February 2026

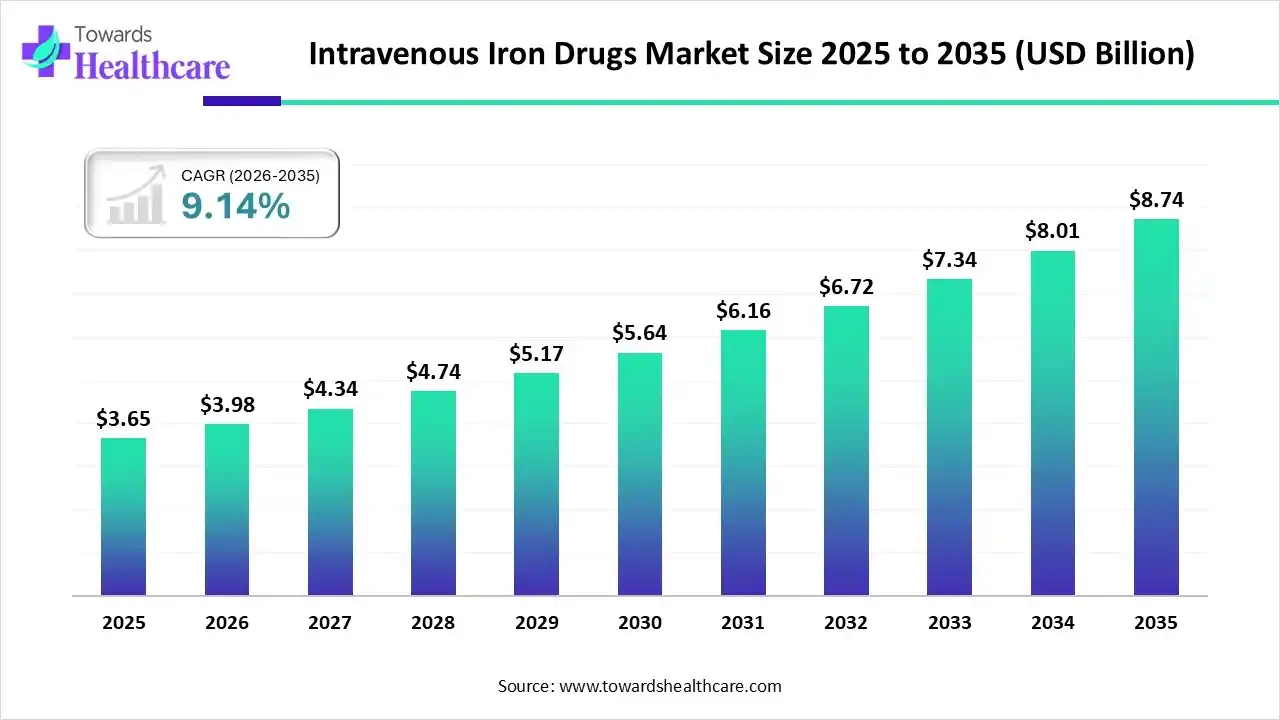

The global intravenous iron drugs market size was estimated at USD 3.65 billion in 2025 and is predicted to increase from USD 3.98 billion in 2026 to approximately USD 8.74 billion by 2035, expanding at a CAGR of 9.14% from 2026 to 2035.

The intravenous iron drugs market is growing as intravenous iron replacement product applied to manage iron deficiency anemia (IDA) in patients with chronic kidney disease (CKD).

The intravenous iron drugs market is growing because IV iron has become crucial for treating iron deficiency and anemia. These medications are used in various clinical situations, such as chronic kidney disease, cancer-related anemia, and gastrointestinal bleeding. They offer faster treatment compared to tablets or dietary changes. Intravenous iron therapy allows for quick replenishment of iron stores and resolution of anemia, with fewer gastrointestinal side effects. The use of IV iron as a first-line treatment in children with chronic conditions has also increased. IV iron helps quickly correct anemia and reduces the need for ESAs compared to oral iron, without evidence of renal toxicity.

Integration of AI-driven technology in intravenous iron drugs drives the growth of the market, driven by AI-based diagnostics and smart infusion tools that enhance dosing and treatment schedules. An AI-based system analyzes a patient's response to prior infusion management and adjusts dosages and drug blends accordingly. Integrating clinical laboratory medicine with an AI-based system enables the extraction and analysis of extensive feature data from clinical tests. AI in medicine includes its varied applications in areas like medical image analysis, drug discovery, and targeted treatment planning.

Novel iron formulations allow for a total dose infusion (TDI) in 15 to 60 min, obviating multiple unnecessary visits for the same clinical advantages without added toxicity.

Trends in ambulatory infusion centers are the incessant development of infusion tools. Modern infusion pumps, which are more accurate and consumer-friendly, are enabling AICs to administer treatments more efficiently.

Intravenous infusions of iron have advanced from a poorly active and dangerous intervention to a safe keystone in the treatment of iron deficiency.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.65 Billion |

| Projected Market Size in 2035 | USD 8.74 Billion |

| CAGR (2026 - 2035) | 9.14% |

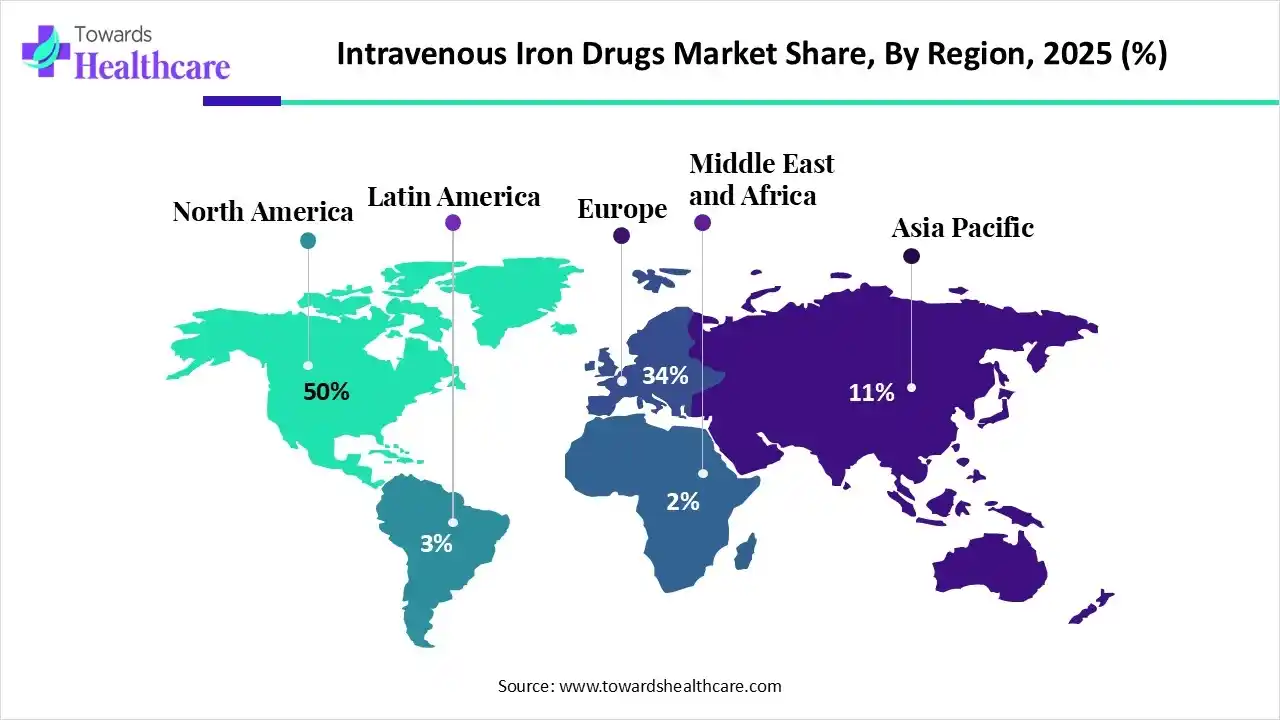

| Leading Region | North America by 50% |

| Market Segmentation | By Product Type, By Application, By End-User, By Region |

| Top Key Players | CSL Vifor, Daiichi Sankyo Company, Ltd., Pharmacosmos A/S, Sanofi S.A.,Fresenius Kabi AG, AbbVie Inc. |

Which Product Type Led the Intravenous Iron Drugs Market in 2025?

In 2025, the ferric carboxymaltose segment held the dominant market share with approximately 48% share in 2025, due to ferric carboxymaltose being an iron replacement therapy applied to treat iron deficiency anemia in offspring and adults with intolerance or inadequate clinical response to oral iron, and in adult patients who have non-dialysis dependent chronic kidney disease. Intravenous ferric carboxymaltose is a stable multifaceted product with the advantage of being non-dextran-containing and having a low immunogenic strength.

Whereas the iron isomaltoside segment is estimated to be the fastest-growing with a CAGR of approximately 10.1% in the market, as iron isomaltoside is a potential treatment choice for iron deficiency in patients experiencing elective surgery. Its applications are in IV formulations for pets, livestock, and horses, especially during periods of stress, disease, or surgery. Iron isomaltoside’s capability to deliver iron proficiently and safely has expanded its use in various industries, from pharmaceuticals to nutraceuticals and veterinary care, making it a multipurpose and valuable compound.

Why did the Chronic Kidney Disease Segment Dominate the Market in 2025?

The chronic kidney disease segment was dominant in the intravenous iron drugs market, with approximately 35% share in 2025, as CKD-ND patients have suggested potential advantages of initiating IV iron therapy before dialysis onset. IV iron is effective for patients in later stages of CKD, particularly if they are getting haemodialysis treatments. Intravenous iron supplementation has become a backbone of therapy in the management of CKD-related anemia.

Oncology/Cancer Anemia

Whereas the oncology/cancer anemia segment is estimated to be the fastest-growing, with a CAGR of approximately 9.8% in the market, as IV iron raises hemoglobin concentration and decreases transfusion rates during different cancer treatment administrations. IV iron is administered safely through the cancer treatment pathway from the main surgery to the palliative setting. IV iron enhances measures of hematopoiesis and iron metabolism in patients with cancer and anemia who are treated with chemotherapy.

Why did the End-User Segment Dominate the Market in 2025?

The hospitals segment was dominant in the intravenous iron drugs market with approximately 58.5% share in 2025, as intravenous infusions of iron have progressed from a poorly effective and dangerous involvement to a safe and significant role in the treatment of iron deficiency. Intravenous iron provides advantages over oral iron for the treatment of iron deficiency anemia in a broad range of disease states. IV iron quickly raises iron and hemoglobin levels in the bloodstream and replenishes body iron stores much more rapidly than oral supplements.

Home Infusion/Telehealth

Whereas the home infusion/telehealth segment is estimated to be the fastest-growing with a CAGR of approximately 11.0% in the market, as Home infusion care can provide safe, clinically effective care, improve patients' quality of life, and lower healthcare expenses. Home infusion therapy, from ease and convenience to concentrated hospital visits. Home infusions are often more costly than lengthy hospital stays or frequent outpatient solutions visits.

In 2025, North America dominated the intravenous iron drugs market with approximately 50% share, as healthcare and private insurers are investigating bundled payment models. Intravenous (IV) iron therapy is a broadly accepted, safe, and effective treatment for iron deficiency anemia. High prevalence of iron deficiency anemia in patients with chronic kidney disease. Increasing government approval, such as FDA approval of Injectafer, a non–dextran-containing iron therapy, provides a new IV treatment choice for patients with iron-deficiency anemia, which drives the growth of the market.

For Instance,

U.S. Market Trends

In the U.S., rapidly growing aging populations and associated demographic shifts, growing disease burdens, and widening gaps in equity demand speed up action. Improved government flexibility for combination therapies, enhancing treatment results in cancer and genetic diseases. The FDA prioritization of expedited approvals and expedited pathways is warranted for medicines with potentially life-saving characteristics.

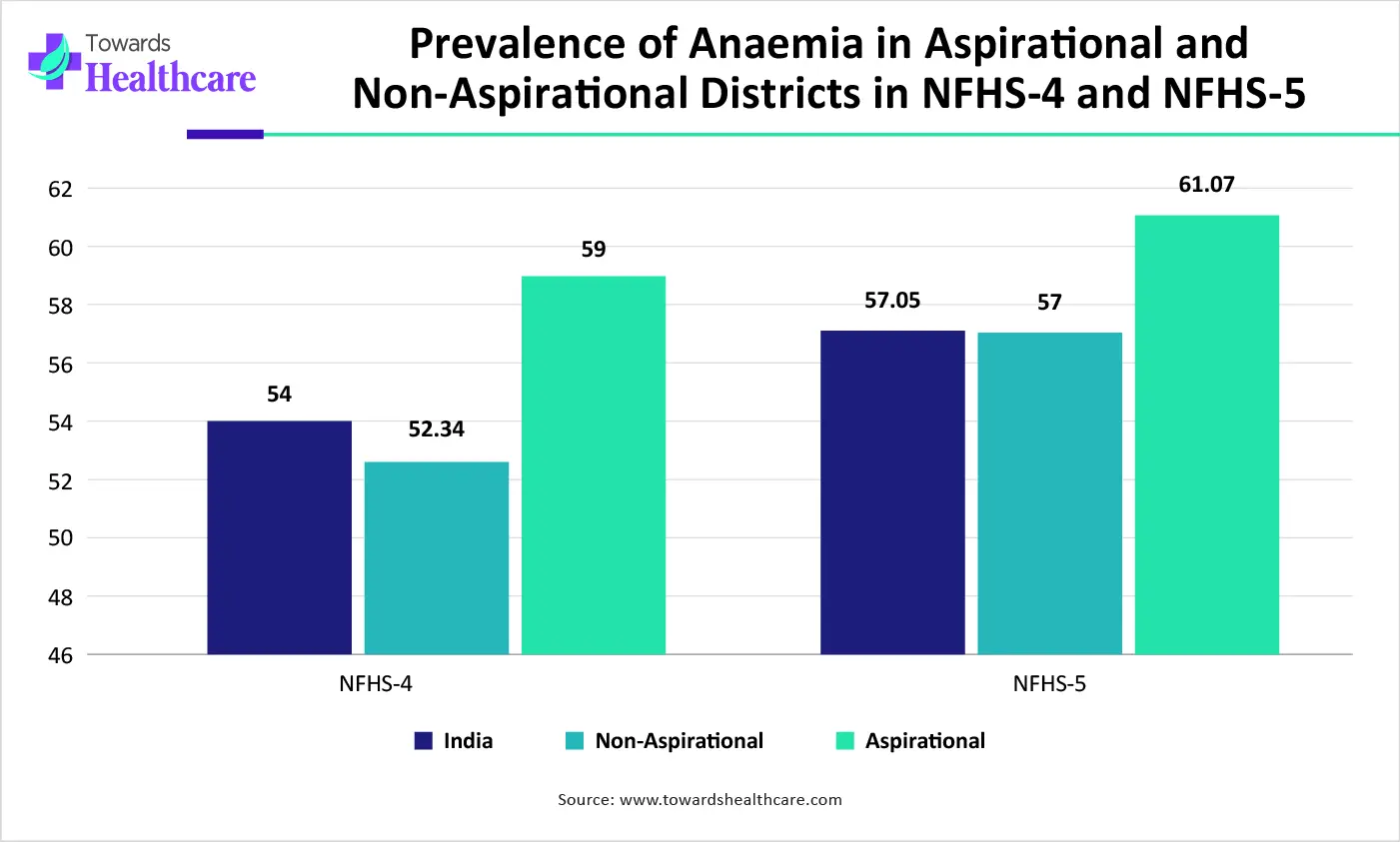

Asia Pacific is expected to see rapid growth of approximately 9.4% in the intravenous iron drugs market, driven by this region accounting for more than 85 % of the absolute anemia load in high-risk groups, and India is the worst hit, with a growing demand for intravenous iron drugs. The APAC healthcare sector has high growth, and the presence of major organizations that drive innovation. Much of the healthcare in Asia and the Pacific, particularly in urban areas, is provided by the private sector, which drives the growth of the market.

India Market Trends

India's anaemia disaster is being exacerbated by a lack of awareness, poor nutrition, and increasing levels of air pollution. India’s anaemia rate is the highest in the global with India’s National Family Health Survey indicating more than 50% of pregnant women were affected by anaemia. Increasing government support, such as India’s Anaemia Mukt Bharat-Intensified National Iron Plus Initiative, aims to lower the prevalence of anaemia in reproductive-age women.

| Company | Headquarters | Latest Update |

| CSL Vifor | Switzerland | In September 2025, CSL Vifor and Travere Therapeutics, Inc., supported the recent publication of the updated clinical practice guidelines for the treatment of IgA Nephropathy (IgAN), Kidney Disease: Improving Global Outcomes (KDIGO) 2025 healthcare practice guideline for the management of IgA Nephropathy and Immunoglobulin A vasculitis. |

| Daiichi Sankyo Company, Ltd. | Japan | Daiichi Sankyo is investing in major manufacturing expansion in the U.S. (Ohio) and China, which is primarily for ADC products. |

| Pharmacosmos A/S | Denmark | Pharmacosmos A/S is a global leader in carbohydrate chemistry and innovative treatments for iron deficiency and iron deficiency anaemia. |

| Sanofi S.A. | France | Sanofi S.A. is heavily focused on transitioning its portfolio toward high-growth immunology, rare disease, and vaccine products. |

| Fresenius Kabi AG | Germany | In December 2025, Fresenius announced the launch of its denosumab biosimilars, Conexxence and Bomyntra, in Europe |

| AbbVie Inc. | United States | In February 2026, AbbVie announced that it had submitted applications for an advanced indication to the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) for upadacitinib for the management of adult and adolescent patients living with non-segmental vitiligo. |

By Product Type

By Application

By End-User

By Region

February 2026

January 2026

January 2026

January 2026