January 2026

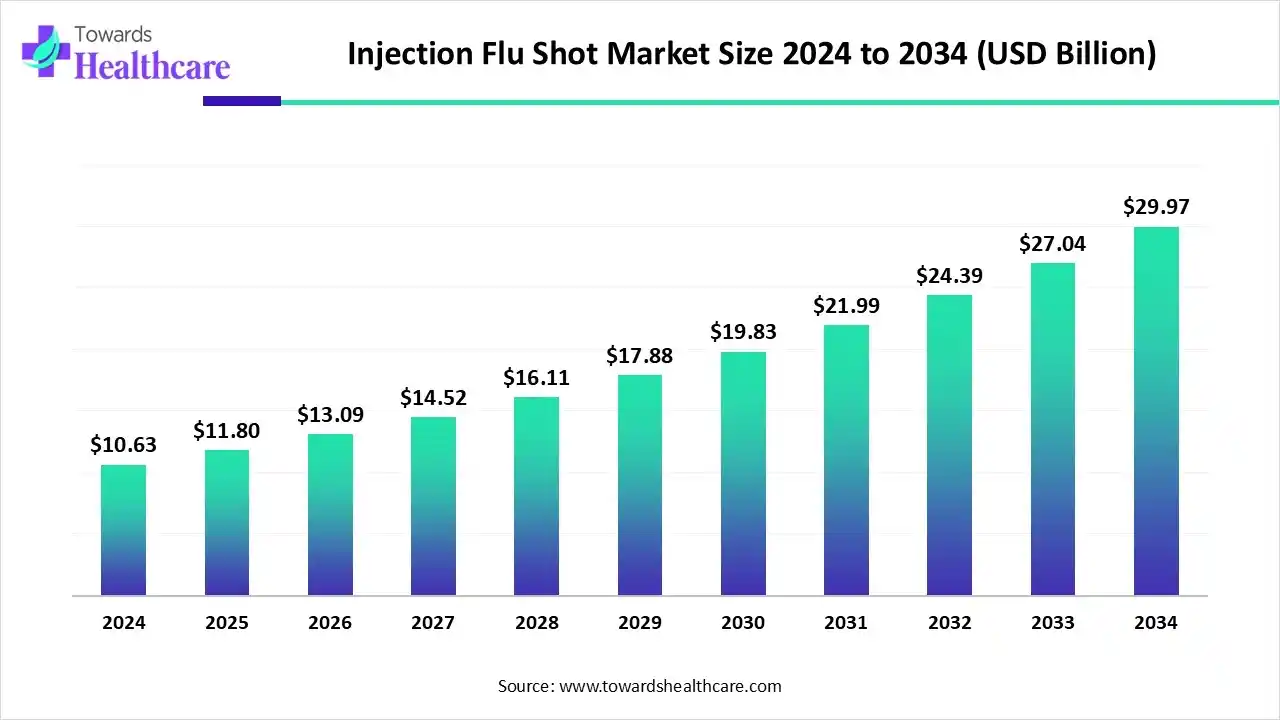

The injection flu shot market size stood at US$ 10.63 billion in 2024, grew to US$ 11.8 billion in 2025, and is forecast to reach US$ 29.97 billion by 2034, expanding at a CAGR of 10.93% from 2025 to 2034.

The global injection flu shot market is witnessing robust growth, driven by increasing seasonal influenza prevalence, rising public awareness, and advancements in vaccine technologies, including mRNA-based formulations. North America dominates the market due to its strong healthcare infrastructure, extensive government-led immunization programs, and high acceptance of vaccination among the population. Additionally, the presence of leading pharmaceutical companies, frequent flu outbreaks, and proactive public health campaigns further reinforce the region’s market leadership, while emerging markets continue to offer new growth opportunities.

| Table | Scope |

| Market Size in 2025 | USD 11.8 Billion |

| Projected Market Size in 2034 | USD 29.97 Billion |

| CAGR (2025 - 2034) | 10.93% |

| Leading Region | North America |

| Market Segmentation | By Vaccine Type / Platform, By Indication / Target Population, By Formulation / Dose Type, By Distribution / Administration Channel, By Payer / Procurement Model, By Region |

| Top Key Players | Seqirus (CSL), Sanofi Pasteur, GlaxoSmithKline (GSK), Pfizer Inc., Moderna, Inc., Lonza, IDT Biologika / Bavarian Nordic, Novartis, Skyepharma, Akston Biosciences, Merck & Co., Inc., QuidelOrtho |

An injection flu shot is a vaccine administered via intramuscular injection to protect against seasonal influenza viruses, helping reduce the risk of severe illness, hospitalization, and complications. The market is driven by rising influenza prevalence, aging populations, and growing public awareness. Opportunities for growth include technological advancements in vaccine development, such as mRNA-based and high-dose formulations, government immunization programs, and expansion into emerging markets. Increasing healthcare accessibility and integration with routine vaccination campaigns further enhance market potential, ensuring broader coverage and higher uptake.

Artificial Intelligence (AI) is revolutionizing the development of flu vaccines by enhancing strain prediction and selection accuracy. Researchers at the Massachusetts Institute of Technology (MIT) have developed an AI tool called VaxSeer, which utilizes deep learning models trained on decades of viral sequences and lab test results. VaxSeer can predict dominant flu strains and identify the most protective vaccine candidates months ahead of flu season, outperforming traditional methods in strain selection.

Similarly, at the University of Missouri, researcher Cheng Gao has created a machine learning-based tool named MAIVeSS. This computational model predicts optimal flu vaccine viruses when provided with a specific strain, aiding in the timely selection of effective vaccine candidates. These AI-driven approaches significantly improve the accuracy of flu vaccine strain selection, potentially leading to more effective vaccines and better public health outcomes.

The inactivated (egg-based) quadrivalent vaccines segment dominates the market with share of approximately 65% due to its proven safety, broad protection against four influenza strains, and long-standing use in annual immunization programs. Its established manufacturing processes, high availability, and widespread acceptance among healthcare providers and patients further reinforce its market leadership, making it a preferred choice for both seasonal flu prevention and large-scale vaccination campaigns worldwide.

The cell-based inactivated vaccines segment is the fastest-growing in the injection flu shot market due to its faster production timelines, higher scalability, and ability to avoid egg-adapted mutations, resulting in improved vaccine efficacy. Growing adoption in North America and Europe, coupled with increasing investments in advanced vaccine technologies and rising awareness of more effective alternatives to traditional egg-based vaccines, drives its rapid market expansion.

The Adults ≥65 years segment dominated the market with share of approximately 25% target population in the injection flu shot market due to their increased susceptibility to severe influenza complications, hospitalizations, and mortality. Higher awareness, government-led vaccination campaigns, and recommendations from healthcare providers further drive vaccine uptake in this age group, making them a critical focus for seasonal immunization programs worldwide.

The pregnant women & high-risk groups segment is estimated to be the fastest-growing in the injection flu shot market due to increased awareness of influenza-related complications, strong recommendations from healthcare authorities, and government immunization programs targeting vulnerable populations. Rising adoption of vaccines among these groups enhances protection and drives rapid market growth globally.

The standard dose (0.5 ml) unadjuvanted segment dominates the market with share of 70% due to its proven safety, broad acceptance, and suitability for all age groups. It offers reliable protection with fewer side effects, making it the preferred choice for routine immunization programs and large-scale public vaccination campaigns worldwide.

The recombinant / cell-based / mRNA presentations segment is anticipated to be the fastest-growing segment in the market due to its rapid manufacturing capability, improved antigen matching, and higher efficacy compared to traditional egg-based vaccines. These technologies eliminate egg-adaptation issues, support scalability during pandemics, and attract strong government and private investments to enhance next-generation influenza vaccine development.

The Pharmacies and retail clinics segment dominate as well as fastest-growing segment in the injection flu shot market due to their easy accessibility, extended operating hours, and ability to provide convenient, walk-in vaccination services. Growing public awareness, government immunization partnerships, and pharmacist-led vaccination programs further drive this segment’s expansion, enhancing vaccination coverage across urban and rural areas.

The public procurement & government programs dominate the market with share of approximately 38% due to large-scale vaccination initiatives, subsidized immunization drives, and strong public health policies. Governments ensure vaccine affordability, equitable distribution, and widespread access through national immunization programs, effectively boosting vaccination rates and preventing seasonal influenza outbreaks.

The private insurance / employer programs segment is the fastest-growing in the market due to rising corporate wellness initiatives, increased healthcare awareness, and expanding insurance coverage for preventive care. Employers actively promote workplace vaccination to reduce absenteeism, while private insurers encourage flu immunization through reimbursement benefits, driving higher participation and rapid segment growth.

North America dominates the injection flu shot market due to strong healthcare infrastructure, high vaccination awareness, and robust government immunization programs. The region’s advanced vaccine research, widespread distribution networks, and supportive reimbursement policies further strengthen its leadership in flu shot adoption.

The U.S. represents the largest and most dominant market with share of approximately 28% due to its strong healthcare infrastructure, high vaccination coverage, and extensive government-backed immunization programs such as the CDC’s seasonal flu campaigns. The presence of leading vaccine manufacturers, advanced research capabilities, and widespread awareness about flu prevention further drive market dominance, supported by robust distribution networks and active public-private partnerships promoting annual influenza vaccination.

The Asia-Pacific region is the fastest-growing injection flu-shot market because rising healthcare access, expanding immunization programs, and increased government funding accelerate vaccine uptake. Faster adoption of next-generation platforms (cell-based, recombinant) and stronger surveillance improve strain matching and demand. Public awareness campaigns, school-based drives, and expanded vaccine availability at primary care and pharmacies also boost coverage. Recent 2025 actions Australia’s amplified vaccination push and plan to introduce nasal FluMist in NSW, and Japan’s regulatory updates for seasonal vaccine composition have driven regional growth.

China is emerging as one of the most promising markets in the injection flu shot segment due to growing government emphasis on preventive healthcare and domestic vaccine production. National immunization programs and public-private collaborations have expanded flu shot access across urban and rural areas. In 2025, China’s National Health Commission launched enhanced influenza vaccination campaigns targeting schoolchildren and older adults, significantly boosting vaccination rates and public awareness.

India’s injection flu shot market is expanding rapidly, driven by rising healthcare awareness, improved vaccine distribution, and increasing private sector participation. Government initiatives under the Universal Immunization Programme and collaborations with state health departments are promoting adult flu vaccination. In 2025, India’s Ministry of Health introduced a seasonal flu vaccination awareness campaign across metro cities, encouraging hospital partnerships and workplace immunization drives, accelerating market growth and coverage.

Europe is experiencing notable growth in the injection flu shot market due to strong public health policies, high vaccination awareness, and widespread government-supported immunization programs. Advanced healthcare infrastructure, easy access to vaccines, and seasonal influenza campaigns targeting vulnerable populations, such as older adults and high-risk groups, further drive adoption. Additionally, growing uptake of next-generation vaccines like cell-based and adjuvanted formulations supports market expansion.

The R&D phase involves virus strain selection, antigen design, and vaccine formulation to ensure safety, efficacy, and immunogenicity. Innovative platforms like cell-based, recombinant, and mRNA vaccines are also explored to enhance protection.

Key Organizations: Sanofi Pasteur, GlaxoSmithKline (GSK), Seqirus, Moderna, Pfizer

This phase includes preclinical studies, Phase I–III clinical trials, and post-marketing surveillance to assess safety, efficacy, and dosage. Regulatory bodies review submissions for approval before market launch.

Key Organizations: U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), National Medical Products Administration (NMPA, China), Central Drugs Standard Control Organization (CDSCO, India)

Vaccines are produced at scale under strict GMP conditions, then packaged, stored, and transported through cold-chain logistics to ensure potency and safety.

Key Organizations: Pfizer, Moderna, Sanofi Pasteur, Serum Institute of India, Seqirus

Includes vaccination awareness campaigns, education, immunization clinics, and follow-up for adverse events. Pharmacist-led programs and government initiatives ensure broad access and adherence.

Key Organizations: Centers for Disease Control and Prevention (CDC, U.S.), Ministry of Health (various countries), Pharmacies & Retail Clinics (CVS, Walgreens, Boots), Nonprofit organizations promoting vaccination

Sanofi Pasteur

Offerings: Sanofi provides a range of influenza vaccines, including Fluzone (standard-dose inactivated vaccine) and Fluad (adjuvanted vaccine for seniors). They also offer FluMist (live attenuated nasal spray vaccine) and Flublok (recombinant hemagglutinin protein vaccine).

GlaxoSmithKline (GSK)

Offerings: GSK's influenza vaccine portfolio includes Fluarix and Flulaval (both trivalent inactivated vaccines). They are also exploring mRNA-based flu vaccine candidates in collaboration with other biotech firms.

CSL Seqirus

Offerings: CSL Seqirus offers a diverse range of flu vaccines, including Afluria (egg-based), Flucelvax (cell-based), and Fluad® (adjuvanted for older adults). Their Holly Springs, North Carolina facility is the largest cell-based influenza vaccine manufacturing facility in the world.

AstraZeneca

Offerings: AstraZeneca manufactures FluMist (live attenuated nasal spray vaccine), which is approved for home delivery in several U.S. states. They are also developing mRNA-based flu vaccine candidates.

Moderna

Offerings: Moderna is advancing in the development of mRNA-based influenza vaccines, leveraging their expertise from COVID-19 vaccine development to create more effective flu vaccines.

Pfizer

Offerings: Pfizer is collaborating with BioNTech to develop mRNA-based influenza vaccines, aiming to provide broader protection and faster production times compared to traditional methods.

Seqirus (a subsidiary of CSL Limited)

Offerings: In addition to their offerings under CSL Seqirus, they provide Fluad (adjuvanted vaccine) and Flucelvax (cell-based vaccine), focusing on innovative manufacturing techniques and global distribution.

By Vaccine Type / Platform

By Indication / Target Population

By Formulation / Dose Type

By Distribution / Administration Channel

By Payer / Procurement Model

By Region

January 2026

October 2025

November 2025

October 2025