February 2026

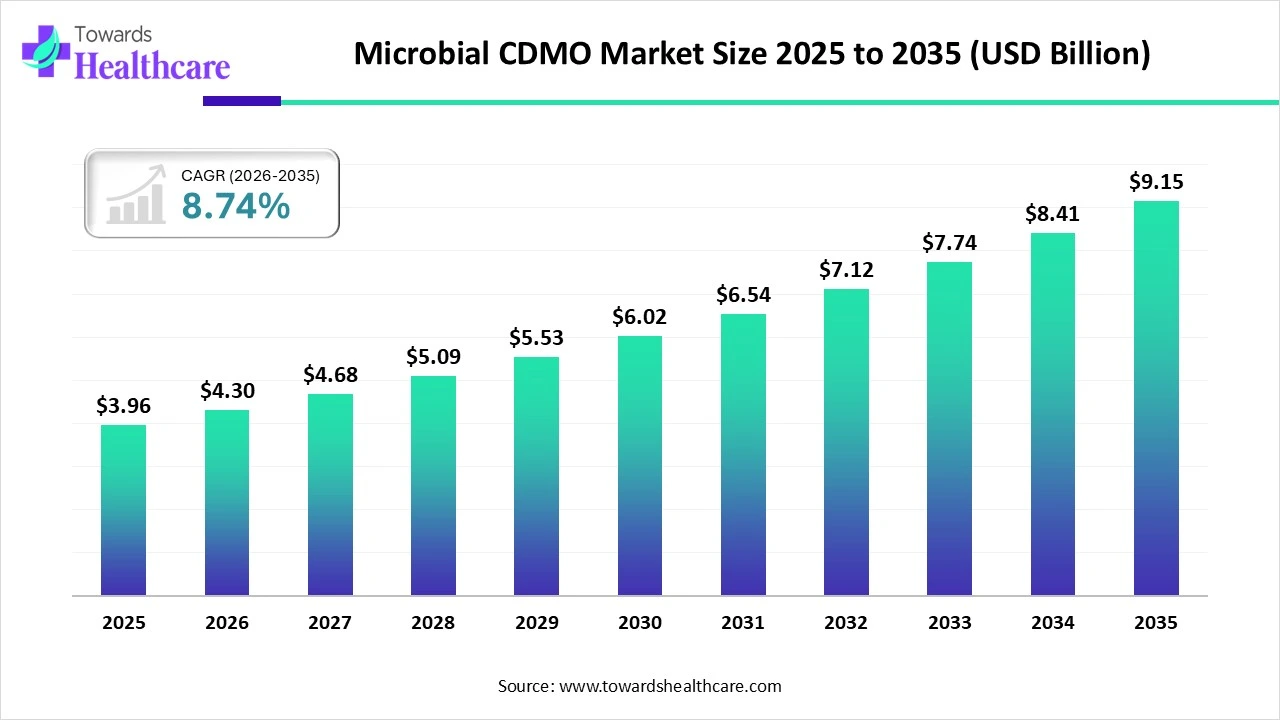

The global microbial CDMO market size was estimated at USD 3.96 billion in 2025 and is predicted to increase from USD 4.3 billion in 2026 to approximately USD 9.15 billion by 2035, expanding at a CAGR of 8.74% from 2026 to 2035.

The market is growing steadily as drug developers rely on specialized partners for efficient microbial-based manufacturing of biologics, vaccines, and complex therapeutic products.

A microbial CDMO is a service provider that develops and manufactures biologics using microbial systems on behalf of pharmaceutical and biotechnology companies. The microbial CDMO market is expanding as biopharmaceutical companies outsource manufacturing to improve efficiency and reduce capital investment. Microbial platforms enable faster scale-up, cost-effective production, and reliable quality for biologics, vaccines, and enzymes. Growing biologics pipelines, capacity constraints within companies, and increasing regulatory complexity are further encouraging partnerships with specialized microbial CDMO providers.

| Year | Metric | Value/Statistic |

| 2024 | Total vaccine doses delivered globally | 2.78 billion doses |

| 2024 | Global infant coverage (DTP-1) | 89% |

| 2024 | Global infant coverage (DTP-3) | 85% |

| 2024 | Potential reduction in antibiotic use due to vaccines | Up to 2.5 billion doses annually |

| 2025 | Number of antibiotic resistance cases reported globally | >23 million infection cases analyzed |

| 2024 | Percentage of the U.S. population receiving ≥1 antibiotic | 44% |

Artificial intelligence is transforming the microbial CDMO market by optimizing strain development, fermentation parameters, and process scale-up through data-driven insights. AI-enabled analytics reduce development timelines, improve yield consistency, and minimize production failures. Predictive modeling also supports quality control and regulatory compliance, allowing microbial CDMOs to deliver faster, more cost-efficient, and reliable manufacturing solutions to biopharmaceutical companies.

| Key Elements | Scope |

| Market Size in 2026 | USD 4.3 Billion |

| Projected Market Size in 2035 | USD 9.15 Billion |

| CAGR (2026 - 2035) | 8.74% |

| Leading Region | North America by 41.5% |

| Market Segmentation | By Molecule Type, By Expression System, By End-User, By Region |

| Top Key Players | Lonza Group AG, Fujifilm Diosynth Biotechnologies, AGC Biologics, Thermo Fisher Scientific, Boehringer Ingelheim, WuXi Biologics |

Why Did the Recombinant Proteins Segment Dominate in the Market in 2025?

The recombinant proteins segment dominated its microbial CDMO market with a share of approximately 45.0% in 2025 because these proteins are widely used in therapeutics, diagnostics, and industrial enzymes. Microbial hosts like E coli and yeast enable efficient, high-yield production at lower cost. Established processes, strong demand for biologic drugs, and scalable fermentation capacity made recombinant protein manufacturing the largest and most mature service category in the market.

Plasmid DNA

The plasmid DNA segment is projected to grow at the fastest CAGR of approximately 16.4% due to rising use in gene therapy, cell therapy, and vaccine development. Increasing clinical trials and commercialization of genetic medicine are boosting demand for high-purity plasmid DNA. Limited in-house capabilities and complex manufacturing requirements are encouraging companies to outsource plasmid production to specialized microbial CDMOs, accelerating market growth during the forecast period.

How the Bacterial Systems Segment Dominated the Microbial CDMO Market in 2025?

The bacterial systems segment dominated the market with a revenue share of approximately 68% in 2025 because bacteria are easy to culture, grow fast, and deliver high yields at low cost. Their well-established processes and broad use of producing recombinant proteins and enzymes make them preferred for large-scale manufacturing. This efficiency and cost advantage helped bacterial systems lead this market over other expression platforms.

Engineered Yeast

The engineered yeast segment is expected to grow at the fastest CAGR of approximately 13.1% because yeast systems combine easy cultivation with the ability to produce complex proteins and post-translationally modified products. Their versatility and higher yields make them attractive for vaccines, biopharmaceuticals, and industrial enzymes. As demand grows for advanced biologics with human-like structure, more companies are choosing yeast platforms, driving rapid expansion in this segment.

Why the Antibiotics/Vaccines Segment Dominated the Microbial CDMO Market?

The antibiotics/vaccines segment dominated the market with a considerable revenue share of approximately 41% due to strong global demand for infectious disease treatments and prevention therapies. Microbial systems are widely used for producing antibiotics and vaccine components at large scale with consistent quality. Rising antimicrobial resistance, routine immunization programs, and increased vaccine development have driven biopharmaceutical companies to rely heavily on microbial CDMOs for efficient, compliant manufacturing support.

Gene Therapy/mRNA Feedstock

The gene therapy/mRNA feedstock segment is expected to grow at the fastest CAGR of approximately 15.8% because gene-based treatments and mRNA vaccines are rapidly advancing into clinical and commercial stages. These applications require high-quality microbial production of key genetic materials and supporting components. Increasing investment in precision medicine, expanding therapeutic pipelines, and the need for scalable, compliant manufacturing are driving strong demand in this application market.

What Made the Big Pharma Segment Dominate in the Microbial CDMO Market in 2025?

The big pharma segment dominated the market with a revenue share of approximately 54% in 2025 because large pharmaceutical companies rely on external manufacturing to optimize costs, access specialized microbial expertise, and scale production efficiently. With extensive biologics and vaccine pipelines, big pharma firms leveraged CDMOs to meet regulatory standards and tight timelines. Their substantial outsourcing budget and long -term partnerships ensured they remained the largest end-user group in the market.

Biotech Startups

The biotech startups segment is expected to grow at the fastest CAGR of approximately 14.2% because emerging companies are rapidly advancing novel therapies and biologics that require flexible, outsourced manufacturing support. Startups often lack in-house production capacity and turn to microbial CDMIs for expertise, scalability, and cost control. Increased funding for innovative biotech research and strategic partnerships with CDMOs are fueling strong segment growth during the forecast period.

Strong Biopharma Ecosystems Driving North America’s Market Leadership

North America dominated the global microbial CDMO market in 2025 with approximately 41.5% share due to its well established biopharmaceutical industry, strong outsourcing culture, and advanced manufacturing infrastructure. The region hosts numerous leading CDMOs and biopharma companies with high demand for biologics, vaccines, and genetic materials. Favorable regulatory framework, robust R&D investment, and early adoption of advanced microbial technologies further reinforced North America’s leading market position.

U.S. Market Trends

The U.S. led the microbial CDMO Market in 2025 by capturing the largest revenue share due to its strong biopharmaceutical presence and high outsourcing adoption. Extensive biologics pipelines, significant R&D spending, and the availability of advanced microbial manufacturing facilities supported market growth. Additionally, the presence of major CDMOs, skilled workforce, and a well-defined regulatory environment enabled efficient commercialization, reinforced the U.S. as the dominant revenue -generating market.

Asia Pacific is expected to grow at the fastest CAGR due to expanding biopharmaceutical manufacturing, rising outsourcing to cost-efficient CDMOs, and increasing investment in biologics and vaccines. Growing biotech activity, improving regulatory frameworks, and expanding production capacity in countries such as China, India, and South Korea are attracting global partnerships. Additionally, a large patient population and strong government support for life sciences are accelerating microbial CDMO market growth across the region.

India Market Trends

India is anticipated to grow at a rapid CAGR due to its strong pharmaceutical manufacturing base and increasing adoption of outsourcing by global biopharma companies. competitive production cost, skilled scientific workforce, and expanding microbial fermentation capabilities are attracting international partnerships. Government initiatives supporting biotechnology, rising domestic biologics demand, and improving regulatory standards are further accelerating India’s growth in the microbial CDMO market during the forecast period.

Europe is expected to grow at a notable CAGR due to rising investment in biologics, vaccines, and advanced therapies across the region. Strong regulatory standards, growing outsourcing by pharmaceutical companies, and the presence of established CDMOs support market expansion. Additionally, increasing collaborations between biotech firms and contract manufacturers, along with government support for life sciences innovation, are driving steady growth of the microbial CDMO market in Europe during the forecast period.

UK Market Trends

The UK is anticipated to grow at a rapid CAGR due to its strong biotechnology ecosystems and increasing focus on biologics and advanced therapies. Rising R&D activity, supportive government funding, and a growing number of biotech startups are boosting demand for outsourced microbial manufacturing. Additionally, the presence of skilled talent, established regulatory frameworks, and expanding CDMO collaborations are accelerating the adoption of microbial CDMO services across the UK during the forecast period.

| Companies | Headquarters | Offerings |

| Lonza Group AG | Basel, Switzerland | Provides development and manufacturing services, including microbial expression systems and scalable GMP production, as part of its biologics CDMO portfolio |

| Fujifilm Diosynth Biotechnologies | Morrisville, North Carolina | Global CDMO that develops and manufactures biopharmaceuticals, including microbial-derived products, process development, and fillfinish services. |

| AGC Biologics | Washington, USA | Offers microbial fermentation development and GMP manufacturing, including protein expression, plasmid DNA, and other microbial biologics services. |

| Thermo Fisher Scientific | Massachusetts, USA | Through its Patheon brand, delivers microbial and biologics development, formulation, and manufacturing services across clinical and commercial stages. |

| Boehringer Ingelheim | Ingelheim, Germany | Offers contract development and manufacturing for biopharmaceuticals, including microbial and yeast fermentation production at global sites like Shanghai |

| WuXi Biologics | Jiangsu, China | A global CRDMO providing microbial and other biologics manufacturing, with facilities in China, Europe, and the U.S., supporting recombinant proteins, plasmid DNA, vaccines, etc |

By Molecule Type

By Expression System

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026