February 2026

The Latin America clinical trials market size is calculated at US$ 4.67 billion in 2025, grew to US$ 4.62 billion in 2026, and is projected to reach around US$ 9.17 billion by 2035. The market is expanding at a CAGR of 6.30% between 2026 and 2035.

The Pan American Health Organization (PAHO) made efforts to expand the Latin America clinical trials market, improve clinical trials, offer high-quality results on health interventions, and improve research quality and coordination. The establishment of networks and collaboration supports the conduct of high-impact clinical trials and the expansion of research capacities. Advancing ethical and regulatory efficiency is of utmost importance to review and assess trials for their safety and effectiveness. The International Clinical Trials Registry Platform (ICTRP) of the World Health Organization (WHO) is a public platform that provides the required information on clinical trials conducted globally.

| Table | Scope |

| Market Size in 2025 | USD 4.67 billion |

| Projected Market Size in 2035 | USD 9.17 Billion |

| CAGR (2026 - 2035) | 6.30% |

| Market Segmentation | By Phase, By Study Design, By Indication, By Region |

| Top Key Players | ICON Plc, IQVIA, Medpace, Parexel, Syneos Health, PPD, Sanofi |

The clinical trials are research studies related to nutritional, surgical, and behavioral interventions to evaluate the effectiveness and health outcomes. They help clinical researchers to find safe and promising interventions to expand the Latin America clinical trials market in the form of vaccines, treatments, therapies, medications, and diagnostic tests that improve the health and well-being of the population.

ICON Plc is the first contract research organization (CRO) in Latin Central America, with its leading presence in some countries like Brazil, Argentina, Mexico, Peru, Colombia, and Guatemala. It represents a versatile platform to conduct essential clinical trials and drive development projects on a local, global, and cross-regional basis. Latin America remains a region of choice for ICON Plc to conduct clinical trials due to patient access, a lack of language barriers, quality of trials and inspections, and the overall market potential.

In November 2024, the Pan American Health Organization (PAHO) supported more than ten countries in the Caribbean and Latin America to develop policies, laws, and regulations, and promote the improved ethical governance of health research.

The integration of AI into clinical and public health practices introduced the shift from diagnostics to drug discovery. AI expands access to healthcare and related services across under-resourced areas. AI-powered technologies help in natural disasters and infectious disease testing. Healthcare systems are enabled to expand the Latin America clinical trials market by utilizing AI through robotics, portable tools, and predictive models that improve efficiency and avoid dependency on personnel. AI assists researchers and healthcare professionals in the diagnosis and prevention of cancer.

The significant government organizations, like the WHO, focus on improving trial design, achieving data transparency, and bringing trials into national health systems. For instance, in September 2025, the World Health Organization (WHO) reported that the largest funders of medical research were committed to strengthening clinical trials globally.

The major pharmaceutical companies like Glenmark are aiming to expand capabilities in research and development. For instance, in September 2025, Glenmark Pharmaceuticals Ltd. reported the submission of a clinical trial application in Russia and its efforts to open additional clinical trial sites in Mexico and Brazil, further expanding the global footprint.

| Sr. No. | Governance Structure |

| 1 |

Regulatory Bodies

|

| 2 |

Collaborations

|

| 3 |

Tax Incentives

|

| 4 |

Competitive Advantages

|

The phase 3 segment dominated the market in 2024, owing to the high need for ensuring safety, efficacy, and data management. The novel trial design and the use of real-world evidence support promising health outcomes. The adoption of digital technologies improves speed, accuracy, and transparency in clinical research and drug development.

The phase 2 segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increased efforts for drug safety monitoring and determination of dosage and effectiveness. The increased efficiency and greater flexibility of clinical trials drive their importance in R&D and the Latin America clinical trials market. The expected results of trials help professionals to deliver personalized treatments and medicines to patients in need.

The interventional study segment dominated the market in 2024 and is estimated to grow at the fastest rate in the market during the predicted timeframe due to advancements in medical knowledge, regulatory approvals, and scientific assessment. The increased focus on diagnosing, preventing, and treating several health conditions is supported by technological integration in clinical care. The rising patient population is driving the need for novel treatment approaches and innovative medicines.

The oncology segment dominated the market in 2024 and is anticipated to grow at a notable rate in the market during the upcoming period due to the rising prevalence of cancer and related health conditions. The supportive R&D, government initiatives, and investments aim to promote cancer-fighting solutions and help patients combat cancer. The oncology sector is expanding due to novel clinical research, development, and improved patient care.

Latin America dominated the market in 2024, owing to the remarkable success of Latin American countries like Brazil, Mexico, and Argentina in the Latin America clinical trials market in conducting several clinical trials and clinical studies. In October 2024, the Latin American Federation of the Pharmaceutical Industry (FIFARMA) published a report after examining access to innovative medicines in Latin America across five therapeutic areas, such as immunological disorders, inflammatory diseases, oncology, orphan diseases, the central nervous system, and cardiometabolic diseases.

The FIFARMA also monitored 365 treatments approved by the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA) between 2014–2023. It has further analyzed 10 countries like Mexico, Peru, Argentina, Brazil, Colombia, Chile, Costa Rica, Ecuador, Panama, and the Dominican Republic. There is an improved availability of certain drugs between 2023 and 2024.

The integrated hospital management, digital technologies, and public-private partnerships are the three major pillars of the growing and expanding clinical research in Brazil. Some of the initiatives in Brazil focused on integrating electronic consent platforms, electronic medical records, remote monitoring tools, and electronic data capture systems. This country makes efforts to improve patient care, deliver more efficient healthcare services, and adopt digital technologies.

In May 2025, Novo Nordisk invested $1.09 billion for the expansion of GLP-1 production capacity in Brazil and the inclusion of a quality control laboratory, a warehouse, and aseptic production processes.

In August 2025, Sanofi announced the investment of R$100 million in clinical research in Brazil to become the market leader in treatments of immunological conditions such as asthma, eosinophilic esophagitis, and multiple sclerosis by 2030.

Clinical trial scenarios in Mexico involve a growing pharmaceutical sector driven by lower costs, a diverse patient population for diseases like diabetes and cancer, and a supportive regulatory environment under the Federal Commission for the Protection against Sanitary Risks (COFEPRIS).

In August 2025, AstraZeneca and Bayer announced the investment of $600 million to expand Mexican operations.

In July 2025, President Claudia Sheinbaum announced the investment of $10.4 billion to strengthen the Mexican

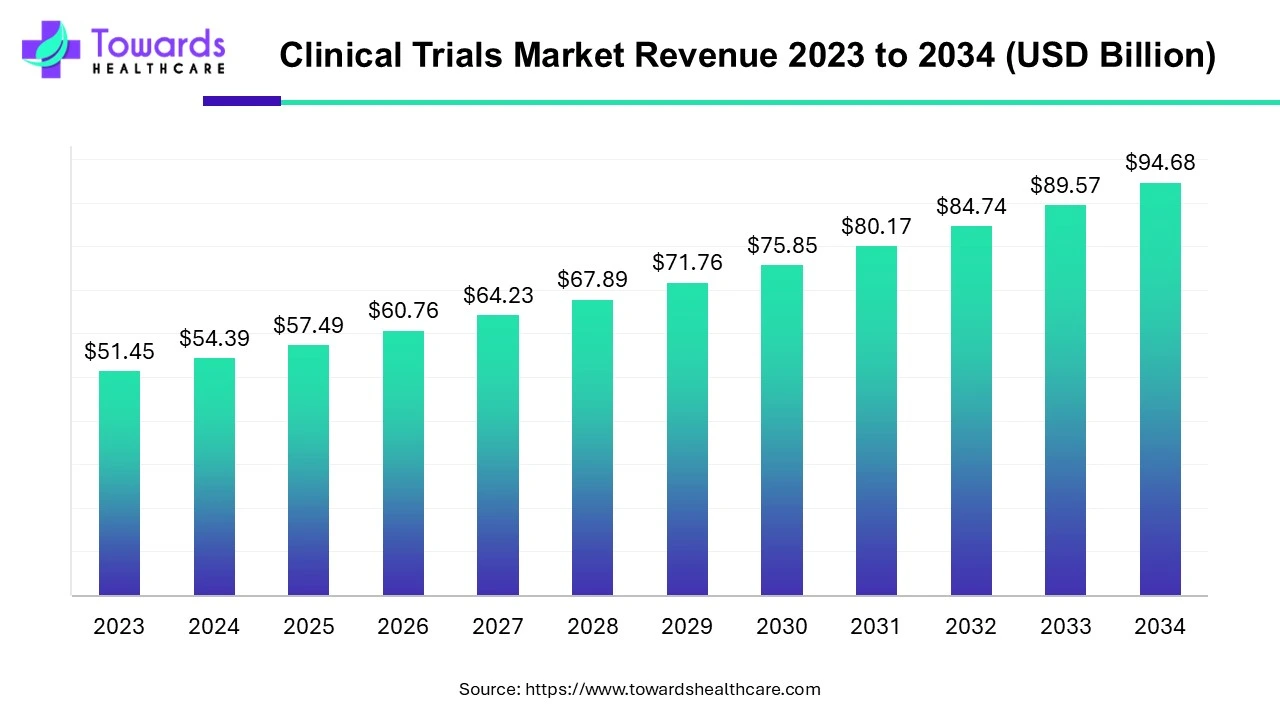

The global clinical trials market is valued at USD 98.91 billion in 2026 and is projected to reach USD 174.18 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2026 to 2035.

The R&D process for clinical trials in Mexico encompasses preclinical development, regulatory and ethics approval, conducting the clinical trial, registration and market access, and post-market surveillance.

Key Players: IQVIA, Parexel, Medpace, ICON Plc, Syneos Health, etc.

The regulatory agencies, like the FDA and EMA, aim to streamline processes, increase transparency, and improve patient safety through digitization in clinical trials and approvals.

Key Players: IQVIA, Parexel, ICON Plc.

The patient support programs and services include educational initiatives, home healthcare, logistical support, and continuous monitoring.

Key Players: H Clinical, ICON Plc, IQVIA, Parexel, bioaccess.

By Phase

By Study Design

By Indication

By Region

February 2026

February 2026

February 2026

February 2026