February 2026

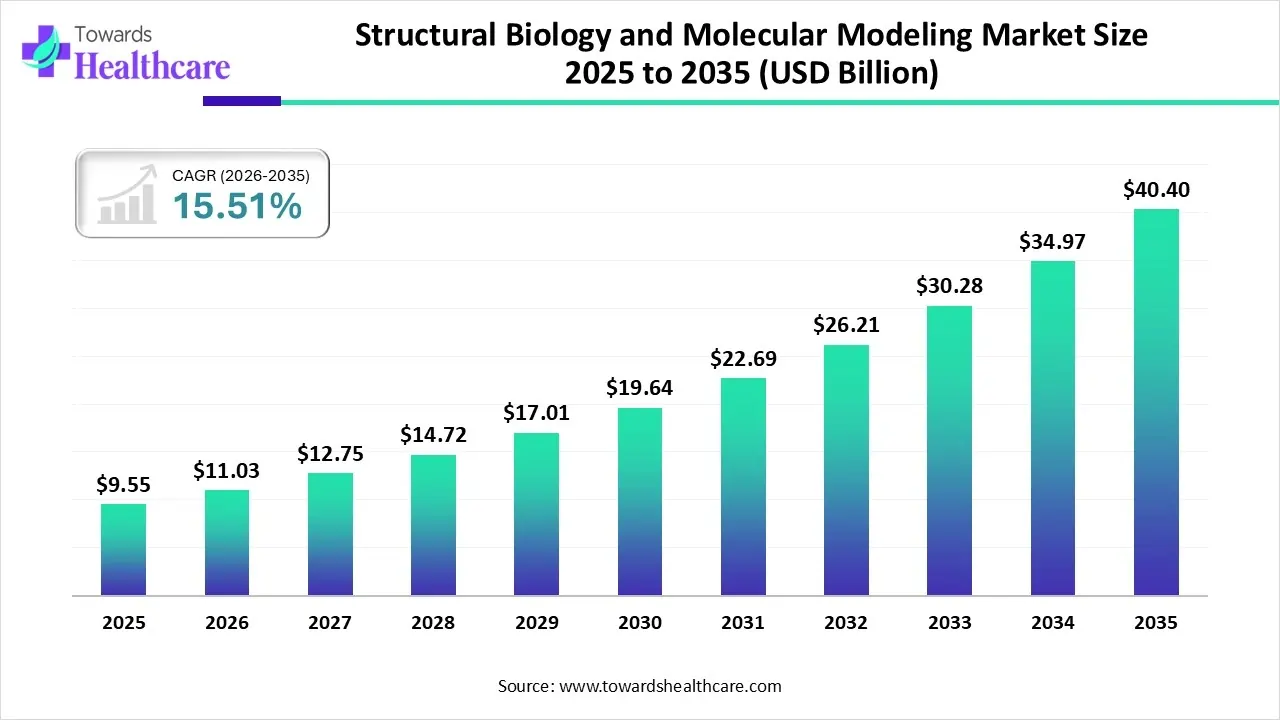

The global structural biology and molecular modeling market size is calculated at USD 9.55 billion in 2025, grew to USD 11.03 billion in 2026, and is projected to reach around USD 40.4 billion by 2035. The market is expanding at a CAGR of 15.51% between 2026 and 2035.

The structural biology and molecular modeling market is primarily driven by the rising need for targeted therapeutics and personalized medicines. Molecular modeling enables researchers to develop novel drugs based on a protein’s structure, ensuring targeted treatment. Several in silico tools and software have revolutionized the structural biology field. Artificial intelligence (AI) streamlines the prediction of 3D protein structure and analyzes complex data.

| Key Elements | Scope |

| Market Size in 2025 | USD 9.55 Billion |

| Projected Market Size in 2035 | USD 40.4 Billion |

| CAGR (2025 - 2035) | 15.51% |

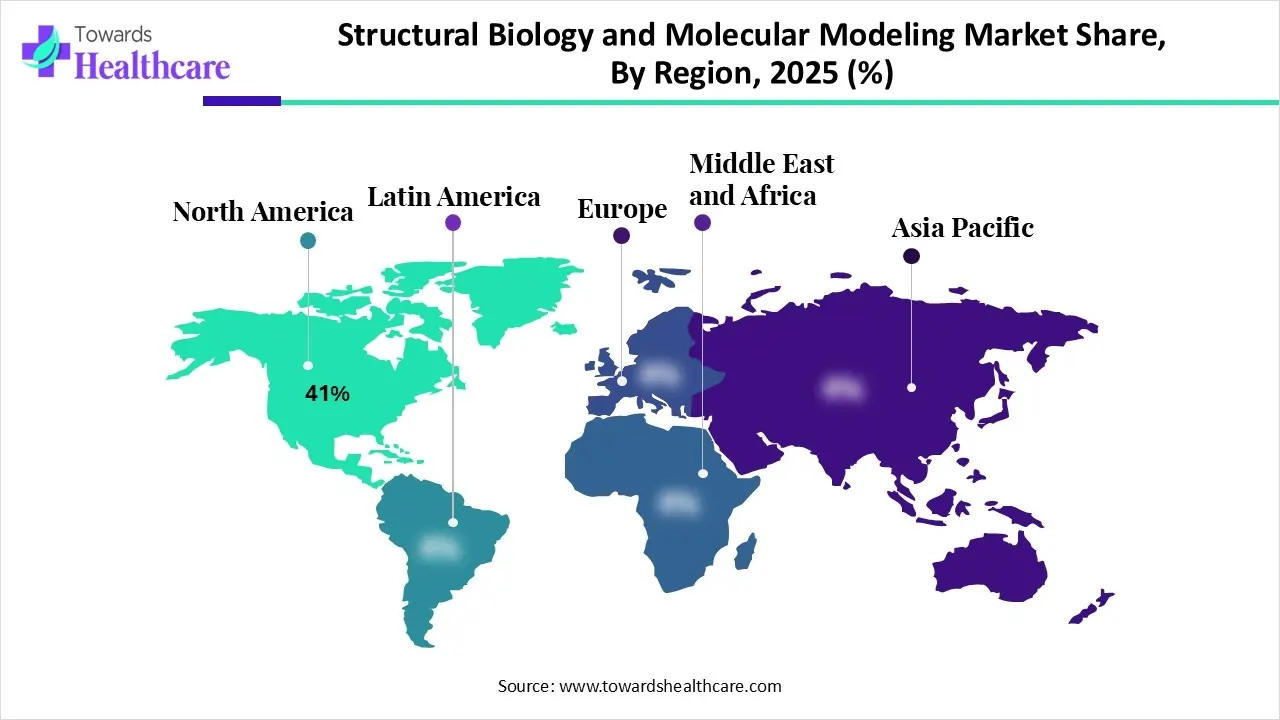

| Leading Region | North America by 41% |

| Market Segmentation | By Application, By Tool/Technique, By Component, By End-User, By Therapeutic Area, By Region |

| Top Key Players | Chemical Computing Group (CCG), Accelrys (now part of BIOVIA), Cresset Group, Leadscope (Instem), Cambridge Crystallographic Data Centre (CCDC), Acellera Ltd., Nimbus Therapeutics, RELION (University of Cambridge), DeepMind (AlphaFold), Biovia Discovery Studio, OpenMM / GROMACS |

The structural biology and molecular modeling market is fueled by the growing demand for personalized medicines, advances in molecular modeling, and increasing R&D investments. It encompasses computational and experimental techniques used to determine and predict the 3D structures of biological macromolecules, such as proteins, nucleic acids, and complexes, and to simulate their interactions, dynamics, and functions.

These tools are crucial for understanding biological mechanisms, drug discovery, and rational drug design. Structural biology techniques such as X-ray crystallography, NMR spectroscopy, cryo-electron microscopy (cryo-EM), and computational molecular modeling (e.g., molecular dynamics, homology modeling, quantum mechanics/molecular mechanics hybrid modeling) help researchers visualize molecular structures, design targeted therapeutics, and predict binding affinities and biological activities.

AI revolutionizes the structural biology and molecular modeling market by predicting protein structure at a faster speed and with high sensitivity, enhancing accuracy and precision. AI and ML can analyze vast amounts of complex data from techniques such as X-ray crystallography and cryo-EM. They accelerate molecular simulations and aid in interpreting experimental data. Moreover, AI and ML can simplify researchers’ tasks by studying protein-protein and drug-protein interactions using in silico molecular modeling tools. They help understand the interplay between protein components, revealing a mechanism for regulating cell signaling cascades.

Which Application Segment Dominated the Market?

Drug Discovery & Design

The drug discovery & design segment held a dominant presence in the structural biology and molecular modeling market with a share of approximately 42% in 2024, due to the need for targeted therapeutics. The rising prevalence of chronic disorders and rapidly changing demographics necessitate researchers to develop novel personalized medicines. Government bodies and regulatory agencies support the use of advanced molecular modeling tools for drug development. The increasing number of drug approvals promotes the use of molecular modeling. In 2024, the U.S. Food and Drug Administration (FDA) approved 50 novel drugs.

Biomolecular Interaction Prediction

The biomolecular interaction prediction segment is expected to grow at the fastest CAGR in the market during the forecast period. Large datasets and advanced computational models facilitate the prediction of biomolecular interactions. The advent of AI, ML, and deep learning models aids in understanding the mechanisms of biomolecular interactions by identifying key residues and predicting drugs’ side effects.

Protein Engineering

The protein engineering segment is expected to show a notable CAGR due to the need to study the structure-function relationships. Protein engineering is a technique to derive modified proteins with new or improved functions by predicting amino acid changes. It includes rational design, directed evolution, peptidomimetics, and de novo protein design. Modeling tools help researchers design amino acid sequences that fold into precise 3D structures.

Why Did the X-Ray Crystallography Segment Dominate the Market?

The x-ray crystallography segment held the largest revenue share of approximately 37% in the structural biology and molecular modeling market in 2024, due to high resolution and the ability to provide highly accurate, atomic-level structural data. X-ray crystallography is an age-old technique to determine protein structure and is still preferred due to its higher affordability than other methods. Advances in X-ray crystallography technologies have led to large-scale fragment screening experiments, accelerating the drug discovery process.

Cryo-Electron Microscopy (Cryo-EM)

The cryo-electron microscopy segment is expected to grow with the highest CAGR in the market during the studied years. Cryo-EM is an advanced version of X-ray crystallography that delivers resolution in the range of 2-3 Å. It is ideal for large complexes and membrane proteins and allows for the visualization of multiple protein conformations. It can be applied to a wide range of biological samples, including proteins, viruses, cells, and tissues.

Molecular Dynamics Simulation (MDS)

The molecular dynamics simulation segment is expected to show lucrative growth, due to the ability of MDS to capture the behavior of proteins in full atomic detail. MDS is an advanced computational technique that is emerging as a powerful tool in biomedical research. It offers insights into intricate biomolecular processes, such as structural flexibility and molecular interactions. It plays a crucial role in elucidating protein behavior and its interactions with ligands.

How the Software Segment Dominated the Market?

Software

The software segment contributed the biggest revenue share of approximately 46% in the structural biology and molecular modeling market in 2024, due to the availability of user-friendly tools and cost-effectiveness. Software enables researchers to have complete control over their research data and maintain confidentiality. They can be operated on a cloud platform, allowing researchers to manage large datasets. They offer high scalability and flexibility, as well as automate repetitive tasks.

Services

The services segment is expected to expand rapidly in the market in the coming years. Services are preferred by researchers and companies that lack sufficient tools and software for conducting biomedical research. They provide customized solutions to complex research problems. Molecular modeling services complement software tools by providing services and support to researchers and organizations.

Hardware

The hardware segment is expected to grow in the coming years. Hardware equipment, such as high-performance computing (HPC) systems and GPU accelerators, is essential to conduct complex procedures. GPUs required for MDS are high-end GeForce RTX GPUs and mid-tier NVIDIA professional RTX GPUs. Multi-GPU setups are extremely popular for scaling performance or running jobs in parallel.

Which End-User Segment Led the Market?

The pharmaceutical & biotechnology companies segment led the structural biology and molecular modeling market with a share of approximately 52% in 2024, due to favorable infrastructure and suitable capital investments. The growing number of startups contributes to the segment’s growth. The increasing competition among companies encourages them to expand their product pipeline and strengthen their market position. This helps them to develop targeted and more efficacious drugs.

Contract Research Organizations (CROs)

The contract research organizations (CROs) segment is expected to witness the fastest growth in the market over the forecast period. Large-, small-, and mid-scale companies outsource their research services to CROs. CROs possess advanced tools and hardware to perform complex research activities, assisting in drug discovery and development. They have skilled professionals to provide tailored solutions.

Academic & Research Institutes

The academic & research institutes segment is expected to grow significantly, due to growing research and development activities and suitable facilities. Institutions have expert-level professionals and facilities to screen hit molecules. They receive funding from the government and private organizations to adopt advanced tools for molecular modeling.

What Made Oncology the Dominant Segment in the Market?

The oncology segment accounted for the highest revenue share of approximately 44% in the structural biology and molecular modeling market in 2024, due to the rising prevalence of cancer and growing cancer research globally. Ongoing efforts are made to identify complex biomarkers and proteins involved in cancer progression. Structural biology and molecular modeling enable researchers to study cancer pathways and derive targeted therapeutics. Over the past five years, a total of 75 oncology drugs were approved by the FDA, of which 46 were precision oncology therapies.

Neurological Disorders

The neurological disorders segment is expected to show the fastest growth over the forecast period. The development of targeted therapeutics for neurological disorders is difficult due to the involvement of complex pathways. Researchers are constantly evaluating molecular interactions and their role in disease progression. Advanced computational methods are used to investigate neuronal circuits.

Infectious Diseases

The infectious diseases segment is expected to grow in the upcoming years, due to the increasing incidence of seasonal infections and global pandemics. The COVID-19 pandemic has shifted researchers’ attention toward developing therapeutics for infectious diseases, addressing concerns related to drug resistance. Structural biology tools can be used to explain interactions between pathogens and hosts, as well as to study the viral envelope.

North America dominated the global structural biology and molecular modeling market with a share of approximately 41% in 2024. The availability of state-of-the-art research and development facilities, the presence of major pharmaceutical and biotech players, and increasing investments are the major factors that govern market growth in North America. The growing number of new drug approvals encourages key players to develop more effective medicines and strengthen their market position.

Key players, such as Schrödinger, Inc., OpenEye Scientific, and Acellera Ltd., are the major contributors to the market in the U.S. The National Institute of Health (NIH) provides funding of $48 million annually for medical research. NIH funding has led to breakthroughs and new treatments. Numerous government departments fund RCSB PDB, which contains 244,730 structures from the PDB archive.

Asia-Pacific is expected to host the fastest-growing structural biology and molecular modeling market in the coming years. Researchers are becoming more aware of molecular modeling tools for new drug discovery. Government and private institutions conduct workshops, seminars, and conferences to share the latest updates and train individuals about structural biology. Countries like China, India, and Japan witness high investments in computational biology and AI-based modeling. The increasing collaboration between academia and industry and biopharma outsourcing contributes to market growth.

The growing awareness of structural biology and molecular modeling promotes market growth in China. The Chinese University of Hong Kong Department of Physics hosted a “2025 Hong Kong Symposium on Molecular Modeling and Simulation” in May 2024 to share the latest research work of experts. In September 2024, the Chinese Academy of Sciences proposed an efficient multi-scale machine learning force field model suitable for large-scale molecular simulations of organic systems.

Europe is expected to grow at a considerable CAGR in the structural biology and molecular modeling market in the upcoming period. European nations, such as Germany, the UK, and France, conduct advanced research activities for new drug development. The growing demand for personalized medicines and the increasing adoption of computational biology tools propel the market. The increasing investment and collaboration among key players and academic institutions also foster market growth. Favorable government support and supportive regulatory policies potentiate the use of structural biology and molecular modeling.

The French government and the pharmaceutical industry have pledged to increase spending on medical R&D by 10% over the next three years (2023-2026). The government has launched several initiatives, doubled tax breaks for companies investing in R&D, and introduced a specific tax break for the pharmaceutical sector.

| Companies | Headquarters | Offerings | Revenue (2024) |

| Schrödinger, Inc. | New York, United States | Maestro for structural biology, chemical simulation, and computational modeling | $207.5 million |

| Dassault Systèmes | Vélizy-Villacoublay, France | BIOVIA and molecular simulation programs like NAMD and CHARMm | €6.21 billion |

| OpenEye Scientific | New Mexico, United States | Molecular modeling and cheminformatics software tools and Structural Biology tools | - |

| Certara, Inc. | Pennsylvania, United States | Provides modeling and simulation services to optimize drug development and increase confidence for critical decisions | $385.1 million |

| Simulations Plus, Inc. | California, United States | Offer biosimulation software and solutions that bridge AI/ML, PBPK/pharmacokinetics, pharmacometrics | $18.7 million |

By Application

By Tool/Technique

By Component

By End-User

By Therapeutic Area

By Region

February 2026

February 2026

February 2026

February 2026