February 2026

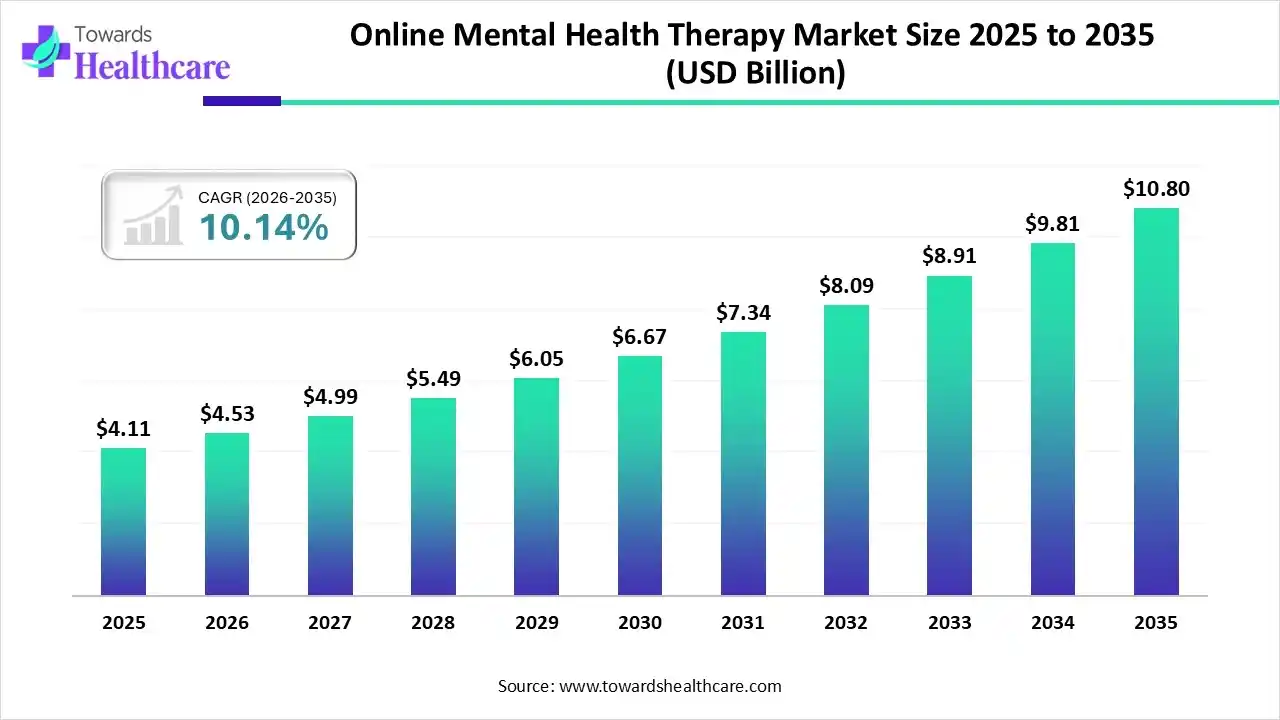

The global online mental health therapy market size was estimated at USD 4.11 billion in 2025 and is predicted to increase from USD 4.53 billion in 2026 to approximately USD 10.8 billion by 2035, expanding at a CAGR of 10.14% from 2026 to 2035.

The era is immensely leveraging AI-assisted solutions/platforms in mental health therapy, like virtual reality therapy, online chatbots, and at-home tools. Alongside, the corporate world is bolstering its mental health measures by adopting many wellness programs and integrated digital platforms. Moreover, the market is shifting towards broader use of predictive analytics in the development of precision treatments, along with the rise of text-based counseling.

| Key Elements | Scope |

| Market Size in 2026 | USD 4.53 Billion |

| Projected Market Size in 2035 | USD 10.8 Billion |

| CAGR (2026 - 2035) | 10.14% |

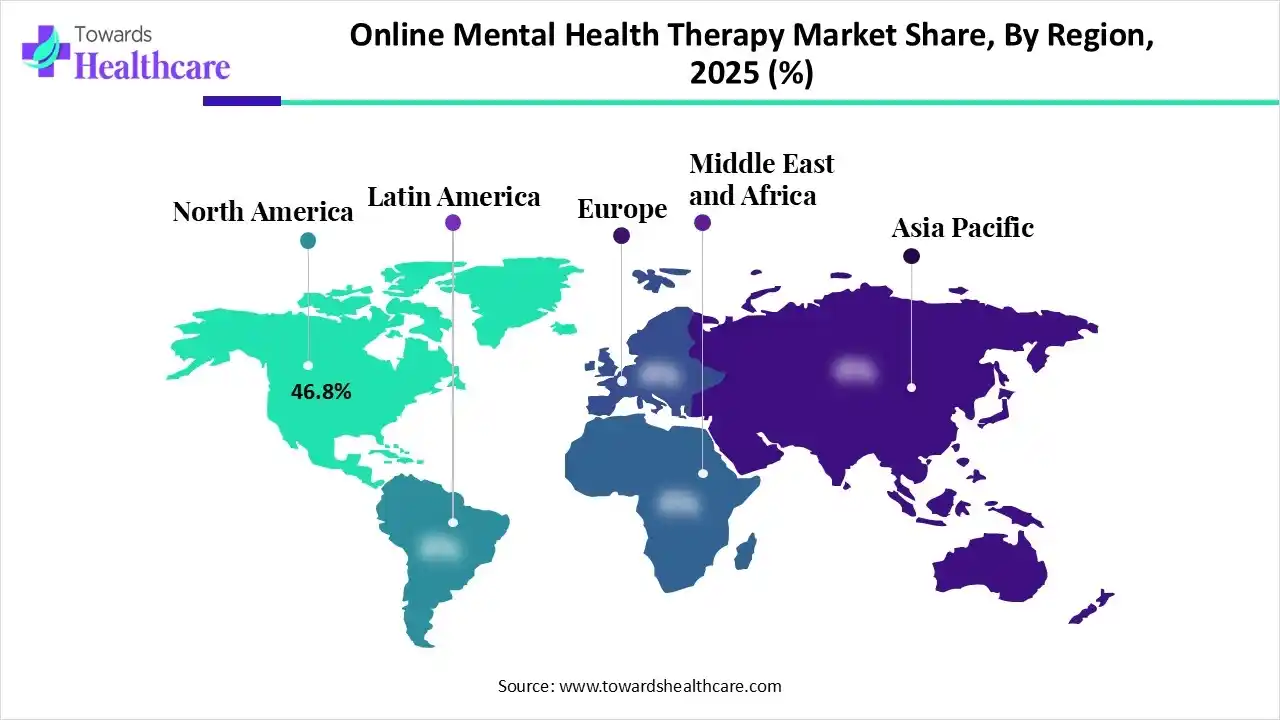

| Leading Region | North America by 46.8% |

| Market Segmentation | By Therapy Type/Modality, By Interaction/Session Medium, By End-User/Application, By Age Group, By Region |

| Top Key Players | BetterHelp, Talkspace, Amwell, MDLive, Teladoc Health, Cerebral, Lyra Health, Ginger, SonderMind, Woebot Health |

The online mental health therapy market includes digital platforms, teletherapy services, and virtual counseling solutions that connect individuals with licensed mental health professionals remotely via video, audio, text, and other interactive tools. Market growth is driven by rising mental health awareness, telehealth adoption, the convenience of at-home access, and technological advancements in secure digital delivery. It supports various therapy modalities such as cognitive behavioral therapy (CBT), psychodynamic therapy, and other evidence-based treatments.

Currently, the globe is increasingly fostering advancements in multimodal emotion recognition, which helps in the analysis of a combined facial expression, vocal tone, and speech patterns during sessions. Noah AI is an example of an advanced platform that uses sophisticated sentiment analysis to detect emotional shifts via voice tone and speech patterns with up to 80% accuracy. However, recently Dartmouth researchers performed the first-ever randomized controlled trial of a generative AI therapy chatbot, leading to a 51% average reduction in depressive symptoms and a 31% improvement in anxiety.

Technological breakthroughs are promoting the perfect integration of face-to-face elements with remote sessions for substantial experiences. Alongside, AI solutions are managing increased demand, lowering waitlists, and serving underserved areas, mainly in rural communities.

Researchers are exploring smartphone sensors for consistent, real-world data collection on behavior patterns, alongside key players are emerging apps for self-help, coaching, and early intervention.

Specifically, the market will highly employ predictive analytics for the detection of possible mental health concerns, and further leverage tailored treatment strategies with enhanced efficiency of both medicaKey tion and therapeutic modalities.

| Key Efforts | Description |

| University of Bridgeport (UB) (August 2025) | Secured a $2.4M grant from the Health and Human Services Administration (HRSA) for the expansion of the online program. |

| Lewis Capaldi (July 2025) | Partnered with BetterHelp to explore 734,000 Hrs of free online therapy. |

| BetterHelp (June 2025) | Made a multi-year tie-up with WNBA's Las Vegas Aces, Dallas Wings, and 2024 Champion New York Liberty to provide access to licensed psychologists, marriage and family therapists, clinical social workers, and board-licensed professional counselors |

Which Therapy Type/Modality Led the Online Mental Health Therapy Market in 2025?

In 2025, the cognitive behavioral therapy (CBT) segment held a 43.5% share of the market. It is primarily fueled by its proven effectiveness, increased accessibility through technology, and expanding mental health awareness. The latest extensive solutions include mindfulness-based cognitive therapy (MBCT), acceptance & commitment therapy (ACT), and dialectical behavior therapy (DBT). Moreover, the globe is emphasising physical health interventions, including exercise and nutrition management, which treat the "whole person" instead of just isolated symptoms.

Psychodynamic Therapy

The psychodynamic therapy segment will expand rapidly. This therapy prominently provides greater self-insight, raised self-esteem, and healthier relationships by implementing unconscious patterns from past experiences. Whereas, the worldwide therapists are actively exploring new skills to encourage "telepresence" and navigate risks like "screen transference". Inclusion of recent developments, such as Brief Psychodynamic Therapy (BPT), which comprises Core Conflictual Relationship Theme (CCRT) & problematic relationship scripts are supporting the overall market growth.

Why did the Video-Based Therapy Segment Dominate the Market in 2025?

The video-based therapy segment led with a 42.7% share of the online mental health therapy market in 2025. Key benefits are escalated accessibility, specifically for rural or mobility-limited individuals, and enhanced convenience, with raised comfort and privacy at home. Additionally, the market has developed advanced solutions, like EndeavorRx, a prescription-only video game for children with ADHD for optimizing attention skills, and also Freespira, a digital therapeutic for anxiety and panic disorder.

Text-Based Counseling

In the future, the text-based counseling segment is predicted to expand fastest. Mainly, the prominent, non-face-to-face nature of text communication is supporting the reduction of patient issues regarding confidentiality, privacy, and the stigma linked with looking for mental health assistance. Woebot is one of the popular AI chatbot platforms that primarily offers cognitive-behavioral therapy (CBT) based techniques for depression and anxiety. Also, the BetterLYF is widely used in India, which facilitates confidential chat-based sessions with experienced and accredited psychologists and counselors.

How did the Residential/Home Use Segment Lead the Market in 2025?

In 2025, the residential/home use segment held a 43.4% share of the online mental health therapy market. This mainly resolves limitations about long waiting times and transportation restrictions associated with traditional in-person visits. Specifically, virtual reality (VR) therapy, united with home-based treatment, further allows patients to safely confront phobias, PTSD triggers, and anxiety in controlled, simulated environments.

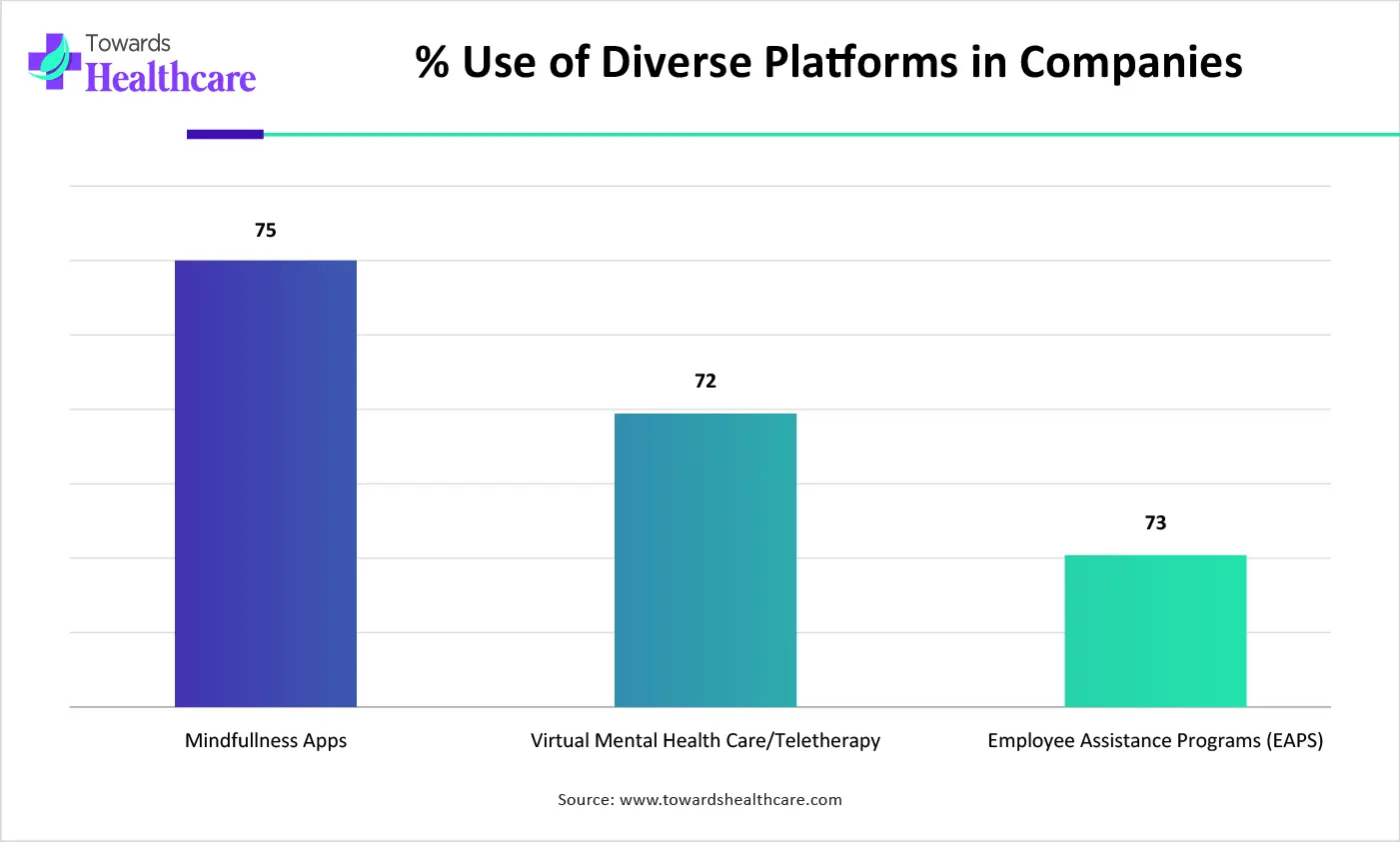

Corporate/Employee Wellness

Moreover, the corporate/employee wellness segment is estimated to witness rapid expansion. Many well-developed & developing companies are executing workshops, mindfulness apps, and AI-powered stress monitoring. These firms are rigorously shifting towards combined digital platforms, like Meditopia for Work, Modern Health, and Lyra Health, which integrate different resources, including 1:1 teletherapy, coaching, self-guided modules, and mindfulness content in one accessible hub.

Which Age Group Led the Online Mental Health Therapy Market in 2025?

The adults segment captured a 57.5% share of the market in 2025. Segmental growth is propelled by a rise in mental health disorders, a robust preference for convenient digital solutions, and the boosting acceptance of teletherapy. Day by day, tech firms are leveraging smartwatches and other biosensors, like Fitbit, which help in monitoring passive symptoms with a track of physiological data, like heart rate variability, sleep patterns, and stress levels.

Children & Adolescents

The children & adolescents segment is anticipated to expand rapidly. They are prominently choosing online platforms for privacy, bypassing potential shame or judgment from parents/peers. The market is widely employing advanced digital games that have evolved for therapeutic or educational goals, and also for cognitive training and skill-building. The latest examples, like Calm Harm & & Clear Fear Apps for teens, are managing urges to self-harm or anxiety, providing plans and support.

With a 46.8% share, North America was dominant in the online mental health therapy market. It is specifically impelled by the enhanced digital innovation (AI, apps, VR), better insurance/policy (parity), employer wellness programs, and rising consumer demand for convenience. Various Canadian healthcare plans cover visits to family doctors and psychiatrists, and other hospital-based mental health services. Recently, Medicare widened its mental health coverage, such as expanded access to licensed mental health counselors and marriage/family therapists, along with persistent coverage for telehealth services.

U.S. Market Trends

Although the U.S. clinicians are greatly adopting AI algorithms for automated note-taking, diagnostic clarification assistance, and simplifying insurance billing, this lowers the administrative burden and enables therapists to focus more on patient care.

For instance,

Asia Pacific will register rapid expansion in the online mental health therapy market, as many governments are promoting campaigns, celebrity involvement, and public awareness efforts for the reduction of stigma, with the expansion of help-seeking. Recently developed MindFi, a Southeast Asia-focused platform, provides meditation, therapy, and habit-forming modules, and Safe Space, a Singapore-based digital mental health ecosystem offer a blend of online and offline therapy solutions.

India Market Trends

However, India is fostering many advanced solutions through their Economic Survey 2024-25, which recommends reinforcing Tele-MANAS and uniting AI solutions into mental healthcare. The recent developments include Manoshala, a platform that offers a customized therapist matching service, free 15-minute consultations, and diverse workshops and group sessions.

During the prospective period, Europe will grow notably in the online mental health therapy market. In this region, especially Germany, is exploring major initiatives, such as DiGA, which are approving and reimbursing digital mental health apps, for the robust market development. Besides this, they are putting efforts into enhancements in a Child and Youth Mental Health Network and a prevention toolkit, for the protection of minors from the negative impacts of social media under the Digital Services Act.

UK Market Trends

Specific rollout in 2025 by the UK government comprises the Medicines and Healthcare products Regulatory Agency (MHRA)’s new guidance to assist manufacturers of digital mental health technologies (DMHTs) in ensuring their products are safe and effective under UK medical device regulations. This was partly powered by the Wellcome Trust, which focuses on building public trust and clarity in the quickly establishing market.

| Company | Description |

| BetterHelp | It facilitates a complete set of digital mental health services through a network of over 33,000 licensed therapists. |

| Talkspace | A firm offers individual, couples, and teen therapy (ages 13+), spotlighting asynchronous messaging (text/audio/video) and live video sessions with licensed therapists, etc. |

| Amwell | This mainly specializes in live video therapy with licensed professionals for different conditions. |

| MDLive | It facilitates 24/7 video or phone access to licensed therapists for talk therapy and board-certified psychiatrists |

| Teladoc Health | Its services include self-guided tools like activities, meditations, and skill-building courses, & specialized care for children and teens. |

| Cerebral | This explored a structured clinical approach called "The Cerebral Way". |

| Lyra Health | Its platform offers virtual video sessions, medication management, and digital tools (like Calm). |

| Ginger | A company integrates human care with technology to facilitate a full spectrum of mental health services. |

| SonderMind | This primarily connects users with licensed professionals for virtual (video, phone, text) or in-person sessions, covering individual, couples, and family therapy. |

| Woebot Health | It leverages AI-driven digital mental health tools evolved as adjuncts to traditional clinical care. |

By Therapy Type/Modality

By Interaction/Session Medium

By End-User/Application

By Age Group

By Region

February 2026

February 2026

February 2026

February 2026