October 2025

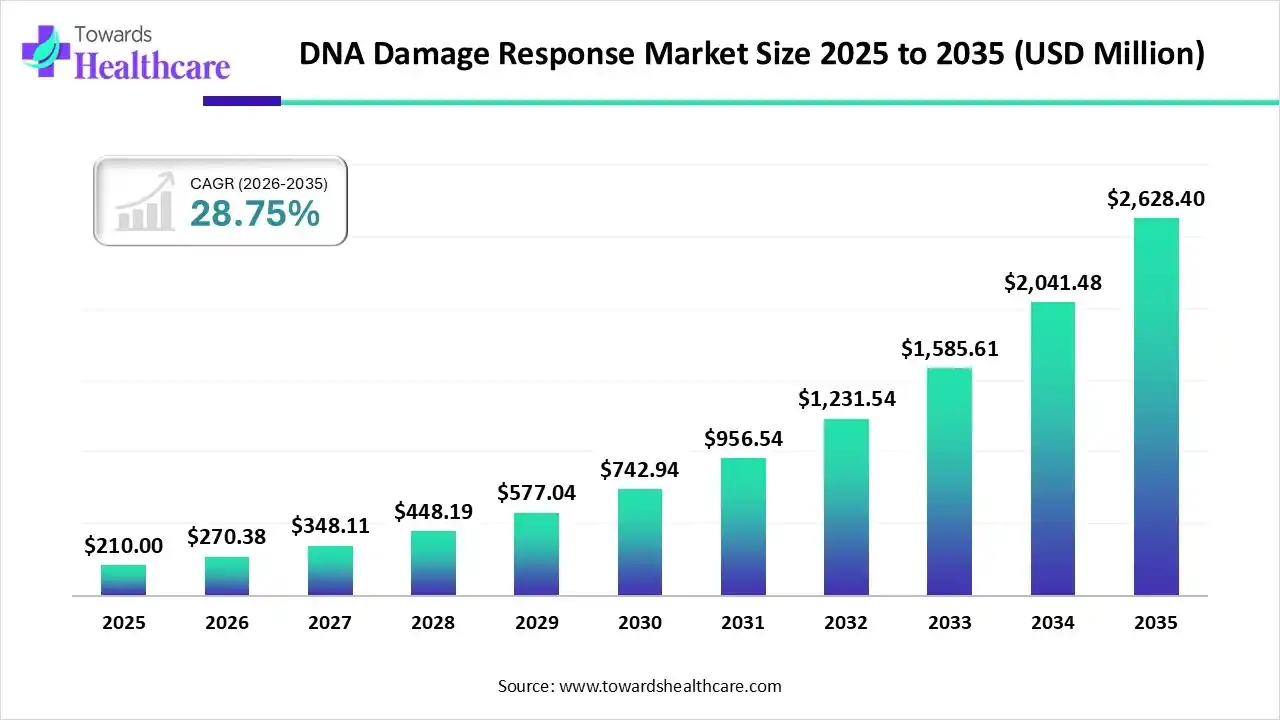

The global DNA damage response (DDR) market size was estimated at USD 210 million in 2025 and is predicted to increase from USD 270.38 million in 2026 to approximately USD 2628.4 million by 2035, expanding at a CAGR of 28.75% from 2026 to 2035.

The market is growing steadily, driven by increasing cancer cases, advances in precision oncology, and a strong R&D focus on targeted therapies like PARP inhibitors and next-generation DDR inhibitors.

DNA damage response (DDR) is a cellular system that detects DNA damage, activates repair pathways, and maintains genome stability to prevent disease progression, including cancer. The DNA damage response (DDR) market is expanding due to the rising global cancer burden, growing adoption of targeted and personalized cancer therapies, and increasing use of DDR inhibitors in combination treatments. Advances in genomics, improved biomarker identification, strong oncology drug pipelines, and higher investment in cancer research and clinical trials further support market growth.

AI can revolutionize the DNA damage response (DDR) market by accelerating drug discovery, identifying novel DDR targets, and predicting patient response to therapies. Machine learning improves biomarker discovery, optimizes clinical trial design, enables precise patient stratification, and supports personalized combination therapies, increasing treatment effectiveness and reducing development time.

| Key Elements | Scope |

| Market Size in 2026 | USD 270.38 Million |

| Projected Market Size in 2035 | USD 2628.4 Million |

| CAGR (2026 - 2035) | 28.75% |

| Leading Region | North America |

| Market Segmentation | By Therapeutic Class, By Indication, By End User, By Region |

| Top Key Players | AstraZeneca, Merck KGaA, Pfizer, GlaxoSmithKline, Repare Therapeutics, Artios Pharma |

Why Did the PARP inhibitors Segment Dominate in the Market in 2025?

The PARP inhibitors segment dominated the DNA damage response (DDR) market in 2025, due to strong clinical validation in ovarian, breast, prostate, and pancreatic cancers. Their proven efficacy in BCR-mutant tumors, expanding label approvals, growing use in combination therapies, and widespread adoption as maintenance treatments strengthened physician confidence and supported consistent demand across major oncology markets.

ATM/ATR Inhibitors

The ATM/ATR inhibitors segment is expected to grow at the fastest pace due to their potential to treat tumors resistant to PARP inhibitors and chemotherapy. Increasing clinical trial activity, strong pipeline momentum, and promising results in combination with immunotherapy and radiotherapy are driving interest. Additionally, broader applicability across multiple solid tumors supports rapid future adoption.

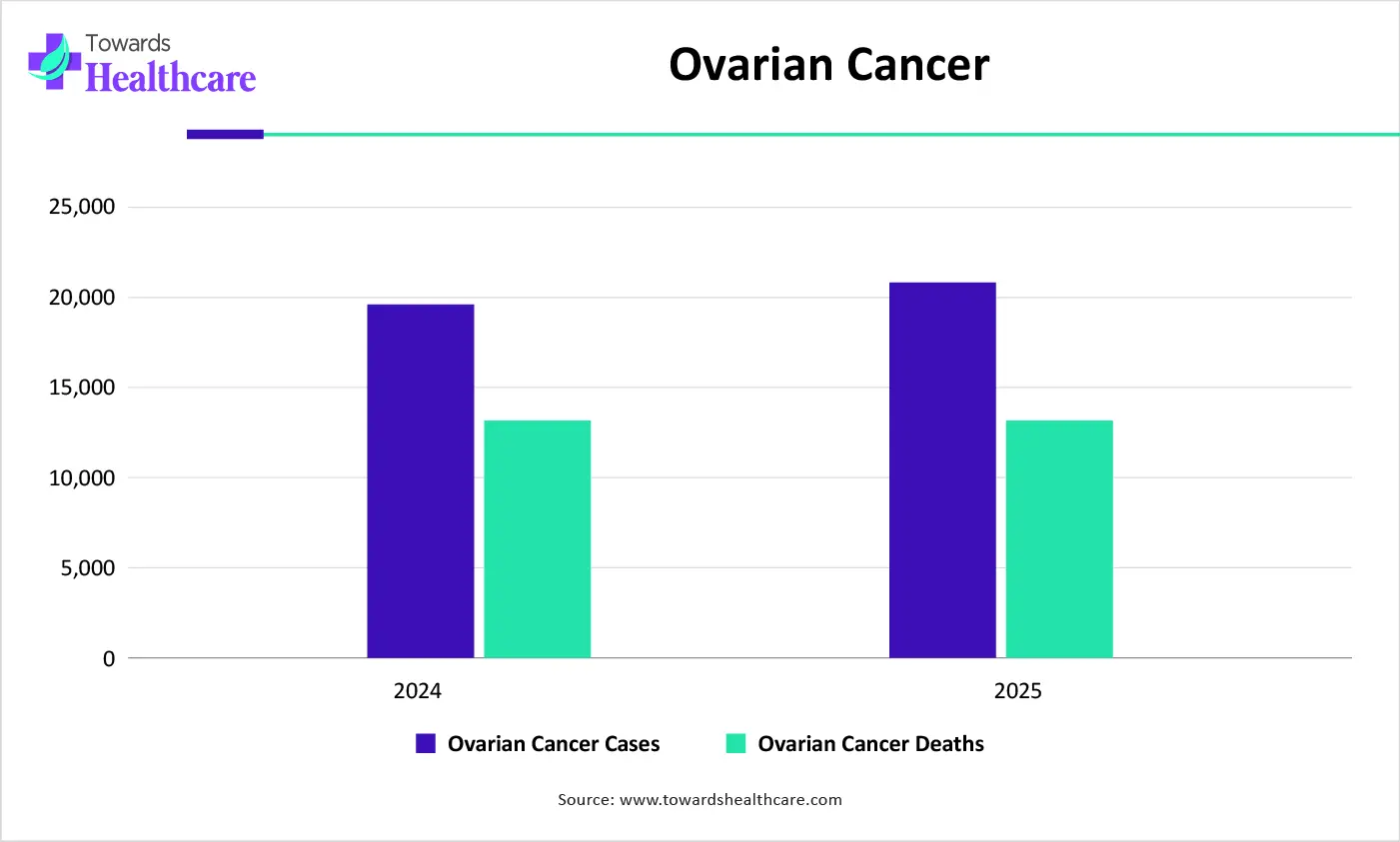

How the Ovarian Cancer Segment Dominated the Market in 2025?

The ovarian cancer segment dominated the DNA damage response (DDR) market due to high adoption of DDR-targeted therapies, especially PARP inhibitors, as standard maintenance treatment. Strong clinical evidence, early biomarker testing for BRCA mutations, and favorable reimbursement supported widespread use. Additionally, high recurrence rates and unmet treatment needs drove sustained demand for effective targeted therapies in ovarian cancer care.

Prostate Cancer

The prostate cancer segment is expected to grow at the fastest rate due to rising incidence, increased genetic testing for DNA repair defects, and expanding approvals of DDR-targeted therapies. Growing use of PARP inhibitors in metastatic castration-resistant prostate cancer, along with promising combination regimens and earlier-line treatment adoption, is accelerating clinical uptake and driving strong future growth.

Why the Academic & Research Institutes Segment Dominated the DNA Damage Response (DDR) Market?

The academic & research institutes segment dominated the market due to their central role in basic DDR biology target discovery and early-stage drug development. Strong government and public funding, widespread use of genomic and screening platforms, and leadership in translation research and clinical collaboration enabled these institutions to drive innovation and generate foundational data supporting DDR therapeutic advancements.

Specialty Cancer Hospitals

The specialty cancer hospitals segment is expected to grow at the fastest rate due to the increasing adoption of precision oncology cancer care. These centers lead in biomarker testing, combination treatment protocols, and clinical trial participation. Rising patient referrals, access to novel DDR drugs, and investment in advanced diagnostic infrastructure further support rapid growth during the forecast period.

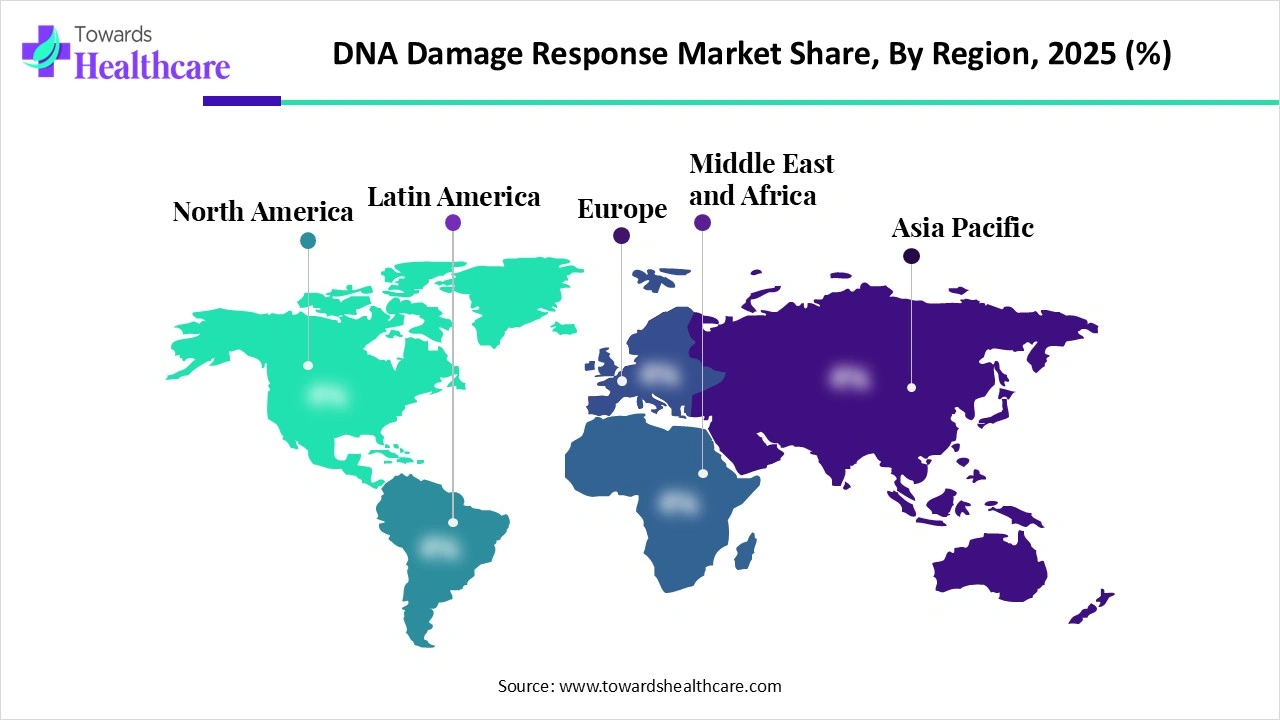

North America dominated the market due to a high cancer burden strong presence of leading pharmaceutical and biotechnology companies, and an advanced healthcare infrastructure. Early adoption of precision oncology, widespread genetic testing, and favorable reimbursement in cancer research and clinical trials further strengthened the region’s leadership in DDR therapeutics.

U.S. Market Trends

The U.S. led the DDR market in 2025 by capturing the largest revenue share due to advanced healthcare infrastructure, high cancer prevalence, and early adoption of DDR-targeted therapies. Strong R&D investment, extensive clinical trials activity, favorable regulatory framework, and widespread use of genetic testing and precision oncology supported the rapid uptake of PARP inhibitors and emerging DDR drugs, solidifying its market dominance.

The Asia Pacific DDR market is anticipated to grow at the fastest rate due to rising cancer incidence, increasing healthcare expenditure, and access to advanced diagnostics and targeted therapies. Growing adoption of precision oncology, supportive government initiatives, improving clinical trial infrastructure, and the entry of global DDR-focused pharmaceutical companies are driving market expansion across the countries during the forecast period.

India Market Trends

India is anticipated to grow rapidly in the DDR market due to increasing cancer prevalence, rising awareness of precision oncology, and expanding access to advanced diagnostics and targeted therapies. Supportive government initiatives, growing clinical trial activity, improving healthcare infrastructure, and the entry of global DDR-Focused pharmaceutical companies are accelerating adoption, making India a key emerging market in DNA damage response therapeutics.

Europe is expected to grow at a notable CAGR due to increasing cancer prevalence, strong research infrastructure, and widespread adoption of DDR-targeted therapies. Supportive regulatory frameworks, robust clinical trial activity, and the presence of leading pharmaceutical companies developing PARP and emerging DDR inhibitors are fueling market expansion across the region.

UK Market Trends

The UK is anticipated to grow rapidly in the market due to a strong focus on precision oncology, increasing cancer incidence, and widespread adoption of DDR-targeted therapies. Robust clinical trial networks, government support for cancer research, advanced healthcare infrastructure, and active participation of leading pharmaceutical companies in DDR drug development are driving faster market growth compared to other European countries.

| Companies | Headquarters | Offerings |

| AstraZeneca | Cambridge, UK | Offers established PARP inhibitors such as olaparib (Lynparza) and is developing additional DDR agents, including ATR and WEE1 inhibitors, to expand beyond PARP-targeted therapy. |

| Merck KGaA | Darmstadt, Germany | Has a broad DDR pipeline with investigational agents like ATR inhibitor tuvusertib (M1774), next-gen PARP1 inhibitor M9466, ATM inhibitor lartesertib (M4076), DNA-PK inhibitor peposertib, and DDR-linked antibody-drug conjugates (ADCs). |

| Pfizer | U.S. | Markets the PARP inhibitor talazoparib (Talzenna) for DDR-deficient cancers and is active in next-generation DDR research and combinations. |

| GlaxoSmithKline | London, UK | Provides the PARP inhibitor niraparib as part of its oncology portfolio and supports related DDR research and development programs. |

| Repare Therapeutics | Boston/Montreal | Focused on DDR drug discovery, notably ATR inhibitor camonsertib (RP-3500) in clinical trials, often in combination with PARP inhibitors to target DDR alterations. |

| Artios Pharma | Cambridge, UK | Develops next-gen DDR therapies, including ATR inhibitor alnodesertib (ART0380) and Polθ inhibitor ART6043, leveraging a proprietary DDR discovery platform. |

By Therapeutic Class

By Indication

By End User

By Region

October 2025

November 2025

November 2025

November 2025