February 2026

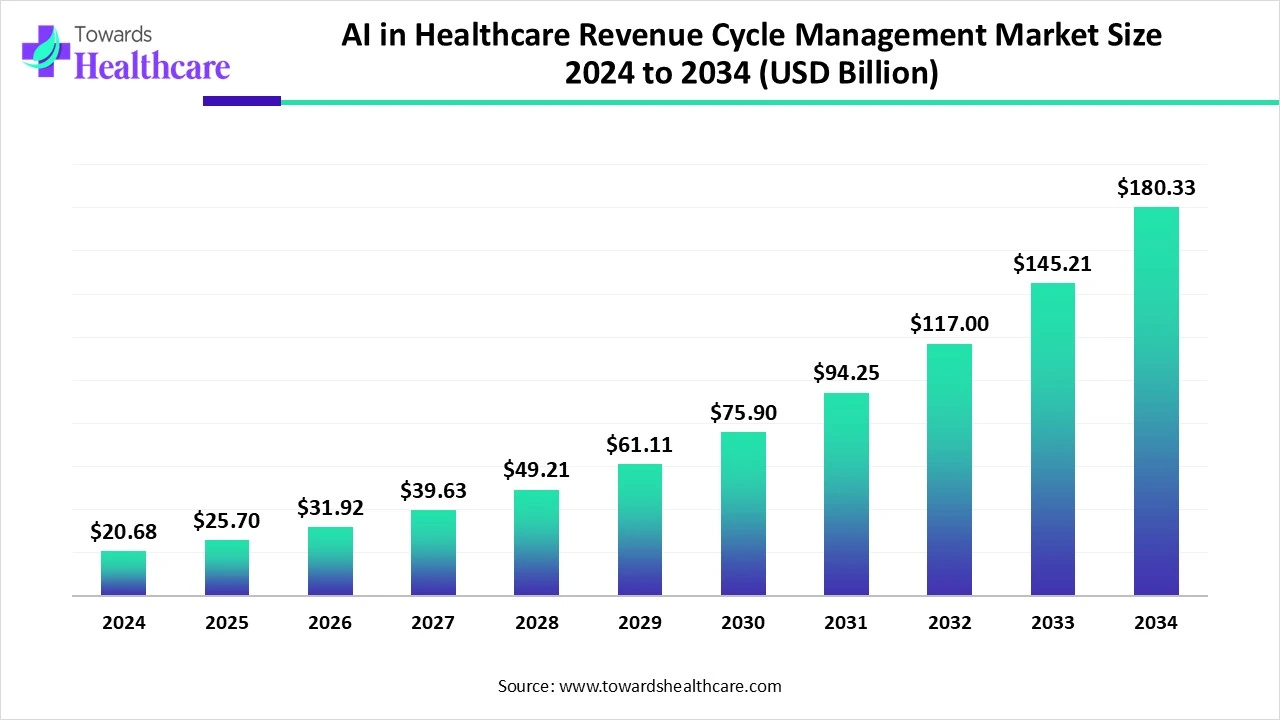

The global AI in healthcare revenue cycle management market size is calculated at USD 20.68 billion in 2024, grows to USD 25.7 billion in 2025, and is projected to reach around USD 180.33 billion by 2034.The market is expanding at a CAGR of 24.20% between 2024 and 2034.

The AI in healthcare revenue cycle management (RCM) market is growing as healthcare providers increasingly adopt AI to streamline billing, coding, and claims processes. AI helps reduce human errors, minimize claim denials, and speed up reimbursements, leading to improved financial performance. The demand for real-time data insights, automated workflows, and predictive analytics is driving the adoption of AI-powered RCM solutions. This shift supports greater efficiency and accuracy in managing complex healthcare administrative and financial tasks.

| Metric | Details |

| Market Size in 2025 | USD 25.7 Billion |

| Projected Market Size in 2034 | USD 180.33 Billion |

| CAGR (2025 - 2034) | 24.20% |

| Leading Region | North America |

| Top Key Players | AGS Health, LLC, AdvantEdge Healthcare Solutions, Inc, CareCloud, Conifer Health Solutions, McKesson Corporation, The SSI Group Inc, Athenahealth, Change Healthcare, R1 RCM, GE HealthCare, Oracle |

AI in healthcare revenue cycle management is the use of artificial intelligence to automate and improve billing, coding, claims processing, and payment tasks, making healthcare finance more accurate and efficient. The AI in the healthcare revenue cycle management market is evolving rapidly as providers seek smarter, more efficient ways to handle complex administrative tasks. AI is being used to automate medical coding, detect billing errors, predict claim denials, and streamline payment collections. The integration of AI with electronic health records and cloud platforms is enhancing real-time data processing and decision-making. As a result, healthcare organizations are improving cash flow, reducing costs, and achieving greater accuracy in financial operations.

For Instance,

Increased Claim and Complexity

The rise in claim denials and growing complexity in billing processes drive the need for AI in healthcare revenue cycle management. Manual systems often struggle with identifying errors, coding issues, or payer-specific rules, leading to delays and revenue loss. AI solutions can analyze large volumes of data, detect denial trends, and automate corrections in real time. This helps providers reduce denials, streamline resubmission, and enhance reimbursement rates, ultimately improving financial performance and operational efficiency.

For Instance,

High Implementation and Integration Costs

High implementation and integration costs are a major restraint in the AI in healthcare revenue cycle management market because many healthcare organizations, especially small to mid-sized providers, lack the financial resources to invest in advanced AI systems. These solutions often require costly infrastructure upgrades, integration with existing EHR systems, staff training, and ongoing maintenance. Additionally, customizing AI tools to fit specific workflows adds to the expense. These financial and technical burdens can delay or prevent adoption, limiting market growth.

Adoption of Value-Based Care Models

The adoption of value-based care models presents a key opportunity for AI in healthcare revenue cycle management as providers shift focus from volume to outcomes. These models require advanced tools to track performance metrics, predict reimbursements, and manage complex payment structures. AI can streamline these tasks by analyzing large datasets in real time, improving accuracy, and supporting strategic financial decisions. This enhances operational efficiency and ensures healthcare organizations remain financially sustainable under outcome-based reimbursement systems.

In 2024, the software segment held a major share of the AI in healthcare revenue cycle management market due to its ability to automate complex billing, coding, and claim processes. Healthcare providers increasingly adopted AI-driven software for real-time analytics, denial management, and seamless integration with EHR systems. Its scalability, ease of updates, and ability to reduce administrative burden made it the preferred choice, driving strong revenue growth and solidifying its dominance in the overall market.

For Instance,

The services segment is witnessing rapid growth as healthcare organizations increasingly seek expert assistance to manage AI-driven revenue cycle tools. Beyond just installation, providers rely on services for system optimization, compliance support, and continuous performance monitoring. The complexity of AI integration and the need for tailored solutions across diverse healthcare settings are fueling demand for professional services, making this segment the fastest-growing component in the AI healthcare RCM market.

For Instance,

The integrated AI-RCM platforms segment led the AI in healthcare revenue cycle management market due to its ability to unify various revenue cycle processes within one system, eliminating the need for multiple disconnected tools. This all-in-one approach enhances coordination, improves data accuracy, and accelerates decision-making. Healthcare providers prefer integrated platforms for their flexibility, scalability, and ability to support seamless interactions across departments, which ultimately helps improve cash flow and financial performance, making them the top choice in the market.

The standalone AI-RCM tools segment is projected to grow rapidly as many healthcare providers prefer adopting specialized tools that address specific challenges, such as claim denials or payment delays. These solutions are often quicker to deploy, require less integration effort, and offer measurable results in targeted areas. Their ability to enhance existing workflows without the need for full system replacement makes them an attractive option, particularly for organizations with limited resources or phased digital strategies.

The cloud/web-based segment dominated the AI in healthcare revenue cycle management market in 2024 as providers increasingly prioritized solutions that offer real-time data accessibility, automatic updates, and lower upfront costs. These platforms support remote operations, simplify compliance with evolving regulations, and reduce dependency on in-house IT resources. Their ability to quickly adapt to changing workflows and scale with organizational needs made them the preferred deployment model for hospitals and clinics seeking efficiency and agility in revenue management.

The rapid growth of the cloud-based deployment segment is driven by its ability to support dynamic healthcare environments with minimal upfront investment. It allows providers to adopt AI tools without complex hardware setups, offering on-demand scalability and centralized access to financial data. As more organizations prioritize digital agility and remote capabilities, cloud-based solutions are becoming essential for streamlining revenue cycle operations, reducing downtime, and enabling faster decision-making, which fuels their rising adoption and strong market momentum.

For Instance,

The claims & denials management segment led the AI in healthcare revenue cycle management market in 2024 because of the growing burden of administrative tasks and high volumes of rejected claims. Healthcare providers face mounting pressure to secure timely reimbursements, prompting the adoption of AI solutions that can detect errors early, streamline appeals, and predict denial risks. These tools enhance efficiency and accuracy, making them critical to maintaining steady revenue flow, driving their dominance in applications across the healthcare revenue cycle management landscape.

The eligibility and benefits verification segment is projected to grow quickly because healthcare providers are under pressure to improve front-end accuracy and reduce downstream billing issues. With rising patient volumes and diverse insurance plans, verifying coverage manually is time-consuming and error-prone. AI tools offer automated, real-time checks that help prevent claim rejections and reduce administrative workload. This not only speeds up the intake process but also ensures cleaner claims and faster reimbursements, making it a high-growth application area.

The hospitals and health systems segment led the revenue market share in 2024 because they face extensive administrative demands and require comprehensive financial solutions to manage diverse services and payer contracts. Their need to streamline operations, improve cash flow, and handle large-scale claims processing has driven strong adoption of AI-enabled RCM tools. With greater access to funding and infrastructure, these organizations are better positioned to implement advanced technologies, making them key contributors to market dominance in this segment.

For Instance,

North America leads the market due to advanced healthcare infrastructure, early adoption of AI technologies, and high healthcare spending. The region benefits from strong government support for digital health, widespread use of electronic health records, and a growing focus on reducing administrative costs. Additionally, the presence of key industry players and continuous investment in AI-driven RCM solutions further strengthen North America’s leading position in the market.

The market is growing rapidly due to increasing healthcare costs and the rising complexity of billing and reimbursement processes. Healthcare providers are turning to AI to automate tasks, reduce administrative errors, and improve claim accuracy. The widespread adoption of cloud-based RCM platforms supports scalable and real-time AI integration. Additionally, regulatory changes and a shift towards value-based care require advanced data analytics and predictive tools, further driving the demand for AI-powered RCM solutions across the country.

For Instance,

The market in Canada is growing due to increased investment in digital health infrastructure and a rising need to streamline administrative processes. Healthcare providers are adopting AI and automation tools to improve claims processing, reduce denials, and enhance billing accuracy. Government support for healthcare innovation and the integration of AI with EHR systems helps improve operational efficiency, lower costs, and support better financial outcomes for Canadian healthcare organizations.

The Asia Pacific region is expected to witness the highest CAGR in the market during the forecast period due to the rapid digital transformation in healthcare, expanding infrastructure, and rising healthcare expenditure. Governments across the regions are actively promoting healthcare modernization and the adoption of electronic health records. Additionally, the growing middle-class populations, increased demand for efficient billing systems, and rising use of telehealth services are driving the need for AI-powered RCM solutions, boosting market growth in the region.

China’s market is growing rapidly due to its extensive digitized hospital networks, large patient volumes, and strong government backing. With over 38000 hospitals integrated into unified EMR systems and centralized health data, RCM solutions benefit from seamless EHR integration and payer analytics. Adoption of cloud-based platforms, increased use of AI-driven denial management, and automation of claims and eligibility checks further accelerate the uptake of AI-powered RCM across China.

India’s market is growing rapidly due to rising digital health adoption, government initiatives like the National Digital Health Mission, and increased use of EHR and Cloud-based systems. Healthcare providers are leveraging AI to automate claims, reduce denials, and improve billing accuracy. The surge in telehealth and support from health tech startups is also driving faster adoption of AI-powered RCM solutions, helping improve efficiency and financial outcomes across the sector.

For Instance,

Europe is driving growth by investing in digital transformation across hospitals and healthcare systems. The rise of national health digitization programs, increased funding for AI innovation, and focus on cross-border data interoperability are enabling faster AI adoption. Additionally, the growing demand for cost-efficiency, reduced administrative workload, and enhanced reimbursement accuracy is pushing providers to implement AI tools that streamline billing coding and claims processes across various healthcare environments.

The UK market is expanding due to increased government investment in NHS digital transformation, rising healthcare demand, and a growing focus on cost efficiency. AI is being adopted to reduce claim denials, streamline billing, and improve overall financial performance. Integration with EHR systems and the shift towards value-based care further support the use of AI-powered RCM solutions. These factors collectively drive the growth of intelligent revenue cycle tools across the UK healthcare.

Germany’s market is growing due to strong national efforts to modernize healthcare IT systems and improve financial workflows. The push for automation to reduce administrative burden, along with the rise in private healthcare services, is encouraging providers to adopt AI for faster claims processing and accurate billing. Additionally, collaborations between health tech firms and hospitals are accelerating innovations, while growing pressure to control costs is making AI-based RCM solutions increasingly valuable.

For Instance,

In June 2025, FinThrive will showcase its advanced revenue cycle management platform at the 2025 HFMA Conference, highlighting its new Agentic AI technology. Unlike traditional tools, Agentic AI uses intelligent digital agents for autonomous decisions, real-time workflow optimization, and faster revenue recovery. Combined with machine learning, generative AI, and RPA, it enhances processes like prior authorizations and cash flow forecasting. With strong cloud infrastructure and real-time data analysis, FinThrive delivers smarter, enterprise-wide revenue cycle transformation. (Source - Finthrive)

By Component

By Type

By Deployment Mode

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026