February 2026

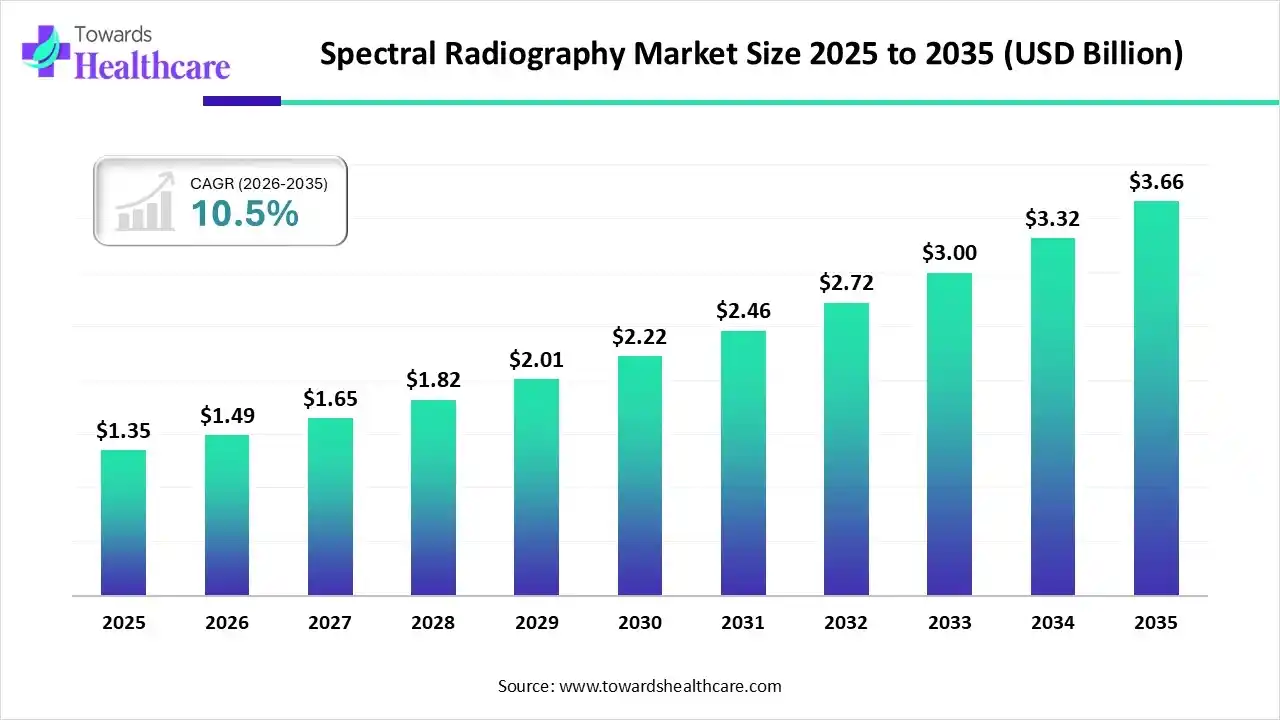

The global spectral radiography market size was estimated at USD 1.35 billion in 2025 and is predicted to increase from USD 1.49 billion in 2026 to approximately USD 3.66 billion by 2035, expanding at a CAGR of 10.5% from 2026 to 2035.

The era is highly demanding of early diagnosis in cardiac cases, cancers, and other severe instances, where these advanced technologies are offering greater accuracy and higher resolution imaging. Moreover, the market is executing novelty in PCCT, AI-enabled platforms, and innovations in material science.

Primarily, spectral radiography is a modern X-ray imaging technique that collects X-ray information at various energy levels. Moreover, the spectral radiography market is propelled by the rising instances of cancer, cardiovascular diseases, and neurological disorders, which need advanced, high-resolution imaging for earlier diagnosis and treatment strategies. Also, the growing demand for non-invasive diagnostics and ongoing extensive technological breakthroughs in detectors & AI are fueling the overall market growth. Currently, the globe is emphasizing the evaluation of this radiography to bolster the visualization of root canals, bone structures, and dental materials in panoramic radiography.

The worldwide rising adoption of AI algorithms is supporting the advances in spectral radiography as well. Recently, AI-assisted photon-counting CT technology employed for blooming functional imaging and substantial radiation dose lowering. This shows that AI significantly impacts the analysis of high-resolution data. Alongside, the emergence of deep-learning reconstruction, like GE Pristina Recon DL are highly developing sharper, more consistent 3D mammography images at standard dose levels by employing sequential AI models.

PCCT has superior spatial resolution and crucially reduces radiation doses, assisting in its widespread use across the globe for the detection of smaller, more subtle lesions.

The market is promoting tiny, lighter, and more portable spectral detectors, such as advances in cold-cathode x-ray systems, which allow for tomosynthesis and, in the future, it would be portable CT.

Researchers are focusing on novelty in materials, including Cadmium Telluride (CdTe), Cadmium Zinc Telluride (CZT), and Gallium Arsenide (GaAs) for enhanced, affordable, and high-efficiency sensors.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.49 Billion |

| Projected Market Size in 2035 | USD 3.66 Billion |

| CAGR (2026 - 2035) | 10.5% |

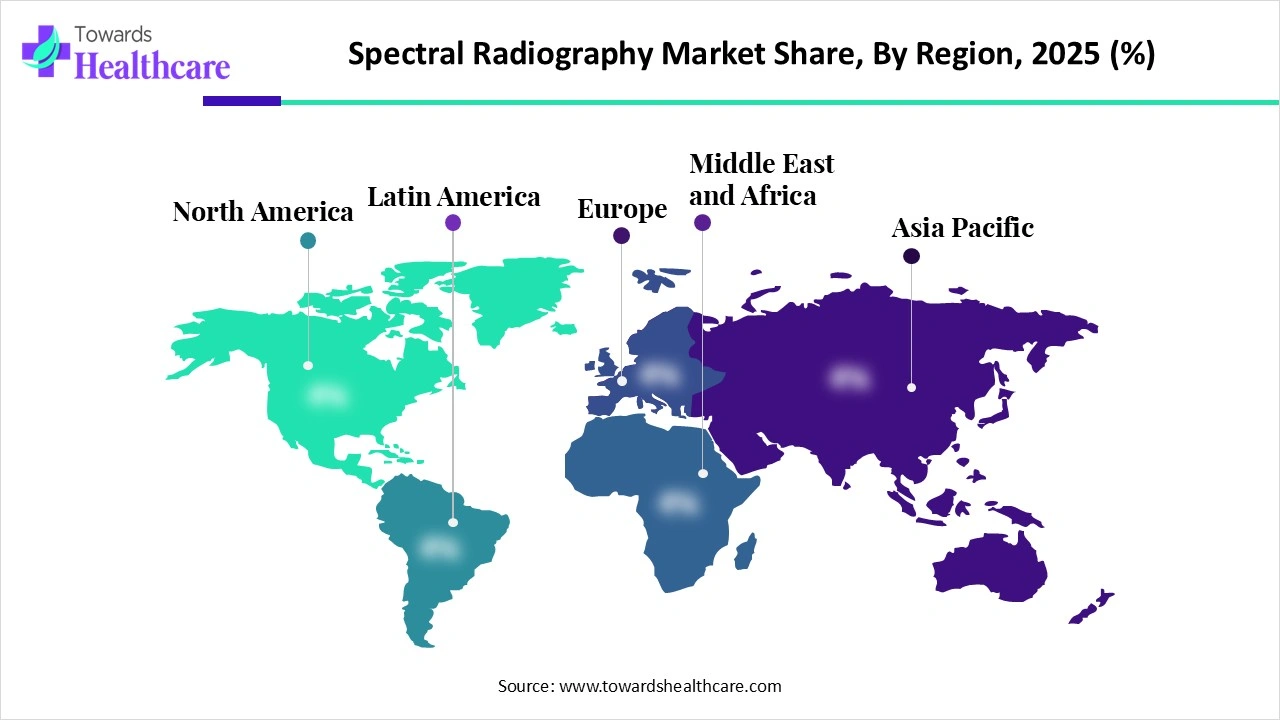

| Leading Region | North America |

| Market Segmentation | By Technology, By Application, By Product/Equipment Type, By End-User/Care Setting, By Region |

| Top Key Players | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Shimadzu Corporation, Fujifilm Healthcare, Hitachi Medical Systems, Carestream Health, Konica Minolta Healthcare, Hologic, Inc. |

Which Technology Dominated the Spectral Radiography Market in 2025?

In 2025, the dual-energy x-ray imaging segment captured the largest share of the market. This technology distinguishes materials dependent on atomic numbers, which enables robust tissue characterization and minimal image artifacts as compared to single-energy systems. Recently, scientists found that AI can estimate hip fractures and mortality from dual-energy. Also, Samsung's GM85 mobile DR leverages novel glass-free flat panel detectors (FPDs) to lower weight and foster dual-energy imaging at the bedside.

Photon-Counting Detector (PCD) Radiography

The photon-counting detector (PCD) radiography segment will witness rapid growth. Its adoption is driven by its strong dose efficacy, which also allows vital radiation dose reductions, & this is substantial for pediatric and longitudinal studies. Moreover, it is beneficial for patients with renal impairment. This technology directly converts X-ray photons into electrical signals, with the elimination of the requirement for scintillator-based conversion, & ultimately lowers electronic noise and enables multi-energy binning.

How did the Chest & Pulmonary Imaging Segment Lead the Market in 2025?

The chest & pulmonary imaging segment held a major share of the spectral radiography market in 2025. Globally accelerating smoking-related and environmental lung diseases, like COPD, interstitial lung diseases & expanding need for long-term monitoring of lung damage are propelling the overall demand. Dynamic Chest Radiography (DCR) has an immersive role in screening and monitoring COPD by mapping lung ventilation, perfusion, and regional diaphragmatic motion.

Oncology/Tumor Characterization

The oncology/tumor characterization segment will expand rapidly. Rising cancer cases are encouraging the use of (PCCT) and Dual-Layer CT, which have a pivotal role in developing low-keV monoenergetic images & boost contrast between tumors and surrounding healthy tissue, supporting diagnosis. By using Iodine Concentration (IC) Mapping, studies have explored differentiation between well-differentiated and poorly differentiated adenocarcinoma, with increased IC reflecting higher microvascular density in more aggressive cancers.

Which Product/Equipment Type Led the Spectral Radiography Market in 2025?

In 2025, the fixed spectral radiography systems segment was dominant in the market. These systems are ceiling-mounted or floor-to-ceiling mounted, which have wider preference in hospitals and giant imaging centers for their high-resolution imaging, durability, and ability to manage high patient counts. Currently, scientists at Argonne National Laboratory are establishing quantum shell scintillators to raise X-ray sensitivity in fixed digital radiography systems, to facilitate greater resolution, i.e., up to 25.2 lp mm⁻¹ for advanced diagnostics.

Photon-Counting Radiography Platforms

In the future, the photon-counting radiography platforms segment is predicted to grow fastest. This mainly leverages direct conversion detectors, often CZT or CdTe, to count individual X-ray photons. Recently, Siemens Healthineers established NAEOTOM Alpha, which comprises greater count-rate detectors and widened spectral algorithms, such as the QuantaMax detector, to escalate spatial resolution (0.2–0.4 mm) and boost K-edge imaging for iodine/calcium separation.

Why did the Hospitals & Medical Centers Segment Dominate the Market in 2025?

In 2025, the hospitals & medical centers segment captured the dominating share of the spectral radiography market. An accelerating preference towards image-guided, minimally invasive surgeries and interventions is supporting the expansion of these end-users. In the last few months, Nura introduced the CT scan bus by collaborating with Fujifilm Healthcare and Dr. Kutty’s Healthcare, focused on making more sophisticated screening more accessible.

Diagnostic Imaging Centers

The diagnostic imaging centers segment will register the fastest growth. The globe is highly prioritizing these centers over hospitals due to their affordability and implementation of advanced imaging for material differentiation, robust lesion detection, and minimal need for contrast agents, which finally raises diagnostic confidence.

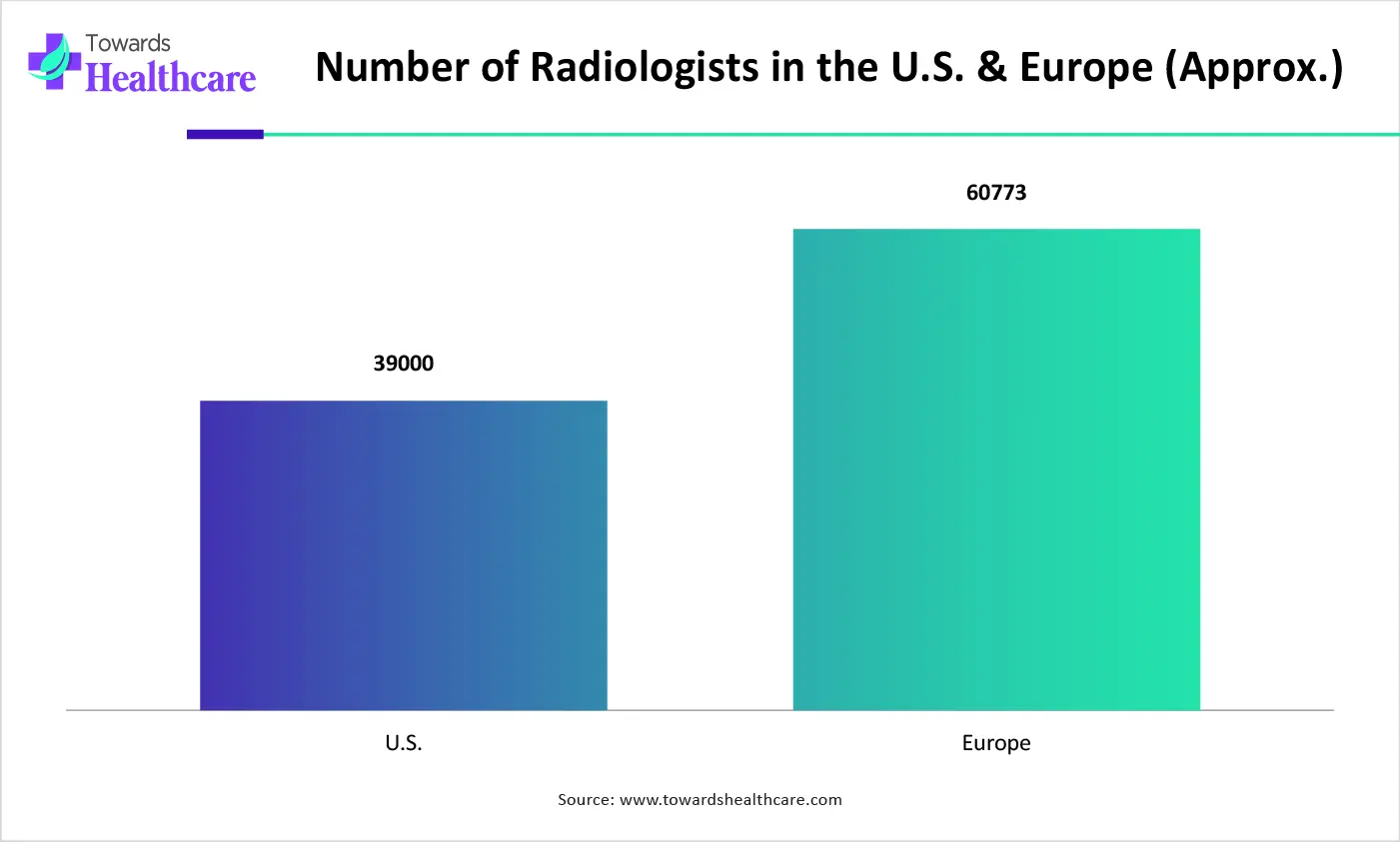

In 2025, North America was dominant in the spectral radiography market due to the substantial technological breakthroughs, rising need for early diagnostics/surveillance, and robust R&D investment. Recent advances include the use of DECT by VGH and the University of British Columbia (UBC) for advanced bone marrow imaging, & also demonstrated the detection of occult fractures and marrow edema.

U.S. Market Trends

Whereas, the U.S was a major contributor to the market as it emphasized radiology, preferred extensive tissue characterization, material decomposition, and AI-enabled, high-speed imaging. Canon Medical received the FDA approval for the Alphenix 4D CT system, which integrates its angiography system with the Aquilion One CT & enable real-time, in-room material analysis for stroke, trauma, and interventional procedures.

Asia Pacific is estimated to grow fastest in the spectral radiography market, as China and India are fostering domestic production of modern CT, with the majority of subsidies for imaging advances. Also, the region is encouraging the integration of spectral data with AI-powered software for automatic analysis of material composition.

China Market Trends

China will expand rapidly in APAC, as the Institute of High Energy Physics (IHEP) in Beijing commenced the High Energy Photon Source (HEPS), & offered immersive, bright hard X-rays for advanced, rapid-speed imaging of microscopic samples for biomedicine and material science.

| Company | Description |

| Siemens Healthineers | Specifically, this offers Dual Energy CT (DECT) technology across its scanner portfolio. |

| GE Healthcare | It emphasizes Gemstone Spectral Imaging (GSI), a dual-energy CT technology. |

| Philips Healthcare | This explores Detector-Based Spectral CT, focused on the Spectral CT 7500. |

| Canon Medical Systems | A firm provides a complete set of spectral radiography and computed tomography (CT) solutions. |

| Shimadzu Corporation | This facilitates diverse spectral radiography and related analytical imaging solutions, spanning medical, industrial, and material science applications. |

| Fujifilm Healthcare | It provides offerings through its Dual Energy Subtraction (DES) technology. |

| Hitachi Medical Systems | A company offers high-definition diagnostic imaging, specifically in CT and MRI. |

| Carestream Health | This company explores through the Eclipse Imaging Intelligence engine and the ImageView Software platform. |

| Konica Minolta Healthcare | This emphasizes Dynamic Digital Radiography (DDR). |

| Hologic, Inc. | Its offerings include high-resolution 3D, contrast-enhanced, or molecular imaging. |

By Technology

By Application

By Product/Equipment Type

By End-User/Care Setting

By Region

February 2026

February 2026

February 2026

January 2026