March 2026

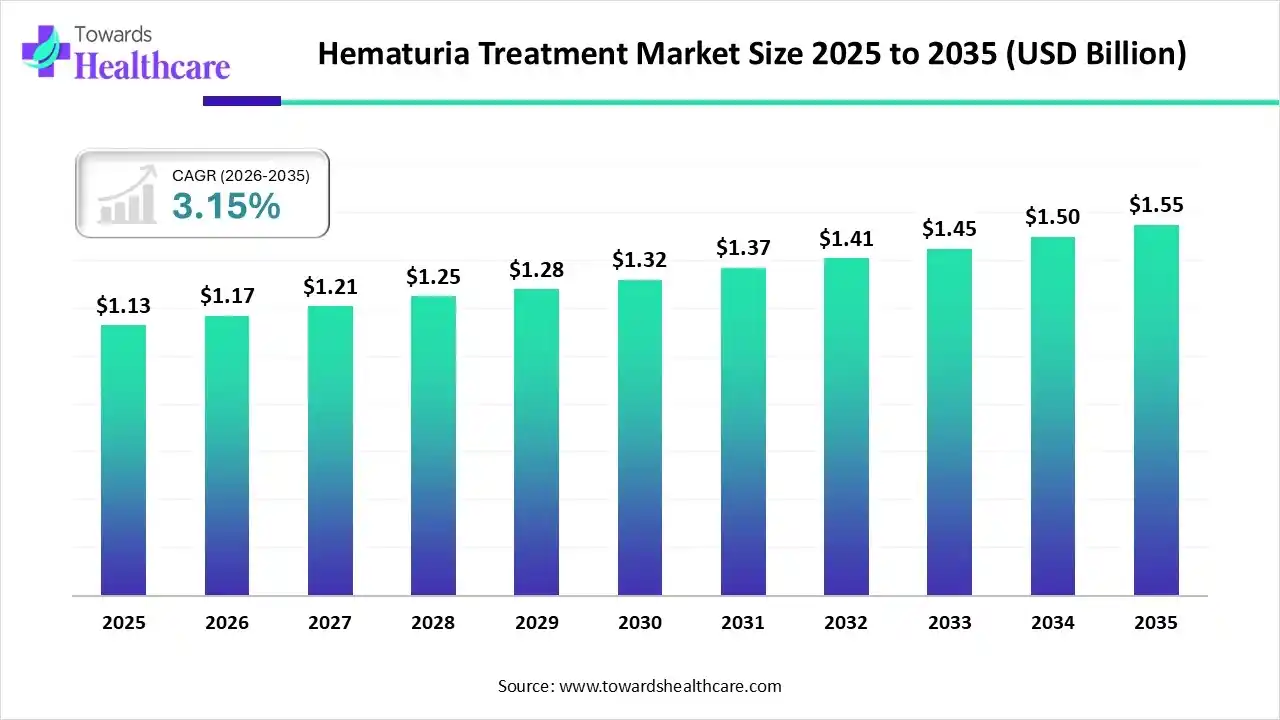

The global hematuria treatment market size is calculated at USD 1.13 billion in 2025, grew to USD 1.17 billion in 2026, and is projected to reach around USD 1.55 billion by 2035. The market is expanding at a CAGR of 3.15% between 2026 and 2035.

The hematuria treatment market is primarily driven by the increasing prevalence of urinary tract disorders and the growing awareness of early interventions. Ongoing efforts are made to develop targeted therapies for hematuria based on patients’ conditions. Artificial intelligence (AI) plays a crucial role in detecting disease stage and suggests appropriate treatment outcomes. The market future is promising, driven by the need for personalized medicines and advancements in diagnostic technologies.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.17 Billion |

| Projected Market Size in 2035 | USD 1.55 Billion |

| CAGR (2026 - 2035) | 3.15% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Type, By Causes, By Treatment, By End-User, By Region |

| Top Key Players | Jabs Biotech Pvt. Ltd., Vera Therapeutics, Apotex, Bristol Myers Squibb, Gilead Sciences, Ardelyx, Janssen Pharmaceuticals Ltd., Shorla Oncology Ltd. |

The hematuria treatment market is experiencing robust growth, driven by the increasing incidence of urinary tract disorders, biologics expansion, and advanced diagnostic technologies. It encompasses the development, manufacturing, and supply of drugs used for the treatment of hematuria. Hematuria is a condition in which blood is visible in the urine. The most common medications for hematuria treatment include antibiotics, analgesics, and hormone-related medicines.

AI is being increasingly used in hematuria treatment by assessing patients’ conditions and suggesting appropriate treatment. This helps healthcare professionals to make effective, accurate, and timely clinical decisions, thereby providing personalized treatment. AI and machine learning (ML) algorithms analyze vast amounts of patient data, enabling researchers to develop personalized, targeted medicines. They also determine the therapeutic potential and adverse effect profile of novel drug candidates. Thus, by leveraging AI in hematuria treatment, healthcare professionals can provide the right treatment to the right patient at the right time.

Which Type Segment Dominated the Hematuria Treatment Market?

The gross or macroscopic hematuria segment held a dominant position in the market in 2024, due to the high severity of macroscopic hematuria. Macroscopic hematuria affects over 19% of patients with urinary tract carcinomas. It is caused by various disorders, such as UTIs, kidney infection, bladder or kidney stone, or an enlarged prostate. It can be easily diagnosed at an early stage as blood is visible in the urine.

Microscopic Hematuria

The microscopic hematuria segment is expected to grow at the fastest CAGR in the market during the forecast period. Microscopic hematuria is a condition in which microscopic traces of blood are seen in the urine. This necessitates early diagnosis of microhematuria through urinalysis or urine microscopy. It is estimated that 3% of people who receive testing for microhematuria have cancer.

Why Did the Kidney Stones Segment Dominate the Hematuria Treatment Market?

The kidney stones segment held the largest revenue share of the market in 2024, due to the increasing incidence of kidney stones, especially in the growing geriatric population. It is estimated that kidney stones will affect around 1 in 10 people at some point in their lifetime. Renal calculus is the most common cause of hematuria and pain in the abdomen, flank, or groin. It is mostly caused by inadequate hydration and low urine volume.

Urinary Tract Infections (UTIs)

The urinary tract infections (UTIs) segment is expected to grow with the highest CAGR in the hematuria treatment market during the studied years. UTI is an infection of the urethra, kidneys, and bladder. Unlike kidney stones, UTI is more prevalent among females. Healthcare professionals treat approximately 8 to 10 million people annually with UTIs. UTIs irritate the urinary tract lining, causing bleeding.

Polycystic Kidney Disease

The polycystic kidney disease segment is expected to show lucrative growth, driven by the rising prevalence of polycystic kidney disease (PKD). About 600,000 people in the U.S. suffer from PKD, making it the fourth leading cause of kidney failure. PKD is a condition in which clusters of cysts grow in the body, mainly in the kidneys. Hematuria is common in patients with autosomal dominant PKD.

How the Drugs Segment Dominated the Hematuria Treatment Market?

The drugs segment contributed the biggest revenue share of the market in 2024, due to the need for cost-effective treatment and the availability of generic alternatives. Conventional pharmaceuticals are more convenient and affordable, enhancing treatment accessibility. Several drugs that are prescribed for treating hematuria include blood thinners, penicillins, sulfa-containing drugs, and cyclophosphamide. These drugs help patients relieve symptoms of pain and bleeding.

Therapeutics

The therapeutics segment is expected to expand rapidly in the market in the coming years. Advances in genomics lead to the development of novel and innovative biologics that provide targeted treatment, curing the disease from its root cause. Biologics are developed for certain autoimmune or rare kidney diseases. The segmental growth is attributed to the ongoing research and the growing demand for personalized medicines.

Which End-User Segment Led the Hematuria Treatment Market?

The hospitals segment led the market in 2024, due to favorable infrastructure and the rising patient preference. Hospitals have professionals from various departments, thereby providing multidisciplinary expertise to patients. Patients usually prefer visiting hospitals due to favorable reimbursement policies and treatment satisfaction. Hospitals are part of certain clinical trials that benefit patients with novel treatment regimens even before market approval.

Clinics

The clinics segment is expected to witness the fastest growth in the hematuria treatment market over the forecast period. Clinics have suitable capital investments to adopt advanced tools for treating hematuria. They possess skilled professionals to provide personalized treatment and care to patients. They offer outpatient services, eliminating the need for patients to stay overnight. This saves a lot of time and costs for patients.

Research Centers

The research centers segment is expected to grow at a notable CAGR due to growing research and development activities and the presence of trained professionals. Research centers focus on identifying the underlying cause of hematuria and developing novel drugs. Research activities in research centers are supported by funding from the government and private bodies.

Asia-Pacific dominated the global market in 2024. The growing geriatric population and the increasing incidence of urinary tract disorders boost the market. People are becoming aware of the early diagnosis and treatment of such disorders, enabling healthcare professionals to provide early intervention. Government organizations provide funding to conduct research and clinical trials related to hematuria. The burgeoning healthcare infrastructure and the presence of generic manufacturers propel the market.

The prevalence rate of kidney stones among Indian adults is approximately 12%, while the recurrence rates are more than 50% within 5 years of a first episode. Apollo Hospitals, Aster Hospitals, and Max Hospitals are prominent healthcare organizations that provide advanced treatment for hematuria. Additionally, Numera Lifesciences, UROMEDi, and Algen Healthcare are urology pharmaceutical companies in India.

North America is expected to grow at the fastest CAGR in the market during the forecast period. The availability of state-of-the-art research and development facilities, the rising prevalence of chronic kidney diseases, and a robust healthcare infrastructure are factors that contribute to market growth in North America. The increasing investments and collaborations among key players contribute to market growth. Favorable regulatory support and reimbursement policies favor hematuria treatment in the region.

The Centers for Disease Control and Prevention (CDC) reported that more than 1 in 7 U.S. adults, or 35.5 million people, suffer from CKD. Americans are at high risk of developing CKD, owing to the rising prevalence of chronic diseases, such as hypertension, diabetes, etc. The Center for Medicare and Medicaid Services (CMS) is a government body that provides reimbursement for chronic diseases. The Medicare program spent $130 million on patients with CKD, accounting for over 24% of total spending.

The South America hematuria treatment market shows steady growth supported by improving diagnostic capabilities. Increased awareness campaigns and improved access to urological services increase the number of patients requiring hematuria workups. Public-private collaborations and the growing availability of affordable generic medications enhance overall treatment accessibility.

Brazil is currently leading the hematuria treatment market expansion across South America. The rising incidence of urinary tract infections and bladder cancer drives increasing patient evaluations. Expanding urban healthcare networks and local promotion of early hematuria screening further bolster demand for treatment and diagnostics.

The Middle East and Africa region demonstrates moderate but consistent hematuria treatment market expansion. This growth is linked to modernizing healthcare infrastructure and increasing adoption of advanced technologies like endoscopic systems. Rising prevalence of kidney stones and associated hematuria symptoms drives procedural therapy demand, especially in key regional markets.

The Gulf Cooperation Council countries are emphasizing technology adoption in hematuria management. Investment in sophisticated diagnostic tools and minimally invasive procedures is notable. The rising older population, combined with high awareness of urological disorders, drives consistent demand for both pharmacotherapy and surgical treatment options.

The latest research focuses on developing novel biologics or repurposing licensed drugs to treat hematuria.

Key Players: Pfizer, Inc., Johnson & Johnson, and Novartis AG.

Clinical trials assess the safety and efficacy of hematuria treatment drugs, which are subsequently approved by regulatory agencies.

Key Players: Vera Therapeutics, UroGen Pharma, and Ferring Pharmaceuticals.

Healthcare professionals guide patients about the dosage regimen and lifestyle regimen.

Company Overview

Corporate Information (Headquarters, Year Founded, Ownership Type)

History and Background

Key Milestones/Timeline

Business Overview

Business Segments/Divisions

Geographic Presence

Key Offerings

End-Use Industries Served

Key Developments and Strategic Initiatives

Mergers & Acquisitions

Partnerships & Collaborations

Extensive collaborations with academic institutions and biotech companies for drug discovery and development, including in areas relevant to hematuria's causes (nephrology, oncology).

Product Launches/Innovations

Focus on launching innovative therapies, including those for chronic kidney disease, an underlying condition that can present with hematuria.

Distribution Channel Strategy

Technological Capabilities/R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

Company Overview

Corporate Information (Headquarters, Year Founded, Ownership Type)

History and Background

Key Milestones/Timeline

Business Overview

Business Segments/Divisions

Geographic Presence

Key Offerings

End-Use Industries Served

Key Developments and Strategic Initiatives

Mergers & Acquisitions

2023: Acquired Seagen for $43 billion to become a leader in protein-based cancer therapies (ADCs). These therapies target tumors in the urinary tract.

Partnerships & Collaborations

Active R&D collaborations with various biotech and academic partners to expand pipeline, especially in oncology and internal medicine.

Product Launches/Innovations

Continuous development and launch of novel oncology drugs and expanded indications for existing drugs used in internal medicine.

Capacity Expansions/Investments

Ongoing modernization and expansion of global manufacturing sites, including a focus on complex biologic therapies.

Regulatory Approvals

Frequent regulatory approvals for new drugs or expanded uses, particularly in the oncology and internal medicine segments.

Distribution Channel Strategy

Technological Capabilities/R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

| Companies | Headquarters | Offerings |

| Novartis AG | Basel, Switzerland | Fabhalta |

| Cipla Ltd. | Mumbai, India | Mesna |

| UroGen Pharma Ltd. | New Jersey, United States | ZUSDURI (mitomycin) |

| Ferring Pharmaceuticals | Saint-Prex, Switzerland | Adstiladrin |

| Johnson & Johnson | New Jersey, United States | INLEXZO (gemcitabine) |

By Type

By Causes

By Treatment

By End-User

By Region

March 2026

March 2026

March 2026

March 2026