January 2026

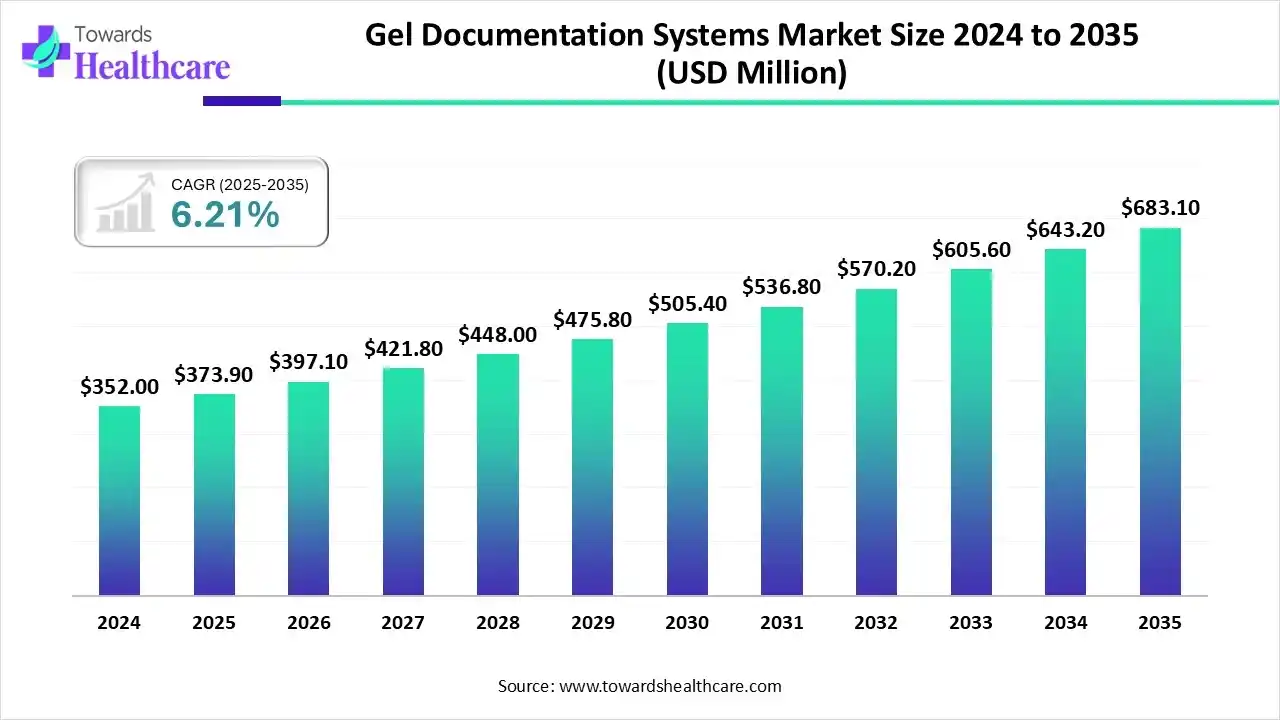

The global gel documentation systems market size is estimated at US$ 373.9 million in 2025, increased to US$ 397.1 million in 2026, and is expected to reach approximately US$ 683.1 million by 2035. The market is growing at a CAGR of 6.21% from 2026 to 2035.

The growing focus on molecular biology research and development is increasing the use of gel documentation systems, where AI is also being employed to improve their features, applications, and workflow. At the same time, strong industries, their expansion, and healthcare investments are boosting the adoption of gel documentation systems across different regions. Additionally, companies are launching new systems, further driving market growth.

| Table | Scope |

| Market Size in 2025 | USD 373.9 Million |

| Projected Market Size in 2035 | USD 683.1 Million |

| CAGR (2026 - 2035) | 6.21% |

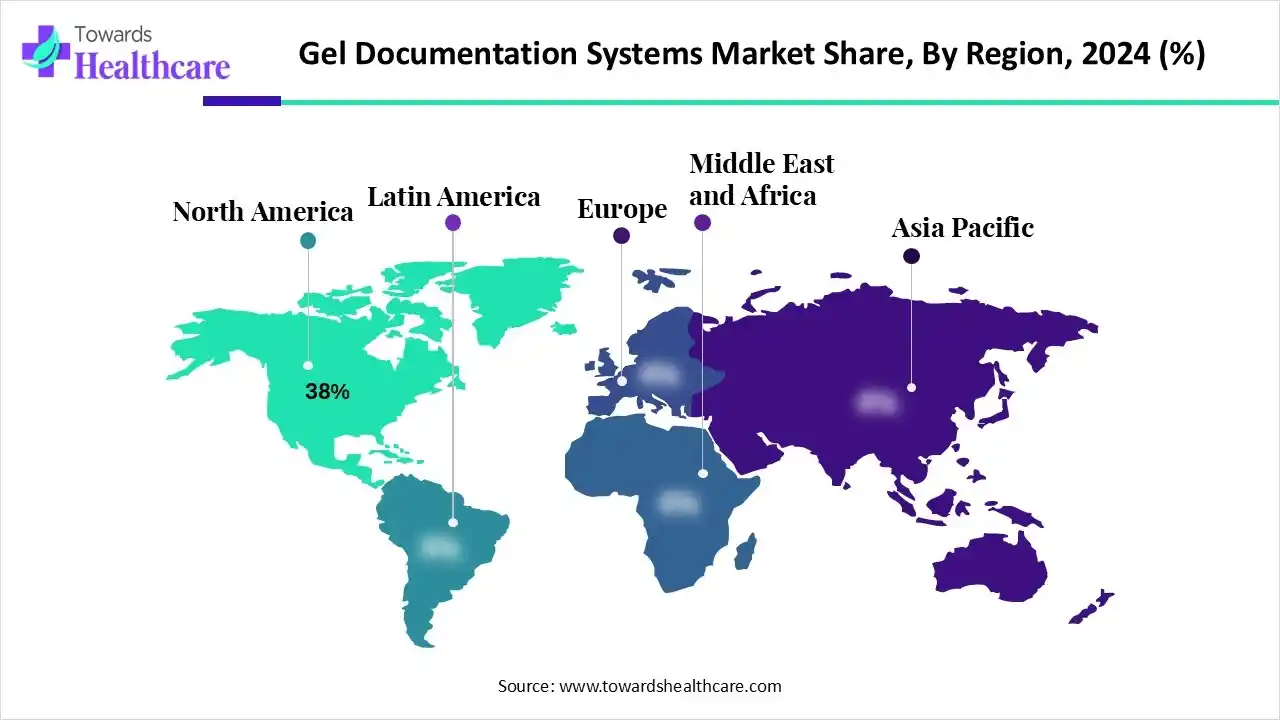

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Light Source Technology, By Application, By Detection Method, By End User, By Region |

| Top Key Players | GE HealthCare Life Sciences, Vilber Lourmat, Cleaver Scientific Ltd., UVP, LLC (Analytik Jena Group), Wealtec Corporation, Bio-Techne Corporation, ATTO Corporation (Japan), Corning Incorporated (Life Sciences Division), ProteinSimple (part of Bio-Techne), Eppendorf AG, LI-COR Biosciences, Major Science, Enduro GDS Systems, Labnet International, Inc., Tanon Science & Technology Co., Ltd. |

The gel documentation systems market is driven by the increasing demand for advanced imaging and analysis in biotechnology and molecular biology. These systems consist of hardware, software, and accessories used for visualizing, capturing, and analyzing nucleic acid (DNA/RNA) and protein gels after electrophoresis. They utilize ultraviolet (UV), white, or blue-light transillumination, along with digital cameras and analytical software, to quantify bands, determine molecular weights, and document experimental results.

In gel documentation systems, AI is used to automate image analysis, which reduces the chances of human errors and ensures the results are accurate and reproducible. This enhances its use in various experiments and multiplex testing, enabling the detection of multiple targets in a single gel with greater precision. Additionally, it also captures, stores, analyzes, organizes, and processes images, improving data management, tracking, and workflow efficiency.

Why Did the Standalone Gel Documentation Systems Segment Dominate in the Gel Documentation Systems Market?

The standalone gel documentation systems segment led the market with about 41% share in 2024. This is mainly because of the growing use of these systems in research labs for dependable imaging and flexibility. They are also easy to operate and affordable, which boosted their adoption. Furthermore, their ability to produce reproducible and consistent images further increased their popularity.

The integrated gel documentation and analysis workstations segment is expected to experience the highest CAGR in the coming years, as these workstations offer automation, cloud integration, and multiplex analysis, which are increasing their adoption. Additionally, their improved accuracy and consistent results are boosting their use by companies handling large volumes of samples.

The compact / portable gel doc units segment is expected to grow significantly during the forecast period due to their ease of use and portability, which is driving adoption by small laboratories. At the same time, increasing R&D activities are boosting their use by institutes, where affordability also plays a role.

What Made UV Transilluminators the Leading Segment in the Gel Documentation Systems Market in 2024?

The UV transilluminators segment led the market with a 44% share in 2024, owing to their well-established role in nucleic acid visualization. Their high sensitivity increased their popularity in molecular biology. Additionally, their ease of use, compatibility with common stains, and ability to produce reproducible and consistent results have further boosted their adoption.

The LED/blue-light transilluminators segment is expected to experience the fastest growth in the coming years due to their safer operation and compatibility with SYBR-safe dyes. At the same time, their high sensitivity and uniform illumination offer improved imaging clarity. Additionally, their longer lifespan is boosting their adoption.

The white light transilluminators segment is expected to grow significantly in the coming years, driven by their compatibility with protein stains. Additionally, they are safe to use, can be integrated with advanced gel documentation systems, and do not damage samples, which increases their popularity in proteomic research.

How Does the Nucleic Acid Quantification & Visualization (DNA/RNA Gels) Segment Dominate the Gel Documentation Systems Market in 2024?

The nucleic acid quantification & visualization (DNA/RNA gels) segment led the market with about 36% share in 2024, as they are fundamental to molecular biology and remain the main application. This, in turn, increased their use in PCR, gene expression studies, and forensic analysis. Additionally, they were widely adopted for genetic and molecular diagnostic research purposes.

The protein gel imaging & western blot documentation segment is expected to experience the fastest growth in the coming years, driven by proteomics research and antibody validation workflows. Additionally, improved imaging features with high sensitivity and multiplex detection are increasing their use. They are also being utilized in biomarker analysis.

The gene expression & PCR product analysis segment is expected to grow significantly over the forecast period due to its increasing use in diagnosing infectious diseases and genetic testing. This, in turn, has led to greater use in R&D focused on molecular diagnostics and genomics. Additionally, they are also employed in developing personalized and targeted treatment options.

What Made UV Detection the Dominant Segment in the Gel Documentation Systems Market in 2024?

The UV detection segment held the largest share of approximately 38% in the market in 2024, as they are standard for DNA gels. Furthermore, they offered high sensitivity for DNA and RNA molecules and were cost-effective. Their compatibility with staining and consistent imaging increased their use in research activities.

The fluorescence detection segment is expected to expand at the highest CAGR over the projected timeframe, driven by improvements in safety and sensitivity. They are also being used in simultaneous detection of multiple targets, driving their use in genomics and proteomics. Additionally, they are also being used in the quantitative analysis of nucleic acids.

The chemiluminescence imaging (western blot) segment is expected to grow rapidly in the near future, driven by increasing use for protein detection and quantification. Moreover, their high sensitivity and accuracy are increasing their use for drug discovery and development. Additionally, they are being used for multiplex detection and diagnostic applications.

Why the Academic & Research Institutes Segment Dominated the Gel Documentation Systems Market?

The academic & research institutes segment dominated the global market with approximately 47% share in 2024, driven by growing R&D and ongoing experimentation. This, in turn, contributed to the bulk of demand for gel documentation tools. Furthermore, the funding and investments promoted the adoption of advanced gel documentation systems.

The clinical & diagnostic laboratories segment is expected to grow at the fastest rate during the forecast period, as they integrate gel documentation into molecular diagnostic validation and QA workflows. At the same time, they are also being used in the development of personalized medicines. Additionally, advanced, automated gel documentation systems are being used heavily in these settings to handle large volumes of samples.

The biotechnology & pharmaceutical companies segment is expected to grow over the forecast period, driven by increasing research in genomics and proteomics. Moreover, the growing drug discovery and development are also increasing the use of gel documentation systems. They are also being used for qualitative analysis and vaccine and biologics development.

North America dominated the gel documentation systems market by capturing 38% share in 2024. This is primarily due to the presence of well-developed industries, which have increased the use of gel documentation systems for research purposes. At the same time, the growing experimentation in institutes also increased their use. Moreover, healthcare investments encouraged their adoption, thereby contributing to market growth.

The growth in R&D investment in the U.S. is boosting the use of advanced gel documentation systems. The presence of a large industrial hub is also increasing their application in diagnostics, genomics, proteomics, and molecular biology. Furthermore, they are developing new gel documentation systems, supported by funding from various sources.

The market in Asia Pacific is expected to experience the fastest growth during the forecast period, driven by the expanding healthcare sector that is investing heavily in molecular biology, which increases the demand for gel documentation systems. These systems are also used for various R&D activities. Additionally, government funding is speeding up their adoption, further boosting market growth.

The increasing demand for molecular diagnostics and genomics is driving up the use of gel documentation systems. Additionally, expanding industries and diagnostic labs are adopting these systems for various applications. Moreover, government initiatives are supporting their adoption and innovation to develop affordable solutions.

Europe is expected to see significant growth in the gel documentation systems market during the forecast period due to its strong pharmaceutical and biotechnology industries, which support the use of such systems. Increasing research on biomarker discovery, multiplex testing, and proteomics is driving demand. Consequently, these advancements along with government funding are boosting market growth.

The well-developed healthcare industry and research institutes in Germany are driving higher R&D activities, which in turn are increasing the use of gel documentation systems for various applications. Additionally, these research efforts are backed by investments from multiple sources, boosting the adoption of advanced or portable gel documentation systems. Furthermore, their improved sensitivity and automation are expanding their use in various diagnostic laboratories.

In South America, the growth of the gel documentation systems market is driven by the expansion of lifesciences research infrastructure and increasing biotechnology investment in countries such as Brazil and Argentina. Growing academic and pharmaceutical R&D activity has raised demand for imaging and documentation tools used in electrophoresis and proteomics workflows. In addition, cost-sensitive laboratories in the region favor relatively affordable geldocumentation systems over higher-end alternatives, further fueling adoption.

Brazil is the major contributor to the South American market, largely due to its dominant position in the region’s biotechnology and life sciences sectors. Brazil hosts around 60% of South America’s biotechs and roughly 30% of deep tech firms in the region, indicating a strong underlying research infrastructure that supports equipment adoption.

In the Middle East & Africa (MEA), the growth of the market is being driven by increasing investments in lifesciences research and healthcare infrastructure expansion, especially in countries such as Saudi Arabia, UAE, and South Africa. The adoption of advanced molecular biology techniques (including protein and nucleicacid electrophoresis) along with software-enabled imaging workflows is further accelerating demand for modern, high-throughput geldocumentation systems. Furthermore, government and private sector collaborations aimed at building research capabilities and diagnostic capacity are opening up significant new opportunities for equipment suppliers in this emerging region.

In the Middle East & Africa (MEA), Saudi Arabia stands out as one of the major contributors to the gel documentation systems market, driven by substantial national investment in lifesciences research infrastructure and diagnostic capabilities. For example, Saudi Arabia is identified among the leading countries in the MEA region regarding adoption of advanced molecularbiology tools. The country’s governmentled initiatives to build academic research centres and modern clinical laboratories provide a strong base for equipment suppliers of gel documentation systems.

The R&D of gel documentation systems focuses on developing automated, more sensitive, and multimodal imaging platforms with advanced software, integrating AI and cloud connectivity to improve data management, quantification, and user-friendliness.

Key Players: Bio-Rad Laboratories, Inc., Syngene International Ltd., Thermo Fisher Scientific Inc., Azure Biosystems, Inc.

Clinical trials and regulatory approvals for gel documentation systems focus on ensuring compliance with basic safety and manufacturing quality standards appropriate for lab equipment.

Key Players: Bio-Rad Laboratories, Inc., Syngene International Ltd., Thermo Fisher Scientific Inc., Azure Biosystems, Inc.

Support and services for gel documentation systems focus on instrument maintenance, data management, and operation.

Key Players: Bio-Rad Laboratories, Inc., Syngene International Ltd., Thermo Fisher Scientific Inc., Azure Biosystems, Inc.

Corporate Information : Headquarters: Hercules, California, U.S. | Year Founded: 1952 (founded by David Schwartz and Alice Schwartz).

Business Overview

BioRad Laboratories is a global provider of life science research and clinical diagnostic products. It manufactures instruments, systems, reagents, consumables and software used in molecular biology, proteomics, genomics, electrophoresis, and diagnostics workflows. Its offerings cater to academic research, biotechnology companies, pharmaceutical & biopharma industries, and clinical/diagnostic laboratories.

Business Segments / Divisions

The company operates primarily through two major segments:

Geographic Presence

BioRad has a global footprint: its operations extend across the United States, Europe, Asia, and Latin America. For example, in 2022, about 41 % of net sales were from the U.S. and about 59 % from international markets. The company serves customers in over 100 countries.

Key Offerings

SWOT Analysis

| Companies | Headquarters | Key Strength | Products |

| Thermo Fisher Scientific Inc. | Massachusetts, U.S. | Integrated lab equipment | iBright Imaging Systems, E-Gel Power Snap System |

| Syngene International Ltd. | Cambridge, UK | Imaging solutions for gels and chemiluminescence | G: BOX Series, Ingenius Series |

| Azure Biosystems, Inc. | California, U.S. | Quantitative western blotting systems | Azure Imaging systems, ChemiSOLO |

| Analytik Jena AG | Jena, Germany | Imaging and analysis solutions, and all-in-one systems | UVP GelStudio Series, UVP GelSolo |

The global gel documentation systems market is entering a stage of strategic maturation, underpinned by the twin imperatives of molecularbiology intensification and workflow automation. Advances in genomics, proteomics, and translational medicine are driving labs to invest in imaging platforms that deliver higher resolution, integrated analytics, and seamless data traceability. In this context, the demand for gel documentation systems extends beyond basic electrophoresis imaging to encompass full lifecycle documentation, real-time image quantitation, and cloud-enabled connectivity.

Emerging geographies, particularly in AsiaPacific and Latin America, represent compelling greenfield opportunities, as their research infrastructures scale and adopt next-generation laboratory instrumentation. Coupled with sustainability pressures, digitization of lab workflows and regulatory demands for reproducibility, vendors can capture premium margins by offering modular, software-augmented systems that reduce manual interventions and accelerate throughput. In short, the geldocumentation segment is evolving from a niche accessory to a cornerstone instrumentation category in modern life‐science laboratories, presenting a strong growth horizon for incumbents and new entrants alike.

By Product Type

By Light Source Technology

By Application

By Detection Method

By End User

By Region

January 2026

November 2025

December 2025

November 2025