February 2026

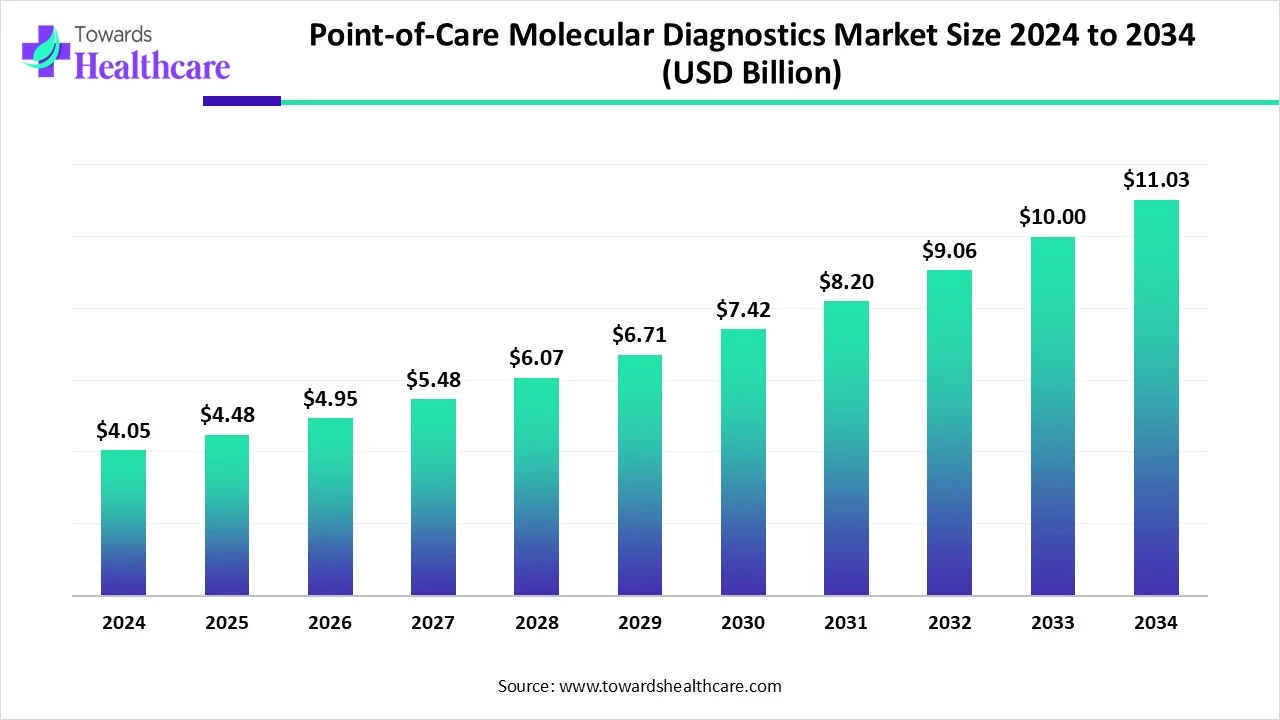

The global point-of-care molecular diagnostics market size is calculated at US$ 4.05 billion in 2024, grew to US$ 4.48 billion in 2025, and is projected to reach around US$ 11.03 billion by 2034. The market is expanding at a CAGR of 10.45% between 2025 and 2034.

The use of point-of-care (POC) molecular diagnostics is increasing globally due to growing demand for rapid and accurate diagnosis of diseases. The companies are contributing to new acquisitions and investment rounds to accelerate their development. To enhance their accuracy and adaptability, AI is also being used. Moreover, their use for at-home testing is increasing their adoption rates. Additionally, the expansion of the healthcare sector is also accelerating its adoption. Furthermore, new strategies and launches are also being revealed by the companies. Thus, this promotes the market growth.

| Table | Scope |

| Market Size in 2025 | USD 4.48 Billion |

| Projected Market Size in 2034 | USD 11.03 Billion |

| CAGR (2025 - 2034) | 10.45% |

| Leading Region | North America |

| Market Segmentation | By Technology/Assay Chemistry, By Product Type/Offering, By Test Format/Throughput, By Clinical Application/Indication, By End-User/Deployment Site, By Region |

| Top Key Players | Abbott Laboratories, Roche Diagnostics, Danaher Corporation, bioMérieux, Hologic, Inc., Thermo Fisher Scientific, Qiagen, QuidelOrtho, LumiraDx, Mesa Biotech, Molbio Diagnostics, Becton, Dickinson and Company (BD), Meridian Bioscience, Binx Health, Biocartis, Abbott ID NOW, Seegene, GenMark Diagnostics, MGI / BGI, Newer entrants / CRISPR-NAAT specialists |

Point-of-care molecular diagnostics are decentralized nucleic-acid–based tests and systems that detect DNA/RNA (pathogen or host markers) near the patient (clinic, ED, pharmacy, bedside, or home) and deliver rapid, clinically actionable results without routing samples to a central laboratory. POC molecular platforms include rapid PCR/RT-PCR, isothermal NAATs (LAMP, RPA), cartridgeized closed systems, microfluidic lab-on-chip devices, and emerging CRISPR-based NAATs, together with their consumables (assays/reagents) and software/connectivity modules. POC molecular tests are used primarily for infectious disease detection (respiratory, STIs, GI, sepsis panels), antimicrobial stewardship, and increasingly for certain oncology/genetic rapid assays.

Growing innovations: The industries and institutes are contributing to the growing research and development, which is increasing the number of innovations. Advanced technologies are also being used for their development. Hence, to leverage these technologies, there is a rise in the number of acquisitions. This is being supported by the growing investments from the private sector.

For instance,

The sensitivity and specificity of POC molecular diagnostics are improved with the use of AI. This decreases the chances of false positive or false negative results. Real-time tracking of pathogen evolution can be done with the use of deep learning, which can provide early detection and predict outbreaks of infections. It also helps in the development of personalized diagnostics. It also helps in enhancing global disease surveillance and pandemic preparedness. Thus, with the use of AI, the adaptability and accuracy of the POC molecular diagnostics are being enhanced.

Rising at Home Testing

There is a rise in at-home testing, which in turn is increasing the demand for POC molecular diagnostics. They support the growing patient demand for rapid and accurate diagnostic tests, eliminating the need to visit the hospital. At the same time, due to its growing innovation for the detection of chronic diseases such as cancer, STIs, etc, its use is increasing. They are also being integrated with telehealth, which in turn is encouraging their use. Thus, this drives the point-of-care molecular diagnostics market growth.

High Cost

For the development of point-of-care molecular diagnostics, sophisticated instruments are required, which are expensive. Moreover, the consumables and materials are repeatedly used. This increases the demand for investments for their adoption. Hence, this increases the cost of the POC molecular diagnostics. Thus, this can limit their use.

Why is Multiplex Test Advancements an Opportunity in the Market?

Due to growing demand for rapid and accurate diagnosis, and growing diseases is increasing the development of multiplex tests. The multiplex POC tests provide rapid and accurate detection of various pathogens or biomarkers. Hence, new multiplex platforms are being developed for the detection of complex conditions such as GI infection, respiratory infection, etc. They are also being used in the detection of antibiotic resistance genes. Moreover, the presence of one test cartridge minimizes the risk of contamination. Hence, this increases their use in decentralized settings as well. Thus, this promotes the point-of-care molecular diagnostics market growth.

For instance,

By technology/assay chemistry type, the real-time PCR/RT-PCR segment led the point-of-care molecular diagnostics market with approximately 45% share in 2024, due to its high specificity and sensitivity. They were used for the detection of flu, STIs, etc. Moreover, their fast results increased their use. This contributed to the market growth.

By technology/assay chemistry type, the CRISPR-based detection segment is expected to show the highest growth at a notable CAGR during the predicted time. They offer fast detection along with enhanced specificity. They provide a wide range of diagnostic applications. Moreover, their portability is enhancing their adoption.

By product type/offering type, the instrument/platform segment held the largest share of approximately 50% in the point-of-care molecular diagnostics market in 2024, as they were crucial for the development. Moreover, the growing technological advancements have increased their use. Additionally, the growing developments in multiplex testing have increased its use.

By product type/offering type, the handheld/truly portable devices segment is expected to show the highest growth during the upcoming years. They can be used anywhere, which increases their use in home testing. Moreover, the growing advancements in telehealth are also supporting their adoption. This enhances the patient's convenience.

By test format/throughput type, the single-test rapid systems segment led the point-of-care molecular diagnostics market with approximately 55% share in 2024, because of its rapid results. It requires minimal sample and is easy to use. This increases its use in rural clinical or at-home settings. Thus, this enhanced the market growth.

By test format/throughput type, the multiplex cartridges segment is expected to show the fastest growth rate during the predicted time. It provides the detection of various infections simultaneously. They can also differentiate the infection with similar symptoms. This is increasing their use in emergency situations.

By clinical application/indication type, the respiratory infections segment held the dominating share of approximately 35% in the point-of-care molecular diagnostics market in 2024, for their accurate diagnosis. These infections often showed similar symptoms, which increased the use of POC molecular diagnostics for their differentiation. Moreover, it also provided fast results. This increased their use in hospitals and clinical settings as well.

By clinical application/indication type, the antimicrobial resistance markers segment is expected to show the highest growth during the forthcoming years. Tackling the growing antibiotic misuse leading to antimicrobial resistance is increasing the demand for POC molecular diagnostics. Hence, with its use, the resistance genes can be easily detected. Furthermore, for the detection of resistant pathogens, the use of multiplex POC tests is increasing.

By end-user/deployment site type, the hospital ED/inpatient wards/perioperative suites segment led the global point-of-care molecular diagnostics market with approximately 40% share in 2024, due to high patient volumes. They were used for the diagnosis of various diseases. Moreover, they were also used for the detection of post-operative infection. This promotes market growth.

By end-user/deployment site type, the pharmacy/community testing sites segment is expected to show the fastest growth rate during the upcoming years. They are offering a variety of POC molecular diagnostic kits. They are increasing the accessibility of the POC molecular diagnostics. This, in turn, is enhancing patient convenience.

North America dominated the point-of-care molecular diagnostics market in 2024. North America consisted of a well-developed healthcare sector, which encouraged the development of POC molecular diagnostics. The presence of advanced technologies, along with investments from various sources, also contributed to the same. This enhanced the market growth.

The healthcare infrastructure in the U.S is well-developed, along with the presence of advanced technologies. This, in turn, enhanced the development of POC molecular diagnostics. The industries are also developing new platforms to improve their application and portability. These developments are provided with fast approval by regulatory bodies, promoting their innovations.

The rising chronic diseases are increasing the development as well as the adoption of POC molecular diagnostics. Moreover, AI-based platforms are also being developed for decentralized testing. Thus, the investments from the government are promoting their development.

Asia Pacific is expected to host the fastest-growing point-of-care molecular diagnostics market during the forecast period. To deal with the growing disease burden, the adoption of POC molecular diagnostics is increasing in the Asia Pacific. The expanding healthcare sector is also increasing its use. The technological advancements are increasing their innovations as well as manufacturing. The growing awareness through the screening programs is also increasing their use. Thus, this promotes the market growth.

The R&D of point-of-care molecular diagnostics includes the development of multiplexing tests and advancements in miniaturization, microfluidics, and nanotechnology, and is focusing on improving their accuracy and speed.

Key players: Roche, Abbott, Cepheid

Different types of kits and materials, such as consumables, test cartridges, swabs, vials, etc., of point-of-care molecular diagnostics are distributed to the hospitals and pharmacies.

Key players: Abbott, Cepheid, BioFire

The patient support and services provided through point-of-care molecular diagnostics include fast results, easy use, enhanced accessibility, remote monitoring, and at-home testing.

Key players: Abaxis, Accel Diagnostics, Altratech

In June 2025, the molecular diagnostics strategy will be refocused by QuidelOrtho Corporation, where its president and chief executive officer, Brian J. Blaser, stated that, to drive shareholder value, they have been continuously reviewing their strategy for around a year since joining. To realign their product portfolio and enhance future growth, a significant step was announced. They are focusing on enhancing their presence in point-of-care molecular diagnostics, which is one of the fastest and largest growing segments in the diagnostics industry, with their intended acquisition of LEX Diagnostics.

By Technology/Assay Chemistry

By Product Type/Offering

By Test Format/Throughput

By Clinical Application/Indication

By End-User/Deployment Site

By Region

February 2026

February 2026

January 2026

December 2025