March 2026

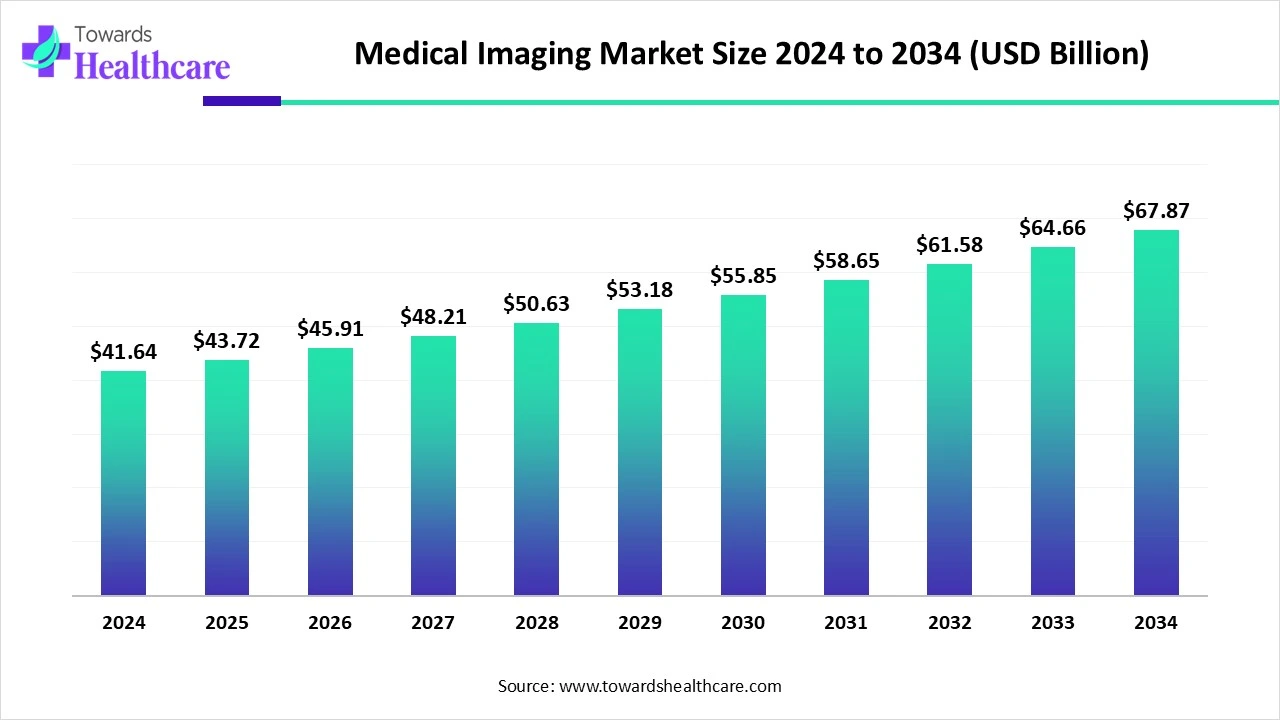

The global medical imaging market size is calculated at USD 41.64 billion in 2024, grew to USD 43.72 billion in 2025, and is projected to reach around USD 67.87 billion by 2034. The market is expanding at a CAGR of 4.99% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 43.72 Billion |

| Projected Market Size in 2034 | USD 67.87 Billion |

| CAGR (2025 - 2034) | 4.99% |

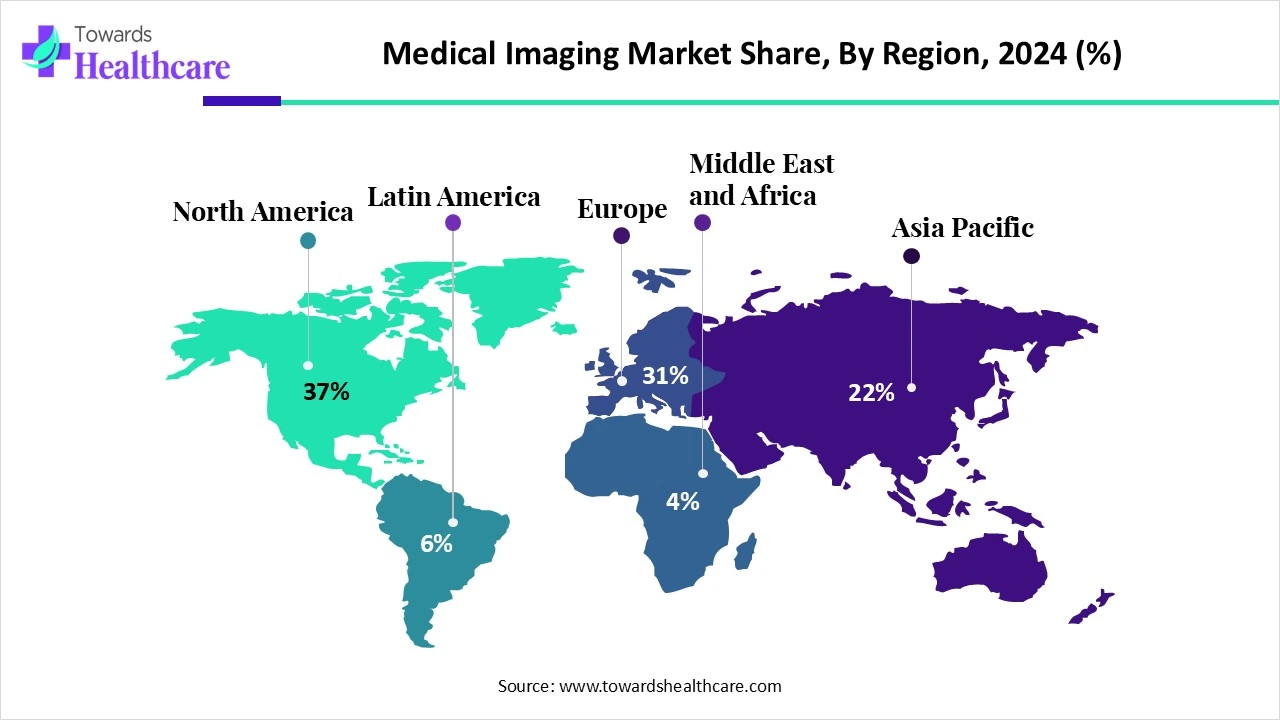

| Leading Region | North America share by 37% |

| Market Segmentation | By Technology, By Application, By End-Use, By Region |

| Top Key Players | Aiforia Technologies, Brainomix, Carestream Health, GE Healthcare, Hologic, Inc., Lunit, NVIDIA, Royal Philips, Samsung Medison, Siemens Healthineers, Spark Radiology, Stratasys Ltd., Sutter Health |

Medical imaging is an advanced technology for viewing the human body and organs to diagnose, monitor, or treat medical conditions. Advanced imaging techniques seek to reveal internal structures hidden by the skin and bones. They enable healthcare professionals to identify abnormalities. Some common examples of medical imaging techniques include X-ray, MRI, ultrasound, CT scan, radiography, fluoroscopy, and mammography. These techniques also involve the use of surface-mounted sensors to measure electrical activity for electroencephalography (EEG) and electrocardiography (ECG).

The rising prevalence of chronic disorders necessitates that healthcare professionals and patients diagnose the disease, facilitating the use of medical imaging. Technological advancements drive the latest innovations in medical imaging techniques. Several government organizations launch initiatives to encourage patients to screen and receive early diagnosis of chronic disorders. The increasing investments and collaborations favor the adoption of advanced imaging tools in various healthcare organizations.

Artificial intelligence (AI) mainly transforms the healthcare diagnostic sector by enhancing diagnostic accuracy and efficiency. It automates the entire process and can detect even minute changes in the imaging data that are otherwise not visible to human eyes. AI and machine learning (ML) algorithms can analyze vast amounts of patient data, providing consistent and precise image analysis. Integrating AI in medical imaging enables healthcare professionals to provide precision medicine by combining imaging data with patient history and genetic information. Hence, AI and ML can reduce diagnostic errors, streamline workflows, and improve patient outcomes.

Early Disease Detection

The major growth factor of the medical imaging market is the growing need for early disease detection. Early diagnosis is essential as it helps to determine patient conditions before disease progression. Numerous government organizations also focus on promoting early disease diagnosis, especially in high-risk individuals. Healthcare providers can provide appropriate intervention to a disease before it reaches an advanced stage, managing the disease progression effectively. The rising prevalence of chronic disorders, such as cancer, diabetes, cardiovascular disorders, and infectious diseases, promotes the use of medical imaging. According to the International Diabetes Federation (IDF) report, approximately 853 million people, or 1 in 8 adults, will be living with diabetes by 2050. (Source - International Diabetes Federation)

Data Quality Issues

The major challenge of the medical imaging market is the data quality issues of imaging data. These issues may lead to incorrect diagnoses and misinterpretations, resulting in delayed treatments. Inaccurate imaging data can have severe consequences on patient treatment and can also reduce patient trust in the healthcare system.

What is the Future of Medical Imaging?

The future of medical imaging is promising, driven by the advent of 3D and 4D imaging. 3D imaging enables radiologists and other healthcare professionals to view a patient’s organs from every angle, making it easier to diagnose medical conditions. 4D imaging technique adds a fourth dimension to imaging by capturing real-time movements of human organs, providing valuable insights into organ formation and development. These techniques enhance visualization and diagnosis, enabling healthcare professionals to get more detailed information about human organs. Thus, these imaging techniques broaden the scope and utility of medical imaging, overcoming the inherent limitations of the original scans.

By technology, the magnetic resonance imaging segment held a dominant presence in the market in 2024. This segment dominated because magnetic resonance imaging (MRI) is a non-invasive imaging technique that produces detailed images of internal organs, such as organs, bones, muscles, and blood vessels. The rising prevalence of musculoskeletal disorders and neurological disorders necessitates the use of MRI. It is estimated that around 100-150 million MRI scans are performed annually in the world. Approximately 5,000 new MRI units are sold worldwide every year. (Source - COLLECTIVE MINDS)

By technology, the computed tomography segment is expected to grow at the fastest rate in the market during the forecast period. Computed tomography (CT) uses X-ray techniques to create detailed body images. It creates cross-sectional images of the bones, blood vessels, and soft tissues inside the body. CT scans improve cancer diagnosis and treatment and guide the treatment of common conditions, such as injury, cardiac disease, and stroke. They provide ideas to healthcare providers about surgeries. Apart from detailed images, the demand for CT scans is increasing due to their affordability.

By application, the orthopedic imaging segment led the global market in 2024. The rising prevalence of orthopedic disorders, the increasing geriatric population, and the growing number of menopausal women are the major growth factors of the segment. The global prevalence of osteoporosis is estimated to be 18.3%, with a higher incidence in women (23.1%) than in men (11.7%), resulting in fractures. By 2050, the number of hip fractures is projected to reach 21 million globally. (Source - medRxiv)

Moreover, by 2030, the world population of menopausal and post-menopausal women is projected to increase to 1.2 billion. (Source - Bayer)

By application, the oncology segment is anticipated to grow with the highest CAGR in the market during the studied years. The rising prevalence of cancer and its complexity potentiate the demand for medical imaging. The American Cancer Society estimated more than 2 million new cancer cases in the U.S. in 2025. (Source - American Cancer Society)

Favorable government policies for screening and early diagnosis in high-risk individuals also contribute to the segment’s growth. The “2030 UN Agenda for Sustainable Development” aims to reduce premature mortality from cancer. (Source - World Health Organization)

By end-use, the hospitals segment held the largest share of the market in 2024. The segmental growth is attributed to the availability of a favorable infrastructure and suitable capital investments. These aspects enable hospitals to install novel and innovative medical imaging tools. The increasing number of hospital admissions governs the segment’s growth. Patients mostly prefer hospitals for diagnostic imaging due to the presence of skilled professionals and favorable reimbursement policies.

By end-use, the diagnostic imaging centers segment is projected to expand rapidly in the market in the coming years. The increasing number of diagnostic imaging centers and the presence of trained professionals foster the segment’s growth. As of January 2025, there were more than 15,000 active imaging centers across the U.S. (Source - DEFINATIVE HEALTHCARE). These imaging centers contain specialized equipment for diagnosing a wide range of patient conditions.

North America dominated the global medical imaging market share by 37% in 2024. The presence of key players and the rising adoption of advanced technologies are the major growth factors of the market in North America. Key players, such as GE Healthcare and Sectra Medical, hold the major share of the market. The presence of a robust healthcare infrastructure and favorable government support governs the use of medical imaging. The increasing investments and collaborations among key players and academia-industry partnerships also boost the market.

Approximately 40 million MRI scans are performed annually in the U.S. It is estimated that more than 129 million Americans are living with at least one chronic disorder. In March 2024, the Advanced Research Projects Agency for Health (ARPA-H) collaborated with the Center for Devices and Radiological Health (CDRH) to streamline access to affordable, high-quality medical imaging data. (Source - ARPA-H)

The Canadian government actively supports medical imaging in Canada. The Canada Drug Agency formed the Canadian Medical Imaging Inventory (CMII) to document current practices and developments in the supply, distribution, technical operations, and general clinical and research use of advanced imaging equipment across Canada. (Source - CDA-AMC)

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The rising prevalence of chronic disorders due to the increasing geriatric population boosts the market. The rapidly expanding healthcare sector and increasing investments and collaborations also contribute to market growth. Several government organizations launch initiatives to encourage people to screen for and seek early disease diagnosis. They also provide funding for installing advanced equipment in healthcare organizations.

The Chinese government aims to develop an action plan for dementia in place by 2030, encompassing all aspects of the disease from prevention and early diagnosis, treatment, rehabilitation, and care. The authorities will conduct widespread cognitive functional screenings for the elderly and identify those at risk of developing dementia. (Source - myNEWS)

Indian healthcare organizations collectively have a total of 4,500 MRI machines. The Indian government has also launched the PLI Scheme for Medical Devices that provides financial incentives to manufacturers in key segments, such as radiology, imaging, cancer care, and implants. It announced an investment of Rs 3,420 crore from 2020-21 to 2027-28. (Source - Azadi Ka Amrut Mahotsav)

Europe is considered to be a significantly growing area in the medical imaging market, due to the increasing adoption of medical imaging tools and the burgeoning healthcare sector. Favorable government policies support the development and use of novel medical imaging tools. Several government and private organizations conduct seminars, conferences, and workshops to encourage the general public to diagnose disease conditions at an early stage.

Germany has around 32.5 MRI machines per million population, ranking fifth in the universal healthcare countries. Additionally, there are more than 37,000 medical technology companies in Germany. Major players like Siemens Healthineers and SternMed are the largest distributors of imaging devices in Germany.

The Society of Radiographers in the UK received government funding of £1.5 billion for new surgical hubs and scanners, and £70 million for radiotherapy machines in October 2024. The funding was in view of more than 7.6 million people waiting for appointments, scans, or operations in August 2024. (Source - SOR)

The Middle East & Africa are considered to be a significantly growing area in the medical imaging market, due to the rising prevalence of chronic disorders and the growing geriatric population. The increasing adoption of advanced technologies promotes the development of innovative medical imaging tools. Government organizations launch initiatives to encourage people to screen for and seek early diagnosis of chronic disorders. The presence of key players and rising collaborations among them contribute to market growth.

It is estimated that 1 in every 3 adults in the UAE suffers from one or more chronic disorders, accounting for 60% of adults. In June 2024, the Emirates Health Services (EHS) launched a campaign in collaboration with the “Eye Care” company to detect diabetic retinopathy early. The campaign aims to boost community health, increase awareness, prevent diseases, and enhance the quality of life for diabetic patients.

The South African National Department of Health (NDOH) partnered with the CDC to detect, prevent, and control infectious disease outbreaks, as well as build and strengthen the country’s core public health capabilities. These include data and surveillance, laboratory capacity, workforce and institutions, and prevention and response.

Koninklijke Philips N.V. is a Dutch multinational health technology company. It provides numerous imaging systems and software, including MRI, CT, fluoroscopy, and radiography, thereby boosting clinical confidence and streamlining workflows. The group sales were EUR 4.3 billion in Q2 2025, an increase of 1%. The diagnosis and treatment segment accounted for sales of EUR 2,084 in Q2 2025.

FUJIFILM Holdings Corporation is a Japanese company that offers a wide range of imaging systems, from digital X-ray to 3D mammography, ultrasound, and MRI. The company generated a revenue of JPY 3,195.8 billion, an increase of 7.9% in the fiscal year ending March 2025. This increase in revenue was attributed to a robust performance in the Electronics and Imaging businesses and the favorable impact of exchange rates.

Catherine Estrampes, U.S. and Canada President & CEO at GE Healthcare, commented on its collaboration with Sutter Health to increase access to innovative imaging services, stating that this Care Alliance is a customized, clinician-focused approach. The collaboration was made to provide their latest imaging technology in the right settings to serve patients most efficiently throughout their care journey. (Source - businesswire)

By Technology

By Application

By End-Use

By Region

March 2026

February 2026

February 2026

February 2026