February 2026

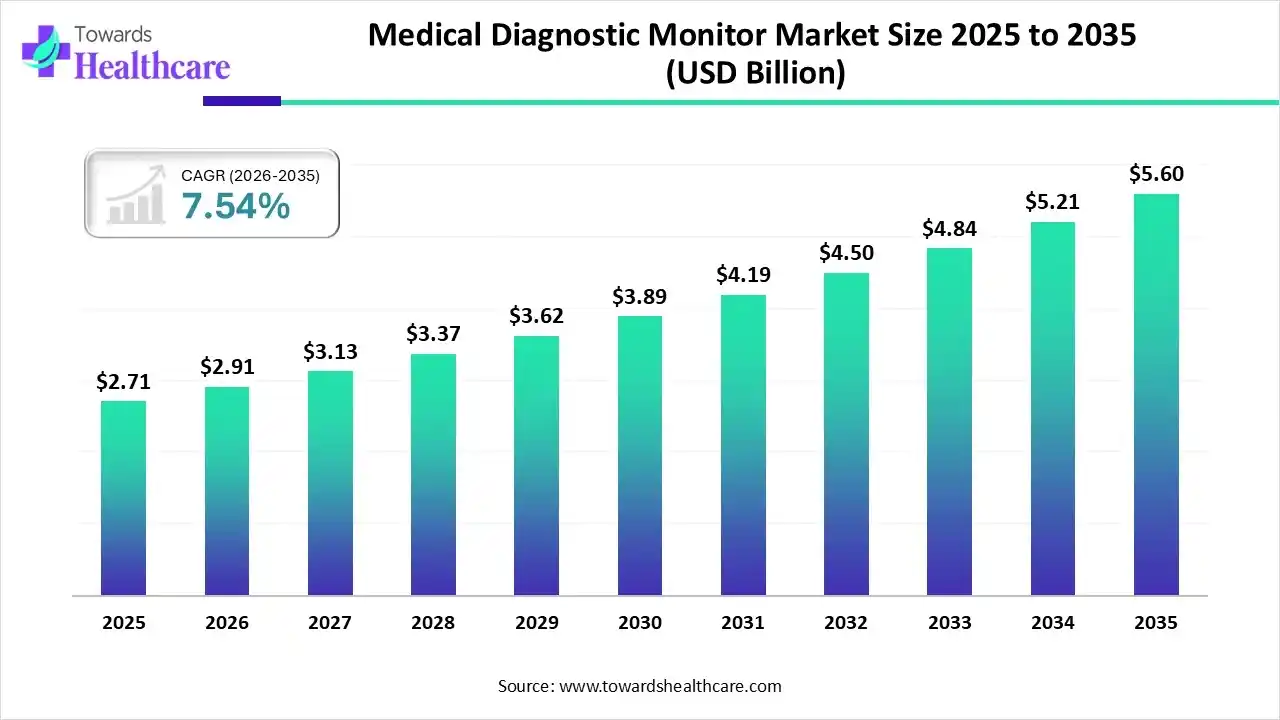

The global medical diagnostic monitor market size was estimated at USD 2.71 billion in 2025 and is predicted to increase from USD 2.91 billion in 2026 to approximately USD 5.6 billion by 2035, expanding at a CAGR of 7.54% from 2026 to 2035.

The expanding healthcare and its digitalization are increasing the use of medical diagnostic monitors. The growing AI integration, chronic disease burden, and new launches are also promoting the market growth.

The medical diagnostic monitor market is driven by a combination of demographic shifts, systemic changes in healthcare, and technological leaps. The medical diagnostic monitor refers to the specialized display screen used to view and analyze medical images for disease diagnosis and clinical decision-making. These monitors provide enhanced accuracy, colour/grayscale reproduction, and brightness.

The use of AI in the market is increasing as it helps in enhancing the imaging clarity, offering subtle details, and automated detection of abnormalities. It also helps in real-time qualitative analysis of lesions, remote diagnosis, as well as enhance the workflow efficiency. Additionally, the images from different scans can be combined using AI, promoting better diagnosis.

Growing digital transformation in the healthcare sector is increasing the use of telemedicine, teleradiology, etc which is increasing the adoption of various medical diagnostic monitors.

The use of medical diagnostic monitors is increasing across surgical and multi-modality operations, driving their adoption across hybrid imaging suites, operating rooms, and advanced procedural environments for acute and frequent imaging of diseases.

The companies are developing and utilizing various advanced technologies, such as advanced visualization, higher resolution tech, and multi-modality support tools, to enhance display accuracy and remote monitoring of the medical diagnostic monitor.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.91 Billion |

| Projected Market Size in 2035 | USD 5.6 Billion |

| CAGR (2026 - 2035) | 7.54% |

| Leading Region | North America |

| Market Segmentation | By Device Type, By Resolution, By Panel Size, By Application, By End-User, By Region |

| Top Key Players | Barco NV, EIZO Corporation, LG Electronics, Sony Electronics, Siemens Healthineers, Jusha Medical, Double Black Imaging, Advantech Co., Ltd, FSN Medical, Reshin |

Why Did the LED Monitors Segment Dominate in the Medical Diagnostic Monitor Market in 2025?

The LED monitors segment held the largest share in the market in 2025, due to their high brightness, suitable for MRI, X-rays, and CT scans. They also offered enhanced image uniformity and low power consumption, which increased their use, where their widespread availability also increased their adoption rates.

OLED Monitors

The OLED monitors segment is expected to show the fastest growth rate during the predicted time, due to their faster response time and infinite contrast. Moreover, their high colour accuracy and flexibility, offering imaging from different positions, are also increasing their use in the pathology and surgical procedures.

How 2MP Segment Dominated the Medical Diagnostic Monitor Market in 2025?

The 2MP segment led the market in 2025, as it was ideal for radiology procedures. Their affordability and enhanced compatibility with other healthcare systems also increased their use. At the same time, it also offered improved image clarity, which increased their adoption across mid sided hospital with limited infrastructure.

6MP

The 6MP segment is expected to show the highest growth during the predicted time, driven by its detailed visibility. Their potential to offer 3MP imaging at a time on the screen is reducing the demand for multiple monitors, promoting their use. Their growing application across the radiology sector is also driving their demand.

Which Panel Size Type Segment Held the Dominating Share of the Medical Diagnostic Monitor Market in 2025?

The 23-26.9 inches segment held the dominating share in the market in 2025, as they offered comfortable viewing, reducing eye strain during the diagnostic session. Their affordability and compatibility with various healthcare systems also increased their use. They also offered enhanced flexibility during their mounting and adjustment, which increased their use in routine diagnostic procedures.

27 Inches and Above

The 27 inches and above segment is expected to show the fastest growth rate during the predicted time, due to the high-resolution power. It also provides a detailed scan, which is increasing its use in mammography and CT scans. Their side-to-side comparison is also increasing their use in complex case evaluation.

What Made Radiology the Dominant Segment in the Medical Diagnostic Monitor Market in 2025?

The radiology segment led the market in 2025, due to growth in the imaging volume. This increased the demand for specialized diagnostic monitors that comply with the regulatory standards. The growth in chronic disease and the shift towards preventive care also increased their use.

Pathology

The pathology segment is expected to show the highest growth during the upcoming years, due to growing cancer diagnoses. This is increasing the demand for high-resolution medical diagnostic monitors for enhanced colour accuracy and detail visibility. Moreover, their growing advancements and remote diagnostics are also increasing their use.

Why Hospitals Segment Dominated the Medical Diagnostic Monitor Market?

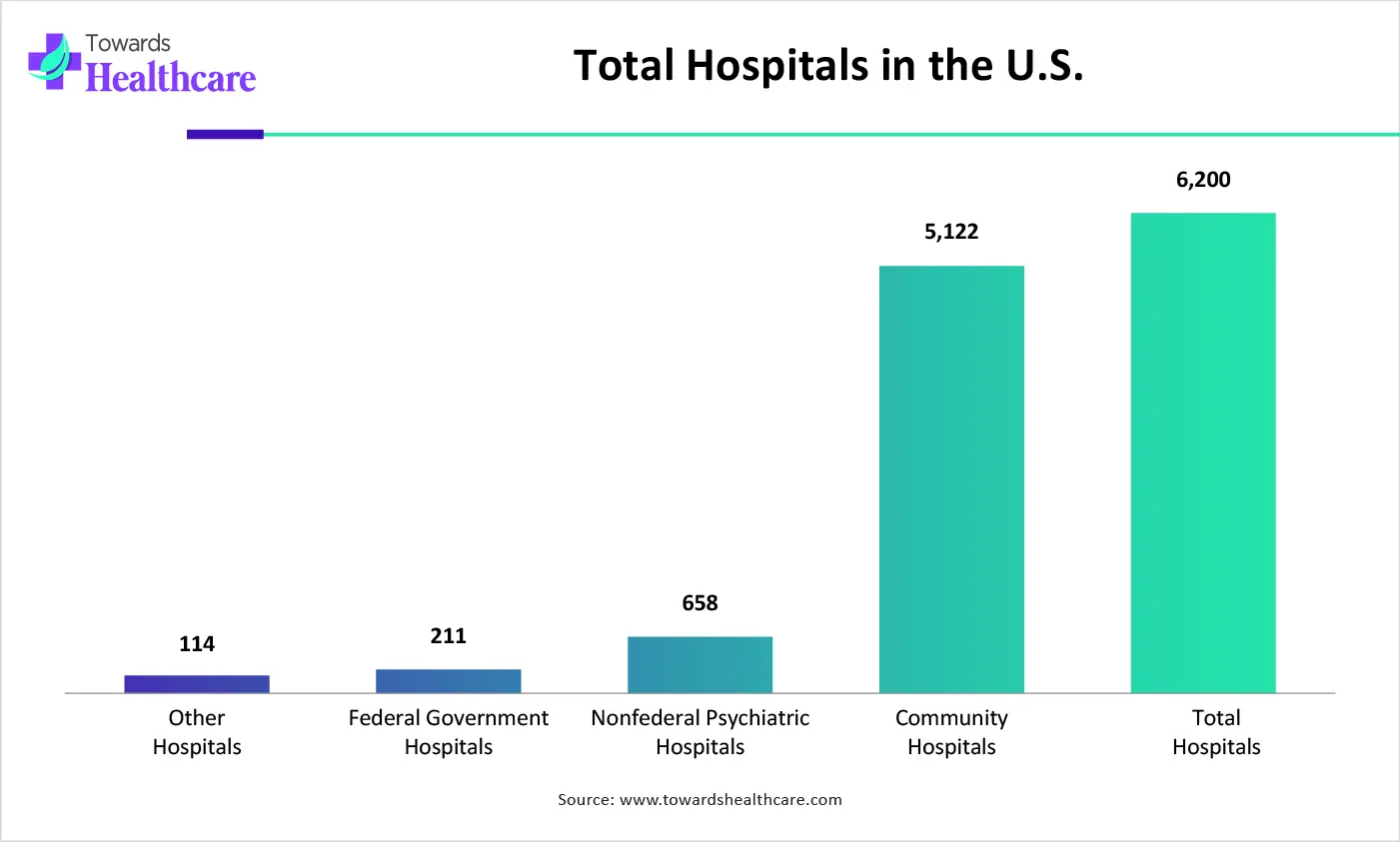

The hospitals segment held the largest share in the market in 2025, due to growth in the patient volume. Moreover, the presence of multi-specialist departments and advanced infrastructure also increased the use of medical diagnostic monitors. Their 24/7 availability also increased patient reliance on them.

Diagnostic Centers

The diagnostic centers segment is expected to show the fastest growth rate during the upcoming years, due to growing outpatient imaging. The increasing preventive healthcare and expanding diagnostic centres are also increasing the adoption of various medical diagnostic monitors, which are supported by healthcare investments.

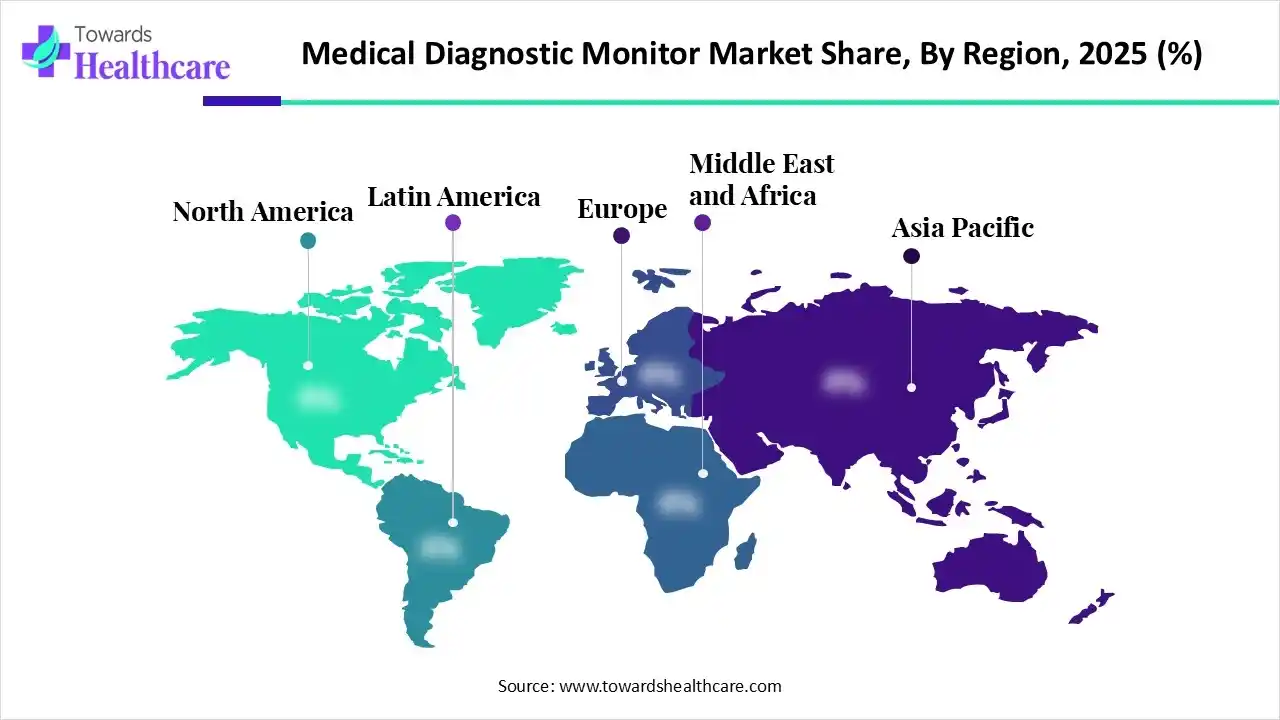

North America dominated the medical diagnostic monitor market in 2025, due to the presence of advanced healthcare infrastructure, which encouraged the early adoption of advanced technologies like medical diagnostic monitors. The presence of robust industries and growth in healthcare investment also increased their innovations, which contributed to the market growth.

U.S. Market Trends

The growing healthcare investment and technological innovations in the U.S. are increasing the adoption and advancement of medical diagnostic monitors. The growing number of surgical procedures and expanding radiology and pathological operations are also increasing their adoption rates.

Asia Pacific is expected to host the fastest-growing medical diagnostic monitor market during the forecast period, due to expanding healthcare infrastructure and increasing chronic diseases. This is driving the adoption of medical diagnostic devices, where the growing digitalization is also increasing their use, enhancing the market growth.

China Market Trends

The growing chronic disease is increasing the patient volume, driving the demand for medical diagnostic monitors across China. The expanding healthcare and government initiatives are also increasing their use, and the growing technological advancements are accelerating their innovations.

Europe is expected to grow significantly in the medical diagnostic monitor market during the forecast period, due to stringent regulations, which are increasing the demand for certified medical diagnostic monitors. The advanced healthcare is increasing its use to control the growing cancer cases, and is encouraging its advancements, promoting the market growth.

UK Market Trends

The UK consists of a well-developed healthcare system, which is increasing the use of medical diagnostic monitors for early detection of diseases. The presence of stringent regulation, the growing shift towards preventive care, and increasing healthcare investments are also promoting their use.

| Companies | Headquarters | Medical Diagnostic Monitors |

| Barco NV | Kortrijk, Belgium | Coronis, MammoTom, Nio |

| EIZO Corporation | Hakusan, Japan | RadiForce |

| LG Electronics | Seoul, South Korea | LG Medical Displays |

| Sony Electronics | Tokyo, Japan | LMD Series |

| Siemens Healthineers | Erlangen, Germany | Syngo Integrated Displays |

| Jusha Medical | Nanjing, China | Jusha Professional Displays |

| Double Black Imaging | Westminster, U.S. | Gemini and Orion |

| Advantech Co., Ltd | Taipei, Taiwan | Kostec and DSD Series |

| FSN Medical | Brea, U.S. | FSN Surgical Displays |

| Reshin | Shenzhen, China | Reshin Diagnostic Series |

By Device Type

By Resolution

By Panel Size

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026