January 2026

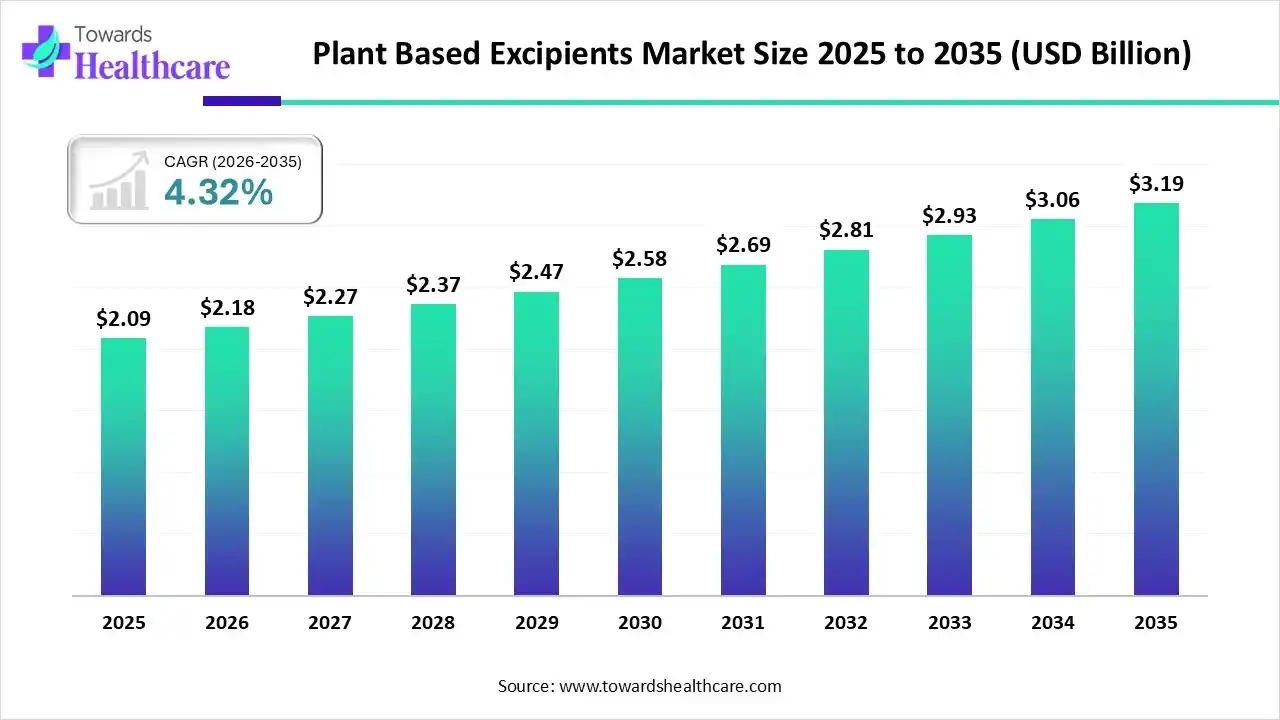

The global plant-based excipients market size was estimated at USD 2.09 billion in 2025 and is predicted to increase from USD 2.18 billion in 2026 to approximately USD 3.19 billion by 2035, expanding at a CAGR of 4.32% from 2026 to 2035.

The plant-based excipients market is witnessing steady growth, driven by rising demand for clean-label, sustainable, and health-focused products, with expanding use across food and beverages, nutraceuticals, cosmetics, and animal nutrition industries.

Plant-based excipients are inactive pharmaceutical ingredients derived from natural plant sources, used to aid drug formulation, stability, delivery, and manufacturing without providing therapeutic effects. The plant-based excipients market is growing due to the rising demand for natural, clean-label, and sustainable pharmaceutical ingredients. Increasing focus on patient safety, biocompatibility, and reduced side effects is encouraging the shift from synthetic excipients. growth in herbal medicine, nutraceuticals, and vegan-friendly drug formulation, along with regulatory support for naturally derived materials, is further accelerating market adoption globally.

Artificial intelligence is transforming the plant-based excipients market by accelerating ingredient discovery, optimizing formulation performance, and improving quality control. AI-driven data analytics helps identify suitable plant sources, predict excipient behavior, and ensure batch consistency. Additionally, AI supports efficient manufacturing, regulatory compliance, and cost optimization, enabling faster product development and wider adoption of sustainable, plant-derived excipients in pharmaceutical and nutraceutical applications.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.18 Billion |

| Projected Market Size in 2035 | USD 3.19 Billion |

| CAGR (2026 - 2035) | 4.32% |

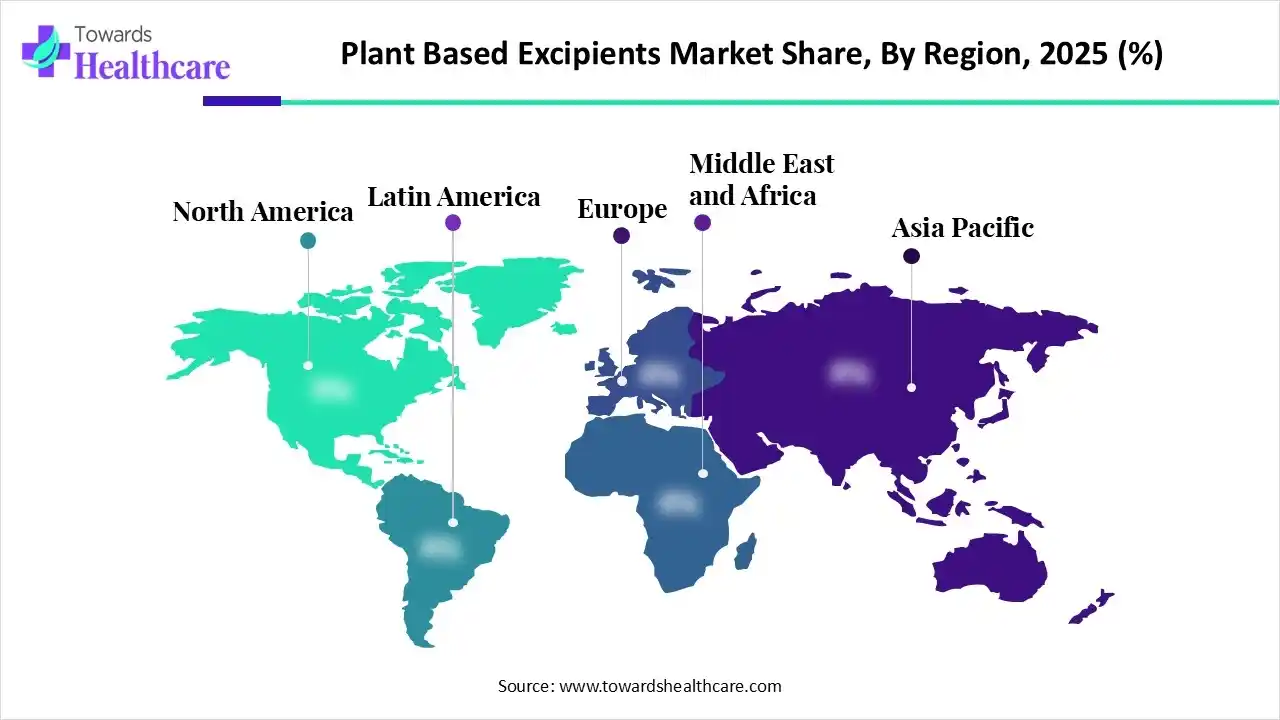

| Leading Region | North America |

| Market Segmentation | By Chemical Nature, By Applications and Function, By Region |

| Top Key Players | Roquette Frères, BASF Corporation (BASF SE), Lonza Group AG, DFE Pharma, Evonik Industries AG, Micro Powders, Inc. |

Why Did the Carbohydrates Segment Dominate in the Market in 2025?

The carbohydrates segment dominates the plant-based excipients market because carbohydrates like starches, cellulose, and gums are highly versatile, water-soluble, and biocompatible. They provide excellent binding, thickening, and stabilizing properties in pharmaceutical and nutraceutical formulations. Their natural origin, low toxicity, and compatibility with various active ingredients make them ideal for controlled-release and immediate-release formulations. These characteristics, combined with cost-effectiveness and wide availability, have positioned carbohydrates as the most widely used plant-based excipients globally.

Ethers & Carboxylic Acids

The ethers & carboxylic acids segments are expected to grow at the fastest CAGR because these excipients offer enhanced solubility, stability, and controlled-release properties in formulations. Their chemical versatility allows improved drug delivery, bioavailability, and compatibility with diverse active ingredients. Increasing demand for advanced, high-performance plant-based excipients in pharmaceuticals and nutraceuticals is driving rapid adoption and fueling market growth during the forecast period.

How the Binders & Diluents Segment Dominated the Market in 2025?

The binders & diluents segments dominated the plant-based excipients market in 2025 because these excipients are essential for ensuring tablet cohesion, stability, and proper dosage uniformity. Their natural origin, safety, and compatibility with a wide range of active pharmaceutical ingredients make them highly preferred in formulations. Growing demand for clean-label, sustainable, and effective drug delivery systems further reinforced their leading position in the market.

Film Forming & Coating Agents

The film-forming & coating agents segment is expected to grow at a notable rate during the forecast period because these plant-based excipients enhance tablet stability, controlled release, and taste masking. Rising demand for natural, clean-label, and patient-friendly oral dosage forms, along with innovations in plant-derived polymers, is driving their increased adoption in pharmaceutical and nutraceutical formulations globally.

North America dominated the market in 2025 due to strong pharmaceutical and nutraceutical industries, high consumer awareness of natural and clean-label products, and strict regulatory standards favoring safe, plant-derived ingredients. Advanced R&D infrastructure, rapid adoption of innovative formulations, and growing demand for sustainable and biocompatible excipients further strengthened the region's leading position in the global market.

U.S. Market Trends

The U.S. led the market in 2025 by capturing the largest revenue share due to its advanced pharmaceutical and nutraceutical sectors, high consumer preference for natural and clean-label products, and strong regulatory support for safe, plant-derived ingredients. Robust R&D activities, widespread adoption of innovative formulations, and increasing demand for sustainable and biocompatible excipients further strengthened the country’s market dominance.

Asia Pacific is expected to grow at a faster CAGR in the market during the forecast period due to rising pharmaceutical and nutraceutical manufacturing, increasing consumer awareness of natural and clean-label products, and cost-effective production capabilities. Expanding healthcare infrastructure, supportive regulations, and growing demand for sustainable and biocompatible excipients are further driving rapid market adoption in the region.

India Market Trends

India is anticipated to grow at a rapid CAGR in the market during the forecast period due to its expanding pharmaceutical and nutraceutical industries, low manufacturing costs, and increasing focus on natural and clean-label products. Supportive government initiatives, rising healthcare infrastructure, and growing consumer preference for sustainable and safe excipients are driving strong market adoption across the country.

Europe is expected to grow at the fastest CAGR in the market during the forecast period due to strict regulatory emphasis on sustainability, safety, and clean-label formulations. Strong demand for natural pharmaceutical ingredients, increasing adoption of eco-friendly excipients, advanced R&D capabilities, and rising use in nutraceutical and specialty drug formulations are driving rapid market expansion across the region.

UK Market Trends

The UK is anticipated to grow at the fastest CAGR in the plant-based excipients market during the forecast period due to strong emphasis on sustainable healthcare solutions and clean-label pharmaceutical formulations. Rising investment in pharmaceutical R&D, increasing adoption of natural excipients, supportive regulatory frameworks, and growing demand from nutraceutical and specialty drug manufacturers are collectively accelerating market growth across the country.

| Companies | Headquarters | Offerings |

| Roquette Frères | Lestrem, France | Global producer of plant-based ingredients and pharmaceutical excipients such as starches, polyols, and formulation aids for oral and specialty drug delivery. |

| BASF Corporation (BASF SE) | Ludwigshafen, Germany | Offers a broad portfolio of pharmaceutical raw materials and excipients, including solubilizers, binders, and formulation enhancers across oral, parenteral, and topical applications. |

| Lonza Group AG | Basel, Switzerland | A major CDMO and supplier of formulation solutions, including capsule technologies (e.g., Capsugel®), drug delivery supports, and tailored dosage form expertise |

| DFE Pharma | Goch, Germany | Specializes in high-quality functional excipients such as fillers, binders, and disintegrants used in pharmaceutical and nutraceutical formulations. |

| Evonik Industries AG | Essen, Germany | Supplies specialty excipients and formulation additives that improve stability, solubility, and performance in advanced drug delivery systems. |

| Micro Powders, Inc | New York, USA | Manufacturer of specialty fine powders, micronized waxes, and additives that support formulation performance in coatings, personal care, and select pharmaceutical excipient applications. |

By Chemical Nature

By Applications and Function

By Region

January 2026

January 2026

January 2026

January 2026