February 2026

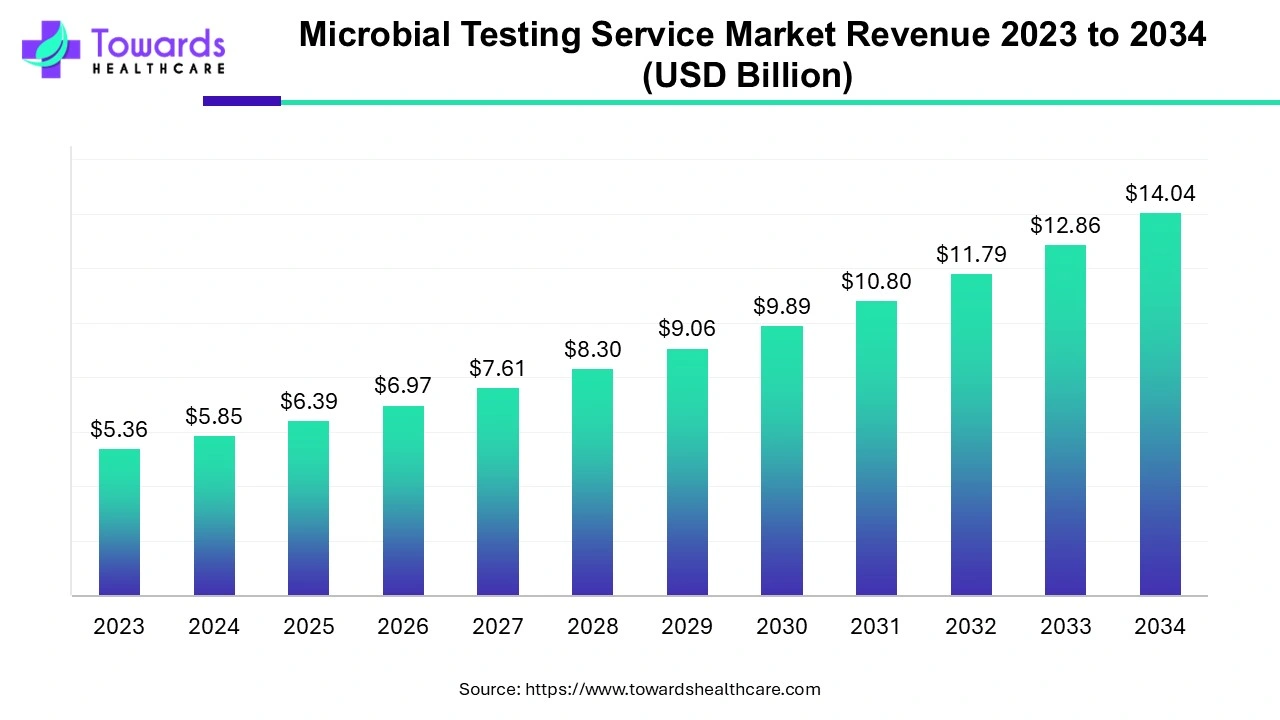

The global microbial testing service market was estimated at US$ 5.36 billion in 2023 and is projected to grow to US$ 14.04 billion by 2034, rising at a compound annual growth rate (CAGR) of 9.15% from 2024 to 2034. The demand for microbial testing services is increasing due to increasing research and development in testing new drugs and therapeutics, essentially due to the growing antibiotic resistance among pathogens.

Microbial testing services are procedures conducted to detect the presence of microbes and the identification of the type of microorganism in different settings such as hospitals, pharmaceuticals, and biotechnology. The microbial testing service market is growing significantly due to prevalence of infectious diseases. Apart from this, the services are needed to ensure patient safety to avoid any health risks. Organization and healthcare service providers follow strict regulatory guidelines to ensure patient safety.

In September 2023, the women's health startup Evvy announced that it has finished its $14 million Series A fundraising round, which it plans to utilize to expand its platform for vaginal health testing and care.

| Name of the Company | Base | Funding to Date, 2024 (In US$ Million) |

| Pendulum Therapeutics | U.S. | $111M |

| veMico | UK | $33.3M |

| Pluton Biosciences | U.S. | $24.2M |

| Digbi Health | U.S. | $8.5M |

| Alba Health | Sweden | $2.5M |

| LyteGro | UK | $2.2M |

| BoobyBiome | UK | $2M |

| Bac3Gel | Portugal | $1.7M |

The table lists the name of the microbiome start-ups and the funding they got till 2024. The growth of these companies is directly going to promote the growth of the microbial testing service market because these companies are going to conduct microbial testing on daily basis.

The pharmaceutical industry is growing significantly due to the growing prevalence of infectious diseases, chronic conditions, and geriatric population. The microbial testing service market will grow in the future with the growth of the pharmaceutical industry. Microbial testing is conducted to ensure the safety of patients during the development of therapeutic drugs, vaccines, kits, and reagents. Microbial testing is also done during the production of biologics, post-sterilization, and after packaging. Microbial testing is mandatory in order to maintain the Good Manufacturing Practices (GMP) proposed by WHO.

The growth of the market is limited up to some extent by the high cost of microbial testing services. The cost is of testing is high due to the use of equipment with advanced technology and demand for skilled staff. Without these two requirements, the chances of human errors increase, leading to false results. With technological advancements and the integration of AI & machine learning, the equipment is getting more advanced and expensive. Training sessions are also needed to train the professionals to use the advanced equipment, which further increases the cost of the services.

The rising prevalence of chronic disorders and the increasing number of surgeries necessitate the use of medical devices. Medical devices perform numerous functions, from diagnosis to cure, for different chronic disorders. Technological advancements lead to the development of innovative medical devices. Stringent regulations establish specific guidelines for microbial testing to ensure that products are safe. Regulatory agencies approve novel medical devices or existing devices for novel use only after assessing microbial test results.

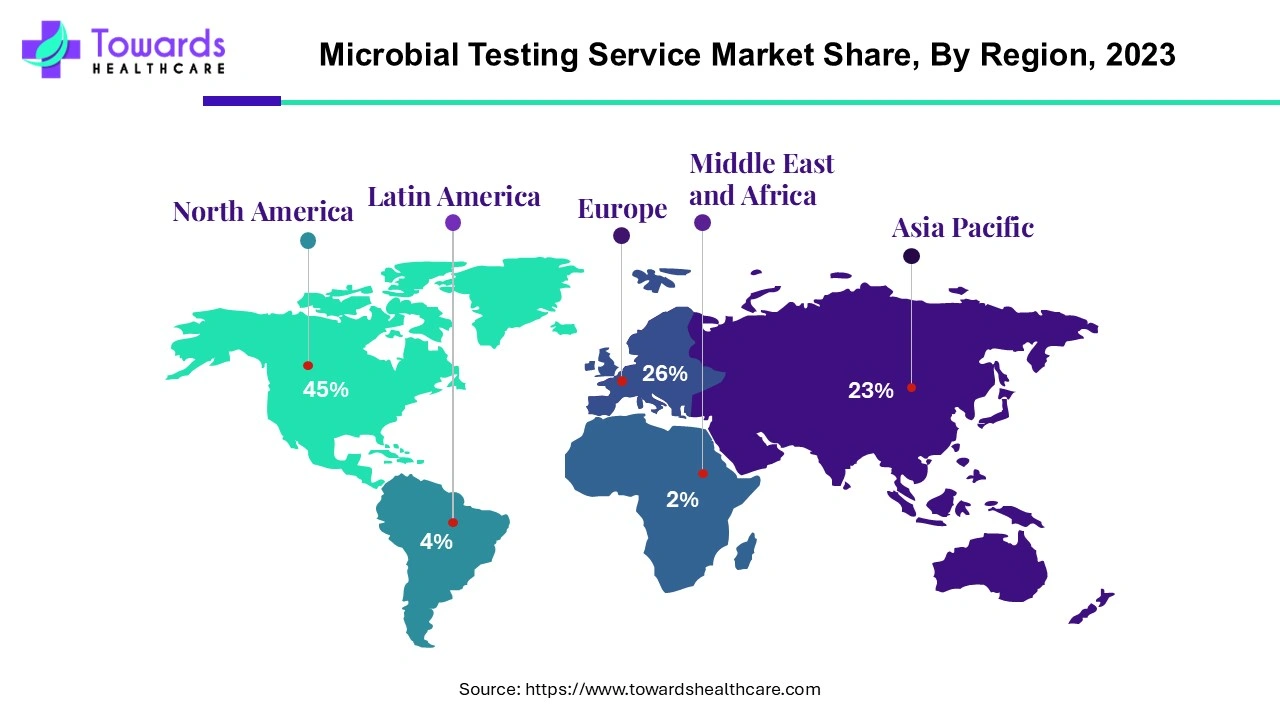

North America dominated the microbial testing service market share by 45% in 2023. One of the major factors contributing to the market’s growth in the region is the presence of pharmaceutical and biotechnology companies. These companies use microbial testing services during development & testing of therapeutics drugs, making of vaccines, development and analysis of genetically modified microorganisms, testing of new treatment procedure, and so on.

The U.S. held the largest share of the microbial testing service market in 2023. The country has advanced healthcare, pharmaceutical, and biotechnology sectors. There are organization like FDA that promote the growth of the market in the U.S. by providing guidelines, and investments for innovation and research. There is a strong presence of organizations that use microbial testing for maintaining GMPs.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The microbial testing service market is growing rapidly in the region due to the growing prevalence of infectious diseases. The region has the largest population which further increases the number of patients. Countries like China, India, South Korea, and Japan are the major contributors for the market’s growth. India and China have the largest population which increases the demand for therapeutics and drugs. China has the second-largest and India has the third-largest pharmaceutical industry worldwide.

Apart from this, the governments are also taking initiates to improve the healthcare industry. These initiatives include investments, awareness program, support to start-ups, healthcare programs in remote areas, production of vaccines and medicines for exporting, and programs for free vaccines. All these initiatives use microbial testing to maintain GMPs.

For instance,

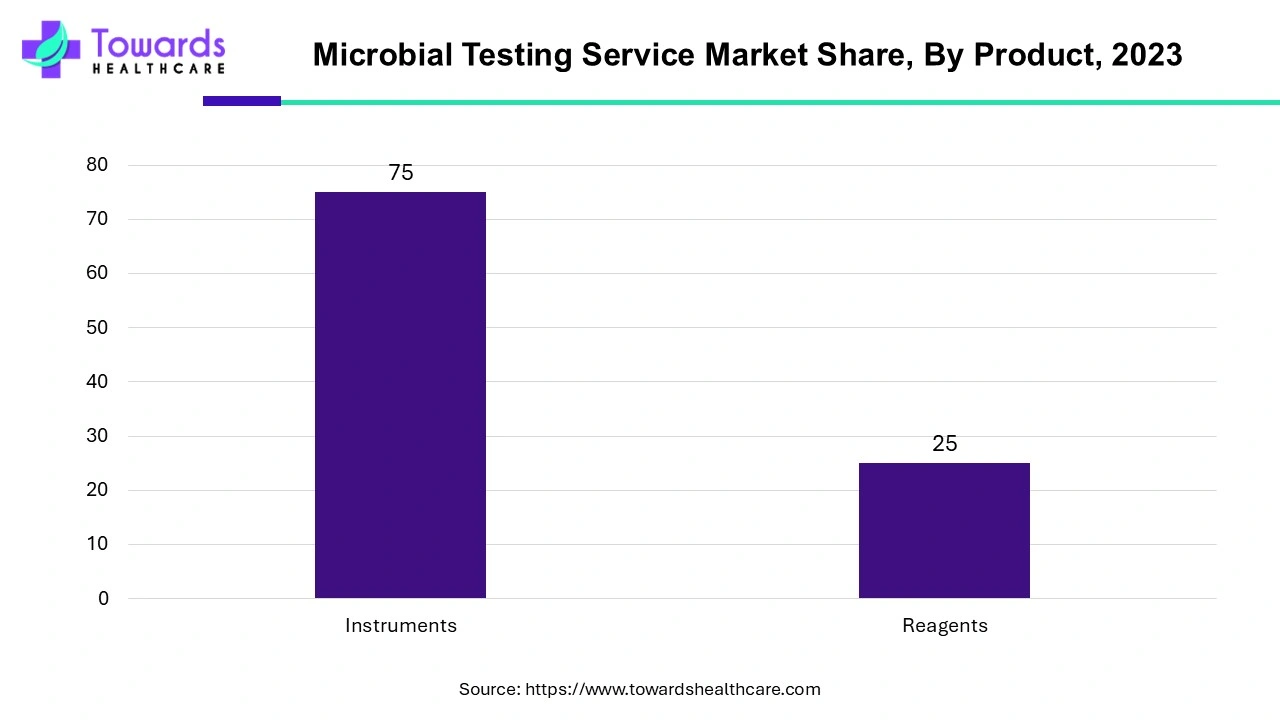

By product, the instruments segment dominated the market. This segment dominated due to advancements in technology and advanced services. Microbial service instruments include microscopes, slides, incubators, centrifuge, autoclaves, pH meter, colony counter, Bunsen burner and so on. These instruments are automated, semi-automated or manual. Each instrument is needed for conducting proper microbial service.

By test type, the bacterial segment held the major share of the market. The segment is dominant because bacterial testing is conducted in hospitals, pharmaceutical industries, biotechnology industries, and diagnostics labs to ensure that products, and surfaces are free of bacteria. Its is essential for ensuring patient safety. Apart from this the growing prevalence of infectious diseases caused by bacteria promote the segment’s growth.

By application, the gastrointestinal diseases segment dominated the microbial testing service market. This is due to the rising prevalence of digestive disorders. Worldwide, digestive illnesses are quite common, can be deadly, and cause a great deal of suffering. A significant portion of health care cost and consumption is attributed to digestive illnesses (1,2). The productivity and quality of life of patients are also impacted by several of these illnesses (3). Over 40 million people in the US suffer from digestive disorders, which also result in millions of clinical visits each year and $119.6 billion in medical expenses.

By end-user, the hospitals segment held the largest share of the market. This is due to the availability of favorable infrastructure and the presence of skilled professionals. In hospitals microbial testing is conducted after sterilization of broths and mediums for growing culture, for diagnosis microbial disease/infection, for developing proper treatment option, for avoiding development of hospital-based infections, and during pandemics.

Dr. Anirvan Chatterjee, Co-founder at HayStack Analytics, commented that the company is amongst the few deeptech startups that focus on enabling a judicious use of antibiotics by adding key RNA viruses to the existing comprehensive NGS-based infexn test, contributing to faster and better treatment outcomes. (Source: Finance Express)

By Product

By Test Type

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026