December 2025

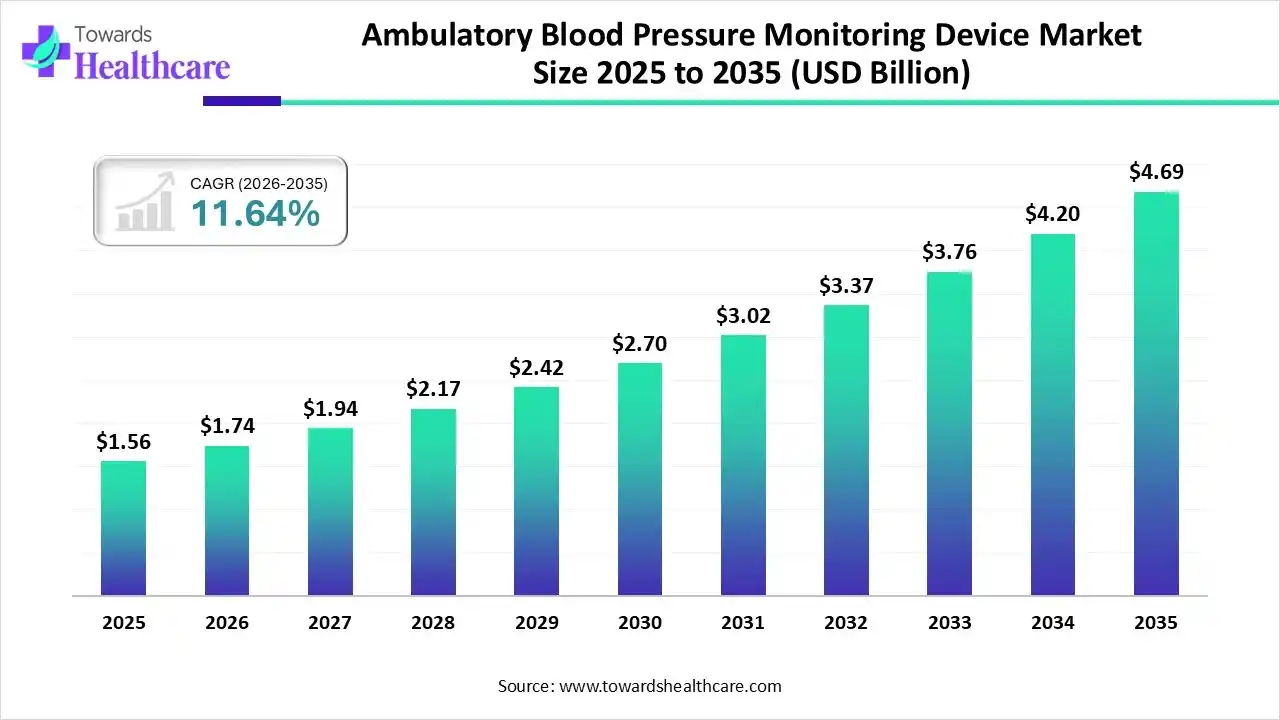

The global ambulatory blood pressure monitoring device market size was estimated at USD 1.56 billion in 2025 and is predicted to increase from USD 1.74 billion in 2026 to approximately USD 4.69 billion by 2035, expanding at a CAGR of 11.64% from 2026 to 2035.

The growing burden of hypertension globally is increasing the demand for ambulatory blood pressure monitoring devices. The companies are launching and utilizing AI technologies, which are increasing their adoption rates and promoting market growth.

The ambulatory blood pressure monitoring device market is driven by growing hypertension cases, adoption in home care settings, and technological advancements. The ambulatory blood pressure monitoring devices refer to the medical devices used to measure and record the blood pressure of the patient. These devices offer 24-hour or more blood pressure monitoring, helping in the detection of BP fluctuations and risk of cardiovascular diseases.

AI show wide range of applications in the ambulatory blood pressure monitoring device market. With the use of AI in these devices, complex blood pressure patterns can be detected along with their accurate interpretation. Its predictive analytics also help in early detection of cardiovascular risks, where it is also being used for remote monitoring, and in the development of wearable devices and new mobile applications.

The growing shift toward home healthcare and telemedicine for effective hypertension management is increasing the use of home blood pressure monitoring devices, promoting their innovations.

Different types of wearable and miniaturized ambulatory blood pressure monitoring devices are being developed by companies to offer 24-hour remote monitoring and enhance patient comfort.

The companies are developing various ambulatory blood pressure monitoring devices with the integration of Bluetooth, cloud connectivity, and wi-fi to enhance the data transfer and remote patient monitoring.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.74 Billion |

| Projected Market Size in 2035 | USD 4.69 Billion |

| CAGR (2026 - 2035) | 11.64% |

| Leading Region | North America |

| Market Segmentation | By Modality, By Indication, By Type, By Patient Demographics, By Region |

| Top Key Players | BPL Medical Technologies, A&D Company, Contec Medical Systems, Microlife Corporation, Philips Healthcare, Schiller AG, Spacelabs Healthcare, SunTech Medical, Bosch+Sohn GmbH, IEM GmbH |

Why Did the Oscillometric Segment Dominate in the Market in 2025?

The oscillometric segment led the ambulatory blood pressure monitoring device market in 2025, due to its automatic and consistent results. Their easy integration and 24-hour monitoring features also increased their use. Moreover, easy use and affordability also increased their adoption rates.

Auscultatory

The auscultatory segment is expected to show a rapid growth rate during the predicted time, due to the enhanced accuracy. Additionally, the presence of advanced acoustic sensors is also increasing their use, where their demand for the detection of complex conditions like irregular rhythms and movements is also increasing.

Which Indication Type Segment Held the Dominating Share of the Market in 2025?

The hypertension detection and monitoring segment held the dominating share in the ambulatory blood pressure monitoring device market in 2025, due to a growth in the hypertension incidence rates and awareness. This, in turn, increased the use of ambulatory blood pressure monitoring devices.

Diagnosis and Management of Orthostatic Hypotension

The diagnosis and management of orthostatic hypotension segment is expected to show the highest growth during the predicted time, due to growing health awareness. The growing chronic diseases, geriatric population, and technological innovations are also increasing the use of ambulatory blood pressure monitoring devices.

How the Ambulatory Blood Pressure Monitor Segment Dominated the Market in 2025?

The ambulatory blood pressure monitor segment led the ambulatory blood pressure monitoring device market in 2025, due to its accurate blood pressure monitoring. They helped in the early detection of hypertension, where their continuous BP monitoring also increased their adoption rates.

Home Blood Pressure Monitor

The home blood pressure monitor segment is expected to show a rapid growth rate during the upcoming years, due to a growing shift towards home-based care. The growing number of hypertension cases and geriatric populations is also increasing their use. Moreover, their portability, easy use, and affordability are also attracting the patients.

What Made Adult the Dominant Segment in the Market in 2025?

The adult segment held the largest share in the ambulatory blood pressure monitoring device market in 2025, due to growth in exposure to the risk factors, which led to a rise in the hypertension cases. This increased the use of ambulatory blood pressure monitoring devices for BP monitoring and their effective management.

Geriatric

The geriatric segment is expected to show the highest growth during the upcoming years, due to growing complications associated with hypertension. The growing incidence of orthostatic hypotension and demand for preventive care are also increasing the use of ambulatory blood pressure monitoring devices.

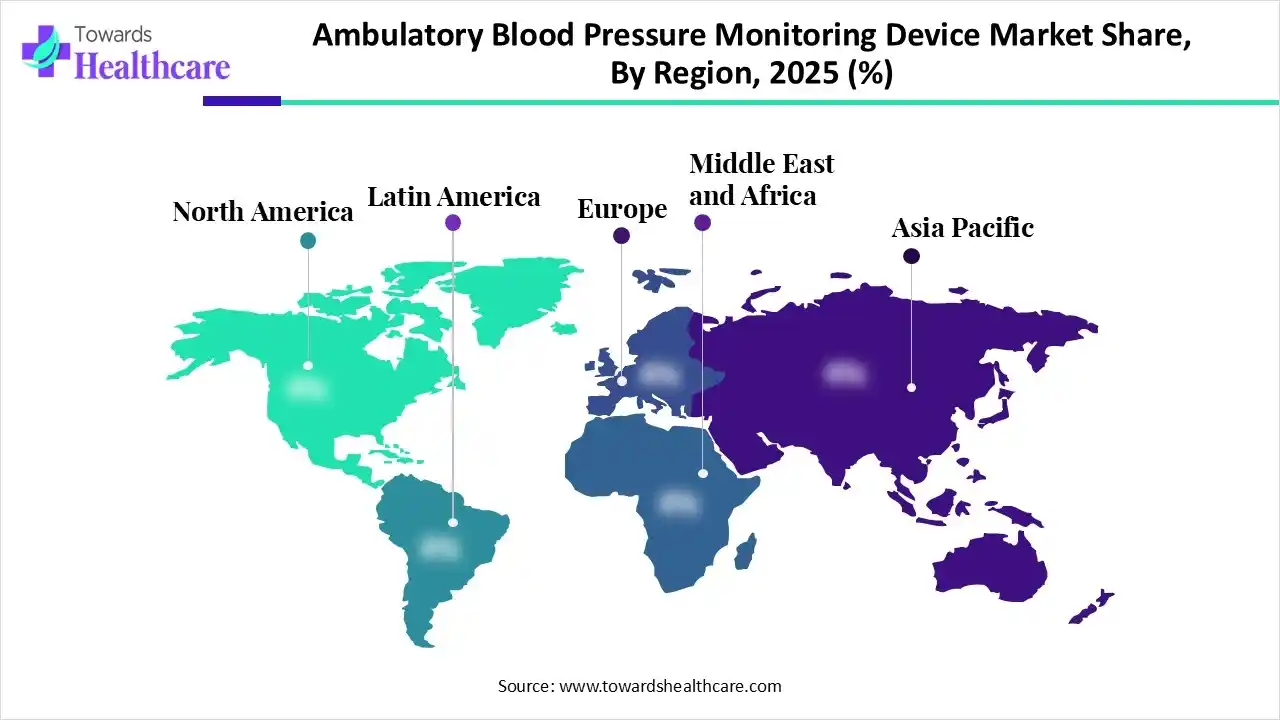

North America dominated the ambulatory blood pressure monitoring device market in 2025, due to early adoption of ambulatory blood pressure monitoring devices. The growth in the number of hypertension cases and advanced healthcare also increased their use for effective management. Additionally, the growth in healthcare investments and innovations also contributed to the market growth.

U.S. Market Trends

The presence of advanced healthcare in the U.S. is increasing the use of ambulatory blood pressure monitoring devices. The growing cardiovascular diseases, technological innovations, and health awareness are also increasing their demand, driving their early adoption. The presence of reimbursement policies is also increasing their accessibility and use.

Asia Pacific is expected to host the fastest-growing ambulatory blood pressure monitoring device market during the forecast period, due to the presence of a large population, which increases the incidence of cardiovascular diseases. Moreover, the growing health awareness, expanding healthcare, increasing innovations, and shift towards home-based care are also enhancing the market growth.

China Market Trends

China is experiencing a rise in the number of hypertension cases due to the presence of a large population. The expanding healthcare is also increasing the adoption of various ambulatory blood pressure monitoring devices. Furthermore, the growing government initiatives and health awareness are also promoting the innovation of these devices.

Europe is expected to grow significantly in the ambulatory blood pressure monitoring device market during the forecast period, due to growing hypertension cases. At the same time, the presence of advanced healthcare is also increasing the adoption of advanced devices like ambulatory blood pressure monitoring devices, where the growing health awareness is also increasing their use, promoting the market growth.

UK Market Trends

The UK consists of robust healthcare systems, which promote the use of ambulatory blood pressure monitoring devices for effective and early detection of hypertension. They also offer reimbursement policies and preventive care, which attracts the patients. Additionally, the growing technological advancements are also increasing their innovations.

| Companies | Headquarters | Ambulatory Blood Pressure Monitoring Devices |

| BPL Medical Technologies | Bangalore, India | BPL Walk T1 ABPM |

| A&D Company | Tokyo, Japan | TM-2441 |

| Contec Medical Systems | Hebei, China | ABPM 50 |

| Microlife Corporation | Taipei, Taiwan | Microlife WatchBP O3 Series |

| Philips Healthcare | Amsterdam, Netherlands | Cardiac Workstation 7000 system |

| Schiller AG | Baar, Switzerland | BR-102 plus |

| Spacelabs Healthcare | Washington, U.S. | OnTrak and Spacelabs ABPM devices |

| SunTech Medical | North Carolina, U.S. | Oscar 2 |

| Bosch+Sohn GmbH | Jungingen, Germany | boso TM-2450 |

| IEM GmbH | Aachen, Germany | Mobil-O-Graph |

By Modality

By Indication

By Type

By Patient Demographics

By Region

December 2025

December 2025

December 2025

December 2025