February 2026

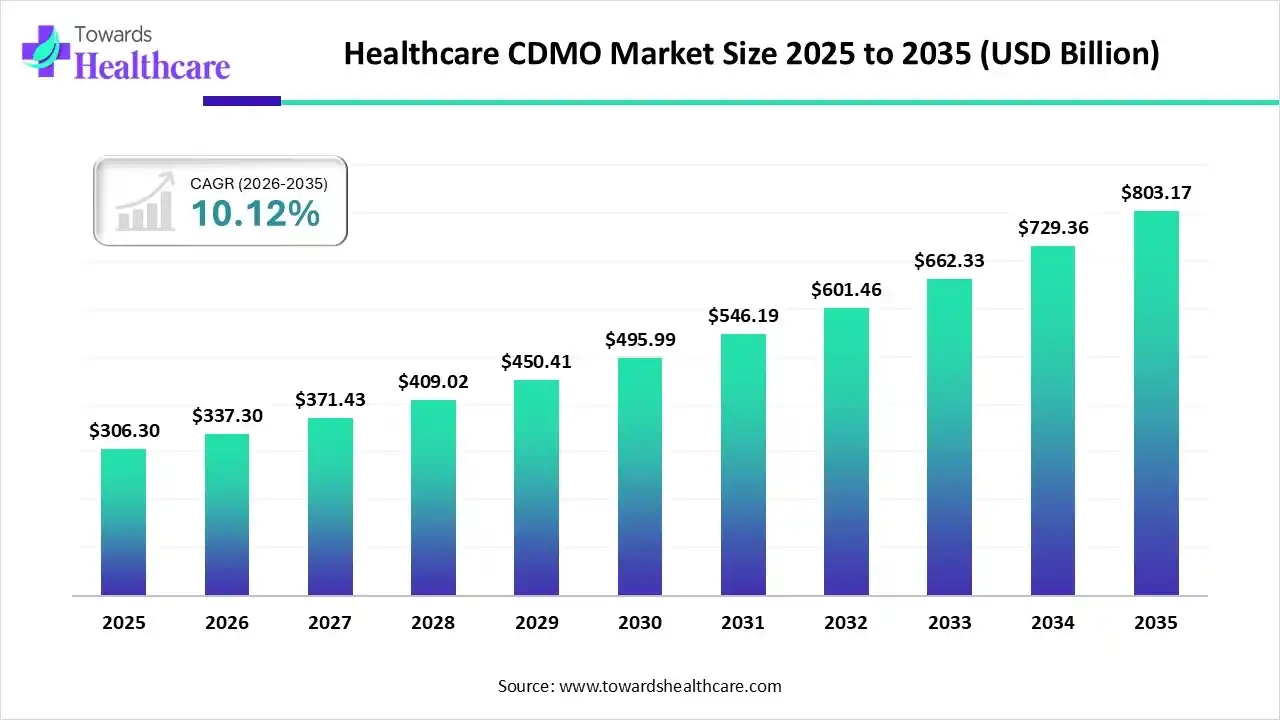

The global healthcare CDMO market size was estimated at USD 306.3 billion in 2025 and is predicted to increase from USD 337.3 billion in 2026 to approximately USD 803.17 billion by 2035, expanding at a CAGR of 10.12% from 2026 to 2035.

The healthcare CDMO market is growing as CDMO supports complex activities, including active pharmaceutical ingredient (API) manufacturing, formulation advancement, government compliance, healthcare trial management, process development, upscaling, and commercial manufacturing.

The healthcare CDMO market is expanding because CDMOs uniquely integrate drug manufacturer expertise with production abilities under one contract. The significance of CDMOs in pharma is further increased by their noteworthy participation in both the creation and manufacturing of healthcare products, making them significant associates in the medical care value chain. CDMO offers a more inclusive range of solutions that extend beyond production to include product manufacturing. This includes responsibilities like formulation development, process development, and sometimes government compliance, providing an all-in-one one-stop shop service.

Integration of AI-driven technology in healthcare CDMO drives the growth of the market, as CDMOs accept AI-driven technology to improve efficacy, ensure quality, and cut development timelines. AI-driven technology supports them in optimizing processes, avert equipment downtime, enhance quality control, and deliver challenging cancer therapies rapidly while preserving government compliance.

AI-based technology speeds up drug discovery by analysing massive biological datasets to recognize novel drug targets, predicting drug-target connections, and improving lead compounds. AI-driven technology is playing a significant role in this growth, providing tools to streamline operations, monitor regulatory changes, and predict potential challenges.

CDMOs are a multi-facility strategy, multi-sourcing of materials, and flexible operations, including reshoring and expanding vendor bases to mitigate challenges from tariffs and geopolitical instability.

Demand for highly potent active pharmaceutical ingredients (HPAPIs) remains high in the face of a sustained focus by the pharmaceutical industry on the oncology space, targeted therapies, and precision medicine.

CDMOs drive sustainability via process innovation, accepting green chemistry principles to diminish solvent use and dangerous waste.

| Key Elements | Scope |

| Market Size in 2026 | USD 337.3 Billion |

| Projected Market Size in 2035 | USD 803.17 Billion |

| CAGR (2026 - 2035) | 10.12% |

| Leading Region | North America |

| Market Segmentation | By Service Type , By Product Type, By Therapeutic Area, By End-User, Regional Outlook |

| Top Key Players | Lonza Group AG, Thermo Fisher Scientific Inc, Catalent, Inc., WuXi AppTec, Samsung Biologics, Siegfried Holding AG |

Which Service Type Led the Healthcare CDMO Market in 2025?

In 2025, the contract manufacturing segment held the dominant market share with approximately 62% share in 2025, as contract manufacturing supports international businesses in getting their invention manufactured at lower costs, particularly when the local producers are positioned in countries which have lower material and labour expenses. With the support of contract manufacturing, international organizations are able to produce their goods on a large scale without the need spending in setting up manufacturing facilities.

Contract Development

Whereas the contract development segment is the fastest-growing in the market, as healthcare contract development plays a significant role in the worldwide healthcare ecosystem. Contract manufacturers utilize their economies of scale, dedicated infrastructure, and expertise to produce drugs efficiently. This strategy minimizes operational expenses and allows pharmaceutical companies to provide affordable medicines, promoting both the industry and patients.

Why did the Small Molecules Segment Dominate the Market in 2025?

The small molecules segment is dominant and fastest-growing in tissue regenerative therapy, with approximately 55% share in 2025, as small molecules provide benefits like better tissue permeability, longer half-lives, and lower manufacturing expenses. Ground-breaking small molecule drugs such as penicillin for treating bacterial infections, aspirin for pain relief and inflammation, and statins for handling cholesterol levels have reformed the medical care landscape and transformed patient results worldwide.

Biologics

Whereas the biologics segment is the fastest-growing in the market, as biologic treatments have revolutionized the treatment of patients with serious inflammatory autoimmune diseases and, more recently, with severe osteoporosis. Biologics shown remarkable efficacy in improving symptoms, slowing disease progression, and enhancing patients' quality of life. Biologics are designed to slow down tumor growth and progression, or even support the body's recovery from other anti-cancer treatments.

Why did the Oncology Segment Dominate the Market in 2025?

The oncology segment is dominant in the healthcare CDMO market with approximately 38% share in 2025, as CDMO companies, specifically those concentrating in oncology, have profound expertise in developing and manufacturing cancer drugs. This specialty is significant for ensuring that the unique challenges of oncology drug development are met efficiently. This enables oncology pharmaceutical organizations to allocate resources more effectively, focusing on research and development, though leaving industry to experts.

Metabolic (GLP-1s)

Whereas the specialty clinics segment is the fastest-growing in the market, as increasing demand from patients for GLP-1s has inescapably equated to quickly increasing demand for their solutions. The major focus of CDMO demand has been on sterile capabilities and capacity, as the GLP-1s have mainly been administered parenterally. CDMOs are working to ramp up their production abilities to try to keep up with the increasing demand.

Why did the Big Pharma/Large OEMs Segment Dominate the Market in 2025?

The big pharma/large OEMs segment is dominant in the healthcare CDMO market with approximately 52% share in 2025, as large-scale production services offered by CDMOs provide flexibility, partnership, and innovation services that accelerate drug development and reduce expenses. The capability of a CDMO to manage projects efficiently, while scaling processes to meet manufacturing demands, without compromising on quality control.

Small & Mid-size Biotech

Whereas the small & mid-size biotech segment is the fastest-growing in the market, as this provides scalability, expertise, affordability, and speed, CDMOs allow biotech organizations to focus on novelty and strategy while trusting the production process to specialists. CDMOs regularly work with small biotech organizations, startups, and virtual pharmaceutical companies.

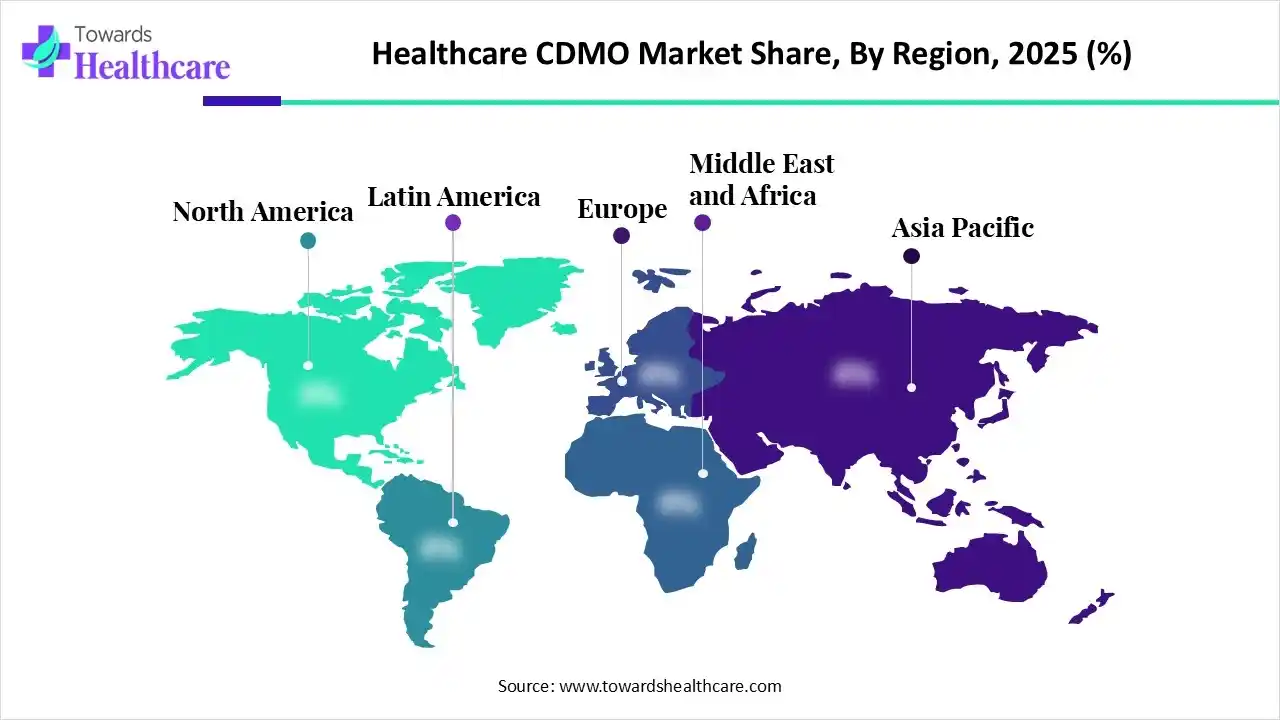

In 2025, North America dominated the healthcare CDMO market with approximately 42% – 45% share, as growing spending in R&D, biopharmaceutical investigators, and scientists have gained a better understanding of diseases and a greater ability to harness novel technology. Targeted medicine focuses on drugs intended for particular patient profiles, often people with a specific genetic structure or disease subtype, which contributes to the growth of the market.

For Instance,

U.S. Market Trends

The U.S. is a hub to 85% of the global small, research-intensive biopharma organizations. These start-ups are significant to drug development and U.S. competitiveness. The U.S. leads in the development of complex, next-generation therapies, including cell and gene therapies, mRNA vaccines, and antibody-drug conjugates (ADCs).

Asia Pacific is expected to see rapid growth in the healthcare CDMO market, driven by increasing demand for outsourcing production to Asia Pacific, which supports organizations to save high expenditures that incur massive rates over time and advantages from higher efficiency. APAC major organizations retain powerful legacy benefits, leveraging lower production expenses, abundant resources, and recognized supply chains to maintain worldwide competitiveness.

India Market Trends

In India, an aging demographic and the increasing prevalence of long-term diseases create a huge demand for healthcare, further increasing CDMO demand. Indian CDMOs provide a unique integration of affordable, practical expertise from a large pool of skilled experts, WHO-GMP and USFDA-compliant services, and end-to-end solution capabilities. India has become a preferred destination for worldwide outsourcing, leading to the rise of many top Indian pharma CDMO organizations, with Cablin Healthcare being a reliable and quickly increasing one.

Europe is significantly growing in the healthcare CDMO market, due to the European CDMO for drug product manufacturing, providing expertise in biologics, government compliance, and well-organized commercial delivery. CDMO provides integrated development and production solutions. EU-wide R&D funding schemes and tax credits for revolution inspire outsourcing to CDMOs.

| Company | Headquarters | Latest Update |

| Lonza Group AG | Switzerland | In April 2025, Lonza announced that its new simplified and streamlined operating model is effective. Lonza’s new simplified and streamlined operating model is designed to support its One Lonza vision and strategy. |

| Thermo Fisher Scientific Inc | United States | In 2025, Thermo Fisher Scientific (TMO) will have aggressively strengthened its position as a top-tier global Healthcare Contract Development and Manufacturing Organization (CDMO). |

| Catalent, Inc. | United States | Catalent delivers end-to-end pharma solutions as a trusted CDMO, advancing drug development and manufacturing worldwide. |

| WuXi AppTec | China | WuXi AppTec has demonstrated robust financial resilience and continued, rapid expansion as a Contract Research, Development, and Manufacturing Organization (CRDMO). |

| Samsung Biologics | South Korea | Samsung Biologics provides seamless development and manufacturing services from cell line development to final aseptic fill/finish. |

| Siegfried Holding AG | Switzerland | Siegfried signed binding agreements to acquire three drug substance sites in the US and Australia. |

By Service Type

By Product Type

By Therapeutic Area

By End-User

Regional Outlook

February 2026

February 2026

February 2026

February 2026