February 2026

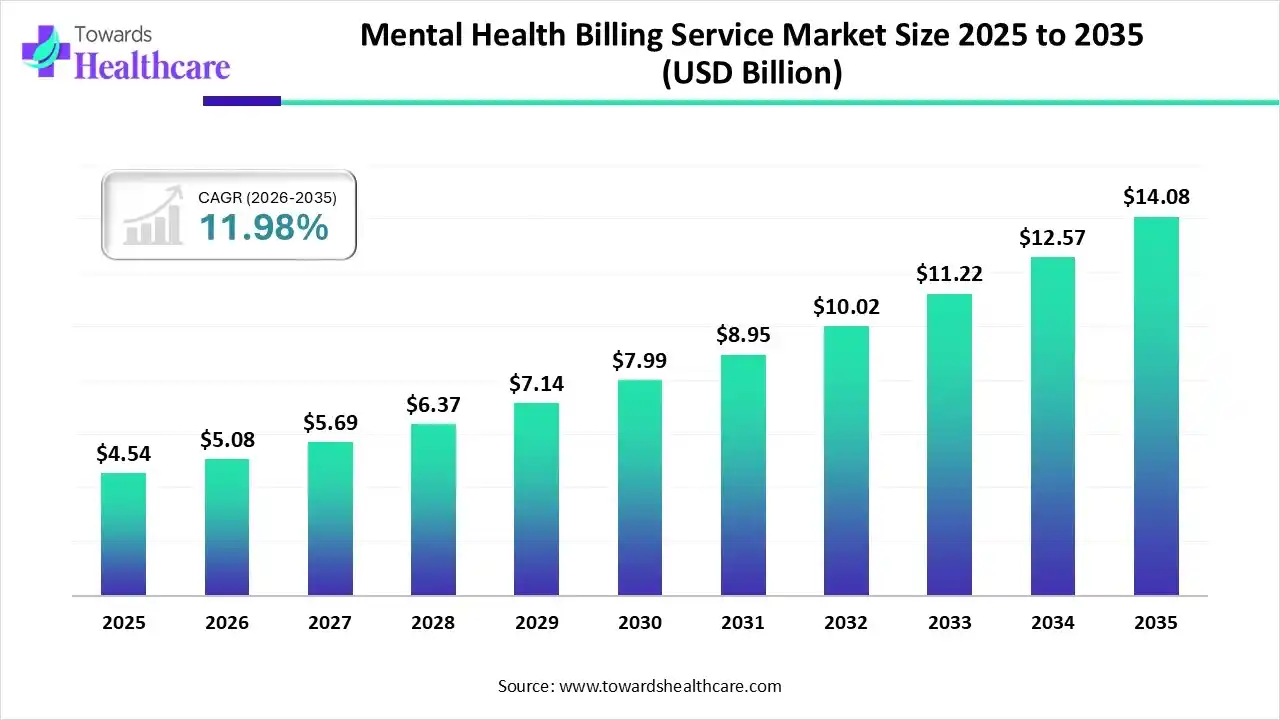

The global mental health billing service market size is expected to be worth around USD 14.08 Billion by 2035, from USD 4.54 billion in 2025, growing at a CAGR of 11.98% during the forecast period from 2026 to 2035.

The mental health billing service market is experiencing robust growth, driven by the rising demand for mental health treatment, regulatory complexity, and the need for accurate reimbursement across CPT codes and parity laws. Mental health professionals can benefit from billing service providers as they can focus more on patients’ health and well-being. Technological advancements, such as the automation of medical billing, present future opportunities for market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.08 Billion |

| Projected Market Size in 2035 | USD 14.08 Billion |

| CAGR (2026 - 2035) | 11.98% |

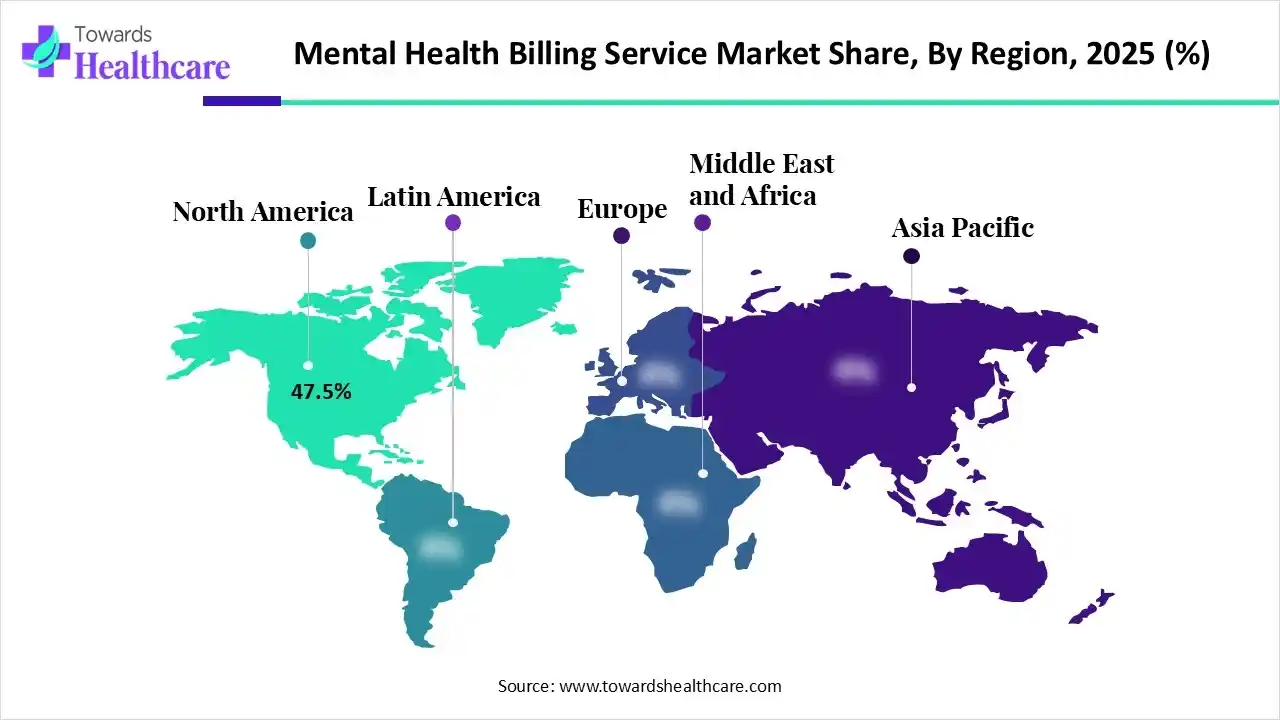

| Leading Region | North America by 47.5% |

| Market Segmentation | By Type, By Application/End-User, By Service Model, By Deployment/Technology, By Region |

| Top Key Players | Waystar Holding Corp., AdvancedMD, ePsych Billing, Ensora Health, Athenahealth, Kareo, Invensis Technologies Pvt. Ltd., Raintree Systems, Plutus Health, Inc., Coronis Health |

The mental health billing service market comprises specialized revenue cycle management (RCM) and claims to provide processing services tailored for cognitive and behavioral healthcare providers to manage complex insurance coding, billing submissions, denial management, and reimbursements. These services improve financial performance, compliance, and operational efficiency for private practices, clinics, and health systems. Service providers customize mental health billing services based on the clients’ requirements.

Artificial intelligence (AI) is the mental health billing service market, including mental and behavioral billing services. AI can drive precision, mitigate risk, and create scalable billing infrastructures, supporting the growth of healthcare organizations. AI and machine learning (ML) algorithms can analyze vast amounts of data and can detect errors in claims, such as multiple unspecified codes. They reduce human errors and speed up the claims processing, benefiting patients, providers, and insurers. They issue correct and prompt patient statements to ensure improved cash flow by reducing claims rejection or denial.

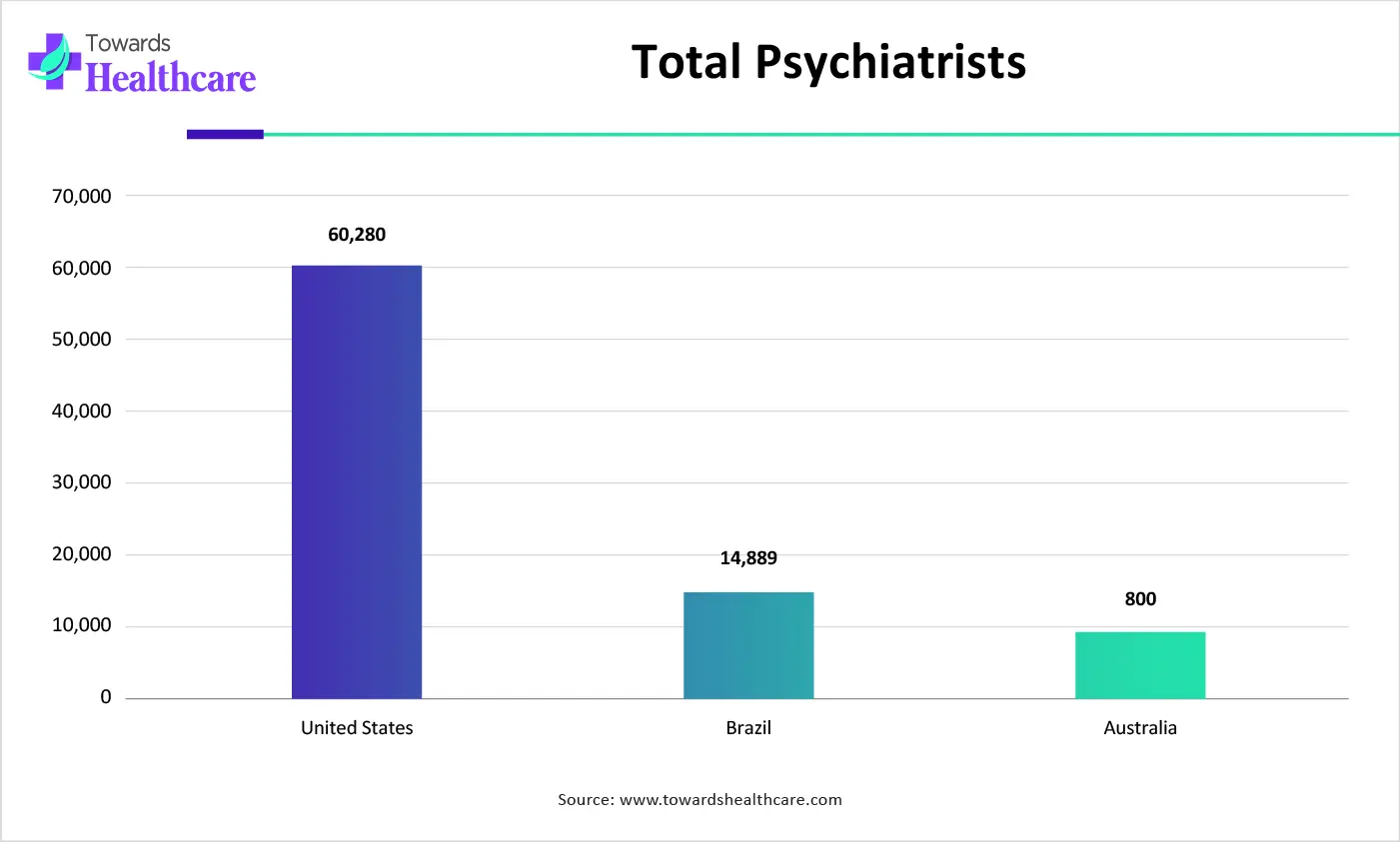

| Countries | Number of Psychiatrists |

| United States | 59,284 |

| Brazil | 13,886 |

| Australia | 7,580 |

Which Type Segment Dominated the Mental Health Billing Service Market?

The behavioral health billing segment held a dominant position in the market with a share of 42.6% in 2025, due to the rising incidence of substance use disorders and other behavioral disorders. In 2024, 70.5 million people, or 24.9% of Americans aged 12 years and above, used illegal drugs or misused prescription drugs. The U.S. government allocated $45.5 billion for drug control in 2024. Behavioral health billing may cover a wide range of functions, from psychiatric evaluations to virtual therapy sessions.

Psychotherapy Billing

The psychotherapy billing segment is expected to grow at the fastest CAGR of 8.6% in the market during the forecast period. Psychotherapy billing helps with new patient registration, electronic claims, authorization reminders, and claim denial resolution. Billing services benefit psychiatrists, psychologists, social workers, and therapists. The growing awareness of mental health therapy and personality growth and development boosts the segment’s growth.

How the Private Practices Segment Dominated the Mental Health Billing Service Market?

The private practices segment held the largest revenue share of 34.8% in the market in 2025, due to the increasing patient admissions and the preference for in-person visits. Patients prefer in-person visits due to more accurate diagnosis and better treatment. Billing services enable private practitioners to focus on quality client care. Government bodies promote mental health parity in private practices due to high out-of-pocket costs and limited access to mental health.

Telehealth Providers

The telehealth providers segment is expected to grow with the highest CAGR of 8.5% in the market during the studied years. The growing demand for telehealth and remote monitoring augments the segment’s growth. According to a recent survey on 1226 participants, 29% of participants, or 361 people, preferred telemedicine. Telemedicine eliminates the need for patients to visit a healthcare organization, saving time and costs. It also enables patients to receive treatment from providers across diverse geographical locations.

Why Did the Outsourced Billing Services Segment Dominate the Mental Health Billing Service Market?

The outsourced billing services segment contributed the biggest revenue share of 51.3% in the market in 2025, due to high flexibility and scalability. Outsourced billing services can scale billing operations up or down without the hassle of hiring or layoffs. Service providers have relevant expertise to solve complex problems and provide tailored solutions. They help reduce the cost and allow healthcare professionals to focus on their core competencies.

Hybrid Solutions

The hybrid solutions segment is expected to expand rapidly with a CAGR of 8.4% in the market in the coming years. Hybrid solutions provide the benefits of both in-house and outsourced billing services, including high flexibility and reduced cost. They provide complete control over the entire billing process and reduce the risk of data security breaches. They offer customization to better align with clients’ needs and help enhance revenue.

Which Deployment/Technology Segment Led the Mental Health Billing Service Market?

The cloud-based platforms segment led the market with a share of 54.8% in 2025, due to the ability to store vast amounts of patient data. Cloud-based platforms can help providers and patients access data from anywhere and at any time through internet connectivity. They perform multiple functions, such as managing appointments, storing patient files, handling billing and claims, and processing payments. They eliminate the need for a suitable infrastructure for hardware components.

SaaS Billing Solutions

The SaaS billing solutions segment is expected to witness the fastest growth with a CAGR of 8.3% in the market over the forecast period. Software-as-a-Service (SaaS) billing solutions provide numerous advantages, such as reduced upfront cost, high accessibility, and quick setup and deployment. They facilitate lower costs, high compatibility, and convenience. They eliminate the need to have a dedicated IT infrastructure, reducing IT workloads. SaaS solutions are suitable for small- and medium-sized enterprises, minimizing software use that requires the high cost of licensing.

North America dominated the global market in 2025. The presence of key players, availability of a robust healthcare infrastructure, and favorable reimbursement policies are major factors that drive market growth in North America. The increasing burden of mental and behavioral health disorders and the growing demand for personalized care propel the market. The region has a suitable regulatory framework to deploy advanced billing solutions and services in mental health organizations.

U.S. Market Trends

The U.S. is home to numerous key players, such as Waystar Holding Corp., Athenahealth, and Plutus Health, Inc., that provide advanced mental health billing services. The Centers for Medicare & Medicaid Services (CMS) is a government body that provides insurance coverage for people with mental illnesses. The Food and Drug Administration (FDA) and CMS recently collaborated to establish coding and separate payment for certain digital mental health treatment devices.

Asia-Pacific is expected to host the fastest-growing market in the coming years. The growing patient population, lack of skilled professionals, and favorable government support foster market growth. Government organizations raise awareness about mental health screening, diagnosis, and treatment, as well as encourage people to adopt insurance coverage. The increasing adoption of advanced technologies and telehealth expansion, particularly in emerging countries, boost the market. The growing need for personalized care and the increasing competition among mental health professionals also contribute to market growth.

India Market Trends

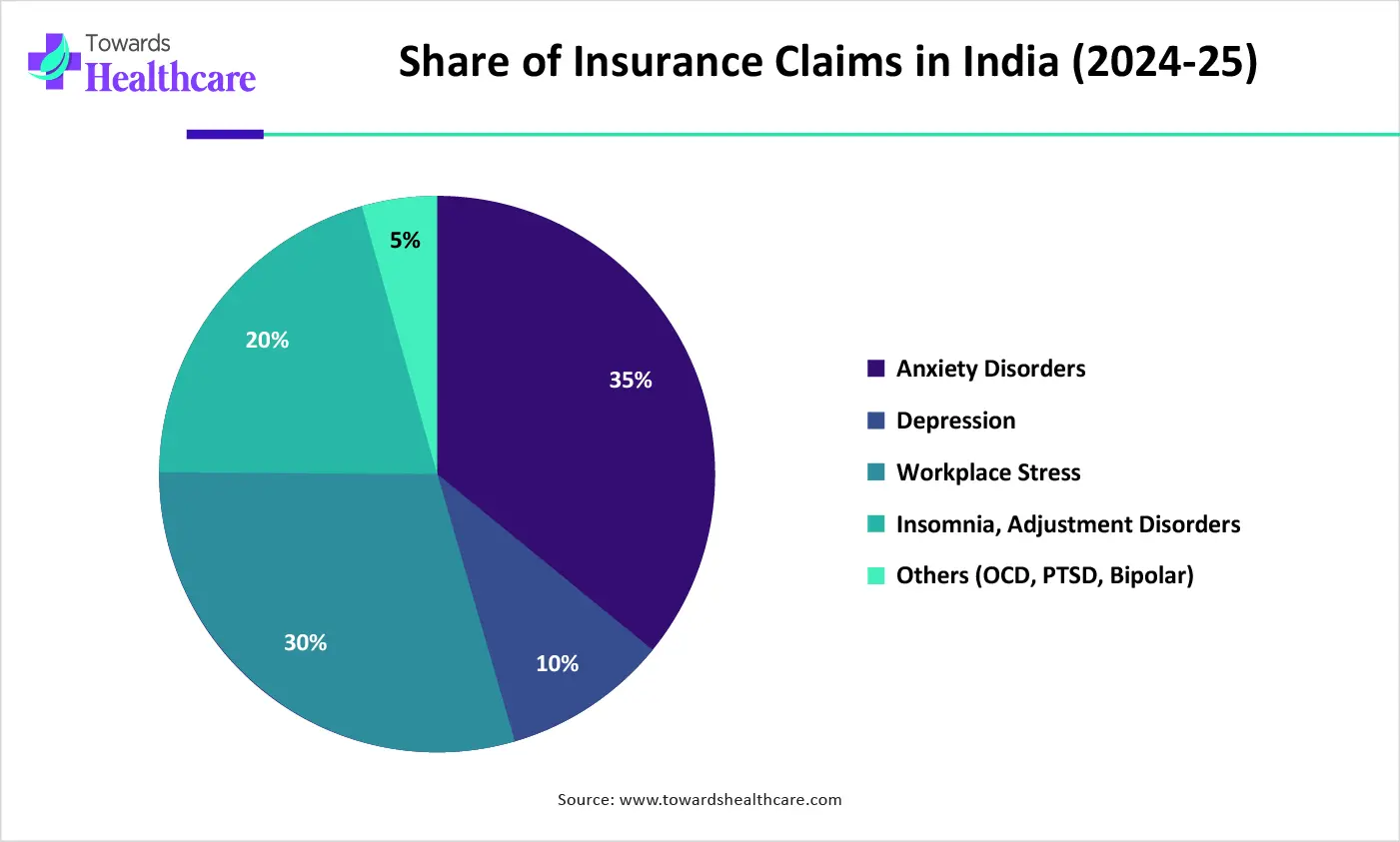

Mental health disorder is a growing concern among Indians with sedentary lifestyles and genetic factors. Thus, the Indian government offers TeleMANAS, a telehealth service for people with mental illnesses. More than 12.33 lakh calls were received on the platform in 2025. India is also making constant efforts to accelerate the implementation of digital systems in healthcare organizations. Approximately 35% of Indian hospitals have adopted EMR/EHR systems.

| Disorders | Share of Insurance Claims in India (2024-25) |

| Anxiety Disorders | 35% |

| Depression | 10% |

| Workplace Stress | 30% |

| Insomnia, Adjustment Disorders | 20% |

| Others (OCD, PTSD, Bipolar) | 5% |

Europe is considered to be a significantly growing area, due to evolving regulatory landscapes, the increasing need for insurance policies for mental health disorders, and the rising use of telehealth. As of 2023, digital health solutions are reimbursable in most European nations, including Belgium, France, Germany, Italy, the Netherlands, Sweden, and the UK. Government bodies also launch initiatives to conduct mental health campaigns. The increasing investments and collaborations among healthcare professionals also bolster the market.

UK Market Trends

Thousands of people in the UK are deemed incapable of any work every month due to mental health problems. The Department for Work and Pensions (DWP) reported that 20,000, or one-third, of incapacity benefit claims are for mental health problems. It also reported that 2 million people in the UK are receiving universal credit health benefits, representing an increase of 400,000 in a year.

| Companies | Headquarters | Offerings |

| Waystar Holding Corp. | Utah, United States | Its cloud-based software provides end-to-end RCM solutions to simplify healthcare payments and accelerate financial results. |

| AdvancedMD | Utah, United States | It offers outsourced medical billing services using the cloud platform for managed billing, as well as EMR/EHR software. |

| ePsych Billing | Las Vegas, United States | It offers a complete range of billing and practice management services tailored to behavioral health providers. |

| Ensora Health | Alabama, United States | It provides TheraNest, a billing software, to streamline and automate the claims and payments process. |

| Athenahealth | Massachusetts, United States | It offers medical billing, practice management software & services with the athenaOne solution, enhancing operational efficiency. |

| Kareo | California, United States | Its billing services optimize medical practices’ revenue cycles, ensuring accurate billing, timely payments, and improved financial performance. |

| Invensis Technologies Pvt. Ltd. | Bengaluru, India | It provides expert mental health billing services for accurate coding and hassle-free claims management. |

| Raintree Systems | California, United States | Raintree offers RCM and billing software for physical therapy, occupational therapy, speech, and multidisciplinary practices. |

| Plutus Health, Inc. | Texas, United States | It provides exceptional RCM services, including medical billing, medical coding, AR management, and denial management. |

| Coronis Health | Illinois, United States | It is a medical billing service provider with customized solutions for all healthcare organizations and specialties. |

By Type

By Application/End-User

By Service Model

By Deployment/Technology

By Region

February 2026

February 2026

February 2026

February 2026