February 2026

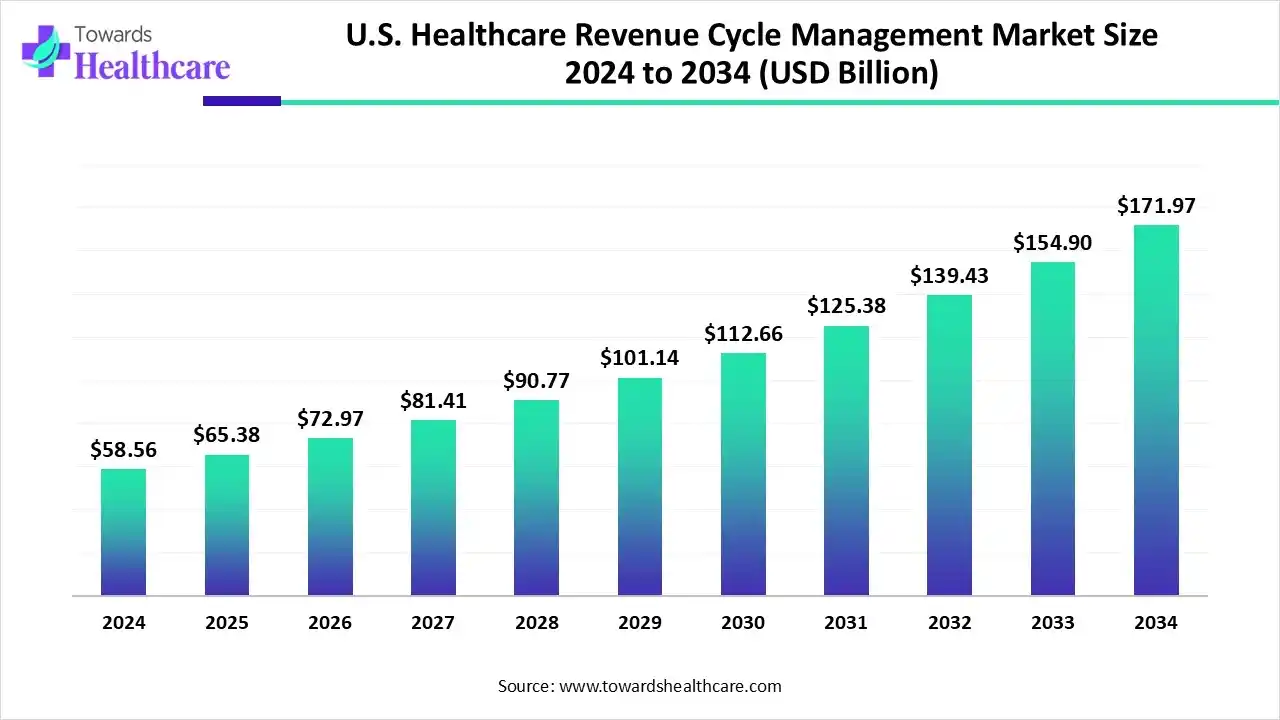

The U.S. healthcare revenue cycle management market size is calculated at US$ 65.38 billion in 2025, grew to US$ 72.96 billion in 2026, and is projected to reach around US$ 195.92 billion by 2035. The market is expanding at a CAGR of 11.6% between 2026 and 2035.

Thanks to developments in AI and machine learning, the healthcare sector is moving away from Computer-Assisted Coding (CAC) and towards Autonomous Coding. Autonomous coding completely automates the process, reducing the need for human intervention, in contrast to CAC, which uses NLP to help coders with code ideas. By tackling problems including human error, weariness, and changing standards, this change seeks to increase automated medical coding and billing's efficacy, accuracy, and cost-effectiveness. Research shows its increasing popularity and advantages.

| Table | Scope |

| Market Size in 2025 | USD 65.38 Billion |

| Projected Market Size in 2035 | USD 195.92 Billion |

| CAGR (2026 - 2035) | 11.6% |

| Market Segmentation | By Product Type, By Function Type, By Deployment Type, By End-user |

| Top Key Players | Optum (UnitedHealth Group), Oracle Cerner, Epic Systems Corporation, R1 RCM, McKesson Corporation, Waystar, Athenahealth, Conifer Health Solutions, Experian Health, The SSI Group, eClinicalWorks, FinThrive Revenue Systems, Ensemble Health Partners, NextGen Healthcare, AdvantEdge Healthcare Solutions (Health Prime International), GeBBS Healthcare Solutions, Huron Consulting Group, Cognizant (Trizetto Provider Solutions), MedEvolve, CareCloud |

The U.S. healthcare revenue cycle management market is driven by the rising demand for better non-medical services in healthcare. The method used by healthcare organisations to oversee the financial activities involved in billing and collecting payment for medical services is known as revenue cycle management, or RCM. By decreasing claim denials, cutting down on days in accounts receivable, and boosting collections, RCM contributes to increased revenue. As a consequence, healthcare providers maximise their financial performance and obtain accurate and timely reimbursements. In addition to helping healthcare organisations meet legal obligations, effective RCM may significantly increase patient satisfaction.

The U.S. healthcare revenue cycle management market is greatly impacted by artificial intelligence. Tasks carried out by artificial intelligence can be completed quickly and with few or no mistakes. AI has the power to completely transform RCM in the US healthcare sector by optimising workflows, cutting expenses, raising precision, and enhancing patient happiness and profitability. Additionally, workers may rely on AI to streamline laborious activities so they can concentrate more on troubleshooting and critical thinking.

Rise in outsourcing: One of the major trends in the U.S. healthcare revenue cycle management market is rise in outsourcing the RCM services. Hospitals and other healthcare service providers majorly focus on provide high-quality care and hence are inexperienced or are unable to focus on other non-medical aspects of healthcare services. Due to this, these healthcare providers are outsourcing RCM services in order to solely focus on patient care.

For instance,

By product type, the integrated segment dominated the U.S. healthcare revenue cycle management market in 2024 and is expected to grow at the fastest CAGR during the forecast period. For healthcare organisations, integrated systems provide a number of advantages. They streamline departmental data flow, centralise billing data, and increase the accuracy of claims submissions. This enhancement produces superior financial outcomes. Integrated RCM solutions let up healthcare institutions to concentrate more on patient care than administrative duties by minimising errors and decreasing manual entry.

By function type, the claims & denial management segment dominated the U.S. healthcare revenue cycle management in 2024.The strategic process of locating, looking into, resolving, and avoiding denied insurance claims in order to maximize a healthcare provider's revenue cycle and financial stability is known as claims and denial management. To prevent further rejections, it entails methodically examining denials to identify the underlying reasons, such as coding mistakes or missing documentation, and then revising and resubmitting claims or putting process enhancements into place. Efficient denial management guarantees prompt payment for medical services, enhances cash flow, and lessens administrative workloads.

By function type, the medical coding & billing segment is expected to grow at the fastest CAGR during the forecast period. In the complex realm of healthcare, denial management has become essential to both financial stability and effective medical billing. This crucial procedure entails locating, addressing, and averting insurance denials and claim rejections in order to guarantee that medical providers are paid on time and in full. Through creative solutions, businesses are spearheading the transformation in medical billing denial management as automation and technology develop.

By deployment type, the cloud-based segment dominated the U.S. healthcare revenue cycle management in 2024 and is expected to grow at the fastest CAGR during the forecast period. The power of digital technology and the internet is brought to this vital area of healthcare administration through cloud-based RCM systems. These systems streamline RCM by automating processes such as payment collection, insurance claims, scheduling, and billing. They boost overall process efficiency, lower the possibility of human mistake, and give real-time access to patient data.

By end-user, the physician office segment dominated the U.S. healthcare revenue cycle management market in 2024. Revenue Cycle Management (RCM) is used by a doctor's office to oversee the financial aspects of patient care, including scheduling, insurance verification, filing claims, and collecting payments. RCM solutions are essential to the practice's financial stability and capacity to deliver high-quality treatment because they simplify billing and coding, lessen administrative workloads, and guarantee prompt payment from patients and insurance companies.

By end-user, the hospitals segment is expected to grow at the fastest CAGR during the forecast period. Effective revenue cycle management for hospitals ensures financial stability, boosts cash flow, and reduces administrative expenses. Simplifying each step can help hospitals decrease claim denials, expedite reimbursements, and maintain compliance with healthcare standards.

AI-native revenue management solutions are now vital as U.S. healthcare providers struggle with increasing administrative complexity and margin pressure. Revenue cycle activities alone cost hospitals more than $160 billion a year, and administrative expenditures make up more than 40% of total hospital spending.

In June 2025, the rapidly expanding enterprise Al healthcare technology firm Commure, which powers providers' next-generation infrastructure, announced that it has obtained $200 million in expansion investment from the Customer Value Fund (CVF) of General Catalyst.

In January 2025, a strategic investment from affiliates of New Mountain Capital, LLC ("New Mountain"), a prominent growth-oriented investment company with around $55 billion in assets under management, was announced by Access Healthcare, a leading revenue cycle management (RCM) platform powered by technology.

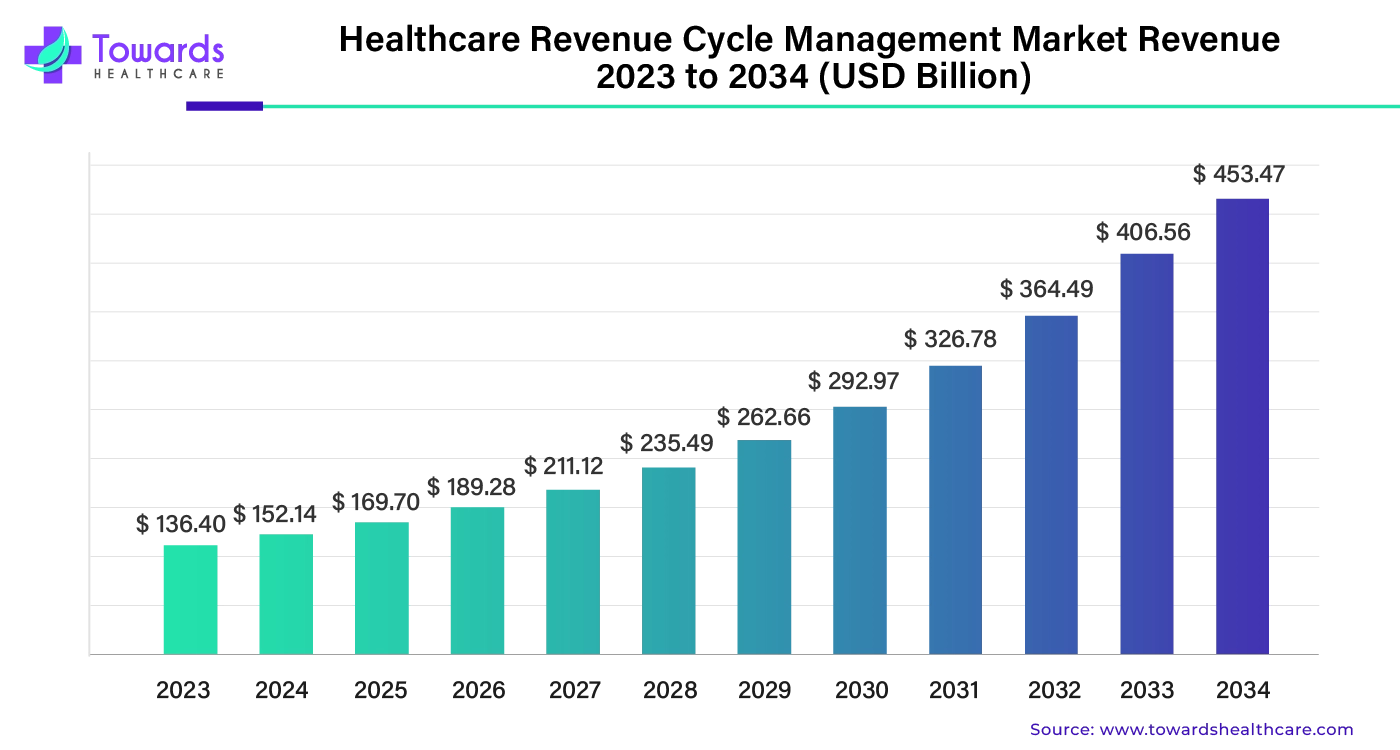

The global healthcare revenue cycle management market was valued at US$ 136.40 billion in 2023 and is expected to reach US$ 453.47 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.54% between 2024 and 2034.

By Product Type

By Function Type

By Deployment Type

By End-user

February 2026

February 2026

February 2026

February 2026