February 2026

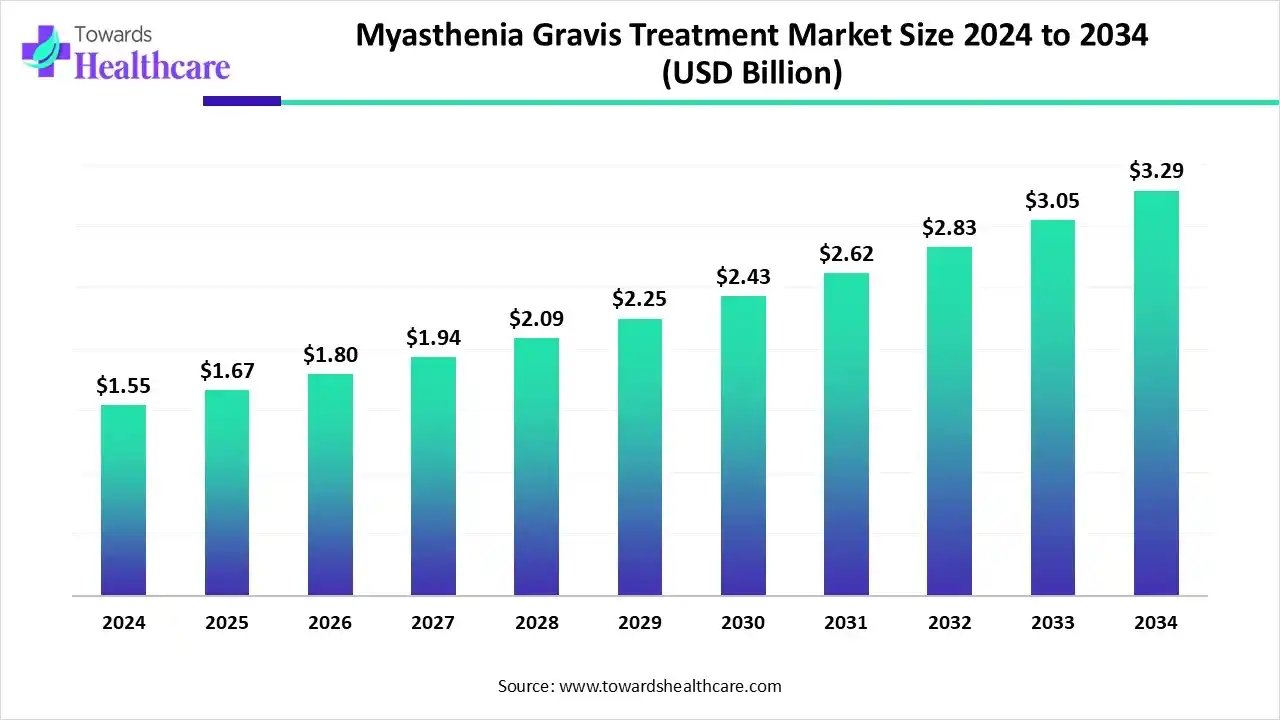

The global myasthenia gravis treatment market size is estimated at US$ 1.55 billion in 2024 and is projected to grow to US$ 1.67 billion in 2025, reaching around US$ 3.29 billion by 2034. The market is projected to expand at a CAGR of 7.84% between 2025 and 2034.

The myasthenia gravis treatment market is growing because of the rising rate of diagnostics, increasing prevalence disease, and recent advancements in targeted therapy. Increasing awareness and continuing research lead to efficient and personalized treatment choices. North America is dominant in the market due to the presence of a strong patient base and adoption of advanced technologies, while the Asia-Pacific is the fastest growing in the market as it increases government support for healthcare services.

| Table | Scope |

| Market Size in 2025 | USD 1.67 Billion |

| Projected Market Size in 2034 | USD 3.29 Billion |

| CAGR (2025 - 2034) | 7.84% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Distribution Channel, By Region |

| Top Key Players | AbbVie Inc., F.Hoffmann-La Roche AG, GlaxoSmithKline Plc., Bausch Health Companies Inc., Shire plc |

The myasthenia gravis treatment market is expanding as increasing focus on advanced therapies for this autoimmune neuromuscular disease. The market is significantly driven by the rising prevalence of myasthenia gravis, increasing awareness of the disease, and modern advancements in diagnostic and treatment choices, particularly for targeted therapies. There’s no exact cure for myasthenia gravis. But efficient treatment is available to support managing the patient’s symptoms, like medications, plasma exchange, monoclonal antibodies, IV or SQ immunoglobulin, and surgery. The mainstay of treatment in MG includes immunosuppressive agents and cholinesterase enzyme inhibitors.

Integration of AI in myasthenia gravis treatment drives the growth of the myasthenia gravis treatment market, as AI-driven technology includes a wide spectrum of technologies, with expert systems, natural language processing, machine learning, and computer vision. In all this technology, machine learning has developed as a compelling challenge in predicting and disease management diseases, demonstrating excellent utility in addressing multifaceted and heterogeneous healthcare conditions. Machine learning algorithms provide various advantages over outdated statistical approaches by processing high-dimensional data, capturing complicated inter-variable relationships, and uncovering hidden prognostic patterns which is conventional strategies fail to identify.

Increasing awareness about myasthenia gravis in people is also leading to significant research about the disease, which contributes to the growth of the myasthenia gravis treatment market.

For instance,

Increasing approval of novel treatment to manage myasthenia gravis by the government, which drives the growth of the market.

For Instance,

| Company | Approval |

| Johnson & Johnson | In April 2025, Johnson & Johnson received FDA approval for IMAAVYTM, a novel FcRn blocker providing long-lasting disease control in the broadest population of people living with generalized myasthenia gravis (gMG) |

| Argenx | The US Food and Drug Administration (FDA) approved a new option for patients to self-inject VYVGART® Hytrulo with a prefilled syringe. |

| RemeGen | RemeGen announced positive Phase 3 results for its MG therapy, telitacicept (RC18), with government approval anticipated in China |

In drug class, the IVIg segment led the myasthenia gravis treatment market, as it is an exclusive and generally used immunotherapy for patients with an exacerbation of MG, but its efficiency has only recently been established in a randomized clinical trial. It is also used in double-blind, randomized, placebo-controlled trials intended to ultimately determine if IVIG has advantages for patients with MG who present with worsening weakness. IVIg has massive efficacy compared to PLEX in the therapy of patients with moderate to severe MG.

On the other hand, the monoclonal antibodies segment is projected to experience the fastest CAGR from 2025 to 2034, as it is conventional treatments and plasma exchange reduce autoantibody levels to produce their therapeutic effect, although prednisone and immunosuppressive do so by controlling antibody production. The widespread advances in monoclonal antibody technology, enabling particular modulation of biological pathways, have led to a tremendous increase in the latent treatment choices.

By distribution channel, the hospital pharmacies segment led the myasthenia gravis treatment market in 2024, as hospital pharmacy is a great source of advice for patients. This type of pharmacy provides data on potential adverse effects and checks that medicines are well-suited for presenting medication. They frequently monitor the effects of treatments to confirm that they are showing effective, appropriate, and safe for the user. As hospital pharmacies are required to work closely with other members of staff, like physicians, dieticians, and nurses, information is passed on in a way that is clear to appreciate.

On the other hand, the online pharmacies segment is projected to experience the fastest CAGR from 2025 to 2034, as this pharmacy offers competitive pricing, discounts, and generic alternatives, leading to massive cost savings for patients. An online pharmacy is a simple and convenient way to purchase medicines. It is specifically advantageous for patients who live far away from drug stores. By providing a convenient opportunity for retrieving medications, online pharmacies contribute to enhancing medical care results and lowering disparities in access to vital treatments.

North America is dominant in the myasthenia gravis treatment market in 2024, due to a well-established medical care system facilitating significant access to cutting-edge treatments and a high prevalence of MG in the region, along with increasing healthcare services and diagnosis of autoimmune diseases. Rapidly adopts and integrates novel therapies such as recently approved monoclonal antibodies, such as eculizumab, efgartigimod, ravulizumab, rozanolixizumab-noli, and zilucoplan.

For Instance,

In the U.S. increasing focus on biosimilars and biologics, specifically monoclonal antibodies such as eculizumab and rituximab, because of their effectiveness in symptom lowering. Numerous novel therapies in the U.S., including complement inhibitors, FcRn inhibitors, and B-cell targeting agents, have been approved or are in late-stage clinical trials, which drives the growth of the market.

Canada has a huge aging population, and an increasing incidence of MG observed in people over 65, contributing to the growing number of patients who need treatment. Growing awareness among medical professionals and the availability of more precise diagnostic tests. The Government of Canada approved novel treatments for refractory MG, and modest to serious non-refractory MG have the potential to enhance the patient’s quality of life by lowering the intensity and frequency of symptoms.

Asia Pacific is the fastest-growing region in the myasthenia gravis treatment market in the forecast period, due to the growing cases of myasthenia gravis in many Asia Pacific countries. Growing awareness regarding neuromuscular disorders and massive development in healthcare services. Technological advancements have allowed for more precise and timely diagnosis of MG. The advancement of sophisticated antibody tests for AChR and MuSK has lowered the time to diagnosis and improved the demand for treatment, which drives the growth of the market.

The research and development (R&D) process for myasthenia gravis (MG) treatments includes a many-stage pipeline that develops from early-stage discovery to late-stage clinical trials. It contributes to drug discovery and preclinical research, and in vitro and in vivo studies.

Key Players: AstraZeneca and argenx SE

Clinical trials of myasthenia gravis (MG) treatments include controlled studies and use standardized measurement tools for patient results, with incessant monitoring continuing even after a drug is approved. It also includes a double-blind and placebo-controlled trial assessing the efficacy and safety of treatment.

Key Players: UCB and Johnson & Johnson

Different type of patient treatment services, alone or together, supports symptoms of myasthenia gravis. Medical therapies are used in MG patients for either direct alleviation of symptoms or as immunomodulatory drugs to dampen the underlying immunopathology causing the disease.

Key Players: Novartis and Mitsubishi Tanabe Pharma

By Drug Class

By Distribution Channel

By Region

February 2026

January 2026

January 2026

January 2026