January 2026

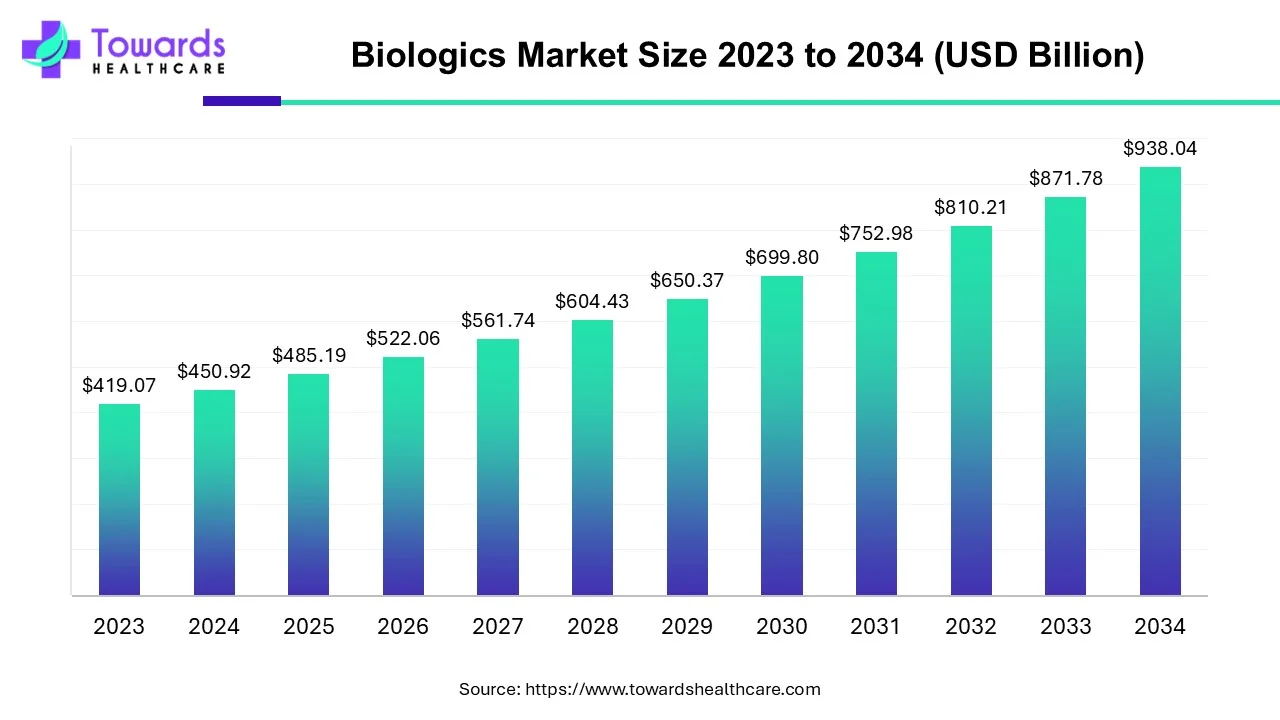

The biologics market size is projected to reach USD 1009.33 billion by 2035, growing from USD 522.06 billion in 2026, at a CAGR of 7.6% during the forecast period from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 522.06 Billion |

| Projected Market Size in 2035 | USD 1009.33 Billion |

| CAGR (2026 - 2035) | 7.6% |

| Leading Region | North America |

| Market Segmentation | By Source, By Product, By Disease Category, By Manufacturing, By Region |

| Top Key Players | Amgen, Merck & Co., F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb, Sanofi, Bayer AG, AstraZeneca, GlaxoSmithKline Plc., Novartis AG, Eli Lilly and Company |

The American Cancer Society estimates 1.92 million new cancer cases and 609,360 deaths in the U.S., contributing to a global toll of 9.6 million lives lost in 2022. Biologics, monoclonal antibodies, and immunotherapies revolutionize cancer care, boosting survival and minimizing side effects.

Biologics are therapeutic products derived from living organisms or their components, such as cells, proteins, or nucleic acids. Unlike traditional drugs, which are often chemically synthesized, biologics are typically large and complex molecules produced using advanced technologies like genetic engineering. This complexity allows them to closely mimic the natural substances in the human body, making them more targeted and specific in their actions. One significant aspect of biologics is their role in treating diseases at the molecular and cellular levels. They are designed to interact with specific biological pathways and mechanisms, making them highly effective in addressing the underlying causes of various diseases. This targeted approach can result in better treatment outcomes and, in many cases, fewer adverse effects than conventional drugs.

The application of biologics spans a wide range of therapeutic areas. One prominent example is their use in oncology. Monoclonal antibodies, a biologic, have revolutionized cancer treatment by selectively targeting cancer cells while sparing healthy cells. This targeted action helps minimize damage to surrounding tissues and reduces side effects commonly associated with traditional chemotherapy. In autoimmune disorders, where the immune system mistakenly attacks the body's tissues, biologics can modulate specific immune response components. This helps to restore the balance and alleviate symptoms without suppressing the entire immune system, as is often the case with conventional treatments.

The growth of the biologics market is fueled by ongoing advancements in biotechnology, such as improved techniques for protein engineering and manufacturing processes. These innovations enable the development of novel and more sophisticated biological therapies. It's important to note that biologics often come with higher production costs and can be more challenging to manufacture than small-molecule drugs. This can result in higher prices for biological treatments. Despite this, the demand for biologics continues to rise due to their ability to provide effective and often life-changing solutions for patients facing various health challenges.

Additionally, the biologics market represents a transformative shift in medicine, offering targeted and personalized treatments that leverage the body's natural processes to address diseases at their roots. As research and development in biotechnology advance, we can expect further innovations and an expanding role for biologics in improving healthcare outcomes across diverse therapeutic areas.

| Regulatory Agency | 2023 | 2024 |

| FDA | 17 | 18 |

| NMPA | 22 | 20 |

| EMA | 18 | - |

Artificial intelligence (AI) is poised to transform the biologics market by enhancing various stages of drug development and manufacturing. AI's integration promises to accelerate the discovery of biologics, including monoclonal antibodies and vaccines, by analyzing large datasets to identify promising candidates and predict their efficacy. Machine learning algorithms can streamline the drug discovery process, reducing time and cost while improving accuracy.

In clinical trials, AI enhances patient recruitment by analyzing electronic health records and genetic data to identify suitable candidates, thus improving trial efficiency and success rates. AI also optimizes trial design and predicts patient responses, minimizing risks and enhancing data analysis.

During biologics production, AI-driven automation and predictive analytics improve process control and yield optimization. AI systems can monitor production processes in real-time, detect anomalies, and adjust parameters to maintain product quality. Additionally, AI aids in personalized medicine by analyzing patient data to tailor biologic therapies to individual needs, further expanding market opportunities.

For instance,

The demand for biologics, which target specific pathways and cells in tough-to-treat areas like cancer and rare diseases, is on the rise. New modalities such as mRNA are broadening the scope of treatments available to patients and healthcare professionals. However, the high costs associated with developing these drugs often make them less affordable. This is where biosimilars come in. They provide similar treatments at a lower cost, helping patients and healthcare systems save money and allowing resources to be redirected to other areas of patient care.

Over the next decade, more than 55 blockbuster drugs, each with peak sales exceeding $1 billion, are expected to lose their exclusivity. This will likely spur increased competition among biosimilar companies. In this competitive landscape, being quick to market and keeping development costs low will be crucial for success. However, as biosimilars start targeting more complex molecules and technological platforms, R&D expenses are expected to increase. This means that companies will need to focus even more on cost management to ensure their businesses remain sustainable.

In 2023, the World Health Organization (WHO) revealed that globally, 41 million people die each year due to Noncommunicable Diseases (NCDs), accounting for 74% of worldwide deaths. The leading causes of NCD-related deaths include cardiovascular diseases (17.9 million annually), cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, which includes deaths from diabetes-induced kidney disease). The escalating prevalence of chronic diseases, such as cancer, autoimmune disorders, and diabetes, has spurred a surge in demand for effective and innovative treatment solutions worldwide. These persistent health conditions necessitate ongoing and targeted medical interventions, propelling the growth of the biologics market.

Biologics, crafted to interact with specific biological pathways within the body, exemplify their efficacy in managing the complexities of chronic diseases. In cancer treatment, they exhibit precision by targeting and inhibiting the growth of cancer cells. At the same time, in autoimmune disorders, they modulate the immune response to alleviate inflammation and prevent damage to healthy tissues. This targeted approach sets biologics apart from traditional drugs, offering precision and effectiveness that mitigates side effects often associated with broader-acting medications. As awareness of available treatment options grows, there is a rising patient demand for innovative therapies. Biologics' unique ability to address specific disease mechanisms aligns with these expectations, driving their adoption. Additionally, the long-term management requirements of chronic diseases find a fitting solution in biologics, as their targeted mechanisms of action make them well-suited for sustained use.

The economic and social impact of the increasing burden of chronic diseases on healthcare systems underscores the urgency to find effective treatments that not only improve patient outcomes but also alleviate the overall economic strain. This imperative has fueled substantial investments in research and development within the biopharmaceutical industry, with pharmaceutical companies actively exploring and developing new biologics to meet the unmet medical needs associated with chronic diseases. In essence, the pervasive prevalence of chronic diseases is a pivotal factor propelling the biologics market forward, driven by the pressing demand for advanced, effective, and targeted treatments to address the challenges posed by these persistent health conditions.

The growing patient demand for innovative treatments, particularly in chronic health conditions, is a multifaceted trend shaped by several key factors. As individuals become more informed about available treatment options, they increasingly seek therapies that offer effectiveness, innovation, and personalization.

The advent of biosimilars has introduced a significant challenge to the established biologics market. Biosimilars, while similar in function to existing biologics, are different, and their entry into the market poses a threat to the market share and profitability of originator biologic manufacturers. Often entering the market at lower prices, biosimilars create pricing pressures that force original biologic manufacturers to reconsider their pricing strategies.

This intensified competition can result in a shift in consumer preferences and market dynamics as biosimilars gain acceptance. To navigate this challenge, biologic manufacturers must strategically adapt their approaches, potentially exploring innovations and new formulations or emphasizing superior efficacy and safety. Furthermore, educating healthcare professionals and patients about the unique benefits and proven track record of original biologics becomes crucial to maintaining trust and market presence. Legal considerations, such as protecting intellectual property and managing patent challenges, add another layer of complexity to the competitive landscape. Overall, the biosimilar challenge compels biologic manufacturers to engage in strategic initiatives to preserve their market position, emphasizing the need for adaptability and differentiation in the evolving pharmaceutical landscape.

By disease category, the oncology segment held a dominant presence in the market in 2024, due to the rising prevalence of cancer and growing research activities. Biologics treat oncology disorders by providing targeted action, resulting in fewer side effects. They offer superior advantages over conventional drugs and prevent cancer recurrence. The availability of biosimilars reduces economic burden on patients and their families due to cancer.

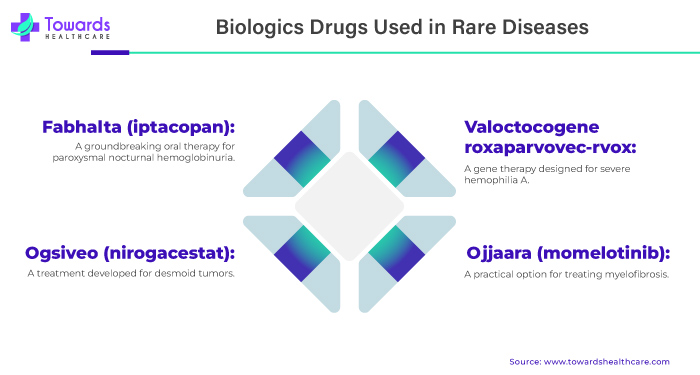

By disease category, the hematological disorder segment is expected to grow at the fastest CAGR in the market during the forecast period. Hematological disorders, such as certain inherited blood disorders, anemia, and hemophilia, pose a significant health burden on humans. Biologics can cure hematological disorders from their root cause. Thus, healthcare professionals prescribe blood and blood products to treat hematological disorders, blood cancer, and neurological disorders by removing harmful antibodies from the body.

By source, the microbial segment held the largest revenue share of the market in 2024, due to advances in genetic engineering techniques and cellular biologics. Biologics are isolated from microorganisms, such as bacteria, fungi, and microalgae, using biotechnology methods and other cutting-edge technologies. Products, such as recombinant insulin, platelet-derived growth factor, and recombinant interferons, are some biologics that are derived from microbes.

By source, the mammalian expression systems segment is expected to grow with a significant CAGR in the market during the studied years. Mammalian expression is the system for studying the function of a particular protein in the most physiologically relevant environment. Mammalian-expressed biologics account for the greatest percentage of candidates in the biopharma pipeline. This is due to advances in cell-line development and cell culture technologies.

By manufacturing, the in-house segment contributed the biggest revenue share of the market in 2024, due to the availability of favorable infrastructure and suitable venture capital investments. Investments allow biopharmaceutical companies to adopt advanced technologies for biologics research and manufacturing. In-house manufacturing enables manufacturers to provide complete control over their manufacturing process.

By manufacturing, the outsourcing segment is expected to expand rapidly in the market in the coming years. Small- and mid-sized biopharma companies lack sufficient infrastructure, necessitating them to outsource their research and manufacturing activities to contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs). CROs/CDMOs have skilled professionals that provide relevant expertise and customized solutions to complex problems.

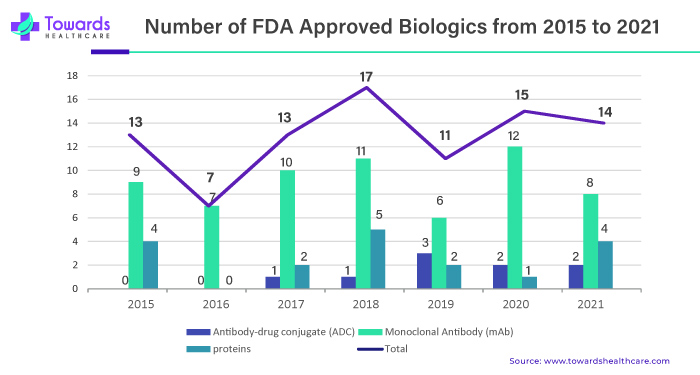

By product, the monoclonal antibodies segment led the market in 2024, due to the growing need for immune-modulatory agents. Monoclonal antibodies (mAbs) are proteins that bind to a specific antigen responsible for disease progression. They are widely used due to their high specificity and selectivity, fewer side effects, and a longer half-life. The recent surge in FDA approval of mAbs has potentiated their demand. In 2024, the U.S. Food and Drug Administration (FDA) approved a total 13 mAbs, out of 16 biologics.

By product, the antisense and RNAi therapeutics segment is expected to witness the fastest growth in the market over the forecast period. Antisense and RNAi therapeutics are emerging as prominent biologics for the treatment of various disorders, such as neurodegenerative disorders, genetic diseases, and respiratory disorders. They offer numerous advantages, including higher affinity due to chemical modifications, more stability, and reduced side effects due to off-target effects.

Several factors contribute to the growth of the biologics market in North America. One key reason is the high number of people dealing with long-term health issues. North America has many top biopharmaceutical companies, and the reimbursement policies for these advanced therapies are favorable. The use of biological prescriptions is increasing, and a lot of money is invested in developing targeted drugs, which is helping the market grow. Additionally, the approval of new and innovative biological drugs, like gene therapy and RNAi therapeutics, is expected to push the market further. In the North American map, places like Boston, San Francisco, and San Diego stand out as central hubs for these advancements, with numerous biotech companies, research centers and clinical trial sites contributing to the region's prominence in the biologics landscape.

The Center for Biologics Evaluation and Research (CBER) regulates the approval of biologics in the U.S. The growing demand for biosimilars is likely to dominate the market. According to the IQVIA report, expected launches and uptake could increase the overall spending on biosimilars to $20-$49 billion in 2027, with cumulative sales of $129 billion over five years.

Health Canada regulates the safety and effectiveness of biologics, including vaccines and biotechnology products. From 2020 to 2025, the Government of Canada invested more than $2.3 billion across 41 projects in the biomanufacturing, vaccine, and therapeutics ecosystem.

The geographical landscape of the biologics market in the Asia-Pacific (APAC) region has been dynamic and characterized by growth. Japan's well-established pharmaceutical industry has been a critical player in the APAC biologics market. The country has a robust regulatory framework and has seen the development and approval of various biologic drugs. India has a strong presence in the generic pharmaceutical market, and the biologics sector has been gaining traction. The country's biotech industry has been expanding, focusing on biosimilars. The COVID-19 pandemic has influenced biologics, with increased attention to biopharmaceutical research and vaccine and treatment development.

China has around 870,000 liters of active production capacity of biopharmaceuticals, ranking fifth in the world. China ranks second in terms of the total number of biopharmaceutical manufacturing facilities, accounting for 209 facilities.

India has 941,000 liters of active production capacity of biopharmaceuticals. India provides much of the world’s demand for biogenerics. The total annual turnover of pharmaceuticals in FY2024 was Rs 4.17 lakh crore, growing at an average rate of 10.1% in the last five years. India’s pharmaceutical exports are expected to grow from $27 billion in 2023 to $65 billion by 2030.

The presence of established pharmaceutical companies and emerging biotechnology firms characterize the competitive landscape of the biologics market. The landscape is dynamic, with ongoing research and development, collaborations, mergers, and acquisitions shaping the industry. Companies often engage in collaborations and partnerships to enhance their biologics pipelines. Collaborations between big pharmaceutical and smaller biotech firms are typical for developing novel therapies. Mergers and acquisitions are prevalent in the biologics sector, allowing companies to expand their portfolios and strengthen their positions. The competitive landscape is influenced by product innovation, clinical trial success, regulatory approvals, and market expansion strategies.

| Company Name | Kodiak Sciences Inc. |

| Headquarters | California, U.S. |

| Recent Launch |

The following biologics are in the pipeline:

|

The latest research of biologics is driven by advancements in genetic engineering techniques, leading to the development of innovative products.

Key Players: Twist Bioscience, Biocon Biologics, and WuXi Biologics.

Clinical trials are conducted to assess the safety and efficacy of biologics and identify their expanded application, which are then subsequently approved by regulatory agencies.

Key Players: MedPace, Syneos Health, Lindus Health, and Parexel.

Biologics are distributed to patients, healthcare professionals, and retail pharmacies through distributors or wholesalers.

Key Players: BioLogic, HC Biologics, and Millenium Science.

By Source

By Product

By Disease Category

By Manufacturing

By Region

January 2026

January 2026

January 2026

January 2026