February 2026

The bRo5 molecules market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2026 to 2035. This growth is driven by emerging trends and strong demand across key sectors.

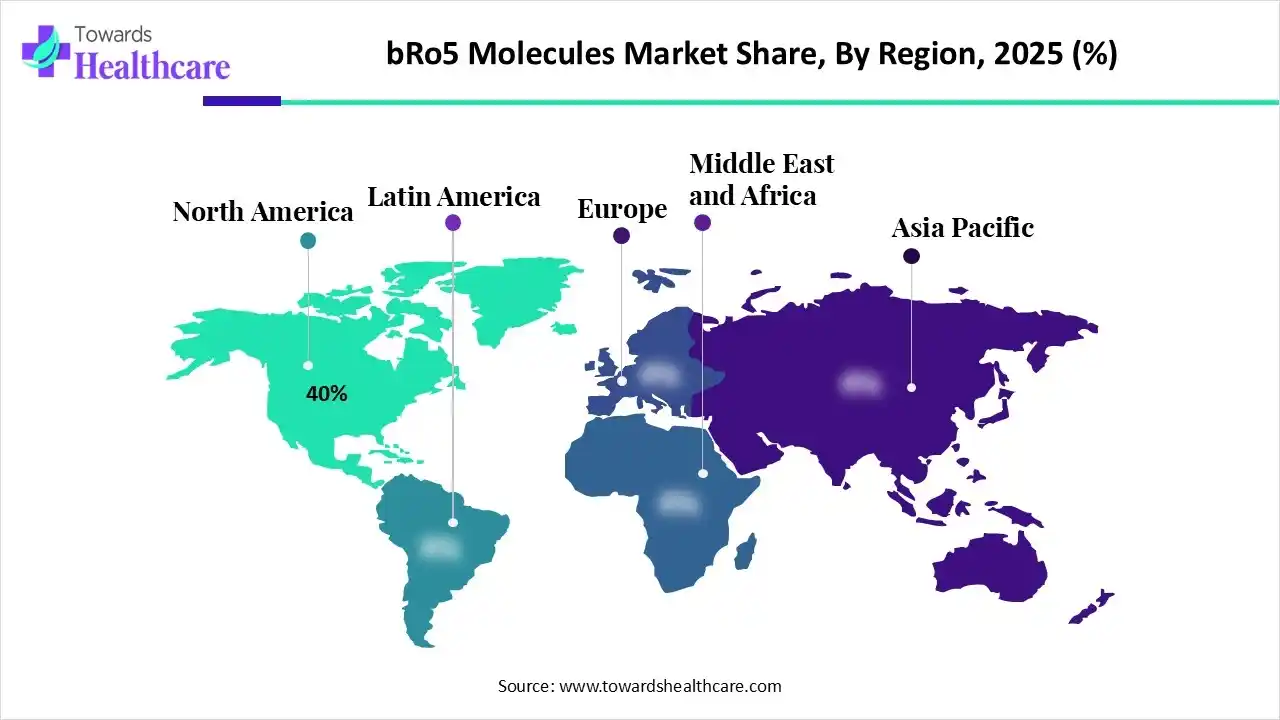

The bRo5 molecule market is gaining attention due to its potential therapeutic efficacy and advancing clinical research. Strong research infrastructure, early technology adoption, and active participation of pharmaceutical innovators have positioned North America as the dominant region. Favourable regulatory pathways, robust funding for drug development, and increasing focus on targeted and precision therapies continue to support overall market growth.

A bRo5 molecule refers to a complex and structurally advanced drug compound designed to address challenging biological targets that conventional small molecules often cannot. These molecules enable higher target specificity and improved therapeutic performance in certain disease areas. The global bRo5 molecules market has been driven by progress in medicinal chemistry, enhanced formulation technologies, growing focus on precision therapies, and increased pharmaceutical investment in next-generation drug platforms.

AI integration can significantly improve the manufacturing of bRo5 molecules by optimizing complex synthesis pathways and reducing process variability. Machine learning models enable predictive process control, helping manufacturers identify optimal reaction conditions, improve yield consistency, and minimize waste. AI-driven analytics also enhance quality assurance by detecting impurities and deviations in real time. Additionally, automation supported by AI accelerates scale-up from laboratory to commercial production, shortens development timelines, and improves supply chain planning. Together, these capabilities enable more efficient, cost-effective, and reliable manufacturing of bRo5 molecules while maintaining high regulatory and quality standards.

Pharmaceutical companies are increasingly developing bRo5 molecules to address complex and previously “undruggable” biological targets, expanding treatment possibilities for cancer, neurological, and rare diseases.

Innovative formulation approaches are improving the solubility, stability, and bioavailability of bRo5 molecules, helping overcome historical challenges and making them more viable for therapeutic use.

Cross-sector collaborations between academia, biotech, and pharma are accelerating bRo5 discovery and development, pooling expertise and reducing time to market.

Regulatory agencies are adapting frameworks to better accommodate novel molecules, which may streamline approvals and encourage broader investment in bRo5 therapeutics.

bRo5 molecules are being explored beyond traditional fields, with growing interest in immunology, metabolic disorders, and infectious diseases, indicating a widening future application landscape.

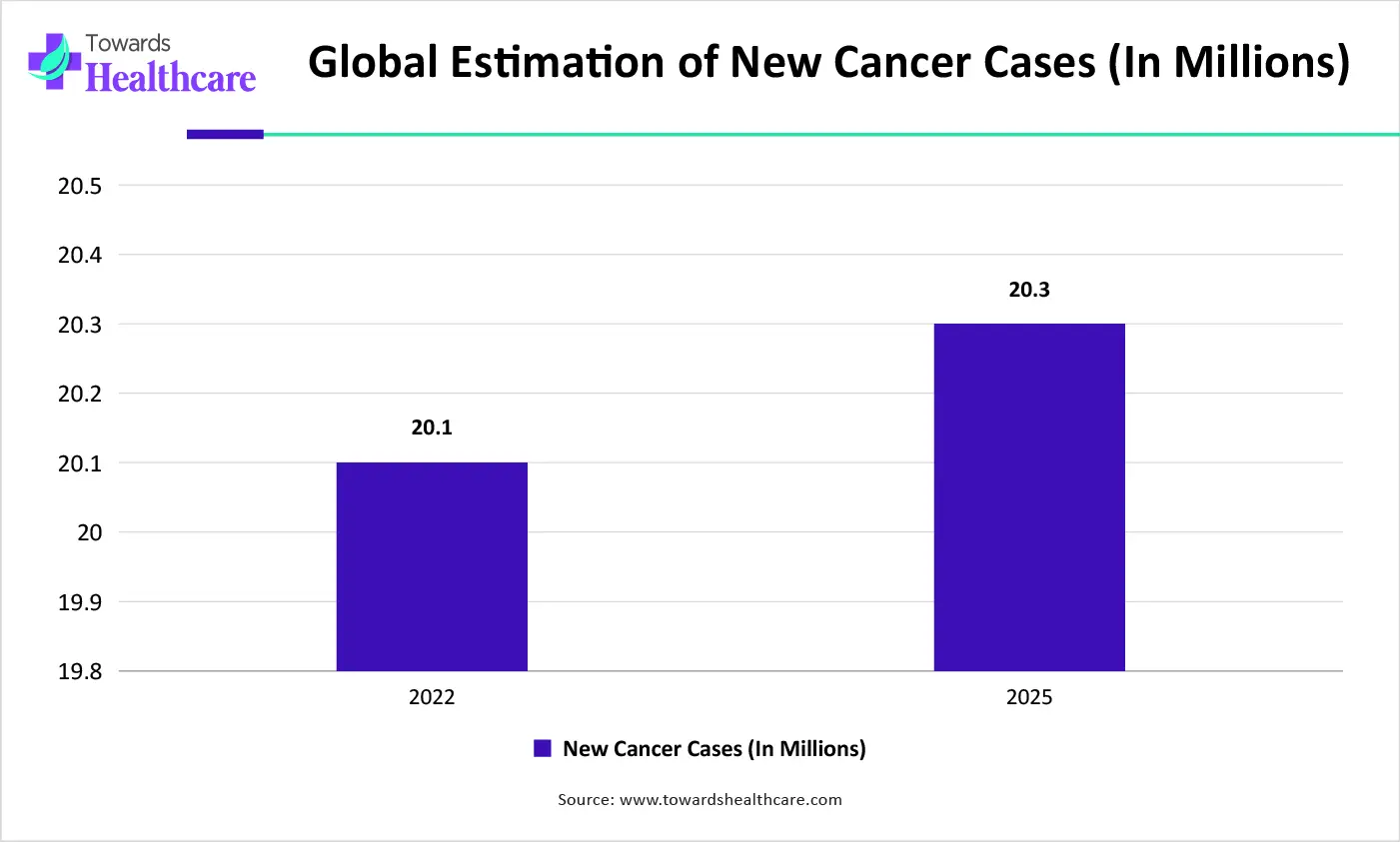

Rising prevalence of oncology drives the growth of the bRo5 molecules market because bRo5 molecules are particularly suited for designing complex, large, and highly selective drug candidates that conventional small molecules cannot effectively target.

| Year | New Cancer Cases (Globally) | Globally, Deaths Caused Due to Cancer |

| 2022 | 21 Million | 9.8 Million |

| 2025 | 20.5 Million | 10.6 Million |

Which Molecule Type Segment Dominated the bRo5 Molecules Market?

The bRo5 small molecules segment dominates the market with a share of approximately 40% due to its relatively simpler synthesis, established manufacturing infrastructure, and easier scalability compared with larger modalities. Strong clinical familiarity, effective target engagement in challenging biological pathways, and existing regulatory experience also enhance adoption, while broader therapeutic applicability keeps this segment at the forefront of investment and development.

Macrocycles & Cyclic Peptides

The macrocycles & cyclic peptides segment is estimated to be fastest growing segment with a CAGR of approximately 20% due to superior target specificity, improved stability, and enhanced binding to complex biological targets. Their structural diversity enables modulation of challenging proteins, while advances in synthesis and screening technologies boost discovery. Broad therapeutic potential across oncology, immunology, and infectious diseases fuels rapid adoption and investment.

Why Did the Oncology Segment Dominate the bRo5 Molecules Market?

The oncology segment dominates the market with a share of approximately 32% due to the high demand for targeted cancer therapies and the ability of bRo5 compounds to engage complex tumor-related proteins. Strong clinical focus, extensive research funding, and unmet needs in resistant cancers drive development, making oncology a primary application area for these advanced molecules.

CNS Disorders

The CNS disorders segment is anticipated to be the fastest growing in the bRo5 molecules market, with a CAGR of approximately 24%, because bRo5 molecules can effectively interact with complex neurological targets and cross the blood-brain barrier. Rising prevalence of neurodegenerative and psychiatric conditions, increased research focus, and unmet therapeutic needs drive innovation. Enhanced formulation techniques and supportive clinical data further accelerate adoption in CNS drug development.

Why Did Computational Drug Design & AI-Assisted Platforms Dominate the bRo5 Molecules Market?

The computational drug design & AI-assisted platforms segment dominates the bRo5 molecules market with a share of approximately 36% due to its ability to model complex structures, optimize pharmacokinetics, and predict viable candidates efficiently. Enhanced screening accuracy, reduced experimental costs, and accelerated discovery timelines empower researchers to tackle challenging targets, making this segment central to modern bRo5 development strategies.

Structure-Based Drug Design (SBDD)

The structure‑based drug design (SBDD) segment is estimated to be the fastest growing in the market, with a CAGR of approximately 26%, because it enables precise optimization of bRo5 molecules by revealing atomic‑level interactions. Its ability to identify high‑affinity fragments and guide rational modifications accelerates discovery. Improved success rates, reduced trial‑and‑error, and better target engagement are driving rapid adoption in complex drug development.

Which Proprietary bRo5 Molecule Libraries Segment Led the bRo5 Molecules Market?

The proprietary bRo5 molecule libraries segment dominates the market with a share of approximately 42% because it provides exclusive access to diverse, well-characterized compounds, enabling faster hit identification and optimized lead discovery. Strong intellectual property protection, extensive structural diversity, and curated bioactivity data enhance research efficiency, making proprietary libraries a preferred choice for pharmaceutical companies developing complex bRo5 therapeutics.

Discovery & Lead Optimization Tools

The discovery & lead optimization tools segment is anticipated to be the fastest growing in the market, with a CAGR of approximately 25% due to its ability to enhance the efficiency of bRo5 molecule development. By streamlining hit-to-lead progression, improving synthetic yields, and enabling precise molecular modifications, these tools accelerate research timelines, reduce resource consumption, and support the creation of high-quality, therapeutically effective compounds.

Which End-User Segment Dominated the bRo5 Molecules Market?

The large pharmaceutical companies segment dominates the bRo5 molecules market with a share of approximately 45% due to their strong R&D capabilities, extensive funding, and established infrastructure. Their ability to conduct complex drug discovery , manage large-scale clinical trials, and maintain global distribution networks enables faster development and commercialization of bRo5 molecules, ensuring market leadership.

Biotech Innovators & Startups

The biotech innovators & startups segment is estimated to be the fastest growing in the market with a CAGR of 26% due to agility in exploring novel targets, adopting cutting-edge technologies, and pursuing high-risk, high-reward research. Their focus on niche therapeutic areas, flexible collaboration models, and rapid prototyping accelerates bRo5 molecule discovery, driving innovation and attracting strategic partnerships and investments in the market.

Direct Licensing & Partnerships

The direct licensing & partnerships segment dominates the bRo5 molecules market with a share of approximately 48% because it allows companies to access proprietary compounds, share development risks, and leverage complementary expertise. Strong collaborations between pharma, biotech, and research institutions accelerate drug discovery, streamline commercialization, and ensure faster market entry, making this channel highly preferred.

Digital/Software Tool Subscriptions

The digital/software tool subscriptions segment is anticipated to be the fastest growing with a CAGR of approximately 28%, due to its ability to provide continuous access to advanced modeling, data analytics, and virtual screening platforms. Flexible subscription models, real-time updates, and scalable solutions enable researchers to accelerate bRo5 molecule discovery, optimize workflows, and reduce costs, driving rapid adoption across the industry.

North America dominated the bRo5 molecules market with a share of approximately 40% in 2025. North America dominates the market due to a strong biopharmaceutical ecosystem, high R&D investments, advanced drug discovery infrastructure, early adoption of novel therapeutic modalities, presence of leading pharmaceutical companies, favourable regulatory pathways, robust funding for biotech startups, and extensive academic-industry collaborations driving innovation.

The U.S. leads growth in the North America BRO5 molecules market due to robust biopharma R&D investment, cutting-edge research infrastructure, strong intellectual property protection, favourable regulatory support for novel therapeutics, extensive clinical trial activity, presence of major biotech firms, strategic partnerships, and high healthcare expenditure, accelerating the adoption of advanced molecular technologies.

Asia Pacific is estimated to host the fastest-growing bRo5 molecules market with a CAGR of approximately of 24% during the forecast period. The Asia-Pacific region’s rapid growth in the market is driven by expanding healthcare infrastructure, increasing biopharmaceutical R&D initiatives , rising government support for biotech innovation, growing clinical research activity, cost-competitive manufacturing capabilities, expanding skilled talent pool, and rising adoption of advanced molecular therapies across emerging markets such as China, India, and Japan.

China dominates the Asia-Pacific market due to strong government support for biotech innovation, significant investments in life sciences research, expanding biopharmaceutical infrastructure, growing clinical trial activity, a large pool of scientific talent, favourable regulatory reforms, strategic partnerships with global firms, and increasing adoption of advanced molecular technologies across its healthcare sector.

Europe is expected to grow at a significant CAGR in the market during the forecast period. Europe is growing at a notable rate in the global market due to strong biopharmaceutical research ecosystems, supportive regulatory frameworks, increased public and private R&D funding, advanced biotechnology infrastructure, rising clinical trial activity, and extensive collaborations between academic institutions and industry, driving novel therapeutic development.

The UK’s growth in the Europe bRo5 molecules market is driven by strong biopharmaceutical research and innovation, supportive government policies, world-class academic and clinical research institutions, extensive industry partnerships, substantial R&D investment, a favourable regulatory environment post-Brexit, and a highly skilled talent pool accelerating development and adoption of novel molecular therapies.

| Company (Top Vendor) | Primary Offerings in bRo5 Market | Headquarters |

| WuXi AppTec | End-to-end drug discovery, development & manufacturing services including complex small molecules, peptides, synthetic compounds & CRO services supporting bRo5 modalities. | Shanghai, China |

| Insilico Medicine | AI-driven drug discovery platform (Pharma.AI) enabling de novo design of complex molecules beyond traditional Ro5 boundaries. | Boston, MA, USA |

| Astex Pharmaceuticals | Structure-guided drug discovery for oncology/CNS; expertise in fragment-based and molecular design relevant to larger, complex molecules. | Cambridge, UK |

| BioDuro | Integrated CRDMO services from discovery chemistry to manufacturing, including complex molecule synthesis supportive of bRo5 research. | Irvine, CA, USA |

| Verseon | Physics-based computational drug discovery platform for novel chemical matter, useful for complex and challenging targets. | Fremont, CA, USA |

| Collaborative Drug Discovery (CDD) | Data management & bioassay informatics platform aiding optimization/analytics in complex drug discovery workflows. | Burlingame, CA, USA |

| XtalPi Holdings | AI & quantum algorithm-based early discovery services to screen and generate novel molecular structures. | Shenzhen, China |

| Excelsior Sciences | AI-accelerated small molecule discovery platform aiming to cut candidate development timelines for complex structures. | New York, NY, USA |

| Takeda (partnered with AI/biotech) | Large pharma with strategic collaborations (e.g., AI drug discovery with partners) advancing novel modality candidate pipelines, including beyond-Ro5 targets. | Tokyo, Japan |

| Eli Lilly | AI-enabled drug discovery platform & partnerships facilitating design and optimization of complex molecules beyond traditional small molecules. | Indianapolis, IN, USA |

By Molecule Type

By Therapeutic Area

By Technology Platform

By Product Type

By End-User

By Distribution Channel

By Region

February 2026

February 2026

January 2026

January 2026