January 2026

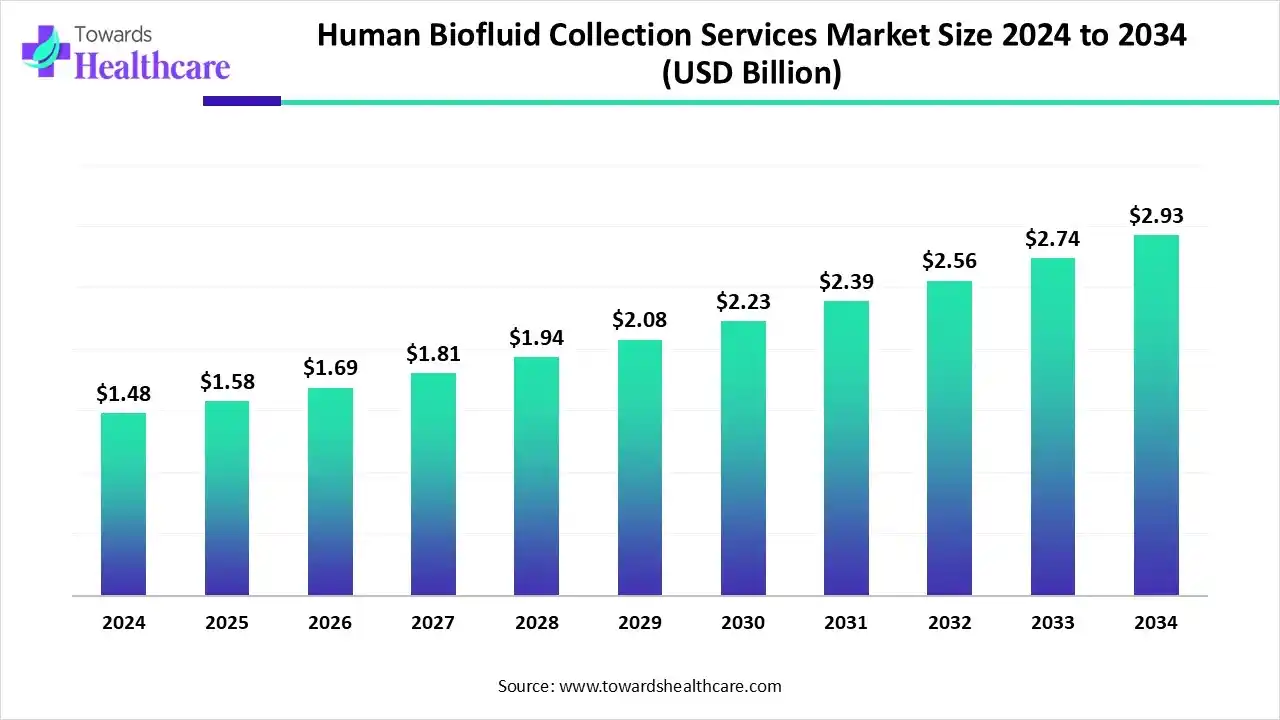

The global human biofluid collection services market size is calculated at US$ 1.48 billion in 2024, grew to US$ 1.58 billion in 2025, and is projected to reach around US$ 2.93 billion by 2034. The market is expanding at a CAGR of 7.08% between 2025 and 2034.

The high-quality blood and biofluids are in great demand for research, driving the human biofluid collection services market. The blood and biofluid products are available for shipping from inventory or through custom collections to meet specific needs. The FDA-registered Blood Establishment donor center of Precision Medicine Group works to collect its biospecimens from healthy donors. These products are made from human whole blood, plasma, serum, and other biofluids.

| Table | Scope |

| Market Size in 2025 | USD 1.58 Billion 2025 |

| Projected Market Size in 2034 | USD 2.93 Billion 2034 |

| CAGR (2025-2034) | 7.08% |

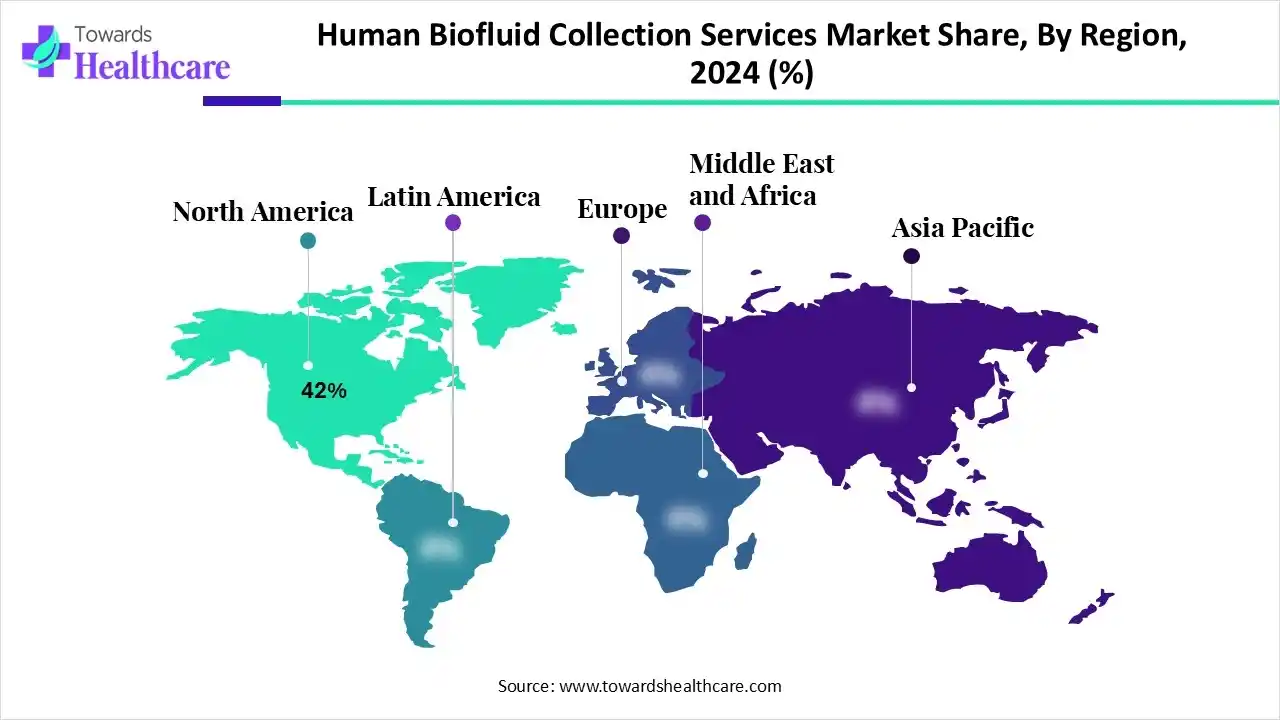

| Leading Region | North America by 42% |

| Market Segmentation | By Fluid Type, By Service Offering, By Application, By End Customer, By Region |

| Top Key Players | Thermo Fisher Scientific, Becton Dickinson, Labcorp/Covance, Eurofins Scientific, BioIVT, Cryoport, Azenta, Avantor, Merck KGaA, QIAGEN, Tecan, Bio-Rad Laboratories, Precision for Medicine, MT Group, Coriell Institute/Coriell Biobanking services |

The human biofluid collection services market is rapidly growing and expanding due to the expanded portfolio of human blood biospecimens to support drug development, cell therapy, and regenerative medicine. Human biofluid collection services provide end-to-end procurement, stabilization, processing, cold-chain logistics, and storage of human biofluids (blood, plasma/serum, urine, saliva, CSF, and other fluids) for clinical trials, diagnostics, biomarker discovery, biobanking, and translational research. Services include standardized collection kits and devices, on-site phlebotomy or remote collection, sample stabilization (preservatives/temps), controlled-temperature transport, centralized processing/aliquoting, chain-of-custody documentation, regulatory/compliance support, and long-term storage/retrieval for downstream assays and commercialization.

Human-AI collaboration drives the human biofluid collection services market by enhancing biological collection, curation, and research. AI replaces human expertise, which is necessary for quality control and high-level decision-making. AI assists in biofluid collection procedures by providing safety features and delivering high accuracy. The wearable biosensors and microfluidics help with real-time analysis and at-home collection.

The blood segment dominated the market in 2024, with a revenue of approximately 70% owing to the critical role of different types of blood fluids, such as plasma, serum, and whole blood, in robust research and development across various healthcare areas. They facilitate minimally invasive collection, at-home and remote testing, and dried blood sample testing. The shipping and storage of these blood fluids and related blood products became simplified, avoiding the need for cold-chain transport.

The saliva/oral fluids segment is expected to grow at the fastest CAGR in the human biofluid collection services market during the forecast period due to the important role of saliva in biofluid collection for early disease detection and monitoring. The saliva or oral biofluids are critical in substance abuse and toxicology screening, and stress and hormone monitoring. Oral fluid testing at the workplace offers a convenient, cost-effective, and non-invasive solution for employers, particularly for roadside screenings, pre-employment, and post-accident.

The sample collection & devices segment dominated the market in 2024, with a revenue of approximately 35% owing to expanded access to remote and home healthcare, as well as improved sample quality and data integrity. These medical appliances enable precision medicine and research with the help of specialized kits and biomarker analysis. They introduce reduced errors, decentralized diagnostics, with enhanced stability, comfort, and convenience.

The sample stabilization & processing segment is estimated to grow at the fastest rate in the human biofluid collection services market during the predicted timeframe due to the urgent need to ensure the integrity and accuracy of samples. The high-quality samples adapt to decentralized and patient-centric healthcare. Researchers address challenges in complex biofluids while advancing quality control through technologies.

The clinical trials & pharma/biotech R&D segment dominated the market in 2024, with a revenue of approximately 55% owing to the various functions in R&D, including precision medicine, non-invasive liquid biopsies, and real-time monitoring. The technological innovations are reshaping biofluid collection through wearable and smart technology, and AI and advanced analytics. Decentralized and patient-centric trials facilitate at-home collection and patient-centric sampling.

The diagnostics & laboratory testing segment is anticipated to grow at a notable rate in the human biofluid collection services market during the upcoming period due to improved facilities for non-invasive and decentralized collection, multi-omics analysis, and predictive diagnostics. The alternative biofluids, at-home collection, and wearable biosensors are accelerating diagnostics. The wide applications in clinical practice are associated with personalized medicine, early disease detection, and infectious disease surveillance.

The pharmaceutical & biotech sponsors segment dominated the market in 2024, with a revenue of approximately 60% owing to strategic partnerships, outsourcing, compliance, and ethical standards. The integration of technologies is driven by real-world data, AI, data analytics, etc. The enhanced safety protocols and regulatory navigation ensure compliance and ethical standards.

The diagnostic labs & reference labs segment is predicted to grow at a rapid rate in the human biofluid collection services market during the studied period due to a widespread collection network, broad test panels, and adoption of self-collection kits. The expanded point-of-care testing, focus on efficiency, and digital integration drive major developments and introduce new trends. The patient service centers and mobile services provide at-home sample collection for convenience and accessibility.

North America dominated the human biofluid collection services market share by 42% in 2024, owing to the expanding home-care services and preventive healthcare awareness. The National Institutes of Health (NIH) selected Precision for Medicine to support regulatory submissions for the Vanguard Study of the National Cancer Institute (NCI), which is a significant initiative in multi-cancer detection research. The Organization for Economic Co-operation and Development (OECD) launched a cooperative research program to advance sustainable agriculture and food systems.

The National Institutes of Health (NIH) published a new policy to enhance security measures for human biospecimens. This new policy focuses on preventing access to the sensitive personal data of Americans and U.S. government-related data by countries of concern. The NIH has also put new restrictions on entities that hold human biospecimens of U.S. people. The NIH funds support the collection, acceptance, storage, use, and distribution of human biospecimens.

The Centers for Medicare & Medicaid Services (CMS)/Medicare remains the largest payer of clinical laboratory services in the U.S. The CMS plays a vital role in setting payment rates for laboratory tests based on current charges in the private healthcare market. The Centers for Disease Control and Prevention (CDC) launched a program to reduce diagnostic errors and boost safety.

Asia Pacific is expected to grow at the fastest CAGR in the human biofluid collection services market during the forecast period due to the growth of genomic research, targeted therapies, and a large patient pool. According to the World Health Organization (WHO), more than 1.2 million rapid diagnostic tests for cholera were shipped to 14 countries, which have marked the largest global deployment. The digital health regulations in the Asia Pacific drive a rapid adoption of digital health solutions, including Software as a Medical Device (SaMD).

The Asian Pacific countries like Japan and South Korea are updating their regulatory frameworks to address cybersecurity, AI, and interoperability. According to the report published by the International Data Corporation (IDC), Asia-Pacific healthcare organizations will double their investments in Generative AI, with an estimated $100 billion in annual healthcare savings in Asia-Pacific by 2025. It has also been reported that these investments will be made to boost hyper-personalized patient experiences, drive equity, and improve collaboration by the end of 2027.

In April 2024, the World Health Organization (WHO) reported that the global deployment of rapid diagnostic tests will accelerate the fight against cholera, with the first shipment landed in Malawi.

India is transforming healthcare through digitalization, from data to diagnosis, driven by policy reforms, technological advancements, and government initiatives. There is a rapidly growing population and a rising demand for quality healthcare in India. Digital healthcare infrastructure in India connects urban and rural healthcare services, uses telemedicine, AI-driven diagnostics, and electronic health records.

In June 2025, Amazon India announced the launch of at-home diagnostics in collaboration with Orange Health Labs, which promises sample collection from the patient’s home within 60 minutes and faster results in less than 6 hours for routine tests. This offering is at doorstep convenience across six major cities, including Noida, Mumbai, Hyderabad, Bengaluru, Delhi, and Gurgaon, which also covers 450 PIN codes.

Europe is expected to grow at a notable rate in the human biofluid collection services market in 2024. This regional growth is attributed to the enhanced collection devices and the growth of biobanking in the European market. The European Union actively supports the digitalization of healthcare systems across member states. The EU funding, with over €16 billion provided through programs like the Recovery and Resilience Facility and the Cohesion Policy, was pivotal in HealthTech advancements. The emerging HealthTech startups across Europe will redefine accessibility, monitoring, and management of well-being. These rising market players across Europe include Adsilico, AERA Health, Axithra, Biorce, Callyope, CareLoop Health, and several other developing companies in the HealthTech sector.

In October 2024, the European Innovation Council (EIC) announced the investment of €1.4 billion to support European deep tech research and high-potential startups.

Germany remains a leading player in the global life sciences industry, fostering biotechnology, pharmaceutical, and medical technology companies. Over 3,842 companies in the sector boost Germany to be a hub for innovation. This growth is led by strong public-private collaborations and cutting-edge research.

In April 2024, Merck invested more than € 300 million in a new life science research center in Germany to accelerate biopharmaceutical product development.

The R&D process for human biofluid collection services includes a highly regulated and multi-stage process that encompasses market and needs assessment, conceptualization and design, verification and validation, quality control and ethical review, regulatory compliance, and implementation and technology transfer.

Key Players: BioIVT, iSpecimen, Bay Biosciences, Amsbio, Grifols Bio Supplies.

A rapid shift toward direct-to-patient (DTP) models and specialized logistics and cold chain support biological sample handling, body fluid collection, diagnostics, and biological sample logistics.

Key Players: Becton, Dickinson and Company (BD), Thermo Fisher Scientific Inc., F. Hoffmann-La Roche AG, Qiagen, Greiner AG, Cardinal Health.

The at-home and remote collection services provide microsampling and kits, capillary blood collection, and telehealth integration. These services are supported by transparent communication, education and awareness, and consent and privacy.

Key Players: Becton, Dickinson and Company (BD), Terumo Corporation, Greiner Bio-One, Thermo Fisher Scientific Inc., YourBio Health.

By Fluid Type

By Service Offering

By Application

By End Customer

By Region

January 2026

January 2026

January 2026

January 2026