Allergy Diagnostics And Therapeutics Market Size, Key Players with Dynamics and Forecast

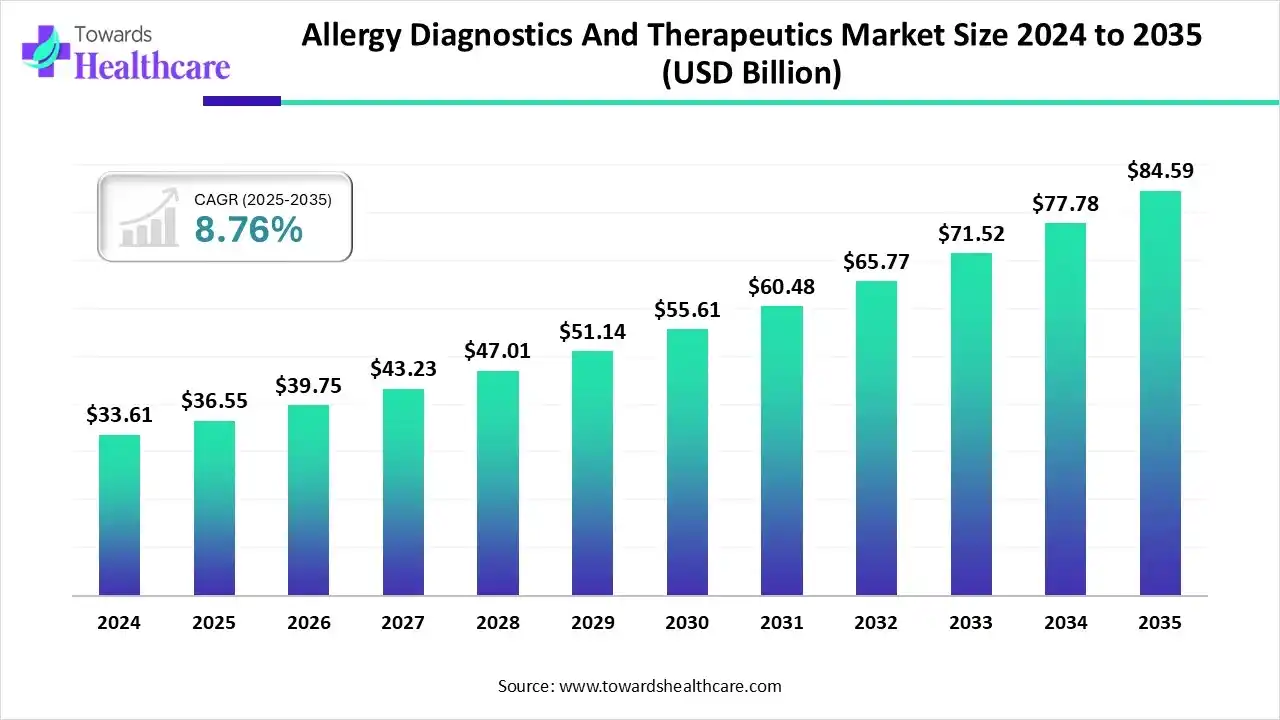

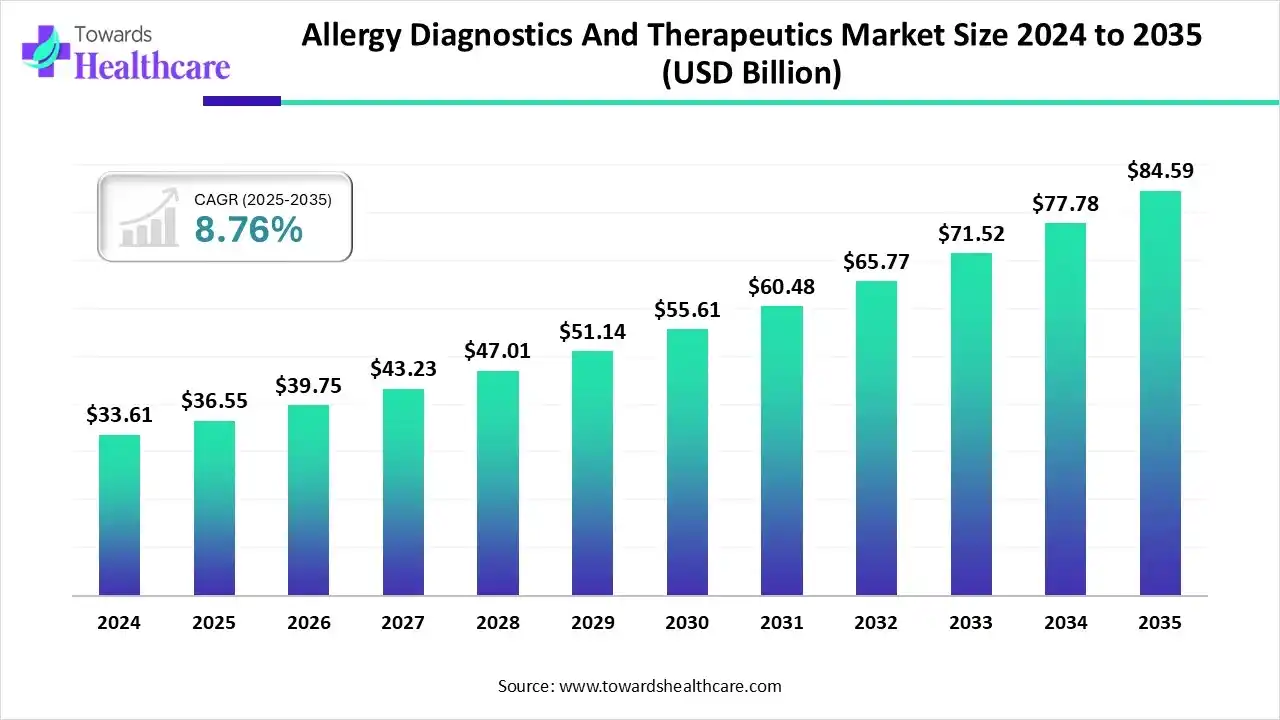

The allergy diagnostics and therapeutics market size stood at US$ 36.55 billion in 2025, grew to US$ 39.75 billion in 2026, and is forecast to reach US$ 84.59 billion by 2035, expanding at a CAGR of 8.76% from 2026 to 2035.

The allergy diagnostics and therapeutics market is expanding rapidly due to the rising incidence of allergic conditions such as asthma, rhinitis, and food allergies. Growing awareness, technological advancements in testing, and increased demand for effective treatments are fueling growth. Additionally, supportive government initiatives and improved healthcare access are enhancing market adoption globally.

Key Takeaways

- Allergy diagnostics and therapeutics sector pushed the market to USD 36.55 billion by 2025.

- Long-term projections show USD 84.59 billion valuation by 2035.

- Growth is expected at a steady CAGR of 8.76% in between 2026 to 2035.

- North America dominated the allergy diagnostics and therapeutics market in 2024.

- Europe is expected to grow at the fastest CAGR in the market during the forecast Period.

- By type, the therapeutics segment held the largest market share in 2024.

- By type, the diagnostic segment is expected to grow at the fastest CAGR in the market during the forecast Period.

- By allergen, the inhaled allergies segment dominated the market with a revenue share of in 2024.

- By allergen, the drug allergies segment is expected to grow at the fastest CAGR in the market during the forecast Period.

- By test type, the in vitro test segment led the market with the largest revenue share in 2024.

- By test type, the in vivo test segment is expected to grow at a lucrative rate in the market during the forecast Period.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 36.55 Billion |

| Projected Market Size in 2035 |

USD 84.59 Billion |

| CAGR (2026 - 2035) |

8.76% |

| Leading Region |

North America |

| Market Segmentation |

By Type, By Allergen Type, By Test Type, By Region |

| Top Key Players |

R-Biopharm AG, DASIT Group SPA, EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.), AESKU.GROUP GmbH, bioMérieux, Siemens Healthcare GmbH, Stallergenes Greer, HYCOR Biomedical, Minaris Medical America, Inc., Omega Diagnostics Group PLC, Lincoln Diagnostics, Inc., HOB Biotech Group Corp., Ltd., Danaher, Alcon, AbbVie, Inc., Sanofi, Allergy Therapeutics, Pfizer, Inc., Teva Pharmaceutical Industries Ltd., GSK plc, Sun Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Astellas Pharma Inc., Epigenomics AG |

What are Allergy Diagnostics and Therapeutics?

The allergy diagnostics and therapeutics market involves the development and use of tests and treatments to identify, manage, and prevent allergic diseases caused by allergens such as pollen, food, or dust. The market is growing due to the rising global prevalence of allergic diseases, increasing environmental pollution, and growing awareness of early diagnosis and treatment. Advancements in diagnostic technologies, such as molecular and component-resolved testing, are enhancing accuracy.

For Instance,

- In February 2024, the U.S. FDA approved Xolair (omalizumab) injection for treating IgE-mediated food allergies in adults and children aged one year and above. The approval aims to reduce allergic reactions, including the risk of anaphylaxis, from accidental exposure to multiple food allergens.

Allergy Diagnostics And Therapeutics Market Outlook

- Sustainability Trends: Sustainability trends in the market include eco-friendly production processes, reduced waste in diagnostic kits, and the use of biodegradable materials. Companies are focusing on energy-efficient manufacturing, digital testing platforms, and sustainable packaging to minimize environmental impact while ensuring safe, effective allergy care.

- Global Expansion: Global expansion in the market is driven by increasing allergy prevalence, rising healthcare investments, and growing adoption of advanced diagnostic technologies. Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth due to improved healthcare infrastructure, awareness programs, and access to innovative allergy treatments.

- Startup Ecosystems: The startup ecosystem in the allergy diagnostics and therapeutics market is growing rapidly, driven by innovation in AI-based allergy testing, personalized immunotherapy, and digital health platforms. Emerging startups are focusing on rapid diagnostic tools, home-based testing kits, and novel biologic therapies to improve allergy management and patient outcomes globally.

How Can AI Affect the Market?

AI is transforming the allergy diagnostics and therapeutics market by enabling faster and more accurate allergy detection through data-driven analysis and predictive modeling. It supports personalized treatment plans, enhances diagnostic accuracy, and streamlines research and drug discovery. Additionally, AI-powered tools improve clinical decision-making and patient monitoring, leading to better allergy management outcomes.

Segmental Insights

Type Insights

How Does the Therapeutics Segment Dominate the Market in 2024?

The therapeutics segment held the largest allergy diagnostics and therapeutics market share in 2024 due to the increasing demand for effective allergy treatments, such as antihistamines, corticosteroids, and immunotherapies. Rising allergy prevalence, growing awareness about long-term relief options, and advancements in biologic therapies have further fueled segment growth. Additionally, the development of targeted treatments and increased accessibility to allergy medications strengthened its market dominance.

Diagnostic

The diagnostic segment is expected to record the fastest CAGR during the forecast period due to rising awareness about early allergy detection and the growing adoption of advanced testing technologies. Increased cases of allergic diseases, along with the demand for accurate and quick testing solutions, are driving growth. Additionally, the expansion of home-based and digital diagnostic tools further boosts the segment's development.

Allergen Insights

What Made the Inhaled Allergies Segment Dominant in the Market in 2024?

The inhaled allergies segment dominated the allergy diagnostics and therapeutics market in 2024 due to the high prevalence of respiratory allergies caused by airborne allergens such as pollen, dust mites, mold, and pet dander. Increased cases of asthma and allergic rhinitis, along with rising air pollution levels and urbanization, have driven demand for effective diagnostic and therapeutic solutions. Moreover, growing awareness and availability of advanced treatment have further strengthened its dominance in this segment in the market.

For Instance,

- In August 2025, London Allergy Care and Knowledge reported that in the UK, around 20% of schoolchildren suffer from asthma, 15% from hay fever, 10–16% from eczema, and 6–8% from food allergies, highlighting the growing burden of allergic diseases among children.

Drug Allergies

The drug allergies segment is expected to grow at a fast pace during the forecast period due to the rising incidence of adverse drug reactions and increasing use of complex medications including antibiotics and biologics. Growing awareness about drug hypersensitivity, advancements in diagnostic testing, and improved reporting systems are supporting early detection. Additionally, expanding R&D efforts to develop safer drugs and personalized treatment approaches is further driving the segment’s growth.

Food Allergies

The food allergies segment is expected to grow at a notable rate in the allergy diagnostics and therapeutics market during the forecast period due to the rising prevalence of food-related allergic reactions, particularly among children. Increased awareness about food allergens, improved diagnostic accuracy, and the growing demand for effective treatments are driving this growth. Additionally, the introduction of innovative therapies, stricter food labeling regulations, and advancements in allergy testing methods are further supporting the expansion of the market globally.

Test Type Insights

How the In Vitro Test Dominated the Market in 2024?

The in vitro test segment held the largest revenue share in the allergy diagnostics and therapeutics market in 2024 due to its high accuracy, safety, and convenience compared to traditional skin tests. These tests eliminate the risk of allergic reactions during testing and allow simultaneous screening for multiple allergens. Growing adoption of automated diagnostic systems, rising preference for non-invasive testing methods, and technological advancements in immunoassay and molecular diagnostics further strengthened the dominance of the in vitro test segment in the market.

In Vivo Test

The in vivo test segment is expected to grow ta lucrative rate during the forecast period due to its reliability in providing real-time allergic reliability in providing real-time allergic response results and accurate assessment of allergen sensitivity. Increased use of skin prick and patch tests in clinical settings, along with their cost-effectiveness and quick results, supports market growth. Additionally, the rising prevalence of allergic diseases and growing awareness about early diagnosis are driving the expansion of this segment.

Regional Insights

Why North America Dominated the Allergy Diagnostics And Therapeutics Market in 2024?

North America dominated the market in 2024 due to the high prevalence of allergic diseases, advanced healthcare infrastructure, and the strong presence of leading pharmaceutical and diagnostic companies. Increased adoption of innovative testing technologies, rising awareness about allergy management, and favorable reimbursement policies further boosted regional growth. Additionally, continuous R&D investments and FDA approvals for novel allergy treatments contributed to North America’s leading market position.

Rising Awareness and Innovation Fuel Rapid Growth of the U.S.

The U.S. allergy diagnostics and therapeutics market is expanding due to the rising prevalence of allergic conditions, growing awareness of early diagnosis, and increasing adoption of advanced diagnostic tools. Strong healthcare infrastructure, high R&D investments, and the availability of innovative biologic therapies are driving growth. Additionally, supportive regulatory policies and insurance coverage further promote market expansion across the country.

For Instance,

- In October 2024, the FDA approved the AccuTest allergy skin testing device, designed with smaller tine lengths and diameters to enhance accuracy and reduce patient discomfort. The device also features non-slip rubber trays for improved stability during testing.

- In the U.S. in recent years, about 31.8% of adults and 27.2% of children report diagnosed allergies.

Europe: Accelerating Ahed as the Next Powerhouse in Allergy Diagnostics and Therapeutics

Europe is expected to grow at the fastest CAGR in the allergy diagnostics and therapeutics market during the forecast period due to rising cases of allergic diseases, increasing healthcare spending, and growing awareness about early allergy diagnosis and treatment. Strong government support for allergy research, advancements in diagnostic technologies, and the presence of leading biotechnology firms are driving regional growth. Additionally, expanding access to immunotherapy and improved healthcare infrastructure are further contributing to Europe’s rapid market expansion.

Rising Allergy Prevalence and Innovation

The UK allergy diagnostics and therapeutics market is expanding due to the rising prevalence of allergic conditions such as asthma, hay fever, and food allergies, particularly among children. Growing public awareness, increased government support for allergy research, and advancements in diagnostic technologies are driving market growth. Additionally, the presence of specialized allergy centers, improved access to immunotherapy, and ongoing innovations in treatment options are further fueling the market’s expansion across the country.

For Instance,

- In August 2025, researchers from King’s College London and Guy’s and St Thomas’ NHS Foundation Trust launched a study to develop a more affordable and accurate test for diagnosing milk allergies in children.

- In the UK, around 6% of adults have a clinically confirmed food allergy (≈2.4 million people).

Asia Pacific: Thrives Amid Rising Allergy Burden and Medical Advancements

The Asia-Pacific allergy diagnostics and therapeutics market is growing rapidly due to the rising prevalence of allergic diseases, increasing pollution levels, and changing lifestyles. Expanding healthcare infrastructure, growing awareness of allergy management, and government initiatives promoting early diagnosis are driving market growth. Additionally, increasing investments by pharmaceutical companies, the availability of advanced diagnostic tools, and a growing focus on personalized medicine are further accelerating the market’s expansion across the region.

Increasing cases of Allergy in India

The Indian allergy diagnostics and therapeutics market is growing due to increasing cases of asthma, rhinitis, and food allergies driven by pollution, urbanization, and changing lifestyles. Rising awareness about early diagnosis, improving healthcare infrastructure, and the availability of advanced testing technologies are fueling market expansion. Additionally, growing investments in healthcare, government support for allergy research, and a surge in demand for affordable and effective treatment options are further boosting market growth in India.

South America Spotlight: Expanding Access to Allergy Care

Clinics and labs across the region are expanding allergy testing and immunotherapy access, driven by urbanization, better diagnostics, and regional healthcare investment, boosting patient diagnosis rates and treatment uptake, according to recent market analyses.

Brazil Beat: Rising Allergy Awareness and Diagnostics Growth

2024 cohort data show allergic rhinitis at 24.6% among 22-year-olds and wheezing at 30.7% indicating a substantial adolescent and young adult burden; diagnostics expansion and guideline updates improve detection and care across urban and rural settings nationwide.

MEA Momentum: Building Regional Allergy Infrastructure

Governments and private clinics in the Middle East and Africa are investing in allergy diagnostics and immunotherapy infrastructure, with increased testing availability, training programs, and policy attention improving diagnosis rates despite uneven data and access across countries, and regional initiatives.

UAE Pulse: Precision Therapies Transforming Allergy Management

Recent expert panels estimate allergic rhinitis prevalence between 20 and 30 percent in the UAE in 2024, while asthma affects about 7.4 percent; growing private clinics and testing services are expanding diagnosis and tailored immunotherapy options across the emirates.

Company Landscape

Thermo Fisher Scientific Inc.

Corporate Information:

- Headquarters: Waltham, Massachusetts, United States

- Year Founded: 2006 (Formed by the merger of Thermo Electron and Fisher Scientific)

- Ownership Type: Public (NYSE: TMO)

History and Background:

- Formed from the merger of Thermo Electron Corporation (founded 1956) and Fisher Scientific International Inc. (founded 1902).

- Became a dominant force in the life sciences, analytical instruments, and specialty diagnostics market through consistent strategic acquisitions.

- The allergy diagnostics business is primarily anchored by the former Phadia AB, a Swedish company acquired in 2011, which pioneered the ImmunoCAP technology.

Key Milestones/Timeline:

- 2006: Thermo Electron and Fisher Scientific complete merger.

- 2011: Acquires Phadia AB, becoming the global leader in specific IgE in-vitro diagnostics.

- 2020: Significant role in COVID-19 testing, reinforcing its diagnostics capabilities.

- 2021: Acquired PPD, a leading clinical research organization (CRO), further expanding its service offerings in drug development, which includes therapeutics.

Business Overview:

- World leader in serving science, providing analytical instruments, reagents and consumables, software, and services for research, diagnostics, and industrial applications.

- Annual Revenue (Latest Statistics): Over $42 Billion (FY 2024 estimate).

Business Segments/Divisions:

- Life Sciences Solutions: Reagents, instruments, and consumables for biological and medical research.

- Analytical Instruments: Instruments, consumables, software, and services for a range of lab applications.

- Specialty Diagnostics: Diagnostic products, including clinical chemistry, immunodiagnostics (where allergy testing falls), and transplant diagnostics.

- Laboratory Products and Biopharma Services: Laboratory equipment, chemicals, supplies, and clinical trial services (PPD).

Geographic Presence:

- Global presence with operations in over 50 countries.

- Strong market position across North America, Europe, and Asia-Pacific.

Key Offerings (Allergy):

- Diagnostics: ImmunoCAP Specific IgE tests (considered the gold standard for in-vitro allergy testing), ImmunoCAP ISAC (multiplex allergen component testing), and Phadia Laboratory Systems (fully automated analyzers like Phadia 250/2500/5000).

- Services: Allergen Encyclopedia, scientific resources, and Phadia Academy for training.

End-Use Industries Served:

- Clinical Diagnostic Laboratories (main end-user for allergy diagnostics)

- Hospitals and Physician Offices

- Academic Research Institutions

- Biotechnology and Pharmaceutical Companies

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Continual strategic acquisitions to expand core technology, such as the PPD acquisition to bolster Biopharma Services.

- Partnerships & Collaborations: Partnership with Kroger Health (May 2023) to expand access to ImmunoCAP allergy testing across U.S. Little Clinic locations.

- Product Launches/Innovations: Focus on expanding the menu of allergen components for the ImmunoCAP system and enhancing the automation capabilities of the Phadia instruments.

- Capacity Expansions/Investments: Continuous investment in manufacturing and R&D facilities globally to meet growing demand for diagnostics and biopharma services.

- Regulatory Approvals: Ongoing pursuit of FDA and international regulatory clearances for new allergen component tests and diagnostic platforms.

Distribution Channel Strategy:

- Direct sales force globally to large hospitals and reference labs.

- Distributor network for smaller labs and emerging markets.

- Direct-to-consumer partnerships for specific diagnostic services (e.g., Kroger Health).

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: ImmunoCAP Technology (fluorescence enzyme immunoassay), which enables quantitative, high-sensitivity detection of allergen-specific IgE. Patents cover the solid-phase allergen carrier and assay methodology.

- Research & Development Infrastructure: Operates numerous R&D centers globally, focusing on assay development, instrument automation, and digital integration.

- Innovation Focus Areas: Molecular diagnostics (Component Resolved Diagnostics - CRD), high-throughput automation (Phadia Prime), and integrating digital solutions for data analysis and clinical decision support.

Competitive Positioning:

- Strengths & Differentiators: ImmunoCAP is the market leader and recognized gold standard for in-vitro allergy testing. Unmatched test menu size and clinical validation. Strong global distribution and installed base of Phadia systems.

- Market Presence & Ecosystem Role: Dominant player in the in-vitro allergy diagnostics segment, serving as a primary supplier to reference laboratories worldwide. Key enabler for personalized allergy management and immunotherapy planning.

SWOT Analysis:

- Strengths: Market-leading ImmunoCAP technology, vast product portfolio, robust global distribution, strong financial position.

- Weaknesses: High cost of ImmunoCAP system/tests compared to some competitors, reliance on strategic acquisitions for growth.

- Opportunities: Expansion of Component Resolved Diagnostics (CRD), growth in emerging markets, integration of AI/digital health for diagnostic insights.

- Threats: Intense competition from major diagnostics players (e.g., Siemens Healthineers, Danaher) and emerging specialized diagnostics companies, and regulatory changes.

Recent News and Updates (2024-2025):

- Press Releases: Focused on launching new specialty tests (e.g., expanded panels for specific autoimmune diseases run on Phadia systems) and digital lab solutions to optimize workflow.

- Industry Recognitions/Awards: Frequently recognized for leadership in diagnostics and life science tools.

Siemens Healthineers AG

Corporate Information:

- Headquarters: Erlangen, Bavaria, Germany

- Year Founded: 2017 (Legally carved out from Siemens AG) / Traces roots back to 1847 (Siemens & Halske)

- Ownership Type: Public (FWB: SHL) (Majority-owned by Siemens AG)

History and Background:

- The healthcare division of Siemens AG for over a century formally established as a separate, publicly listed company (majority owned by Siemens AG) in 2017 to increase strategic focus and flexibility.

- A major global player in medical technology, including imaging, diagnostics, and advanced therapies.

- Its allergy diagnostics offering is based on its extensive immunoassay portfolio, notably the IMMULITE and Atellica systems, featuring the 3gAllergy assay menu.

Key Milestones/Timeline:

- 1896: Siemens first enters the medical technology sector.

- 2007: Acquisition of Dade Behring, significantly expanding its laboratory diagnostics business.

- 2017: Separately listed on the Frankfurt Stock Exchange as Siemens Healthineers.

- 2021: Completed the acquisition of Varian Medical Systems, significantly bolstering its Advanced Therapies and Cancer Care portfolio.

Business Overview:

- A leading medical technology company with expertise in diagnostics, therapeutic interventions, and in-vivo/in-vitro diagnostics.

- Annual Revenue (Latest Statistics): Approximately €22 Billion (FY 2024 estimate).

Business Segments/Divisions:

- Imaging: Medical imaging systems (MRI, CT, X-ray, etc.).

- Diagnostics: In-vitro diagnostic instruments, reagents, and assays (including allergy testing) for laboratories.

- Advanced Therapies: Medical devices and services for minimally invasive procedures and interventional radiology/cardiology, bolstered by the Varian acquisition (cancer care).

Geographic Presence:

- Operates globally in over 70 countries.

- Strong market presence in Europe, North America, and Asia.

Key Offerings (Allergy):

- Diagnostics: 3gAllergy assays for allergen-specific IgE testing, compatible with their high-throughput automated immunoassay systems like the IMMULITE and Atellica Solution platforms.

- Systems: IMMULITE 2000 XPi/1000 and the modular, integrated Atellica Solution.

End-Use Industries Served:

- Clinical Diagnostic Laboratories

- Hospital Laboratories and Healthcare Systems (major focus)

- Reference Laboratories

- Private Physician and Outpatient Clinics

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Focus on portfolio optimization and major, transformative acquisitions like Varian. Diagnostics' focus is on integrating acquired technologies (e.g., assays) into the Atellica platform.

- Partnerships & Collaborations: Collaborates with AI firms and digital health specialists to integrate predictive diagnostics and remote monitoring capabilities into its platforms.

- Product Launches/Innovations: Continuous expansion of the 3gAllergy menu for the Atellica Solution to increase test consolidation and workflow efficiency in the lab.

- Capacity Expansions/Investments: Significant investments in the Diagnostics division to digitize and automate laboratory workflows via the Atellica platform.

- Regulatory Approvals: Ongoing regulatory clearances in major markets (FDA, CE-IVDR) for new assays and system enhancements.

Distribution Channel Strategy:

- A strong, centralized global direct sales and service network, particularly focused on large hospital systems and integrated delivery networks.

- Leverages its broad portfolio (imaging, diagnostics, therapy) to secure bundled solutions and long-term contracts.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: 3gAllergy technology for quantitative IgE testing and advanced immunoassay technologies (chemiluminescence) on the IMMULITE and Atellica platforms. Patents focus on immunoassay automation and integrated workflow solutions.

- Research & Development Infrastructure: Global R&D centers focusing on integrating lab diagnostics with clinical workflow and molecular techniques.

- Innovation Focus Areas: Integration of Artificial Intelligence (AI) for predictive diagnostics, development of high-throughput and consolidated systems (Atellica), and expanding the menu of high-value assays.

Competitive Positioning:

- Strengths & Differentiators: Comprehensive, integrated portfolio across the entire patient pathway (Imaging, Diagnostics, Therapy). Strong footprint in hospital labs due to the integrated nature of the Atellica platform. Competitive, automated allergy testing menu (3gAllergy).

- Market Presence & Ecosystem Role: A key competitor in in-vitro diagnostics, challenging the diagnostics leader through workflow automation and system consolidation. A primary technology provider for large-scale, automated clinical laboratories worldwide.

SWOT Analysis:

- Strengths: Global brand recognition, strong financial backing from Siemens AG, integrated in-vitro and in-vivo portfolio, advanced automation platforms (Atellica).

- Weaknesses: Intense competition in the allergy diagnostics segment from the market leader, complexity of platform migration for some users.

- Opportunities: Adoption of the Atellica platform driving assay consolidation, growth in value-based healthcare models favoring integrated solutions, and expansion into digital and predictive diagnostics.

- Threats: Pricing pressure in the diagnostics market, rapid innovation cycles by competitors, and global economic volatility impacting capital equipment sales.

Recent News and Updates (2024-2025):

- Press Releases: Announcements related to new AI-powered applications for imaging and diagnostics, and continued global installations of the Atellica Solution platform.

- Industry Recognitions/Awards: Regularly receives awards for its imaging and diagnostic equipment design and technological advancements.

Allergy Diagnostics And Therapeutics Market Value Chain Analysis

Clinical Trials

- Ongoing clinical trials in allergy diagnostics and therapeutics are exploring advanced and more effective approaches beyond traditional methods like skin prick tests and allergen avoidance.

- Research focuses on innovative treatments such as oral immunotherapy (OIT), sublingual immunotherapy (SLIT), and biologic therapies.

- These trials aim to enhance the safety and effectiveness of treatments for food allergies, allergic asthma, and rhinoconjunctivitis.

Regulatory Approvals

- Regulatory approvals for allergy diagnostics and therapeutics involve detailed evaluation by agencies like the U.S. FDA and the European Medicines Agency (EMA).

- The approval process varies based on the type of product diagnostic or therapeutic, its innovation level, and target market.

- Each product must meet strict safety, quality, and efficacy standards before receiving market authorization.

Patient Support and Services

- Patient support programs for allergy diagnostics and therapeutics guide individuals from diagnosis through long-term treatment management.

- These services provide assistance across medical, financial, and emotional aspects to improve patient outcomes and quality of life.

- They aim to enhance treatment adherence, offer education on allergy management, and connect patients with expert care resources.

Company and Its Offerings in the Allergy Diagnostics and Therapeutics Market

- Danaher Corporation: Offers advanced diagnostic solutions through its subsidiaries, like Beckman Coulter and Cepheid, supporting accurate allergy testing and laboratory automation.

- Alcon: Provides therapeutic eye care solutions for allergic conjunctivitis and other ocular allergies through its range of antihistamine and anti-inflammatory eye drops.

- AbbVie Inc.: Focuses on developing biologic therapies and immunomodulators for allergic and inflammatory conditions.

- Sanofi: Offers a wide portfolio of allergy treatments, including antihistamines and biologics like Dupixent for asthma and atopic dermatitis.

- Pfizer Inc.: Develops and markets innovative therapies targeting allergic and inflammatory diseases, supported by strong R&D in immunology and respiratory care.

Top Companies in the Allergy Diagnostics And Therapeutics Market

- R-Biopharm AG

- DASIT Group SPA

- EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.)

- AESKU.GROUP GmbH

- bioMérieux

- Siemens Healthcare GmbH

- Stallergenes Greer

- HYCOR Biomedical

- Minaris Medical America, Inc.

- Omega Diagnostics Group PLC

- Lincoln Diagnostics, Inc.

- HOB Biotech Group Corp., Ltd.

- Danaher

- Alcon

- AbbVie, Inc.

- Sanofi

- Allergy Therapeutics

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Sun Pharmaceutical Industries Ltd.

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Astellas Pharma Inc.

- Epigenomics AG

Read further to see how top players are redefining the Allergy Diagnostics and Therapeutics Market at: https://www.towardshealthcare.com/companies/allergy-diagnostics-and-therapeutics-companies

Recent Developments in the Allergy Diagnostics And Therapeutics Market

- In August 2025, Sanofi introduced Allegra-D in India, a non-drowsy tablet for allergy and nasal congestion relief. The drug combines Fexofenadine Hydrochloride (60 mg) and Pseudoephedrine Hydrochloride (120 mg) and has been approved by the Drug Controller General of India (DCGI) for use in adults and children aged 12 and above.

- In January 2024, ALK received FDA approval to extend the use of its sublingual immunotherapy tablet, ODACTRA, for treating house dust mite-induced allergic rhinitis in adolescents aged 12 to 17 years.

Segments Covered in the Report

By Type

- Diagnostics

- Instruments

- Consumables

- Services

- Therapeutics

- Antihistamines

- Decongestants

- Corticosteroids

- Mast Cell Stabilizers

- Leukotriene Inhibitors

- Nasal Anti-cholinergic

- Immuno-modulators

- Epinephrine

- Immunotherapy

By Allergen Type

- Food

- Dairy Products

- Poultry Product

- Tree Nuts

- Peanuts

- Shellfish

- Wheat

- Soy

- Other Food Allergens

- Inhaled

- Drug

- Other allergen types

By Test Type

- In Vivo Tests

- Skin Prick Test

- Intradermal Test

- Patch Test

- In Vitro Tests

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA