February 2026

The global healthcare revenue cycle management market was estimated at US$ 169.7 billion in 2025 and is projected to grow to US$ 505.8 billion by 2035, rising at a compound annual growth rate (CAGR) of 11.54% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 189.28 Billion |

| Projected Market Size in 2035 | USD 505.8 Billion |

| CAGR (2026 - 2035) | 11.54% |

| Leading Region | North America by 56% |

| Market Segmentation | By Product Type, By Function Type, By Deployment Type, By End-user, By Region |

| Top Key Players | Allscripts Healthcare, LLC, Cognizant, NextGen Healthcare, Experian, AGS Health Inc., Dell Technologies, Adonis, Cerner Corporation, Athenahealth, Experion Information Solutions, Inc., Change Healthcare, Conifer Health Solutions, LLC., Optum, CareCloud, Inc., Medical Information Technologies, Inc., SSI Group Formativ Health, McKesson Corporation, R1 RCM, Inc. |

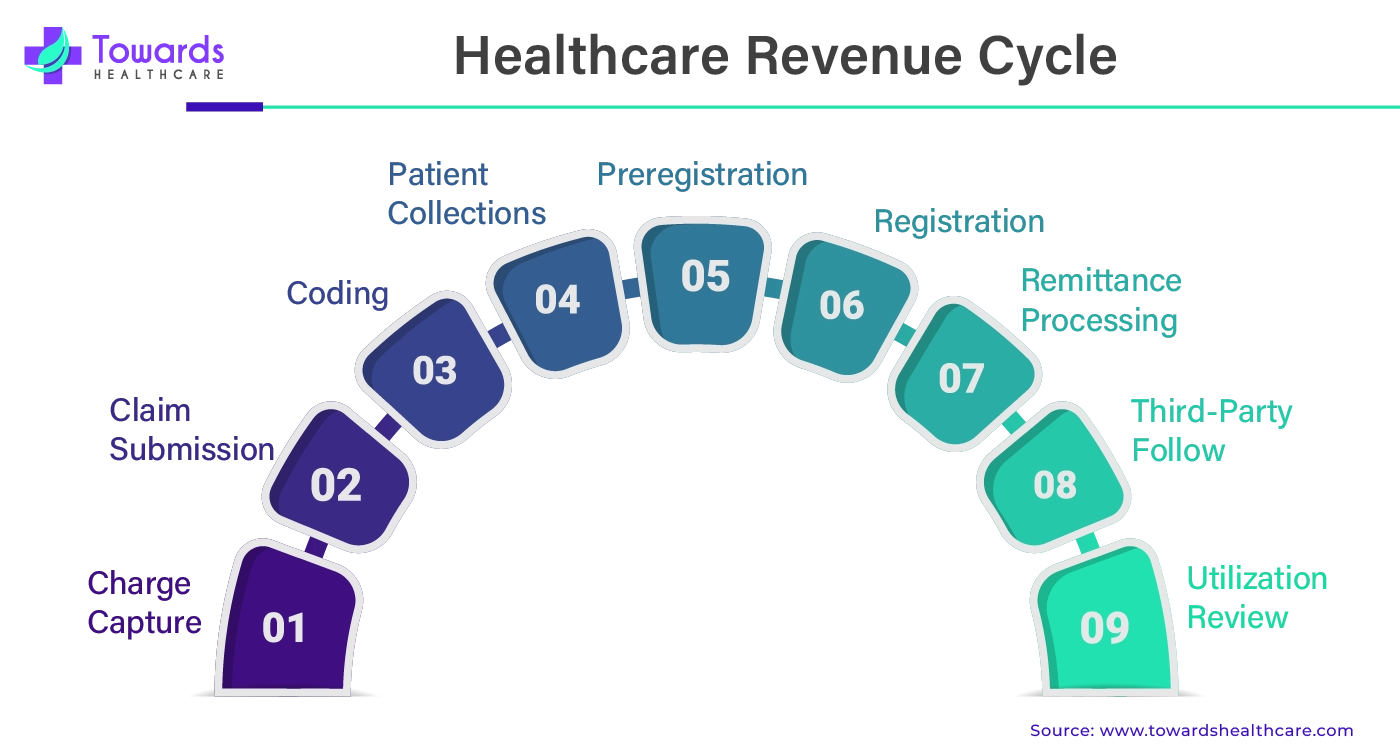

The financial process in which medical billing software is used to track patient care from registration, appointment, scheduling, and final payment to ensure proper identification, collection, and management of patient revenues is called healthcare revenue cycle management (HRCM). HRCM is essential in healthcare in order to ensure financial viability and profitability. HRCM is useful in storing and managing billing records of patients, which leads to error-free management.

Healthcare operations might be greatly enhanced by integrating automated processes and artificial intelligence (AI), especially in the area of revenue-cycle management (RCM). Emerging useful uses for generative AI include processing previous authorizations and producing appeal letters in the event that a claim is denied. Proponents claim that generative AI may optimize coding and other processes by preventing preventable errors by reviewing copious documentation to find missing information or probable problems. AI has the power to completely transform RCM in the healthcare sector by optimizing workflows, cutting expenses, raising accuracy, and enhancing patient happiness and profitability. Employees can also rely on artificial intelligence to expedite tedious work so they can concentrate more on problem-solving and critical thinking.

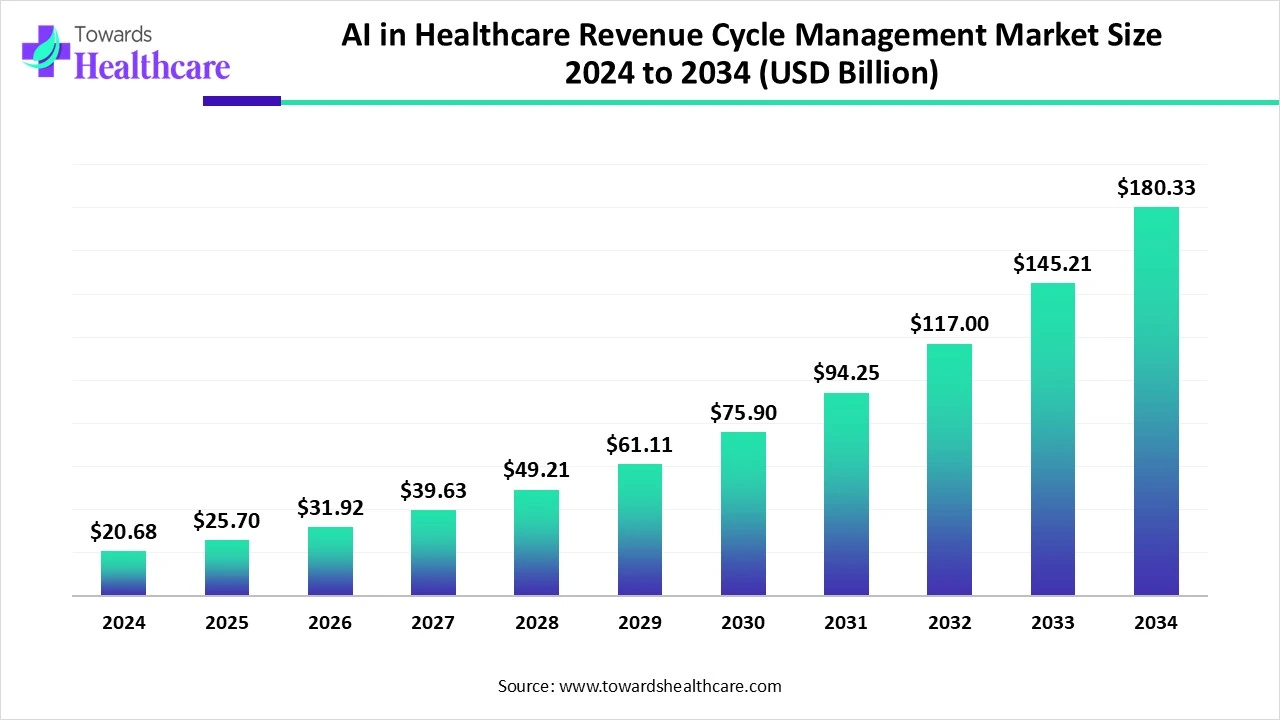

The global AI in healthcare revenue cycle management market size is valued at USD 20.68 billion in 2024, expected to increase to USD 25.7 billion in 2025, and is projected to reach approximately USD 180.33 billion by 2034, expanding at a CAGR of 24.20% from 2024 to 2034.

The healthcare revenue cycle management market is growing due to the continuous demand for managing healthcare financial resources. A simplified revenue cycle becomes crucial in the healthcare industry, where budgetary limits frequently present obstacles. RCM expedites cash flow by reducing the amount of time needed for reimbursement and claim processing. Organizations with efficient Revenue Cycle Management procedures saw a 29% decrease in accounts receivable days, according to a report conducted by the Healthcare Financial Management Association (HFMA). By offering clear billing information, simple-to-read bills, and effective claims processing, a well-run RCM system helps to increase patient satisfaction. In a market where human resources are crucial, revenue cycle management streamlines and automates administrative procedures, relieving the workload of healthcare personnel.

RCM outsourcing in healthcare entails giving a third party access to private patient data. Sensitive data leaving the premises always carries a risk, even in firms with strict data security policies. It is imperative for the healthcare provider to exercise diligence in verifying that their partner complies with data protection regulations, such as HIPAA. Healthcare providers may choose a trustworthy, knowledgeable RCM partner and weigh the possible advantages and disadvantages to make an educated selection that satisfies their dedication to patient care as well as their commercial objectives.

As the pet care industry continues to grow, veterinary practices are increasingly seeking ways to optimize operations and maximize revenue. One of the most overlooked yet impactful areas is revenue cycle management (RCM) the end-to-end process of capturing, managing, and collecting revenue from clinical services. Efficient RCM not only reduces administrative overhead but also plays a critical role in improving veterinary clinic profitability. With the rise of pet insurance, wellness plans, and digital invoicing, modern clinics face new challenges in billing accuracy, claims processing, and timely collections. Investing in smart, automated RCM systems tailored for veterinary workflows can significantly enhance cash flow, minimize revenue leakage, and boost long-term financial performance.

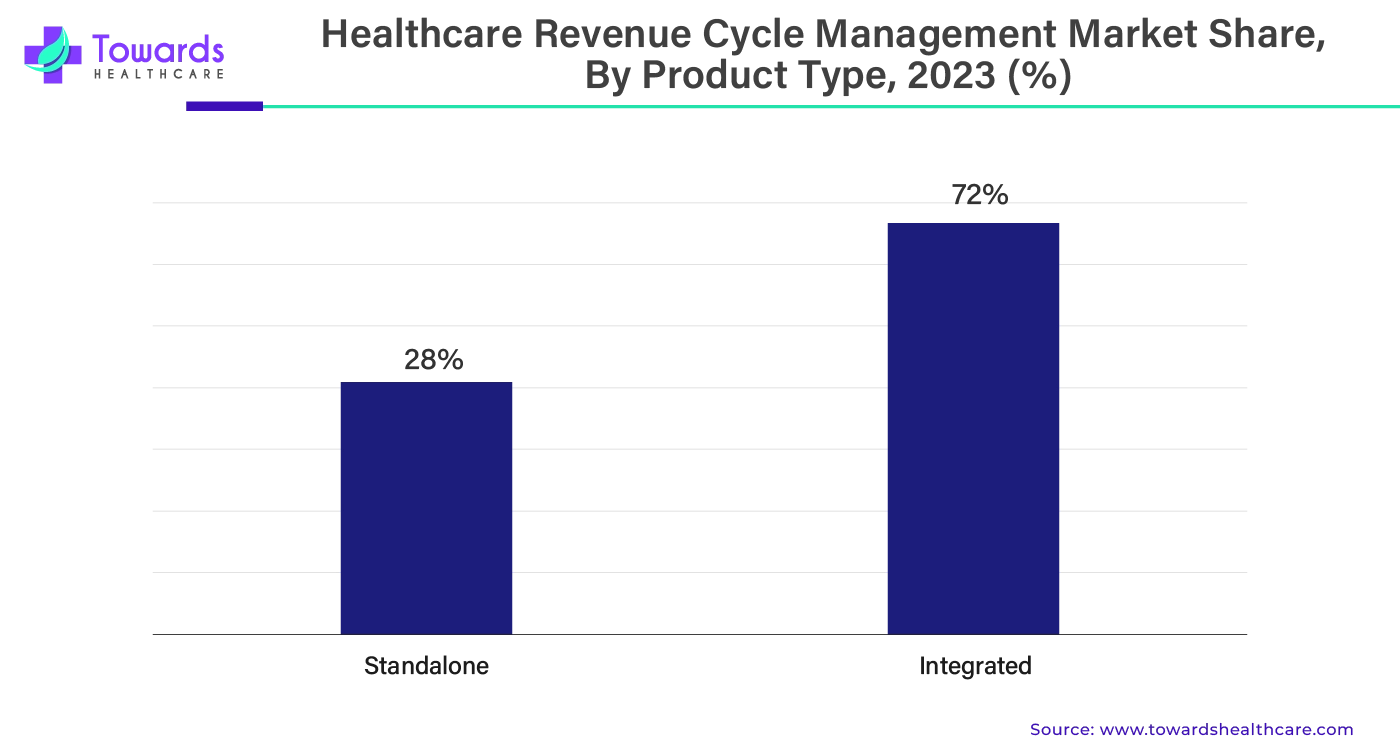

Why Did the Integrated Segment Dominate in the Market?

By product type, the integrated segment dominated the healthcare revenue cycle management market share by 72%. A key component of an integrated revenue cycle is the capacity to seamlessly and securely transfer common data between systems. This lessens the amount of human labor required to enter the data into various systems, increasing accuracy by preventing data entry mistakes. Reducing the amount of physical labor may boost employee productivity and typically lead to higher work satisfaction in addition to better internal procedures. Apart from the transactional advantages, integration guarantees that the company may access combined data from several important systems. This makes it possible for departments to examine how procedures and data coming from one area affect processes farther down the line and affect the billing process.

How the Claims & Denial Management Segment Dominated the Market?

By function, the claims & denial management segment held the largest share of the healthcare revenue cycle management market in 2023. The rejection of a healthcare provider's reimbursement request by a payer is known as a claim denial. Denies can have many different reasons, from incomplete paperwork to not fulfilling the payer's standards. Monitoring performance indicators, examining billers and payers, searching for denial management in healthcare trends, pinpointing root problems, enhancing processes, and taking proactive measures to stop rejections from happening are all part of claims denial management.

In healthcare revenue cycle management (RCM), a complicated field, denial management is essential. Incorrect billing procedures, procedural problems, or misunderstandings between healthcare providers and insurance payers can result in revenue leakage. Thus, it's critical to manage claim denials effectively in order to maximize funds.

For instance,

Which Deployment Type Segment Held the Dominating Share of the Market?

By deployment, the cloud-based segment held the largest share of the healthcare revenue cycle management market in 2023. To genuinely revolutionize the revenue cycle, RCM Cloud is an end-to-end solution for managing the revenue cycle that delivers fully integrated capabilities and Service Level Agreements (SLAs). Digital solutions that minimize manual labor and enhance workflow through automation have taken the role of resource-intensive medical billing procedures in the RCM Cloud software-as-a-service (SaaS) paradigm. By utilizing their technological investment to increase service delivery capacity rather than hiring more staff to support growth, this strategy not only greatly increases operational efficiency but also helps the firm to grow.

What Made Physician Office the Dominant Segment in the Market?

By end-user, the physician office segment dominated the healthcare revenue cycle management market share by 40% in 2023. The physician revenue cycle is a complex sequence of events that starts with patient registration and ends with final payment. These interactions call for accuracy, efficiency, and knowledge of clinical and administrative tasks, financial systems, and operations. Physician revenue cycle management plays a vital role in supporting the healthcare industry's ability to serve communities in today's complicated healthcare environment. Progressive medical practices are implementing patient-focused revenue cycle management techniques. These cutting-edge methods encompass tailored financial aid programs, individualized estimations of out-of-pocket expenses, and thorough patient education regarding prices and coverage.

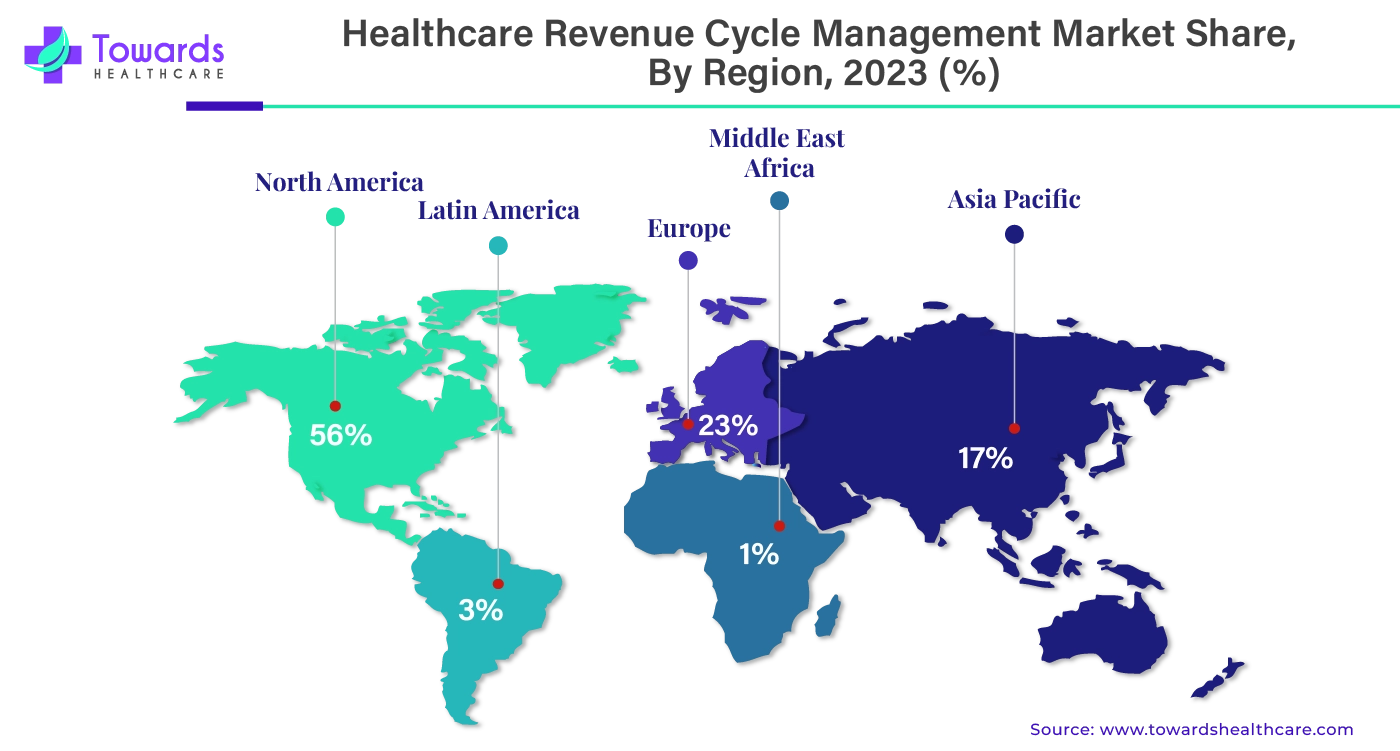

By region, North America dominated the healthcare revenue cycle management market share by 56% in 2025. North America is the leader in technical breakthroughs, and nations like the United States and Canada are helping to fuel the market's expansion in the healthcare information technology sector. Infrastructure for healthcare and technology improvements are major areas of investment for the governments of the United States and Canada.

America's sophisticated healthcare system is a key factor in the country's contribution to the healthcare revenue cycle management market. The increasing number of people suffering from various chronic illnesses is another factor driving the market's rise. The healthcare industry is expanding even faster as artificial intelligence, machine learning, and other technologies are being used in it. Hospitals, both public and private, are widely distributed throughout the U.S.

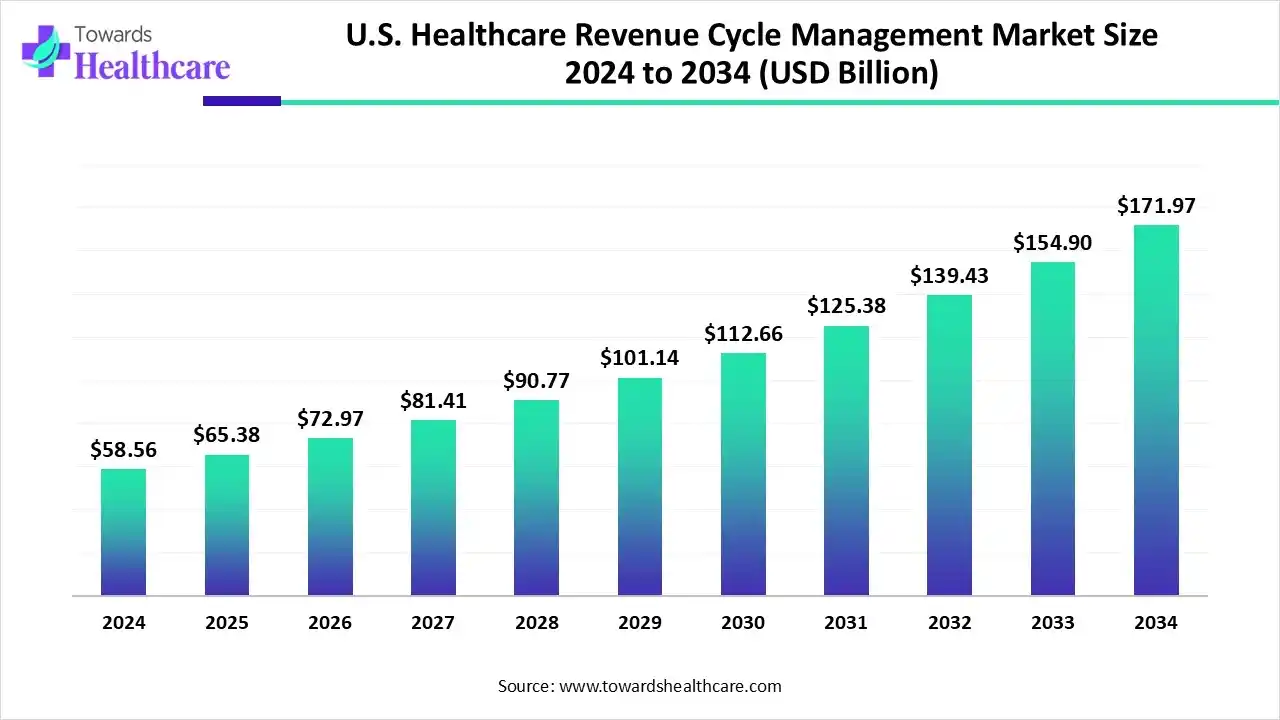

U.S. Healthcare Revenue Cycle Management Market Growth

The U.S. healthcare revenue cycle management market size is calculated at US$ 65.38 billion in 2025, grew to US$ 72.96 billion in 2026, and is projected to reach around US$ 195.92 billion by 2035. The market is expanding at a CAGR of 11.6% between 2026 and 2035.

Advances in AI and machine learning are driving the healthcare sector from Computer-Assisted Coding (CAC) toward Autonomous Coding, which fully automates the coding process with minimal human intervention. Unlike CAC, which uses NLP to suggest codes, autonomous coding addresses issues like human error, fatigue, and evolving standards, enhancing the accuracy, efficiency, and cost-effectiveness of medical coding and billing. Research highlights its growing adoption and benefits.

By region, Asia Pacific is expected to grow at the fastest rate of 15.84% CAGR during the forecast period. The number of patients is rising along with the population growth in the Asia Pacific area. The creation of new healthcare infrastructure is facilitated by these reasons. The market for healthcare revenue cycle management is expanding as a result of all these reasons, since there is a greater amount of financial data related to patients, staff, and facility management. Japan, South Korea, China, and India are the main nations that support the expansion of the Asia-Pacific market. These nations are renowned for their contributions to the growth of the healthcare sector and technology.

China Market Trends

As far as healthcare infrastructure and RCM systems are concerned, China has the largest share of the Asia Pacific healthcare revenue management market for these services. By 2023, the Chinese healthcare security system has helped 250 million patients receive medical treatment, according to the National Medical Products Administration. Furthermore, from 1.38 billion yuan in 2005 to 74.5 billion yuan in 2023, the finances were expanded accordingly.

India Market Trends

Through its investments in the healthcare sector, India is also assisting in the expansion of the healthcare revenue cycle management market. The hospital industry in India was valued at INR 7940.87 billion in FY2021 and is projected to grow to INR 18,348.78 billion by FY2027, according to the government. Telemedicine is becoming more and more popular; by 2025, it is predicted to reach a value of $5.4 billion, with India leading the way. Over the next 10 years, the Indian healthcare sector is predicted to generate over $200 billion in revenue due to the growth of National Digital Health.

Europe is expected to grow at a considerable rate in the upcoming period. The increasing number of hospitalizations due to the rising prevalence of chronic disorders and the growing geriatric population facilitates the demand for revenue cycle management. The increasing healthcare expenditure and favorable reimbursement policies by the government and private insurers boost the market. The growing demand for personalized care encourages healthcare professionals to adopt revenue cycle management, enabling them to focus on patient care.

German Market Trends

The German government supports the adoption of digital tools in the healthcare sector through several initiatives, such as the Digital Act, the Digitalization Strategy for Health and Care, and the Health Data Use Act. Additionally, Germany’s healthcare expenditure represents 12.8% of the country’s GDP.

French Market Trends

According to the French Department of Research, Studies, Evaluation, and Statistics (DRSES)’s “Health expenditure in 2023” report, the healthcare expenditure in France rose by 3.5%, reaching £325 billion in 2023. The expenditure has increased due to the consumption of healthcare and medical goods.

South America is expected to grow notably in the healthcare revenue cycle management market during the forecast period, due to a growing focus on enhancing operational efficiency, which is increasing the adoption of RCM systems. The growing digitalization is also encouraging their use and innovations, enhancing the market growth.

Brazil Market Trends

The presence of large healthcare systems in Brazil is increasing the demand for healthcare RCM systems to streamline their workflows. The growing government initiatives and healthcare investments are also increasing their adoption rates, where companies are developing AI-driven platforms to enhance their accuracy.

MEA is expected to show lucrative growth in the healthcare revenue cycle management market during the forecast period, due to growing healthcare investments and expanding healthcare. At the same time, the rapid digitalization is also increasing their adoption rates, as well as their innovations, promoting the market growth.

Saudi Arabia Market Trends

Saudi Arabia is experiencing an expansion in health insurance policies due to expanding healthcare. This is increasing the demand for healthcare RCM systems to reduce claim rejection and to offer other healthcare applications. Moreover, the companies are also developing advanced solutions, which are backed by investments.

| Company Name | Adonis |

| Headquarters | NYC, U.S., North America |

| Recent Development | In June 2024, Adonis, an automation and intelligence startup for the healthcare revenue cycle, revealed that it had raised $54 million in total, including $31 million in Series B investment. With participation from new investor Kin Ventures as well as returning investors General Catalyst, Max Ventures, and Bling Capital, Point72 Private Investments led the round. |

| Company Name | Waystar |

| Headquarters | U.S., North America |

| Recent Development | In June 2024, the revenue cycle management software provider Waystar Holding Corp. started issuing 45 million shares of its common stock as part of its first public offering. Waystar anticipates giving the offering's underwriters a 30-day window during which they may choose to buy an additional 6,750,000 shares of common stock at the price of the first public offering (minus the underwriting discount). The price per share for the first public offering is projected to be between $20.00 and $23.00. |

By Product Type

By Function Type

By Deployment Type

By End-user

By Region

February 2026

February 2026

February 2026

January 2026