February 2026

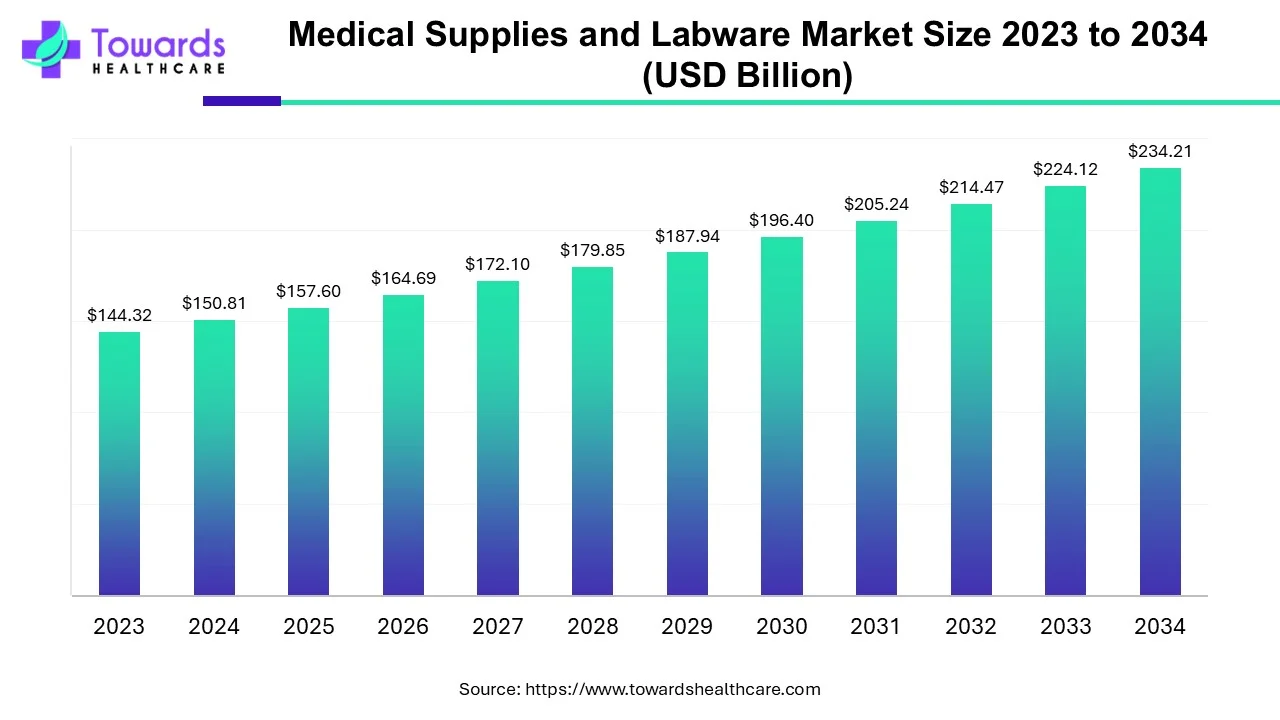

The global medical supplies and labware market size is expected to grow from USD 157.6 billion in 2025 to USD 234.21 billion by 2034, with a CAGR of 4.50% throughout the forecast period from 2025 to 2034.

The medical supplies and labware market manufactures and distributes medical supplies and labware for hospitals, clinics, surgical ambulatory centers, diagnostic laboratories, research laboratories and other medical facilities. More is needed for comprehensive health care services than just medications. The provision of high-quality healthcare and the enhancement of patient health also requires the use of diagnostic tests, medical equipment, and laboratory equipment. Laboratory product suppliers are essential to the efficient operation of hospitals in the complicated and constantly changing field of healthcare. These vendors serve as the backbone of medical laboratories by offering a vast array of key supplies and tools required for precise diagnosis, patient health monitoring, and critical research.

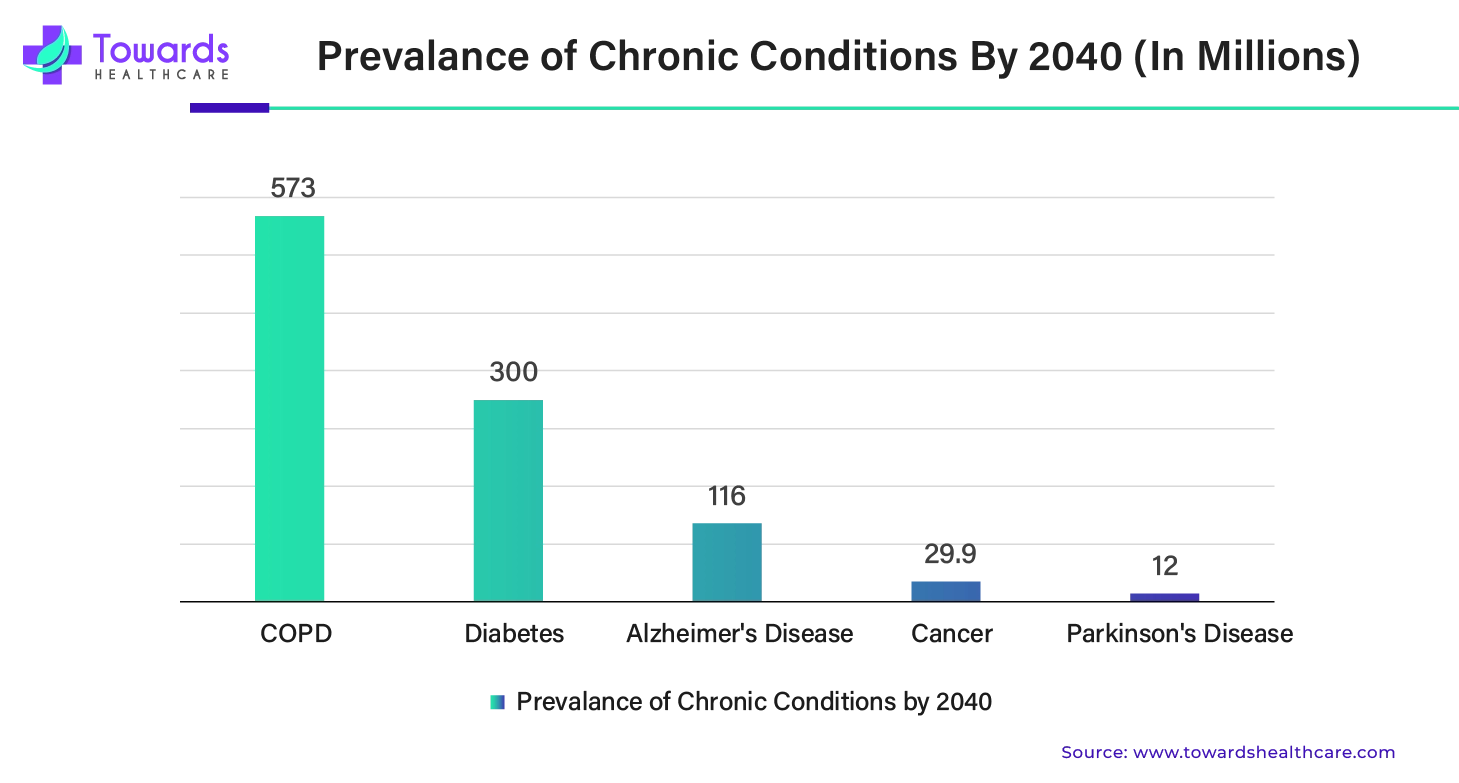

Chronic illness is becoming more commonplace worldwide, which makes it one of the major healthcare challenges of the twenty-first century. Because the impacts of these chronic illnesses are persistent and can affect a person for their whole lifespan, individuals and medical providers need to provide ongoing care. Due to continuous monitoring, treatment, and check-ups, patients with chronic conditions need medical supplies and labware. Many medical supplies and labware are used for single use. As the geriatric population grows, the prevalence of chronic conditions also grows, which is driving the medical supplies and labware market. It is estimated that the healthcare cost of chronic diseases will grow to $37 trillion across the globe by 2030.

During the procedure, a tremendous amount of garbage is produced. About 85% of the garbage produced by healthcare operations is normal, non-hazardous waste, which is similar to waste produced at home. The remaining fifteen percent is regarded as a dangerous material that could be radioactive, toxic, or pathogenic. The average amount of hazardous waste produced daily per hospital bed in high-income countries is up to 0.5 kg, compared to 0.2 kg in low-income ones. Drug-resistant microbes that contaminate the environment and spread from healthcare facilities are one source of potential dangers. The main environmental problems that have a negative impact on health are air and land pollution. By releasing viruses and hazardous substances into the environment, the handling and disposal of medical waste may inadvertently cause health concerns.

The worldwide market for medical supplies has a lot of potential due to the rising investment in healthcare institutions. In order to address the expanding healthcare requirements of growing populations, governments, and private investors are realizing more and more how important it is to have a strong healthcare infrastructure. As a result, financing and investments in healthcare facilities—such as clinics, hospitals, and specialty care centers—have expanded. Consequently, there's a greater need for medical supplies to properly outfit these clinics. This presents a chance for suppliers and producers of medical supplies to increase their market share, establish strategic alliances, and provide cutting-edge goods and services to satisfy the changing demands of healthcare facilities across the globe.

By type, the medical supplies segment held a dominant presence in the medical supplies and labware market in 2024. Some common examples of medical supplies include IV supplies, diagnostic tools like stethoscopes and thermometers, blood pressure kits, and diabetic tools. The increasing number of hospital admissions, due to the rising prevalence of chronic disorders and the growing number of road accidents. The U.S. reported more than 34 million hospital admissions in 2023. The availability of durable medical supplies and the rising demand for home healthcare boost the segment’s growth.

By type, the labware segment is predicted to witness significant growth in the market over the forecast period. Labware refers to general laboratory equipment, such as beakers, petri dishes, and pipettes. The growing research and development activities and increasing investments augment the segment’s growth. The growing need for advanced diagnosis of chronic disorders necessitates diagnostic labs to adopt labware.

By material, the plastic segment held the largest share of the medical supplies and labware market in 2024. The availability of disposable, biodegradable, and single-use plastics promotes the use of plastics in medical supplies and labware. Plastics are more affordable and lightweight, enabling easier transport and avoiding breakage. They are comparatively more durable and are compatible with different sterilization methods. Antimicrobial plastics are in high demand to reduce the risk of healthcare-associated infections.

By material, the metals segment is expected to grow at the fastest rate in the market during the forecast period. The most common types of metals used in medical supplies and labware are stainless steel, copper, titanium, cobalt chrome, and aluminum. Benefits of metals include ease of processing, high strength, and corrosion resistance. Some metals are highly biocompatible with the human body, reducing the risk of infections and immune reactions. Moreover, they are easier to clean and are compatible with numerous sterilization methods.

By application, the therapeutics segment led the global medical supplies and labware market in 2024. The rapidly expanding medical device sector and the rising development of innovative drug delivery systems foster the segment’s growth. Medical supplies and labware provide cutting-edge treatment to patients. Novel drug delivery systems ensure the timely and targeted delivery of drugs. Some implants and medical devices are biocompatible and biodegradable, eliminating the need for an extra surgical procedure to remove the device.

By application, the diagnostics segment is anticipated to show lucrative growth in the market during the forecast period. Favorable government organizations encourage screening and early detection of diseases, facilitating the use of diagnostics. The increasing number of new product launches, such as in vitro diagnostics and companion diagnostics, fosters the use of medical supplies and labware. The U.S. FDA has approved a total of 188 companion diagnostics as of March 2025.

By end-use, the hospitals & clinics segment registered its dominance over the global medical supplies and labware market in 2024. The rising prevalence of acute and chronic disorders necessitates that patients visit hospitals and clinics. The segmental growth is attributed to the presence of skilled professionals and specialized equipment. Hospitals and clinics have favorable infrastructure and suitable capital investments to install cutting-edge technologies. The availability of favorable reimbursement policies also encourages patients to favor hospitals and clinics.

By end-use, the home healthcare segment is projected to expand rapidly in the market in the coming years. The rising geriatric population and the increasing number of employed people govern home healthcare. Healthcare operations, such as rehabilitation and post-surgical care, are primarily conducted in the comfort of the patient’s home to facilitate early recovery. Technological advancements, such as telehealth and novel therapeutic devices, promote home healthcare.

North America dominated the medical supplies and labware market by 43% in 2023. The region is known for this technological advancement, continuous innovation, advanced healthcare system, and strong support from the government. Apart from this, North America is also home to major key players that continuously invest in research and development in order to develop better, advanced, and sustainable products. The major countries that contribute to the growth of the region are the U.S., Canada, and Mexico.

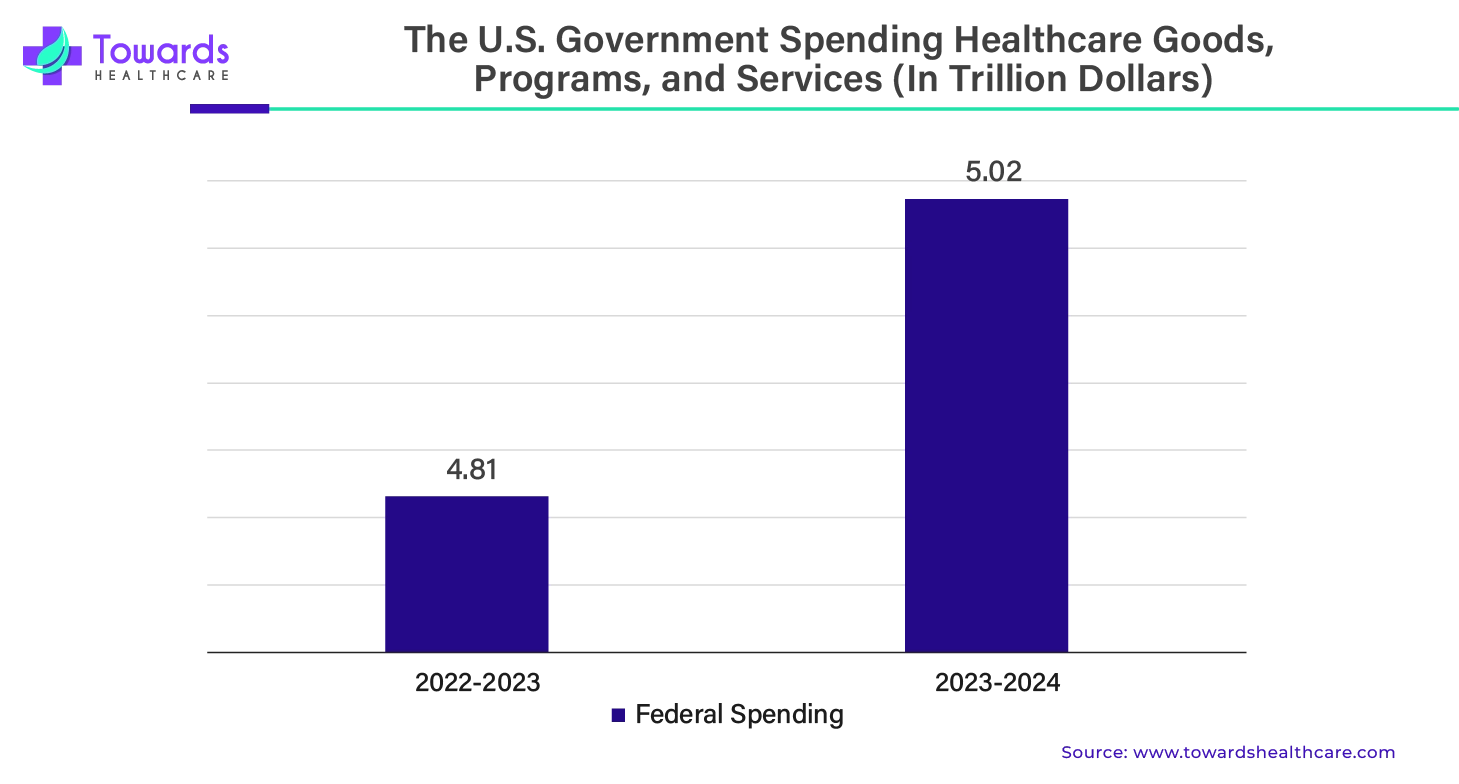

The U.S. is the dominant contributor to the growth of the medical supplies and labware market in North America. The country is known for its advanced healthcare system. To guarantee the efficacy and safety of medical devices sold in the United States, the FDA controls their sale. The Center for Medical Devices and Radiological Health (CDRH) of the FDA regulates nearly 6,000 different types of medical devices, and the classification given to each type is listed in the Medical Device Product Classification database. In order to assist the American people and cover the costs associated with borrowing, the federal government spends money on a wide range of products, services and initiatives.

The medical device sector in Canada is made up mainly of small and medium-sized businesses (SMEs) and is extremely diverse. The medical device industry in Canada was projected to be worth US$6.8 billion in 2022. Up until 2028, the market is predicted to expand by 5.4% yearly. The entire amount spent on healthcare in Canada in 2022 was almost C$331 billion, or C$8,563 per person. With US$3.2 billion in medical device exports into the Canadian market in 2022—42.6% of all imports in this industry—the US remained the leading exporter of medical devices to Canada.

Asia Pacific is estimated to grow at the fastest rate during the forecast period. The growth of the medical supplies and labware market in Asia Pacific is due to continuous efforts by governments to improve healthcare. The region is also focused on healthcare advancements with the help of key market players worldwide. The major countries contributing to the growth of the market in Asia Pacific are China, India, Japan and South Korea.

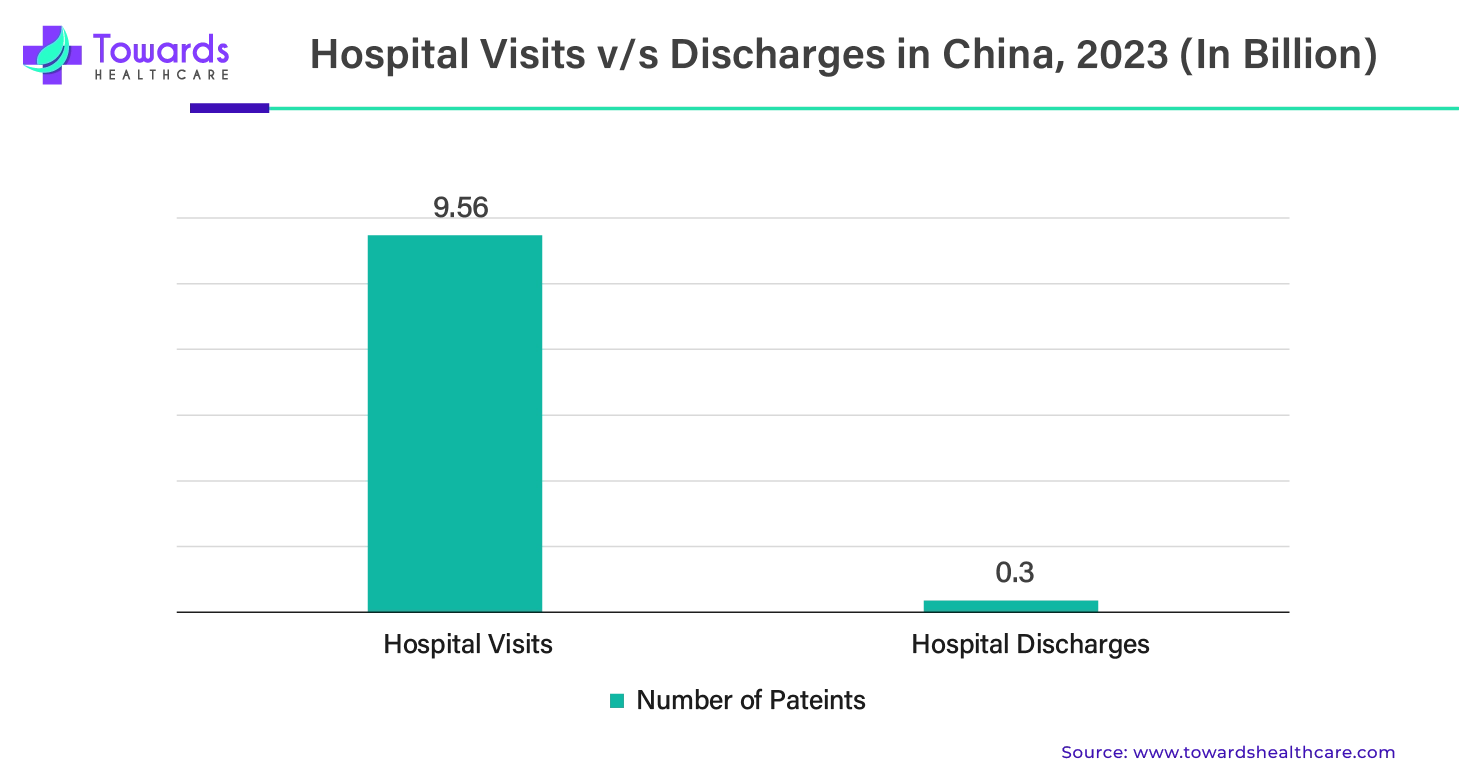

Innovation and technology are centered in China. The nation is always working to create new tools and technology to provide better healthcare services. China exports a range of equipment to foreign nations. At US$650 million, or 8.61 percent, China was the second-biggest supplier of medical equipment to Canada after the United States. In addition, China is renowned for having a highly developed healthcare system.

For instance,

India is significantly contributing to the growth of the medical supplies and labware market. The Indian government is heavily invested in reducing the burden of a growing number of patients. The country is strongly focusing on SDGs to tackle the issue. Various companies are also making efforts to provide medical equipment.

For instance,

| Company Name | Sky Medical Supplies |

| Headquarters | Denver, U.S., North America |

| Recent Launch | In June 2024, Sky Medical Supplies introduced a new range of reasonably priced medical supplies comprising hospital beds, oxygen concentrators, lift chairs, mobility scooters, and wheelchairs with manual and electric functions. The company's goal is to ensure that everyone has access to the resources they need for a higher quality of life by offering trustworthy and reasonably priced medical equipment to those who are in need. By introducing the new line of mobility equipment, Sky is making a big step in the right direction. |

| Company Name | Johnson & Johnson |

| Headquarters | New Jersey, U.S., North America |

| Recent Launch | In April 2024, the Ethizia hemostatic sealing patch and the Cereglide aspiration catheter are the two new items that the massive medical device company Johnson & Johnson (J&J) has introduced in Europe, the Middle East, and Africa. |

By Type

By Material

By Application

By End-Use

By Region

February 2026

February 2026

February 2026

February 2026