February 2026

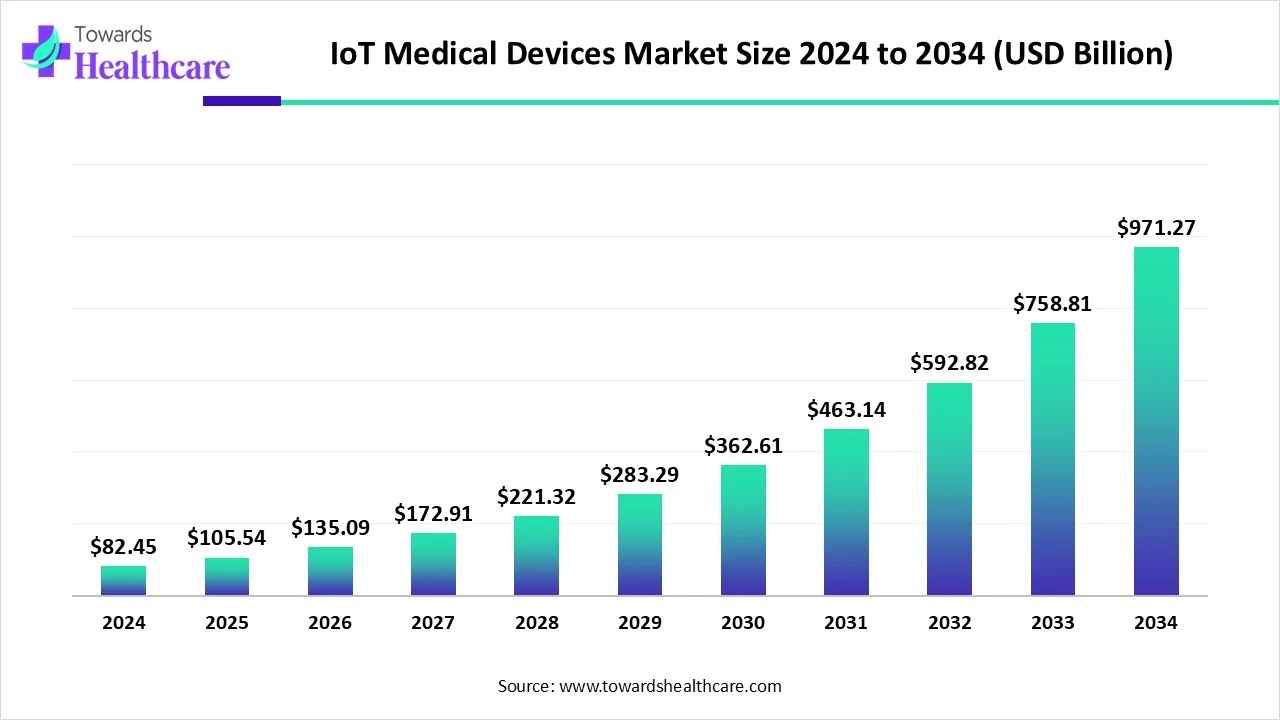

The global IoT medical devices market size is calculated at US$ 82.45 in 2024, grew to US$ 105.54 billion in 2025, and is projected to reach around US$ 971.27 billion by 2034. The market is expanding at a CAGR of 28% between 2025 and 2034.

By facilitating data-driven decision-making, remote diagnostics, and real-time monitoring, Internet of Things (IoT) medical devices are revolutionising the healthcare industry. IoT-enabled gadgets, such smart implants, wearable health monitors, and linked medical equipment, gather and send patient data, enabling medical professionals to keep an eye on vital signs, identify anomalies, and modify treatments instantly.

More individualised treatment is made possible by this constant flow of data, which also enhances patient outcomes, especially in the areas of post-operative care and chronic illness management. IoT medical devices also assist healthcare organisations in streamlining operations by automating maintenance and inventory management, which lowers downtime and boosts overall effectiveness.

| Table | Scope |

| Market Size in 2025 | USD 105.54 Billion |

| Projected Market Size in 2034 | USD 971.27 Billion |

| CAGR (2025 - 2034) | 28% |

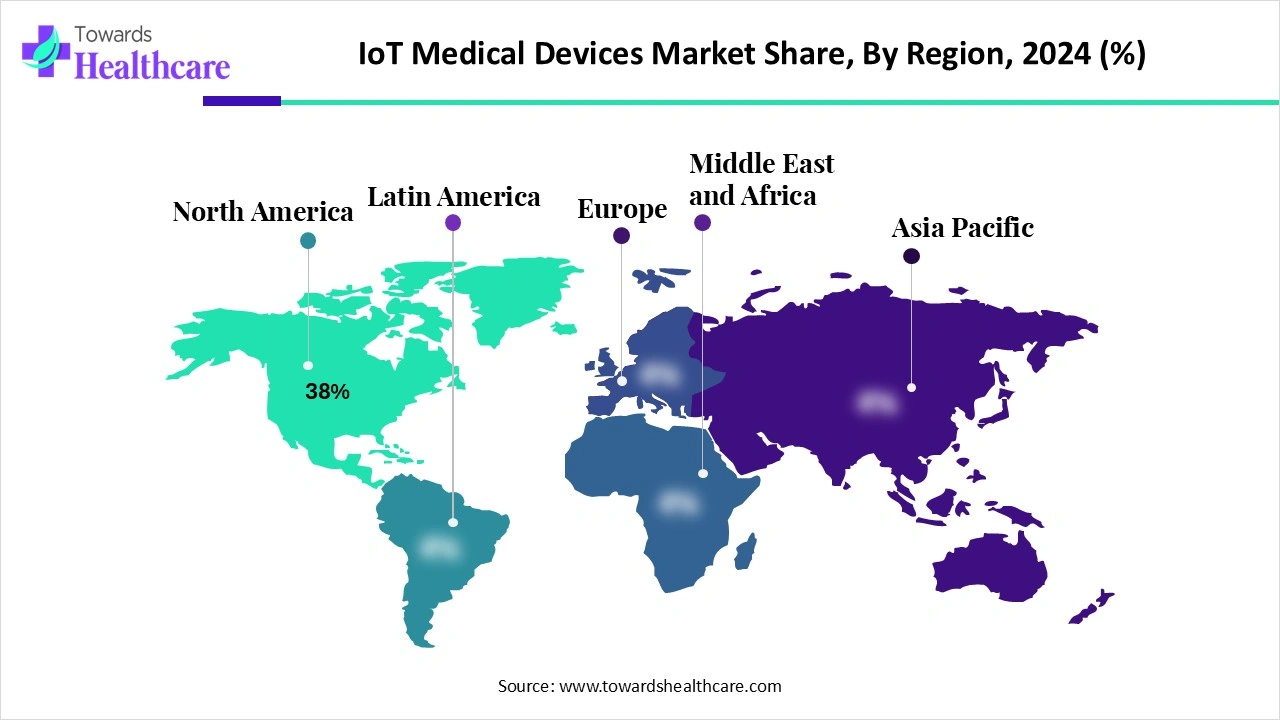

| Leading Region | North America Share 38 % |

| Market Segmentation | By Device Type, By Connectivity Technology, By End-User, By Application, By Region |

| Top Key Players | Medtronic, Abbott Laboratories, Philips Healthcare, GE Healthcare, Johnson & Johnson, Boston Scientific, Siemens Healthineers, Honeywell Life Care Solutions, Omron Healthcare, Qualcomm Life, Fitbit (Google), Apple (Health Devices), Samsung Electronics (Health Devices), Huawei (Health Devices), Dexcom, Withings, iHealth Labs, AliveCor, BioTelemetry (Merit Medical), ResMed |

The IoT (Internet of Things) medical devices market encompasses a broad spectrum of connected medical devices that collect, transmit, and analyze patient health data through integ rated sensors, wireless communication protocols, and cloud-based platforms. These devices enable real-time monitoring of vital signs, remote diagnostics, chronic disease management, predictive analytics, and personalized healthcare delivery. By bridging the gap between healthcare providers and patients, IoT medical devices enhance operational efficiency, reduce hospital readmissions, improve patient outcomes, and support evidence-based clinical decision-making.

The market includes wearable devices, implantable sensors, remote monitoring systems, and hospital-based connected equipment, offering seamless data integration, telemedicine compatibility, and AI-driven analytics. As hospitals, clinics, and home-care settings increasingly adopt connected solutions, the IoT medical devices market continues to expand, driven by technological advancements, rising healthcare expenditure, chronic disease prevalence, and the push for digital health ecosystems.

In addition to improving patient care, the integration of AI with IoT devices for healthcare has the potential to transform the medical field. The Internet of Things also makes it possible to collect enormous volumes of data in real time, which AI then processes, evaluates, and turns into insights that can be put to use. This collaboration results in improved patient monitoring, early identification of possible health problems, and tailored treatment plans in the healthcare industry. AI integration for healthcare IoT devices might be the game-changer as the globe continues to face healthcare issues, such as pandemics and ageing populations.

Enhanced Patient Care is Driving the IoT Medical Devices Market

The Internet of Things has demonstrated potential uses in tying together different medical equipment, sensors, and medical specialists to deliver high-quality healthcare services. As a result, the healthcare sector is now more operationally efficient, patient safety is better, healthcare costs are lower, and healthcare services are more accessible. The Internet of Things has not only increased individual autonomy but also expanded human interaction with the outside world.

Data Privacy & Security

Data security and privacy are two of the biggest issues facing the IoT medical devices market. Real-time data capture and transmission are capabilities of IoT security equipment. However, data standards and security criteria are absent from the majority of IoT devices. Furthermore, there is a great deal of uncertainty around the legislation of data ownership with technological devices. These elements together increase the data's vulnerability to cybercriminals who might breach the system and jeopardise patient and physician Personal Health Information (PHI).

IoT-Based Robotic Assistive Surgery

Surgeons can link to a surgical robot that is based on the Internet of Things to do teleoperations. Compared to open surgery, an IoT-assisted robotic system has the benefit of a larger operative environment. Numerous research that used an Internet of Things-assisted robotic system in a variety of applications, such as remote surgery, robotic assistive-minimally invasive surgery, and microsurgery, have been documented in the literature. In order to allow the surgeon to operate on patients from a remote location via the robotic interface, the Internet of Things-assisted robotic system has recently additionally included haptic technology.

By device type, the wearable devices segment held the largest share of the IoT medical devices market in 2024. At the moment, wearable technology is at the centre of almost every Internet of Things conversation. As the number of older persons is expected to rise dramatically, there is a growing need for preventative medicine and self-health monitoring. IoT sensor-based wearable gear anticipates providing users with personal data. Heart rate, steps, sleep patterns, and other health-related data may all be tracked by these internet-connected gadgets.

By device type, the implantable devices segment is estimated to be the fastest-growing during the forecast period. Healthcare practitioners employ implantable IoT devices to monitor physiological processes, provide medications, or help certain organs or tissues operate. Usually by surgery, they are inserted either permanently or temporarily into the human body. Biochips, smart pacemakers, and glucose monitoring implants are a few examples.

By connectivity technology, the Bluetooth segment led the IoT medical devices market in 2024. An essential component of increasingly complex linked medical device systems is Bluetooth. In the medical device industry, Bluetooth is used to connect medical device hardware to companion software applications on devices such as consumer-level smartphones and tablets, base stations or hubs, and hospital-based devices.

By connectivity technology, the cellular segment is anticipated to witness the fastest growth during the upcoming period. It is anticipated that smart healthcare applications including brain-computer interfaces, tactile internet, and remote surgery would be supported by future 5G and beyond 5G networks. IoT and cutting-edge wireless communication technologies will be used in future smart healthcare networks to overcome present constraints with regard to security, network performance, and coverage.

By end-user, the hospitals & clinics segment was dominant in the IoT medical devices market in 2024. IoT medical devices are used for their original medical purpose by clinics, hospitals, and people. In terms of spending, hospitals are the biggest purchasers of medical equipment, particularly sophisticated or dangerous equipment. General hospitals, university medical centres, and integrated delivery networks (IDNs) that run many hospital facilities are all included in this category. Cost and device adaptability are important factors since clinics and offices often have fewer budgets than hospitals.

By end-user, the home healthcare segment is estimated to achieve the highest CAGR during the predicted time frame. Because it allows patients to receive care in familiar circumstances, home healthcare has grown in popularity as an alternative to hospital-based therapy. Nebulisers, glucose monitors, pulse oximeters, and blood pressure cuffs are a few common medical equipment used at home.

By application, the remote patient monitoring segment captured the major share of the IoT medical devices market in 2024. 5G and IoT together have the potential to revolutionise remote healthcare and bring us one step closer to a time when patients can access hospital-quality treatment from any location. Additionally, wider adoption ought to be fueled by more patient-centered and user-friendly equipment. Healthcare professionals may now continually monitor patients from any location thanks to IoT-enabled devices, eliminating the need for in-person visits that still only record a single instant in time.

By application, the elderly care & assisted living segment is expected to grow at the highest rate in the IoT medical devices market during 2025-2034. Age-related illnesses are a major problem for the elderly, particularly those who live alone. Numerous businesses currently provide IoT-based solutions targeted at the elderly that address various needs. Connected gadgets are also being used by senior care facilities to help manage their elderly residents. Smart technologies provide carers several advantages when it comes to monitoring a resident's activities. The advantages of such systems may include medication compliance, mobility tracking, fall detection monitoring, and emergency notification to family members and carers.

North America dominated the IoT medical devices market share 38% in 2024. because of strong research and development efforts, early use of digital health technology, and sophisticated healthcare infrastructure. The area gains from a high degree of consumer and healthcare provider knowledge, which promotes broad adoption of IoT devices. North America is at the forefront of the worldwide IoT medical devices business because to favourable government efforts, strict data protection legislation, and a developed telehealth ecosystem.

About 950 medical devices that incorporate AI or machine learning have been approved by the U.S. FDA as of August 2024. The majority of these gadgets are made to help with the identification and diagnosis of ailments that can be treated. Radiology, cardiology, neurology, haematology, gastroenterology, and urology are the top 5 medical specialities that use AI technology.

Additionally, the final 2024–2030 Federal Health IT Strategy, released in October 2024 by the Assistant Secretary for Technology Policy in the Office of the National Coordinator for Health Information Technology, aims to improve care delivery and experiences for patients, carers, healthcare providers, public health professionals, and others across the healthcare continuum.

Along with modernising the healthcare system's historical systems, Canada is spearheading initiatives to advance a range of digital health options, including virtual care, telemedicine, and remote patient monitoring. These digital health projects have helped the Canadian healthcare sector revolutionise healthcare access and delivery nationwide.

Asia Pacific is estimated to host the fastest-growing IoT medical devices market during the forecast period. The main causes of this are the rapidly evolving healthcare systems in developing nations like China and India, the sizable patient base, the growing public consciousness, and the rising costs of healthcare brought on by the rise in smoking and the incidence of respiratory conditions like rhinosinusitis and COPD.

China's online healthcare industry is now expanding quickly. A key element of the nation's "Healthy China 2030" plan to achieve its long-term economic and social development objectives is internet healthcare. Through a number of laws and regulations, the Chinese government has increased its efforts to support the growth of the health tech sector since its inception in 2016.

In November 2024, a Rs 500 crore plan to boost India's medical device sector was unveiled by Union Chemicals and Fertilisers Minister JP Nadda on Friday. It focuses on important areas like producing essential parts and accessories, developing skills, assisting with clinical research, building shared infrastructure, and promoting the sector. According to a government announcement, the Rs 500 crore initial investment would last for three years, till the fiscal year 2026–2027 (FY27).

Europe is expected to grow significantly in the IoT medical devices market during the forecast period. driven by the extensive use of IoT technology by healthcare providers to provide remote monitoring services. Due to the growing number of people with chronic illnesses such chronic obstructive pulmonary disease (COPD) and other respiratory conditions, the markets in Germany and the UK are expected to grow quickly. Additionally, the demand for self-health management techniques is growing as individuals realise how important physical fitness and health are. Demand for a variety of medical wearable technology has expanded throughout the area as a result of the easier access to health information.

In July 2024, Germany passed more stringent laws governing the use of cloud computing services for processing health data. A unified norm for the use of cloud computing services in the statutory healthcare system, which serves around 90% of the German population, is what the new Section 393 SGB V seeks to achieve. These specifications, which are meant to guarantee data security, include the restriction of data processing to specific geographic areas and the implementation of organisational and technical safeguards to ensure cloud service providers adhere to specific security standards.

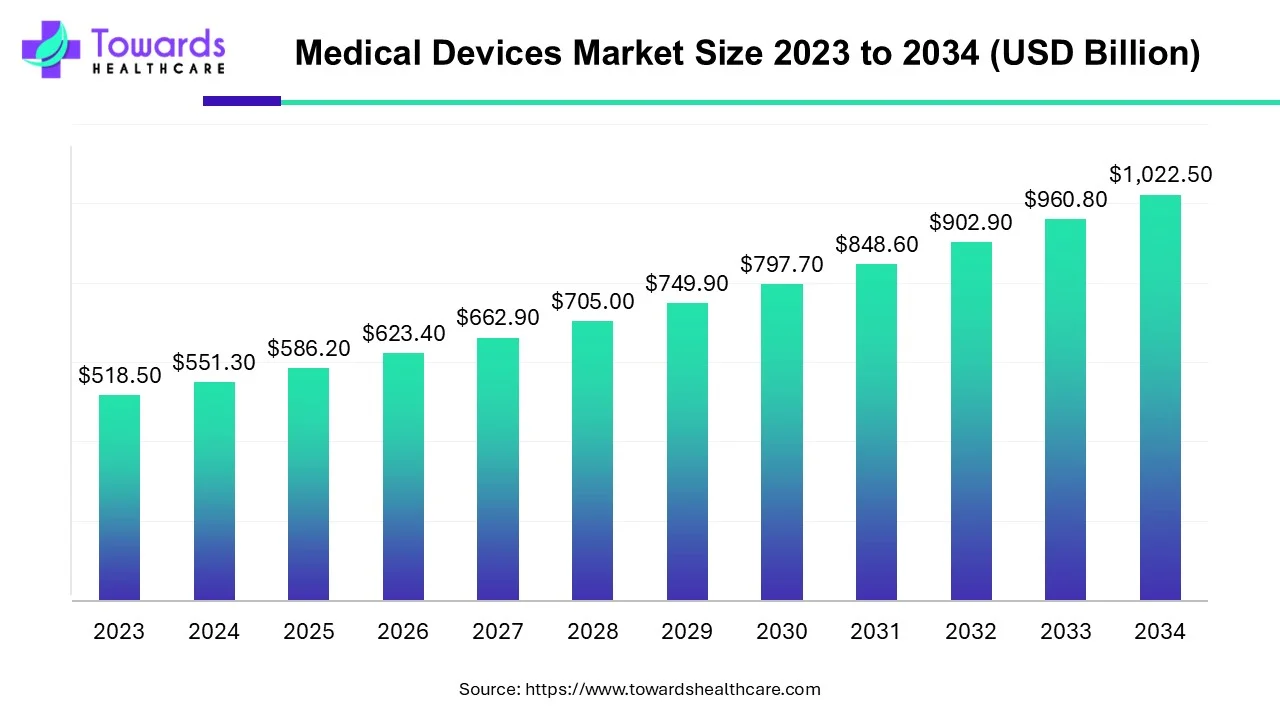

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

In July 2024, an IoT wristwatch for patient monitoring was introduced by mCare Digital, an IoT business. The mCareWatch 241 stands for our commitment to hearing what our clients have to say and meeting their needs. mCare Digital cofounder Peter Apostolopoulos stated in a statement, "We are excited to provide a product that not only meets but exceeds the expectations of those we serve." Our dedication to offering assistive technology that is cutting edge, dependable, and easy to use is reflected in this new model.

By Device Type

By Connectivity Technology

By End-User

By Application

By Region

February 2026

February 2026

February 2026

February 2026