands, including managing multiple departments, outpatient services, and emergency care. Biometric solutions help streamline patient registration, staff authentication, and access control across large facilities. Their extensive infrastructure and higher investment capacity allow the deployment of advanced biometric technologies, making them early adopters. The combination of operational complexity, need for secure workflow, and readiness to invest positions hospitals and health systems as the largest revenue-generating end users.

The long-term care/assisted living segment is projected to grow rapidly in the healthcare biometrics market during 2025-2034 as facilities focus on enhancing operational efficiency and resident experience. Biometric systems enable secure medication administration, track staff-resident interaction, and reduce errors in patient identification. With an aging population and increasing demand for personalized care, these facilities are adopting advanced technologies to improve safety and compliance. The combination of regulatory pressure, technological adoption, and the need for reliable identity verification drives this segment fastest CAGR in the market.

In 2024, the on-premises/enterprise segment dominated the market because healthcare providers value the stability, reliability, and full control these systems offer. On-premise deployment enables seamless integration with legacy hospital systems, reduces risks associated with cloud outage, and allows IT teams to implement customized security protocols. Organizations with large patient volumes and complex operations prefer this mode to ensure uninterrupted access, faster processing, and regulatory compliance, contributing to their larger market share and higher revenue compared to cloud-based solutions.

The cloud/hybrid segment is projected to grow rapidly as healthcare organizations look for solutions that reduce infrastructure costs while supporting multi-site operations. Cloud and hybrid systems allow seamless sharing of biometric data across hospitals, clinics, and remote care platforms, enhancing collaborations and operational efficiency. Their ability to quickly scale with patient volume and integrate with emerging digital health tools makes them attractive for providers aiming to modernize IT systems. This flexibility drives faster adoption and the highest CAGR in the market.

In 2024, the HER/HIS integration solutions segment led the healthcare biometrics market and is anticipated to achieve the highest growth during 2025-2034 because healthcare providers require biometrics that work seamlessly with existing digital systems to optimize care delivery. Integration enables real-time patient verification, simplifies administrative tasks, and supports multi-department coordination. As more hospitals adopt advanced digital platforms and aim to unify patient records across facilities, the need for compatible, scalable biometrics solutions grows. This rising demand positions HER/HIS integration as both the largest and fastest-growing segment in the market.

North America led the market share 42% in 2024, because healthcare institutions prioritized improving operational efficiency and patient experience. The region’s widespread use of electronic health records and integration of advanced IT systems created strong demand for biometric solutions. Furthermore, supportive government initiatives, high healthcare spending, and early adoption of innovative technologies by hospitals and clinics accelerated market growth, enabling North America to secure the largest revenue share compared to other regions.

The U.S. market is expanding as hospitals and clinics seek to improve patient management and reduce administrative burdens. Growing demand for contactless and convenient authentication methods, along with the increasing use of mobile health applications, drives adoption. Additionally, the country’s focus on integrating innovative technologies into healthcare operations and the presence of leading biometric solution providers encourage rapid implementation. These factors collectively support the steady growth of the market in the U.S.

The Canadian market is growing due to the country’s increasing focus on securing patient data and reducing medical identity fraud. Healthcare providers are implementing biometric solutions to streamline patient verification, improve workflow efficiency, and enhance service quality. Rising adoption of electronic health records and digital health initiatives, along with government support for technology-driven healthcare, further fuels market growth. Additionally, advancements in fingerprint, facial, and iris recognition technologies make biometrics a reliable and attractive solution for Canadian healthcare facilities.

The Asia-Pacific market is projected to grow rapidly due to expanding investments in modern healthcare facilities and the adoption of smart hospital technologies. Increasing demand for patient safety, secure access control, and streamlined hospital operations drives the need for biometric solutions. Moreover, rising disposable incomes, government initiatives promoting digital healthcare, and the presence of emerging technology providers in the region support faster deployment of advanced biometric systems, resulting in the highest CAGR compared to other regions.

The Chinese market is growing as healthcare providers seek to modernize facilities and manage large patient volumes more efficiently. Biometric solutions are being adopted to streamline check-ins, control staff access, and secure sensitive medical data. Government initiatives promoting smart hospitals and digital healthcare, along with technological advancements in fingerprint, facial, and vein recognition, are accelerating deployment. Rising patient expectations for faster, safer services also contribute to the increasing adoption of biometric systems across China.

The market in India is growing as healthcare providers aim to enhance operational efficiency and manage large patient populations more effectively. The rising demand for secure, touchless authentication methods, coupled with the expansion of private and multi-specialty hospitals, is driving adoption. Government programs promoting digital health and unique patient identification systems, along with increasing awareness of innovative biometric technologies, are encouraging facilities to implement these solutions, contributing to the rapid growth of the market in India.

Europe is expected to grow significantly in the market during the forecast period by focusing on secure patient identification and data protection. The region is adopting advanced contactless biometric technologies to reduce fraud and streamline healthcare operations. Regulatory requirements for robust authentication methods are driving hospitals and clinics to implement biometric solutions. Initiatives like the European Union’s Entry/Exit System (EES), which uses biometric data for monitoring non-EU travelers, highlight Europe’s emphasis on enhancing security and efficiency through innovative biometric applications in healthcare.

The UK market is expanding due to increasing adoption of digital health technologies and a focus on enhancing patient safety and operational efficiency. Hospitals and clinics are implementing biometric solutions to streamline patient identification, reduce medical errors, and prevent identity fraud. Government initiatives supporting digital health infrastructure, the expansion of telemedicine services, and rising investments in smart hospitals further drive market growth. Additionally, advancements in affordable biometric technologies make them accessible to a wide range of healthcare providers across the UK.

Germany’s market is gaining momentum as hospitals and clinics focus on improving operational efficiency and patient experience. Biometric solutions help manage large patient volumes, secure access to sensitive areas, and reduce administrative delays. The growing integration of smart hospital technologies and digital patient management systems, along with rising demand for reliable, touchless authentication methods, is encouraging adoption. Combined with government initiatives supporting innovation in healthcare, these factors make biometric solutions increasingly essential in Germany’s healthcare sector.

In March 2025, Amazon rolled out a palm-vein biometric payment system for the healthcare sector to streamline patient check-ins and cut front desk waiting times. Launched under the slogan “Your vein, your identity,” the initiative involves collaboration between the UAE’s Federal Authority for Identity, Citizenship, Customs and Port Security (ICP) and local banks. According to Saif Al Zaabi, ICP’s service development branch manager, the registration process scans both the individual’s face and palm veins, linking them so banks can securely use the biometric data.

By Biometric Type

By Solution Component

By Use Case / Application

By End User

By Deployment Mode

By Integration Type

By Region

February 2026

February 2026

February 2026

February 2026