February 2026

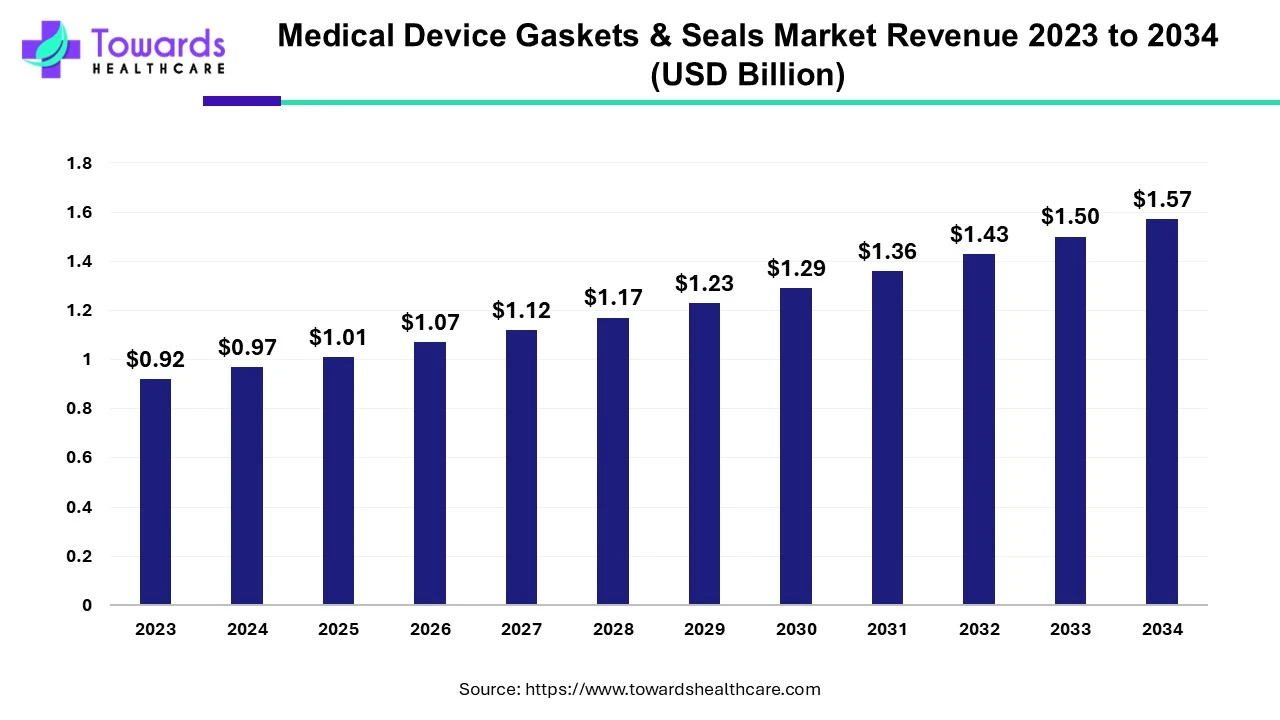

The medical device gaskets & seals market was estimated at US$ 0.92 billion in 2023 and is projected to grow to US$ 1.57 billion by 2034, rising at a compound annual growth rate (CAGR) of 5% from 2024 to 2034. Latest innovations in medical devices, advanced healthcare infrastructure, and increasing investments drive the market.

Medical device gaskets and seals play a vital role in protecting medical devices against fluids, contaminants, electromagnetic interference, and dust. They should have sufficient mechanical strength, chemical resistance, and sanitary sealing capabilities and resist heat, flame, electrostatic discharge, and electrical conductivity. The materials used for medical device gaskets & seals should meet regulatory and functional requirements. The ideal seal in medical devices would be one that can maintain its integrity under varying pressure and temperature conditions.

The gaskets and seals are commonly used in medical pumps, IV components, implant materials, feeding devices, lab equipment, and temperature control devices. The increasing demand for medical devices due to growing healthcare infrastructure and rising chronic disorders boosts the market. The market is also driven by the latest innovations in medical devices and the increasing number of surgeries.

3D printing is an additive manufacturing technique of making a three-dimensional physical object from a digital model. Medical device gaskets & seals can be manufactured using 3D printing technology to accelerate product development and market introduction through rapid prototyping and low-volume production. 3D printing can lead to faster production and customized design. 3D printing can produce gaskets & seals of different sizes or shapes, offering great flexibility in the design phase, which is difficult in bulk manufacturing. The latest innovations in novel medical devices require gaskets & seals of different shapes, fostering demand for 3D printing. The technology is also cost-effective as it causes less material waste and does not require expensive molds or tools.

The major challenge is the leaching of impurities from the seal material. The impurities could leach from the medical device over time and react with the body fluids or tissues. These impurities are carcinogenic or toxic. Another major challenge is the supply chain disruption of raw materials. Gaskets & seals are majorly made up of rubber and silicone, which have potential applications in various industries. The increasing demand disrupts the supply chain, leading to increased costs and potential compromise in the quality of seals.

The major growth factor of the medical device gaskets and seals market is the new launches of medical devices. Medical devices are essential for the prevention, diagnosis, and treatment of chronic disorders. They offer improved patient safety and enhanced quality of life for individuals of all ages. The integration of artificial intelligence (AI) and machine learning (ML) in medical devices improves device functionality and offers enhanced precision. As of July 2025, the U.S. Food and Drug Administration (FDA) approved a total of 1,247 AI-based medical devices. (Source: FDA) The development of new products increases the demand for gaskets and seals.

By type, the rubber segment held a dominant presence in the market. This segment dominated because medical-grade rubbers are widely used to produce seals and gaskets that are able to withstand a wide range of process media. Rubber offers heat resistance, electrical conductivity, and protection against electrostatic discharge. In addition, rubbers are very versatile and cost-effective, fostering their use in medical devices. Rubber can be easily sterilized and processed. It is also biocompatible, biodurable, flexible, and resilient.

By type, the silicone segment is predicted to witness significant growth in the medical device gaskets & seals market over the forecast period. Silicone is widely used for producing gaskets and seals as it offers resistance to bacterial growth and moisture. Silicone is non-toxic, biologically inert, and heat resistant, making it a preferable choice. Additionally, it is biocompatible and, hence, can be used in medical devices that make direct contact with human tissues.

By application, the diagnostic equipment segment registered its dominance over the global market. The increasing incidences of chronic disorders, demand for early detection of disease, and growing medical diagnostic devices sector potentiate the segment growth. Diagnostic equipment requires specialty foam gaskets for displays and dust filters. The commonly used materials for producing gaskets & seals in diagnostic equipment include silicone and neoprene.

By application, the implants & catheters segment will gain a significant share of the medical device gaskets & seals market over the studied period. The rising prevalence of chronic disorders and increasing number of surgeries augment the segment growth. Implants and catheters are the most commonly used medical devices during surgeries. These are widely used in cardiac resynchronization and neurostimulation devices, safe coating for stents, as well as catheters and medical valves. Since they come in direct contact with the body, biocompatible and high-quality regulatory standard gaskets and seals are used.

North America held the largest share in the medical device gaskets & seals market in 2023. The advanced healthcare infrastructure, increased investments & collaborations, and the presence of key players drive the market. The market is also driven by the increasing number of surgeries in the region. It has been reported that more than one million surgeries are performed in Canada annually. The state-of-the-art research & development facilities promote the latest innovations in medical devices. Stringent regulatory bodies like the US FDA regulate the safety and effectiveness of medical devices in the region. In 2022, around 41 new medical devices were approved by the US FDA. The US is the largest medical device market globally, comprising over 40% of the global medtech market.

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The rising incidences of chronic disorders, increasing number of surgeries, favorable manufacturing infrastructure, and growing research & development activities drive the market. It has been reported that around 70% of the healthcare expenditure is on in-patient care, and more than 70% of the inpatient care spending is led by surgeries. It is estimated that around 30 million surgeries are performed in India annually. According to the World Bank Data, around 3,235 per 100,000 surgeries were performed in Korea in 2022. The market is also driven by favorable government policies and regulatory standards for medical devices. In 2023, China’s National Medical Products Administration (NMPA) received 13,260 applications for initial registrations, renewals, and changes in licensing items of Class III (Domestic and Overseas) and Class II (Overseas) medical devices, representing a 25.4% increase than 2022. Out of these, 12,213 applications were approved.

Europe is expected to grow at a considerable CAGR in the medical device gaskets and seals market in the upcoming period. The rising prevalence of chronic disorders potentiates the demand for medical devices. The increasing adoption of advanced technologies and the growing research activities propel the market. The rising collaboration among industry players promotes the development of gaskets and seals. Government organizations support the use of medical and wearable devices through funding and launching initiatives.

More than one quarter (26%) of people aged 16-74 years in the EU use smart wearables, including smartwatches, fitness bands, connected goggles or headsets, and safety trackers. Germany, France, the UK, and Italy are the top four largest countries for medical equipment in the EU. Public hospitals in Italy account for over 75% of medical device purchases, and the private sector accounts for 25%. Additionally, Europe exported 11 billion EUR worth of medical devices in 2023. The U.S., Russian Federation, Australia, India, Saudi Arabia, and Turkey are the top importers of medical devices from Europe. (Source: Medtech Europe)

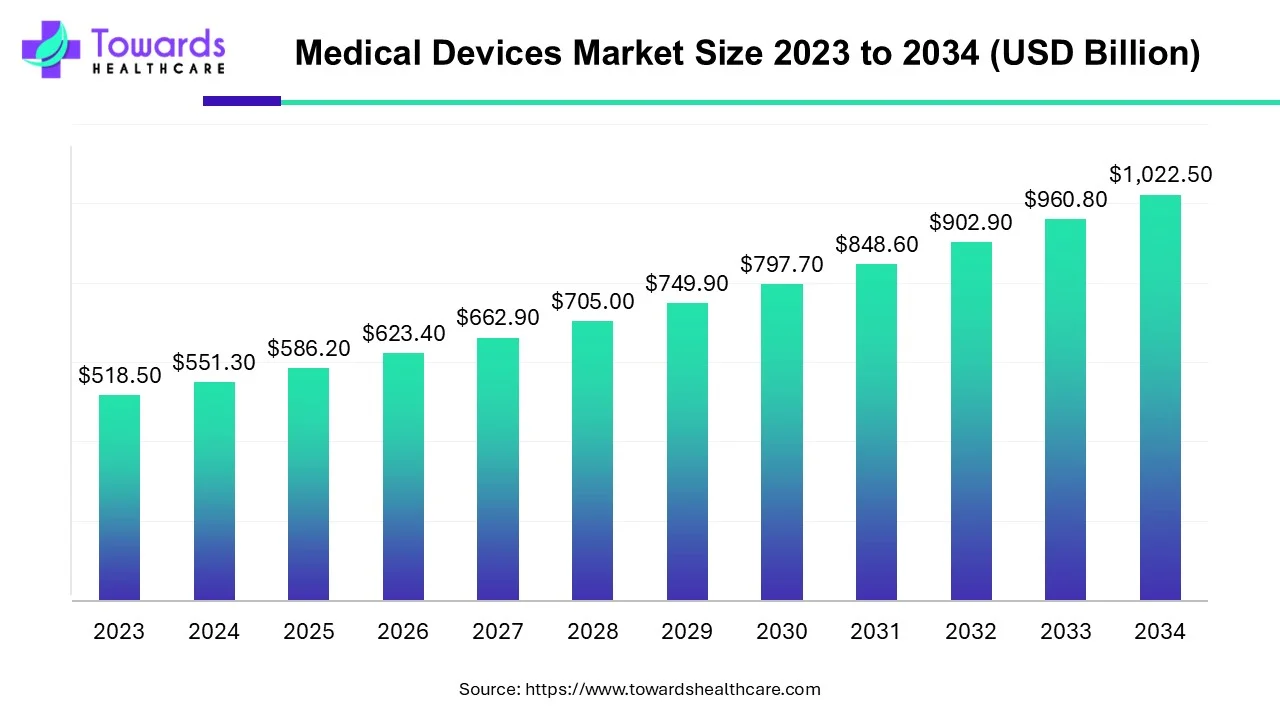

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2025 and 2034. Technological advancements and favorable government policies drive the market.

Martin Kluke, Senior Product Manager for Radical Curing Formulations at DELO Industrial Adhesives, commented that sealing with gaskets is usually done either via compression or molded gaskets like O-rings, and requires more component design knowledge. He also said that solid sealants can seal rippled surfaces better and compensate for larger production tolerances. (Source: Assembly)

By Type

By Application

By Region

February 2026

January 2026

January 2026

January 2026