January 2026

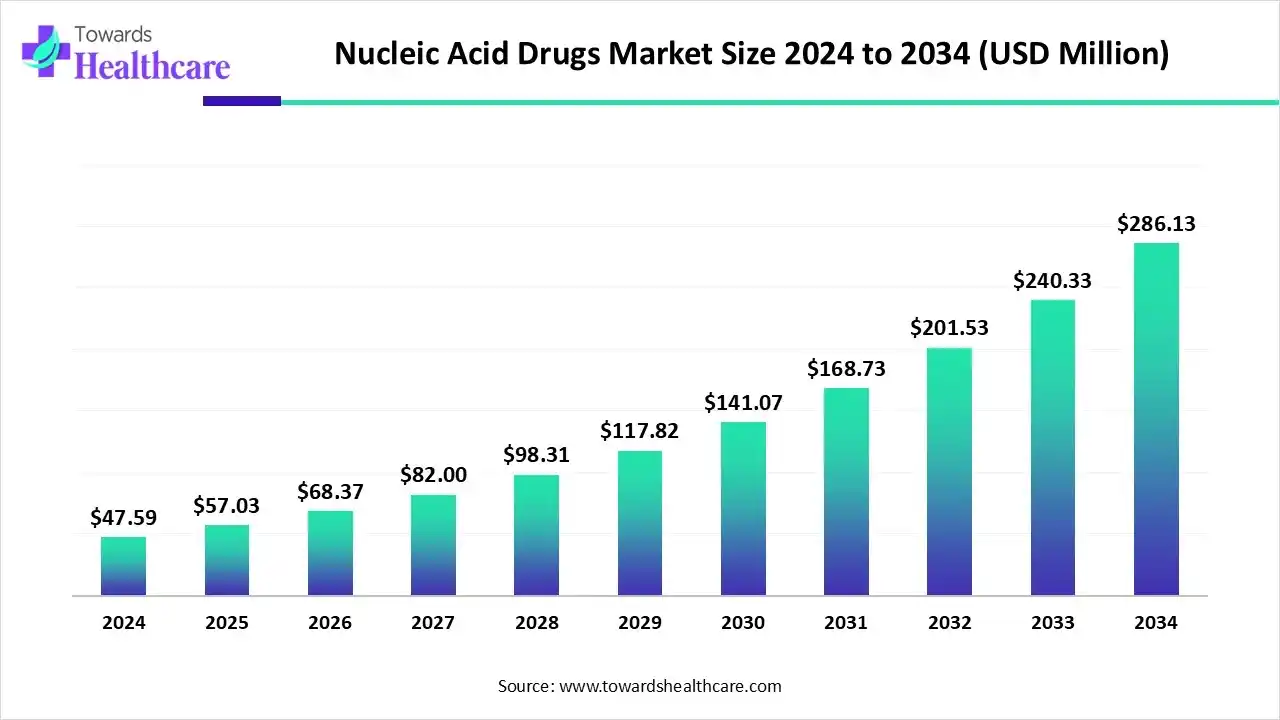

The global nucleic acid drugs market size is calculated at US$ 47.59 million in 2024, grew to US$ 57.03 million in 2025, and is projected to reach around US$ 286.13 million by 2034. The market is expanding at a CAGR of 19.84% between 2025 and 2034.

The growing disease burden is increasing the demand for nucleic acid drugs globally, where they are being used in the development of various target-specific treatment options. AI is also being used in their development to enhance their safety and efficacy. The advanced industries, expanding healthcare, and growing R&D activities are increasing their innovations across various regions, where the companies are launching and investing in new products, promoting market growth.

| Table | Scope |

| Market Size in 2025 | USD 57.03 Million |

| Projected Market Size in 2034 | USD 286.13 Million |

| CAGR (2025 - 2034) | 19.84% |

| Leading Region | North America by 60% |

| Market Segmentation | By Drug Type, By Therapeutic Area, By Delivery Technology, By End User, By Route of Administration, By Region |

| Top Key Players | Arrowhead Pharmaceuticals, Silence Therapeutics, Wave Life Sciences, Arcturus Therapeutics, Translate Bio (Sanofi), Biogen, CureVac AG, Gilead Sciences, Pfizer, AstraZeneca, Takeda Pharmaceutical, Eli Lilly and Company, Roche/Genentech, CSL Behring, Maravai LifeSciences |

The nucleic acid drugs market is driven by rapid advancements in technologies like gene editing and mRNA, increasing incidence of chronic and genetic diseases, and growing R&D investments. The nucleic acid drugs comprise therapeutics that use nucleic acids DNA, RNA, or their analogs to modulate, replace, or silence genes responsible for disease. These include antisense oligonucleotides (ASOs), small interfering RNAs (siRNAs), microRNA (miRNA) modulators, aptamers, plasmid DNA (pDNA), and mRNA therapeutics. They target diseases at the genetic level, offering high specificity and precision.

Various companies, such as Creative Biolabs, are utilizing AI platforms to design and optimize nucleic acid drugs. These platforms can also predict RNA structures as well as their cellular functions. This, in turn, is increasing their use in the development of different types of nucleic acid-based treatment options along with their delivery systems, where modification of the molecules is also possible. With the use of these AI-assisted platforms, the stability, efficacy, safety, and binding affinity can be enhanced.

By drug type, the antisense oligonucleotides (ASO) segment led the market with approximately 30% share in 2024, driven by their enhanced use in genetic diseases. They were easy to synthesize, which increased their production and innovations. Moreover, the growing rare diseases has also increased their use.

By drug type, the messenger RNA (mRNA) segment is expected to show the fastest growth rate during the predicted time. Their use is increasing due to their proven efficacy in post-COVID. At the same time, their expansion in oncology and rare diseases is increasing their manufacturing and R&D.

By therapeutic area type, the oncology segment held the dominating share of approximately 35% in the market in 2024, as the nucleic acid drugs show target-specific action. This, in turn, increased their innovation and clinical trials. Moreover, they were also used in the development of cancer immunotherapies and vaccines.

By therapeutic area type, the genetic disorders segment is expected to show the highest growth during the predicted time. The use of nucleic acid drugs is increasing in these areas, as they provide targeted RNA and DNA-based gene correction approaches for rare diseases. Moreover, they are also being used in the development of personalized therapies.

By delivery technology type, the lipid nanoparticles (LNPs) segment led the market with approximately 40% share in 2024, driven by their proven success in mRNA vaccines. Moreover, their target-specific action increased their safety. This increased their use in the delivery of different types of nucleic acid drugs.

By delivery technology type, the ligand conjugates segment is expected to show the fastest growth rate during the predicted time. They show targeted delivery to hepatic and extrahepatic tissues, which reduces the side effects. This increases their safety, driving their use in siRNA therapy development.

By end user, the pharmaceutical & biotechnology companies segment held the largest share of approximately 60% in the global market in 2024, due to growth in research and development. Moreover, the presence of well-developed infrastructure contributed to the development and optimization of nucleic acid-based therapies. The investments also supported their development.

By end user, the contract development & manufacturing organizations (CDMOs) segment is expected to show the highest growth during the upcoming years. They are driven by expanding capacity for oligonucleotide and mRNA production to meet demand from pharma clients. Additionally, the growing outsourcing trends and demand for expertise are increasing the collaborations with them.

By route of administration type, the intravenous (IV) segment held the largest share of approximately 35% in the market in 2024, driven by its enhanced bioavailability. This route was preferred to protect the fragile nucleic acid molecule from degradation. Similarly, the large and complex molecules were also administered through this route.

By route of administration type, the intramuscular segment is expected to show the fastest growth rate during the upcoming years. This route of administration provides scalability and patient compliance advantages in mRNA vaccine platforms. Moreover, they are easy to administer and show high absorption rates, which is increasing their use.

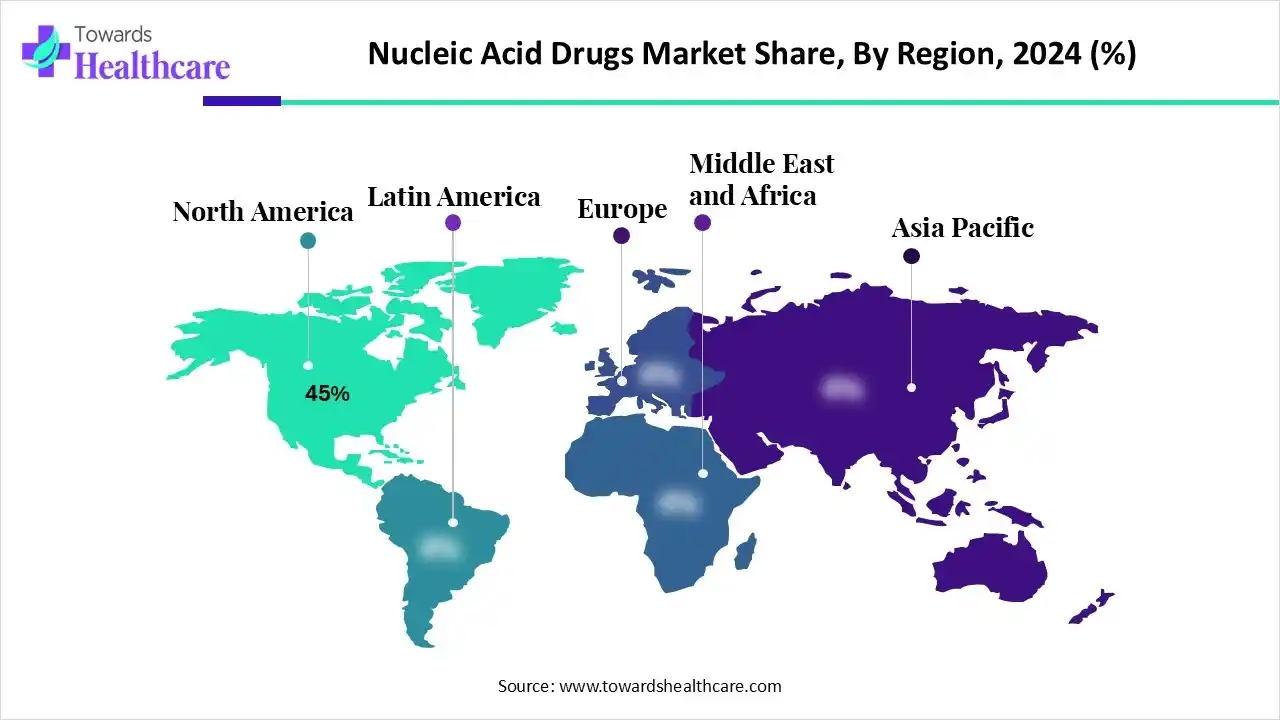

North America dominated the nucleic acid drugs market with 45% in 2024, due to the presence of strong industries, which increased the production of nucleic acid drugs. The institutions, along with the industries, also contributed to their research and development, which were supported by the government and private investments and funding. Moreover, the presence of advanced technologies accelerated their manufacturing, which enhanced the market growth.

The presence of pharmaceutical and biotech hubs, along with well-established institutions in the U.S., is driving the nucleic acid drugs market growth. They are eagerly participating in the R&D to develop various target-specific treatment options for genetic or rare diseases. These advancements are further supported by the healthcare investments, where the growing collaborations with CDMO are also contributing to the same.

For instance,

Asia Pacific is expected to host the fastest-growing nucleic acid drugs market during the forecast period, driven by increasing investment in mRNA vaccine manufacturing. At the same time, the expanding biotech startups and government funding are also increasing the manufacturing of nucleic acid drugs. Additionally, the growing diseases are also increasing their use, contributing to the market growth.

China is experiencing a growth in various chronic diseases, which is increasing the use of nucleic acid drugs, promoting the nucleic acid drugs market. The production and innovations are increasing across various industries and startups, which in turn is increasing their clinical trials. Moreover, to support these advancements and control diseases, new initiatives are also being introduced by the government.

For instance,

Europe is expected to grow significantly in the nucleic acid drugs market during the forecast period, due to growing research and development activities in the industries and institutions. Different types of nucleic acid therapies, technologies, RNA-based drugs, etc., are being developed, which are supported by government funding. Moreover, the growing approvals of these treatment approaches are encouraging innovations for cancer, genetic, and rare diseases, promoting the market growth.

The nucleic acid drugs market in the UK is driven by growing R&D in genetics, cancer, RNA biology, etc, which is increasing the development of various nucleic acid-based therapeutic options. Moreover, the institutions and startups are also developing various antisense oligonucleotides, siRNA, etc., where funding from the government is accelerating their development and clinical trials.

For instance,

To expand the application of nucleic acid drugs for infectious diseases and cancer, and the development of innovative delivery systems and advanced chemical modifications to tackle the challenges, such as instability and poor cellular delivery, are the focus in the R&D of nucleic acid drugs.

Key Players: Moderna Therapeutics, Ionis Pharmaceuticals, Alnylam Pharmaceuticals, Sarepta Therapeutics, BioNTech SE.

The clinical trials and regulatory approval for the nucleic acid drugs include the demonstration of their safety, efficacy, and optimized delivery, along with the validation of their risk-benefit ratio.

Key Players: Moderna Therapeutics, Ionis Pharmaceuticals, Alnylam Pharmaceuticals, Sarepta Therapeutics, BioNTech SE, Pfizer, AstraZeneca.

The formulation and final dosage preparation of the nucleic acid drugs involves the development of a sophisticated delivery system to overcome the stability and cellular uptake challenges.

Key Players: Moderna Therapeutics, Ionis Pharmaceuticals, Alnylam Pharmaceuticals, Sarepta Therapeutics, BioNTech SE, Pfizer, AstraZeneca.

The patient support and services of the nucleic acid drugs include the program provided by the manufacturer, such as patient education, nurse navigation to address high cost and specialized administration of these therapies, financial assistance, and logistical support for complex treatments.

Key Players: Moderna Therapeutics, Ionis Pharmaceuticals, Alnylam Pharmaceuticals, Sarepta Therapeutics, BioNTech SE, AstraZeneca, Biogen.

By Drug Type

By Therapeutic Area

By Delivery Technology

By End User

By Route of Administration

By Region

January 2026

January 2026

January 2026

January 2026