February 2026

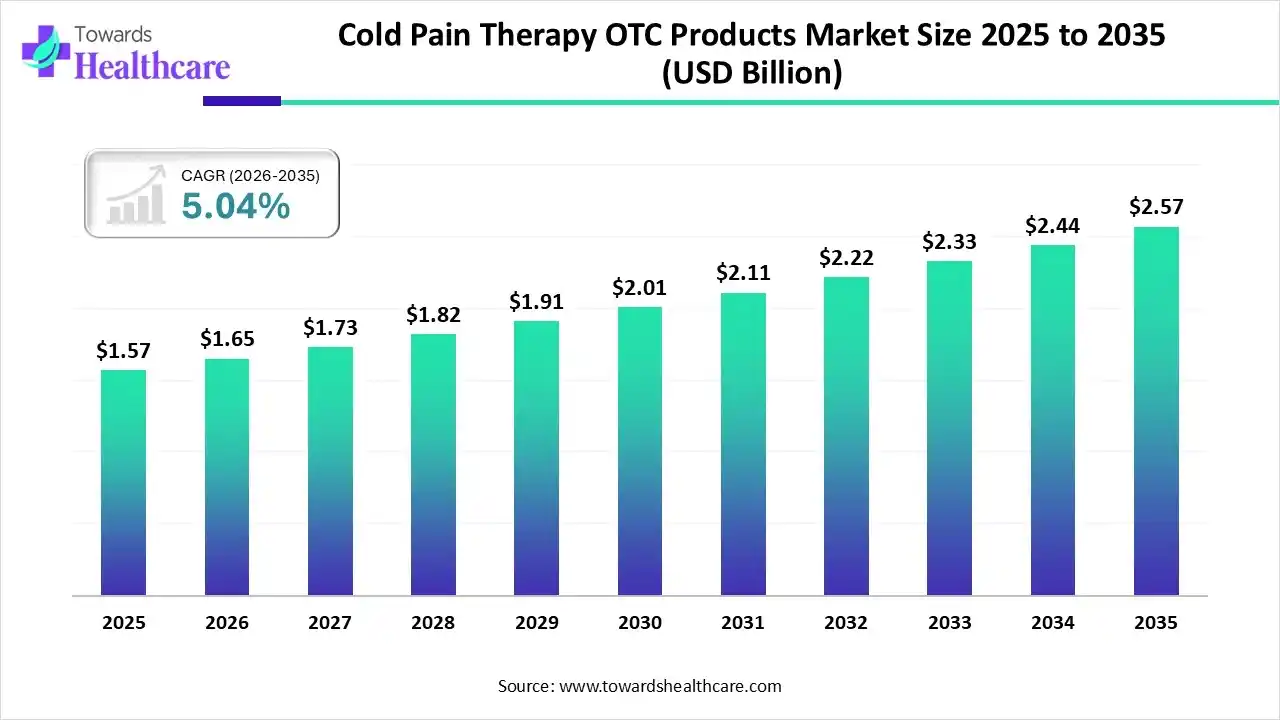

The global cold pain therapy OTC products market size was estimated at USD 1.57 billion in 2025 and is predicted to increase from USD 1.65 billion in 2026 to approximately USD 2.57 billion by 2035, expanding at a CAGR of 5.04% from 2026 to 2035.

The market is expanding steadily, driven by rising self-medication trends, sports injuries, muscle strain cases, and easy availability through retail and online channels.

Cold pain therapy OTC products are non-prescription solutions that use cooling effects to temporarily relieve muscle, joint, and inflammation-related pain. The cold pain therapy OTC products market is growing due to increasing cases of muscle strain, sports injuries, and joint pain across all age groups. Rising preferences for self-care, easy availability without prescription, and quick pain relief benefits are boosting adoption. Additionally, expanding retail and e-commerce channels, growing fitness awareness, and bust lifestyle are encouraging consumers to choose fast, affordable, and convenient cold pain therapy solutions.

Artificial intelligence is transforming the cold pain therapy OTC products market by enabling data-driven product innovation, personalized pain management recommendations, and optimized supply chain operations. AI-powered analytics help manufacturers identify consumer preferences, improve formulation effectiveness, and predict demand patterns. Additionally, AI enhances digital marketing, virtual assistance, and e-commerce targeting, improving customer engagement, brand visibility, and sales efficiency while supporting faster product development and market expansion.

Consumers are increasingly opting for OTC cold pain therapy products to manage minor aches, sports injuries, and inflammation. Easy access, affordability, and quick relief are driving long-term adoption across diverse age groups.

The rapid growth of e-commerce platforms is improving product visibility and accessibility. Digital promotions, home delivery, and subscription models are expected to strengthen market penetration and boost sales in urban and semi-urban regions.

Manufacturers are investing in improved cooling technologies, longer-lasting effects, and user-friendly formats such as patches and roll-ons. Continuous innovation will enhance effectiveness, differentiate brands, and support sustained market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.65 Billion |

| Projected Market Size in 2035 | USD 2.57 Billion |

| CAGR (2026 - 2035) | 5.04% |

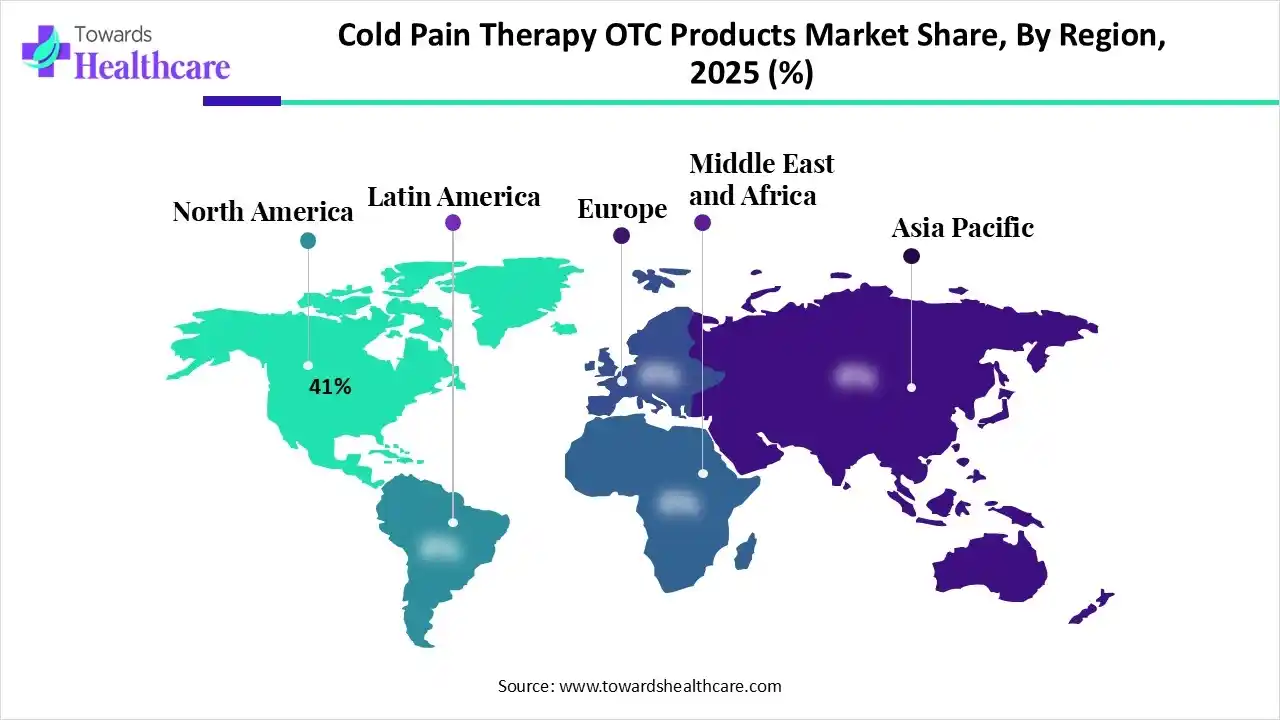

| Leading Region | North America by 41% |

| Market Segmentation | By Product Type, By Application, By Distribution Channel, By Age Group, By Region |

| Top Key Players | Johnson and Johnson Services, Inc, Hisamitsu Pharmaceutical Co., Inc., 3M Company, GlaxoSmithKline plc, Sanofi S.A., Pfizer Inc. |

Why Did the Topical Products Segment Dominate in the Market in 2025?

The topical products segment dominated the cold pain therapy OTC products market with a share of approximately 52.5% in 2025 due to their ease of application, fast localized relief, and minimal systemic side effects. Formats such as gels, sprays, roll-ons, and patches gained strong consumer preference for treating muscle, joint, and sports-related pain. Wide retail availability, affordable pricing, and high brand awareness further supported strong adoption across all age groups.

Transdermal Patches

The transdermal patches segment is expected to grow at the fastest CAGR during the forecast period due to rising preference for long-lasting, targeted pain relief. These patches offer controlled cooling effects, hands-free application, and improved convenience compared to creams or sprays. Increasing adoption among working professionals, athletes, and elderly patients, along with advancements in patch technologies and extended wear duration, is further accelerating demand in the cold pain therapy OTC market.

How the Musculoskeletal Disorders Segment Dominated the Cold Pain Therapy OTC Products Market in 2025?

The musculoskeletal disorders segment dominated the market with a considerable revenue share of approximately 38.2%in 2025 due to the high prevalence of back pain, arthritis, muscle strain, and joint stiffness across all age groups. Sedentary lifestyles, lifestyle sports injuries, and aging populations increased demand for effective pain relief. Cold pain therapy products are widely preferred for reducing inflammation, swelling, and localized discomfort, driving strong and consistent usage in musculoskeletal conditions.

| Musculoskeletal Conditions | Cases | Years Lived With Disability |

| Low Back Pain | 570 million | 26 million |

| Fractures | 440 million | 26 million |

| Osteoarthritis | 528 million | 19 million |

| Neck Pain | 222 million | 22 million |

| Amputations | 180 million | 5.5 million |

| Rheumatoid Arthritis | 18 million | 2.4 million |

| Gout | 54 million | 1.7 million |

Post-Trauma Therapy

The post-trauma therapy segment is expected to grow at the fastest CAGR of approximately 6.2% during the forecast period due to rising cases of sports injuries, accidents, and post-surgical recovery needs. Cold pain therapy products are widely used immediately after trauma to reduce swelling, inflammation, and acute pain. Increasing participation in physical activities, faster rehabilitation focus, and easy OTC across are further accelerating demand for post-trauma cold pain management solutions.

Why the Retail Pharmacies Segment Dominated the Cold Pain Therapy OTC Products Market?

The retail pharmacies segment dominated the market with a revenue share of approximately 48.1% due to strong consumer trust, easy accessibility, and wide product availability. Pharmacies offer immediate purchase, professional guidance from pharmacists, and an established brands presence, making them a preferred choice for pain management solutions. Additionally, dense pharmacy networks, especially in urban and semi-urban areas, and impulse buying for quick pain relief supported higher sales through retail pharmacies.

E-Pharmacies

The e-pharmacies segment is expected to grow at the fastest CAGR of approximately 6.5% during the forecast period due to increasing digital adoption, convenience, and doorstep delivery. Consumers prefer online platforms for easy price comparison and product variety while purchasing OTC pain relief products. Rising smartphone penetration, improved logistics, subscription services, and attractive discounts are further accelerating e-pharmacy adoption, especially among urban and tech-savvy populations.

Why Did the Adults Segment Dominate in the Market in 2025?

The adults segment dominated the cold pain therapy OTC products market with a revenue share of approximately 53.6% in 2025 due to higher exposure to work-related strain, sedentary lifestyle, and sports or fitness activities. Adults frequently experience muscle pain, backaches, and joint discomfort, driving regular product usage. Greater awareness of self-care solutions, higher purchasing power, and preference for quick, non-prescription pain relief further supported strong demand within this age group.

Geriatric

The geriatric segment is expected to grow at the fastest CAGR of approximately 5.9% during the forecast period due to the rising global aging population and increasing prevalence of arthritis, joint stiffness, and chronic musculoskeletal pain. Elderly individuals often prefer non-invasive, easy-to-use OTC cold pain therapy products for safe pain relief. Growing focus on home-based care, improved product accessibility, and higher awareness of self-management solutions are further accelerating adoption among the geriatric population.

North America dominated the global market in 2025, accounting for approximately 41% revenue share, driven by the high prevalence of musculoskeletal disorders, sports injuries, and arthritis. Strong consumer awareness of OTC pain management, widespread availability across retail and e-pharmacies, and high healthcare spending supported market leadership. Additionally, the presence of major brands, advanced product innovations, and well-established distribution networks further strengthened regional demand and consistent product adoption.

U.S. Dominance Driven by String OTC Culture and Advanced Pain Management Demand

The U.S. led the cold pain therapy OTC Products market in 2025 by capturing the largest revenue share due t high incidence of musculoskeletal disorders, sports-related injuries, and an aging population. Strong consumer preference foe self care, widespread availability of OTC products, and robust retail and e-pharmacy networks supported market growth. Additionally, high healthcare spending, brand presence, continuous product innovation, and aggressive marketing strategies further reinforced the U.S. market leadership.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period due to rising healthcare awareness, increasing cases of musculoskeletal disorders, and a growing aging population. Rapid urbanization, expanding middle-class income, and higher participation in fitness and sports activities are boosting demand. Additionally, improving retail and e-pharmacy penetration, expanding access to OTC products, and growing preference for affordable self-care solutions are accelerating market growth in emerging economies.

India’s Rapid Rise in the Cold Pain Therapy OTC Products Market

India is anticipated to grow at a rapid CAGR during the forecast period due to the increasing prevalence of musculoskeletal pain, rising participation in fitness and sports, and a growing aging population. Expanding healthcare awareness, improving access to OTC products, and the rapid growth of retail and e-pharmacies are supporting market expansion. Additionally, rising disposable income, urbanization, and preference for affordable self-care pain relief solutions are further driving demand across the country.

Europe is anticipated to grow at a notable rate during the forecast period due to the rising prevalence of musculoskeletal disorders, an aging population, and increasing participation in recreational and fitness activities. Strong awareness of pain management, well-established healthcare infrastructure, and widespread availability of OTC products across pharmacies and online channels are supporting market growth. Additionally, growing preference for non-prescription, non-invasive pain relief solutions and continuous product innovation are further driving demand across the region.

UK Market Accelerates with Rising Demand for OTC Pain Relief

The UK is expected to grow at a rapid CAGR in the cold pain therapy OTC Products market during the forecast period due to the increasing prevalence of musculoskeletal disorders, sports injuries, and an aging population. Strong awareness of self -care, easy access to OTC products through pharmacies and e-commerce platforms, and growing preference for non-invasive pain management are driving demand. Additionally, supportive healthcare policies, high consumer trust in OTC brands, and continuous product innovation are further fueling market growth across the UK.

| Companies | Headquarters | Offerings |

| Johnson and Johnson Services, Inc | New Jersey, USA | Topical pain relief creams, gels, patches, and OTC analgesics for muscle, joint, and arthritis pain |

| Hisamitsu Pharmaceutical Co., Inc. | Tokyo, Japan | Medicated transdermal pain relief patches and topical cold therapy products are widely used for musculoskeletal pain |

| 3M Company | Minnesota, USA | Drug-free cold and heat therapy products, including reusable cold packs and pain relief wraps for injury and recovery care. |

| GlaxoSmithKline plc | London, UK | OTC pain management brands include topical gels, creams, and oral analgesics targeting muscle pain and inflammation. |

| Sanofi S.A. | Paris, France | OTC pain relief solutions such as topical analgesics and oral pain medications for acute and chronic pain conditions. |

| Pfizer Inc. | New York, USA | OTC analgesics and anti-inflammatory products are used for pain, fever, and musculoskeletal discomfort. |

By Product Type

By Application

By Distribution Channel

By Age Group

By Region

February 2026

February 2026

February 2026

February 2026