January 2026

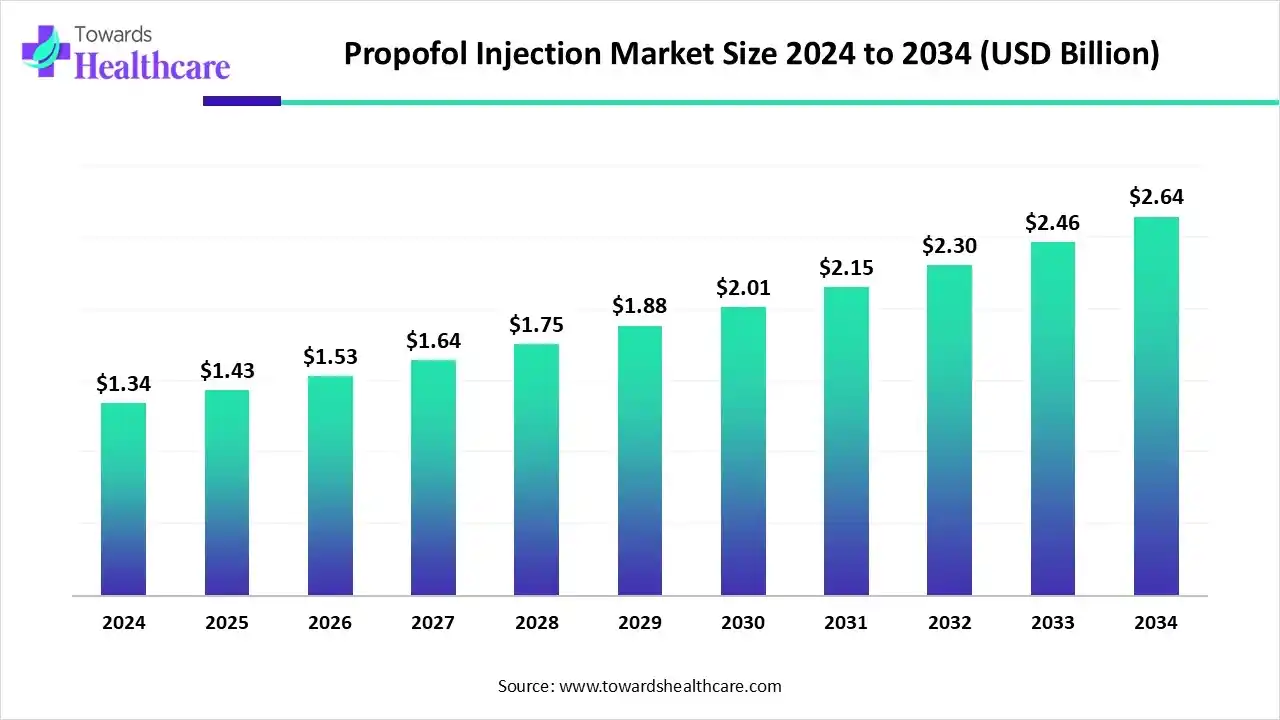

The global propofol injection market size is calculated at USD 1.34 billion in 2024, grew to USD 1.43 billion in 2025, and is projected to reach around USD 2.64 billion by 2034. The market is expanding at a CAGR of 7.14% between 2025 and 2034.

The propofol injection market is primarily driven by the rising prevalence of chronic disorders and the increasing number of hospital admissions. Ongoing efforts are made to reduce the side effects of propofol injection and develop novel drug delivery systems to enhance efficiency and accuracy in dose delivery. Artificial intelligence (AI) monitors and displays the amount of dose delivered through the device.

| Table | Scope |

| Market Size in 2025 | USD 1.43 Billion |

| Projected Market Size in 2034 | USD 2.64 Billion |

| CAGR (2025 - 2034) | 7.14% |

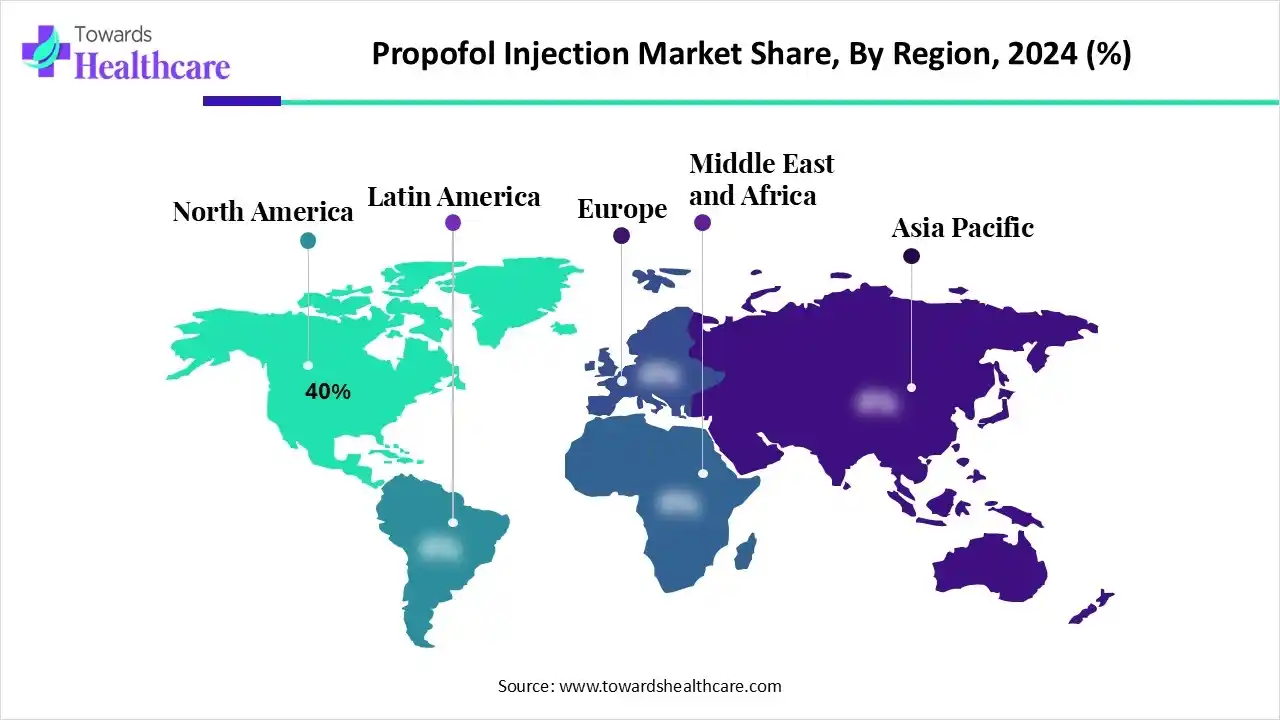

| Leading Region | North America by 40% |

| Market Segmentation | By Formulation Type, By Application, By Concentration, By End-User, By Distribution Channel, By Region |

| Top Key Players | Bharat Serums and Vaccines Ltd., Troikaa Pharmaceuticals Ltd., Sichuan Guorui Pharmaceutical Co., Ltd., Samarth Life Sciences Pvt. Ltd., Jiangsu Nhwa Pharmaceutical Co., Ltd., Neon Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Lupin Limited, Hikma Pharmaceuticals LLC |

The propofol injection market is expanding due to the rising volume of surgical procedures, advancements in drug delivery formulations, and increasing demand for short-acting anesthetics with favorable safety profiles. It encompasses the development, production, and distribution of propofol-based injectable anesthetics used for the induction and maintenance of general anesthesia, sedation in intensive care units (ICUs), and procedural sedation in surgeries and diagnostic procedures. Propofol, a short-acting intravenous sedative-hypnotic agent, offers rapid onset and recovery, making it a cornerstone drug in anesthesiology.

AI can transform the development and production of propofol injections, enhancing efficiency and accuracy. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and suggest an appropriate dosage of propofol. They can also automate drug delivery and track the amount of medication administered. They help researchers determine the pharmacokinetic and pharmacodynamic properties of propofol, enabling them to improve its properties. Additionally, AI can assist in automating record-keeping, predicting adverse events, and monitoring patient vital signs.

By formulation type, the oil-in-water emulsion segment held a dominant presence in the market with a share of approximately 72% in 2024, due to the low water solubility of emulsions. Propofol is formulated using micellar systems or emulsions to reach a clinically viable dose. It is freely dissolved in the emulsion continuous phase, immediately mixing with the bloodstream at the i.v. injection site. The availability of multiple emulsifying agents is expected to boost the segment’s growth.

By formulation type, the microemulsion & nanoemulsion formulations segment is expected to grow at the fastest CAGR in the market during the forecast period. Advances in nanoformulations and the increasing need to overcome limitations of conventional lipid formulations augment the segment’s growth. Innovative manufacturing technologies are adopted to develop novel micro- and nano-emulsions of propofol. Microemulsion and nanoemulsion are increasingly preferred due to improved stability, reduced pain or discomfort, and lower microbial contamination risks.

By application, the induction & maintenance of general anesthesia segment held the largest revenue share of approximately 46% in the market in 2024, due to the increasing number of surgeries and the rapid onset of action of propofol. Propofol is widely used for procedural sedation during monitored anesthesia care or as an induction agent for general anesthesia. Recovery from propofol-induced anesthesia is generally rapid and associated with less frequent side effects. It is typically used for short procedures or minor surgeries.

By application, the procedural sedation segment is expected to grow with the highest CAGR in the market during the studied years. Procedural sedation helps patients tolerate unpleasant or painful procedures while minimizing the risk of distressing memories. Propofol allows a patient to maintain oxygenation and airway control independently. Healthcare professionals have also proven the role of propofol for procedural sedation in pediatric patients.

By end-user, the hospitals segment led the market with a share of approximately 54% in 2024, due to the increasing number of patient admissions and the availability of a favorable infrastructure. Hospitals possess skilled professionals from multiple departments, providing multidisciplinary expertise to patients. Patients also prefer hospitals due to favorable reimbursement policies and the presence of skilled professionals. Hospitals are also part of clinical trials to assess different propofol injections, benefiting patients before regulatory approval.

By end-user, the ambulatory surgical centers (ASCs) segment is expected to expand rapidly in the market in the coming years. ASCs specialize in outpatient services and minor surgeries, eliminating the need for a patient to stay overnight. This saves exorbitant costs and time for patients and healthcare professionals. Propofol injection is particularly used for short procedures due to its rapid onset and quick recovery, enhancing its demand in ASCs. The growing demand for minimally invasive surgeries propels the segment’s growth.

By distribution channel, the hospital pharmacies segment contributed the biggest revenue share of approximately 48% in the market in 2024, due to the presence of favorable infrastructure and the high-volume institutional procurement for surgical use. Pharmacists can directly send propofol injections to the respective healthcare professionals during surgeries or emergencies. Hospital pharmacies are more accessible and possess the desired anesthetics that are prescribed by healthcare professionals.

By distribution channel, the retail & online pharmacies segment is expected to witness the fastest growth in the market over the forecast period. The segmental growth is attributed to the increasing number of retail pharmacies and the burgeoning e-commerce sector. The growth in distribution efficiency and private healthcare procurement models also foster the segment’s growth. Patients or providers can directly purchase propofol injections from retail or online pharmacies. Retail or online pharmacies offer specialized discounts, free home delivery, and 24x7 services.

North America dominated the global market with a share of approximately 40% in 2024. The availability of a robust healthcare infrastructure, favorable regulatory policies, and the increasing number of surgeries are the major growth factors of the market in North America. Favorable reimbursement policies by government and private organizations enhance treatment accessibility and affordability. The presence of key players and increasing investments for the development and manufacturing of propofol boost the market.

According to a recent cross-sectional study, the number of surgeries in the U.S. ranges from 12.0 to 21.4 operations per 100,000 people. The American Hospital Association (AHA) reported that over 34 million people were admitted to hospitals in the U.S. The U.S. also conducts the highest number of clinical trials globally. Out of the total 2,578 studies, about 328 clinical trials were registered from the U.S.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The burgeoning healthcare sector, increasing healthcare expenditure, and the growth in elective and cosmetic surgeries drive the market. Countries like China, India, South Korea, and Japan conduct the highest number of cosmetic surgeries in the Asia-Pacific. Government organizations launch initiatives to promote indigenous manufacturing of propofol injections. The increasing number of people in ICUs and the growing patient population also contribute to market growth.

Cosmetic surgery is booming in China, with the rising disposable incomes and the increasing influence of social media. It is estimated that approximately 20 million Chinese pay for cosmetic procedures. Of these, 80% of patients are women, and the average age of people receiving surgery is 25 years.

Europe is expected to grow at a notable CAGR in the propofol injection market in the foreseeable future. The rising prevalence of chronic disorders and the growing geriatric population promote the market. European countries like Italy and Austria are involved in favorable trade policies of propofol injections, making them the top exporters in the world. The EU GMP guidelines regulate the manufacturing facilities of propofol injections in Europe. The increasing number of clinical trials bolsters market growth.

Italy is the second-largest exporter of propofol injection globally. It exported 363 shipments of propofol from June 2024 to May 2025. These exports were made by 19 Italy exporters to 18 buyers, marking a growth rate of 15%. In May 2025 alone, 29 shipments were made from Italy. Companies like Naprod Life Sciences Pvt. Ltd. and Rhei Life are the major manufacturers of propofol in Italy.

The latest research activities refer to developing propofol-based derivatives with improved drug efficacy and reduced side effects. Novel drug delivery systems are also developed for targeted drug delivery.

Key Players: Bachem, Pfizer, and Amneal Pharmaceuticals

Clinical trials involving propofol are conducted to compare its efficacy with newer anesthetics, as well as to investigate novel therapeutic applications of propofol for various disorders. Regulatory agencies like the FDA, EMA, and NMPA regulate the approval of propofol injections.

Key Players: AstraZeneca, Fresenius Kabi, and B. Braun Melsungen AG

Propofol injection is distributed to hospitals and retail pharmacies either through suppliers or directly through manufacturers.

Key Players: Wellona Pharma, Shreeji Pharma International, and Centurion Healthcare

Patient support & services of propofol injection focus on its safe administration in medical settings and treating cases of misuse and addiction.

By Formulation Type

By Application

By Concentration

By End-User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026