January 2026

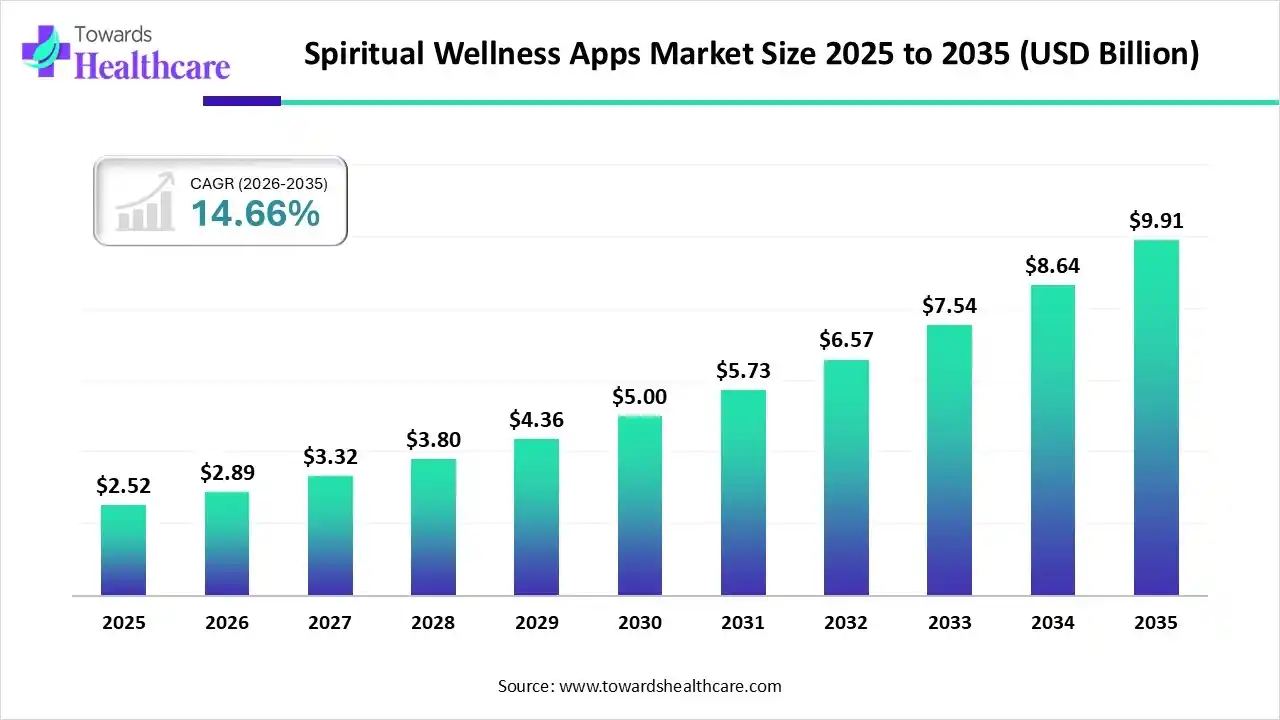

The global spiritual wellness apps market size was estimated at USD 2.52 billion in 2025 and is predicted to increase from USD 2.89 billion in 2026 to approximately USD 9.91 billion by 2035, expanding at a CAGR of 14.66% from 2026 to 2035.

In 2025, many tech companies are exploring advanced platforms through Android or iOS devices, which mainly support the development of meditation apps, spiritual guidance, and physical health monitoring. In this era, the global market is also stepping into the widespread adoption of AI algorithms, the transformation of augmented reality (AR) and virtual reality (VR) to explore enhanced convenience and accessibility in a variety of conditions.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.89 Billion |

| Projected Market Size in 2035 | USD 9.91 Billion |

| CAGR (2026 - 2035) | 14.66% |

| Leading Region | North America |

| Market Segmentation | By Platform, By Device, By Subscription, By Type, By Region |

| Top Key Players | Calm, Headspace, Insight Timer, Breethe, Simple Habit, Waking Up, Aura, Sattva, Smiling Mind, Pray.com |

Primarily, the global spiritual wellness apps market refers to the use of popular platforms, including Headspace, Calm, and Insight Timer, which further facilitate meditations, with the adoption of novel apps, such as Selfgazer and Vedic AstroGPT, by use AI for spiritual guidance. The overall progression is impacted by the rising cases and awareness regarding mental health and the emergence of spirituality in overall well-being. Whereas, nowadays, players are leveraging the application of augmented reality (AR) and virtual reality (VR) for detailed experiences, especially Headspace's launch of Headspace XR, and the integration of AI for tailored dream analysis and spiritual insights.

Specifically, through diverse apps, AI offers hyper-personalised experiences, 24/7 accessible support, and data-powered insights to boost traditional practices instead of replacing human connection. An AI oracle trained solely on Deepak Chopra's teachings facilitates users with on-demand wisdom and guidance. However, recently developed AI Lama, a chatbot created for replying to moral and philosophical questions inspired by Buddhist teachings.

For instance,

| Startup | Notable Efforts |

| InnerBhakti (2024) | It mainly provides customized spiritual wellness programs with guided meditations, deity-based prayers, and AI-enabled mood mapping. |

| Soulsensei (2023) | This usually supports guided meditation, breathwork, self-help, and spiritual guidance, and also secured $1.4M in angel funding in May 2025. |

| Sibyl (2021) | By using AI, it has leveraged a "metaphysical copilot" for conversations and spiritual guidance, incorporating features such as chat visualization and speech-enabled chat. |

| AppsForBharat (2020) | It explores digital tools for daily spiritual practices like pujas and mantras, raising over $53.4 million in total funding. |

Various leading players, such as Calm and Headspace, are fostering apps targeting specific beliefs and demographics, for instance, Catholic-specific prayer apps, including Hallow, and platforms emphasizing astrology, moon-phase tracking, and manifestation.

The market is putting efforts into hybrid solutions by integrating diverse aspects of wellness, especially mental fitness, physical health, nutrition, and spirituality.

Numerous developers are surpassing the use of Augmented Reality (AR) and Virtual Reality (VR) for skipping "subscription fatigue," and innovating rigorous spiritual retreats, guided meditations in virtual natural environments, and interactive breathwork sessions.

The market will have opportunities in collaborating with therapists, psychologists, and mental health organizations to combine clinical insights and therapeutic content into spiritual platforms, coupled with scientific credibility.

Through the strong alliances among key tech players, like Apple (such as the Mindvalley partnership for Apple Vision Pro) and Meta Quest (e.g., Headspace XR), will accelerate accessibility and the user experience through cutting-edge hardware integration.

Especially, digital-first apps will collaborate with physical wellness centers, yoga studios, and retreat organizers to facilitate hybrid online-to-offline experiences, including offering bookings for in-person workshops and retreats.

Which Platform Dominated the Spiritual Wellness Apps Market in 2025?

In 2025, the Android segment held the biggest revenue share of the market. The segment is mainly fueled by the rise in global adoption of Android devices, a huge user base, and the platform's ability to reach a widespread audience. Moreover, the Spirit Daughter's novel meditation and mindfulness app, the use of AI for customised recommendations, and community features are also bolstering the prospective developments.

iOS

Although the iOS segment is predicted to witness rapid expansion, particularly, they include YouVersion Bible App, Sadhguru, and apps based on dream analysis, like Nightcap, Dreamt, assisting in affirmations, and guided spiritual stories. At the same time, Apple has been stepping towards its latest and newly coming Health+ platform and its integration with ChatGPT from passive health tracking to active health intelligence by 2026.

How did the Smartphones Segment Lead the Market in 2025?

The smartphones segment accounted for the largest share of the spiritual wellness apps market in 2025. Involvement of broader smartphone users around the globe is prominently fueling the segmental growth, alongside, they are highly demanding guided meditation, journaling prompts, spiritual videos, and prayer reminders. The emergence of immersive 5G connectivity and extended battery life enables uninterrupted usage during meditation sessions or online worship.

Wearable Devices

On the other hand, the wearable devices segment is estimated to register the fastest growth. This is expanding with their real-time feedback, and a rise in demand for convenient, accessible approaches for stress reduction and mindfulness. The latest advances comprise Muse S Gen 2, a meditation headband that utilises EEG sensors to monitor brain activity during meditation sessions, and Neurable MW75 Neuro Headphones that possess built-in EEG sensors.

Which Subscription Led the Spiritual Wellness Apps Market in 2025?

The paid (In-App Purchase) segment captured a dominant share of the market in 2025. This specifically covers the release of the comprehensive potential of an app, such as the increased guided meditations, specialised courses, longer sessions, sophisticated monitoring, and exclusive community features. Ongoing developments, like Wishtok's All-in-One Wellbeing app, provide access to over 300 certified professionals for therapy, life coaching, and spiritual guidance.

Free

Whereas the free segment will expand rapidly during 2026-2035. These subscriptions assist in developing a large user base, with revenue created through in-app purchases for premium features, while some apps, such as Idanim, are a free model. Furthermore, certain firms are facilitating free spiritual and wellness newsletters, such as On Being, Daily Word, and Spirituality & Health, and famous free podcasts, like The Highest Self, 10% Happier, and Eckhart Tolle: Essential Teachings.

What Made the Meditation and Mindfulness Apps Segment Dominant in the Market in 2025?

In 2025, the meditation and mindfulness apps segment registered dominance in the spiritual wellness apps market. It is propelled by an expansion of corporate wellness programs, expanded smartphone and 5G adoption, and the escalating trend of using at-home wellness solutions, mainly amplified by the COVID-19 pandemic. Popular examples are Calm and Headspace for guided programs, Insight Timer for its vast free library and community, and Waking Up for a philosophical approach.

Yoga And Movement-Based Spirituality Apps

Furthermore, the yoga and movement-based spirituality apps segment will expand at a rapid CAGR. These apps are widely facilitating from guided meditations and movement-based classes to specialised content, including Vedic mantras, mudras, and wisdom teachings, leveraging various levels of experience and spiritual goals. The WHO mYoga app is established by the World Health Organization to foster the practice of quality yoga by making it accessible on smartphones.

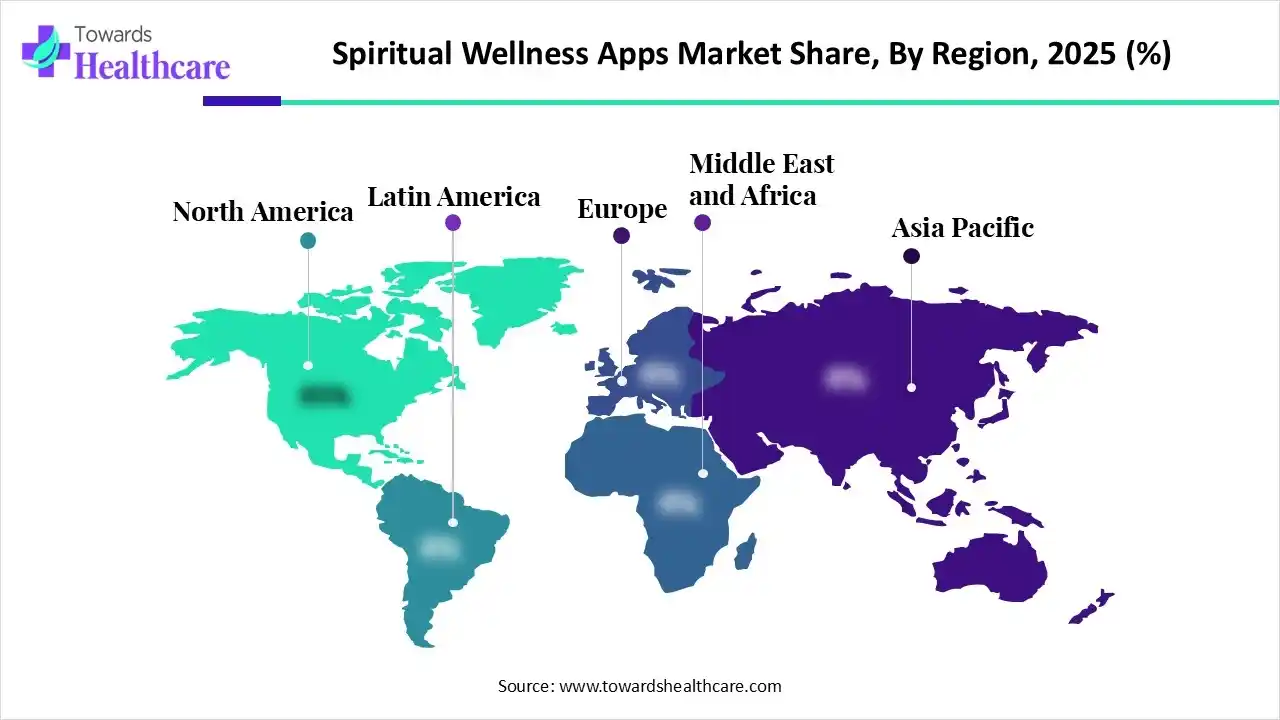

North America held a major share of the spiritual wellness apps market in 2025, due to the accelerating cultural movement towards holistic well-being, as Millennials and Gen Z users are embracing platforms for self-care. Alongside, the region is promoting revolutionary technologies by adopting AI, AR/VR for robust meditation experiences. Recently, in 2025, the University of Rochester partnered with the founders of the "Sol" mental health app, focused on supporting students in addressing their mental health risks.

Whereas the spiritual wellness apps market in the U.S. captured the dominating share, with launches of immersive solutions aiming at particular faiths, astrology, manifestation, energy healing, and hybrid apps by combining spiritual guidance with physical health monitoring. Apps, like Headspace, Calm, are increasingly providing meditation & mindfulness, as well as Aura, Simple Habit, and others like apps, are supporting stress and emotional wellness in the U.S.

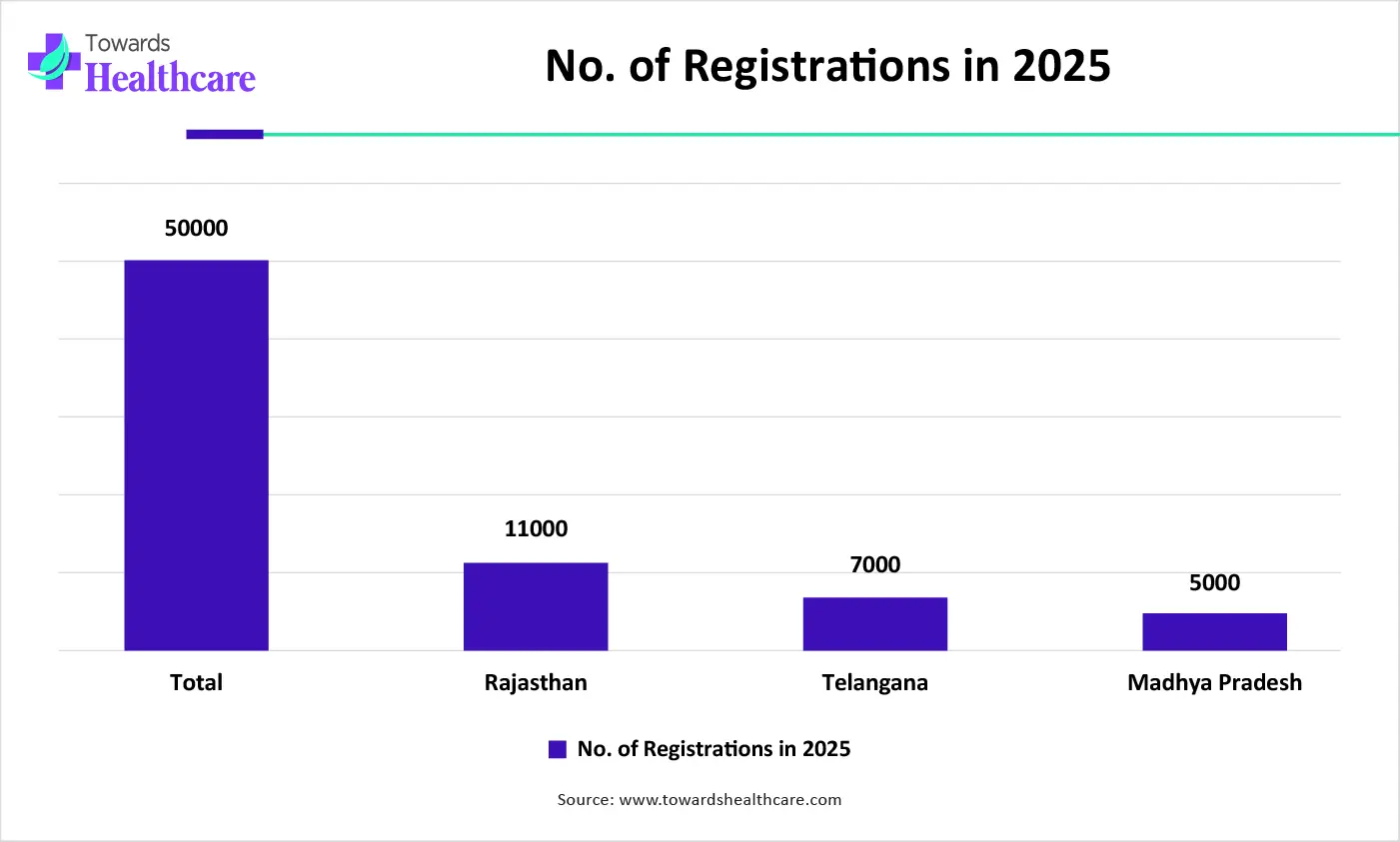

Asia Pacific is anticipated to expand fastest in the upcoming years, with growing integration of traditional practices, stress from urbanisation, increased smartphone and internet penetration, and social media impact. On the other hand, governments of Singapore, Thailand, and India are subsidizing apps for health initiatives or introducing their own programs (like the Indian government's mYoga app with the WHO) to encourage mental wellness and stress management.

With a rapid CAGR, Singapore will expand rapidly in the spiritual wellness apps market, due to the prominent contribution of home-grown apps, such as MindFi and Intellect, and leading global companies unveiling new features.

For instance,

With a lucrative CAGR, Europe is predicted to expand significantly in the spiritual wellness apps market. The regional development is led by its robust digital health policies, which enable the qualification of apps (DiGAs - Digital Health Applications) to be prescribed by doctors and reimbursed by insurance.

In the future, the German market will expand at a notable CAGR, with the broader adoption of 7mind, a German-based meditation app, and Moodfit, which emphasises mental health tracking and CBT techniques. As well as German players are exploring both Android and iOS platforms, looking for major user engagement.

| Company | Headquarters | Offerings |

| Calm | San Francisco, USA | Guided meditations, sleep stories, music, and breathing exercises. |

| Headspace | Santa Monica, USA | Guided meditations, mindful workouts, sleepcasts, and an AI companion. |

| Insight Timer | Santa Monica, USA | Large library of free guided meditations, talks, live events, and a customizable timer. |

| Breethe | Baltimore, USA | Guided meditations, relaxation music, breathing exercises, and personalized plans. |

| Simple Habit | San Francisco, USA | 5-minute meditations for busy professionals, sleep support, and expert-led sessions. |

| Waking Up | USA | Secular, science-based meditation course and philosophical lessons on consciousness. |

| Aura | USA | Personalized daily mindfulness exercises, mood tracking, and emotional wellness support. |

| Sattva | New York, USA | Meditation timers, challenges, community features, and traditional spiritual teachings. |

| Smiling Mind | Australia | Free, evidence-based content for all ages, including programs for home, school, and work. |

| Pray.com | USA | Faith-based content, including daily prayers, Bible stories, and spiritual living guidance. |

By Platform

By Device

By Subscription

By Type

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

January 2026

December 2025

December 2025