December 2025

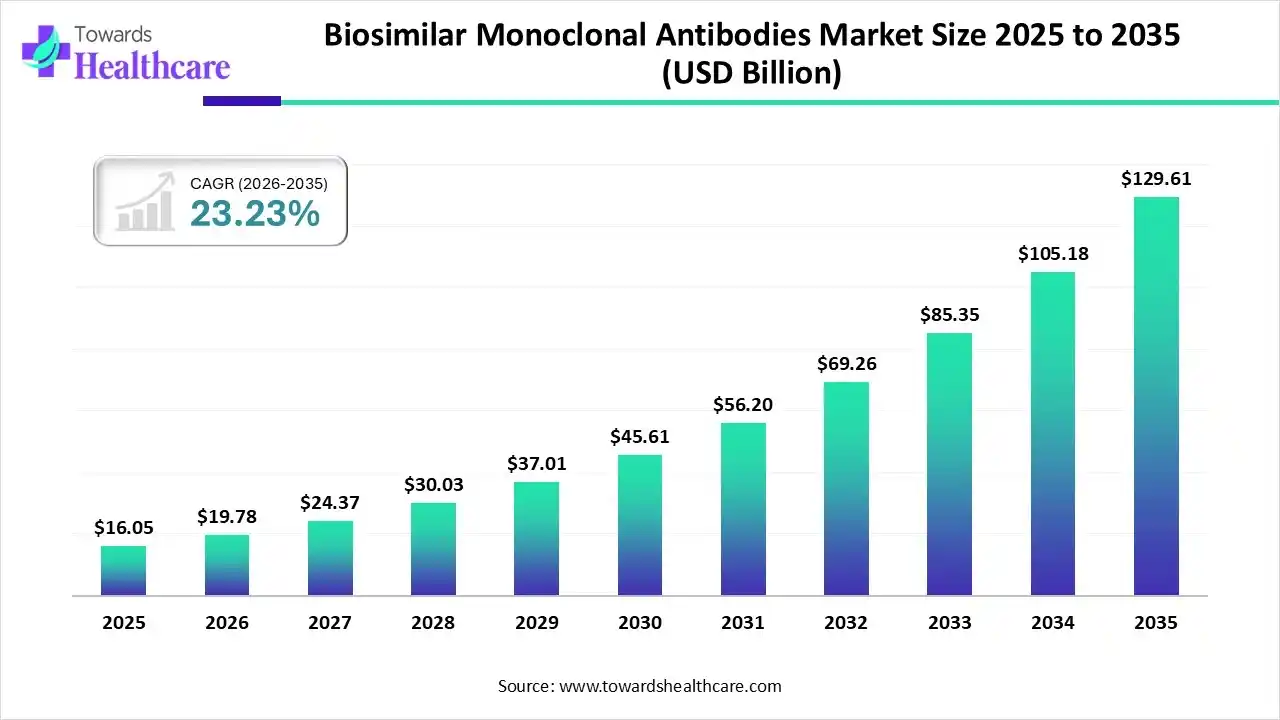

The global biosimilar monoclonal antibodies market size was estimated at USD 16.05 billion in 2025 and is predicted to increase from USD 19.78 billion in 2026 to approximately USD 129.61 billion by 2035, expanding at a CAGR of 23.23% from 2026 to 2035.

The biosimilar monoclonal antibodies market is growing due to increasing applications of these antibodies in oncology autoimmune and inflammatory diseases, ophthalmology, and other areas.

The biosimilar monoclonal antibodies market is growing due to growing access and lower expenses for patients and medical care systems. Monoclonal antibodies (mAbs) are a main class of recombinant deoxyribonucleic acid (rDNA) technology-based biotherapeutic products that attain outstanding achievement in treating many life-threatening and long-term diseases such as cancer, rheumatoid arthritis, and autoimmune disease. Biosimilar antibodies make it possible to research the biological effects of a drug without requiring the sourcing of expensive pharmaceutical-grade therapeutics.

AI is transforming the biosimilar monoclonal antibodies market by accelerating R&D, significantly reducing development timelines and costs. Machine learning models optimize antibody characterization, predict structural similarities to reference products, and enhance manufacturing processes. AI-driven predictive analytics minimize manufacturing waste, ensure consistent quality, and assist in regulatory compliance. Furthermore, AI helps in navigating market penetration, making biosimilars more affordable and accessible, thereby enhancing market competition and patient access.

Antibody engineering allows the manufacturing of antibodies with high specificity, stability, affinity, and low immunogenicity, while also engineering new functionalities beyond those of natural antibodies, therefore increasing their uses in disease treatment and diagnostics.

Next-generation sequencing (NGS) provides an affordable service with increased read depth, enabling an inclusive understanding of diversity.

Multispecific antibodies are evolved to engage two or more different targets, offering medicinal advantages over conventional monoclonal antibodies. These include improved recruitment of immune effector cells, concurrent modulation of multiple signalling pathways, and introduction of apoptosis.

| Key Elements | Scope |

| Market Size in 2026 | USD 19.78 Billion |

| Projected Market Size in 2035 | USD 129.61 Billion |

| CAGR (2026 - 2035) | 23.23% |

| Leading Region | North America |

| Market Segmentation | By Type, By Indication, By End User, By Region |

| Top Key Players | Biocon, Shanghai Henlius Biotech, Inc., Amgen Inc., Biogen, Celltrion Healthcare Co., Ltd., Novartis AG |

Which Type Led the Biosimilar Monoclonal Antibodies Market in 2025?

In 2025, the infliximab segment held the dominant market share, as it is applied alone or in combination with other various treatments to lower the symptoms and prevent the progression of moderate-to-severe active rheumatoid arthritis, psoriatic arthritis, and active ankylosing spondylitis. It works to boost and improve the immune system. The efficiency of infliximab demonstrated the practicality of monoclonal antibody therapies in targeting specific molecules involved in disease pathology.

Adalimumab

Whereas the adalimumab segment is the fastest-growing in the market, as these are used to lessen swelling by working on the immune system. Adalimumab is applied to treat inflammation of the joints, such as rheumatoid arthritis, polyarticular juvenile idiopathic arthritis, and active enthesitis-related arthritis, and skin conditions such as plaque psoriasis and hidradenitis suppurativa. Adalimumab efficiently reduces inflammation, averts tissue damage, and progresses disease management, leading to better long-term results for patients.

Why did the Oncology Segment Dominate the Market in 2025?

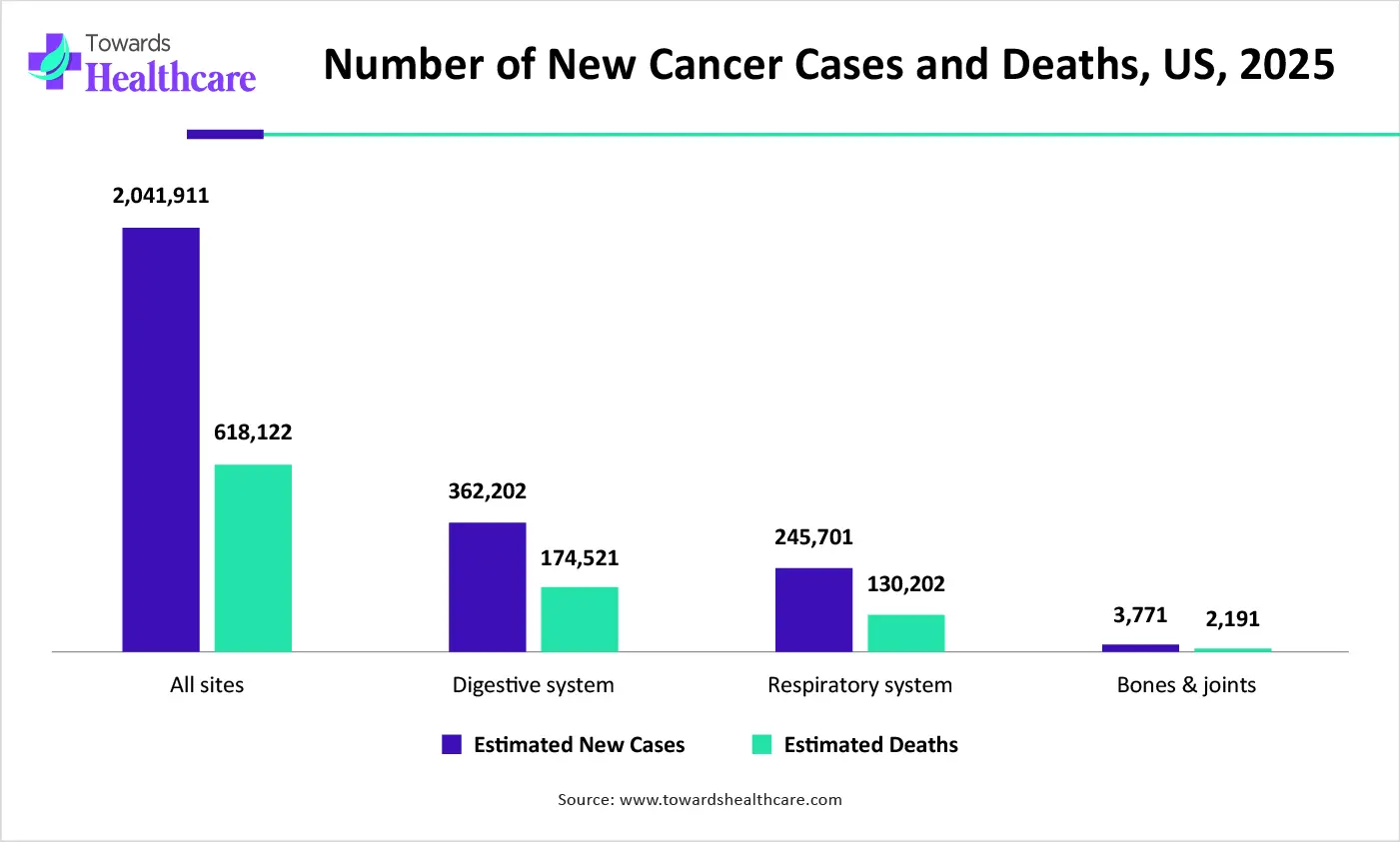

The oncology segment is dominant in the biosimilar monoclonal antibodies market in 2025, and is expected to register the highest CAGR during the forecast period, as it has massive strength advantages in managing cancer. They introduce competition into the drug development process, which leads to investment savings for patients and accelerates the development of novel treatments.

| Sites of Cancer | Estimated New Cases | Estimated Deaths |

| All sites | 2,041,910 | 618,120 |

| Digestive system | 362,200 | 174,520 |

| Respiratory system | 245,700 | 130,200 |

| Bones & joints | 3,770 | 2,190 |

| Skin | 112,690 | 14,110 |

| Breast | 319,750 | 42,680 |

| Genital system | 444,610 | 71,510 |

Why did the Hospital Segment Dominate the Market in 2025?

The hospital segment is dominant in the biosimilar monoclonal antibodies market in 2025 and is expected to register the highest CAGR during the forecast period, as biosimilar monoclonal antibodies present a significant advancement in aligning medical care innovation with medical care affordability. Investigators use mAbs (biosimilars) as tools to research novel therapies and uncover efficacy in off-target applications. Biosimilars provide affordable treatment options that support contain the in-healthcare expenditure.

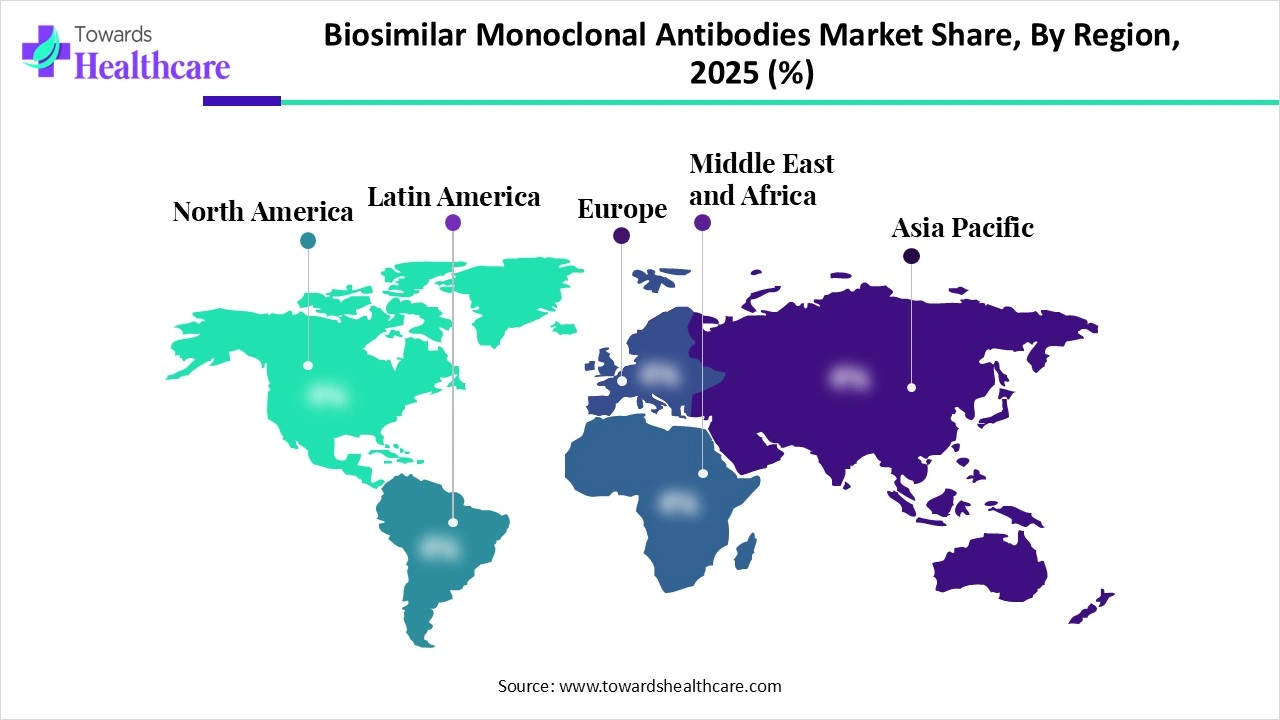

In 2025, North America led the biosimilar monoclonal antibodies market, as the growing prevalence of long term diseases like cancer and autoimmune disorders, and increasing demand for personalized medicine and targeted therapy. The FDA has approved 76 biosimilars, corresponding to a small fraction of approved biologics. There are more than 30,000 approved generics, increasing the number of approved brand drugs, which drives the growth of the market.

For Instance,

U.S. Market Trends

In the U.S. presence of significant pharmaceutical organizations such as Pfizer, Amgen, and Sandoz is headquartered or heavily active in this region, increasing product advancement and introductions. Development in mAb technology is increasing advances in oncology, autoimmune disorders, and infectious diseases. Around 6 in 10 Americans live with at least one chronic disease, with cardiac disease and diabetes, which increases the need for biosimilar monoclonal antibodies.

Asia Pacific is set to experience rapid growth in the biosimilar monoclonal antibodies market, as Asia accounts for 22% of worldwide healthcare investment, with chronic conditions like diabetes and cancer disproportionately affecting the region, which drives the growth of the market. Increasing government support, such as South Korea's Ministry of Health and Welfare (MOHW), will implement the Pharmaceutical Pricing System Improvement Plan.

For Instance,

India Market Trends

The Indian government has set a minimum import price (MIP) for some key pharmaceutical inputs to combat aggressive undercutting and dumping from Chinese manufacturers, which increases the demand for biosimilar monoclonal antibodies.

Europe is experiencing substantial growth in the biosimilar monoclonal antibodies market, as biosimilars continue to be an important part of the European medical system, and it balances pharmaceutical investment by creating savings for payers, generating headroom for novelty, and increasing access to biologic therapy for patients, which drives the growth of the market.

UK Market Trends

The UK has a significant integration of proactive regulatory streamlining (MHRA), strong NHS-led cost-containment and advance approches, enhance physician confidence, and leveraging post-Brexit government autonomy. NHS England is targeting £150 million in savings via the rapid adoption of biosimilar adalimumab.

| Company | Headquarters | Latest Update |

| Biocon | India | In December 2025, Biocon Biologics Ltd. (BBL), a fully integrated global biosimilars company and subsidiary of Biocon Ltd., announced a settlement agreement with Amgen Inc. that clears the path for the commercialization of its Denosumab biosimilars in Europe and the rest of the world. |

| Shanghai Henlius Biotech, Inc. | China | In December 2025, Shanghai Henlius Biotech, Inc. announced that the investigational new drug (IND) application for its HLX18, a proposed nivolumab biosimilar independently developed by the company, was approved by the U.S. Food and Drug Administration (FDA) for the treatment of certain resected solid tumors. |

| Amgen Inc. | United States | In April 2025, Amgen announced that the U.S. Food and Drug Administration (FDA) had approved UPLIZNA as the first and only treatment for adults living with Immunoglobulin G4-related disease (IgG4-RD). |

| Biogen | United States | In November 2025, Biogen will highlight new Lecanemab Data and Scientific Advances at the 18th Clinical Trials on Alzheimer's Disease Conference. |

| Celltrion Healthcare Co., Ltd. | South Korea | In September 2025, Celltrion’s Omlyclo, the first omalizumab biosimilar in Europe, will be commercially available starting in Norway, with subsequent rollouts in European countries. |

| Novartis AG | Switzerland | In September 2025, Novartis acquired Tourmaline Bio, complementing its cardiovascular pipeline with pacibekitug for the treatment of atherosclerotic cardiovascular disease. |

By Type

By Indication

By End User

By Region

December 2025

December 2025

November 2025

November 2025