January 2026

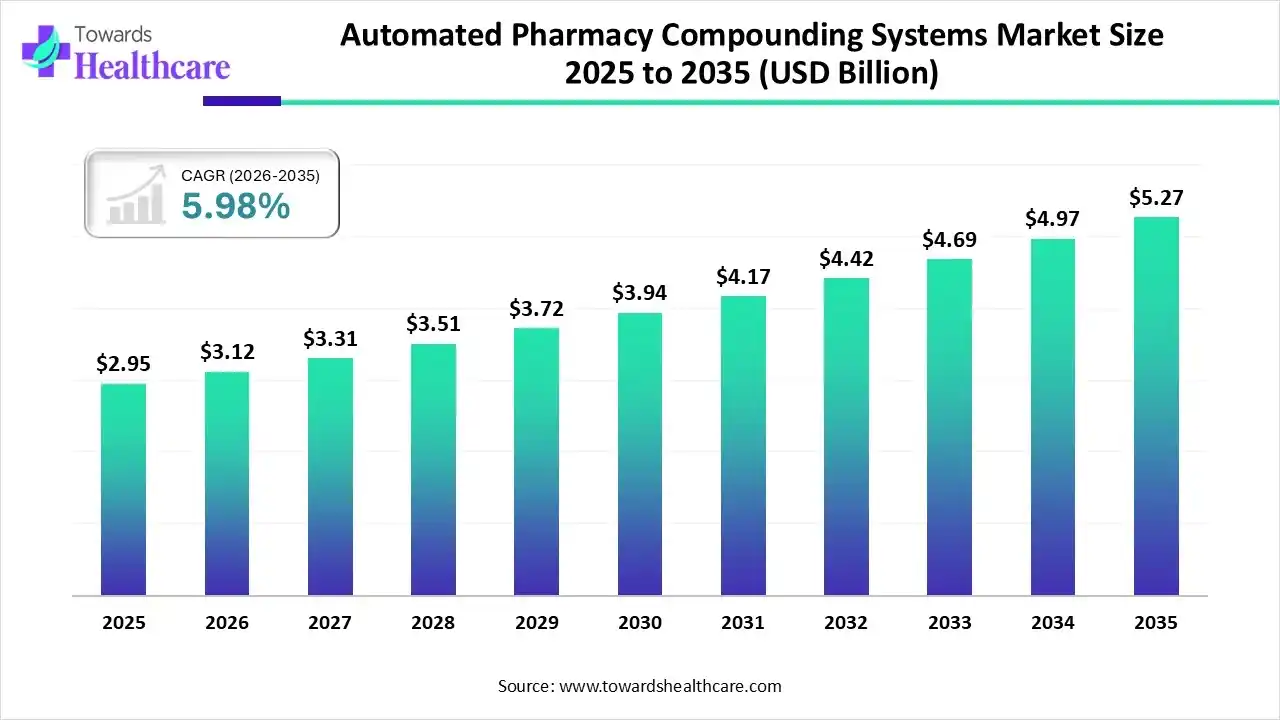

The automated pharmacy compounding systems market size was reported at US$ 2.95 billion in 2025 and is expected to rise to US$ 3.12 billion in 2026. According to forecasts, it will grow at a CAGR of 5.98% to reach US$ 5.27 billion by 2035.

In the future, the global automated pharmacy compounding systems will highly explore automation in pharmacy compounding, dispensing, and labelling with a vital minimisation of errors & boosted efficiency. Moreover, the leading players are putting efforts into the adoption and innovations in robotics automated systems and semi-automated solutions, to achieve inexpensive measures with increased robustness in streamlining workflows.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.12 Billion |

| Projected Market Size in 2035 | USD 5.27 Billion |

| CAGR (2026 - 2035) | 5.98% |

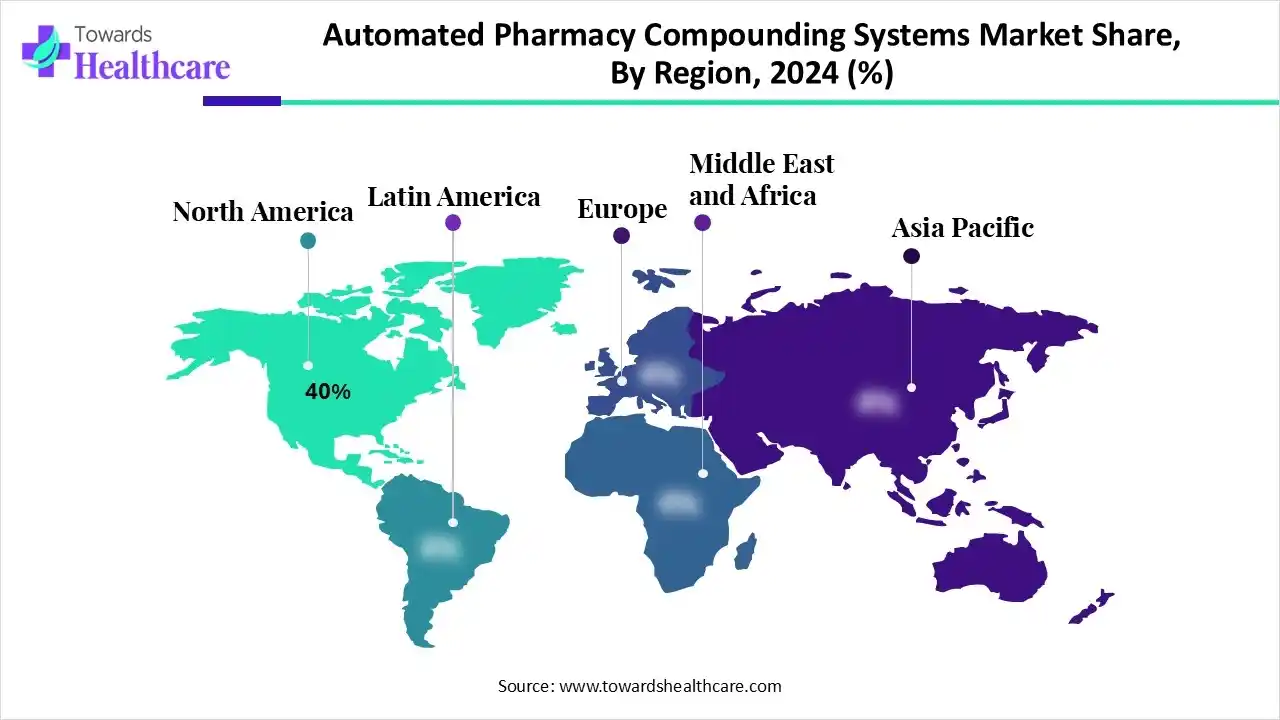

| Leading Region | North America by 40% |

| Market Segmentation | By Product, By Technology, By End User, By Region |

| Top Key Players | Capsa Healthcare, IMA Group, ARxIUM, Medimix Systems, Cerner Corporation, McKesson Corporation, Cardinal Health, Parata Systems, Baxter International, Yuyama Co., Ltd. |

Automated pharmacy compounding systems are devices and software solutions designed to accurately prepare individualised medications by automating the mixing, measuring, and dispensing of pharmaceutical compounds. These systems improve medication safety, enhance workflow efficiency, and reduce human error in hospital, retail, and speciality pharmacy settings.

The worldwide companies are widely adopting digital approaches to streamline their workflows, with enhanced effectiveness and safety as well, including the integration of Electronic Health Records (EHRs) and inventory management software. This further allows real-time tracking from compounding to administration. The global automated pharmacy compounding systems market is putting efforts into automated systems, like the IVX Station from Omnicell and the RIVA system by ARxIUM, which manages the compounding of syringes and IV bags within a highly controlled, aseptic environment.

By capturing a 55% share, the robotic compounding systems segment dominated the automated pharmacy compounding systems market in 2024. The significant benefits of this type include the reduction of medication errors, prevention of contamination risks, and protection from dangerous drugs are impacting the entire progression. Currently, the market is exploring improvements in interoperability with hospital systems via standards, such as HL7, and the application of collaborative robots (cobots) that work alongside human staff.

Whereas, the automated liquid compounding systems segment will expand at an 8.5% CAGR during 2025-2034. Due to the accelerating demand for sterile and precision medications, the requirement for affordable, effective, and accurate drug preparation is propelling its adoption. The leading players are fostering the wider use of hybrid dosing technologies, which integrate the highly accurate gravimetric (weight-based) dosing for active pharmaceutical ingredients (APIs) with volumetric dosing for larger volumes of solvents or excipients.

In the automated pharmacy compounding systems market, the robotic-based systems segment captured a 60% share in 2024. The segment is mainly driven by its automating repetitive and time-consuming tasks, particularly vial filling, labelling, and capping, where robots assist in freeing up pharmacists to emphasise higher-value clinical services and patient consultation. Nowadays, numerous manufacturers are increasingly bolstering the emergence of robotics into closed-loop systems, especially isolators, to offer a Grade A (ISO 5) environment.

On the other hand, the semi-automated systems segment is estimated to expand at an 8.0% CAGR. Ongoing breakthroughs are leveraging specialised semi-automated systems, which are created for high-risk preparations, mainly those for chemotherapy and parenteral nutrition. For this, the Gri-fill 4 system is an example that is specifically developed for compounding intravenous mixtures, such as chemotherapy doses. However, the rising demand for customised medicine for conditions, including chronic pain and hormonal imbalances, for which semi-automated systems that provide the flexibility to personalise preparations with enhanced precision.

In 2024, the hospitals segment held a 50% revenue share of the automated pharmacy compounding systems market. Automated systems are widely used due to rising focus on lowering medication errors, escalated demand for tailored solutions, and a supportive regulatory framework for sterile & hazardous compounding. Moreover, these systems develop complete digital documentation of the entire compounding process, from initial ingredients to the final product. Additionally, hospitals are utilising multi-arm robots to operate separate tasks simultaneously, which ultimately raises throughput.

The retail pharmacies segment is anticipated to grow at an 8.5% CAGR during 2025-2034. The segment is mainly driven by a rise in demand for expanded patient safety, the accelerating volume of prescriptions, and the progression in telehealth. Day by day, these pharmacies are increasingly adopting highly sophisticated robotic systems that are coupled with AI to assist and automate tasks, such as dispensing, counting, and storing medications. The recent developments encompass the launch of prescription-filling devices, especially the KL1Plus by Capsa Healthcare.

North America’s automated pharmacy compounding systems market captured 40% revenue share in 2024. This region is facing consistent limitations of labour, and the boosting demand for precision medicine is supporting innovations in automated compounding systems. Moreover, the ongoing assistance of stricter regulatory standards is impacting the transformation of pharmacies towards automation for ensuring safety and compliance.

For instance,

In the US, the emergence of regulatory scrutiny from the FDA, specifically related to the safety and quality of compounded medications, incentivises the application of technology are support ensuring consistency and sterility. Moreover, the automated pharmacy compounding systems market is promoting cloud-based software coupled with digital formulation libraries. This further encourages robust management & quality control.

Asia Pacific is predicted to register rapid expansion at a 9.0% CAGR in the prospective period. Primarily, ASAP is experiencing a huge requirement for speciality therapies, including those for cancer and autoimmune disorders, which demands more accurate and careful preparation. Alongside, the regional market is promoting integrated systems, such as a combination of compounding solutions with electronic health records (EHRs), with other pharmacy systems to enable real-time monitoring & expanded patient safety.

The Indian automated pharmacy compounding systems market is stepping into the incorporation of built-in quality control tools that measure and record the weight of each dose in real-time. Further, it confirms mass uniformity for every tablet and provides 100% quality control during manufacturing. Whereas many leading Indian players are seeking foreign manufacturers that are often involved in partnerships with local companies to manage distribution, installation, and after-sales service.

Primarily, Europe is exploring innovative technologies comprising cloud-based platforms, AI/machine learning for predictive inventory, and the combination of e-prescribing & tele-pharmacy. Along with this, Europe is greatly involved in bringing automated, quality-controlled production to the point of care, like a community or hospital pharmacy, instead of depending solely on large centralised facilities.

For instance,

Germany is experiencing a notable expansion in the automated pharmacy compounding systems market. This is escalated by a rise in innovations in platforms by applying 3D printing technology, especially for non-sterile compounding of personalised dosage forms, mainly for paediatrics. Besides this, German companies are bolstering the integration of automated compounding with IV workflow technologies. In the last years, in Germany, the Deenova Closed Loop Medication Management (CLMM) system was the foremost deployed at Marienhospital Gelsenkirchen.

By Product

By Technology

By End User

By Region

North America

South America

Europe

Eastern Europe

Asia Pacific

MEA

January 2026

January 2026

December 2025

November 2025