February 2026

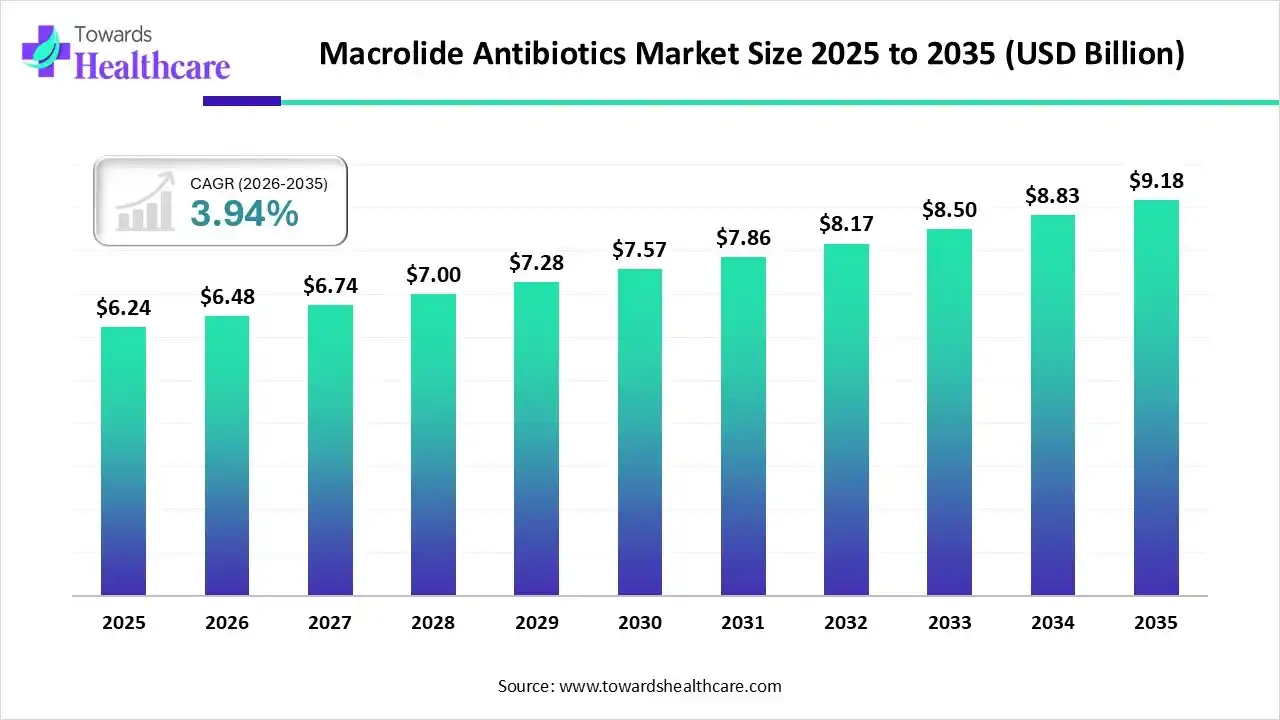

The global macrolide antibiotics market size was estimated at USD 6.24 billion in 2025 and is predicted to increase from USD 6.48 billion in 2026 to approximately USD 9.18 billion by 2035, expanding at a CAGR of 3.94% from 2026 to 2035.

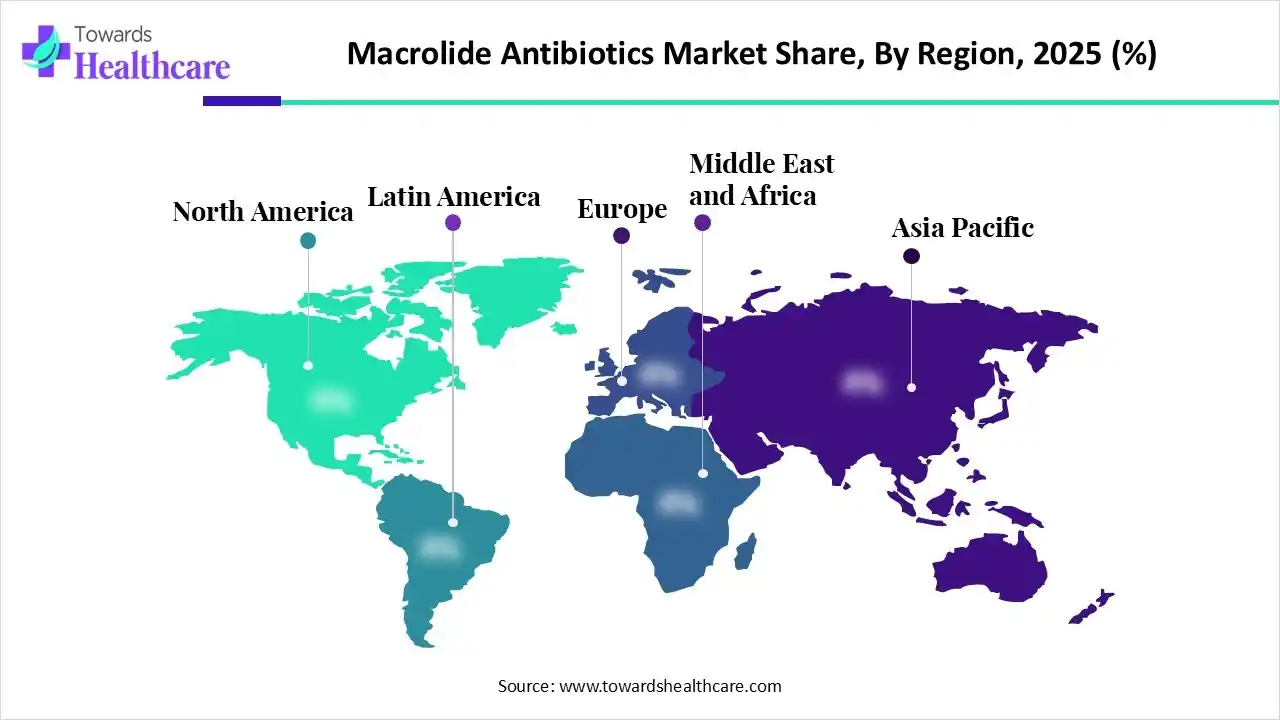

The macrolide antibiotics market is dominated by the Asia-Pacific region, driven by high infectious disease prevalence, large patient populations, and widespread access to cost-effective generic formulations. Strong domestic pharmaceutical manufacturing, expanding healthcare infrastructure, and increased antibiotic utilization in both urban and rural settings further support regional leadership. Government initiatives to improve healthcare access and rising awareness of bacterial infection management continue to reinforce Asia-Pacific’s dominance.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.48 Billion |

| Projected Market Size in 2035 | USD 9.18 Billion |

| CAGR (2026 - 2035) | 3.94% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Drug Type, By Route of Administration, By Indication, By Distribution Channel, By Region |

| Top Key Players | Pfizer Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Novartis AG / Sandoz Intl. GmbH, Abbott Laboratories, Sanofi S.A., Viatris Inc. (formerly Mylan), Alkem Laboratories Ltd. |

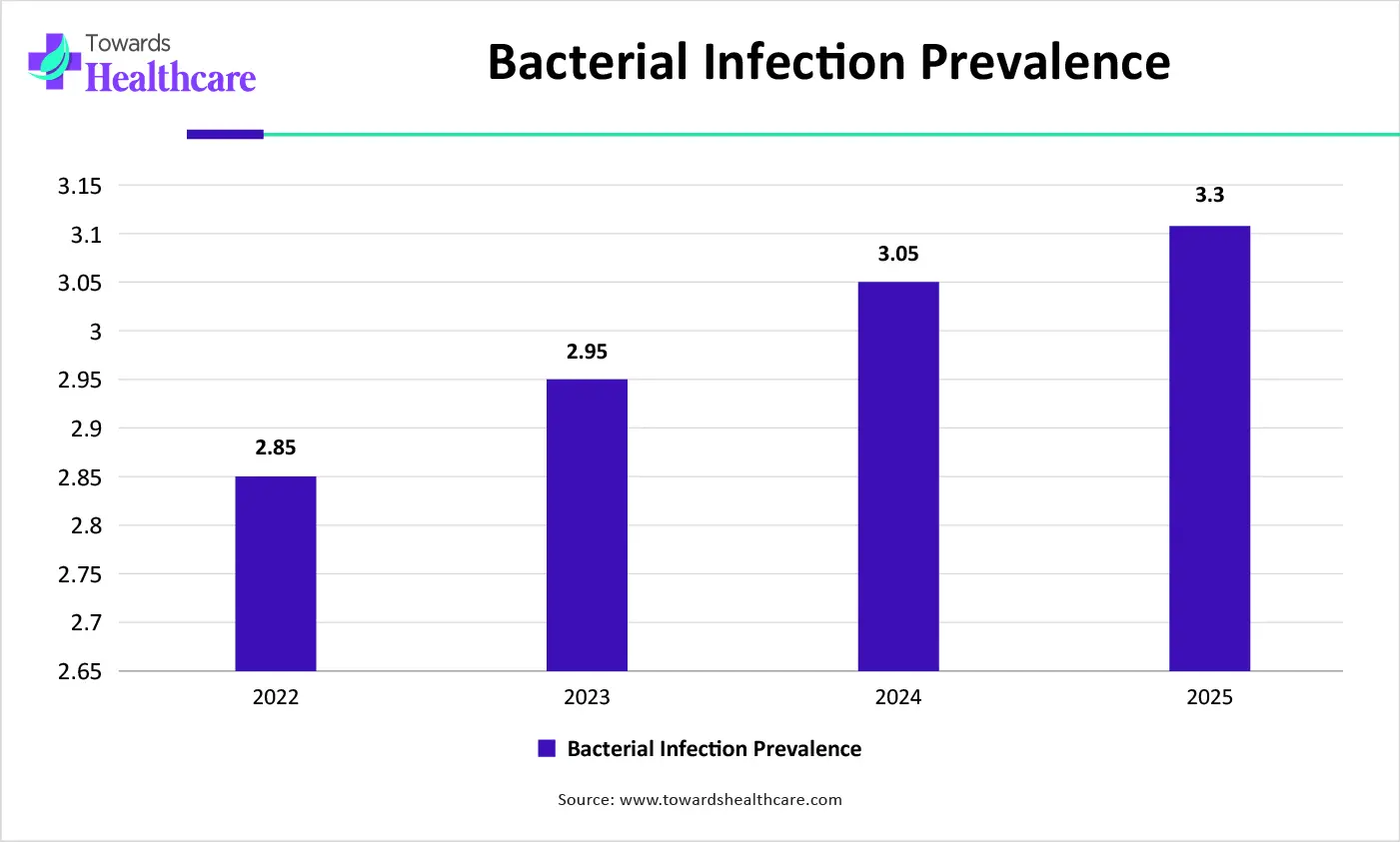

The macrolide antibiotics market is driven by the rising prevalence of bacterial infections, increasing respiratory and sexually transmitted diseases, growing outpatient antibiotic prescriptions, and the widespread use of macrolides due to their broad-spectrum activity and favourable safety profile. Macrolide antibiotics are a class of antibacterial drugs characterized by a large macrocyclic lactone ring structure. They work by inhibiting bacterial protein synthesis, making them effective against many Gram-positive and some Gram-negative bacteria, including atypical pathogens.

Artificial intelligence (AI) integration can significantly improve the macrolide antibiotics market by enhancing drug discovery, development, and clinical use. AI-driven models accelerate molecule screening and optimize macrolide structures to combat antimicrobial resistance. In manufacturing, AI improves quality control, yield optimization, and supply forecasting. Additionally, AI-enabled clinical decision support systems guide appropriate antibiotic prescribing, reducing misuse and resistance while improving treatment outcomes and market sustainability.

There’s a growing preference for widely prescribed macrolides such as azithromycin and clarithromycin because of their broad‑spectrum activity and fewer gastrointestinal side effects, reinforcing their role as frontline treatments for common infections.

Macrolide antibiotics like tylosin and tilmicosin are increasingly used in livestock and companion animal care to manage respiratory and gastrointestinal infections, driven by the expanding global meat and dairy industry.

Growing global concern about antimicrobial resistance is pushing the macrolide antibiotics market to develop next‑generation macrolide derivatives and combination therapies to improve clinical efficacy and counter resistant pathogens.

The expansion of affordable generic macrolide antibiotics improves patient access, lowers treatment costs, and boosts uptake in emerging markets, transforming treatment patterns and competitive dynamics.

Healthcare systems are implementing antibiotic stewardship initiatives to optimize antibiotic use, which influences prescribing practices and encourages careful use of macrolides to slow resistance development.

Which Drug Type Segment Dominated the Macrolide Antibiotics Market?

The azithromycin segment dominates the market due to its broad-spectrum activity, high efficacy against respiratory and sexually transmitted infections, and convenient once-daily dosing. Strong physician preference, well-established clinical guidelines, and extensive availability of both branded and generic formulations further reinforce its widespread adoption across hospitals and outpatient settings.

Erythromycin

The erythromycin segment is anticipated to be the fastest-growing in the macrolide antibiotics market due to its effectiveness against Gram-positive and atypical bacterial infections, expanding use in pediatric and dermatological applications, and increasing adoption in hospitals and outpatient care. Rising awareness of its therapeutic benefits and the availability of new formulations further accelerate growth.

Why Did the Oral Segment Dominate the Macrolide Antibiotics Market?

The oral segment dominates the market due to its convenience, ease of administration, and patient compliance, especially in outpatient and home care settings. Widespread availability of oral formulations like tablets and suspensions, coupled with established dosing regimens, supports its preference among physicians and patients over other administration routes.

Parenteral

The parenteral segment is estimated to be the fastest-growing in the macrolide antibiotics market due to its rapid onset of action, suitability for severe and hospital-treated infections, and use in patients unable to take oral medications. Increasing hospital admissions and critical care requirements drive higher demand for injectable macrolide formulations.

Why Did Respiratory Tract Infections Dominant Segment in the Macrolide Antibiotics Market?

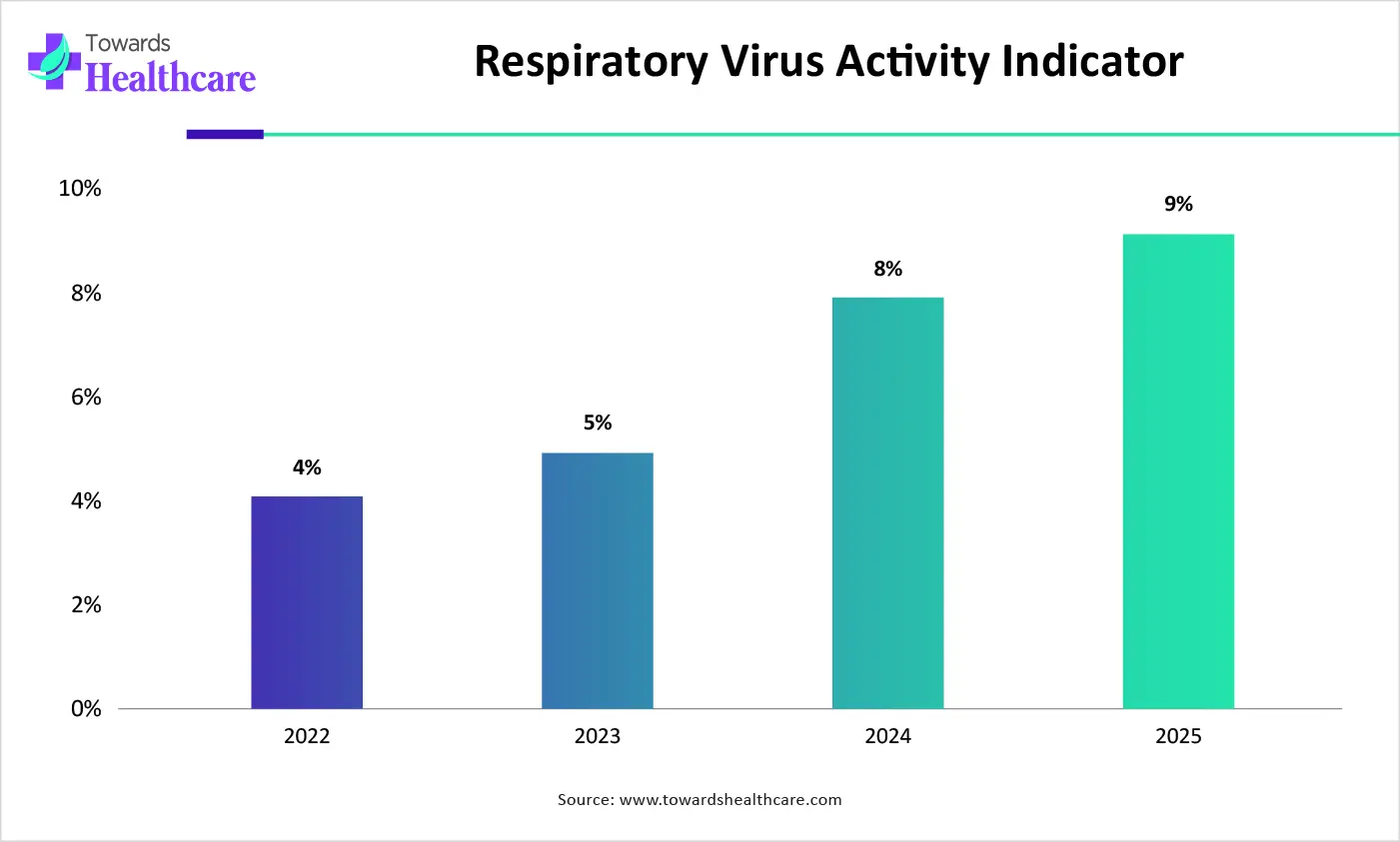

The respiratory tract infections segment dominates the market due to the high prevalence of conditions such as pneumonia, bronchitis, and sinusitis worldwide. Macrolides’ broad-spectrum activity, effectiveness against both typical and atypical respiratory pathogens, and favourable safety profile make them a preferred choice. Strong physician preference and widespread outpatient prescriptions further reinforce this segment’s leadership.

Gastrointestinal Infections

The gastrointestinal infections segment is anticipated to be the fastest-growing in the macrolide antibiotics market due to the rising prevalence of bacterial gastrointestinal disorders and foodborne infections. Increased awareness of effective treatments, expanding hospital and outpatient care, and the proven efficacy of macrolides against pathogens like H. pylori and Campylobacter drive segment growth.

Which Distribution Channel Segment Led the Macrolide Antibiotics Market?

The hospital pharmacies segment dominates the market due to direct access to inpatient and outpatient prescriptions, high demand for effective infection management, and integration with hospital treatment protocols. Strong physician preference, bulk procurement practices, and streamlined distribution within healthcare facilities further reinforce its leadership as the primary distribution channel.

Online Providers

The online providers segment is anticipated to be the fastest-growing distribution channel in the macrolide antibiotics market due to increasing e-pharmacy adoption, rising patient preference for home delivery, and greater accessibility in remote areas. Convenience, digital prescription services, and expanding telemedicine integration further drive the rapid growth of online antibiotic sales globally.

Asia-Pacific dominates the macrolide antibiotics market due to its large patient population, high prevalence of respiratory and bacterial infections, and widespread use of cost-effective generic drugs. Strong domestic pharmaceutical manufacturing, improving healthcare access, and supportive government policies promoting affordable antibiotic availability further strengthen the region’s leadership across hospital and outpatient settings.

China Market Trends

China leads the Asia-Pacific market due to its large population, high incidence of infectious diseases, and extensive use of antibiotics across hospitals and community settings. Strong domestic pharmaceutical manufacturing, large-scale API production, government-supported healthcare expansion, and efficient distribution networks further reinforce China’s dominant position in the regional market.

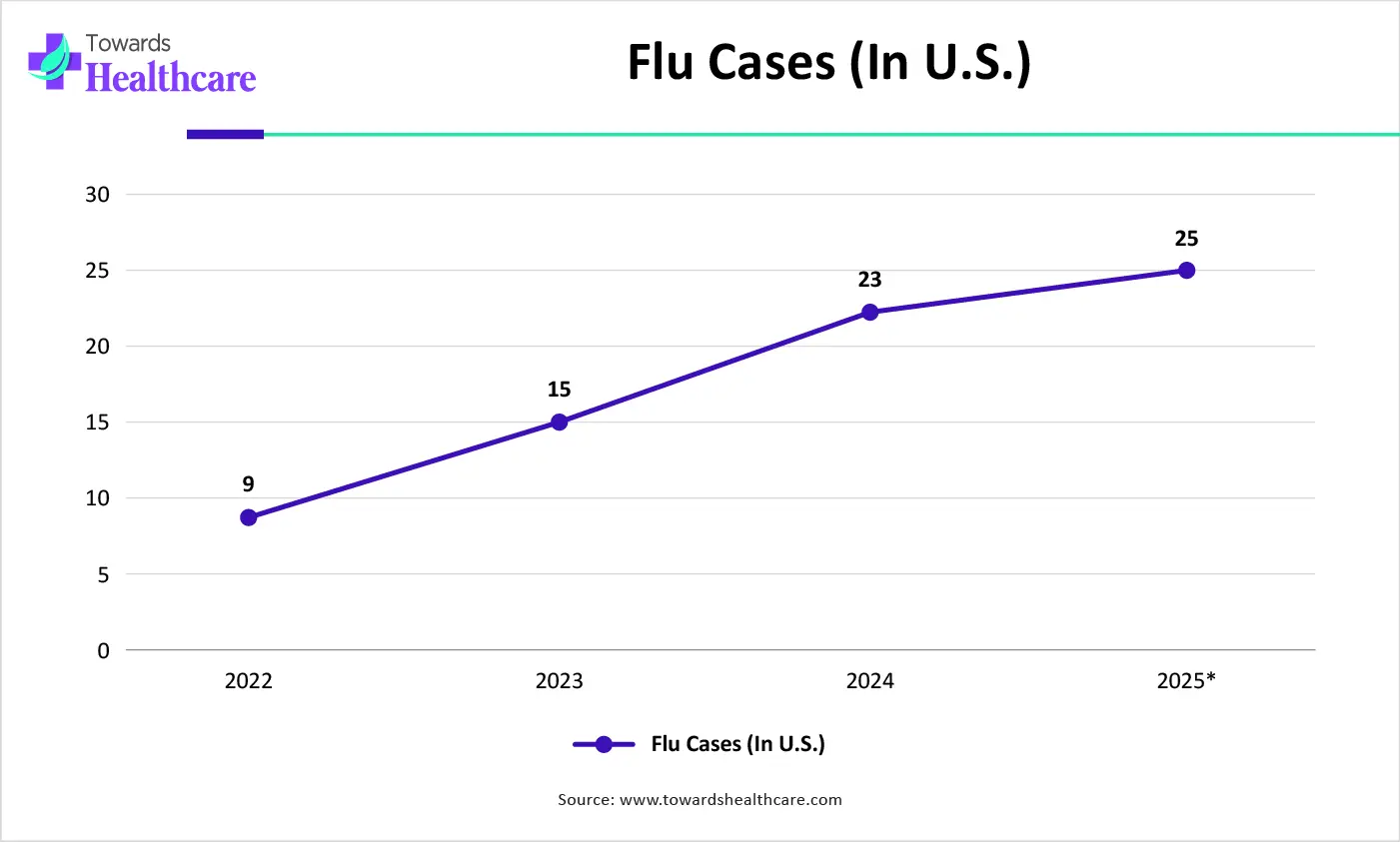

North America is expected to be the fastest-growing region in the macrolide antibiotics market due to rising awareness of antimicrobial resistance, increasing outpatient antibiotic prescriptions, and strong adoption of guideline-based therapies. Advanced healthcare infrastructure, continued investment in antibiotic research, and growing demand for effective treatments for respiratory and sexually transmitted infections further accelerate regional growth.

U.S Market Trends

The U.S. dominates the North American market due to its advanced healthcare infrastructure, high diagnosis and treatment rates for bacterial infections, and strong presence of leading pharmaceutical companies. Robust research funding, rapid adoption of updated treatment guidelines, and wide availability of branded and generic macrolide antibiotics further reinforce U.S. market leadership.

Europe is a notably growing region in the market due to increasing antimicrobial stewardship initiatives, rising focus on appropriate antibiotic prescribing, and strong public healthcare systems. Growing investment in infection control programs, expanding geriatric populations, and continued regulatory support for essential antibiotics further contribute to sustained regional market growth.

UK Market Trends

The UK leads the European macrolide antibiotics market due to its well-established public healthcare system, strong antimicrobial stewardship programs, and high adherence to clinical prescribing guidelines. Government support for antibiotic access, advanced diagnostic capabilities, and active involvement in antimicrobial resistance research and surveillance further strengthen the UK’s dominant position across hospital and community care settings.

| Sr. No. | Vendor / Company | Macrolide Offerings & Typical Products |

| 1 | Pfizer Inc. | Zithromax (azithromycin) and other branded macrolide formulations; a broad portfolio including oral and IV azithromycin. |

| 2 | Merck & Co., Inc. | Generic and branded macrolides (azithromycin, clarithromycin, erythromycin) are part of a broad anti-infective portfolio. |

| 3 | Teva Pharmaceutical Industries Ltd. | High-volume generic macrolides (azithromycin/clarithromycin) for global markets. |

| 4 | Sun Pharmaceutical Industries Ltd. | Generic macrolide antibiotics (e.g., clarithromycin formulations like Crixan) are used in respiratory and skin infections. |

| 5 | GlaxoSmithKline plc (GSK) | Part of the broader anti-infectives, generic and licensed macrolide products vary by market. |

| 6 | Novartis AG / Sandoz Intl. GmbH | Generic macrolide antibiotics through Sandoz; erythromycin/clarithromycin generics. |

| 7 | Abbott Laboratories | Generic macrolides as part of broad antibiotic offerings; distribution in multiple regions. |

| 8 | Sanofi S.A. | Branded generics and licensed macrolide products in select markets. |

| 9 | Viatris Inc. (formerly Mylan) | Generic macrolide antibiotics (e.g., azithromycin/erythromycin) under multiple scalar brands. |

| 10 | Alkem Laboratories Ltd. | Generic macrolide antibiotic formulations (azithromycin/clarithromycin) are mainly in the Asia-Pacific region. |

By Drug Type

By Route of Administration

By Indication

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026