January 2026

The worldwide tumor fluid biopsy market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034. This growth is driven by emerging trends and strong demand across key sectors.

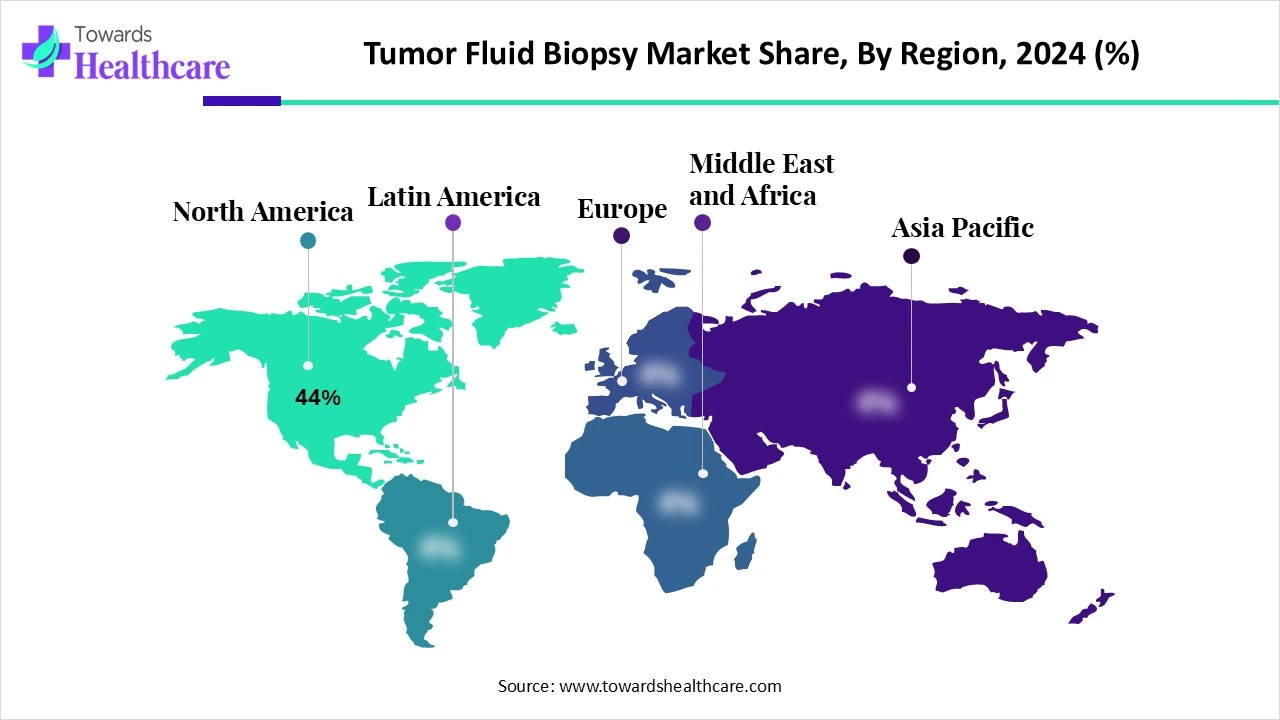

The tumor fluid biopsy market is expanding due to the increasing due for its non-invasive technology for cancer monitoring and diagnosis. This technique allows specific treatment selection, early detection, and real-time monitoring of tumor progression or recurrence. North America is dominant in the market due to the increasing incidence of cancer, rising demand for targeted medicine, and advancement in treatment options like next-generation sequencing. Asia Pacific is growing due to the presence of advanced healthcare infrastructure and growing government investment in healthcare.

The tumor fluid biopsy market refers to the industry focused on the collection and molecular analysis of tumor-associated bodily fluids such as pleural effusion, cerebrospinal fluid (CSF), ascitic fluid, pericardial effusion, and urine, to detect, characterize, and monitor cancer.Unlike traditional solid tissue biopsies, tumor fluid biopsies offer minimally invasive access to tumor-derived materials (e.g., ctDNA, RNA, proteins, exosomes, and cells), especially from difficult-to-biopsy locations like the brain, lungs, or peritoneum. These biopsies are increasingly used in precision oncology, early-stage cancer detection, and treatment resistance monitoring, driven by advancements in NGS, digital PCR, and liquid biopsy technologies.

Integration of AI in the biopharmaceutical contract manufacturing drives the growth of the market as AI improves the strength of liquid biopsies by enhancing diagnostic accuracy through advanced algorithms such as convolutional neural networks (CNNs) and natural language processing (NLP). These AI models analyse challenging biomedical data, providing higher specificity and sensitivity in cancer monitoring. The interaction between AI and liquid biopsies potential for early detection, enhanced disease monitoring, and modified treatment approaches. Integrating AI with liquid biopsy technology increases its efficiency, accuracy, and prognostic power, renovating cancer recognition and patient management.

For Instance,

Increasing Burden of Cancer Worldwide

The global burden of cancer is increasing, with over 35 million new cases expected by 2050, representing a 77% rise from an estimated 20 million cases in 2022. This rapid growth is driven by population aging, overall population increase, and shifts in exposure to risk factors linked to socioeconomic development. The rising cancer rates are part of a vicious cycle involving obesity, highly processed foods, and sedentary lifestyles. This cycle also contributes to the growth of the tumor fluid biopsy market.

For Instance,

Major Challenges of Tumor Fluid Biopsy

The accuracy of liquid biopsies varies based on cancer type and stage, often struggling to detect low levels of ctDNA in early-stage cancers. While they offer important genetic and molecular information, they do not provide the detailed cellular architecture seen in tissue biopsies. This limitation hampers the expansion of the tumor fluid biopsy market.

Increasing Advancement in Tumor Fluid Biopsy

Liquid biopsy has become a promising method for non-invasive and quick collection of pathological data from patient body fluids. Initially focused on individual biomarkers, recent advancements have turned it into a multi-parametric diagnostic tool, offering real-time insights into tumor growth, metastasis, and treatment response. Next-generation sequencing (NGS) technologies now enable detailed molecular profiling of circulating tumor cells (CTCs), helping detect genetic mutations, epigenetic changes, and signs of therapeutic resistance. A significant breakthrough is the use of single-cell sequencing on CTCs, providing unparalleled insights into intratumoral heterogeneity, clonal evolution, and epithelial-mesenchymal transition (EMT), which drives the expansion of the tumor fluid biopsy market.

For instance,

By fluid type, the pleural effusion fluid segment led the tumor fluid biopsy market, due to this fluid functions as a lubricant to enable the two layers of the pleura to glide smoothly past each other while respiration. The pressure of the pleural fluid is subatmospheric and preserves the negative pressure in the lungs and thoracic cavity, which is required for inhalation while also preventing the lungs from collapsing.

On the other hand, the cerebrospinal fluid (CSF) segment is projected to experience the fastest CAGR from 2025 to 2034, as CSF is an outstanding source of liquid biopsies in primary and metastatic brain tumors. It has a higher output than plasma for the identification of tumor-derived genomic material. It provides advantages, such as proximity to cancer and detection of brain-specific modifications. The cerebrospinal fluid (CSF) offers an unparalleled source of information about the cancer, with much less challenges than traditional biopsies.

By biomarker type, the circulating tumor DNA (ctDNA) segment is dominant in the Tumor Fluid Biopsy Market in 2024, as the use of ctDNA-based liquid biopsy provides several advantages, such as non-invasive or minimally invasive collection techniques, has ability to conduct recurrent assessment, and inclusive insights into cancer biology. It plays a significant role in cancer management by facilitating the screening of high-risk patients, dynamically monitoring therapeutic diagnosis and responses.

The exosomes & extracellular vesicles segment is projected to grow at the fastest CAGR from 2025 to 2034, as it is small membrane-bound vesicles secreted by cells, and has gained significant attention for its therapeutic potential. Measuring 30–100 nm in diameter and derived from different cell types, exosomes play a significant role in intercellular communication by transferring lipids, proteins, and RNA among cells. Transfer of EVs between cancer cells and stromal cells has been identified as a mechanism to reprogram the host tissue to modify tissue homeostasis and aid cancer progression.

By technology, the next-generation sequencing (NGS) segment led the tumor fluid biopsy market in 2024 due to its application to identify new and rare cancer mutations, identify familial cancer mutation carriers, and offer molecular rationale for suitable targeted therapy. It holds major benefits, like the ability to fully sequence entire types of mutations for a large number of genes in a single test at a relatively low cost. Next-generation sequencing (NGS) has been broadly implemented for whole-genome sequencing, transcriptome sequencing, specific region sequencing, epigenetic sequencing, and other sequencing.

The PCR-based techniques segment is projected to experience the fastest CAGR from 2025 to 2034, as PCR (dPCR) is a technique used to measure nucleic acids in a sample with precision and no need for a standard curve. In liquid biopsy examination, precisely designed assays are used with dPCR experiments to perform absolute quantification of tumor-derived mutations on circulating tumor DNA (ctDNA) present in a DNA sample collected from plasma. This helps in biomarker research related to early-stage cancers, potential cancer development, as well as supports research exploring the diagnosis and clinical management of tumors.

By cancer type, the lung cancer segment led the tumor fluid biopsy market in 2024, as liquid biopsies are advantageous as they are nontraumatic, simple to obtain, reflect the complete state of the tumor, and enable real-time monitoring. Liquid biopsies mainly include circulating tumor cells, circulating tumor DNA, exosomes, microRNA, circulating RNA, tumor platelets, and tumor endothelial cells. Liquid biopsy is an evolving process with a potential role in the early detection and screening of lung cancer.

On the other hand, the brain/CNS tumors segment is projected to experience the fastest CAGR from 2025 to 2034, as liquid biopsy provides data on an array of biomarkers, but mainly circulating tumor cells (CTCs) and circulating cell-free DNA (cfDNA) in the blood circulation of individuals. They are applied as a significant diagnostic tool, as well as to measure prognosis and disease monitoring. Additionally, post-surgical liquid biopsy assessment is used as a mechanism to identify early relapse.

By application, the molecular diagnostics & mutation detection segment led the tumor fluid biopsy market in 2024 due to fluid biopsy providing an alternative sampling for molecular testing. It is most usually applied to the collection of peripheral blood for examination of cell-free circulating tumor deoxyribonucleic acids (DNA). It is also used for the detection of disease relapse, the detection of treatment resistance and clonal evolution, and prognostication.

On the other hand, the minimal residual disease (MRD) tracking segment is projected to experience the fastest CAGR from 2025 to 2034, as liquid biopsy offers comprehensive genomic profiling of advanced tumors, with developing healthcare applications in minimal residual disease monitoring. It is less invasive, they provide a more inclusive molecular overview of tumor heterogeneity, and make it simple to obtain repeated blood samples over time to recognize the dynamics of the response to a particular treatment.

By end user, the clinical laboratories & diagnostic centers segment led the tumor fluid biopsy market in 2024 due to tumor fluid biopsy, which requires smaller sample volumes and offers rapid results, making them appropriate for healthcare applications. These technologies provide high-throughput screening and multiplex assays, allowing simultaneous analysis of multiple biomarkers. The technological approaches in liquid biopsy have transformed cancer diagnostics and management, allowing sensitive and targeted detection of tumor-derived components in clinical laboratories & diagnostic centers.

On the other hand, the biotech & pharma companies segment is projected to experience the fastest CAGR from 2025 to 2034, as increasing healthcare applications of liquid biopsies, encompassing the initial diagnosis and cancer identification, the application as a tool for prediction in early and advanced cancer settings, the identification of potentially actionable alterations, the monitoring of response and resistance under systemic therapy in biotech and pharma companies.

North America is dominant in the market share by 44% in 2024, as growing demand for personalized medicine cancer treatment, to find patients who have a major risk of getting cancer, and if they require screening or treatment to reduce these challenges, so increasing application of fluid biopsy due to it provides real-time, tumor-specific genetic data. Increasing government spending on cancer therapies is largely due to high launch prices of new therapeutics and price increases of present products. As North America spent $99 billion and clinician-administered anticancer therapies in 2023, and spending is projected to increase to $180 billion by 2028, which contributes to the growth of the market.

For Instance,

Increasing prevalence of cancer in the U.S., in 2025, 2,041,910 new cancer cases and 618,120 cancer deaths are projected to occur, which will increase the demand for tumor fluid biopsy technology. Also, the United States has a well-established healthcare and diagnostic infrastructure, which allows the adoption of revolutionary technology, which contributes to the growth of the market.

The growing cancer cases and deaths are expected due to the growing and aging population. In 2024, 247,100 Canadians are projected to hear the words compared to the 239,100 novel cancer cases in 2023, which drives the growth of the market.

Asia Pacific is expected to be the fastest-growing region in the market during the forecast period, as this region major hub for healthcare operations software because of its demographic complexity, increasing patient volume, and under-digitized healthcare infrastructure; therefore, it is increasing R&D investment in oncology and biotechnology. The growing incidence of breast, colorectal, and lung cancer in the Asia Pacific region compared to the global which contributes to the growth of the market.

In China, significant development in cancer therapy, driven by the progress in healthcare technology, research and development, and government initiatives. China’s progressive facilities, cutting-edge medicines, and active participation in clinical trials position it to continue creating significant contributions to worldwide cancer care. Increasing government guidelines for advanced care of cancer, such as the ‘Chinese Integrated Cancer Diagnosis and Treatment Guidelines’, cover 53 cancer types and 60 treatment modalities and techniques for use in diagnostics, treatment, and care.

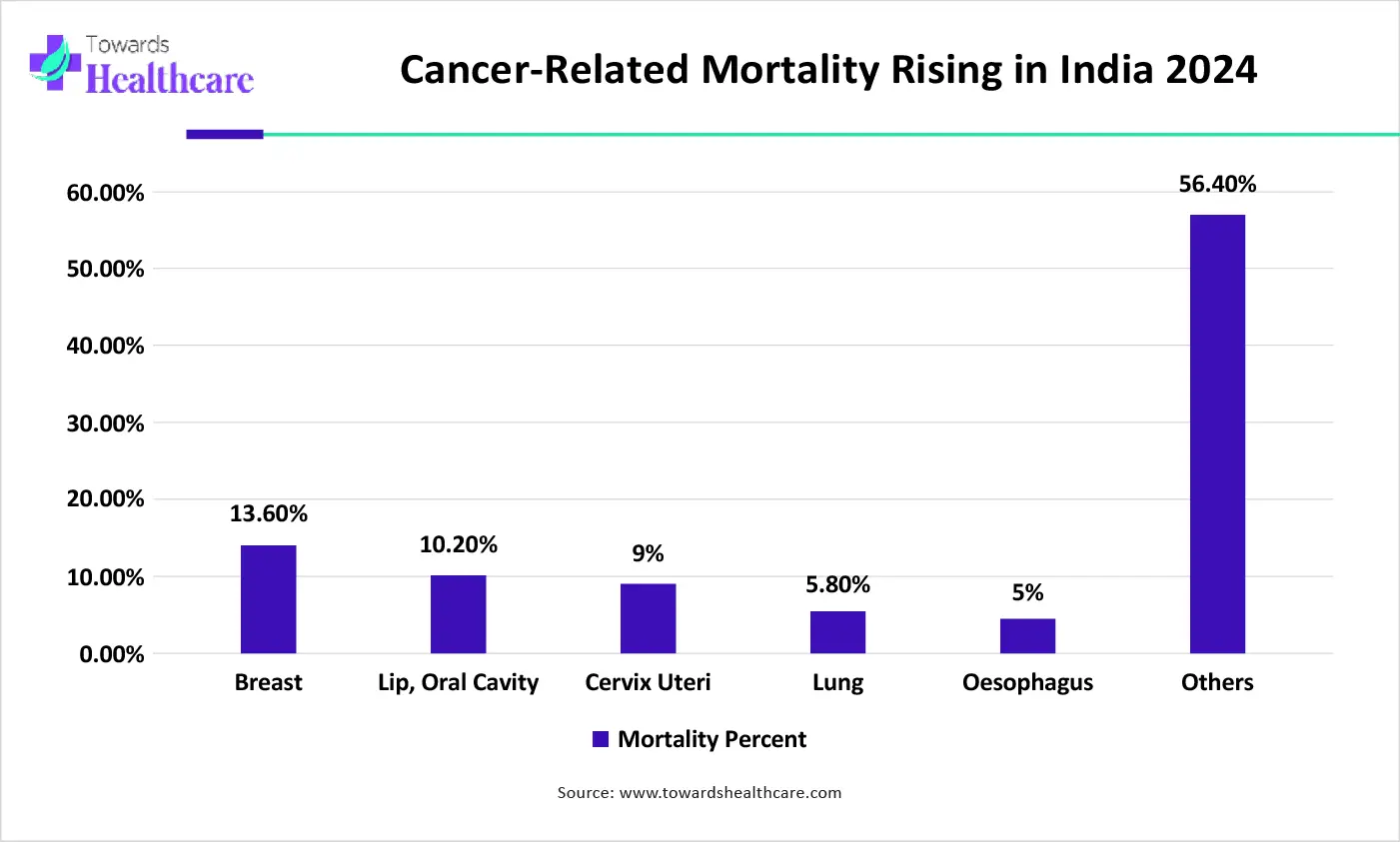

In India, increasing incidence of cancer, with certain types becoming more prevalent due to a complex interplay of lifestyle, genetic, dietary, environmental, and healthcare factors. The huge disease burden is combined with late-stage detection caused mainly due to a lack of awareness and low penetration of screening programs. India has a poor cancer detection rate of 29%, with only 15% and 33% of breast, lung, and cervical cancers being diagnosed in stages 1 and 2, respectively, which increases the demand for advanced treatment therapy such as tumor fluid biopsy.

Europe is estimated to be notably growing in the market during 2025-2034, as the increasing old age population in Europe, the number of people being diagnosed with cancer increase by up to 18% in 2040. Cancer endures to wreck lives, influence families, and put major pressure on health and social systems and economies in Europe. Cancer is a major cause of death among Europeans under 65, which is increasing the demand for tumor fluid biopsy.

For Instance,

In Germany, growing trends of precision oncology and patient-specific treatment increase the use of tumor fluid biopsy techniques. Growing access to progressive healthcare services in developing areas is accelerating market expansion.

Growing academic-industry partnership and cross-border investigation are increasing medical care facilities and growing adoption of liquid biopsy tests, which drives the growth of the market. The growing rates of cancer in the UK are driven by various factors, from an ageing population to the adoption of a modern lifestyle and environmental exposures, which drive the growth of the market.

In June 2025, FCS President & Managing Physician Lucio N. Gordan, MD., stated, “With genomic profiling, we can identify actionable mutations for the majority of cancer patients, creating a uniquely personalized treatment approach. It is at the core of our focus on precision oncology.”

By Fluid Type

By Biomarker Type

By Technology

By Cancer Type

By Application

By End User

By Region

January 2026

January 2026

January 2026

November 2025