February 2026

The global drug discovery market size is calculated at USD 71.96 billion in 2025, grew to USD 78.61 billion in 2026, and is projected to reach around USD 174.14 billion by 2035. The market is expanding at a CAGR of 9.24% between 2026 and 2035.

The drug discovery market is primarily driven by growing research and development (R&D) activities and favorable government support. Key players invest heavily in R&D activities to develop innovative products. Prominent players collaborate with contract research organizations (CROs) to expand their product pipeline and geographical presence. Artificial intelligence (AI) revolutionizes drug discovery by reducing timelines and saving costs. The need for personalized medicines and advanced tools presents future opportunities for the market.

| Table | Scope |

| Market Size in 2026 | USD 78.61 Billion |

| Projected Market Size in 2035 | USD 174.14 Billion |

| CAGR (2026 - 2035) | 9.24% |

| Leading Region | North America |

| Market Segmentation | By Functional Workflow/Stage, By Modality, By Technology/Platform, By Service Model/Provider Type, By End-User, By Therapeutic Area Focus, By Region |

| Top Key Players | Atomwise, BenevolentAI, Charles River Laboratories, Certara, Evotec, Exscientia, Genedata, Insilico Medicine, IQVIA, Labcorp / Covance, Novartis (discovery & platform investments), Recursion Pharmaceuticals, Schrödinger, Thermo Fisher Scientific, WuXi AppTec |

The drug discovery market refers to an ecosystem of products, platforms, services, and workflows used to identify and validate biological targets, discover hit compounds or biologics, optimize leads, predict ADMET/toxicity, and progress candidates toward preclinical and IND-enabling studies. Includes in-silico tools, screening libraries, high-throughput screening (HTS), medicinal chemistry, biologics discovery, assay development, screening services, CRO/CDMO support, translational biology, and enabling data/analytics sold to pharma, biotech, academic labs, and emerging biotech.

Increasing Collaboration: Key players collaborate to access advanced technologies and take advantage of each other’s expertise.

Increasing Investments: Investments enable companies to expand their facilities and functionalities, improving their operations.

AI plays a crucial role in drug discovery by expediting the entire process and leading to the development of more efficacious drugs. A recent research report found that AI-based drug discovery could save approximately 70% of costs to pharmaceutical and biotech companies. AI and machine learning (ML) can predict complex structures of proteins/targets, enabling researchers to design drugs based on their structure. AI-based drug discovery results in faster drug discovery, cost savings, reduced resource and manpower usage, and decreased attrition rates in clinical trials.

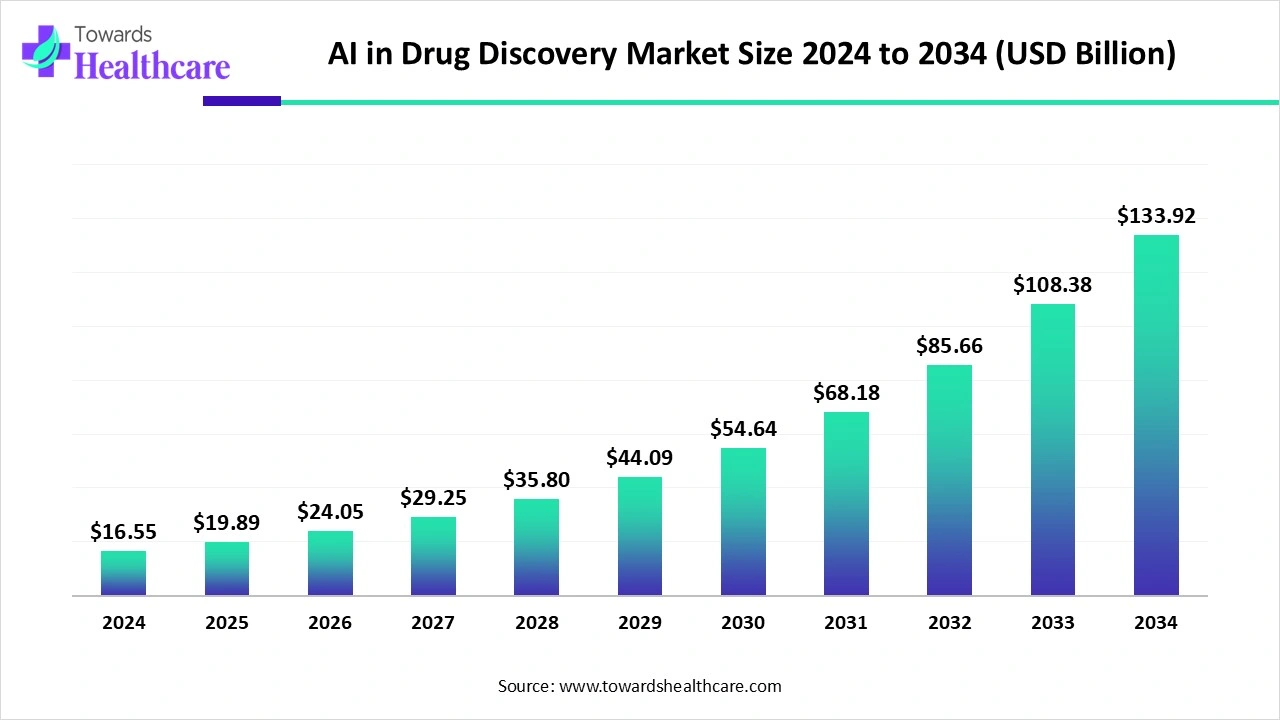

The global AI in drug discovery market is valued at USD 19.89 billion in 2025 and is projected to reach approximately USD 133.92 billion by 2034, growing at a CAGR of 23.22% between 2024 and 2034.

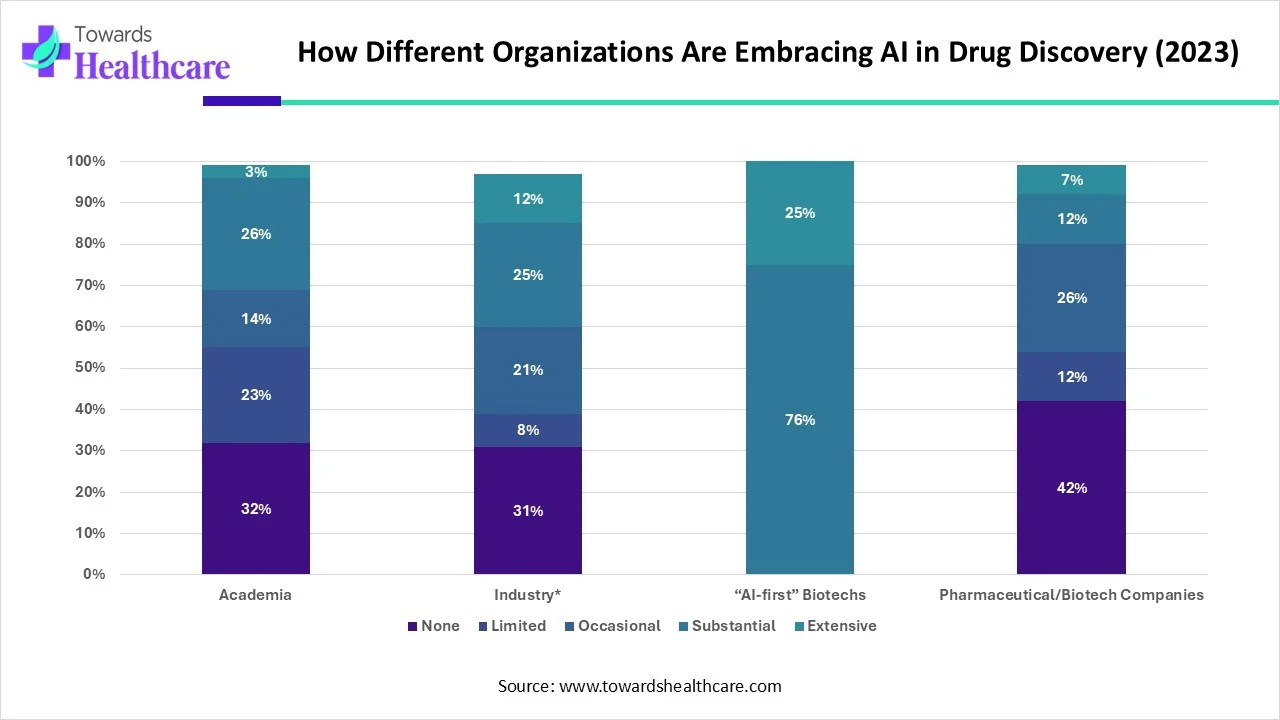

The table shows that AI-first biotechs lead AI adoption in drug discovery, with all of them using AI either substantially or extensively. Academia and general industry show moderate adoption, but a significant share still uses little to no AI. Pharmaceutical and biotech companies remain the most cautious, with the highest percentage reporting no AI adoption. Overall, the data highlights a clear gap: organizations built around AI embrace it deeply, while traditional sectors continue to adopt it slowly.

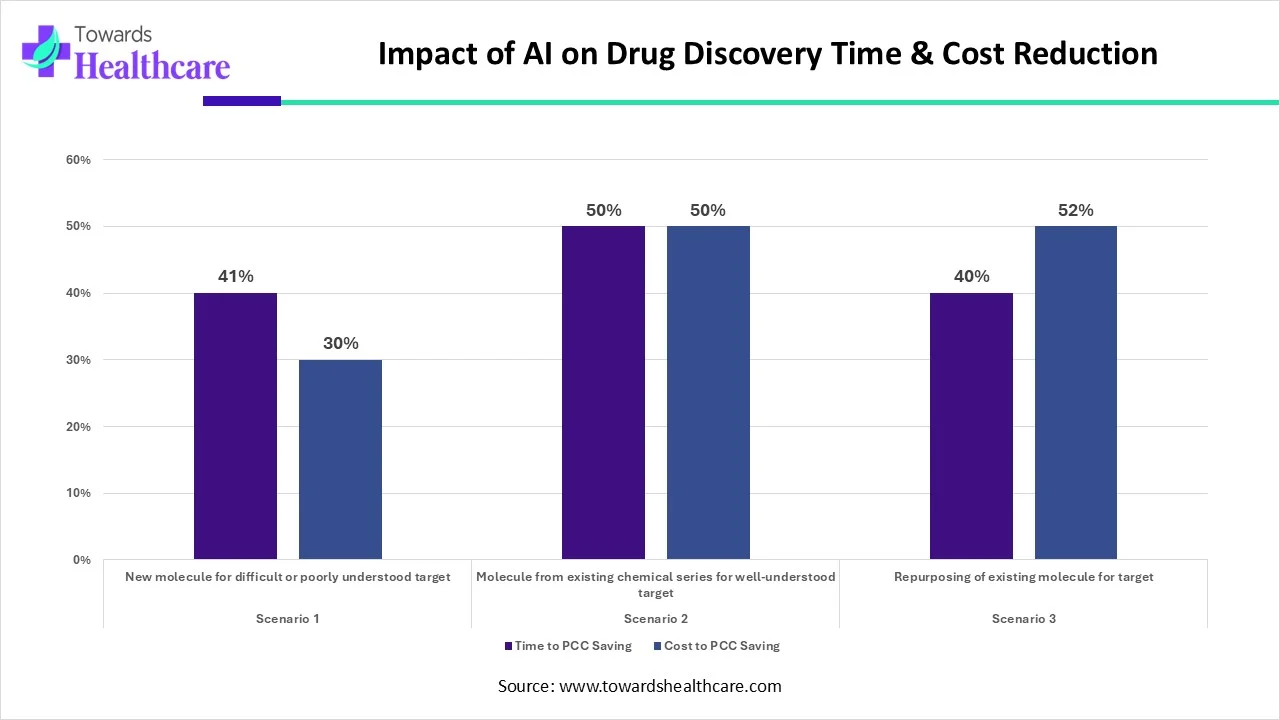

AI is helping the drug discovery process become faster and cheaper. The impact depends on the type of project:

1. When scientists develop a completely new molecule for a difficult or poorly understood target, AI reduces the time by 41% and cuts the cost by 30%.

In this case, the work is complex, so the savings are helpful but not the highest.

2. When researchers work with an existing chemical series for a well-understood target, AI provides the biggest benefit.

It cuts both time and cost by 50% because the starting point is stronger, and AI can optimize more efficiently.

3. When teams repurpose an already-known molecule for a new target, AI again saves 40% of time and reduces costs by 52%.

This is because much of the basic research is already done, and AI speeds up the matching process.

Increasing Investments

The major growth factor for the drug discovery market is the increasing R&D investments. The average cost of discovering a new drug and bringing into the market is around $2 to $3 billion. This requires high amount of investments by several government and private bodies. In 2024, Merck & Co. invested the highest amount for drug discovery R&D in around 27 projects. Roche has set a goal to launch 20 transforming drugs by 2029 in different therapeutic areas with high societal impact. All these efforts accelerate the drug discovery process, leading to the development of more efficacious drugs.

Clinical Failure

Several limitations, such as a lack of efficacy, insufficient safety, and unacceptable toxicity levels, limit the total number of drug candidates reaching the market. Almost 90% of drugs developed at the laboratory scale usually fail at the clinical stage.

What is the Future of the Drug Discovery Market?

The market future is promising, driven by the growing demand for personalized medicines and advanced bioinformatics tools. Personalized medicines enable researchers to develop novel drugs that are designed based on patients’ genetic profiles. This allows healthcare professionals to treat a disease from its root cause. Advanced bioinformatics tools enable the efficient analysis and interpretation of large-scale biological data, facilitating target identification and lead optimization. These tools enable researchers to enhance the effectiveness and precision of clinical medicines and study protein targets accurately.

By functional workflow/stage, the hit identification segment held a dominant presence in the market in 2024. This is due to the growing demand for small molecules and the development of drugs with higher efficacy. Hit identification is a process of identifying and delivering a compound with confirmed biological activity against a target. It is a part of the screening process that results in drug candidates with favorable biological activity. This step helps researchers to discover hit compounds for further medicinal chemistry optimization.

By functional workflow/stage, the target discovery & validation segment is expected to grow at the fastest CAGR in the market during the forecast period. Advancements in genomics & proteomics and the widespread availability of innovative bioinformatics tools boost the segment’s growth. Target discovery & validation is the foremost step in drug discovery, enabling researchers to design targeted therapeutics. Ongoing efforts are made to develop drugs that bind to multiple targets simultaneously. Hence, knowing the structural features of every target is necessary.

By modality, the small molecules segment held the largest revenue share of the market in 2024. This segment dominated due to the favorable pharmacokinetic properties of small molecules. Small molecules offer numerous benefits, such as high oral bioavailability and lower cost, enhancing patient compliance. AI and computational modeling revolutionize the development of small molecules. Small-molecule permeation enhancers and certain chemical modification techniques help overcome pharmacokinetic limitations, unlocking new possibilities. The DrugBank database contains 3006 approved small-molecule drugs.

By modality, the biologics segment is expected to grow with the highest CAGR in the market during the studied years. The shifting trend towards more targeted therapeutics and high-value assets promotes the development of biologics. Biologics can cure a disease from its root cause and result in reduced adverse effects. They are also found to treat complex and rare diseases that are otherwise difficult to treat with conventional molecules. As of August 2025, the U.S. Food and Drug Administration (FDA) has approved 7 biologics for various disorders.

By technology/platform, the high-throughput screening (HTS) & compound libraries segment contributed the biggest revenue share of the market in 2024. The HTS & compound libraries method is a conventional technique for developing efficacious drugs. The availability of advanced and comprehensive computational platforms transforms the development of hits. It enhances the efficiency and throughput for a wide variety of detection technologies.

By technology/platform, the computational/in silico drug discovery segment is expected to expand rapidly in the market in the coming years. Computational drug discovery reduces the complexities of wet lab experiments and expedites the drug discovery process. It saves the cost related to screening thousands of compounds in a lab. In silico tools can predict and validate drug targets and drug-like molecules. They can assess the binding affinity of drug candidates with the target.

By service model/provider type, the full service CROs/discovery CDMOs segment accounted for the highest revenue share of the market in 2024. This is due to the availability of favorable infrastructure and the presence of skilled professionals in CROs and CDMOs. Skilled professionals provide relevant expertise to complex research problems. CROs and CDMOs perform the entire operation, from target identification to regulatory approval, allowing companies to focus on their core competencies.

By service model/provider type, the SaaS/platform providers segment is expected to witness the fastest growth in the market over the forecast period. SaaS providers provide advanced platforms for streamlining the drug discovery process. This allows companies to develop novel and efficacious drugs faster, reducing the time to market approval. These platforms are available through licensing and success-fee models on a subscription basis.

By end-user, the large pharmaceutical companies segment led the market in 2024. The segmental growth is attributed to the presence of favorable infrastructure and suitable capital investment. Large companies invest 5-30% of their total revenues in drug discovery research. The increasing competition among key players encourages them to develop innovative drugs and expand their product pipeline. The increasing number of drug approvals strengthens a company’s market position.

By end-user, the small virtual biotech/startups segment is expected to show the fastest growth over the forecast period. Drug discovery startups expedite the identification, design, and development of new therapeutic agents. They raise funding from venture capitalists to facilitate the development of novel drugs or drug discovery platforms. They leverage state-of-the-art computational methods, AI algorithms, and bioinformatics to spearhead innovative therapeutics.

By therapeutic focus area, the oncology segment held a major revenue share of the market in 2024. This is due to the rising prevalence of cancer and its complexities, as well as the increasing discovery programs and funding. Researchers focus on identifying novel drug targets involved in cancer progression. They also focus on repurposing existing licensed medications that are approved for different disorders for the treatment of cancer. This helps healthcare professionals to prescribe medications with known efficacy and toxicity profiles.

By therapeutic focus area, the CNS/neurology segment is expected to account for the highest growth in the forecast period. The World Health Organization (WHO) reported that over 1 in 3 people are affected by neurological conditions globally. CNS/neurology disorders are the leading cause of disability and illness. This encourages researchers to develop targeted drugs with reduced side effects. Advances in genomics and the availability of computational tools potentiate drug development.

North America dominated the global market in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable regulatory policies are the major growth factors for the market in North America. Government organizations provide sufficient funding to promote drug discovery. The rising adoption of advanced technologies and a strong demand for new treatments propel the market.

Key players, including Evotec, Greiner Bio-One, Pfizer, Charles River Laboratories, and Johnson & Johnson, are major contributors to the market in the U.S. Out of all drugs approved in 2023, 85% of novel drugs were developed by Charles River Laboratories. The National Institute of Health (NIH) provides funding for conducting research activities, accounting for approximately $48 million of the annual budget.

Companies like Dalton Pharma Services, Dalriada Drug Discovery, and SV ChemBio Tech conduct drug discovery research or provide research services in Canada. The Canadian government invested around $49 million through its Strategic Innovation Fund (SIF) for the creation of the Conscience Open Science Drug Discovery Network. The network will address gaps in potential drug and therapeutic development.

Asia-Pacific is expected to host the fastest-growing market in the coming years. The rapidly expanding pharmaceutical and biotech sectors and the fastest capacity growth in CROs boost the market. The increasing collaboration, public-private partnerships, and mergers & acquisitions also contribute to market growth. The rising prevalence of chronic disorders, the growing geriatric population, and sedentary lifestyles necessitate the development of novel drugs. The National Medical Products Administration (NMPA) of China approved a total of 228 new drug applications in 2024.

Drug discovery R&D involves 5 steps: 1) Target identification & validation; 2) lead discovery; 3) lead optimization; 4) preclinical testing; 5) clinical trials. These steps play a vital role in developing safe and effective drugs.

Key Players: Roche, Pantheon Pharma Services, and Bristol Myers Squibb.

Clinical trials are conducted to assess the safety and efficacy of novel drugs on humans in different phases. The results obtained from clinical trials are considered by regulatory agencies to provide marketing authorization to a drug.

Key Players: Charles River Laboratories, Eli Lilly & Company, and AbbVie.

Patients are involved in the research and clinical trial process to help shape the development of valuable drugs through their symptoms and treatment outcomes. Patient support & services also refer to providing reimbursement for expensive targeted therapeutics.

Dr. Neil Torbett, CEO of PhoreMost, commented that the FDA-approved molecular glues have treated millions of patients and generated billions of dollars in revenue. The company’s GlueSEEKER can radically enable the discovery of new molecular glue therapies, directing this modality towards specific targets across a broad array of E3 ligases.

By Functional Workflow/Stage

By Modality

By Technology/Platform

By Service Model/Provider Type

By End-User

By Therapeutic Area Focus

By Region

February 2026

February 2026

February 2026

February 2026