February 2026

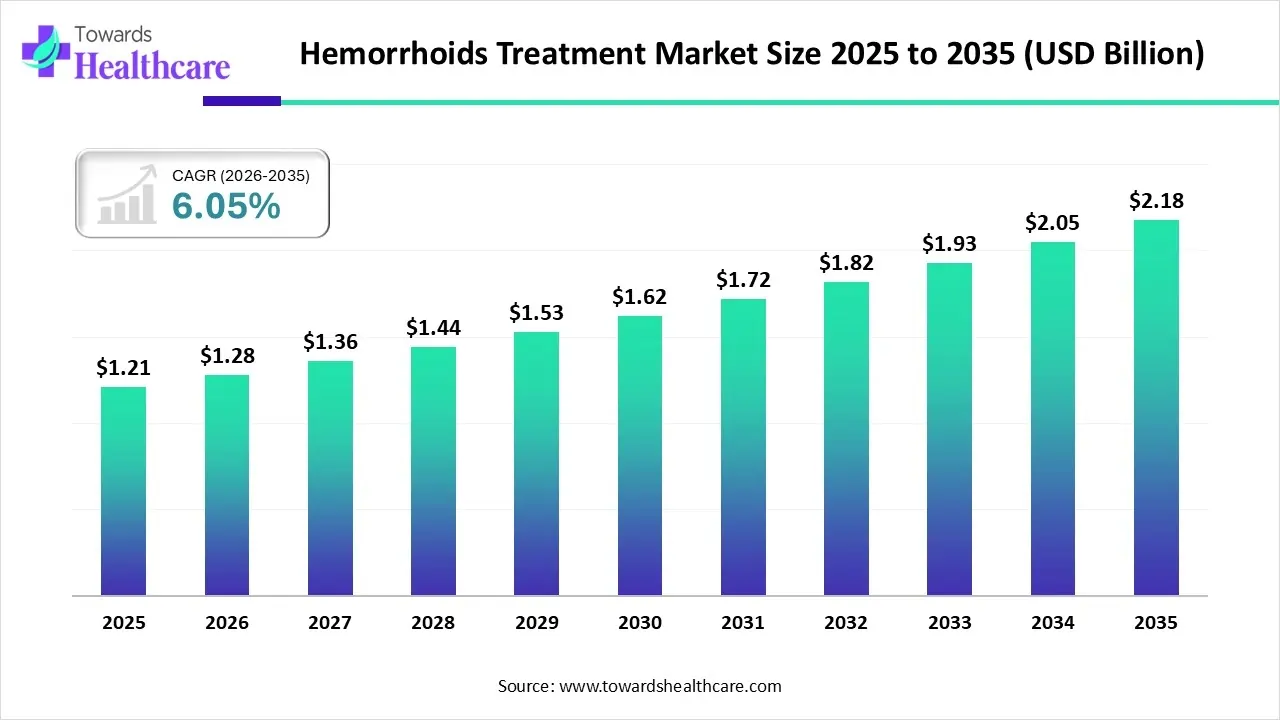

The global hemorrhoids treatment market size is calculated at USD 1.21 billion in 2025, grew to USD 1.28 billion in 2026, and is projected to reach around USD 2.18 billion by 2035. The market is expanding at a CAGR of 6.05% between 2026 and 2035.

The hemorrhoids treatment market is primarily driven by the growing geriatric population and pregnancy among women. Hemorrhoids are commonly caused by straining during bowel movements, chronic constipation or diarrhea, and weakening of the supporting tissues in the anus or rectum. The growing research and development activities and the increasing investments by government and private organizations foster the market. Artificial intelligence (AI) revolutionizes the effective treatment of hemorrhoids.

| Key Elements | Scope |

| Market Size in 2025 | USD 1.21 billion |

| Projected Market Size in 2035 | USD 2.18 billion |

| CAGR (2025 - 2035) | 6.05% |

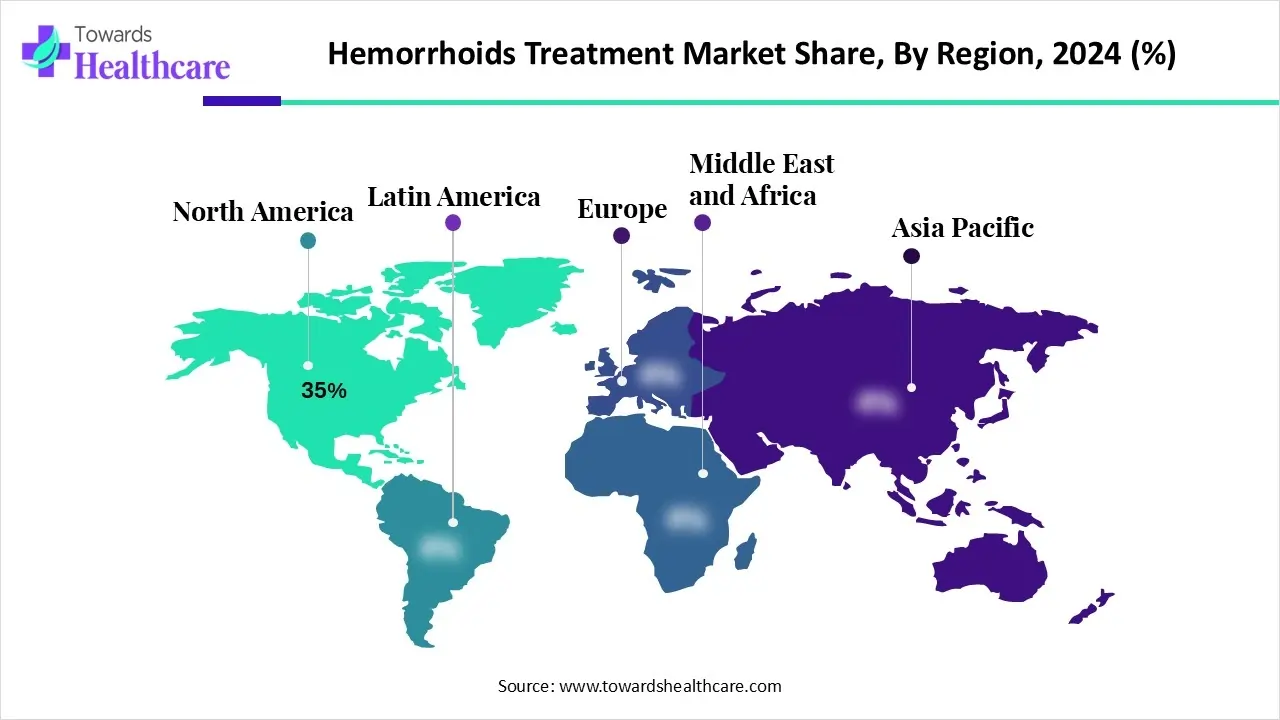

| Leading Region | North America by 35% |

| Market Segmentation | By Treatment Type, By Hemorrhoid Type, By Route of Administration, By End-User, By Distribution Channel, By Region |

| Top Key Players | RG Hospitals, Abbott Laboratories, AstraZeneca, Boston Scientific, Olympus Corporation, Conmed, PACE Hospitals, Cook Medical |

The hemorrhoids treatment market is experiencing robust growth, driven by rising prevalence due to sedentary lifestyles, aging populations, chronic constipation, pregnancy-related cases, and increasing availability of minimally invasive outpatient procedures with shorter recovery times. It includes pharmaceuticals, minimally invasive procedures, surgical interventions, medical devices, and supportive care products used to treat internal and external hemorrhoids. Therapies include OTC and prescription medications, non-surgical office-based procedures, surgical hemorrhoidectomy, stapled hemorrhoidopexy, lifestyle and dietary interventions, and supportive care products.

AI and machine learning (ML) algorithms transform the diagnosis and treatment of hemorrhoids. They enhance the accuracy, precision, and high speed of hemorrhoid treatment. They analyze large datasets of patient outcomes and recommend personalized treatment plans. They assist researchers in developing customized treatment plans for long-term relief. AI-enabled robots improve precision in hemorrhoid surgery, reducing blood loss, complications, and recovery time. AI can analyze patient anatomy and severity to assist surgeons in planning minimally invasive laser surgeries.

Which Treatment Type Segment Dominated the Hemorrhoids Treatment Market?

Pharmacological Treatments

The pharmacological treatments segment held a dominant presence in the market with a share of approximately 45% in 2024, due to high affordability and the need for non-invasive treatment. Pharmacological treatments include medications that treat a disease effectively. The availability of over-the-counter (OTC) medicines for hemorrhoid treatment also boosts the segment’s growth. OTC medicines enhance affordability, accessibility, and patient convenience, making them a suitable treatment option.

Minimally Invasive Procedures

The minimally invasive procedures segment is expected to grow at the fastest CAGR of approximately 8% in the market during the forecast period. The demand for minimally invasive procedures is increasing as they provide superior symptomatic relief, leading to faster recovery and lower recurrence. Surgeries offer targeted treatment to patients and completely remove the risk of disease recurrence.

Supportive Care Products

The supportive care products segment is expected to grow significantly, due to the growing demand for non-pharmacological treatment. Supportive treatments, such as sitz baths, wipes & pads, and dietary fiber supplements, provide supplementary care to patients with hemorrhoids. They provide synergistic therapeutic effects to patients, enabling them to relieve symptoms faster.

Why Did the Internal Hemorrhoids Segment Dominate the Hemorrhoids Treatment Market?

Internal Hemorrhoids

The internal hemorrhoids segment held the largest revenue share of approximately 55% in the market in 2024, due to the growing geriatric population and the rising prevalence of internal hemorrhoids. Internal hemorrhoids affect over half of the population by the age of 50. It leads to swollen veins inside the rectum that are usually not painful but can bring discomfort and bleeding. It can be treated with self-care methods and lifestyle adjustments.

Mixed Hemorrhoids

The mixed hemorrhoids segment is expected to grow with the highest CAGR of approximately 7% in the market during the studied years. Mixed hemorrhoids occur when both internal and external hemorrhoids exist at the same time. They are comparatively more severe than internal or external hemorrhoids. Surgery is the most effective and strongly recommended treatment for patients with mixed hemorrhoids.

External Hemorrhoids

The external hemorrhoids segment is expected to grow at a notable CAGR. External hemorrhoids are swollen veins under the skin around the anus. Common treatment regimens for external hemorrhoids include topical products and a cold compress. External hemorrhoids account for approximately 20% of all hemorrhoid cases in the world.

How the Topical Segment Dominated the Hemorrhoids Treatment Market?

Topical

The topical segment contributed the biggest revenue share of approximately 50% in the market in 2024, due to the need for targeted therapeutic effects and high patient convenience. Creams, ointments, and pads with hydrocortisone and lidocaine are applied to the affected part. They provide topical relief of the symptoms associated with hemorrhoids, such as swelling, itching, and pain. The topical route is preferred by patients of all age groups.

Device-assisted Treatment

The device-assisted treatment segment is expected to expand rapidly in the market with a CAGR of approximately 10% in the coming years. Advancements in medical technologies and the growing demand for minimally invasive surgeries contribute to the segment’s growth. Medical devices assist surgeons in endoscopy, laser-assisted hemorrhoidoplasty, and physical therapy. The integration of AI/ML in medical devices enhances their functionality and improves accuracy.

Injectable

The injectable segment is expected to grow in the coming years. Injections are given to patients undergoing sclerotherapy. A special chemical solution, sclerosant, is injected into the area around the hemorrhoid, triggering a scarring reaction. This makes the hemorrhoid gradually shrink or shrivel up over time. Injections offer high bioavailability and a faster onset of action.

Which End-User Segment Led the Hemorrhoids Treatment Market?

Retail Pharmacies & Drug Stores

The retail pharmacies & drug stores segment led the market with a share of approximately 40% in 2024, due to the availability of a favorable infrastructure and the presence of skilled professionals. Skilled professionals provide tailored guidance to patients about hemorrhoid treatment. Retail pharmacies store a variety of products, including OTC and generic alternatives. They offer numerous benefits, such as specialized discounts and 24/7 facilities.

Ambulatory Surgical Centers

The ambulatory surgical centers segment is expected to witness the fastest growth with a CAGR of approximately 10% in the market over the forecast period. Ambulatory surgical centers (ASCs) are emerging as effective sites for minimally invasive surgeries. Patients prefer visiting ASCs as they provide personalized outpatient services. This eliminates the need for patients to stay overnight, saving exorbitant costs.

Online Pharmacies

The online pharmacies segment is expected to show a lucrative growth, driven by the burgeoning e-commerce sector and the growing geriatric population. Online pharmacies enable patients to order the desired medications from the comfort of their homes. Patients can compare prices of different products, allowing them to purchase high-quality products at affordable rates. Online pharmacies offer numerous benefits, such as free home delivery and virtual consultations.

What Made Over-the-Counter (OTC) the Dominant Segment in the Hemorrhoids Treatment Market?

Over-the-Counter (OTC)

The over-the-counter (OTC) segment accounted for the highest revenue share of approximately 55% in the market in 2024, due to its high affordability and increasing awareness of self-medication. Certain pain relievers do not need a doctor’s prescription. OTC drugs are usually preferred by patients during the early stages of hemorrhoids. According to a recent systematic review and meta-analysis, the prevalence rate of self-medication in India is 64.4%.

Direct-to-Consumer (D2C)/Online

The direct-to-consumer (D2C)/online segment is expected to show the fastest growth with a CAGR of approximately 12% over the forecast period. Manufacturers and developers have the right to sell their proprietary products to patients through online platforms directly. This eliminates the need for wholesalers and distributors, reducing extra costs. Online platforms enable manufacturers to reach a wider consumer base across different geographical locations.

Prescription-based

The prescription-based segment is expected to grow in the upcoming years. Corticosteroids, anesthetics, and astringents require prescriptions to administer to a patient. They are needed for surgeries or pre-surgical care. Anesthetics are used to make a patient unconscious either locally or generally, based on the type of surgery. Local anesthetics may also help alleviate pain and soreness.

North America dominated the global market with a share of approximately 35% in 2024. The availability of a robust healthcare infrastructure and state-of-the-art research and development facilities are the factors that contribute to market growth in North America. Favorable regulatory policies and a suitable clinical trial infrastructure lead to the development of novel, innovative medicines and medical devices. Increasing investments and collaborations among key players facilitate market growth.

Healthcare organizations, such as Johns Hopkins Medicine, Hemorrhoid Centers of America, and Harvard Health, provide hemorrhoid treatment to Americans. As of November 18, 2025, a total of 218 clinical trials are registered on the clinicaltrials.gov website related to hemorrhoids, of which 29 are registered in the U.S.

Asia-Pacific is expected to grow at the fastest CAGR of approximately 10% in the market during the forecast period. The rising prevalence of hemorrhoids and growing research and development activities boost the market. The burgeoning healthcare sector and the presence of healthcare organizations with advanced facilities augment market growth. Government bodies provide funding and launch initiatives to adopt advanced surgical tools and build appropriate facilities in hospitals and clinics.

China accounts for the highest number of hemorrhoid cases globally. It is estimated that the prevalence of hemorrhoidal disease in China is around 50.28%. People mostly prefer Traditional Chinese Medicine (TCM) for a variety of diseases, including hemorrhoids. In 2023, TCM healthcare institutions provided diagnoses and treatment to 1.28 billion people in China.

Europe is expected to grow at a considerable CAGR in the upcoming period. Favorable government support and the rising adoption of advanced technologies propel market growth. The presence of key players leads to the development of novel products and the offering of personalized treatment to patients. The Hemorrhoid Clinic London, AmberCell Solutions, and Hila are major players in the field of hemorrhoid treatment.

Germany’s advanced healthcare system ensures the wide availability of hemorrhoid treatment in state-of-the-art facilities nationwide. Approximately 50,000 hemorrhoid surgeries are performed annually in Germany. The availability of health insurance increases the affordability of hemorrhoid care. Statutory health insurance (SHI) or substitutive private health insurance (PHI) provides health insurance to Germans.

South America’s hemorrhoids treatment market growth stems from a large, increasing patient population. Sedentary lifestyles are linked to a rise in symptomatic cases across the region. Latest professional reports show a strong patient preference for minimally invasive procedures, like rubber band ligation, due to their quicker recovery times.

Brazil, a major country, sees a high patient volume driven by lifestyle factors like a poor diet. Brazilian specialists report diagnosing hemorrhoidal disease in approximately 35% of all treated patients. This patient surge is boosting the adoption of advanced techniques and new outpatient medical procedures for better outcomes.

The Middle East and Africa show a strong patient base, with up to one-quarter of the population over 50 experiencing symptoms. Improved healthcare access is encouraging more patients to seek care. This trend is accelerating the use of modern procedures, including infrared coagulation and other laser-based options in clinics.

The GCC hemorrhoids treatment market is characterized by patients seeking premium, advanced hemorrhoid treatment technologies. Increasing rates of obesity and low-fiber diets contribute to a growing patient count. The patient's focus is highly directed towards innovative procedures such as Doppler-guided artery ligation for minimal discomfort and quicker return to work.

Company Overview

Corporate Information (Headquarters, Year Founded, Ownership Type)

History and Background

Key Milestones/Timeline:

Business Overview

Business Segments/Divisions:

Geographic Presence

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives

Technological Capabilities/R&D Focus

Competitive Positioning

SWOT Analysis:

Recent News and Updates

Company Overview

Corporate Information (Headquarters, Year Founded, Ownership Type)

History and Background

Key Milestones/Timeline

Business Overview

Business Segments/Divisions

Geographic Presence

Key Offerings

End-Use Industries Served

Key Developments and Strategic Initiatives

Technological Capabilities/R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

| Companies | Headquarters | Specialty | Offerings |

| Johnson & Johnson | New Jersey, United States | Surgical equipment | PROXIMATE PPH Hemorrhoidal Circular Stapler Set |

| Medtronic | Dublin, Ireland | Surgical equipment | HET Bipolar System |

| Norwell Consumer Healthcare, Inc. | Canada | OTC medication | Hemovel |

| Max Healthcare | New Delhi, India | Treatment and patien care | Provides laser and RFA treatments |

| eXroid Technology Ltd. | United Kingdom | Treatment and surgical care | Electrotherapy |

By Treatment Type

By Hemorrhoid Type

By Route of Administration

By End-User

By Distribution Channel

By Region

February 2026

February 2026

January 2026

January 2026