January 2026

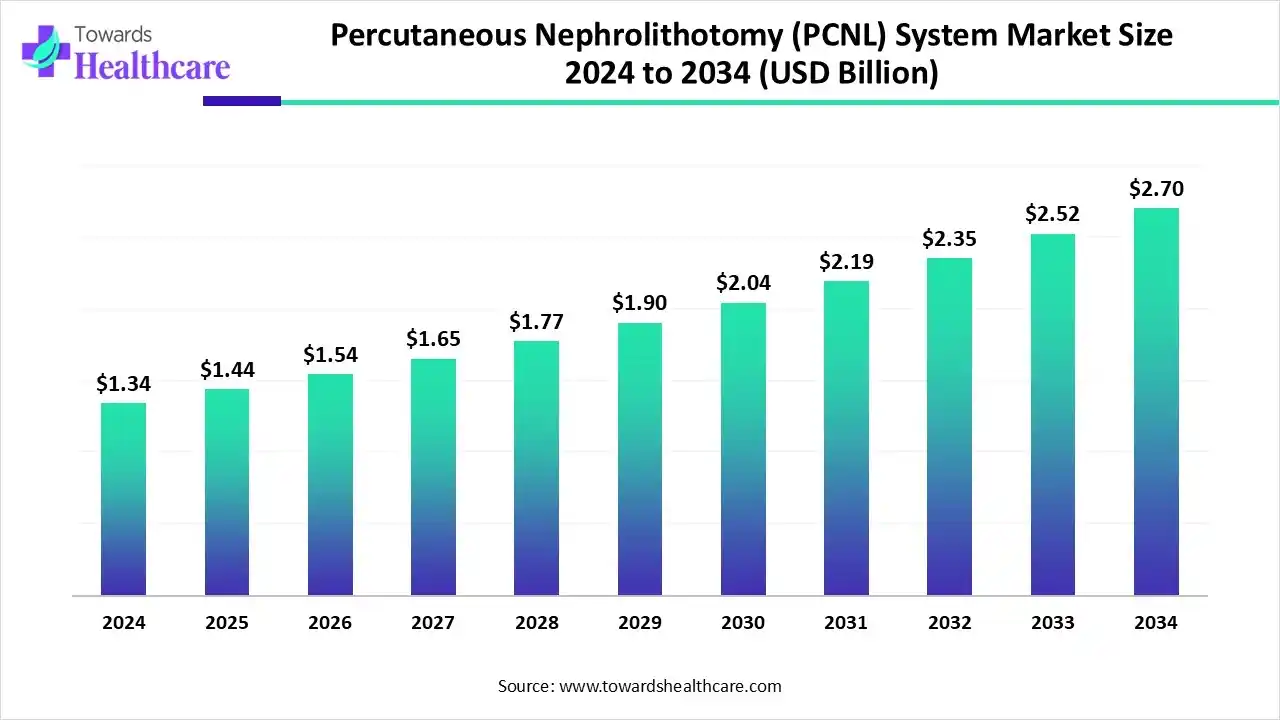

The global percutaneous nephrolithotomy (PCNL) system market size is calculated at US$ 1.34 billion in 2024, grew to US$ 1.44 billion in 2025, and is projected to reach around US$ 2.7 billion by 2034. The market is expanding at a CAGR of 7.25% between 2025 and 2034.

Across the world, many medical device manufacturers are fostering the broader developments of single-use or disposable product types in effective surgical procedures. The percutaneous nephrolithotomy (PCNL) system market is exploring several advancements in laser technology, mini-PCNL/miniaturized PCNL, as well as growth in urology surgical infrastructure (especially in hospitals and ambulatory surgical centers), which is also bolstering the overall market development.

| Table | Scope |

| Market Size in 2025 | USD 1.44 Billion |

| Projected Market Size in 2034 | USD 2.7 Billion |

| CAGR (2025 - 2034) | 7.25% |

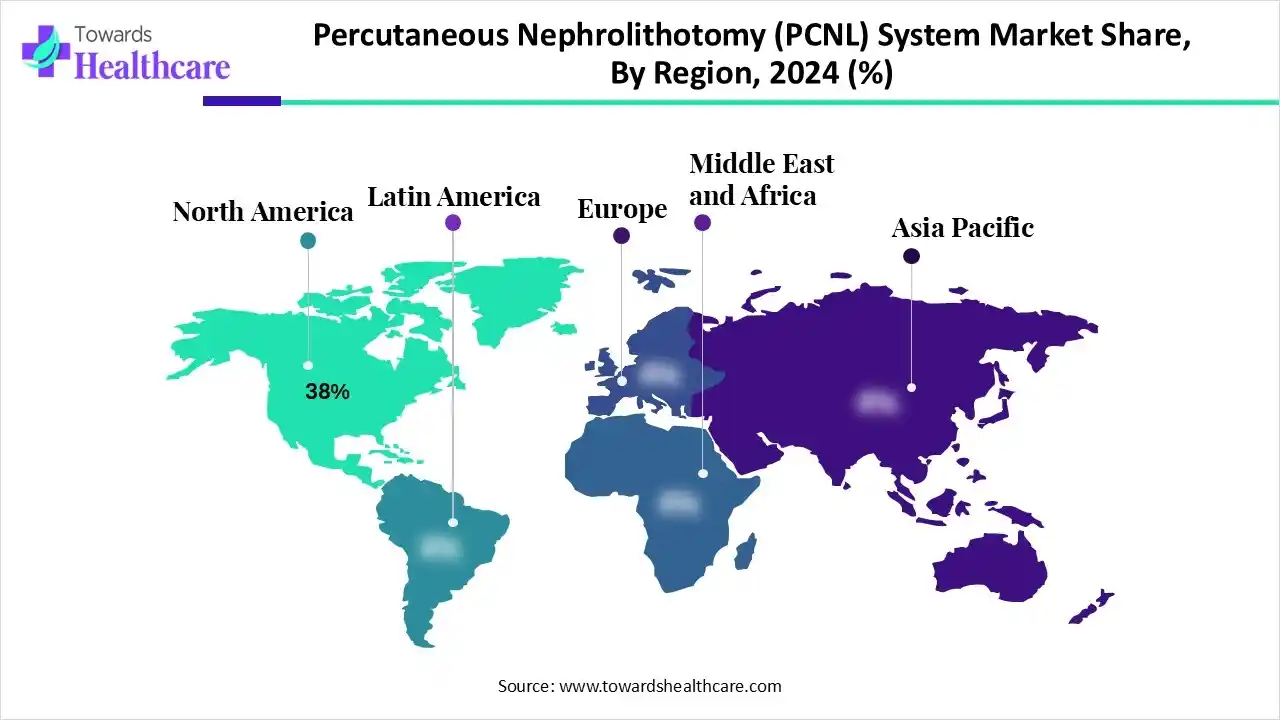

| Leading Region | North America by 38% |

| Market Segmentation | By Product/System Component, By Procedure Type/Approach, By Device Type, By End-User/Facility Type, By Region |

| Top Key Players | Electro Medical Systems SA, Terumo Corporation, Coloplast A/S, B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc., Teleflex Incorporated, Dornier MedTech GmbH, Merit Medical Systems, Inc., Attikouris Enterprises Ltd., Advin Urology, Guangzhou Potent Optotronic Technology Co., Ltd.,Surgimedik, Allengers Medical Systems Ltd., Rocamed SAM, Well Lead Medical Co., Ltd. |

The percutaneous nephrolithotomy (PCNL) system market covers the range of devices, accessories, consumables, and technologies used to perform percutaneous nephrolithotomy, a minimally invasive surgical procedure to remove kidney stones via a small skin incision, tract creation into the kidney, and instrument access for fragmentation and extraction. Growth is driven by increasing incidence of kidney stone disease globally, preference for minimally invasive urological treatments, expansion of urology surgical infrastructure (especially in hospitals and ambulatory surgical centers), and continual product innovation (mini-, ultra-mini-, micro-PCNL, integrated imaging/robotics).

The systems include nephroscopes, dilators/access sheaths, lithotripters (ultrasonic, pneumatic, laser, electrohydraulic), imaging guidance modules, and ancillary kits (access guidance, suction/irrigation, stone retrieval).

Around the globe, the percutaneous nephrolithotomy (PCNL) system market has been putting efforts into innovative technologies, such as automated needle targeting. This possesses X-ray coupled with AI algorithms, which accelerates automated calculation and adjustment of the needle towards the targeted calyx. Furthermore, the major leaders are exploring novel robotic systems that integrate robotic assistance with 3D modeling and real-time ultrasound guidance. This promising system helps in the reduction of manual errors and smooths the learning curve for novice surgeons.

Why did the Nephroscopes & Endoscopes Segment Lead the Market in 2024?

In 2024, the nephroscopes & endoscopes segment captured a 25% share of the percutaneous nephrolithotomy (PCNL) system market. This type offers enhanced image quality, lowered cross-contamination risk, and a plug-and-play design. The market is leveraging sophisticated digital nephroscopes that are replacing conventional fiber-optic models, with wider advances in three-dimensional visualization with optimized depth perception, anatomical detail, and surgical control for complex procedures.

Lithotripsy Generators & Probes

The lithotripsy generators & probes segment will expand fastest in the coming years. Mainly, it comprises advancements with lasers, which have made PCNL a highly efficient and safer procedure. The recently developed Swiss LithoClast Trilogy is a single-probe, dual-energy device that describes a milestone step. The use of tiny, robust lithotripter probes allows the progression of mini- and micro-PCNL, which use smaller access tracts.

Access Sheaths, Dilators & Tract Kits

The access sheaths, dilators & tract kits segment will expand notably in the future. Ongoing advances are fostering smaller-diameter access sheaths (14–20 Fr), dilators, and nephroscopes are employed for mini-PCNL. The emergence of balloon dilation promotes a faster, single-step method that employs an expandable balloon catheter to dilate the tract.

How did the Standard (Conventional) PCNL Segment Dominate the Market in 2024?

The standard (conventional) PCNL segment led with a 40% share of the percutaneous nephrolithotomy (PCNL) system market in 2024. A rise in the geriatric population, which is more prone to kidney stones, has fueled the significant demand for this procedure. According to a study, in 2021, 106 million cases of kidney stones were found, and it is predicted to rise to $1.24 billion/yr by 2030.

Mini-PCNL/Miniaturized PCNL

The mini-PCNL/miniaturized PCNL segment will expand rapidly during 2025-2034. Current advances are bolstering variations in this approach, like mini-PCNL, ultra-mini-PCNL, micro-PCNL, and super-mini-PCNL (SMP), each with its own set of instruments and intended utilization. Alongside, the market is revolutionizing surgical tools, including smaller nephroscopes and novel laser techniques, and advanced percutaneous sheaths.

Supine PCNL vs the Prone PCNL

The supine PCNL vs the prone PCNL segment will expand significantly. The latest breakthroughs of this solution are facilitating reduced operative times, minimizing anesthetic risks, and convenient access for bilateral or simultaneous procedures. Incorporation of the Galdakao-modified Valdivia position is crucial for optimizing stone clearance.

Why did the Reusable Rigid/Video Nephroscopes Segment Dominate the Market in 2024?

By capturing a 55% share, the reusable rigid/video nephroscopes segment led the percutaneous nephrolithotomy (PCNL) system market in 2024. These types are offering their stability, durability, affordability, and feasible utility, mainly in removing large or complex kidney stones. Alongside, the video type explores superior high-definition visualization and expanded maneuverability.

Single-Use/Disposable Scopes & Sheaths

The single-use/disposable scopes & sheaths segment is predicted to register rapid expansion. This leverages a guarantee of a sterile device for every patient, diminishing reprocessing errors and connected hospital-acquired infections (HAIs). Innovative digital disposable nephroscopes facilitate a chip-on-tip design that conveys high-quality imaging without requiring separate, bulky processors and light sources.

Disposable Access Kits/Dilator Sets

The disposable access kits/dilator sets segment will expand at a lucrative CAGR. Specifically, modern kits are firm, kink-resistant guidewires and puncture needles with special tips for enhanced ultrasound visualization. Some of them encompass polytetrafluoroethylene (PTFE) coating on guidewires and dilators to lower friction.

What Made the Hospitals (Tertiary & General Hospitals) Segment Dominant in the Market in 2024?

In 2024, the hospitals (tertiary & general hospitals) segment captured a 60% share of the percutaneous nephrolithotomy (PCNL) system market. They are increasingly investing in advanced PCNL systems, lasers, and imaging equipment to transform and boost the urological treatment. Also, they are necessary in training new urologists in PCNL techniques, to ensure a pipeline of skilled professionals.

Ambulatory Surgical Centers (ASCs)/Day-Case Units

Whereas the ambulatory surgical centers (ASCs)/day-case units segment is estimated to register the fastest growth. They offer raised safety and effectiveness, with lower expenses, and expanded patient satisfaction. A major development includes complete or hybrid ultrasound-guided PCNL, which skips radiation exposure for both patients and staff.

Specialty Urology Clinics/Stone Centers

The speciality urology clinics/stone centers segment will expand significantly in the future. Nowadays, they are using the "totally tubeless" technique to minimize the requirement for any drainage tubes (nephrostomy tube or internal stent) in select cases. Besides this, they employ sophisticated 3D imaging, navigation systems, and mixed-reality (MR) technology to boost puncture accuracy.

North America’s percutaneous nephrolithotomy (PCNL) system market held a 38% share in 2024. The drivers are suitable reimbursement policies, accelerated patient awareness, government funding for research, and the faster adoption of novel medical technologies. Certain centers of this region are safely executing protocols for same-day discharge in select PCNL patients. Researchers are working on laser technology, especially the thulium fiber laser and high-power holmium YAG laser.

The U.S. is a major country in the percutaneous nephrolithotomy (PCNL) system market, including the respective one, which escalates with the broader emergence of robotics systems, which enable assistance to surgeons with needle punctures and new robotic systems assist surgeons with needle punctures and instrument manipulation for higher accuracy. Alongside, the US is widely adopting minimally invasive techniques, which boost inpatient to outpatient settings.

The rising cases of kidney stone disease are driven by dietary habits, sedentary lifestyles, and metabolic disorders, which support the prospective growth in the percutaneous nephrolithotomy (PCNL) system market. Alongside, ASAP is increasingly shifting towards the progression and wider adoption of advanced PCNL systems, such as miniaturized instruments, which are impacting the patient base to include pediatric and geriatric cases.

For instance,

The respective market in China is highly promoting the developments in the "Chinese mini-PCNL" which utilizes a tiny 14–18F percutaneous tract and an 8/9.8F rigid ureteroscope. This assists in lowering blood loss, minimizing hospital stays, and reducing postoperative pain compared to conventional PCNL, particularly for complex stones. The widespread adoption of SAS technology is refined with the double-sheath negative pressure mini-PCNL, which has shown superior immediate outcomes.

Europe is experiencing a notable expansion in the percutaneous nephrolithotomy (PCNL) system market. This region is leveraging AI-enabled algorithms in the analysis of patient data and imaging for estimating surgical success (stone-free rate) and complication risks. Moreover, the emergence of endoscopically guided access (ECIRS) is integrating flexible ureteroscopy with PCNL, which offers the detection of the optimal puncture site from within the kidney.

For instance,

The percutaneous nephrolithotomy (PCNL) system market in South America is growing steadily as hospitals modernize and minimally invasive procedures gain popularity. Increasing awareness of advanced kidney stone treatments and improving healthcare accessibility are fueling regional adoption across both public and private sectors.

In Brazil, PCNL system adoption is accelerating due to expanding healthcare infrastructure, skilled urologist training programs, and government support for modern surgical technologies. The shift toward less invasive kidney stone removal methods positions Brazil as a leading market in South America’s urology advancement.

Primarily, the Germany percutaneous nephrolithotomy (PCNL) system market possesses leading medical device manufacturers, including Karl Storz GmbH & Co. KG and Dornier MedTech GmbH, which are immensely putting efforts into global PCNL advancements with the production of cutting-edge equipment, such as mini-nephroscopes and advanced lithotripters. Also, Germany is emphasizing making the procedure robust, less invasive, and safer by adopting miniaturization, robotics, and improved imaging.

A prominent factor driving the percutaneous nephrolithotomy (PCNL) system market in MEA is a rise in healthcare expenses, which further offers advanced infrastructure modernization and energy-sector projects, especially in the Middle East. In certain countries, including Saudi Arabia are highly adopting advanced PCNL solutions, though standard approaches (prone position, fluoroscopy) remain dominant for various urologists. At the same time, Africa is bolstering needs-based international alliances and workshops that are important to boost endourology access and establish local expertise in low-resource settings.

In the four Saudi Arabian medical centers, it has demonstrated a comparative study was conducted to analyze the efficiency of mini-PCNL versus flexible ureteroscopy (fURSL) for treating calyceal diverticulum stones between January 2020 and June 2024. This has further displayed that mini-PCNL is highly efficacious in a specific kind of stone.

Company Overview

Corporate Information

History & Background

Founded to develop advanced medical devices, Boston Scientific has grown into a global med-tech leader across cardiovascular, urology, endoscopy, and other segments.

Key Milestones/Timeline

Business Overview

Key Developments & Strategic Initiatives

Competitive Positioning

SWOT Analysis:

Recent News & Updates

Press Releases / Industry Recognitions / Awards:

Company Overview

Corporate Information

History & Background

Originally an optics and precision machinery company, Olympus evolved to focus on medical systems (endoscopes, surgical/therapeutic devices), significantly restructuring by divesting camera and scientific imaging businesses. Wikipedia+1

Key Milestones / Timeline

Business Overview

Key Developments & Strategic Initiatives

Competitive Positioning

SWOT Analysis:

Recent News & Updates

Press Releases / Industry Recognitions / Awards:

Key Companies and Their contributions and offerings

By Product/System Component

By Procedure Type/Approach

By Device Type

By End-User/Facility Type

By Region

January 2026

December 2025

December 2025

December 2025